The BFS or blow-fill-seal process refers to the simple combination of an automated seal, fill, and form packaging sequence into one single machine. Plastic containers are filled and blow-molded with liquid product and sealed in one ongoing operation under aseptic processing conditions. The Latin America blow fill seal (BFS) technology market is estimated to be driven by augmented use of the technology in the pharmaceutical sector.

In this manufacturing technology, large (over 500 mL) and small (0.1 mL) volume of liquid filled containers are produced. This technique finds augmented utilization in the pharmaceutical sector to fill up parental preparation with minimum intervention of people.

The Latin America blow fill seal (BFS) technology market is estimated to witness considerable growth in the years to come owing to the growing pharmaceutical sector in the region. This blow fill seal technology is considered as an improved form of aseptic processing by many of the medicinal regulatory agencies such as FDA in the US in the packaging of pharmaceutical and healthcare products.

On the other hand, high manufacturing cost is estimated to be one of the main factors that are restricting the expansion of the Latin America blow fill seal (BFS) technology market.

Thanks to the rising demand for pharmaceutical products that are manufactured using aseptic technology, the market for blow fill seal (BFS) technology in Latin Africa has been displaying a substantial rise in its size and valuation. Over the forthcoming years, this market is expected to be greatly influenced by several market trends, such as the advent of co-extrusion and blow fill insert seal technologies.

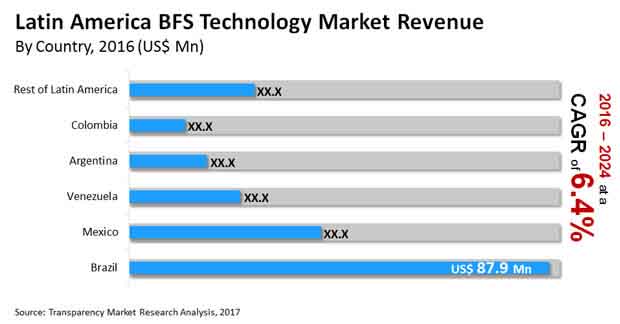

The leading players operating in this market are focusing aggressively on improvements in the production process in order to minimize the generation of non-viable particulate matter, which is likely to support the growth of this market substantially in the near future. The opportunity in this market is estimated to increase at a CAGR of 6.40% between 2016 and 2024, rising from US$205.5 mn in 2016 to a value of US$337.8 mn by the end of 2024.

Polyethylene (PE), polypropylene (PP), and several other materials, such as ethylene vinyl alcohol (EVOH) are the key components required for the production of blow fill seal. With a share of 62.4%, the PE segment led this Latin American market in 2016 and is expected to continue to rise significantly over the next few years. Due to its low gas and water permeability, PE does not interfere with the drug. This factor is expected to fuel the growth of this segment in the years to come. Among all PE materials, LDPE is reporting a higher demand due to its excellent resistance to acid and bases and non reactivity at room temperature. HDPE is also projected to witness increased demand over the years to come, thanks to its high strength to density ratio, resulting in less spillage occurrences.

The pharmaceuticals, food and beverages, and the cosmetics and personal care industries have emerged as the key end users of BFS technology in Latin America. The products available in the Latin America market for BFS technology is primarily utilized in the pharmaceutical industry, which acquired a demand share of 98.4% in 2015. Researchers expect this scenario to remain so over the next few years, thanks to the growing need for user-friendly and flexible container designs among consumers. Among others, the food and beverages industry is poised to be the next lucrative end-use segment for BFS product manufacturers in the near future. The rising demand for sports and nutritional drinks is anticipated to fuel the uptake of BFS technology in the food and beverages industry in this region.

In terms of geography, the Latin America market for BFS technology reports its presence across Brazil, Argentina, Mexico, Venezuela, Colombia, and the Rest of Latin America. In 2016, Brazil held a share of nearly 43% in the overall market, registering its dominance. Researchers project this domestic market to remain on the top over the next few years, thanks to the significant rise in its pharmaceutical sector. Mexico, which stood second in the overall market in 2015, is also estimated to witness high growth in its BFS market in the coming years due to a relatively stable economy and the growing trade relations with the U.S.

Nephron Pharmaceuticals Corp., Weiler Engineering Inc., Horizon Pharmaceuticals Inc., Rommelag Kunststoff-Maschinen Vertriebsgesellschaft mbH, Unipharma LLC, Brevetti Angela S.R.L., Takeda Pharmaceuticals International AG, and Unither Pharmaceuticals are leading players in the Latin America BFS technology market.

Latin America blow fill seal (BFS) technology market is expected to reach a value of US$337.8 mn by the end of 2024

Latin America blow fill seal (BFS) technology market is estimated to increase at a CAGR of 6.40% between 2016 and 2024

Blow fill seal (BFS) technology market in latin america is driven by augmented use of the technology in the pharmaceutical sector

The PE segment led this Latin America blow fill seal (BFS) technology market and is expected to continue to rise significantly during the forecast period

Key players in the Latin America blow fill seal (BFS) technology market include Nephron Pharmaceuticals Corp., Weiler Engineering Inc., Horizon Pharmaceuticals Inc., Rommelag Kunststoff-Maschinen Vertriebsgesellschaft mbH, Unipharma LLC, Brevetti Angela S.R.L., Takeda Pharmaceuticals International AG

1. Executive Summary

2. Assumptions and Acronyms Used

3. Research Methodology

4. Latin America BFS Technology Market Introduction

4.1. BFS Technology Market Definition

4.2. Latin America BFS Technology Market Taxonomy

5. Latin America BFS Technology Market Analysis Scenario

5.1. Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast

5.1.1. Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast and Y-o-Y Growth

5.1.2. Absolute $ Opportunity

5.2. Latin America BFS Technology Market Overview

5.2.1. Value Chain

5.2.2. Profitability Margins

5.2.3. List of Active Participants

5.2.3.1. Raw Material Suppliers

5.2.3.2. Film Suppliers

5.2.3.3. Packaging Converters/Manufacturers

5.2.3.4. Distributors / Retailers

6. Latin America BFS Technology Market Dynamics

6.1. Macro-economic Factors

6.2. Drivers

6.2.1. Supply Side

6.2.2. Demand Side

6.3. Restraints

6.4. Opportunity

6.5. Industry Trends and Recent Developments

6.5.1. Design Level Trends and Market Developments

6.5.2. Products Level Trends and Market Developments

6.5.3. Business Level Trends and Market Developments

6.5.4. Case Studies

6.6. Forecast Factors – Relevance and Impact

7. Latin America BFS Technology Market Analysis and Forecast, By Product Type

7.1. Introduction

7.1.1. Market Share & Basis Point Share (BPS) Analysis, By Product Type

7.1.2. Y-o-Y Growth Projections, By Product Type

7.2. Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, By Product Type

7.2.1. Bottles

7.2.1.1. 0.2-100 ml

7.2.1.2. 100-500 ml

7.2.1.3. Above 500 ml

7.2.2. Ampoules

7.2.2.1. 0.1-10 ml

7.2.2.2. 10-100 ml

7.2.3. Vials

7.2.3.1. 0.1-10 ml

7.2.3.2. 10-50 ml

7.2.4. Others

7.3. Latin America BFS Technology Market Attractiveness Analysis, By Product Type

7.4. Prominent Trends

8. Latin America BFS Technology Market Analysis and Forecast, By Material Type

8.1. Introduction

8.1.1. Market Share & Basis Point Share (BPS) Analysis, By Material Type

8.1.2. Y-o-Y Growth Projections, By Material Type

8.2. Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, By Material Type

8.2.1. PE

8.2.1.1. LDPE

8.2.1.2. HDPE

8.2.2. PP

8.2.3. Others

8.3. Latin America BFS Technology Market Attractiveness Analysis, By Material Type

8.4. Prominent Trends

9. Latin America BFS Technology Market Analysis and Forecast, By End Use

9.1. Introduction

9.1.1. Market Share & Basis Point Share (BPS) Analysis, By End Use

9.1.2. Y-o-Y Growth Projections, By End Use

9.2. Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, By End Use

9.2.1. Pharmaceutical

9.2.2. Food & Beverage

9.2.3. Cosmetic & Personal Care

9.2.4. Others

9.3. Latin America BFS Technology Market Attractiveness Analysis, By End Use

9.4. Prominent Trends

10. Latin America BFS Technology Market Analysis and Forecast, By Country

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, By Country

10.2.1. Brazil

10.2.2. Argentina

10.2.3. Mexico

10.2.4. Venezuela

10.2.5. Colombia

10.2.6. Rest of Latin America

10.3. Latin America BFS Technology Market Attractiveness Analysis, By Country

11. Competition Landscape

11.1. Competition Dashboard

11.2. Company Market Share Analysis

11.3. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT)

11.4. Latin America Players (Blow Fill Seal Packaging)

11.4.1. Unither Pharmaceuticals

11.4.1.1 Overview

11.4.1.2 Financials

11.4.1.3 Strategy

11.4.1.4 Recent Developments

11.4.1.5 SWOT

11.4.2. Takeda Pharmaceuticals International AG

11.4.2.1 Overview

11.4.2.2 Financials

11.4.2.3 Strategy

11.4.2.4 Recent Developments

11.4.2.5 SWOT

11.4.3. Brevetti Angela S.R.L.

11.4.3.1 Overview

11.4.3.2 Financials

11.4.3.3 Strategy

11.4.3.4 Recent Developments

11.4.3.5 SWOT

11.4.4. Unipharma, LLC

11.4.4.1 Overview

11.4.4.2 Financials

11.4.4.3 Strategy

11.4.4.4 Recent Developments

11.4.4.5 SWOT

11.4.5. Rommelag Kunststoff-Maschinen Vertriebsgesellschaft mbH

11.4.5.1 Overview

11.4.5.2 Financials

11.4.5.3 Strategy

11.4.5.4 Recent Developments

11.4.5.5 SWOT

11.4.6. Horizon Pharmaceuticals, Inc.

11.4.6.1 Overview

11.4.6.2 Financials

11.4.6.3 Strategy

11.4.6.4 Recent Developments

11.4.6.5 SWOT

11.4.7. Weiler Engineering Inc.

11.4.7.1 Overview

11.4.7.2 Financials

11.4.7.3 Strategy

11.4.7.4 Recent Developments

11.4.7.5 SWOT

11.4.8. Nephron Pharmaceuticals Corporation

11.4.8.1 Overview

11.4.8.2 Financials

11.4.8.3 Strategy

11.4.8.4 Recent Developments

11.4.8.5 SWOT

List of Tables

Table 01: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Product Type, 2015–2024

Table 02: Latin America BFS Technology Market Value (US$ Mn) And Volume (Mn Units) Forecast, by Material type, 2015–2024

Table 03: Latin America BFS Technology Market Value (US$ Mn) And Volume (Mn Units) Forecast, by End Use, 2015–2024

Table 04: Latin America BFS Technology Market Value (US$ Mn) And Volume (Mn Units) Forecast, by End Use, 2015–2024

List of Figures

Figure 01: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units), 2015–2024

Figure 02: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 03: Latin America BFS Technology Market Value Share, by Product type, 2016

Figure 04: Latin America BFS Technology Market Value Share, by Material Type, 2016

Figure 05: Latin America BFS Technology Market Value Share, by End Use, 2016

Figure 06: Latin America BFS Technology Market Value Share, by Region, 2016

Figure 7: Latin America BFS Technology Market, BPS Analysis, by Product Type, 2016 and 2024

Figure 8: Latin America BFS Technology Market Y-o-Y Growth (%), by Product Type, 2015–2024

Figure 9: Latin America BFS Technology Market Value (US$ Mn) and Volume ( Mn Units) Forecast, by Bottles Segment, 2015–2024

Figure 10: Latin America BFS Technology Y-o-Y Growth, by Bottles Segment, 2016–2024

Figure 11: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Bottles Capacity 0.2-100 ml Segment, 2015–2024

Figure 12: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by Bottles Capacity 0.2-100 ml Segment, 2016–2024

Figure 13: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Bottles Capacity 100-500 ml Segment, 2015–2024

Figure 14: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by Bottles Capacity 100-500 ml Segment, 2016–2024

Figure 15: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Bottles Capacity above 500 ml Segment, 2015–2024

Figure 16: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by Bottles Capacity above 500 ml Segment, 2016–2024

Figure 17: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Ampoules Segment, 2015–2024

Figure 18: Latin America BFS Technology Y-o-Y Growth, by Ampoules Segment, 2016–2024

Figure 19: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Ampoules Capacity 0.1-10ml Segment, 2015–2024

Figure 20: Latin America BFS Technology Absolute $ Opportunity (US$ Mn), by Ampoules Capacity 0.1-10ml Segment, 2016–2024

Figure 21: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Ampoules Capacity 10-100ml Segment, 2015–2024

Figure 22: Latin America BFS Technology Absolute $ Opportunity (US$ Mn), by Ampoules Capacity 10-100ml Segment, 2016–2024

Figure 23: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Vials Segment, 2015–2024

Figure 24: Latin America BFS Technology Y-o-Y growth, by Vials Segment, 2016–2024

Figure 25: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Vials Capacity 0.1-10ml Segment, 2015–2024

Figure 26: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by Vials Capacity 0.1-10 ml Segment, 2016–2024

Figure 27: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Vials Capacity 10-50ml Segment, 2015–2024

Figure 28: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by Vials Capacity 10-50ml Segment, 2016–2024

Figure 29: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Others Segment, 2015–2024

Figure 30: Latin America BFS Technology Market Y-o-Y growth, by Others Segment, 2016–2024

Figure 31: Latin America BFS Technology Market Attractiveness Index, by Product Type, 2016–2024

Figure 32: Latin America BFS Technology Market, BPS Analysis, by Material type, 2016 and 2024

Figure 33: Latin America BFS Technology Market Y-o-Y Growth (%), by Material type, 2015–2024

Figure 34: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by PE Segment, 2015–2024

Figure 35: Latin America BFS Technology Market Y-o-Y growth, by PE Segment, 2016–2024

Figure 36: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by LDPE Segment, 2015–2024

Figure 37: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by LDPE Segment, 2016–2024

Figure 38: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by HDPE Segment, 2015–2024

Figure 39: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by HDPE Segment, 2016–2024

Figure 40: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by PP Segment, 2015–2024

Figure 41: Latin America BFS Technology Market Y-o-Y growth, by PP Segment, 2016–2024

Figure 42: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Others Segment, 2015–2024

Figure 43: Latin America BFS Technology Market Y-o-Y growth, by Others Segment, 2016–2024

Figure 44: Latin America BFS Technology Market Attractiveness Index, by Product type, 2016–2024

Figure 45: Latin America BFS Technology Market, BPS Analysis, by End Use, 2016 and 2024

Figure 46: Latin America BFS Technology Market Y-o-Y Growth (%), by End Use, 2015–2024

Figure 47: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Pharmaceuticals Segment, 2015–2024

Figure 48: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by Pharmaceuticals Segment, 2016–2024

Figure 49: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Food & Beverage Segment, 2015–2024

Figure 50: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by Beverage Segment, 2016–2024

Figure 51: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Cosmetics & Personal Care Segment, 2015–2024

Figure 52: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by Cosmetics & Personal Care Segment, 2016–2024

Figure 53: Latin America BFS Technology Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Personal Care Segment, 2015–2024

Figure 54: Latin America BFS Technology Market Absolute $ Opportunity (US$ Mn), by Others Segment, 2016–2024

Figure 55: Latin America BFS Technology Market Attractiveness Index, by End Use, 2016–2024

Figure 56: Latin America BFS Technology Market, BPS Analysis, by End Use, 2016 and 2024

Figure 57: Latin America BFS Technology Market Y-o-Y Growth (%), by Country, 2015–2024

Figure 58: Brazil BFS Technology Value (US$ Mn) and Volume (Mn Units) Forecast, 2015–2024

Figure 59: Brazil BFS Technology Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 60: Argentina BFS Technology Value (US$ Mn) and Volume (Mn Units) Forecast, 2015–2024

Figure 61: Argentina BFS Technology Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 62: Mexico BFS Technology Value (US$ Mn) and Volume (Mn Units) Forecast, 2015–2024

Figure 63: Mexico BFS Technology Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 64: Venezuela BFS Technology Value (US$ Mn) and Volume (Mn Units) Forecast, 2015–2024

Figure 65: Venezuela BFS Technology Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 66: Colombia BFS Technology Value (US$ Mn) and Volume (Mn Units) Forecast, 2015–2024

Figure 67: Colombia BFS Technology Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 68: Rest of Latin America BFS Technology Value (US$ Mn) and Volume (Mn Units) Forecast, 2015–2024

Figure 69: Rest of Latin America BFS Technology Absolute $ Opportunity (US$ Mn), 2016–2024

Figure 70: Latin America BFS Technology Market Attractiveness Index, by Country, 2016–2024