Reports

Reports

Analysts’ Viewpoint on Market Scenario

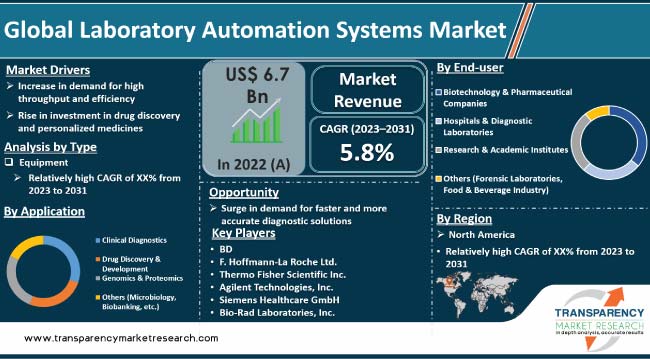

Increase in demand for higher efficiency, accuracy, and productivity in laboratories is a major factor driving the laboratory automation systems market size. Automated laboratory solutions streamline complex and repetitive tasks, minimizing human errors and variability, thus enhancing the reliability and reproducibility of results.

Rise in demand for high throughput screening, particularly in drug discovery and clinical diagnostics, is pushing laboratories to adopt automation to handle larger volumes of samples efficiently. Vendors in the global laboratory automation systems industry are focusing on the integration of advanced technologies, such as robotics, artificial intelligence, and data analytics, to further amplify the benefits of automation.

The laboratory automation systems sector is a rapidly evolving sector within the healthcare, research, and diagnostics industries. Laboratory automation systems encompass a wide array of technologies, including robotics, liquid handling systems, software platforms, and advanced analytics, all aimed at reducing manual labor, minimizing errors, and accelerating workflows.

Laboratories across various domains, such as pharmaceuticals, biotechnology, clinical diagnostics, and academic research, are embracing robotic lab automation to optimize resource utilization, ensure reproducibility, and expedite scientific advancements.

Recent developments have seen the integration of advanced technologies, such as robotics, artificial intelligence, and cloud-based solutions, into automation systems, enabling enhanced data analysis, adaptive workflows, and remote monitoring. Thus, surge in need for precision, efficiency, and innovation in modern laboratory operations is expected to spur the laboratory automation systems market growth in the near future.

Workforce shortage in laboratories and growth in need for cost-effective solutions are also contributing to the demand for automation, allowing laboratories to optimize resources while maintaining operational quality.

Laboratories across diverse sectors, including pharmaceuticals, biotechnology, clinical diagnostics, and research, are confronted with a mounting need to process larger volumes of samples and data within shorter timeframes. This surge in demand arises from various factors such as expansion of research endeavors, rise in diagnostic testing requirements, and exploration of more extensive compound libraries in drug discovery.

Laboratory automation systems offer a transformative approach to streamlining repetitive and time-consuming tasks, such as sample preparation, analysis, and data management. By automating these processes, laboratories can significantly accelerate their workflows, enabling them to analyze a larger number of samples in less time compared to manual methods. This heightened throughput capacity increases productivity and allows researchers and healthcare professionals to access results more swiftly, facilitating informed decision-making and faster response times. Thus, rise in demand for high throughput and efficiency is propelling the laboratory automation systems market development.

Demand for high-throughput lab systems is closely intertwined with the quest for consistent and reliable outcomes. Automation minimizes the influence of human variability and errors, leading to more reproducible results. This aspect is particularly crucial in research, where data integrity and accuracy are paramount. Automation's ability to generate consistent and standardized results further bolsters its appeal in both research and clinical settings.

Integration of automation systems becomes a strategic imperative as laboratories are striving to manage growth in demand for diagnostic testing, drug discovery, and research. The ability to efficiently handle larger workloads and complex data sets while maintaining precision positions laboratory automation as an indispensable solution. Hence, rise in demand for high throughput and operational efficiency is augmenting the laboratory automation systems market statistics.

The field of drug discovery is evolving rapidly, with an emphasis on identifying new therapeutic compounds efficiently and expediting the development of targeted treatments. Laboratory automation systems play a pivotal role in this endeavor by enabling high-throughput screening of compounds, optimizing experimental conditions, and analyzing vast libraries of potential drug candidates. By automating these intricate and time-consuming processes, researchers can rapidly assess a multitude of compounds for their potential therapeutic efficacy, significantly shortening the drug development timeline.

In parallel, the paradigm of personalized medicine is gaining prominence, shifting healthcare towards tailored treatments that consider an individual's genetic makeup, disease characteristics, and response to therapies. Laboratory automation systems are indispensable in this context as they facilitate the processing and analysis of patient samples to generate precise molecular profiles. These profiles guide treatment decisions, helping healthcare professionals select the most effective interventions based on a patient's unique attributes. Automation ensures that these personalized profiles are generated accurately and reproducibly, maintaining the integrity of patient data critical for precise diagnostics and therapeutic strategies.

The convergence of drug discovery and personalized medicine is creating synergistic opportunities for automation systems. This, in turn, is driving the laboratory automation systems market trajectory. The need for efficient and systematic analysis of patient-derived data is growing as researchers are focusing on developing treatments that cater to specific patient populations. Automation enables the rapid screening of compounds against patient-derived samples, accelerating the identification of targeted therapies tailored to individual patients' needs.

The equipment type segment accounted for major share in 2022. Laboratory automation equipment play a pivotal role in enabling comprehensive and streamlined laboratory processes. Laboratory automation systems encompass a diverse range of equipment including liquid handling systems, robotic workstations, microplate readers, automated storage and retrieval systems, and integrated software solutions. Laboratory equipment forms the foundation of automation, serving as the core tools that execute various tasks with precision and efficiency.

According to the latest global laboratory automation systems market trends, the clinical diagnostics application segment dominated the industry during the forecast period. Clinical diagnostics play a critical role in transforming healthcare delivery through efficient and accurate diagnostic processes. Clinical diagnostics encompass a broad spectrum of tests and procedures aimed at detecting, diagnosing, and monitoring various diseases and health conditions.

Growth in burden of chronic diseases, infectious diseases, and lifestyle-related disorders has heightened the demand for rapid and reliable diagnostic solutions. Laboratory automation systems empower clinical laboratories to handle larger volumes of patient samples efficiently, ensuring timely diagnoses and facilitating prompt patient care. The ability to process a high number of samples in a short period is vital for managing disease outbreaks, conducting mass screenings, and responding to public health emergencies.

Integration of automation with molecular diagnostics, immunoassays, and advanced imaging techniques further enhances the capabilities of clinical diagnostics. Automation systems enable the simultaneous analysis of multiple analytes, providing a comprehensive picture of a patient's health status. This capability is crucial for complex diagnoses such as cancer profiling, genetic testing, and infectious disease detection.

The pharmaceutical & biotechnology companies end-user segment held largest share in 2022. Laboratory automation systems play a critical role in expediting drug discovery processes. Pharmaceutical & biotechnology companies are constantly seeking new therapeutic compounds and molecules to address unmet medical needs. Automation enables high-throughput screening of vast compound libraries, accelerating the identification of potential drug candidates. By automating tasks such as compound management, assay development, and data analysis, pharmaceutical and biotechnology companies can optimize their research workflows and bring promising candidates to the forefront more efficiently.

The complexity of modern drug development demands precise and reproducible results. Laboratory automation systems mitigate human error, ensuring that experimental conditions are consistent and results are reliable. This is particularly crucial during preclinical and clinical studies, where accurate data is essential for making informed decisions about a compound's safety and efficacy.

Pharmaceutical & biotechnology companies are increasingly focusing on personalized medicine and targeted therapies. Automation systems facilitate the analysis of patient samples, genetic markers, and molecular signatures, aiding in the identification of patient subgroups that are likely to respond positively to specific treatments. This approach improves the efficiency of clinical trials and enhances the probability of successful drug development.

According to the latest laboratory automation systems market analysis and forecast, North America is projected to hold largest share from 2023 to 2031. Presence of advanced healthcare infrastructure and high investment in R&D activities are fueling the market dynamics of the region.

Presence of major pharmaceutical & biotechnology companies is augmenting the laboratory automation systems market share of North America. The region's healthcare facilities, including clinical laboratories and research centers, are at the forefront of adopting cutting-edge technologies to enhance diagnostic accuracy, patient care, and research capabilities. This proclivity for innovation is driving the demand for laboratory automation systems that enable these institutions to optimize workflows and improve efficiency.

Major pharmaceutical & biotechnology companies in North America are continually investing in research, development, and drug discovery efforts. They are relying on laboratory automation systems to streamline processes and accelerate the identification of potential therapeutic candidates. Hence, surge in investment in drug discovery is propelling the demand for laboratory automation systems in the region.

Europe boasts a rich scientific heritage, with a long tradition of contributing to medical advancements and research breakthroughs. The region is home to renowned universities, research institutions, and medical centers that actively engage in cutting-edge research across various disciplines. Rise in need to optimize research workflows, enhance diagnostic capabilities, and accelerate the pace of scientific discovery is driving market progress in Europe.

Asia Pacific is witnessing rapid economic growth and urbanization, leading to increase in healthcare expenditure and surge in investment in healthcare infrastructure. This, in turn, is contributing to growth in demand for advanced medical technologies, including laboratory automation systems, to improve healthcare delivery, diagnostics, and research capabilities. This is projected to fuel the laboratory automation systems market expansion in the region.

Rise in number of clinical trials and research studies is boosting demand for high-throughput solutions for sample processing, analysis, and data management in Asia Pacific. Automation systems facilitate the efficient conduct of these trials, from patient recruitment to data analysis, thereby contributing to the region's market revenue.

The global industry is fragmented with the presence of several laboratory automation system companies. Most laboratory automation system manufacturers are launching new products to expand their product portfolio. In May 2023 Opentrons introduced the Opentrons Flex robot. This innovative robot represents a more accessible and user-friendly version of liquid-handling lab robots.

BD, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Siemens Healthcare GmbH, Bio-Rad Laboratories, Inc., Hitachi High-Tech Corporation, Danaher (Beckman Coulter, Inc.), Abbott, Shimadzu Corporation, and Hudson Robotics, Inc. are key players in the laboratory automation systems market.

Each of these players has been profiled in the laboratory automation systems market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. The report also highlights the latest advancements in the laboratory automation systems market.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 6.7 Bn |

| Forecast Value in 2031 | More than US$ 11.0 Bn |

| Growth Rate (CAGR) | 5.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.7 Bn in 2022

It is projected to reach more than US$ 11.0 Bn by the end of 2031

It is anticipated to be 5.8% from 2023 to 2031

Increase in demand for high throughput and efficiency and rise in investment in drug discovery and personalized medicines

North America is expected to record the highest demand from 2023 to 2031

BD, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Siemens Healthcare GmbH, Bio-Rad Laboratories, Inc., Hitachi High-Tech Corporation, Danaher (Beckman Coulter, Inc.), Abbott, Shimadzu Corporation, and Hudson Robotics, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Laboratory Automation Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Laboratory Automation Systems Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projection (US$ Bn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Product/Brand Analysis

5.3. Regulatory Scenario

5.4. COVID-19 Impact Analysis

6. Global Laboratory Automation Systems Market Analysis and Forecast, By Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, By Type, 2017 - 2031

6.3.1. Equipment

6.3.1.1. Automated Workstations

6.3.1.2. Automated Storage & Retrieval Systems

6.3.1.3. Automated Liquid Handlers

6.3.1.4. Automated Plate Handlers

6.3.1.5. Robotic Arms

6.3.2. Software

6.3.3. Services

6.4. Market Attractiveness By Type

7. Global Laboratory Automation Systems Market Analysis and Forecast, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, By Application, 2017 - 2031

7.3.1. Clinical Diagnostics

7.3.2. Drug Discovery & Development

7.3.3. Genomics & Proteomics

7.3.4. Others (Microbiology, Biobanking, etc.)

7.4. Market Attractiveness By Application

8. Global Laboratory Automation Systems Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, By End-user, 2017 - 2031

8.3.1. Biotechnology & Pharmaceutical Companies

8.3.2. Hospitals & Diagnostic Laboratories

8.3.3. Research & Academic Institutes

8.3.4. Others (Forensic Laboratories, Food & Beverage Industry)

8.4. Market Attractiveness By End-user

9. Global Laboratory Automation Systems Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Laboratory Automation Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, By Type, 2017 - 2031

10.2.1. Equipment

10.2.1.1. Automated Workstations

10.2.1.2. Automated Storage & Retrieval Systems

10.2.1.3. Automated Liquid Handlers

10.2.1.4. Automated Plate Handlers

10.2.1.5. Robotic Arms

10.2.2. Software

10.2.3. Services

10.3. Market Value Forecast, By Application, 2017 - 2031

10.3.1. Clinical Diagnostics

10.3.2. Drug Discovery & Development

10.3.3. Genomics & Proteomics

10.3.4. Others (Microbiology, Biobanking, etc.)

10.4. Market Value Forecast, By End-user, 2017 - 2031

10.4.1. Biotechnology & Pharmaceutical Companies

10.4.2. Hospitals & Diagnostic Laboratories

10.4.3. Research & Academic Institutes

10.4.4. Others (Forensic Laboratories, Food & Beverage Industry)

10.5. Market Value Forecast, By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Laboratory Automation Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, By Type, 2017 - 2031

11.2.1. Equipment

11.2.1.1. Automated Workstations

11.2.1.2. Automated Storage & Retrieval Systems

11.2.1.3. Automated Liquid Handlers

11.2.1.4. Automated Plate Handlers

11.2.1.5. Robotic Arms

11.2.2. Software

11.2.3. Services

11.3. Market Value Forecast, By Application, 2017 - 2031

11.3.1. Clinical Diagnostics

11.3.2. Drug Discovery & Development

11.3.3. Genomics & Proteomics

11.3.4. Others (Microbiology, Biobanking, etc.)

11.4. Market Value Forecast, By End-user, 2017 - 2031

11.4.1. Biotechnology & Pharmaceutical Companies

11.4.2. Hospitals & Diagnostic Laboratories

11.4.3. Research & Academic Institutes

11.4.4. Others (Forensic Laboratories, Food & Beverage Industry)

11.5. Market Value Forecast, By Country/Sub-region, 2017 - 2031

11.5.1. Germany

11.5.2. France

11.5.3. U.K.

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Laboratory Automation Systems Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, By Type, 2017 - 2031

12.2.1. Equipment

12.2.1.1. Automated Workstations

12.2.1.2. Automated Storage & Retrieval Systems

12.2.1.3. Automated Liquid Handlers

12.2.1.4. Automated Plate Handlers

12.2.1.5. Robotic Arms

12.2.2. Software

12.2.3. Services

12.3. Market Value Forecast, By Application, 2017 - 2031

12.3.1. Clinical Diagnostics

12.3.2. Drug Discovery & Development

12.3.3. Genomics & Proteomics

12.3.4. Others (Microbiology, Biobanking, etc.)

12.4. Market Value Forecast, By End-user, 2017 - 2031

12.4.1. Biotechnology & Pharmaceutical Companies

12.4.2. Hospitals & Diagnostic Laboratories

12.4.3. Research & Academic Institutes

12.4.4. Others (Forensic Laboratories, Food & Beverage Industry)

12.5. Market Value Forecast, By Country/Sub-region, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Laboratory Automation Systems Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, By Type, 2017 - 2031

13.2.1. Equipment

13.2.1.1. Automated Workstations

13.2.1.2. Automated Storage & Retrieval Systems

13.2.1.3. Automated Liquid Handlers

13.2.1.4. Automated Plate Handlers

13.2.1.5. Robotic Arms

13.2.2. Software

13.2.3. Services

13.3. Market Value Forecast, By Application, 2017 - 2031

13.3.1. Clinical Diagnostics

13.3.2. Drug Discovery & Development

13.3.3. Genomics & Proteomics

13.3.4. Others (Microbiology, Biobanking, etc.)

13.4. Market Value Forecast, By End-user, 2017 - 2031

13.4.1. Biotechnology & Pharmaceutical Companies

13.4.2. Hospitals & Diagnostic Laboratories

13.4.3. Research & Academic Institutes

13.4.4. Others (Forensic Laboratories, Food & Beverage Industry)

13.5. Market Value Forecast, By Country/Sub-region, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Laboratory Automation Systems Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, By Type, 2017 - 2031

14.2.1. Equipment

14.2.1.1. Automated Workstations

14.2.1.2. Automated Storage & Retrieval Systems

14.2.1.3. Automated Liquid Handlers

14.2.1.4. Automated Plate Handlers

14.2.1.5. Robotic Arms

14.2.2. Software

14.2.3. Services

14.3. Market Value Forecast, By Application, 2017 - 2031

14.3.1. Clinical Diagnostics

14.3.2. Drug Discovery & Development

14.3.3. Genomics & Proteomics

14.3.4. Others (Microbiology, Biobanking, etc.)

14.4. Market Value Forecast, By End-user, 2017 - 2031

14.4.1. Biotechnology & Pharmaceutical Companies

14.4.2. Hospitals & Diagnostic Laboratories

14.4.3. Research & Academic Institutes

14.4.4. Others (Forensic Laboratories, Food & Beverage Industry)

14.5. Market Value Forecast, By Country/Sub-region, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis By Company (2022)

15.3. Company Profiles

15.3.1. BD

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. F. Hoffmann-La Roche Ltd.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Thermo Fisher Scientific Inc.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Agilent Technologies, Inc.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Siemens Healthcare GmbH

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Bio-Rad Laboratories, Inc.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Hitachi High-Tech Corporation

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Danaher (Beckman Coulter, Inc.)

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Abbott

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Shimadzu Corporation

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Hudson Robotics, Inc.

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

List of Tables

Table 01: Global Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 02: Global Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Equipment, 2017-2031

Table 03: Global Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Application,2017-2031

Table 04: Global Laboratory Automation Systems Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 05: Global Laboratory Automation Systems Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 06: North America Laboratory Automation Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 07: North America Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 08: North America Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Equipment, 2017-2031

Table 09: North America Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 10: North America Laboratory Automation Systems Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 11: Europe Laboratory Automation Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 12: Europe Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 13: Europe Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Equipment, 2017-2031

Table 14: Europe Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 15: Europe Laboratory Automation Systems Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Laboratory Automation Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 17: Asia Pacific Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 18: Asia Pacific Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Equipment, 2017-2031

Table 19: Asia Pacific Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 20: Asia Pacific Laboratory Automation Systems Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 21: Latin America Laboratory Automation Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 22: Latin America Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 23: Latin America Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Equipment, 2017-2031

Table 24: Latin America Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 25: Latin America Laboratory Automation Systems Market Size (US$ Bn) Forecast, by End-user, 2017-2031

Table 26: Middle East & Africa Laboratory Automation Systems Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 27: Middle East & Africa Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 28: Middle East & Africa Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Equipment, 2017-2031

Table 29: Middle East & Africa Laboratory Automation Systems Market Size (US$ Bn) Forecast, by Application, 2017-2031

Table 30: Middle East & Africa Laboratory Automation Systems Market Size (US$ Bn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Laboratory Automation Systems Market Value (US$ Bn) Forecast, 2017-2031

Figure 02: Global Laboratory Automation Systems Market Value Share, by Type, 2022

Figure 03: Global Laboratory Automation Systems Market Value Share, by Application, 2022

Figure 04: Global Laboratory Automation Systems Market Value Share, by End-user, 2022

Figure 05: Global Laboratory Automation Systems Market Value Share Analysis, by Type, 2022 and 2031

Figure 06: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Equipment, 2017-2031

Figure 07: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Automated Workstations, 2017-2031

Figure 08: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Automated Storage & Retrieval Systems, 2017-2031

Figure 09: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Automated Liquid Handlers, 2017-2031

Figure 10: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Automated Plate Handlers, 2017-2031

Figure 11: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Robotic Arms, 2017-2031

Figure 12: Global Laboratory Automation Systems Market Value Share Analysis, by Software, 2022 and 2031

Figure 13: Global Laboratory Automation Systems Market Value Share Analysis, by Services, 2022 and 2031

Figure 14: Global Laboratory Automation Systems Market Attractiveness Analysis, by Type, 2023-2031

Figure 15: Global Laboratory Automation Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 16: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Clinical Diagnostics, 2017-2031

Figure 17: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Drug Discovery & Development, 2017-2031

Figure 18: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Genomics & Proteomics, 2017-2031

Figure 19: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Others (Microbiology, Biobanking, etc.), 2017-2031

Figure 20: Global Laboratory Automation Systems Market Attractiveness Analysis, by Application, 2023-2031

Figure 21: Global Laboratory Automation Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 20: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Biotechnology & Pharmaceutical Companies, 2017-2031

Figure 21: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Hospitals & Diagnostic Laboratories, 2017-2031

Figure 22: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Research & Academic Institutes, 2017-2031

Figure 23: Global Laboratory Automation Systems Market Revenue (US$ Bn), by Others (Forensic Laboratories, Food & Beverage Industry), 2017-2031

Figure 24: Global Laboratory Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 25: Global Laboratory Automation Systems Market Value Share Analysis, by Region, 2022 and 2031

Figure 26: Global Laboratory Automation Systems Market Attractiveness Analysis, by Region, 2023-2031

Figure 27: North America Laboratory Automation Systems Market Value (US$ Bn) Forecast, 2017-2031

Figure 28: North America Laboratory Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 29: North America Laboratory Automation Systems Market Attractiveness Analysis, by Country, 2023-2031

Figure 30: North America Laboratory Automation Systems Market Value Share Analysis, by Type, 2022 and 2031

Figure 31: North America Laboratory Automation Systems Market Attractiveness Analysis, by Type, 2023-2031

Figure 32: North America Laboratory Automation Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 33: North America Laboratory Automation Systems Market Attractiveness Analysis, by Application, 2023-2031

Figure 34: North America Laboratory Automation Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 35: North America Laboratory Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 36: Europe Laboratory Automation Systems Market Value (US$ Bn) Forecast, 2017-2031

Figure 37: Europe Laboratory Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 38: Europe Laboratory Automation Systems Market Attractiveness Analysis, by Country, 2023-2031

Figure 39: Europe Laboratory Automation Systems Market Value Share Analysis, by Type, 2022 and 2031

Figure 40: Europe Laboratory Automation Systems Market Attractiveness Analysis, by Type, 2023-2031

Figure 41: Europe Laboratory Automation Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 42: Europe Laboratory Automation Systems Market Attractiveness Analysis, by Application, 2023-2031

Figure 43: Europe Laboratory Automation Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 44: Europe Laboratory Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 45: Asia Pacific Laboratory Automation Systems Market Value (US$ Bn) Forecast, 2017-2031

Figure 46: Asia Pacific Laboratory Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 47: Asia Pacific Laboratory Automation Systems Market Attractiveness Analysis, by Country, 2023-2031

Figure 48: Asia Pacific Laboratory Automation Systems Market Value Share Analysis, by Type, 2022 and 2031

Figure 49: Asia Pacific Laboratory Automation Systems Market Attractiveness Analysis, by Type, 2023-2031

Figure 50: Asia Pacific Laboratory Automation Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 51: Asia Pacific Laboratory Automation Systems Market Attractiveness Analysis, by Application, 2023-2031

Figure 52: Asia Pacific Laboratory Automation Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 53: Asia Pacific Laboratory Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 54: Latin America Laboratory Automation Systems Market Value (US$ Bn) Forecast, 2017-2031

Figure 55: Latin America Laboratory Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 56: Latin America Laboratory Automation Systems Market Attractiveness Analysis, by Country, 2023-2031

Figure 57: Latin America Laboratory Automation Systems Market Value Share Analysis, by Type, 2022 and 2031

Figure 58: Latin America Laboratory Automation Systems Market Attractiveness Analysis, by Type, 2023-2031

Figure 59: Latin America Laboratory Automation Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 60: Latin America Laboratory Automation Systems Market Attractiveness Analysis, by Application, 2023-2031

Figure 61: Latin America Laboratory Automation Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 62: Latin America Laboratory Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 63: Middle East & Africa Laboratory Automation Systems Market Value (US$ Bn) Forecast, 2017-2031

Figure 64: Middle East & Africa Laboratory Automation Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 65: Middle East & Africa Laboratory Automation Systems Market Attractiveness Analysis, by Country, 2023-2031

Figure 66: Middle East & Africa Laboratory Automation Systems Market Value Share Analysis, by Type, 2022 and 2031

Figure 67: Middle East & Africa Laboratory Automation Systems Market Attractiveness Analysis, by Type, 2023-2031

Figure 68: Middle East & Africa Laboratory Automation Systems Market Value Share Analysis, by Application, 2022 and 2031

Figure 69: Middle East & Africa Laboratory Automation Systems Market Attractiveness Analysis, by Application, 2023-2031

Figure 70: Middle East & Africa Laboratory Automation Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 71: Middle East & Africa Laboratory Automation Systems Market Attractiveness Analysis, by End-user, 2023-2031

Figure 72: Company Share Analysis