The labels market is at the cusp of some very significant changes and these are taking it on a high growth trajectory over the period of 2019 to 2027. Technology plays a key role in propelling growth in the market and determine market share for players operating the playfield. Some of the factors that are massive contributors to growth is going demand for pressure sensitive labels owing to their cost and versatility and increasing efficacy – an outcome of aggressive and proactive measures from players.

Some of the top factors, trends and developments, as identified by Transparency Market Research, are outlined below.

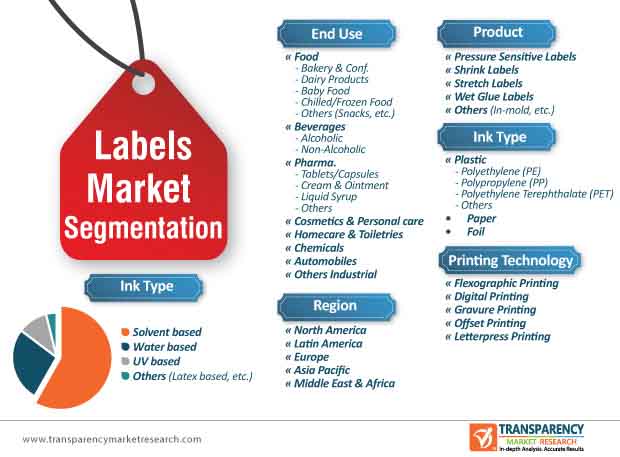

The versatility and cost-effectiveness of pressure sensitive labels (PSL) are contributing toward market growth. Light application of pressure without the need for heat, water or solvent are attributing to PSL’s easy-to-use features in the food industry. As such, the revenue of PS labels is anticipated for exponential growth in the labels market, where the global market is estimated to be valued at ~US$ 51 Bn by the end of 2027. Thus, to boost their credibility credentials in the market landscape, manufacturers are increasing their efficacy in PSL made from recycled materials.

Radio Frequency Identification (RFID) is emerging as a game changer in the labels market. RFID inlays are being embedded by PS labels that deploy intelligent labeling solutions to stakeholders in the food industry. As such, the ever-evolving food industry is generating maximum incremental opportunities for label manufacturers. On the other hand, the RFID technology is being used for tracking, authentication, and anti-counterfeit of goods.

Linerless Labels Boost Productivity Levels in Retail and Logistics Sector

Companies in the labels market are broadening their scope for revenue opportunities by increasing their production capacities in linerless labels. For instance, Mitsubishi Hitec Paper Europe— an innovator of high-quality coated specialty papers, is acquiring global recognition by manufacturing environmentally responsible and versatile linerless labels.

Linerless labels are gaining prominence in both retail and logictics applications. These novel labels can be used with mobile printers as well as with robust industrial printers. Such innovations are bolstering volume growth in the labels market, where the global market is estimated to reach an output of ~85,100 million square meters.

Advantages of linerless labels are benefitting stakeholders in the retail and logistics sector, owing to its attributes of material savings. Abundance of labels per roll are helping to reduce transportation and storage costs of these labels. Thus, stakeholders in the retail and logistics sector can meet their productivity targets since more labels per roll lead to less frequent exchanging of rolls.

Apart from leading players in the labels market, local and regional players that dictate ~65%-78% share of the market are gravitating toward latest innovations in inkjet printing. However, manufacturers dealing in traditional printing methods involving shrink sleeve labels such as flexographic printing and gravure printing require the need to create etched templates for each new run. Thus, manufacturers dealing in conventional printing methods are lagging behind in the global market competition. Hence, increased awareness about digital inkjet printing is helping label manufacturers to join the bandwagon of latest printing innovations.

The labels market is undergoing a change with the introduction of digital inkjet printing. As such, digital printing dictates the highest revenue among print technologies and is projected for aggressive growth during the forecast period. Digital inkjet printing is eliminating the need for plates or cylinders, thus emerging as a cost-effective choice for small batch printing.

Companies in the labels market are focusing on cast coated label papers that offer top performance. These one-of-its-kind papers are gaining prominence in wet glue labels. As such, wet glue labels account for the third-highest revenue among all product types in the market landscape. High gloss, first-class printability and good processing & finishing are becoming key focus points for stakeholders. End users are pervasively using premium label papers that create the best first impression at the point of sale. The use of premium label papers in beverage applications make rival products simply look weak. Thus, along with the food industry, the revenue of beverage end user is predicted for stellar growth in the market.

Good finishing properties of cast coated label papers such as embossing, bronzing, and metallizing are gaining consumer attention at retail stores. Its applicability in wet glue labels is anticipated to boost growth of the labels market, owing to its advantages of universal printability involving traditional and digital printing methods.

Analysts’ Viewpoint

Top-quality inkjet papers are becoming increasingly commonplace for the production of sophisticated and full-color labels. The labels market is anticipated to progress at a modest CAGR of 5% during the forecast period. However, novel introductions, such as removable and repositionable films for pharmaceutical and beverage labeling are contributing toward market growth.

Asia Pacific is expected for a stellar growth among all regions in the market landscape. However, there is a need to fulfill the requirements in thermal labels that place high demands on materials. Hence, companies should increase their production capabilities in thermal papers with high dynamic sensitivity for use on fast thermal printers.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Opportunity Analysis

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Labels Market Overview

3.1. Introduction

3.2. Global Economic Outlook

3.3. Global Manufacturing Value Added

3.4. Global Packaging Market Outlook

3.5. Key Developments in Labels Market

3.6. Macro-economic Factors

3.7. Forecast Factors – Relevance & Impact

3.8. Value Chain Analysis

3.8.1. List of Active Participants

3.8.1.1. Raw Material Suppliers

3.8.1.2. Manufacturers

3.8.1.3. Distributors

3.8.1.4. End Users

3.8.2. Profitability Margins

3.9. Labels Market Dynamics

3.9.1. Drivers

3.9.2. Restraints

3.9.3. Opportunity

3.9.4. Trends

4. Labels Market Analysis

4.1. Market Size (US$ Mn) and Forecast Analysis

4.2. Market Size and Y-o-Y Growth

4.3. Absolute $ Opportunity

4.4. Pricing Analysis

5. Global Labels Market Analysis and Forecast, by Product

5.1. Introduction

5.1.1. Market share and Basis Points (BPS) Analysis, by Product

5.1.2. Y-o-Y Growth Projections, by Product

5.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Product

5.3. Market Size (US$ Mn) and Volume (Mn Sq. M.) Forecast Analysis 2019-2027, by Product

5.3.1. Pressure Sensitive Labels (PSL)

5.3.2. Shrink Labels

5.3.3. Stretch Labels

5.3.4. Wet Glue Labels

5.3.5. Others (In-mold, Pre-gummed, etc.)

5.4. Market Attractiveness Analysis, by Product

6. Global Labels Market Analysis and Forecast, By Face Material

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis, By Face Material

6.1.2. Y-o-Y Growth Projections, By Face Material

6.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, By Face Material

6.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, By Face Material

6.3.1. Plastic

6.3.1.1. Polyethylene

6.3.1.1.1. LDPE

6.3.1.1.2. HDPE

6.3.1.1.3. LLDPE

6.3.1.2. Polypropylene

6.3.1.3. Polyethylene Terephthalate

6.3.1.4. Others

6.3.2. Paper

6.3.3. Foil

6.4. Market Attractiveness Analysis, By Face Material

7. Global Labels Market Analysis and Forecast, by Printing Technology

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, by Printing Technology

7.1.2. Y-o-Y Growth Projections, by Printing Technology

7.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Printing Technology

7.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Printing Technology

7.3.1. Flexographic Printing

7.3.2. Digital Printing

7.3.3. Gravure Printing

7.3.4. Offset Printing

7.3.5. Letterpress Printing

7.4. Market Attractiveness Analysis, by Printing Technology

8. Global Labels Market Analysis and Forecast, by Ink Type

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, by Ink Type

8.1.2. Y-o-Y Growth Projections, by Ink Type

8.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Ink Type

8.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Ink Type

8.3.1. Solvent based

8.3.2. Water based

8.3.3. UV based

8.3.4. Others (Latex based, etc.)

8.4. Market Attractiveness Analysis, by Ink Type

9. Global Labels Market Analysis and Forecast, by End Use

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, by End Use

9.1.2. Y-o-Y Growth Projections, by End Use

9.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by End Use

9.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by End Use

9.3.1. Food

9.3.1.1. Bakery & Confectionaries

9.3.1.2. Dairy Products

9.3.1.3. Baby Food

9.3.1.4. Chilled/Frozen Food

9.3.1.5. Others (Snacks, etc.)

9.3.2. Beverages

9.3.2.1. Alcoholic

9.3.2.2. Non-Alcoholic

9.3.3. Pharma.

9.3.3.1. Tablet/Capsules

9.3.3.2. Cream & Ointment

9.3.3.3. Liquid Syrup

9.3.3.4. Others

9.3.4. Cosmetics & Personal Care

9.3.5. Homecare & Toiletries

9.3.6. Chemicals

9.3.7. Automobiles

9.3.8. Others Industrial

9.4. Market Attractiveness Analysis, by End Use

10. Global Labels Market Analysis and Forecast, by Region

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, by Region

10.1.2. Y-o-Y Growth Projections, by Region

10.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Region

10.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific

10.3.5. Middle East and Africa (MEA)

10.4. Market Attractiveness Analysis, by Region

11. North America Labels Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, by Country

11.1.2. Y-o-Y Growth Projections, by Country

11.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Country

11.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Country

11.3.1. U.S.

11.3.2. Canada

11.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Product

11.5. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, by Product

11.5.1. Pressure Sensitive Labels (PSL)

11.5.2. Shrink Labels

11.5.3. Stretch Labels

11.5.4. Wet Glue Labels

11.5.5. Others (In-mold, Pre-gummed, etc.)

11.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, By Face Material

11.7. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, By Face Material

11.7.1. Plastic

11.7.1.1. Polyethylene

11.7.1.1.1. LDPE

11.7.1.1.2. HDPE

11.7.1.1.3. LLDPE

11.7.1.2. Polypropylene

11.7.1.3. Polyethylene Terephthalate

11.7.1.4. Others

11.7.2. Paper

11.7.3. Foil

11.8. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Printing Technology

11.9. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Printing Technology

11.9.1. Flexographic Printing

11.9.2. Digital Printing

11.9.3. Gravure Printing

11.9.4. Offset Printing

11.9.5. Letterpress Printing

11.10. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Ink Type

11.11. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Ink Type

11.11.1. Solvent based

11.11.2. Water based

11.11.3. UV based

11.11.4. Others (Latex based, etc.)

11.12. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by End Use

11.13. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by End Use

11.13.1. Food

11.13.1.1. Bakery & Confectionaries

11.13.1.2. Dairy Products

11.13.1.3. Baby Food

11.13.1.4. Chilled/Frozen Food

11.13.1.5. Others (Snacks, etc.)

11.13.2. Beverages

11.13.2.1. Alcoholic

11.13.2.2. Non-Alcoholic

11.13.3. Pharma.

11.13.3.1. Tablet/Capsules

11.13.3.2. Cream & Ointment

11.13.3.3. Liquid Syrup

11.13.3.4. Others

11.13.4. Cosmetics & Personal Care

11.13.5. Homecare & Toiletries

11.13.6. Chemicals

11.13.7. Automobiles

11.13.8. Others Industrial

11.14. Market Attractiveness Analysis

11.14.1. By Country

11.14.2. By Product

11.14.3. By Face Material

11.14.4. By Printing Technology

11.14.5. By Ink Type

11.14.6. By End Use

12. Latin America Labels Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, by Country

12.1.2. Y-o-Y Growth Projections, by Country

12.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Country

12.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 By Country

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Argentina

12.3.4. Rest of Latin America

12.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Product

12.5. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, by Product

12.5.1. Pressure Sensitive Labels (PSL)

12.5.2. Shrink Labels

12.5.3. Stretch Labels

12.5.4. Wet Glue Labels

12.5.5. Others (In-mold, Pre-gummed, etc.)

12.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, By Face Material

12.7. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, By Face Material

12.7.1. Plastic

12.7.1.1. Polyethylene

12.7.1.1.1. LDPE

12.7.1.1.2. HDPE

12.7.1.1.3. LLDPE

12.7.1.2. Polypropylene

12.7.1.3. Polyethylene Terephthalate

12.7.1.4. Others

12.7.2. Paper

12.7.3. Foil

12.8. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Printing Technology

12.9. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Printing Technology

12.9.1. Flexographic Printing

12.9.2. Digital Printing

12.9.3. Gravure Printing

12.9.4. Offset Printing

12.9.5. Letterpress Printing

12.10. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Ink Type

12.11. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Ink Type

12.11.1. Solvent based

12.11.2. Water based

12.11.3. UV based

12.11.4. Others (Latex based, etc.)

12.12. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by End Use

12.13. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by End Use

12.13.1. Food

12.13.1.1. Bakery & Confectionaries

12.13.1.2. Dairy Products

12.13.1.3. Baby Food

12.13.1.4. Chilled/Frozen Food

12.13.1.5. Others (Snacks, etc.)

12.13.2. Beverages

12.13.2.1. Alcoholic

12.13.2.2. Non-Alcoholic

12.13.3. Pharma.

12.13.3.1. Tablet/Capsules

12.13.3.2. Cream & Ointment

12.13.3.3. Liquid Syrup

12.13.3.4. Others

12.13.4. Cosmetics & Personal Care

12.13.5. Homecare & Toiletries

12.13.6. Chemicals

12.13.7. Automobiles

12.13.8. Others Industrial

12.14. Market Attractiveness Analysis

12.14.1. By Country

12.14.2. By Product

12.14.3. By Face Material

12.14.4. By Printing Technology

12.14.5. By Ink Type

12.14.6. By End Use

13. Europe Labels Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, by Country

13.1.2. Y-o-Y Growth Projections, by Country

13.1.3. Key Regulations

13.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Country

13.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 by Country

13.3.1. Germany

13.3.2. Spain

13.3.3. Italy

13.3.4. France

13.3.5. U.K.

13.3.6. BENELUX

13.3.7. Nordic

13.3.8. Russia

13.3.9. Poland

13.3.10. Rest of Europe

13.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Product

13.5. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, by Product

13.5.1. Pressure Sensitive Labels (PSL)

13.5.2. Shrink Labels

13.5.3. Stretch Labels

13.5.4. Wet Glue Labels

13.5.5. Others (In-mold, Pre-gummed, etc.)

13.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, By Face Material

13.7. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, By Face Material

13.7.1. Plastic

13.7.1.1. Polyethylene

13.7.1.1.1. LDPE

13.7.1.1.2. HDPE

13.7.1.1.3. LLDPE

13.7.1.2. Polypropylene

13.7.1.3. Polyethylene Terephthalate

13.7.1.4. Others

13.7.2. Paper

13.7.3. Foil

13.8. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Printing Technology

13.9. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Printing Technology

13.9.1. Flexographic Printing

13.9.2. Digital Printing

13.9.3. Gravure Printing

13.9.4. Offset Printing

13.9.5. Letterpress Printing

13.10. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Ink Type

13.11. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Ink Type

13.11.1. Solvent based

13.11.2. Water based

13.11.3. UV based

13.11.4. Others (Latex based, etc.)

13.12. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by End Use

13.13. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by End Use

13.13.1. Food

13.13.1.1. Bakery & Confectionaries

13.13.1.2. Dairy Products

13.13.1.3. Baby Food

13.13.1.4. Chilled/Frozen Food

13.13.1.5. Others (Snacks, etc.)

13.13.2. Beverages

13.13.2.1. Alcoholic

13.13.2.2. Non-Alcoholic

13.13.3. Pharma.

13.13.3.1. Tablet/Capsules

13.13.3.2. Cream & Ointment

13.13.3.3. Liquid Syrup

13.13.3.4. Others

13.13.4. Cosmetics & Personal Care

13.13.5. Homecare & Toiletries

13.13.6. Chemicals

13.13.7. Automobiles

13.13.8. Others Industrial

13.14. Market Attractiveness Analysis

13.14.1. By Country

13.14.2. By Product

13.14.3. By Face Material

13.14.4. By Printing Technology

13.14.5. By Ink Type

13.14.6. By End Use

14. Asia Pacific Labels Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, by Country

14.1.2. Y-o-Y Growth Projections, by Country

14.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Country

14.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 By Country

14.3.1. China

14.3.2. India

14.3.3. Japan

14.3.4. ASEAN

14.3.5. Australia and New Zealand

14.3.6. Rest of APAC

14.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Product

14.5. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, by Product

14.5.1. Pressure Sensitive Labels (PSL)

14.5.2. Shrink Labels

14.5.3. Stretch Labels

14.5.4. Wet Glue Labels

14.5.5. Others (In-mold, Pre-gummed, etc.)

14.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, By Face Material

14.7. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, By Face Material

14.7.1. Plastic

14.7.1.1. Polyethylene

14.7.1.1.1. LDPE

14.7.1.1.2. HDPE

14.7.1.1.3. LLDPE

14.7.1.2. Polypropylene

14.7.1.3. Polyethylene Terephthalate

14.7.1.4. Others

14.7.2. Paper

14.7.3. Foil

14.8. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Printing Technology

14.9. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Printing Technology

14.9.1. Flexographic Printing

14.9.2. Digital Printing

14.9.3. Gravure Printing

14.9.4. Offset Printing

14.9.5. Letterpress Printing

14.10. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Ink Type

14.11. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Ink Type

14.11.1. Solvent based

14.11.2. Water based

14.11.3. UV based

14.11.4. Others (Latex based, etc.)

14.12. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by End Use

14.13. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by End Use

14.13.1. Food

14.13.1.1. Bakery & Confectionaries

14.13.1.2. Dairy Products

14.13.1.3. Baby Food

14.13.1.4. Chilled/Frozen Food

14.13.1.5. Others (Snacks, etc.)

14.13.2. Beverages

14.13.2.1. Alcoholic

14.13.2.2. Non-Alcoholic

14.13.3. Pharma.

14.13.3.1. Tablet/Capsules

14.13.3.2. Cream & Ointment

14.13.3.3. Liquid Syrup

14.13.3.4. Others

14.13.4. Cosmetics & Personal Care

14.13.5. Homecare & Toiletries

14.13.6. Chemicals

14.13.7. Automobiles

14.13.8. Others Industrial

14.14. Market Attractiveness Analysis

14.14.1. By Country

14.14.2. By Product

14.14.3. By Face Material

14.14.4. By Printing Technology

14.14.5. By Ink Type

14.14.6. By End Use

15. Middle East and Africa Labels Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, by Country

15.1.2. Y-o-Y Growth Projections, by Country

15.2. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Country

15.3. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Country

15.3.1. North Africa

15.3.2. GCC countries

15.3.3. South Africa

15.3.4. Turkey

15.3.5. Israel

15.3.6. Rest of MEA

15.4. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Product

15.5. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, by Product

15.5.1. Pressure Sensitive Labels (PSL)

15.5.2. Shrink Labels

15.5.3. Stretch Labels

15.5.4. Wet Glue Labels

15.5.5. Others (In-mold, Pre-gummed, etc.)

15.6. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, By Face Material

15.7. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027 Analysis 2019-2027, By Face Material

15.7.1. Plastic

15.7.1.1. Polyethylene

15.7.1.1.1. LDPE

15.7.1.1.2. HDPE

15.7.1.1.3. LLDPE

15.7.1.2. Polypropylene

15.7.1.3. Polyethylene Terephthalate

15.7.1.4. Others

15.7.2. Paper

15.7.3. Foil

15.8. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Printing Technology

15.9. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Printing Technology

15.9.1. Flexographic Printing

15.9.2. Digital Printing

15.9.3. Gravure Printing

15.9.4. Offset Printing

15.9.5. Letterpress Printing

15.10. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by Ink Type

15.11. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by Ink Type

15.11.1. Solvent based

15.11.2. Water based

15.11.3. UV based

15.11.4. Others (Latex based, etc.)

15.12. Historical Market Value (US$ Mn) and Volume (Mn. Sq. M.), 2014-2018, by End Use

15.13. Market Size (US$ Mn) and Volume (Mn. Sq. M.) Forecast Analysis 2019-2027, by End Use

15.13.1. Food

15.13.1.1. Bakery & Confectionaries

15.13.1.2. Dairy Products

15.13.1.3. Baby Food

15.13.1.4. Chilled/Frozen Food

15.13.1.5. Others (Snacks, etc.)

15.13.2. Beverages

15.13.2.1. Alcoholic

15.13.2.2. Non-Alcoholic

15.13.3. Pharma.

15.13.3.1. Tablet/Capsules

15.13.3.2. Cream & Ointment

15.13.3.3. Liquid Syrup

15.13.3.4. Others

15.13.4. Cosmetics & Personal Care

15.13.5. Homecare & Toiletries

15.13.6. Chemicals

15.13.7. Automobiles

15.13.8. Others Industrial

15.14. Market Attractiveness Analysis

15.14.1. By Country

15.14.2. By Product

15.14.3. By Face Material

15.14.4. By Printing Technology

15.14.5. By Ink Type

15.14.6. By End Use

16. Competitive Landscape

16.1. Competition Dashboard

16.2. Company Market Share Analysis

16.3. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

16.4. Global Players

16.4.1. CCL Industries Inc.

16.4.1.1. Overview

16.4.1.2. Financials

16.4.1.3. Production Capacities

16.4.1.4. Plant/Units Locations

16.4.1.5. Recent Developments

16.4.1.6. SWOT Analysis

16.4.2. Fuji Seal International, Inc

16.4.2.1. Overview

16.4.2.2. Financials

16.4.2.3. Production Capacities

16.4.2.4. Plant/Units Locations

16.4.2.5. Recent Developments

16.4.2.6. SWOT Analysis

16.4.3. 3M Company

16.4.3.1. Overview

16.4.3.2. Financials

16.4.3.3. Production Capacities

16.4.3.4. Plant/Units Locations

16.4.3.5. Recent Developments

16.4.3.6. SWOT Analysis

16.4.4. Multi-Color Corporation

16.4.4.1. Overview

16.4.4.2. Financials

16.4.4.3. Production Capacities

16.4.4.4. Plant/Units Locations

16.4.4.5. Recent Developments

16.4.4.6. SWOT Analysis

16.4.5. Avery Dennison Corporation

16.4.5.1. Overview

16.4.5.2. Financials

16.4.5.3. Production Capacities

16.4.5.4. Plant/Units Locations

16.4.5.5. Recent Developments

16.4.5.6. SWOT Analysis

16.4.6. Fort Dearborn Company

16.4.6.1. Overview

16.4.6.2. Financials

16.4.6.3. Production Capacities

16.4.6.4. Plant/Units Locations

16.4.6.5. Recent Developments

16.4.6.6. SWOT Analysis

16.4.7. Klöckner Pentaplast Europe GmbH & Co KG

16.4.7.1. Overview

16.4.7.2. Financials

16.4.7.3. Production Capacities

16.4.7.4. Plant/Units Locations

16.4.7.5. Recent Developments

16.4.7.6. SWOT Analysis

16.4.8. Coveries Holding

16.4.8.1. Overview

16.4.8.2. Financials

16.4.8.3. Production Capacities

16.4.8.4. Plant/Units Locations

16.4.8.5. Recent Developments

16.4.8.6. SWOT Analysis

16.4.9. Huhtamäki Oyj

16.4.9.1. Overview

16.4.9.2. Financials

16.4.9.3. Production Capacities

16.4.9.4. Plant/Units Locations

16.4.9.5. Recent Developments

16.4.9.6. SWOT Analysis

16.4.10. Lintec

16.4.10.1. Overview

16.4.10.2. Financials

16.4.10.3. Production Capacities

16.4.10.4. Plant/Units Locations

16.4.10.5. Recent Developments

16.4.10.6. SWOT Analysis

16.4.11. Bemis (Amcor Plc)

16.4.11.1. Overview

16.4.11.2. Financials

16.4.11.3. Production Capacities

16.4.11.4. Plant/Units Locations

16.4.11.5. Recent Developments

16.4.11.6. SWOT Analysis

16.4.12. WS Packaging Group, Inc

16.4.12.1. Overview

16.4.12.2. Financials

16.4.12.3. Production Capacities

16.4.12.4. Plant/Units Locations

16.4.12.5. Recent Developments

16.4.12.6. SWOT Analysis

16.4.13. Walle Corporation

16.4.13.1. Overview

16.4.13.2. Financials

16.4.13.3. Production Capacities

16.4.13.4. Plant/Units Locations

16.4.13.5. Recent Developments

16.4.13.6. SWOT Analysis

16.4.14. Resource Label Group, LLC

16.4.14.1. Overview

16.4.14.2. Financials

16.4.14.3. Production Capacities

16.4.14.4. Plant/Units Locations

16.4.14.5. Recent Developments

16.4.14.6. SWOT Analysis

16.4.15. Hub Labels, Inc.

16.4.15.1. Overview

16.4.15.2. Financials

16.4.15.3. Production Capacities

16.4.15.4. Plant/Units Locations

16.4.15.5. Recent Developments

16.4.15.6. SWOT Analysis

16.4.16. Axiom Label Group

16.4.16.1. Overview

16.4.16.2. Financials

16.4.16.3. Production Capacities

16.4.16.4. Plant/Units Locations

16.4.16.5. Recent Developments

16.4.16.6. SWOT Analysis

16.4.17. Anchor Printing

16.4.17.1. Overview

16.4.17.2. Financials

16.4.17.3. Production Capacities

16.4.17.4. Plant/Units Locations

16.4.17.5. Recent Developments

16.4.17.6. SWOT Analysis

16.4.18. Traco Manufacturing, Inc

16.4.18.1. Overview

16.4.18.2. Financials

16.4.18.3. Plant/Units Locations

16.4.18.4. Recent Developments

16.4.18.5. SWOT Analysis

16.4.19. H Derksen & Sons Company

16.4.19.1. Overview

16.4.19.2. Financials

16.4.19.3. Plant/Units Locations

16.4.19.4. Recent Developments

16.4.19.5. SWOT Analysis

16.4.20. Reflex Labels Ltd

16.4.20.1. Overview

16.4.20.2. Financials

16.4.20.3. Plant/Units Locations

16.4.20.4. Recent Developments

16.4.20.5. SWOT Analysis

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Global Labels Market Value (US$ Mn) and Volume (Mn Sq.m.) Analysis, by Product Type, 2014H-2027F

Table 02: Global Labels Market Value (US$ Mn) Analysis, by Material, 2014H-2027F

Table 03: Global Labels Market Volume (Mn Sq.m.) Analysis, by Material, 2014H-2027F

Table 04: Global Labels Market Value (US$ Mn) and Volume (Mn Sq.m.) Analysis, by Print Technique Type, 2014H-2027F

Table 05: Global Labels Market Value (US$ Mn) and Volume (Mn Sq.m.) Analysis, by Ink Type, 2014H-2027F

Table 06: Global Labels Market Value (US$ Mn) Analysis, by End Use, 2014H-2027F

Table 07: Global Labels Market Volume (Mn Sq.m.) Analysis, by End Use, 2014H-2027F

Table 08: Global Labels Market Value (US$ Mn) and Volume (Mn Sq.m.) Analysis, by Region, 2014H-2027F

Table 09: North America Labels Market Analysis, in Value (US$ Mn), 2014H-2027F

Table 10: North America Labels Market Analysis, in Volume (Mn Sq.m.), 2014H-2027F

Table 11: Latin America Labels Market Analysis, in Value (US$ Mn), 2014H-2027F

Table 12: Latin America Labels Market Analysis, in Volume (Mn Sq.m.), 2014H-2027F

Table 13: Europe Labels Market Analysis, in Value (US$ Mn), 2014H-2027F

Table 14: Europe Labels Market Analysis, in Volume (Mn Sq.m.), 2014H-2027F

Table 15: Asia Pacific Labels Market Analysis, in Value (US$ Mn), 2014H-2027F

Table 16: Asia Pacific Labels Market Analysis, in Volume (Mn Sq.m.), 2014H-2027F

Table 17: MEA Labels Market Analysis, in Value (US$ Mn), 2014H-2027F

Table 18: MEA Labels Market Analysis, in Volume (Mn Sq.m.), 2014H-2027F

List of Figure

Figure 01: Global Labels Market Share Analysis by Product, 2019(E) & 2027F)

Figure 02: Global Labels Market Attractiveness Analysis by Product, 2019E-2027F

Figure 03: Global Labels Market Share Analysis by Material, 2019(E) & 2027F)

Figure 04: Global Labels Market Attractiveness Analysis by Material, 2019E-2027F

Figure 05: Global Labels Market Share Analysis by Print Technique, 2019(E) & 2027F)

Figure 06: Global Labels Market Attractiveness Analysis by Print Technique, 2019E-2027F

Figure 07: Global Labels Market Share Analysis by Ink Type, 2019(E) & 2027F)

Figure 08: Global Labels Market Attractiveness Analysis by Ink Type, 2019E-2027F

Figure 09: Global Labels Market Share Analysis by End Use, 2019(E) & 2027F)

Figure 10: Global Labels Market Attractiveness Analysis by End Use, 2019E-2027F

Figure 11: Global Labels Market Share Analysis by Region, 2019(E) & 2027F)

Figure 12: Global Labels Market Attractiveness Analysis by Material, 2019E-2027F

Figure 14: North America Labels Market Attractiveness Analysis by Product Type, 2019E-2027F

Figure 13: North America Labels Market Share Analysis by Country, 2019(E)

Figure 15: North America Labels Market Attractiveness Analysis by Material, 2019E-2027F

Figure 16: North America Labels Market Attractiveness Analysis by Printing Technique, 2019E-2027F

Figure 18: North America Labels Market Share Analysis by End Use, 2019(E)

Figure 17: North America Labels Market Attractiveness Analysis by Ink Type, 2019E-2027F

Figure 20: Latin America Labels Market Attractiveness Analysis by Product Type, 2019E-2027F

Figure 19: Latin America Labels Market Share Analysis by Country, 2019(E)

Figure 21: Latin America Labels Market Attractiveness Analysis by Material, 2019E-2027F

Figure 22: Latin America Labels Market Attractiveness Analysis by Printing Technique, 2019E-2027F

Figure 24: Latin America Labels Market Share Analysis by End Use, 2019(E)

Figure 23: Latin America Labels Market Attractiveness Analysis by Ink Type, 2019E-2027F

Figure 26: Europe Labels Market Attractiveness Analysis by Product Type, 2019E-2027F

Figure 25: Europe Labels Market Share Analysis by Country, 2019(E)

Figure 27: Europe Labels Market Attractiveness Analysis by Material, 2019E-2027F

Figure 28: Europe Labels Market Attractiveness Analysis by Printing Technique, 2019E-2027F

Figure 30: Europe Labels Market Share Analysis by End Use, 2019(E)

Figure 29: Europe Labels Market Attractiveness Analysis by Ink Type, 2019E-2027F

Figure 32: Asia Pacific Labels Market Attractiveness Analysis by Product Type, 2019E-2027F

Figure 31: Asia Pacific Labels Market Share Analysis by Country, 2019(E)

Figure 33: Asia Pacific Labels Market Attractiveness Analysis by Material, 2019E-2027F

Figure 34: Asia Pacific Labels Market Attractiveness Analysis by Printing Technique, 2019E-2027F

Figure 36: Asia Pacific Labels Market Share Analysis by End Use, 2019(E)

Figure 35: Asia Pacific Labels Market Attractiveness Analysis by Ink Type, 2019E-2027F

Figure 38: MEA Labels Market Attractiveness Analysis by Product Type, 2019E-2027F

Figure 37: MEA Labels Market Share Analysis by Country, 2019(E)

Figure 39: MEA Labels Market Attractiveness Analysis by Material, 2019E-2027F

Figure 40: MEA Labels Market Attractiveness Analysis by Printing Technique, 2019E-2027F

Figure 42: MEA Labels Market Share Analysis by End Use, 2019(E)

Figure 41: MEA Labels Market Attractiveness Analysis by Ink Type, 2019E-2027F