The global laryngeal implants market is consistent, driven by the evolution in surgical techniques and rise in awareness of voice restoration solutions. With the growing geriatric population and the rising diagnosis of vocal disorders, the medical community is responding with biocompatible material technology and minimally invasive techniques.

Not only are these advancements improving patient recovery but also promoting the adoption of implant therapy by practicing professionals more readily, particularly in developed economies as access widens.

Manufacturers have increasingly been concentrating on the customization and refinement of implant design in the last few years. Adjustable and injectable laryngeal implants, for instance, are gaining popularity as they have a higher precision quotient and lower revision rates. A case in point is the growth in the use of injectable implants such as hyaluronic acid derivatives in outpatient settings.

The market is also being driven by an increasing population of patients with voice disorders caused by neurological illnesses, injury, or cancer therapies. In the U.S., Germany, and Japan, hospitals are reporting an increase in laryngoplasty operations. This development rests on enhanced reimbursement policies as well as a more robust referral system among speech therapists and ENT professionals.

Further, partnerships between device makers and research facilities are speeding up the development cycles for products. For instance, Dutch and South Korean research facilities have helped develop newer polymer mixes with increased implant strength and compatibility with neighboring tissues. Such continuous upgrades are establishing faith in the long-term performance of laryngeal implants, resulting in a market that will progress consistently.

The global laryngeal implants industry over the next decade will be highlighted by steady growth based on shifting clinical demands and burgeoning access to specialist otolaryngology services. Among the prime movers in the trend is the heightened awareness of the importance of post-surgery recovery, especially among patients who have been treated for throat operations or injury to the vocal cords.

With greater numbers of patients and professionals being aware of the importance of early treatment for the voice, reconstructive laryngeal implant surgeries are increasingly being sought.

Also fueling the growth in the industry is the change in the health infrastructure in emerging economies with more investment being poured into advanced ENT care centers. India, Brazil, and Malaysia are all experiencing new centers with the ability for treating advanced voice disorder conditions, opening up the opportunity prospects for laryngeal implant operations.

This goes hand-in-hand with a worldwide trend for decentralized specialized care away from the metropolitan areas, making the recovery of the voice more attainable for more people.

Technologically, an increase in the application of lighter, patient-specific implant materials is facilitating higher procedural success rates. Surgical planning facilitated by the application of 3D printing and sophisticated imaging modalities has become more accurate, thereby increasing implant placement and recovery rates in patients. Higher procedural accuracy is making practitioners less nervous and patients less reluctant.

Also, professionals including the performing artist, teacher, and broadcaster are increasingly seeking treatment for voice dysfunction and fatigue. This group of users will be a main catalyst for elective laryngeal implant surgeries, especially in markets such as the U.S. and South Korea, in which voice health takes on cultural and vocational importance.

| Attribute | Detail |

|---|---|

| Laryngeal Implants Market Drivers |

|

One of the most influential drivers of the growth of the laryngeal implants market is the increase in incidence of voice disorders with aging. With the aging of the body, the larynx experiences body composition changes, including muscle atrophy, vocal cord elasticity loss, and nerve degeneration.

All these changes can lead to presbyphonia and vocal cord paralysis. All these voice disorders are bound to impact communication skills, quality of life, and social interaction and hence need clinical intervention. Older patients are the preferred choice for laryngeal augmentation surgery as they are prone to aspiration, respiratory complications, and poor vocal projection.

Healthcare professionals are embracing the need for providing restorative care, which implies restoring both - airway and voice function. For instance, Western European hospitals have seen an increased volume of medialization laryngoplasties among patients over the age of 65, signaling a growth dependency on implants for insufficient vocal folds.

In Japan, with more than 28% of the population over age 65, medical facilities have made enhanced investments into specialized voice clinics in order to accommodate this burgeoning demand.

The expanding geriatric population is thereby becoming a foundational catalyst, not just boosting procedural volume but also stimulating implant makers into developing age-specific implant systems suitable for these special anatomical and functional demands.

Continuous innovation in implantable materials, surgical tools, and procedural guidance systems is another major force driving the laryngeal implants market. With the advent of minimally invasive techniques, along with biocompatible and adjustable implants, the process is safer and more effective.

Technologies like shape-memory alloys and polymer implants have improved surgeons' skills toward greater tension and symmetry in the vocal folds and directly impacting voice quality. For example, several U.S.-based surgical centers have complemented intraoperative adjustability with titanium-based implants, providing real-time intraoperative adjustment to accommodate the unique vocal anatomy of each patient. This has minimized revision surgeries as well as recovery time.

In addition, the integration of advanced endoscopic tools and 3D imaging ensures precise placement, thereby further enhancing patient outcomes. In South Korea, multiple hospitals have begun utilizing AI-powered voice analysis software pre-operatively to decide the best implant strategy, enabling tailored intervention.

All such ongoing technological development is changing clinical workflow as well as patient expectations, rendering laryngeal implant procedures mainstream in both - developed and developing economies.

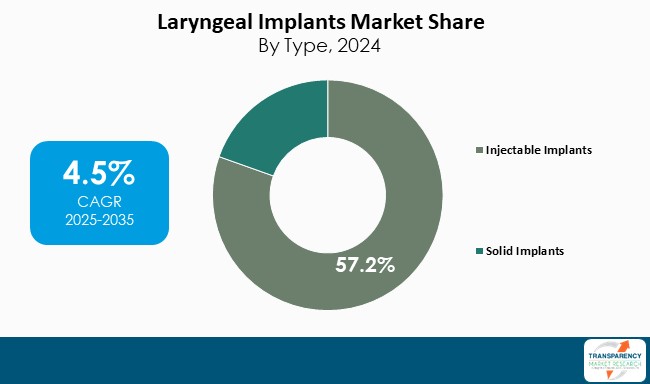

By type, the injectable implants segment leads the laryngeal implants market globally and is forecast to continue with the winning streak between 2024 and 2035. Injectable implants are likely to have a strong hold on the larynges market globally during the forecast period as they are minimally invasive, affordable, and can be used to treat a vast number of vocal disorders.

Injectable implants, commonly consisting of hyaluronic acid, calcium hydroxylapatite, or collagen derivative materials, are optimally suited for unilateral vocal fold paralysis or glottic insufficiency patients who need to obtain voice urgently without subjecting them to lengthy surgery.

Injectable implants are less dangerous and have lower recovery periods than traditional structural implants that require an operating room and general anesthesia since they can frequently be done in outpatient settings with local anesthesia.

For example, ENT clinics in the U.S. and Germany have increasingly used injectable implants composed of hyaluronic acid more frequently for transient medialization in patients with imminent nerve recovery following thyroid or cardiac surgery. Such treatments have resulted in promising results in the rehabilitation of vocal clarity and strength within minutes of injection.

Japanese voice rehabilitation clinics, in another instance, have utilized calcium-based injectables in geriatric patients who are not good surgical candidates, allowing quicker voice correction with lesser physical stresses.

The ease of dosage flexibility, adjustability, and the facility of retreatment options also enhance the popularity of injectables with clinicians and patients. Such a flexible and an easy application model is sure to propel their steady market leadership over the next few years.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

According to the latest trends in the laryngeal implants market, North America is expected to retain the highest percentage of the global market share. The region is covered by several ENT specialists and medical device companies that continually upgrade and expand their implant product portfolios.

Exposure to state-of-the-art surgical devices and early embracing of minimally invasive procedures have enabled practitioners across the United States and Canada to deliver improved treatment outcomes for voice disorders, which, in turn, fuel increasing procedural volumes.

For instance, the major U.S. academic medical centers such as the Mayo Clinic and Johns Hopkins Medicine have observed growth in laryngeal implant use in the treatment of temporary as well as permanent vocal fold paralysis. The centers are also involved in pilot programs and clinical trials assessing newer injectable products, which again contributes to the region's product development leadership and evidence-based practice.

Further, North America's demographic trend of an aging population and the occurrence of voice-affecting disorders such as Parkinson's disease and laryngeal cancer generate a constant demand for voice rehabilitation products.

Government assistance by way of Medicare and private insurance also increases the availability of patients to such procedures. This interactive network of technology, research, and delivery of healthcare sustains North America's leadership in the global market for laryngeal implants.

Merz Pharmaceuticals, LLC, E- Mold Techniques, Medtronic, Soluvos Medical, APrevent, E. Benson Hood Laboratories, Inc. are some of the players covered in the global laryngeal implants market report.

Each of these players has been profiled in the carrier screening market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

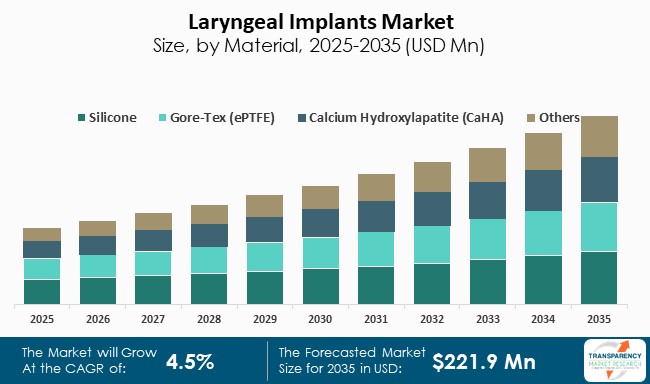

| Size in 2024 | US$ 136.1 Mn |

| Forecast Value in 2035 | US$ 221.9 Mn |

| CAGR | 4.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Mn |

| Laryngeal Implants Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The laryngeal implants market was valued at US$ 136.1 Mn in 2024.

The laryngeal implants market is projected to cross US$ 221.9 Mn by the end of 2035.

Rising incidence of voice disorders among aging population and technological advancements in implant design and surgical techniques.

The CAGR is anticipated to be 4.5% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Merz Pharmaceuticals, LLC, E-Mold Techniques, Medtronic, Soluvos Medical, APrevent, E. Benson Hood Laboratories, Inc., and others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Laryngeal Implants Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Laryngeal Implants Market Analysis and Forecast, 2020-2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Market Trends

5.3. Key Industry Events

5.4. PESTEL Analysis

5.5. Regulatory Scenario by Key Countries/Regions

5.6. PORTER’s Five Forces Analysis

5.7. Reimbursement Scenario by Key Countries

5.8. Pricing Analysis

5.9. Product/Brand Analysis

5.10. Supply Chain Analysis

6. Global Laryngeal Implants Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2020-2035

6.3.1. Injectable Implants

6.3.2. Solid Implants

6.4. Market Attractiveness Analysis, by Type

7. Global Laryngeal Implants Market Analysis and Forecast, by Material

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Material, 2020-2035

7.3.1. Silicone

7.3.2. Gore-Tex (ePTFE)

7.3.3. Calcium Hydroxylapatite (CaHA)

7.3.4. Others

7.4. Market Attractiveness Analysis, by Material

8. Global Laryngeal Implants Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2020-2035

8.3.1. Vocal Cord Paresis

8.3.2. Glottic Insufficiency

8.3.3. Augmentation for Professional Voice Users

8.4. Market Attractiveness Analysis, by Application

9. Global Laryngeal Implants Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2020-2035

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Specialty Clinics

9.3.4. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Laryngeal Implants Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2020-2035

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Region

11. North America Laryngeal Implants Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2020-2035

11.2.1. Injectable Implants

11.2.2. Solid Implants

11.3. Market Value Forecast, by Material, 2020-2035

11.3.1. Silicone

11.3.2. Gore-Tex (ePTFE)

11.3.3. Calcium Hydroxylapatite (CaHA)

11.3.4. Others

11.4. Market Value Forecast, by Application, 2020-2035

11.4.1. Vocal Cord Paresis

11.4.2. Glottic Insufficiency

11.4.3. Augmentation for Professional Voice Users

11.5. Market Value Forecast, by End-user, 2020-2035

11.5.1. Hospitals

11.5.2. Ambulatory Surgical Centers

11.5.3. Specialty Clinics

11.5.4. Others

11.6. Market Value Forecast, by Country, 2020-2035

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Material

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Laryngeal Implants Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2020-2035

12.2.1. Injectable Implants

12.2.2. Solid Implants

12.3. Market Value Forecast, by Material, 2020-2035

12.3.1. Silicone

12.3.2. Gore-Tex (ePTFE)

12.3.3. Calcium Hydroxylapatite (CaHA)

12.3.4. Others

12.4. Market Value Forecast, by Application, 2020-2035

12.4.1. Vocal Cord Paresis

12.4.2. Glottic Insufficiency

12.4.3. Augmentation for Professional Voice Users

12.5. Market Value Forecast, by End-user, 2020-2035

12.5.1. Hospitals

12.5.2. Ambulatory Surgical Centers

12.5.3. Specialty Clinics

12.5.4. Others

12.6. Market Value Forecast, by Country/Sub-region, 2020-2035

12.6.1. Germany

12.6.2. UK

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Material

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Laryngeal Implants Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2020-2035

13.2.1. Injectable Implants

13.2.2. Solid Implants

13.3. Market Value Forecast, by Material, 2020-2035

13.3.1. Silicone

13.3.2. Gore-Tex (ePTFE)

13.3.3. Calcium Hydroxylapatite (CaHA)

13.3.4. Others

13.4. Market Value Forecast, by Application, 2020-2035

13.4.1. Vocal Cord Paresis

13.4.2. Glottic Insufficiency

13.4.3. Augmentation for Professional Voice Users

13.5. Market Value Forecast, by End-user, 2020-2035

13.5.1. Hospitals

13.5.2. Ambulatory Surgical Centers

13.5.3. Specialty Clinics

13.5.4. Others

13.6. Market Value Forecast, by Country/Sub-region, 2020-2035

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Material

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Laryngeal Implants Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2020-2035

14.2.1. Injectable Implants

14.2.2. Solid Implants

14.3. Market Value Forecast, by Material, 2020-2035

14.3.1. Silicone

14.3.2. Gore-Tex (ePTFE)

14.3.3. Calcium Hydroxylapatite (CaHA)

14.3.4. Others

14.4. Market Value Forecast, by Application, 2020-2035

14.4.1. Vocal Cord Paresis

14.4.2. Glottic Insufficiency

14.4.3. Augmentation for Professional Voice Users

14.5. Market Value Forecast, by End-user, 2020-2035

14.5.1. Hospitals

14.5.2. Ambulatory Surgical Centers

14.5.3. Specialty Clinics

14.5.4. Others

14.6. Market Value Forecast, by Country/Sub-region, 2020-2035

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Type

14.7.2. By Material

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Laryngeal Implants Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Type, 2020-2035

15.2.1. Injectable Implants

15.2.2. Solid Implants

15.3. Market Value Forecast, by Material, 2020-2035

15.3.1. Silicone

15.3.2. Gore-Tex (ePTFE)

15.3.3. Calcium Hydroxylapatite (CaHA)

15.3.4. Others

15.4. Market Value Forecast, by Application, 2020-2035

15.4.1. Vocal Cord Paresis

15.4.2. Glottic Insufficiency

15.4.3. Augmentation for Professional Voice Users

15.5. Market Value Forecast, by End-user, 2020-2035

15.5.1. Hospitals

15.5.2. Ambulatory Surgical Centers

15.5.3. Specialty Clinics

15.5.4. Others

15.6. Market Value Forecast, by Country/Sub-region, 2020-2035

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Type

15.7.2. By Material

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis, by Company (2024)

16.3. Company Profiles

16.3.1. Merz Pharmaceuticals, LLC.

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. E- Mold Techniques

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. Medtronic

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. Soluvos Medical

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. APrevent

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. E. Benson Hood Laboratories, Inc.

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

List of Tables

Table 01: Global Laryngeal Implants Market Value (US$ Mn) Forecast, by Type, 2020-2035

Table 02: Global Laryngeal Implants Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 03: Global Laryngeal Implants Market Value (US$ Mn) Forecast, By Application, 2020-2035

Table 04: Global Laryngeal Implants Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Table 05: Global Laryngeal Implants Market Value (US$ Mn) Forecast, By Region, 2020-2035

Table 06: North America Laryngeal Implants Market Value (US$ Mn) Forecast, by Country, 2020-2035

Table 07: North America Laryngeal Implants Market Value (US$ Mn) Forecast, by Type, 2020-2035

Table 08: North America Laryngeal Implants Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 09: North America Laryngeal Implants Market Value (US$ Mn) Forecast, By Application, 2020-2035

Table 10: North America Laryngeal Implants Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Table 11: Europe Laryngeal Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe Laryngeal Implants Market Value (US$ Mn) Forecast, by Type, 2020-2035

Table 13: Europe Laryngeal Implants Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 14: Europe Laryngeal Implants Market Value (US$ Mn) Forecast, By Application, 2020-2035

Table 15: Europe Laryngeal Implants Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Table 16: Asia Pacific Laryngeal Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific Laryngeal Implants Market Value (US$ Mn) Forecast, by Type, 2020-2035

Table 18: Asia Pacific Laryngeal Implants Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 19: Asia Pacific Laryngeal Implants Market Value (US$ Mn) Forecast, By Application, 2020-2035

Table 20: Asia Pacific Laryngeal Implants Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Table 21: Latin America Laryngeal Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America Laryngeal Implants Market Value (US$ Mn) Forecast, by Type, 2020-2035

Table 23: Latin America Laryngeal Implants Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 24: Latin America Laryngeal Implants Market Value (US$ Mn) Forecast, By Application, 2020-2035

Table 25: Latin America Laryngeal Implants Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Table 26: Middle East and Africa Laryngeal Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East and Africa Laryngeal Implants Market Value (US$ Mn) Forecast, by Type, 2020-2035

Table 28: Middle East and Africa Laryngeal Implants Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 29: Middle East and Africa Laryngeal Implants Market Value (US$ Mn) Forecast, By Application, 2020-2035

Table 30: Middle East and Africa Laryngeal Implants Market Value (US$ Mn) Forecast, by End-user, 2020-2035

List of Figures

Figure 01: Global Laryngeal Implants Market Value Share Analysis, by Type, 2024 and 2035

Figure 02: Global Laryngeal Implants Market Attractiveness Analysis, by Type, 2025-2035

Figure 03: Global Laryngeal Implants Market Revenue (US$ Mn), by Injectable Implants, 2020-2035

Figure 04: Global Laryngeal Implants Market Revenue (US$ Mn), by Solid Implants, 2020-2035

Figure 05: Global Laryngeal Implants Market Value Share Analysis, by Material, 2024 and 2035

Figure 06: Global Laryngeal Implants Market Attractiveness Analysis, by Material, 2025-2035

Figure 07: Global Laryngeal Implants Market Revenue (US$ Mn), by Silicone, 2020-2035

Figure 08: Global Laryngeal Implants Market Revenue (US$ Mn), by Gore-Tex (ePTFE), 2020-2035

Figure 09: Global Laryngeal Implants Market Revenue (US$ Mn), by Calcium Hydroxylapatite (CaHA), 2020-2035

Figure 10: Global Laryngeal Implants Market Revenue (US$ Mn), by Others, 2020-2035

Figure 11: Global Laryngeal Implants Market Value Share Analysis, by Application, 2024 and 2035

Figure 12: Global Laryngeal Implants Market Attractiveness Analysis, by Application, 2025-2035

Figure 13: Global Laryngeal Implants Market Revenue (US$ Mn), by Vocal Cord Paresis, 2020-2035

Figure 14: Global Laryngeal Implants Market Revenue (US$ Mn), by Glottic Insufficiency, 2020-2035

Figure 15: Global Laryngeal Implants Market Revenue (US$ Mn), by Augmentation for Professional Voice Users, 2020-2035

Figure 16: Global Laryngeal Implants Market Value Share Analysis, by End-user, 2024 and 2035

Figure 17: Global Laryngeal Implants Market Attractiveness Analysis, by End-user, 2025-2035

Figure 18: Global Laryngeal Implants Market Revenue (US$ Mn), by Hospitals, 2020-2035

Figure 19: Global Laryngeal Implants Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2020-2035

Figure 20: Global Laryngeal Implants Market Revenue (US$ Mn), by Specialty Clinics, 2020-2035

Figure 21: Global Laryngeal Implants Market Revenue (US$ Mn), by Others, 2020-2035

Figure 22: Global Laryngeal Implants Market Value Share Analysis, By Region, 2024 and 2035

Figure 23: Global Laryngeal Implants Market Attractiveness Analysis, By Region, 2025-2035

Figure 24: North America Laryngeal Implants Market Value (US$ Mn) Forecast, 2020-2035

Figure 25: North America Laryngeal Implants Market Value Share Analysis, by Country, 2024 and 2035

Figure 26: North America Laryngeal Implants Market Attractiveness Analysis, by Country, 2025-2035

Figure 27: North America Laryngeal Implants Market Value Share Analysis, by Type, 2024 and 2035

Figure 28: North America Laryngeal Implants Market Attractiveness Analysis, by Type, 2025-2035

Figure 29: North America Laryngeal Implants Market Value Share Analysis, by Material, 2024 and 2035

Figure 30: North America Laryngeal Implants Market Attractiveness Analysis, by Material, 2025-2035

Figure 31: North America Laryngeal Implants Market Value Share Analysis, by Application, 2024 and 2035

Figure 32: North America Laryngeal Implants Market Attractiveness Analysis, by Application, 2025-2035

Figure 33: North America Laryngeal Implants Market Value Share Analysis, by End-user, 2024 and 2035

Figure 34: North America Laryngeal Implants Market Attractiveness Analysis, by End-user, 2025-2035

Figure 35: Europe Laryngeal Implants Market Value (US$ Mn) Forecast, 2020-2035

Figure 36: Europe Laryngeal Implants Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: Europe Laryngeal Implants Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 38: Europe Laryngeal Implants Market Value Share Analysis, by Type, 2024 and 2035

Figure 39: Europe Laryngeal Implants Market Attractiveness Analysis, by Type, 2025-2035

Figure 40: Europe Laryngeal Implants Market Value Share Analysis, By Material, 2024 and 2035

Figure 41: Europe Laryngeal Implants Market Attractiveness Analysis, By Material, 2025-2035

Figure 42: Europe Laryngeal Implants Market Value Share Analysis, by Application, 2024 and 2035

Figure 43: Europe Laryngeal Implants Market Attractiveness Analysis, by Application, 2025-2035

Figure 44: Europe Laryngeal Implants Market Value Share Analysis, by End-user, 2024 and 2035

Figure 45: Europe Laryngeal Implants Market Attractiveness Analysis, by End-user, 2025-2035

Figure 46: Asia Pacific Laryngeal Implants Market Value (US$ Mn) Forecast, 2020-2035

Figure 47: Asia Pacific Laryngeal Implants Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 48: Asia Pacific Laryngeal Implants Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 49: Asia Pacific Laryngeal Implants Market Value Share Analysis, by Type, 2024 and 2035

Figure 50: Asia Pacific Laryngeal Implants Market Attractiveness Analysis, by Type, 2025-2035

Figure 51: Asia Pacific Laryngeal Implants Market Value Share Analysis, By Material, 2024 and 2035

Figure 52: Asia Pacific Laryngeal Implants Market Attractiveness Analysis, By Material, 2025-2035

Figure 53: Asia Pacific Laryngeal Implants Market Value Share Analysis, by Application, 2024 and 2035

Figure 54: Asia Pacific Laryngeal Implants Market Attractiveness Analysis, by Application, 2025-2035

Figure 55: Asia Pacific Laryngeal Implants Market Value Share Analysis, by End-user, 2024 and 2035

Figure 56: Asia Pacific Laryngeal Implants Market Attractiveness Analysis, by End-user, 2025-2035

Figure 57: Latin America Laryngeal Implants Market Value (US$ Mn) Forecast, 2020-2035

Figure 58: Latin America Laryngeal Implants Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 59: Latin America Laryngeal Implants Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 60: Latin America Laryngeal Implants Market Value Share Analysis, by Type, 2024 and 2035

Figure 61: Latin America Laryngeal Implants Market Attractiveness Analysis, by Type, 2025-2035

Figure 62: Latin America Laryngeal Implants Market Value Share Analysis, By Material, 2024 and 2035

Figure 63: Latin America Laryngeal Implants Market Attractiveness Analysis, By Material, 2025-2035

Figure 64: Latin America Laryngeal Implants Market Value Share Analysis, by Application, 2024 and 2035

Figure 65: Latin America Laryngeal Implants Market Attractiveness Analysis, by Application, 2025-2035

Figure 66: Latin America Laryngeal Implants Market Value Share Analysis, by End-user, 2024 and 2035

Figure 67: Latin America Laryngeal Implants Market Attractiveness Analysis, by End-user, 2025-2035

Figure 68: Middle East & Africa Laryngeal Implants Market Value (US$ Mn) Forecast, 2020-2035

Figure 69: Middle East & Africa Laryngeal Implants Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 70: Middle East & Africa Laryngeal Implants Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 71: Middle East and Africa Laryngeal Implants Market Value Share Analysis, by Type, 2024 and 2035

Figure 72: Middle East and Africa Laryngeal Implants Market Attractiveness Analysis, by Type, 2025-2035

Figure 73: Middle East and Africa Laryngeal Implants Market Value Share Analysis, by Material, 2024 and 2035

Figure 74: Middle East and Africa Laryngeal Implants Market Attractiveness Analysis, By Material, 2025-2035

Figure 75: Middle East and Africa Laryngeal Implants Market Value Share Analysis, by Application, 2024 and 2035

Figure 76: Middle East and Africa Laryngeal Implants Market Attractiveness Analysis, by Application, 2025-2035

Figure 77: Middle East and Africa Laryngeal Implants Market Value Share Analysis, by End-user, 2024 and 2035

Figure 78: Middle East and Africa Laryngeal Implants Market Attractiveness Analysis, by End-user, 2025-2035