Analysts’ Viewpoint on Laboratory Information Systems Scenario

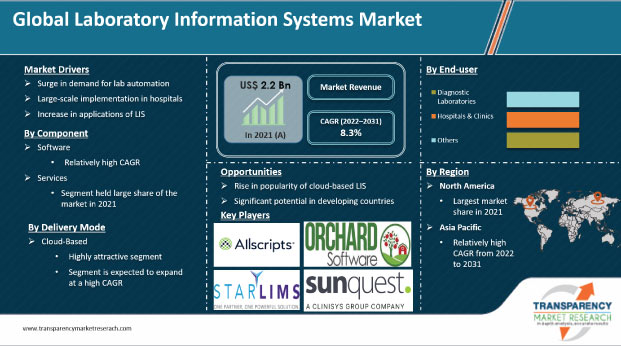

The global laboratory information systems (LIS) market is driven by the rise in demand for lab automation, large-scale implementation of laboratory information systems in hospitals, and technological advancements in laboratory information system/laboratory information management system (LIMS) offerings. The number of samples generated for research and analysis has increased in the past few years due to the rise in number of life-threatening diseases. Additionally, quality of samples and management of the same have become a cause of concern. Laboratory information systems play a vital role in advancing discoveries with the provision of concerned biospecimen to end-users, i.e. hospitals and clinics. However, high cost associated with the implementation of the laboratory management system is expected to hamper the market.

Rise in automation in laboratories, technological advancements in laboratory information systems, need for regulatory compliance, and increase in R&D spending are the key drivers of the global laboratory information systems market. Surge in demand for managing laboratory data via cloud-based solutions is also a significant factor propelling the global market. Storage of data via cloud-based solutions is reliable, agile, and secure. Adoption of cloud-based LIMS in healthcare laboratories is increasing. These solutions offer a host of benefits such as reliability, security, and constant data storage access. Large volume of data, due to the surge in the number of patients undergoing diagnostics, has increased complexities in workflow management. LIMS has proven to be highly beneficial for laboratories during the COVID-19 pandemic. Laboratories equipped with LIMS have constantly been performing diagnostics faster, with reduced turnaround times. This has a major impact on reducing the quarantine period of suspected patients and initiating a proper treatment for COVID-19 positive patients.

Demand for laboratory information system (LIS) is driven by the increase in lab automation and advancements in R&Ds labs, primarily in pharmaceutical and biotechnological laboratories. Lab automation reduces human errors while performing repetitive tasks such as pipetting and moving plates. It also improves accuracy. Furthermore, high efficiency of laboratory informatics products is propelling the laboratory information systems (LIS) market.

According to a 2020 survey conducted by Astrix Technologies LLC, a professional healthcare IT service provider, 61% of laboratory information management system (LIMS) users profited from the removal of manual operations, 57% improved their sample management approach, and 46% saw a substantial rise in productivity within their laboratory setting.

According to the World Health Organization’s (WHO) 2019 report on patient safety and risk management service, 5% diagnostic errors are reported in outpatient care settings in the U.S. It also stated that diagnostic errors accounted for 6% to 17% of all the harmful events in hospitals. This is likely to augment the global laboratory information systems market.

Governments, through various initiatives, support the adoption of IT solutions and products in healthcare. Additionally, increase in need to curb rising healthcare costs is projected to drive the global laboratory information systems (LIS) market during the forecast period.

Increase in access to advanced healthcare in hospitals is a major factor driving the demand for LIS. Rise in access to advanced healthcare in hospitals can be ascribed to better cost management structure, lean structure with respect to manpower employment, need to automate clinical testing for faster generation of results, and lesser chances of disruption between management regarding implementation of software, as most of the hospitals are solely owned. Demand is high in smaller hospitals in the U.S.

Involving patients as active participants in their care is an important approach toward improving overall healthcare. Patients must be able to access and share their health information. Currently, patients increasingly desire an access to their health-related documents. This is expected to drive the adoption of LIS in hospitals and clinics in the near future. Under the Health Insurance Portability and Accountability Act (HIPAA), patients have the right to see and obtain a copy of their completed test reports from laboratories within 30 days of request.

Increase in competition among hospitals to provide quality care has resulted in high demand for LIS, as it facilitates systematic documentation and eliminates paper work and chance of errors associated with clinical tests report writing. Thus, it enables a streamlined work flow. LIS also acts as a decision support system for enhancing decision-making in the clinical workflow. This improves healthcare quality in hospitals and clinics, thus increasing demand for LIS software and services in these facilities.

In terms of component, the global laboratory information systems market has been bifurcated into services and software. The services segment dominated the global market, with around 55% share in terms of revenue in 2021. This can be ascribed to the increase in need of LIMS implementation, integration, maintenance, validation, and support. Additionally, high demand for LIMS outsourcing solutions is expected to drive the segment. Large pharmaceutical research labs lack resources and skills required for the deployment of analytics. Hence, these services are outsourced. Outsourcing can be short term, project-based, or a long-term contract.

Based on delivery mode, the global laboratory information systems market has been split into on-premises and cloud-based. The cloud-based segment dominated the global market, with more than 65% share in terms of revenue in 2021. The segment is likely to maintain its leading position, growing at the fastest CAGR during the forecast period. In a cloud-based system, data can be accessed from multiple locations, multiple systems, and multiple branches. Furthermore, reduced IT manpower, cost-effective data management, and easy deployment are driving the segment.

In terms of end-user, the global laboratory information systems market has been divided into diagnostic laboratories, hospitals & clinics, and others. The diagnostic laboratories segment held the largest share of the global market in 2021. This trend is likely to continue during the forecast period. The segment is driven by the rise in number of diagnostic laboratories and increase in number of people suffering from chronic diseases across the world. Furthermore, adoption of LIS in diagnostic laboratories has made laboratory processes easier for healthcare professionals and patients.

North America accounted for the largest share of around 35% of the global market in terms of revenue in 2021. Well-developed infrastructure and increase in demand for digitalized technologies across North America are driving the implementation of different analytical solutions among industries. North America’s dominance of the global market can be ascribed to strong economic growth in the U.S. and Canada, which have enabled significant investments in new technologies, growth in biobanks, easy availability of LIMS products & services, and stringent regulatory requirements across industries.

In August 2020, Medical Information Technology (MEDITECH) partnered with TECHNATION Health in Canada to enhance the privacy and security framework of healthcare providers across the country, ensuring better patient data security.

The market in Asia Pacific is expected to expand at the fastest growth rate during the forecast due to the increase in disposable income, rise in elderly population, and surge in public healthcare funding in major emerging economies such as India and China.

In the past few years, a number of companies in the LIS industry have entered into partnerships and collaborations in order to stay ahead of their competitors. For instance, in July 2020, Allscripts Healthcare Solutions, Inc. and Microsoft Corporation extended their long-term strategic alliance to enable the development and delivery of cloud-based health IT solutions. This supported Microsoft Corporation with the cloud-based Sunrise EHR and helped it create a more-scalable technology.

Key players operating in the global laboratory information systems market are Allscripts Healthcare Solutions, Inc., Orchard Software Corporation, CompuGroup Medical, Labvantage Solutions, Inc., Thermo Fisher Scientific, Inc., Sunquest Information Systems, Inc., and STARLIMS Corporation.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 2.2 Bn |

| Market Forecast Value in 2031 | More than US$ 4.9 Bn |

| Growth Rate (CAGR) | 8.3% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global laboratory information systems market was valued at US$ 2.2 Bn in 2021.

The global market is projected to reach more than US$ 4.9 Bn by 2031.

The global laboratory information systems market grew at a CAGR of 7.0% from 2017 to 2021.

The global laboratory information systems market is anticipated to grow at a CAGR of 8.3% from 2022 to 2031.

Surge in demand for lab automation is driving the global laboratory information systems market

Allscripts Healthcare Solutions, Inc., Orchard Software Corporation, CompuGroup Medical, Labvantage Solutions, Inc., Thermo Fisher Scientific, Inc., Sunquest Information Systems, Inc., and STARLIMS Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Laboratory Information System Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Laboratory Information System Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Mergers & Acquisitions

5.3. COVID-19 Impact Analysis

6. Global Laboratory Information System Market Analysis and Forecast, by Component

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Component, 2017-2031

6.3.1. Software

6.3.2. Services

6.4. Market Attractiveness Analysis, by Component

7. Global Laboratory Information System Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017-2031

7.3.1. Diagnostic Laboratories

7.3.2. Hospitals & Clinics

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Laboratory Information System Market Analysis and Forecast, by Delivery Mode

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Delivery Mode, 2017-2031

8.3.1. On-premises

8.3.2. Cloud-based

8.4. Market Attractiveness Analysis, by Delivery Mode

9. Global Laboratory Information System Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Laboratory Information System Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Component, 2017-2031

10.2.1. Software

10.2.2. Services

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Diagnostic Laboratories

10.3.2. Hospitals & Clinics

10.3.3. Others

10.4. Market Value Forecast, by Delivery Mode, 2017-2031

10.4.1. On-premises

10.4.2. Cloud-based

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Component

10.6.2. By End-user

10.6.3. By Delivery Mode

10.6.4. By Country

11. Europe Laboratory Information System Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Component, 2017-2031

11.2.1. Software

11.2.2. Services

11.3. Market Value Forecast, by End-user, 2017-2031

11.3.1. Diagnostic Laboratories

11.3.2. Hospitals & Clinics

11.3.3. Others

11.4. Market Value Forecast, by Delivery Mode, 2017-2031

11.4.1. On-premises

11.4.2. Cloud-based

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Component

11.6.2. By End-user

11.6.3. By Delivery Mode

11.6.4. By Country/Sub-region

12. Asia Pacific Laboratory Information System Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Component, 2017-2031

12.2.1. Software

12.2.2. Services

12.3. Market Value Forecast, by End-user, 2017-2031

12.3.1. Diagnostic Laboratories

12.3.2. Hospitals & Clinics

12.3.3. Others

12.4. Market Value Forecast, by Delivery Mode, 2017-2031

12.4.1. On-premises

12.4.2. Cloud-based

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Component

12.6.2. By End-user

12.6.3. By Delivery Mode

12.6.4. By Country/Sub-region

13. Latin America Laboratory Information System Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Component, 2017-2031

13.2.1. Software

13.2.2. Services

13.3. Market Value Forecast, by End-user, 2017-2031

13.3.1. Diagnostic Laboratories

13.3.2. Hospitals & Clinics

13.3.3. Others

13.4. Market Value Forecast, by Delivery Mode, 2017-2031

13.4.1. On-premises

13.4.2. Cloud-based

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Component

13.6.2. By End-user

13.6.3. By Delivery Mode

13.6.4. By Country/Sub-region

14. Middle East & Africa Laboratory Information System Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Component, 2017-2031

14.2.1. Software

14.2.2. Services

14.3. Market Value Forecast, by End-user, 2017-2031

14.3.1. Diagnostic Laboratories

14.3.2. Hospitals & Clinics

14.3.3. Others

14.4. Market Value Forecast, by Delivery Mode, 2017-2031

14.4.1. On-premises

14.4.2. Cloud-based

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Component

14.6.2. By End-user

14.6.3. By Delivery Mode

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Autoscribe Informatics, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. CompuGroup Medical

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Thermo Fisher Scientific, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Labware, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Sunquest Information Systems, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. STARLIMS Corporation

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. LabVantage Solutions, Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Orchard Software Corporation

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Soft Computer Consultants, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Modul-Bio

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

List of Tables

Table 01: Global Laboratory Information System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 02: Global Laboratory Information System Market Value (US$ Mn) Forecast, by Delivery Mode, 2017-2031

Table 03: Global Laboratory Information System Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 04: Global Laboratory Information System Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Laboratory Information System Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 06: North America Laboratory Information System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 07: North America Laboratory Information System Market Value (US$ Mn) Forecast, by Delivery Mode, 2017-2031

Table 08: North America Laboratory Information System Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 09: Europe Laboratory Information System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Laboratory Information System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 11: Europe Laboratory Information System Market Value (US$ Mn) Forecast, by Delivery Mode, 2017-2031

Table 12: Europe Laboratory Information System Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Asia Pacific Laboratory Information System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Laboratory Information System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 15: Asia Pacific Laboratory Information System Market Value (US$ Mn) Forecast, by Delivery Mode, 2017-2031

Table 16: Asia Pacific Laboratory Information System Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 17: Latin America Laboratory Information System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Laboratory Information System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 19: Latin America Laboratory Information System Market Value (US$ Mn) Forecast, by Delivery Mode, 2017-2031

Table 20: Latin America Laboratory Information System Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Middle East & Africa Laboratory Information System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Laboratory Information System Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 23: Middle East & Africa Laboratory Information System Market Value (US$ Mn) Forecast, by Delivery Mode, 2017-2031

Table 24: Middle East & Africa Laboratory Information System Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Laboratory Information System Market, by Component, 2021 and 2031

Figure 02: Global Laboratory Information System Market Attractiveness Analysis, by Component, 2022-2031

Figure 03: Global Laboratory Information System Market (US$ Mn), by Software, 2017-2031

Figure 04: Global Laboratory Information System Market (US$ Mn), by Services, 2017-2031

Figure 05: Global Laboratory Information System Market, by Delivery Mode, 2021 and 2031

Figure 06: Global Laboratory Information System Market Attractiveness Analysis, by Delivery Mode, 2022-2031

Figure 07: Global Laboratory Information System Market (US$ Mn), by On-premises, 2017-2031

Figure 08: Global Laboratory Information System Market (US$ Mn), by Cloud-based, 2017-2031

Figure 09: Global Laboratory Information System Market, by End-user, 2021 and 2031

Figure 10: Global Laboratory Information System Market Attractiveness Analysis, by End-user, 2022-2031

Figure 11: Global Laboratory Information System Market (US$ Mn), by Diagnostic Laboratories, 2017-2031

Figure 12: Global Laboratory Information System Market (US$ Mn), by Hospitals & Clinics, 2017-2031

Figure 13: Global Laboratory Information System Market (US$ Mn), by Others, 2017-2031

Figure 14: Global Laboratory Information System Market, by Region, 2021 and 2031

Figure 15: Global Laboratory Information System Market Attractiveness Analysis, by Region, 2022-2031

Figure 16: North America Laboratory Information System Market Value (US$ Mn) Forecast, 2017-2031

Figure 17: North America Laboratory Information System Market, by Country, 2021 and 2031

Figure 18: North America Laboratory Information System Market Attractiveness Analysis, by Country, 2022-2031

Figure 19: North America Laboratory Information System Market, by Component, 2021 and 2031

Figure 20: North America Laboratory Information System Market Attractiveness Analysis, by Component, 2022-2031

Figure 21: North America Laboratory Information System Market, by Delivery Mode, 2021 and 2031

Figure 22: North America Laboratory Information System Market Attractiveness Analysis, by Delivery Mode, 2022-2031

Figure 23: North America Laboratory Information System Market, by End-user, 2021 and 2031

Figure 24: North America Laboratory Information System Market Attractiveness Analysis, by End-user, 2022-2031

Figure 25: Europe Laboratory Information System Market Value (US$ Mn) Forecast, 2017-2031

Figure 26: Europe Laboratory Information System Market, by Country/Sub-region, 2021 and 2031

Figure 27: Europe Laboratory Information System Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 28: Europe Laboratory Information System Market, by Component, 2021 and 2031

Figure 29: Europe Laboratory Information System Market Attractiveness Analysis, by Component, 2022-2031

Figure 30: Europe Laboratory Information System Market, by Delivery Mode, 2021 and 2031

Figure 31: Europe Laboratory Information System Market Attractiveness Analysis, by Delivery Mode, 2022-2031

Figure 32: Europe Laboratory Information System Market, by End-user, 2021 and 2031

Figure 33: Europe Laboratory Information System Market Attractiveness Analysis, by End-user, 2022-2031

Figure 34: Asia Pacific Laboratory Information System Market Value (US$ Mn) Forecast, 2017-2031

Figure 35: Asia Pacific Laboratory Information System Market, by Country/Sub-region, 2021 and 2031

Figure 36: Asia Pacific Laboratory Information System Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 37: Asia Pacific Laboratory Information System Market, by Component, 2021 and 2031

Figure 38: Asia Pacific Laboratory Information System Market Attractiveness Analysis, by Component, 2022-2031

Figure 39: Asia Pacific Laboratory Information System Market, by Delivery Mode, 2021 and 2031

Figure 40: Asia Pacific Laboratory Information System Market Attractiveness Analysis, by Delivery Mode, 2022-2031

Figure 41: Asia Pacific Laboratory Information System Market, by End-user, 2021 and 2031

Figure 42: Asia Pacific Laboratory Information System Market Attractiveness Analysis, by End-user, 2022-2031

Figure 43: Latin America Laboratory Information System Market Value (US$ Mn) Forecast, 2017-2031

Figure 44: Latin America Laboratory Information System Market, by Country/Sub-region, 2021 and 2031

Figure 45: Latin America Laboratory Information System Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 46: Latin America Laboratory Information System Market, by Component, 2021 and 2031

Figure 47: Latin America Laboratory Information System Market Attractiveness Analysis, by Component, 2022-2031

Figure 48: Latin America Laboratory Information System Market, by Delivery Mode, 2021 and 2031

Figure 49: Latin America Laboratory Information System Market Attractiveness Analysis, by Delivery Mode, 2022-2031

Figure 50: Latin America Laboratory Information System Market, by End-user, 2021 and 2031

Figure 51: Latin America Laboratory Information System Market Attractiveness Analysis, by End-user, 2022-2031

Figure 52: Middle East & Africa Laboratory Information System Market Value (US$ Mn) Forecast, 2017-2031

Figure 53: Middle East & Africa Laboratory Information System Market, by Country/Sub-region, 2021 and 2031

Figure 54: Middle East & Africa Laboratory Information System Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 55: Middle East & Africa Laboratory Information System Market, by Component, 2021 and 2031

Figure 56: Middle East & Africa Laboratory Information System Market Attractiveness Analysis, by Component, 2022-2031

Figure 57: Middle East & Africa Laboratory Information System Market, by Delivery Mode, 2021 and 2031

Figure 58: Middle East & Africa Laboratory Information System Market Attractiveness Analysis, by Delivery Mode, 2022-2031

Figure 59: Middle East & Africa Laboratory Information System Market, by End-user, 2021 and 2031

Figure 60: Middle East & Africa Laboratory Information System Market Attractiveness Analysis, by End-user, 2022-2031