Analysts’ Viewpoint

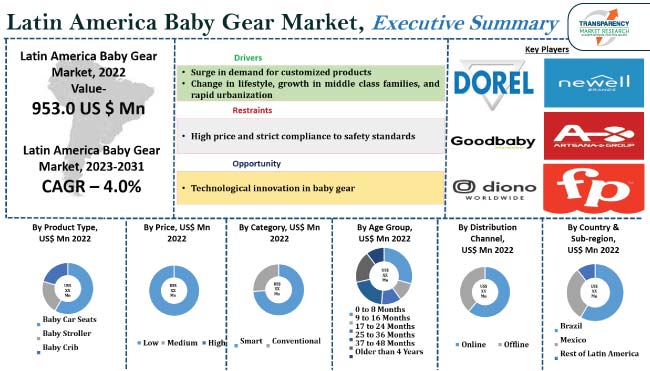

The Latin America baby gear industry has exhibited significant growth and potential in recent years. The region's expanding middle class population and increase in disposable income have led to greater spending on baby products, leading to substantial market progress. Additionally, the rise in awareness of child safety and well-being has fueled demand for high-quality baby gear, including strollers, car seats, and cribs. Rapid urbanization and changing lifestyles have also resulted in substantial Latin America baby gear market demand.

However, the market does face challenges, such as concerns about product safety standards. As a result, the baby gear market in Latin America represents an enticing opportunity for both established and emerging brands willing to tailor their offerings to meet the evolving needs of this dynamic region.

Products for baby gear are essentials that make it easier for parents to care for their young children. These items are made to offer ease, safety, and comfort to both parents and their infant. Baby strollers, car seats, and cribs are a few of the widely used baby gear items.

Baby strollers provide a comfortable and convenient means of transportation for parents who want to venture out with their little one. Baby car seats ensure the baby’s safety while on the road. Baby cribs serve as a secure and cozy sanctuary for an infant to sleep soundly. These are just some of the essential baby gear products that can help make parenting easier while keeping the little one safe and comfortable. In the baby products industry, a number of manufacturers are experimenting to provide innovative products that meet the diverse preferences of parents.

Consumer preference for high-end customizable products, rapid urbanization, safety concerns, and evolving lifestyles are key factors likely to fuel the Latin America baby gear market growth. The baby care gear market in Brazil is changing as a result of these factors, offering lucrative opportunities to local and international manufacturers and dealers to meet the various needs of modern parents.

A growing number of parents are prepared to spend money on items including cribs, high-end strollers, and car seats that improve the comfort, safety, and general wellbeing of babies. Additionally, manufacturers are emphasizing more on customizing their goods. For example, Cradlewise, Inc. combines a bassinet and a crib in order to monitor the baby's every move.

Demand for time-saving and convenient baby gear that make parenting easier has increased due to urbanization, the rise of dual-income households, and the region’s growing middle class population, who have increased disposable income and the ability to spend more on high-quality baby gear products.

The rise in nuclear families has forced parents to rely on cutting-edge baby gear solutions to handle their hectic lifestyles. Products with multiple uses and compact designs that accommodate small living areas and the demand for portability are significant Latin America baby gear market trends. Furthermore, the focus on awareness campaigns and child safety rules are expected to increase the Latin America baby gear industry size in the upcoming years.

The Latin America baby gear market segmentation based on product type includes baby car seats, baby strollers, and baby cribs. Baby strollers are expected to dominate the market in 2023.

Baby strollers are available in a variety of options such as lightweight strollers, convertible or multifunctional strollers, twin and double strollers, prams, travel systems, and others (jogging strollers). Strollers ensure protection for babies against mishaps and provide enough storage space on the go. Moreover, a baby stroller is convenient to use and provides flexibility to move around. These factors are leading to increased demand for baby strollers among consumers in Latin America.

According to the latest Latin America baby gear market forecast, Brazil is likely to dominate the landscape. Surge in disposable incomes, rapid urbanization, and changing lifestyles are driving Brazil's baby gear market. Baby gear products are widely available in the market to meet a variety of parenting requirements and gaining traction among the populace.

Safety features such as adjustable mattress height, solid construction, and adherence to safety standards are highly valued by Brazilian parents, who are increasingly seeking new and superior baby gear products.

Detailed profiles of companies in the Latin America baby gear market research report are provided to evaluate their financials, key product offerings, recent developments, and strategies.

The top manufacturers of baby gear in Latin America include Dorel Industries, Newell Brands, Britax, Artsana Group, Multikids, Goodbaby International Holdings Ltd., Burigotto S/A, Galzerano, Diono LLC, and Mattel (Fisher-Price). These players have been progressively investing in advanced technologies and infrastructure to capture majority of the Latin America baby gear market share.

Each of these players have been profiled in the Latin America baby gear market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 953.0 Mn |

| Market Forecast Value in 2031 | US$ 1.3 Bn |

| Growth Rate (CAGR) | 4.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn/Bn for Value & Thousand Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Country Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 953.0 Mn in 2022

It is expected to reach US$ 1.3 Bn by 2031

Surge in demand for customized products, change in lifestyle, growth of middle class families, and rapid urbanization

The baby stroller segment contributes the largest share

It is booming in Brazil due to rise in disposable incomes, rapid urbanization, and changing lifestyles

Dorel Industries, Newell Brands, Britax, Artsana Group, Multikids, Goodbaby International Holdings Ltd., Burigotto S/A, Galzerano, Diono LLC, and Mattel (Fisher-Price)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Latin America Baby Gear Market Analysis and Forecast, 2023 - 2031

5.7.1. Market Value Projections (US$ Mn)

5.7.2. Market Volume Projections (Thousand Units)

6. Latin America Baby Gear Market Analysis and Forecast, By Product Type

6.1. Latin America Baby Gear Market Size (US$ Mn and Thousand Units), By Product Type, 2023 - 2031

6.1.1. Baby Car Seats

6.1.1.1. Infant Seats

6.1.1.2. Combination Seats

6.1.1.3. Convertible Seats

6.1.1.4. Booster Seats

6.1.1.4.1. High Back Booster Seats

6.1.1.4.2. Backless Booster Seats

6.1.2. Baby Stroller

6.1.2.1. Lightweight Stroller

6.1.2.2. Convertible or Multifunctional Strollers

6.1.2.3. Twin and Double Strollers

6.1.2.4. Prams

6.1.2.5. Travel System

6.1.2.6. Others (Jogging Strollers, etc.)

6.1.3. Baby Crib

6.1.3.1. Standard Cribs

6.1.3.2. Convertible Cribs

6.1.3.3. Others (Mini Crib, Travel, Crib, etc.)

6.2. Incremental Opportunity, By Product Type

7. Latin America Baby Gear Market Analysis and Forecast, By Price

7.1. Latin America Baby Gear Market Size (US$ Mn and Thousand Units), By Price, 2023 - 2031

7.1.1. Low

7.1.2. Medium

7.1.3. High

7.2. Incremental Opportunity, By Price

8. Latin America Baby Gear Market Analysis and Forecast, By Category

8.1. Latin America Baby Gear Market Size (US$ Mn and Thousand Units), By Category, 2023 - 2031

8.1.1. Smart

8.1.2. Conventional

8.2. Incremental Opportunity, By Category

9. Latin America Baby Gear Market Analysis and Forecast, By Age Group

9.1. Latin America Baby Gear Market Size (US$ Mn and Thousand Units), By Age Group, 2023 - 2031

9.1.1. 0 to 8 Months

9.1.2. 9 to 16 Months

9.1.3. 17 to 24 Months

9.1.4. 25 to 36 Months

9.1.5. 37 to 48 Months

9.1.6. Older than 4 Years

9.2. Incremental Opportunity, By Age Group

10. Latin America Baby Gear Market Analysis and Forecast, By Distribution Channel

10.1. Latin America Baby Gear Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2023 - 2031

10.1.1. Online

10.1.1.1. E-commerce Stores

10.1.1.2. Company Owned Website

10.1.2. Offline

10.1.2.1. Supermarket/Hypermarket

10.1.2.2. Departmental Stores

10.1.2.3. Specialty Stores

10.1.2.4. Other Retail Stores

10.2. Incremental Opportunity, By Distribution Channel

11. Latin America Baby Gear Market Analysis and Forecast, Country

11.1. Latin America Baby Gear Market Size (US$ Mn and Thousand Units), By Country, 2023 - 2031

11.1.1. Brazil

11.1.2. Mexico

11.1.3. Rest of Latin America

11.2. Incremental Opportunity, By Country

12. Brazil Baby Gear Market Analysis and Forecast

12.1. Country Snapshot

12.2. Demographic Overview

12.3. Key Trends Analysis

12.3.1. Supply Side

12.3.2. Demand Side

12.4. Market Share Analysis (%)

12.5. Consumer Buying Behavior Analysis

12.6. Pricing Analysis

12.6.1. Weighted Average Selling Price (US$)

12.7. Baby Gear Market Size (US$ Mn and Thousand Units), By Product Type, 2023 - 2031

12.7.1. Baby Car Seats

12.7.1.1. Infant Seats

12.7.1.2. Combination Seats

12.7.1.3. Convertible Seats

12.7.1.4. Booster Seats

12.7.1.4.1. High Back Booster Seats

12.7.1.4.2. Backless Booster Seats

12.7.2. Baby Stroller

12.7.2.1. Lightweight Stroller

12.7.2.2. Convertible or Multifunctional Strollers

12.7.2.3. Twin and Double Strollers

12.7.2.4. Prams

12.7.2.5. Travel System

12.7.2.6. Others (Jogging Strollers, etc.)

12.7.3. Baby Crib

12.7.3.1. Standard Cribs

12.7.3.2. Convertible Cribs

12.7.3.3. Others (Mini Crib, Travel, Crib, etc.)

12.8. Baby Gear Market Size (US$ Mn and Thousand Units), By Price, 2023 - 2031

12.8.1. Low

12.8.2. Medium

12.8.3. High

12.9. Baby Gear Market Size (US$ Mn and Thousand Units), By Category, 2023 - 2031

12.9.1. Smart

12.9.2. Conventional

12.10. Baby Gear Market Size (US$ Mn and Thousand Units), By Age Group, 2023 - 2031

12.10.1. 0 to 8 Months

12.10.2. 9 to 16 Months

12.10.3. 17 to 24 Months

12.10.4. 25 to 36 Months

12.10.5. 37 to 48 Months

12.10.6. Older than 4 Years

12.11. Baby Gear Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2023 - 2031

12.11.1. Online

12.11.1.1. E-commerce Website

12.11.1.2. Company Owned Website

12.11.2. Offline

12.11.2.1. Hypermarket/Supermarket

12.11.2.2. Departmental Stores

12.11.2.3. Specialty Stores

12.11.2.4. Other Retail Stores

12.12. Incremental Opportunity Analysis

13. Mexico Baby Gear Market Analysis and Forecast

13.1. Country Snapshot

13.2. Demographic Overview

13.3. Key Trends Analysis

13.3.1. Supply Side

13.3.2. Demand Side

13.4. Market Share Analysis (%)

13.5. Consumer Buying Behavior Analysis

13.6. Pricing Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Baby Gear Market Size (US$ Mn and Thousand Units), By Product Type, 2023 - 2031

13.7.1. Baby Car Seats

13.7.1.1. Infant Seats

13.7.1.2. Combination Seats

13.7.1.3. Convertible Seats

13.7.1.4. Booster Seats

13.7.1.4.1. High Back Booster Seats

13.7.1.4.2. Backless Booster Seats

13.7.2. Baby Stroller

13.7.2.1. Lightweight Stroller

13.7.2.2. Convertible or Multifunctional Strollers

13.7.2.3. Twin and Double Strollers

13.7.2.4. Prams

13.7.2.5. Travel System

13.7.2.6. Others (Jogging Strollers, etc.)

13.7.3. Baby Crib

13.7.3.1. Standard Cribs

13.7.3.2. Convertible Cribs

13.7.3.3. Others (Mini Crib, Travel, Crib, etc.)

13.8. Baby Gear Market Size (US$ Mn and Thousand Units), By Price, 2023 - 2031

13.8.1. Low

13.8.2. Medium

13.8.3. High

13.9. Baby Gear Market Size (US$ Mn and Thousand Units), By Category, 2023 - 2031

13.9.1. Smart

13.9.2. Conventional

13.10. Baby Gear Market Size (US$ Mn and Thousand Units), By Age Group, 2023 - 2031

13.10.1. 0 to 8 Months

13.10.2. 9 to 16 Months

13.10.3. 17 to 24 Months

13.10.4. 25 to 36 Months

13.10.5. 37 to 48 Months

13.10.6. Older than 4 Years

13.11. Baby Gear Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2023 - 2031

13.11.1. Online

13.11.1.1. E-commerce Website

13.11.1.2. Company Owned Website

13.11.2. Offline

13.11.2.1. Hypermarket/Supermarket

13.11.2.2. Departmental Stores

13.11.2.3. Specialty Stores

13.11.2.4. Other Retail Stores

13.12. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%), 2022

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

14.3.1. Dorel Industries

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Financial/Revenue

14.3.1.4. Strategy & Business Overview

14.3.1.5. Sales Channel Analysis

14.3.1.6. Size Portfolio

14.3.2. Newell Brands

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Financial/Revenue

14.3.2.4. Strategy & Business Overview

14.3.2.5. Sales Channel Analysis

14.3.2.6. Size Portfolio

14.3.3. Britax

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Financial/Revenue

14.3.3.4. Strategy & Business Overview

14.3.3.5. Sales Channel Analysis

14.3.3.6. Size Portfolio

14.3.4. Artsana Group

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Financial/Revenue

14.3.4.4. Strategy & Business Overview

14.3.4.5. Sales Channel Analysis

14.3.4.6. Size Portfolio

14.3.5. Multikids

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Financial/Revenue

14.3.5.4. Strategy & Business Overview

14.3.5.5. Sales Channel Analysis

14.3.5.6. Size Portfolio

14.3.6. Goodbaby International Holdings Ltd.

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Financial/Revenue

14.3.6.4. Strategy & Business Overview

14.3.6.5. Sales Channel Analysis

14.3.6.6. Size Portfolio

14.3.7. Burigotto S/A

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Financial/Revenue

14.3.7.4. Strategy & Business Overview

14.3.7.5. Sales Channel Analysis

14.3.7.6. Size Portfolio

14.3.8. Galzerano

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Financial/Revenue

14.3.8.4. Strategy & Business Overview

14.3.8.5. Sales Channel Analysis

14.3.8.6. Size Portfolio

14.3.9. Diono LLC

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Financial/Revenue

14.3.9.4. Strategy & Business Overview

14.3.9.5. Sales Channel Analysis

14.3.9.6. Size Portfolio

14.3.10. Mattel (Fisher-Price)

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Financial/Revenue

14.3.10.4. Strategy & Business Overview

14.3.10.5. Sales Channel Analysis

14.3.10.6. Size Portfolio

14.3.11. Other Key Players

14.3.11.1. Company Overview

14.3.11.2. Sales Area/Geographical Presence

14.3.11.3. Financial/Revenue

14.3.11.4. Strategy & Business Overview

14.3.11.5. Sales Channel Analysis

14.3.11.6. Size Portfolio

15. Go to Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Understanding the Buying Process of Customers

List of Tables

Table 1: Latin America Baby Gear Market Value (US$ Mn), by Product Type, 2023-2031

Table 2: Latin America Baby Gear Market Volume (Thousand Units), by Product Type, 2023-2031

Table 3: Latin America Baby Gear Market Value (US$ Mn), by Price, 2023-2031

Table 4: Latin America Baby Gear Market Volume (Thousand Units), by Price, 2023-2031

Table 5: Latin America Baby Gear Market Value (US$ Mn), by Category, 2023-2031

Table 6: Latin America Baby Gear Market Volume (Thousand Units), by Category, 2023-2031

Table 7: Latin America Baby Gear Market Value (US$ Mn), by Age Group, 2023-2031

Table 8: Latin America Baby Gear Market Volume (Thousand Units), by Age Group, 2023-2031

Table 9: Latin America Baby Gear Market Value (US$ Mn), by Distribution Channel, 2023-2031

Table 10: Latin America Baby Gear Market Volume (Thousand Units), by Distribution Channel, 2023-2031

Table 11: Latin America Baby Gear Market Value (US$ Mn), by Country, 2023-2031

Table 12: Latin America Baby Gear Market Volume (Thousand Units), by Country, 2023-2031

Table 13: Brazil Baby Gear Market Value (US$ Mn), by Product Type, 2023-2031

Table 14: Brazil Baby Gear Market Volume (Thousand Units), by Product Type, 2023-2031

Table 15: Brazil Baby Gear Market Value (US$ Mn), by Price, 2023-2031

Table 16: Brazil Baby Gear Market Volume (Thousand Units), by Price, 2023-2031

Table 17: Brazil Baby Gear Market Value (US$ Mn), by Category, 2023-2031

Table 18: Brazil Baby Gear Market Volume (Thousand Units), by Category, 2023-2031

Table 19: Brazil Baby Gear Market Value (US$ Mn), by Age Group, 2023-2031

Table 20: Brazil Baby Gear Market Volume (Thousand Units), by Age Group, 2023-2031

Table 21: Brazil Baby Gear Market Value (US$ Mn), by Distribution Channel, 2023-2031

Table 22: Brazil Baby Gear Market Volume (Thousand Units), by Distribution Channel, 2023-2031

Table 23: Mexico Baby Gear Market Value (US$ Mn), by Product Type, 2023-2031

Table 24: Mexico Baby Gear Market Volume (Thousand Units), by Product Type, 2023-2031

Table 25: Mexico Baby Gear Market Value (US$ Mn), by Price, 2023-2031

Table 26: Mexico Baby Gear Market Volume (Thousand Units), by Price, 2023-2031

Table 27: Mexico Baby Gear Market Value (US$ Mn), by Category, 2023-2031

Table 28: Mexico Baby Gear Market Volume (Thousand Units), by Category, 2023-2031

Table 29: Mexico Baby Gear Market Value (US$ Mn), by Age Group, 2023-2031

Table 30: Mexico Baby Gear Market Volume (Thousand Units), by Age Group, 2023-2031

Table 31: Mexico Baby Gear Market Value (US$ Mn), by Distribution Channel, 2023-2031

Table 32: Mexico Baby Gear Market Volume (Thousand Units), by Distribution Channel, 2023-2031

List of Figures

Figure 1: Latin America Baby Gear Market Value (US$ Mn), by Product Type, 2023-2031

Figure 2: Latin America Baby Gear Market Volume (Thousand Units), by Product Type, 2023-2031

Figure 3: Latin America Baby Gear Market Incremental Opportunity (US$ Mn), by Product Type, 2023-2031

Figure 4: Latin America Baby Gear Market Value (US$ Mn), by Price, 2023-2031

Figure 5: Latin America Baby Gear Market Volume (Thousand Units), by Price, 2023-2031

Figure 6: Latin America Baby Gear Market Incremental Opportunity (US$ Mn), by Price, 2023-2031

Figure 7: Latin America Baby Gear Market Value (US$ Mn), by Category, 2023-2031

Figure 8: Latin America Baby Gear Market Volume (Thousand Units), by Category, 2023-2031

Figure 9: Latin America Baby Gear Market Incremental Opportunity (US$ Mn), by Category, 2023-2031

Figure 10: Latin America Baby Gear Market Value (US$ Mn), by Age Group, 2023-2031

Figure 11: Latin America Baby Gear Market Volume (Thousand Units), by Age Group, 2023-2031

Figure 12: Latin America Baby Gear Market Incremental Opportunity (US$ Mn), by Age Group, 2023-2031

Figure 13: Latin America Baby Gear Market Value (US$ Mn), by Distribution Channel, 2023-2031

Figure 14: Latin America Baby Gear Market Volume (Thousand Units), by Distribution Channel, 2023-2031

Figure 15: Latin America Baby Gear Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2023-2031

Figure 16: Latin America Baby Gear Market Value (US$ Mn), by Country, 2023-2031

Figure 17: Latin America Baby Gear Market Volume (Thousand Units), by Country, 2023-2031

Figure 18: Latin America Baby Gear Market Incremental Opportunity (US$ Mn), by Country, 2023-2031

Figure 19: Brazil Baby Gear Market Value (US$ Mn), by Product Type, 2023-2031

Figure 20: Brazil Baby Gear Market Volume (Thousand Units), by Product Type, 2023-2031

Figure 21: Brazil Baby Gear Market Incremental Opportunity (US$ Mn), by Product Type, 2023-2031

Figure 22: Brazil Baby Gear Market Value (US$ Mn), by Price, 2023-2031

Figure 23: Brazil Baby Gear Market Volume (Thousand Units), by Price, 2023-2031

Figure 24: Brazil Baby Gear Market Incremental Opportunity (US$ Mn), by Price, 2023-2031

Figure 25: Brazil Baby Gear Market Value (US$ Mn), by Category, 2023-2031

Figure 26: Brazil Baby Gear Market Volume (Thousand Units), by Category, 2023-2031

Figure 27: Brazil Baby Gear Market Incremental Opportunity (US$ Mn), by Category, 2023-2031

Figure 28: Brazil Baby Gear Market Value (US$ Mn), by Age Group, 2023-2031

Figure 29: Brazil Baby Gear Market Volume (Thousand Units), by Age Group, 2023-2031

Figure 30: Brazil Baby Gear Market Incremental Opportunity (US$ Mn), by Age Group, 2023-2031

Figure 31: Brazil Baby Gear Market Value (US$ Mn), by Distribution Channel, 2023-2031

Figure 32: Brazil Baby Gear Market Volume (Thousand Units), by Distribution Channel, 2023-2031

Figure 33: Brazil Baby Gear Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2023-2031

Figure 34: Mexico Baby Gear Market Value (US$ Mn), by Product Type, 2023-2031

Figure 35: Mexico Baby Gear Market Volume (Thousand Units), by Product Type, 2023-2031

Figure 36: Mexico Baby Gear Market Incremental Opportunity (US$ Mn), by Product Type, 2023-2031

Figure 37: Mexico Baby Gear Market Value (US$ Mn), by Price, 2023-2031

Figure 38: Mexico Baby Gear Market Volume (Thousand Units), by Price, 2023-2031

Figure 39: Mexico Baby Gear Market Incremental Opportunity (US$ Mn), by Price, 2023-2031

Figure 40: Mexico Baby Gear Market Value (US$ Mn), by Category, 2023-2031

Figure 41: Mexico Baby Gear Market Volume (Thousand Units), by Category, 2023-2031

Figure 42: Mexico Baby Gear Market Incremental Opportunity (US$ Mn), by Category, 2023-2031

Figure 43: Mexico Baby Gear Market Value (US$ Mn), by Age Group, 2023-2031

Figure 44: Mexico Baby Gear Market Volume (Thousand Units), by Age Group, 2023-2031

Figure 45: Mexico Baby Gear Market Incremental Opportunity (US$ Mn), by Age Group, 2023-2031

Figure 46: Mexico Baby Gear Market Value (US$ Mn), by Distribution Channel, 2023-2031

Figure 47: Mexico Baby Gear Market Volume (Thousand Units), by Distribution Channel, 2023-2031

Figure 48: Mexico Baby Gear Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2023-2031