Analysts’ Viewpoint on Laboratory Furniture Market Scenario

Europe and Asia Pacific are the most mature laboratory furniture markets. The market in Europe is growing due to a substantial rise in number of clinical, diagnostic, dental, and chemical laboratories owing to rising concerns about health after the COVID-19 pandemic, thereby driving the demand for laboratory furniture. In Europe and Asia Pacific, presence of key players characterizes the laboratory furniture market. Companies operating in the laboratory furniture market are focusing on material quality, durability, modification, sales service, and after-sales services to keep their businesses growing. Moreover, across regions, the increasing trend of setting up laboratories in schools, institutions, and colleges fuels the laboratory furniture market.

Laboratory furniture, such as laboratory benches and cabinets, forensic cabinets, apparel dispensers, carts, chemical cabinets, and drawers, are used in various laboratories such as chemical, clinical, dental, school, electronics, or computer and research laboratories.

Laboratory furniture is specially designed to keep technicians in comfortable and supported positions to prevent any stress injuries and ensure technicians remain highly productive while working. Designers of lab furniture are adopting a new approach to design labs using modern furniture that is modular and can assist in future proofing an existing design. Modular furniture such as storage units, cabinets, and shelves can be re-constructed using simple tools.

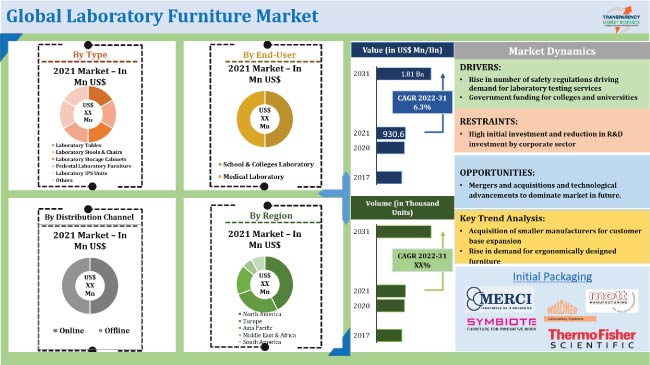

Rise in safety regulations is boosting the demand for laboratory testing services. Additionally, the hygiene needs of an increasing geriatric population and rising incidence of health issues are further driving the demand for lab-tested products. Better awareness about product quality and demand for lab-tested products among people across the globe have led to enactment of safety standards and regulations for product quality and durability by various governments. Some of the factors encouraging the usage of laboratory furniture are the capability to withstand chemicals, moisture, and impact, besides the fact that these modern furniture are specially designed to make work easier, and assist in utilizing space efficiently.

Increasing government spending on education and laboratory expansion is prompting the purchase of laboratory furniture by school and college administration. Government funding for developing medical infrastructure is growing. Growth in medical infrastructure has been one of the key reasons for the rising demand for laboratory furniture. For instance, The European Commission announced completion of the project entitled “Modernizing Schools with Science Laboratories in Primary Education.” The project is valued at around Euro 5 Mn for the establishment of laboratories in primary and secondary schools to educate students. This kind of funding is projected to rise in the near future, and is expected to propel the laboratory furniture market.

Market players are likely to introduce technological features to laboratory furniture by integrating cloud-based systems for temperature regulation and real-time monitoring. For instance, updated laboratory furniture including incubators and freezers are fitted with wireless probes to monitor door status. Growing environmental awareness has bolstered the adoption of eco-friendly materials among lab furniture manufacturers. Increasing usage of sustainable materials such as stainless steel, which not only increases the life of the furniture but also makes recycling possible, is an important and consistent trend that would continue to influence the growth of the laboratory furniture market. Additionally, introduction of adjustable workbenches, laboratory tables, and desks that are more ergonomic, which further prevent neck & back ache, is estimated to help boost the laboratory furniture market size.

In terms of type, the laboratory stools & benches segment held a major share in terms of both value and volume, and the segment is expected to grow at a notable CAGR during the forecast period. Laboratories have different workstations such as hoods, and medium or high benches, and their height level determines the height of the lab chair. Laboratory chairs are available in different height ranges and materials. There are also laboratory stools with 360-degree pneumatic height adjustment, ideal for clinical facilities and university labs. Lab furniture is made from metal welded tubular steel, modular steel, or epoxy powder-coated steel. Metal is easy to maintain, durable, and resists corrosion, chemicals, and abrasions.

Europe, North America, and Asia Pacific are expected to lead the global market during the forecast Europe dominated the global laboratory furniture market closely followed by North America and Asia Pacific. Europe held a dominant share owing to the increasing demand for medical furniture in the region. Additionally, well-developed medical infrastructure in Europe is further attributed to the major share held by the region of the global laboratory furniture market.

Asia Pacific and North America also account for a dominant share of the global laboratory furniture market share. The laboratory furniture market share held by Asia Pacific is anticipated to rise significantly during the forecast period due to a rising population coupled with growth in medical infrastructure in the region. The Government of India supports education projects with the goal of building ‘thinking skills’ that equip children with the ability to quickly learn. Successful integrated projects such as the Teacher Resource Laboratory project (TRL) in Uttar Pradesh and the Innovator’s Laboratory in Bengaluru are some examples.

Detailed profiles of players in the laboratory furniture market have been provided in the report to evaluate their financials, key product offerings, recent developments, and strategies. Majority of firms are spending significant amounts on comprehensive research and development activities, primarily to develop innovative products. Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by lab furniture suppliers and manufacturers.

Key players operating in the global laboratory furniture market are FRIATEC GmbH, GE Healthcare Services, Kewaunee Scientific, LOC Scientific, MERCI, s.r.o, Mott Manufacturing Ltd., PSA Laboratory Furniture LLC, Symbiote, Thermofisher Scientific, and WALDNER Group.

Each of these players has been profiled in the global laboratory furniture market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

USD 930.6 Mn |

|

Market Forecast Value in 2031 |

USD 1.81 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Mn for value, Thousand units for volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

Market Player – Competition Dashboard and Revenue Share Analysis 2021 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The laboratory furniture market stood at US$ 930.6 Mn in 2021

The laboratory furniture market is expected to reach US$ 1.81 Bn by 2031.

Rise in number of safety regulations and government funding for colleges and universities

The laboratory stools & benches segment accounted for highest share of the laboratory furniture market in 2021

The laboratory furniture market in Europe held 35.3% share of global market in 2021.

FRIATEC GmbH, GE Healthcare Services, Kewaunee Scientific, LOC Scientific, MERCI, s.r.o, Mott Manufacturing Ltd., PSA Laboratory Furniture LLC, Symbiote, Thermofisher Scientific, and WALDNER Group.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Furniture Industry Overview

5.5. Covid-19 Impact Analysis

5.6. Regulatory Framework

5.7. Porter’s Five Forces Analysis

5.8. Value Chain Analysis

5.9. Industry SWOT Analysis

5.10. Global Laboratory Furniture Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projections (US$ Mn)

5.10.2. Market Revenue Projections (000’ Units)

6. Global Laboratory Furniture Market Analysis and Forecast, by Type

6.1. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Type, 2017 - 2031

6.1.1. Laboratory Tables

6.1.2. Laboratory Stools & Benches

6.1.3. Laboratory Desk & Storage Cabinets

6.1.4. Pedestal Laboratory Furniture

6.1.5. Laboratory IPS Units

6.1.6. Storage Cabinets & Racks

6.1.7. Others

6.2. Incremental Opportunity, By Type

7. Global Laboratory Furniture Market Analysis and Forecast, by End-user

7.1. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by End-user, 2017 - 2031

7.1.1. School & Colleges Laboratory

7.1.2. Medical Laboratory

7.2. Incremental Opportunity, By End-user

8. Global Laboratory Furniture Market Analysis and Forecast, by Distribution Channel

8.1. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

8.1.1. Online

8.1.2. Offline

8.2. Incremental Opportunity, By Distribution Channel

9. Global Laboratory Furniture Market Analysis and Forecast, by Region

9.1. Laboratory Furniture Market Size (US$ Mn, Thousand Units), by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Global Incremental Opportunity, by Region

10. North America Laboratory Furniture Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Impact Analysis of COVID – 19

10.3. Price Trend Analysis

10.3.1. Weighted Average Price

10.4. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Type, 2017 - 2031

10.4.1. Laboratory Tables

10.4.2. Laboratory Stools & Benches

10.4.3. Laboratory Desk & Storage Cabinets

10.4.4. Pedestal Laboratory Furniture

10.4.5. Laboratory IPS Units

10.4.6. Storage Cabinets & Racks

10.4.7. Others

10.5. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by End-user, 2017 - 2031

10.5.1. School & Colleges Laboratory

10.5.2. Medical Laboratory

10.6. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

10.6.1. Online

10.6.2. Offline

10.7. Laboratory Furniture Market Size (US$ Mn and 000’ Units) Forecast, by Country/Sub-Region, 2017 - 2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Incremental Opportunity Analysis

11. Europe Laboratory Furniture Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Impact Analysis of COVID – 19

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Type, 2017 - 2031

11.4.1. Laboratory Tables

11.4.2. Laboratory Stools & Benches

11.4.3. Laboratory Desk & Storage Cabinets

11.4.4. Pedestal Laboratory Furniture

11.4.5. Laboratory IPS Units

11.4.6. Storage Cabinets & Racks

11.4.7. Others

11.5. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by End-user, 2017 - 2031

11.5.1. School & Colleges Laboratory

11.5.2. Medical Laboratory

11.6. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

11.6.1. Online

11.6.2. Offline

11.7. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Country/Sub-Region, 2017 - 2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Poland

11.7.5. Rest of Europe

11.8. Incremental Opportunity Analysis

12. Asia Pacific Laboratory Furniture Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Impact Analysis of COVID – 19

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Type, 2017 - 2031

12.4.1. Laboratory Tables

12.4.2. Laboratory Stools & Benches

12.4.3. Laboratory Desk & Storage Cabinets

12.4.4. Pedestal Laboratory Furniture

12.4.5. Laboratory IPS Units

12.4.6. Storage Cabinets & Racks

12.4.7. Others

12.5. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by End-user, 2017 - 2031

12.5.1. School & Colleges Laboratory

12.5.2. Medical Laboratory

12.6. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

12.6.1. Online

12.6.2. Offline

12.7. Laboratory Furniture Market Size (US$ Mn and 000’ Units) Forecast, by Country/Sub-Region, 2017 - 2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. Rest of Asia Pacific

12.8. Incremental Opportunity Analysis

13. Middle East & Africa Laboratory Furniture Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Impact Analysis of COVID – 19

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Type, 2017 - 2031

13.4.1. Laboratory Tables

13.4.2. Laboratory Stools & Benches

13.4.3. Laboratory Desk & Storage Cabinets

13.4.4. Pedestal Laboratory Furniture

13.4.5. Laboratory IPS Units

13.4.6. Storage Cabinets & Racks

13.4.7. Others

13.5. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by End-user, 2017 - 2031

13.5.1. School & Colleges Laboratory

13.5.2. Medical Laboratory

13.6. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

13.6.1. Online

13.6.2. Offline

13.7. Laboratory Furniture Market Size (US$ Mn and 000’ Units) Forecast, by Country/Sub-Region, 2017 - 2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Incremental Opportunity Analysis

14. South America Laboratory Furniture Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Impact Analysis of COVID – 19

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Type, 2017 - 2031

14.4.1. Laboratory Tables

14.4.2. Laboratory Stools & Benches

14.4.3. Laboratory Desk & Storage Cabinets

14.4.4. Pedestal Laboratory Furniture

14.4.5. Laboratory IPS Units

14.4.6. Storage Cabinets & Racks

14.4.7. Others

14.5. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by End-user, 2017 - 2031

14.5.1. School & Colleges Laboratory

14.5.2. Medical Laboratory

14.6. Laboratory Furniture Market Size (US$ Mn, Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.6.1. Online

14.6.2. Offline

14.7. Laboratory Furniture Market Size (US$ Mn and 000’ Units) Forecast, by Country/Sub-Region, 2017 - 2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis (%)-2021

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Manufacturing Location, Revenue, Strategy & Business Process Overview)

15.3.1. Aakar Scientific Pvt. Ltd.

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Manufacturing Location

15.3.1.4. Revenue

15.3.1.5. Strategy & Business Process Overview

15.3.2. Compagnie de Saint-Gobain S.A.

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Manufacturing Location

15.3.2.4. Revenue

15.3.2.5. Strategy & Business Process Overview

15.3.3. HEMCO Corporation

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Manufacturing Location

15.3.3.4. Revenue

15.3.3.5. Strategy & Business Process Overview

15.3.4. Innovative Inc.

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Manufacturing Location

15.3.4.4. Revenue

15.3.4.5. Strategy & Business Process Overview

15.3.5. Kewaunee Labway India Pvt. Ltd

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Manufacturing Location

15.3.5.4. Revenue

15.3.5.5. Strategy & Business Process Overview

15.3.6. Kewaunee Scientific Corporation

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Manufacturing Location

15.3.6.4. Revenue

15.3.6.5. Strategy & Business Process Overview

15.3.7. Kottermann GmbH

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Manufacturing Location

15.3.7.4. Revenue

15.3.7.5. Strategy & Business Process Overview

15.3.8. MOTT Manufacturing Ltd.

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Manufacturing Location

15.3.8.4. Revenue

15.3.8.5. Strategy & Business Process Overview

15.3.9. PSA Laboratory Furniture LLC

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Manufacturing Location

15.3.9.4. Revenue

15.3.9.5. Strategy & Business Process Overview

15.3.10. Yamato Scientific co., ltd

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Manufacturing Location

15.3.10.4. Revenue

15.3.10.5. Strategy & Business Process Overview

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. By Type

16.1.2. By End-user

16.1.3. By Distribution Channel

16.1.4. By Region

16.2. Understanding the Procurement Process of Users

16.3. Prevailing Market Risks

16.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Table 2: Global Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Table 3: Global Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Table 4: Global Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Table 5: Global Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Table 6: Global Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Table 7: Global Laboratory Furniture Market by Region, US$ Mn, 2017-2031

Table 8: Global Laboratory Furniture Market by Region, Thousand Units, 2017-2031

Table 9: North America Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Table 10: North America Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Table 11: North America Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Table 12: North America Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Table 13: North America Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Table 14: North America Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Table 15: North America Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Table 16: North America Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

Table 17: Europe Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Table 18: Europe Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Table 19: Europe Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Table 20: Europe Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Table 21: Europe Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Table 22: Europe Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Table 23: Europe Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Table 24: Europe Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

Table 25: Asia Pacific Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Table 26: Asia Pacific Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Table 27: Asia Pacific Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Table 28: Asia Pacific Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Table 29: Asia Pacific Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Table 30: Asia Pacific Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Table 31: Asia Pacific Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Table 32: Asia Pacific Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

Table 33: Middle East & Africa Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Table 34: Middle East & Africa Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Table 35: Middle East & Africa Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Table 36: Middle East & Africa Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Table 37: Middle East & Africa Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Table 38: Middle East & Africa Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Table 39: Middle East & Africa Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Table 40: Middle East & Africa Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

Table 41: South America Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Table 42: South America Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Table 43: South America Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Table 44: South America Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Table 45: South America Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Table 46: South America Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Table 47: South America Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Table 48: South America Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

List of Figures

Figure 1: Global Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Figure 2: Global Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Figure 3: Global Laboratory Furniture Market by Type, 2022-2031

Figure 4: Global Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Figure 5: Global Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Figure 6: Global Laboratory Furniture Market by End-user, 2022-2031

Figure 7: Global Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Figure 8: Global Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Figure 9: Global Laboratory Furniture Market by Distribution Channel, 2022-2031

Figure 10: Global Laboratory Furniture Market by Region, US$ Mn, 2017-2031

Figure 11: Global Laboratory Furniture Market by Region, Thousand Units, 2017-2031

Figure 12: Global Laboratory Furniture Market by Region,2022-2031

Figure 13: North America Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Figure 14: North America Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Figure 15: North America Laboratory Furniture Market by Type, 2022-2031

Figure 16: North America Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Figure 17: North America Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Figure 18: North America Laboratory Furniture Market by End-user, 2022-2031

Figure 19: North America Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Figure 20: North America Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Figure 21: North America Laboratory Furniture Market by Distribution Channel, 2022-2031

Figure 22: North America Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Figure 23: North America Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

Figure 24: North America Laboratory Furniture Market by Country/Sub-Region, 2022-2031

Figure 25: Europe Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Figure 26: Europe Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Figure 27: Europe Laboratory Furniture Market by Type, 2022-2031

Figure 28: Europe Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Figure 29: Europe Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Figure 30: Europe Laboratory Furniture Market by End-user, 2022-2031

Figure 31: Europe Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Figure 32: Europe Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Figure 33: Europe Laboratory Furniture Market by Distribution Channel, 2022-2031

Figure 34: Europe Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Figure 35: Europe Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

Figure 36: Europe Laboratory Furniture Market by Country/Sub-Region, 2022-2031

Figure 37: Asia Pacific Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Figure 38: Asia Pacific Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Figure 39: Asia Pacific Laboratory Furniture Market by Type, 2022-2031

Figure 40: Asia Pacific Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Figure 41: Asia Pacific Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Figure 42: Asia Pacific Laboratory Furniture Market by End-user, 2022-2031

Figure 43: Asia Pacific Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Figure 44: Asia Pacific Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Figure 45: Asia Pacific Laboratory Furniture Market by Distribution Channel, 2022-2031

Figure 46: Asia Pacific Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Figure 47: Asia Pacific Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

Figure 48: Asia Pacific Laboratory Furniture Market by Country/Sub-Region, 2022-2031

Figure 49: Middle East & Africa Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Figure 50: Middle East & Africa Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Figure 51: Middle East & Africa Laboratory Furniture Market by Type, 2022-2031

Figure 52: Middle East & Africa Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Figure 53: Middle East & Africa Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Figure 54: Middle East & Africa Laboratory Furniture Market by End-user, 2022-2031

Figure 55: Middle East & Africa Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Figure 56: Middle East & Africa Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Figure 57: Middle East & Africa Laboratory Furniture Market by Distribution Channel, 2022-2031

Figure 58: Middle East & Africa Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Figure 59: Middle East & Africa Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

Figure 60: Middle East & Africa Laboratory Furniture Market by Country/Sub-Region, 2022-2031

Figure 61: South America Laboratory Furniture Market by Type, US$ Mn, 2017-2031

Figure 62: South America Laboratory Furniture Market by Type, Thousand Units, 2017-2031

Figure 63: South America Laboratory Furniture Market by Type, 2022-2031

Figure 64: South America Laboratory Furniture Market by End-user, US$ Mn, 2017-2031

Figure 65: South America Laboratory Furniture Market by End-user, Thousand Units, 2017-2031

Figure 66: South America Laboratory Furniture Market by End-user, 2022-2031

Figure 67: South America Laboratory Furniture Market by Distribution Channel, US$ Mn, 2017-2031

Figure 68: South America Laboratory Furniture Market by Distribution Channel, Thousand Units, 2017-2031

Figure 69: South America Laboratory Furniture Market by Distribution Channel, 2022-2031

Figure 70: South America Laboratory Furniture Market by Country/Sub-Region, US$ Mn, 2017-2031

Figure 71: South America Laboratory Furniture Market by Country/Sub-Region, Thousand Units, 2017-2031

Figure 72: South America Laboratory Furniture Market by Country/Sub-Region, 2022-2031