Lactose Market: Consumers’ Search for ‘Added Nutrition’ to Create Promising Opportunities

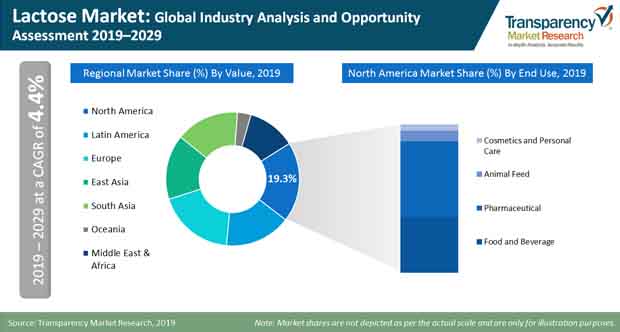

Lactose has been attracting the interest of the nutraceuticals and pharmaceuticals industry in recent times, as the global demographic continued to embrace the health & wellness trend. Our latest research finds that sales of lactose grew in excess of US$ 1.5 billion in 2018, and are set to record a Y-o-Y growth of over 3.5% in 2019. As the consumers’ quest for consuming more nutrition outside of their routine food grows, lactose evolves as the only source of galactose that meets the neural and immunological requirements of consumers. However, the fact that lactose intolerance found in millions of consumers dims the otherwise impressive scramble of lactose, which remains an uphill battle for the lactose manufacturers.

Lactose Market to Harvest Opportunities Sown by Customization of Products and Watered by ‘On-the-Go’ Culture

Surge in the demand for lactose in food and beverages industries cannot be ruled out as trends of customized products continue to accelerate the already robust traction. Recent studies in dairy science and manufacturing technologies have paved way for the development of better, safer, and economical lactose-based solutions, which resonate with evolving preferences of consumers. Efforts of lactose manufacturers to alter the carbohydrate, fat, and cholesterol levels in dairy products that cater to specific consumer demands, will continue favor growth of the lactose market

The fitness trend has been on a notable rise, and more individuals have been partaking in sports and physical activities, be it to meet the weight loss goals or improve endurance. Additionally, focus on ‘taste’ and ‘flavor’ has been moving them past the consumption of milk and streaming a new trend of calcium-fortified beverages induced with lactose. This trend syncs with the ‘on-the-go’ culture adopted by consumers as beverages such as fruit juices, soya milk, soft drinks, sports drink, and even water can undergo the calcium fortification process with contents of lactose.

Calcium-fortified beverages have received a green signal from consumers, and manufacturers operating in food and beverages industry are inspired to expend more efforts towards the diversification of their lactose-based products; preserves and spreads are their latest offerings with lactose.

Lactose Sales in North America Buoyed by Growing Consumer Consciousness on Beauty & Health

Concentration of dietary supplements industry in North America and Europe has played a pivotal role in underpinning the growth of lactose market. Consumers’ behavior of ditching the conventional dairy products for their daily recommended nutrition intake has expended lactose manufacturers’ effort towards making the intake of nutrition as easy as popping a pill, which is received well by consumers of the region. Apart from adult nutrition, lactose has even touched the child nutrition arena with the development of infant formula that caters to the dual-working household demography. Consistent efforts put forth by lactose manufacturers to upgrade their infant nutrition products by offering the ease of swallowing and enhancing taste that closely mimics the human milk are seamlessly strengthening the customer base for the lactose market.

As ‘eat to look fit’ mantra has caused a transition among consumers towards dietary supplements, F&B and cosmetics industries are enumerating applications for lactose. Concerns apropos of dietary fat and cholesterol have caused a switch from conventionally consumed milk to processed milk and dairy products that are altered with only the required nutrients and lactose forms it very basis. This has offered leeway to manufacturers for fostering product innovation by launching ‘consumer-centric’ lactose-induced food and beverages. Marketing becomes effortless for lactose-based products as awareness regarding the anti-aging benefits of lactose either availed by consumption or application on the skin and hair grows among consumers.

Multiple Players, Different Strategies, One Target - Competition Intensity to Turn up a Notch in Lactose Market

The competition present in the lactose market is at multiple levels. The top spots in the market are occupied by a handful of global players that account for a sizeable share of about 40-50%. With a view to armor their position in the market, quality remains their key weapon and the competition remains less intense in the top space. Collaborations with regional suppliers and distributors aid them to strengthen and widen their customer base. In contrast, players constituting the other tiers are investing to multiply their R&D centers and create an appealing product portfolio. Considering the broad scope of application that lactose boasts currently and the pace at which innovations are fueled, it is likely that the competition in the lactose market will only become intense during the forecast period.

The companies profiled in this study include BASF SE, E.I. du Pont de Nemours and Company, Fonterra Co-Operative Group Ltd., Glanbia Plc, Kerry Plc, Merck KGaA, Koninklijke FrieslandCampina N.V., Agropur Co-Operative, Alpavit Käserei Champignon Hofmeister GmbH & Co. KG, Avantor, Inc., Arla Foods, Tnuva Group, Zeria Pharmaceutical Co., Ltd., Hilmar Cheese Company, Inc., Hoogwegt Groep B.V., Meggle Group, Armor Pharma, Lactose Limited, Milei GmbH, Proliant Inc., Saputo Inc., and Tatua Co-Operative Dairy Company Ltd.

Lactose Market is expected to reach US$ 2,697.3 Mn in 2029

Lactose Market is estimated to rise at a CAGR of 4.4% during forecast period

Rising demand for lactose in food and beverages industries is expected to drive the Lactose Market

North America is more attractive for vendors in the Lactose Market

Key players of Lactose Market are BASF SE, E.I. du Pont de Nemours and Company, Fonterra Co-Operative Group Ltd., Glanbia Plc, Kerry Plc, Merck KGaA, Koninklijke FrieslandCampina N.V., Agropur Co-Operative, Alpavit Käserei Champignon Hofmeister GmbH & Co. KG, Avantor, Inc., Arla Foods, Tnuva Group, Zeria Pharmaceutical Co., Ltd., Hilmar Cheese Company, Inc., Hoogwegt Groep B.V., Meggle Group, Armor Pharma, Lactose Limited, Milei GmbH, Proliant Inc., Saputo Inc., and Tatua Co-Operative Dairy Comp

1. Global Lactose Market - Executive Summary

1.1. Global Lactose Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Opportunity Assessment- Winning & Loosing Components

1.5. Proprietary Wheel of Fortune

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Tendencies & Latest Buzz

3.1. Frugality: Product habit or passing fad?

3.2. Attractive segments for all

3.3. Transformed product attribute

3.4. Product and strategy in-synced

3.5. Anchoring potential markets

3.6. International Harmonization

4. Product Launch Track & Trends

4.1. Key Product Launches in last three years

4.2. Product launch frequency

4.3. Type of launches

4.4. Regions and countries in focus

4.5. Available alternatives

5. Risk, Marketing and STP Analysis

5.1. Associated Risk

5.1.1. Pertaining to regulatory framework and approvals

5.1.2. Related to standards and certifications for health concerns

5.1.3. Increasing supply chain volatility

5.1.4. Omni Channel & 21st Century Retailing

5.2. Opportunity

5.2.1. Innovative advertisement campaign

5.2.2. Untapped emerging market

5.2.3. Integrated market strategies

5.2.4. Price and Product Differentiation strategies

6. Market Dynamics

6.1. Macro-economic Factors

6.1.1. Rise in Consumption of Food Items across Globe

6.1.2. Global and Regional Per Capita Food Consumption (kcal per capita per day)

6.1.3. Population of Key Countries

6.1.4. Food and Beverage Industry Overview

6.1.5. Business Environment Outlook

6.1.6. Regional Production Vs. Consumption Outlook

6.1.7. Global Modern Trade Penetration and Grocery Market by Key Countries

6.1.8. Change in Consumer Price Indexes (Percentage Change) 2019 (Forecast)

6.1.9. Global Retail Dynamics

6.1.10. Global Trade Scenario

6.2. Trend Analysis- Impact on Time Line (2019-2029)

6.3. Forecast Factors - Relevance & Impact

6.3.1. Dairy Production Outlook

6.3.2. Trade Tariffs and Regulation Outlook

6.3.3. Production/Processing Capacity Growth

6.3.4. Pharmaceutical Industry Outlook

6.4. Market Dynamics

6.4.1. Drivers

6.4.2. Restraints

6.4.3. Opportunity

7. Key Regulations and Claims

7.1. Regulation by Region

7.2. FDA/USDA Regulation

7.3. Food Packaging Claims

7.4. Labeling and Claims

7.5. Import/Export Regulations

8. What to expect: The Winning Recipe & Challenges Assessment

8.1. Product Positioning Metrics

8.2. Product Utilization in High-Growth End Use Applications

8.3. Quality Certifications and Claims Impact Analysis

9. Supply Chain Analysis

9.1. Profitability Margin Analysis

9.2. List of Active Market Participants

9.2.1. List of Key Manufacturers

9.2.2. List of End User Companies

10. Global Lactose Market Pricing Analysis

10.1. Price Point Assessment by Nature

10.2. Regional Average Pricing Analysis

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. East Asia

10.2.5. South Asia

10.2.6. Oceania

10.2.7. Middle East & Africa

10.3. Price Forecast till 2029

10.4. Factors Influencing Pricing

11. Global Lactose Market Analysis and Forecast

11.1. Market Size Analysis (2014-2018) and Forecast (2019-2029)

11.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

11.1.2. Absolute $ Opportunity

11.2. Global Lactose Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

11.2.1. Forecast Factors and Relevance of Impact

11.2.2. Regional Lactose Market Business Performance Summary

12. Global Lactose Market Analysis Form

12.1. Introduction

12.1.1. Y-o-Y Growth Comparison Form

12.1.2. Basis Point Share (BPS) Analysis Form

12.2. Lactose Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) Form

12.2.1. Powder

12.2.2. Granule

12.3. Market Attractiveness Analysis Form

13. Global Lactose Market Analysis By End Use

13.1. Introduction

13.1.1. Y-o-Y Growth Comparison By End Use

13.1.2. Basis Point Share (BPS) Analysis By End Use

13.2. Lactose Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By End Use

13.2.1. Food and Beverage

13.2.2.1. Bakery

13.2.2.2. Confectionery

13.2.2.3. Functional Food

13.2.2. Pharmaceutical

13.2.3. Animal Feed

13.2.4. Cosmetics and Personal Care

13.3. Market Attractiveness Analysis By End Use

14. Global Lactose Market Analysis and Forecast, By Region

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Region

14.1.2. Y-o-Y Growth Projections By Region

14.2. Lactose Market Size (US$ Mn) and Volume (MT) & Forecast (2019-2029) Analysis By Region

14.2.1. North America

14.2.2. Latin America

14.2.3. Europe

14.2.4. East Asia

14.2.5. South Asia

14.2.6. Oceania

14.2.7. Middle East and Africa

14.3. Market Attractiveness Analysis By Region

15. North America Lactose Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.2. Lactose Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

15.2.1. Market Attractiveness By Country

15.2.1.1. U.S.

15.2.1.2. Canada

15.2.2. By Form

15.2.3. By End Use

15.3. Market Attractiveness Analysis

15.3.1. By Country

15.3.2. By Form

15.3.3. By End Use

15.4. Drivers and Restraints: Impact Analysis

16. Latin America Lactose Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Lactose Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

16.2.1. By Country

16.2.1.1. Brazil

16.2.1.2. Mexico

16.2.1.3. Chile

16.2.1.4. Peru

16.2.1.5. Argentina

16.2.1.6. Rest of Latin America

16.2.2. By Product Type

16.2.3. By Application

16.3. Market Attractiveness Analysis

16.3.1. By Country

16.3.2. By Form

16.3.3. By End Use

16.4. Drivers and Restraints: Impact Analysis

17. Europe Lactose Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.1.3. Key Regulations

17.2. Lactose Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

17.2.1. By Country

17.2.1.1. Poland

17.2.1.2. Germany

17.2.1.3. Italy

17.2.1.4. Spain

17.2.1.5. France

17.2.1.3. U.K.

17.2.1.4. BENELUX

17.2.1.5. Nordic

17.2.1.6. Russia

17.2.1.7. Rest of Europe

17.2.2. By Form

17.2.3. By End Use

17.3. Market Attractiveness Analysis

17.3.1. By Country

17.3.2. By Form

17.3.3. By End Use

17.4. Drivers and Restraints: Impact Analysis

18. East Asia Lactose Market Analysis and Forecast

18.1. Introduction

18.1.1. Basis Point Share (BPS) Analysis By Country

18.1.2. Y-o-Y Growth Projections By Country

18.1.3. Key Regulations

18.2. Lactose Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

18.2.1. By Country

18.2.1.1. China

18.2.1.2. Japan

18.2.1.3. South Korea

18.2.2. By Form

18.2.3. By End Use

18.3. Market Attractiveness Analysis

18.3.1. By Country

18.3.2. By Form

18.3.3. By End Use

19.4. Drivers and Restraints: Impact Analysis

19. South Asia Lactose Market Analysis and Forecast

19.1. Introduction

19.1.1. Basis Point Share (BPS) Analysis By Country

19.1.2. Y-o-Y Growth Projections By Country

19.1.3. Key Regulations

19.2. Lactose Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

19.2.1. By Country

19.2.1.1. Indonesia

19.2.1.2. Malaysia

19.2.1.3. Singapore

19.2.1.4. India

19.2.1.5. Taiwan

19.2.1.6. Thailand

19.2.1.7. Rest of South Asia

19.2.2. By Form

19.2.3. By End Use

19.3. Market Attractiveness Analysis

19.3.1. By Country

19.3.2. By Form

19.3.3. By End Use

19.4. Drivers and Restraints: Impact Analysis

20. Oceania Lactose Market Analysis and Forecast

20.1. Introduction

20.1.1. Basis Point Share (BPS) Analysis By Country

20.1.2. Y-o-Y Growth Projections By Country

20.1.3. Key Regulations

20.2. Lactose Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

20.2.1. By Country

20.2.1.1. Australia

20.2.1.2. New Zealand

20.2.2. By Form

20.2.3. By End Use

20.3. Market Attractiveness Analysis

20.3.1. By Country

20.3.2. By Application

20.3.3. By End Use

20.4. Drivers and Restraints: Impact Analysis

21. Middle East and Africa (MEA) Lactose Market Analysis and Forecast

21.1. Introduction

21.1.1. Basis Point Share (BPS) Analysis By Country

21.1.2. Y-o-Y Growth Projections By Country

21.1.3. Key Regulations

21.2. Lactose Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

21.2.1. By Country

21.2.1.1. Turkey

21.2.1.2. GCC

21.2.1.3. South Africa

21.2.1.4. Rest of MEA

21.2.2. By Form

21.2.3. By End Use

21.3. Market Attractiveness Analysis

21.3.1. By Country

21.3.2. By Form

21.3.3. By End Use

21.4. Drivers and Restraints: Impact Analysis

21.5. Drivers and Restraints: Impact Analysis

22. Competition Assessment

22.1. Global Lactose Market Competition - a Dashboard View

22.2. Global Lactose Market Structure Analysis

22.3. Global Lactose Market Company Share Analysis

22.3.1. For Tier 1 Market Players, 2018

22.3.2. Company Market Share Analysis of Top 10 Players, By Region

23. Brand Assessment

23.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

23.2. Lactose Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

23.3. Brand Strategy

24. Competition Deep-dive (Manufacturers/Suppliers)

24.1. Friesland Foods Domo

24.1.1. Overview

24.1.2. Product Portfolio

24.1.3. Sales Footprint

24.1.4. Production Footprint

24.1.5. Channel Footprint

24.1.5.1. Distributors List

24.1.5.2. Sales Channel (Clients)

24.1.6. Strategy Overview

24.1.6.1. Marketing Strategy

24.1.6.2. Culture Strategy

24.1.6.3. Channel Strategy

24.1.7. SWOT Analysis

24.1.8. Financial Analysis

24.1.9. Revenue Share

24.1.9.1. By Formulation Type

24.1.9.2. By Region

24.1.10. Key Clients

24.1.11. Analyst Comments

24.2. Agropur Inc.

24.3. Alpavit Käserei Champignon Hofmeister GmbH & Co. KG

24.4. Armor Pharma

24.5. Avantor, Inc.

24.6. Arla Food

24.7. Ba'emek Advanced Technologies Ltd (Tnuva Group)

24.8. BASF SE

24.9. Biofac A/S (Zeria Pharmaceutical Co., Ltd.)

24.10. Danisco A/S. (DuPont Nutrition & Health)

24.11. Fonterra Co-Operative Group

24.12. Glanbia plc

24.13. Hilmar Ingredients

24.14. Hoogwegt Groep B.V.

24.15. Kerry plc

24.16. Lactose (India) Limited

24.17. Meggle Group

24.18. Merck KgaA

24.19. Milei GmbH

24.20. Proliant Inc.

24.21. Saputo Inc.

24.22. Tatua Co-operative Dairy Company Ltd.

24.23. Other on additional request

25. Recommendation- Critical Success Factors

26. Research Methodology

27. Assumptions & Acronyms Used

Table 01: Global Lactose Market Market Value (US$ Mn) and Forecast by Region, 2019–2029

Table 02: Global Lactose Market Market Volume (Metric Tons) and Forecast by Region, 2019–2029

Table 03: Global Lactose Market Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 04: Global Lactose Market Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 05: Global Lactose Market Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 06: Global Lactose Market Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 7: North America Lactose Market Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 8: North America Lactose Market Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 9: North America Lactose Market Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 10: North America Lactose Market Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 11: North America Lactose Market Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 12: North America Lactose Market Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 13: Latin America Lactose Market Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 14: Latin America Lactose Market Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 15: Latin America Lactose Market Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 16: Latin America Lactose Market Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 17: Latin America Lactose Market Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 18: Latin America Lactose Market Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 19: Europe Lactose Market Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 20: Europe Lactose Market Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 21: Europe Lactose Market Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 22: Europe Lactose Market Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 23: Europe Lactose Market Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 24: Europe Lactose Market Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 25: East Asia Lactose Market Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 26: East Asia Lactose Market Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 27: East Asia Lactose Market Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 28: East Asia Lactose Market Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 29: East Asia Lactose Market Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 30: East Asia Lactose Market Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 31: South Asia Lactose Market Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 32: South Asia Lactose Market Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 33: South Asia Lactose Market Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 34: South Asia Lactose Market Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 35: South Asia Lactose Market Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 36: South Asia Lactose Market Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 37: Oceania Lactose Market Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 38: Oceania Lactose Market Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 39: Oceania Lactose Market Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 40: Oceania Lactose Market Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 41: Oceania Lactose Market Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 42: Oceania Lactose Market Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 43: Middle East & Africa Lactose Market Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 44: Middle East & Africa Lactose Market Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 45: Middle East & Africa Lactose Market Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 46: Middle East & Africa Lactose Market Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 47: Middle East & Africa Lactose Market Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 48: Middle East & Africa Lactose Market Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Figure 01: Global Lactose Market Value (US$ Mn) and Volume (MT) Forecast, 2019–2029

Figure 02: Global Lactose Market Absolute $ Opportunity (US$ Mn), 2019?2029

Figure 03: Global Lactose Market Value (US$ Mn) and % Growth by Region, 2019 & 2029

Figure 04: Global Lactose Market Y-o-Y Growth Rate by Region, 2019 - 2029

Figure 05: Global Lactose Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 06: Global Lactose Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 07: Global Lactose Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 08: Global Lactose Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 9: Global Lactose Market Attractiveness Analysis by Region, 2019 - 2029

Figure 10: Global Lactose Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 11: Global Lactose Market Attractiveness Analysis by Form, 2019 - 2029

Figure 12: North America Lactose Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 13: North America Lactose Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 14: North America Lactose Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 15: North America Lactose Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 16: North America Lactose Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 17: North America Lactose Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 18: North America Lactose Market Attractiveness Analysis by Region, 2019 - 2029

Figure 19: North America Lactose Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 20: North America Lactose Market Attractiveness Analysis by Form, 2019 - 2029

Figure 21: Latin America Lactose Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 22: Latin America Lactose Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 23: Latin America Lactose Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 24: Latin America Lactose Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 25: Latin America Lactose Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 26: Latin America Lactose Market Attractiveness Analysis by Region, 2019 - 2029

Figure 27: Latin America Lactose Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 28: Latin America Lactose Market Attractiveness Analysis by Form, 2019 - 2029

Figure 29: Europe Lactose Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 30: Europe Lactose Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 31: Europe Lactose Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 32: Europe Lactose Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 33: Europe Lactose Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 34: Europe Lactose Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 35: Europe Lactose Market Attractiveness Analysis by Region, 2019 - 2029

Figure 36: Europe Lactose Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 37: Europe Lactose Market Attractiveness Analysis by Form, 2019 - 2029

Figure 38: East Asia Lactose Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 39: East Asia Lactose Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 40: East Asia Lactose Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 41: East Asia Lactose Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 42: East Asia Lactose Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 43: East Asia Lactose Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 44: East Asia Lactose Market Attractiveness Analysis by Region, 2019 - 2029

Figure 45: East Asia Lactose Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 46: East Asia Lactose Market Attractiveness Analysis by Form, 2019 - 2029

Figure 47: South Asia Lactose Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 48: South Asia Lactose Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 49: South Asia Lactose Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 50: South Asia Lactose Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 51: South Asia Lactose Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 52: South Asia Lactose Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 53: South Asia Lactose Market Attractiveness Analysis by Region, 2019 - 2029

Figure 54: South Asia Lactose Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 55: South Asia Lactose Market Attractiveness Analysis by Form, 2019 - 2029

Figure 56: Oceania Lactose Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 57: Oceania Lactose Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 58: Oceania Lactose Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 59: Oceania Lactose Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 60: Oceania Lactose Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 61: Oceania Lactose Market Attractiveness Analysis by Region, 2019 - 2029

Figure 62: Middle East & Africa Lactose Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 63: Middle East & Africa Lactose Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 64: Middle East & Africa Lactose Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 65: Middle East & Africa Lactose Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 66: Middle East & Africa Lactose Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 67: Middle East & Africa Lactose Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 68: Middle East & Africa Lactose Market Attractiveness Analysis by Region, 2019 - 2029

Figure 69: Middle East & Africa Lactose Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 70: Middle East & Africa Lactose Market Attractiveness Analysis by Form, 2019 - 2029