Analyst Viewpoint

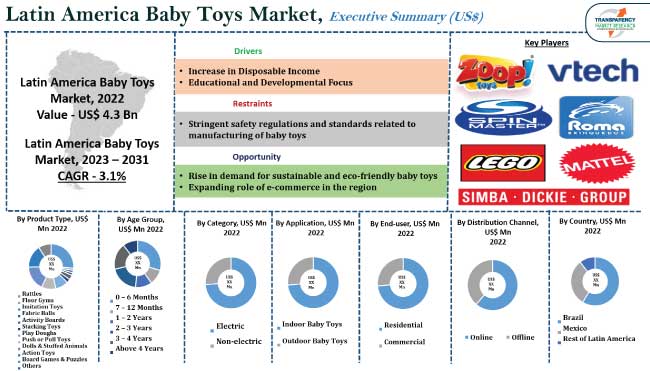

Convergence of cultural, economic, and demographic factors are driving Latin America baby toys market. Rising middle class and increasing disposable incomes are fostering a willingness among parents to invest in high-quality, educational, and innovative toys for their children. Increase in focus on education and development of children is another factor propelling market expansion. Furthermore, rise in awareness about environmental sustainability is leading to development of eco-friendly and sustainable baby toys, which in turn is expected to bolster market size during the forecast period.

Growth of e-commerce in the region presents significant opportunity to market players. Manufacturers are focusing on innovation in toy offerings and technologically advanced products in order to increase market share.

Baby toys market for Latin America is a thriving and dynamic arena, playing a pivotal role in nurturing the growth and development of the region's youngest members. The market is distinguished by its rich diversity, offering an array of toys that not only entertain, but also contribute significantly to the early learning experiences of infants and toddlers.

From traditional toys that resonate with the unique cultural fabric of Latin America to contemporary innovations infused with educational features, the market reflects a broad spectrum of choices. This significance extends beyond mere entertainment, encompassing a crucial role in supporting early childhood development.

Parents across the region seek toys that stimulate cognitive, motor, and sensory skills while aligning with cultural values. The market responds to these varied needs, showcasing various products that cater to different developmental stages.

Latin America baby toys market stands as a testament to the blend of cultural traditions, parental aspirations, and a commitment to providing well-rounded experiences for the youngest members of society.

Rise in disposable income of families is a key factor propelling Latin America baby toys market growth. The region's middle class is growing at a rapid pace, and countries such as Brazil, Mexico, and Colombia are witnessing significant increase in the level of economic prosperity.

The World Bank reports that the growing middle class is a sign of increased purchasing power since it allows families to spend money on things other than necessities, such as buying toys for their kids.

There is a noticeable trend among families when their financial situation improves to spend money on items that enhance their kids' overall growth and happiness. Manufacturers are also coming up with affordable and high quality baby toys for Latin American families. Thus, increase in disposable income is driving demand for baby toys in the region.

Increase in recognition of the critical role that early childhood development plays among parents is a major factor driving Latin America baby toys market demand. Increasing number of parents are making an effort to choose toys that help their kids develop motor, cognitive, and sensory abilities.

A UNICEF report states that early experiences have a major impact on brain development, which ought to make parents more aware of the need of toys that promote learning. Demand for educational toys that encourage creativity, problem-solving, and interactive play is rising. In order to address the rising demand driven by parents' hopes for their children's holistic development, toy producers are responding by bringing a range of educational toys onto the market.

In terms of product type, the action toys segment accounted for the largest Latin America baby toys market share in 2023.

Action toys are designed to promote physical activity, as well as cognitive and social skills, making them highly desirable for young children in the region. Additionally, action toys often come with vibrant, lively colors and interesting characters that appeal to children of all ages. Furthermore, the cost of action toys is usually relatively low, making them affordable for families in Latin America.

According to the latest Latin America baby toys market forecast, Brazil is likely to dominate the market in the region during the forecast period. This is ascribed to its large and economically privileged population.

The country's sizable consumer base, burgeoning middle class, and high disposable income are propelling Latin America baby toys industry growth. Culturally, there is a strong emphasis on family and child-centric activities in Brazil, leading parents to prioritize the well-being and development of their children.

The well-established retail infrastructure, encompassing both traditional and online channels, further enhances accessibility, making the country a key player in Latin America baby toys market.

Detailed profiles of companies in Latin America baby toys market research report are provided to evaluate their financials, key product offerings, recent developments, and strategies. Leading players are investing in advanced technologies and infrastructure to capture majority market share.

Artsana SpA, Basic Fun! Inc., Hasbro, Inc., LEGO System A/S, Linc Limited, Roma Brinquedos, Simba Dickie Group, Spin Master, VTech Holdings Limited, and Zoop Toys are the prominent players in the market.

Each of these players has been profiled in Latin America baby toys market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 4.3 Bn |

| Forecast (Value) in 2031 | US$ 5.7 Bn |

| Growth Rate (CAGR) | 3.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Country Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 4.3 Bn in 2022

It is expected to reach US$ 5.7 Bn by 2031.

Increase in disposable income and educational & developmental focus.

The action toys type segment accounted for largest share in 2022.

Brazil is likely to be a highly lucrative country for baby toys in the next few years.

Artsana SpA, Basic Fun! Inc., Hasbro, Inc., LEGO System A/S, Linc Limited, Roma Brinquedos, Simba Dickie Group, Spin Master, VTech Holdings Limited, and Zoop Toys.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Latin America Baby Toys Market Analysis and Forecast, 2017–2031

5.7.1. Market Value Projections (US$ Mn)

5.7.2. Market Volume Projections (Million Units)

6. Latin America Baby Toys Market Analysis and Forecast, by Product Type

6.1. Latin America Baby Toys Market Size (US$ Mn) (Million Units), by Product Type, 2017–2031

6.1.1. Rattles

6.1.2. Floor Gyms

6.1.3. Imitation Toys

6.1.4. Fabric Balls

6.1.5. Activity Boards

6.1.6. Stacking Toys/Locking Plastic Blocks/Shape Sorters

6.1.7. Play Doughs

6.1.8. Push or Pull Toys

6.1.9. Dolls & Stuffed Animals

6.1.10. Action Toys

6.1.11. Board Games & Puzzles

6.1.12. Others (toy guns, construction toys, etc.)

6.2. Incremental Opportunity, by Product Type

7. Latin America Baby Toys Market Analysis and Forecast, by Age Group

7.1. Latin America Baby Toys Market Size (US$ Mn) (Million Units), by Age Group, 2017–2031

7.1.1. 0 – 6 Months

7.1.2. 7 – 12 Months

7.1.3. 1 – 2 Years

7.1.4. 2 – 3 Years

7.1.5. 3 – 4 Years

7.1.6. Above 4 Years

7.2. Incremental Opportunity, by Age Group

8. Latin America Baby Toys Market Analysis and Forecast, by Category

8.1. Latin America Baby Toys Market Size (US$ Mn) (Million Units), by Category, 2017–2031

8.1.1. Electric

8.1.2. Non-electric

8.2. Incremental Opportunity, by Category

9. Latin America Baby Toys Market Analysis and Forecast, by Application

9.1. Latin America Baby Toys Market Size (US$ Mn) (Million Units), by Application, 2017–2031

9.1.1. Indoor Baby Toys

9.1.2. Outdoor Baby Toys

9.2. Incremental Opportunity, by Application

10. Latin America Baby Toys Market Analysis and Forecast, by End-user

10.1. Latin America Baby Toys Market Size (US$ Mn) (Million Units), by End-user, 2017–2031

10.1.1. Residential

10.1.2. Commercial

10.1.2.1. Day Care Centers

10.1.2.2. Baby Orphanage

10.1.2.3. Pre-school Centers

10.1.2.4. Others (infant hospitals, malls, etc.)

10.2. Incremental Opportunity, by End-user

11. Latin America Baby Toys Market Analysis and Forecast, by Distribution Channel

11.1. Latin America Baby Toys Market Size (US$ Mn) (Million Units), by Distribution Channel, 2017–2031

11.1.1. Online

11.1.1.1. Company Owned Website

11.1.1.2. E-commerce websites

11.1.2. Offline

11.1.2.1. Supermarket/Hypermarket

11.1.2.2. Baby Specialty Stores

11.1.2.3. Departmental Stores

11.1.2.4. Catalogue/Magazine Retail

11.1.2.5. Other Retail Stores

11.2. Incremental Opportunity, by Distribution Channel

12. Latin America Baby Toys Market Analysis and Forecast, by Country

12.1. Latin America Baby Toys Market Size (US$ Mn) (Million Units), by Country, 2017–2031

12.1.1. Brazil

12.1.2. Mexico

12.1.3. Rest of Latin America

12.2. Incremental Opportunity, by Country

13. Brazil Baby Toys Market Analysis and Forecast

13.1. Country Snapshot

13.2. Demographic Overview

13.3. Key Trend Analysis

13.3.1. Supply Side

13.3.2. Demand Side

13.4. Market Share Analysis (%)

13.5. Consumer Buying Behavior Analysis

13.6. Pricing Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Baby Toys Market Size (US$ Mn) (Million Units), by Product Type, 2017–2031

13.7.1. Rattles

13.7.2. Floor Gyms

13.7.3. Imitation Toys

13.7.4. Fabric Balls

13.7.5. Activity Boards

13.7.6. Stacking Toys/Locking Plastic Blocks/Shape Sorters

13.7.7. Play Doughs

13.7.8. Push or Pull Toys

13.7.9. Dolls & Stuffed Animals

13.7.10. Action Toys

13.7.11. Board Games & Puzzles

13.7.12. Others (toy guns, construction toys, etc.)

13.8. Baby Toys Market Size (US$ Mn) (Million Units), by Age Group, 2017–2031

13.8.1. 0 – 6 Months

13.8.2. 7 – 12 Months

13.8.3. 1 – 2 Years

13.8.4. 2 – 3 Years

13.8.5. 3 – 4 Years

13.8.6. Above 4 Years

13.9. Baby Toys Market Size (US$ Mn) (Million Units), by Category, 2017–2031

13.9.1. Electric

13.9.2. Non-electric

13.10. Baby Toys Market Size (US$ Mn) (Million Units), by Application, 2017–2031

13.10.1. Indoor Baby Toys

13.10.2. Outdoor Baby Toys

13.11. Baby Toys Market Size (US$ Mn) (Million Units), by End-user, 2017–2031

13.11.1. Residential

13.11.2. Commercial

13.11.2.1. Day Care Centers

13.11.2.2. Baby Orphanage

13.11.2.3. Pre-school Centers

13.11.2.4. Others (infant hospitals, malls, etc.)

13.12. Baby Toys Market Size (US$ Mn) (Million Units), by Distribution Channel, 2017–2031

13.12.1. Online

13.12.1.1. Company Owned Website

13.12.1.2. E-commerce websites

13.12.2. Offline

13.12.2.1. Supermarket/Hypermarket

13.12.2.2. Baby Specialty Stores

13.12.2.3. Departmental Stores

13.12.2.4. Catalogue/Magazine Retail

13.12.2.5. Other Retail Stores

13.13. Incremental Opportunity Analysis

14. Mexico Baby Toys Market Analysis and Forecast

14.1. Country Snapshot

14.2. Demographic Overview

14.3. Key Trend Analysis

14.3.1. Supply Side

14.3.2. Demand Side

14.4. Market Share Analysis (%)

14.5. Consumer Buying Behavior Analysis

14.6. Pricing Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Baby Toys Market Size (US$ Mn) (Million Units), by Product Type, 2017–2031

14.7.1. Rattles

14.7.2. Floor Gyms

14.7.3. Imitation Toys

14.7.4. Fabric Balls

14.7.5. Activity Boards

14.7.6. Stacking Toys/Locking Plastic Blocks/Shape Sorters

14.7.7. Play Doughs

14.7.8. Push or Pull Toys

14.7.9. Dolls & Stuffed Animals

14.7.10. Action Toys

14.7.11. Board Games & Puzzles

14.7.12. Others (toy guns, construction toys, etc.)

14.8. Baby Toys Market Size (US$ Mn) (Million Units), by Age Group, 2017–2031

14.8.1. 0 – 6 Months

14.8.2. 7 – 12 Months

14.8.3. 1 – 2 Years

14.8.4. 2 – 3 Years

14.8.5. 3 – 4 Years

14.8.6. Above 4 Years

14.9. Baby Toys Market Size (US$ Mn) (Million Units), by Category, 2017–2031

14.9.1. Electric

14.9.2. Non-electric

14.10. Baby Toys Market Size (US$ Mn) (Million Units), by Application, 2017–2031

14.10.1. Indoor Baby Toys

14.10.2. Outdoor Baby Toys

14.11. Baby Toys Market Size (US$ Mn) (Million Units), by End-user, 2017–2031

14.11.1. Residential

14.11.2. Commercial

14.11.2.1. Day Care Centers

14.11.2.2. Baby Orphanage

14.11.2.3. Pre-school Centers

14.11.2.4. Others (infant hospitals, malls, etc.)

14.12. Baby Toys Market Size (US$ Mn) (Million Units), by Distribution Channel, 2017–2031

14.12.1. Online

14.12.1.1. Company Owned Website

14.12.1.2. E-commerce websites

14.12.2. Offline

14.12.2.1. Supermarket/Hypermarket

14.12.2.2. Baby Specialty Stores

14.12.2.3. Departmental Stores

14.12.2.4. Catalogue/Magazine Retail

14.12.2.5. Other Retail Stores

14.13. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Competition Dashboard

15.2. Market Share Analysis % (2022)

15.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

15.3.1. Artsana SpA

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Information

15.3.1.4. (Subject to Data Availability)

15.3.1.5. Business Strategies / Recent Developments

15.3.2. Basic Fun! Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Information

15.3.2.4. (Subject to Data Availability)

15.3.2.5. Business Strategies / Recent Developments

15.3.3. Hasbro, Inc.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Information

15.3.3.4. (Subject to Data Availability)

15.3.3.5. Business Strategies / Recent Developments

15.3.4. LEGO System A/S

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Information

15.3.4.4. (Subject to Data Availability)

15.3.4.5. Business Strategies / Recent Developments

15.3.5. Linc Limited

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Information

15.3.5.4. (Subject to Data Availability)

15.3.5.5. Business Strategies / Recent Developments

15.3.6. Roma Brinquedos

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Information

15.3.6.4. (Subject to Data Availability)

15.3.6.5. Business Strategies / Recent Developments

15.3.7. Simba Dickie Group

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Information

15.3.7.4. (Subject to Data Availability)

15.3.7.5. Business Strategies / Recent Developments

15.3.8. Spin Master

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Information

15.3.8.4. (Subject to Data Availability)

15.3.8.5. Business Strategies / Recent Developments

15.3.9. VTech Holdings Limited

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Information

15.3.9.4. (Subject to Data Availability)

15.3.9.5. Business Strategies / Recent Developments

15.3.10. Zoop Toys

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Information

15.3.10.4. (Subject to Data Availability)

15.3.10.5. Business Strategies / Recent Developments

16. Go To Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Understanding the Buying Process of the Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Latin America Baby Toys Market Value (US$ Mn), by Product Type, 2017-2031

Table 2: Latin America Baby Toys Market Volume (Million Units), by Product Type, 2017-2031

Table 3: Latin America Baby Toys Market Value (US$ Mn), by Age Group, 2017-2031

Table 4: Latin America Baby Toys Market Volume (Million Units), by Age Group, 2017-2031

Table 5: Latin America Baby Toys Market Value (US$ Mn), by Category, 2017-2031

Table 6: Latin America Baby Toys Market Volume (Million Units), by Category, 2017-2031

Table 7: Latin America Baby Toys Market Value (US$ Mn), by Application, 2017-2031

Table 8: Latin America Baby Toys Market Volume (Million Units), by Application, 2017-2031

Table 9: Latin America Baby Toys Market Value (US$ Mn), by End-user, 2017-2032

Table 10: Latin America Baby Toys Market Volume (Million Units), by End-user, 2017-2033

Table 11: Latin America Baby Toys Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 12: Latin America Baby Toys Market Volume (Million Units), by Distribution Channel, 2017-2031

Table 13: Latin America Baby Toys Market Value (US$ Mn), by Country, 2017-2031

Table 14: Latin America Baby Toys Market Volume (Million Units), by Country, 2017-2031

Table 15: Brazil Baby Toys Market Value (US$ Mn), by Product Type, 2017-2031

Table 16: Brazil Baby Toys Market Volume (Million Units), by Product Type, 2017-2031

Table 17: Brazil Baby Toys Market Value (US$ Mn), by Age Group, 2017-2031

Table 18: Brazil Baby Toys Market Volume (Million Units), by Age Group, 2017-2031

Table 19: Brazil Baby Toys Market Value (US$ Mn), by Category, 2017-2031

Table 20: Brazil Baby Toys Market Volume (Million Units), by Category, 2017-2031

Table 21: Brazil Baby Toys Market Value (US$ Mn), by Application, 2017-2031

Table 22: Brazil Baby Toys Market Volume (Million Units), by Application, 2017-2031

Table 23: Brazil Baby Toys Market Value (US$ Mn), by End-user, 2017-2032

Table 24: Brazil Baby Toys Market Volume (Million Units), by End-user, 2017-2033

Table 25: Brazil Baby Toys Market Value (US$ Mn), by Distribution Channel, 2017-2034

Table 26: Brazil Baby Toys Market Volume (Million Units), by Distribution Channel, 2017-2031

Table 27: Mexico Baby Toys Market Value (US$ Mn), by Product Type, 2017-2031

Table 28: Mexico Baby Toys Market Volume (Million Units), by Product Type, 2017-2031

Table 29: Mexico Baby Toys Market Value (US$ Mn), by Age Group, 2017-2031

Table 30: Mexico Baby Toys Market Volume (Million Units), by Age Group, 2017-2031

Table 31: Mexico Baby Toys Market Value (US$ Mn), by Category, 2017-2031

Table 32: Mexico Baby Toys Market Volume (Million Units), by Category, 2017-2031

Table 33: Mexico Baby Toys Market Value (US$ Mn), by Application, 2017-2031

Table 34: Mexico Baby Toys Market Volume (Million Units), by Application, 2017-2031

Table 35: Mexico Baby Toys Market Value (US$ Mn), by End-user, 2017-2032

Table 36: Mexico Baby Toys Market Volume (Million Units), by End-user, 2017-2033

Table 37: Mexico Baby Toys Market Value (US$ Mn), by Distribution Channel, 2017-2034

Table 38: Mexico Baby Toys Market Volume (Million Units), by Distribution Channel, 2017-2031

List of Figures

Figure 1: Latin America Baby Toys Market Value (US$ Mn), by Product Type, 2017-2031

Figure 2: Latin America Baby Toys Market Volume (Million Units), by Product Type, 2017-2031

Figure 3: Latin America Baby Toys Market Incremental Opportunity (US$ Mn), by Product Type, 2023-2031

Figure 4: Latin America Baby Toys Market Value (US$ Mn), by Age Group, 2017-2031

Figure 5: Latin America Baby Toys Market Volume (Million Units), by Age Group, 2017-2031

Figure 6: Latin America Baby Toys Market Incremental Opportunity (US$ Mn), by Age Group, 2023-2031

Figure 7: Latin America Baby Toys Market Value (US$ Mn), by Category, 2017-2031

Figure 8: Latin America Baby Toys Market Volume (Million Units), by Category, 2017-2031

Figure 9: Latin America Baby Toys Market Incremental Opportunity (US$ Mn), by Category, 2023-2031

Figure 10: Latin America Baby Toys Market Value (US$ Mn), by Application, 2017-2031

Figure 11: Latin America Baby Toys Market Volume (Million Units), by Application, 2017-2031

Figure 12: Latin America Baby Toys Market Incremental Opportunity (US$ Mn), by Application, 2023-2031

Figure 13: Latin America Baby Toys Market Value (US$ Mn), by End-user, 2017-2032

Figure 14: Latin America Baby Toys Market Volume (Million Units), by End-user, 2017-2033

Figure 15: Latin America Baby Toys Market Incremental Opportunity (US$ Mn), by End-user, 2017-2034

Figure 16: Latin America Baby Toys Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 17: Latin America Baby Toys Market Volume (Million Units), by Distribution Channel, 2017-2031

Figure 18: Latin America Baby Toys Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2023-2031

Figure 19: Latin America Baby Toys Market Value (US$ Mn), by Country, 2017-2031

Figure 20: Latin America Baby Toys Market Volume (Million Units), by Country, 2017-2031

Figure 21: Latin America Baby Toys Market Incremental Opportunity (US$ Mn), by Country, 2023-2031

Figure 22: Brazil Baby Toys Market Value (US$ Mn), by Product Type, 2017-2031

Figure 23: Brazil Baby Toys Market Volume (Million Units), by Product Type, 2017-2031

Figure 24: Brazil Baby Toys Market Incremental Opportunity (US$ Mn), by Product Type, 2023-2031

Figure 25: Brazil Baby Toys Market Value (US$ Mn), by Age Group, 2017-2031

Figure 26: Brazil Baby Toys Market Volume (Million Units), by Age Group, 2017-2031

Figure 27: Brazil Baby Toys Market Incremental Opportunity (US$ Mn), by Age Group, 2023-2031

Figure 28: Brazil Baby Toys Market Value (US$ Mn), by Category, 2017-2031

Figure 29: Brazil Baby Toys Market Volume (Million Units), by Category, 2017-2031

Figure 30: Brazil Baby Toys Market Incremental Opportunity (US$ Mn), by Category, 2023-2031

Figure 31: Brazil Baby Toys Market Value (US$ Mn), by Application, 2017-2031

Figure 32: Brazil Baby Toys Market Volume (Million Units), by Application, 2017-2031

Figure 33: Brazil Baby Toys Market Incremental Opportunity (US$ Mn), by Application, 2023-2031

Figure 34: Brazil Baby Toys Market Value (US$ Mn), by End-user, 2017-2032

Figure 35: Brazil Baby Toys Market Volume (Million Units), by End-user, 2017-2033

Figure 36: Brazil Baby Toys Market Incremental Opportunity (US$ Mn), by End-user, 2017-2034

Figure 37: Brazil Baby Toys Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 38: Brazil Baby Toys Market Volume (Million Units), by Distribution Channel, 2017-2031

Figure 39: Brazil Baby Toys Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2023-2031

Figure 40: Mexico Baby Toys Market Value (US$ Mn), by Product Type, 2017-2031

Figure 41: Mexico Baby Toys Market Volume (Million Units), by Product Type, 2017-2031

Figure 42: Mexico Baby Toys Market Incremental Opportunity (US$ Mn), by Product Type, 2023-2031

Figure 43: Mexico Baby Toys Market Value (US$ Mn), by Age Group, 2017-2031

Figure 44: Mexico Baby Toys Market Volume (Million Units), by Age Group, 2017-2031

Figure 45: Mexico Baby Toys Market Incremental Opportunity (US$ Mn), by Age Group, 2023-2031

Figure 46: Mexico Baby Toys Market Value (US$ Mn), by Category, 2017-2031

Figure 47: Mexico Baby Toys Market Volume (Million Units), by Category, 2017-2031

Figure 48: Mexico Baby Toys Market Incremental Opportunity (US$ Mn), by Category, 2023-2031

Figure 49: Mexico Baby Toys Market Value (US$ Mn), by Application, 2017-2031

Figure 50: Mexico Baby Toys Market Volume (Million Units), by Application, 2017-2031

Figure 51: Mexico Baby Toys Market Incremental Opportunity (US$ Mn), by Application, 2023-2031

Figure 52: Mexico Baby Toys Market Value (US$ Mn), by End-user, 2017-2032

Figure 53: Mexico Baby Toys Market Volume (Million Units), by End-user, 2017-2033

Figure 54: Mexico Baby Toys Market Incremental Opportunity (US$ Mn), by End-user, 2017-2034

Figure 55: Mexico Baby Toys Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 56: Mexico Baby Toys Market Volume (Million Units), by Distribution Channel, 2017-2031

Figure 57: Mexico Baby Toys Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2023-2031