Analysts’ Viewpoint on Label-free array systems Market Scenario

Label-free array systems have gained popularity as primary research tools in different drug discovery processes over the last few years. Manufacturers are generating biorelevant data using label-free technologies and patient samples, which could help in efficient drug development and precision medicine. Modern medicine is moving toward precision or personalized medicine to eliminate individual dosing redundancy. Businesses are also concentrating on developing appropriate readout systems and cellular models in order to grasp mechanisms and functional studies on a molecular and cellular level. Mass spectroscopy, biochips/microarrays, and other cutting-edge label-free techniques have also shown promise in locating clinical microorganisms. Manufacturers are developing specially formulated imaging biosensors that can be incorporated into microplates to detect molecules, cell lines, and proteins. This is likely to present significant opportunities for players in the global label-free array systems market in the near future.

Label-free detection techniques are employed more often than conventional label-based detection techniques to study molecular interactions. Label-free detection has become vital in applications where label detection could compromise the target characteristic. Usage of heavy fluorescent or other labels is not necessary when using label-free array techniques to find new molecules. In comparison to the conventional labelled technique, the label-free array technique offers a number of benefits including quick delivery, dependability, reliability, and accurate real-time results. Label-free array techniques are less expensive overall, as no radioactive or fluorescent labels, tags, dye, or specialized reagents are needed for the preparation of the assay.

Advancements in material science, nanotechnology, and computational configuration have led to development of label-free microarray methods such as label-free protein microarrays and label-free biosensor arrays. These methods are quite helpful in understanding disease signaling pathway, protein profiling, biomarker screening, drug discovery, drug target identification, and drug target identification.

The usage of surface plasmon resonance (SPR) technology as an optical detection technique for biosensors is gaining popularity. Better understanding and acceptance of the technology is excepted to increase the usage of SPR in clinical chemistry and medicine. The global label-free array systems market size is anticipated to grow at a steady pace during the forecast period owing to the rise in awareness and acceptance of these systems. These techniques reduce cost and time, and offer high throughput results in real time. Label-free methods deliver dependable, quick, and accurate results in less time than conventional methods. Additionally, label-free methods offer real-time data on binding kinetics, affinity, and other crucial analyses, thereby cutting down on the overall processing time.

Atomic force microscopy (AFM) is a potent method for capturing images of nearly any surface including glass, ceramics, composites, polymers, and biological material. AFM is used to quantify and locate a large spectrum of forces including magnetic force and mechanical properties. It can be used to examine cells and molecules at the nanometer scale. It can now be used to diagnose and conduct cancer research. Living cells' physicochemical characteristics change as their changes in physiological conditions. Therefore, these physicochemical characteristics could represent intricate physiological processes that take place in cells. Morphology, elasticity, and adhesion characteristics of cells can change when they are going through the carcinogenesis process and are provided external stimuli. In order to study the mechanical properties of live cells, AFM can perform atomic resolution surface imaging and ultrastructural observation of the cells under conditions that are close to physiological conditions. AFM has the potential to be used as a high-resolution research tool to study the ultrastructure and mechanical characteristics of tumor cells.

The cost and time required to deliver new drugs for clinical use have increased over the last three decades. Attempts to increase the number of compounds entering the drug development pipeline have largely been unsuccessful despite the rise in financial assets in research infrastructure by pharma firms and technical advances in scientific tools. Delivery of new medicines has not become effective despite the increase in cost of drug discovery projects. On the contrary, fewer medications than ever before are passing through the drug development process. The industry's overreliance on high-tech platforms, strict requirements for new drug registration & approval, and exhaustion of obvious and accessible drug targets—all these require the investigation of more complex biological systems—are the primary causes of the productivity decline. These factors are likely to drive the global label-free array systems market in the next few years.

In terms of technique, the global label-free array systems market has been classified into surface plasmon resonance, microcantilever, scanning kelvin nanoprobe, enthalpy array, atomic force microscopy, electrochemical impedance spectroscopy, interference-based technique, ellipsometry technique, and others. Microcantilevers can be used to measure a range of physical, chemical, and even biochemical variables. Microcantilever array detection increases accuracy through the usage of several sensors concurrently. This increased dependability is especially significant for practical applications. Multiple chemical or biological analysts can be detected simultaneously using group-produced microcantilever arrays. Applications could be made for clinical, industrial, military, and consumer markets. This would be particularly true once several target molecule mixtures can be examined and screened on a single, tiny chip.

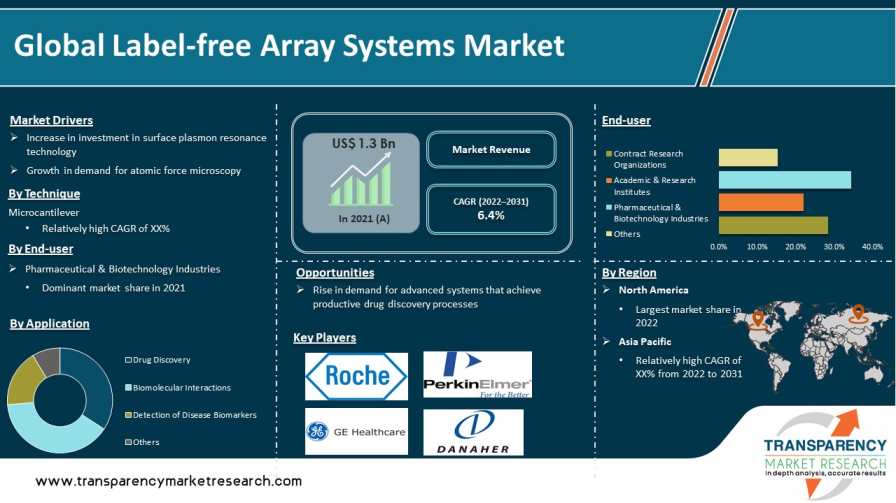

Based on application, the drug discovery segment held major share of the global market in 2021. Rise in application of label-free techniques in drug discovery, increase in R&D costs, and surge in demand for new and targeted drugs in life sciences and pharmaceutical industries are the key drivers of the drug discovery segment. Label-free methods, such as the detection and measurement of a local change in refractive index, can be used to study various interactions, including those between a drug molecule and its receptor. The drug discovery segment is anticipated to witness strong growth during the forecast period due to the increase in government funding for label-free array system market research and rise in label-free technique applications.

In terms of end-user, the global label-free array systems market has been divided into contract research organizations, academic & research institutes, pharmaceutical & biotechnology industries, and others. The pharmaceutical & biotechnology industries segment is anticipated to grow at a rapid pace in the next few years. Increase in R&D investments by pharmaceutical and biotech companies is the major factor propelling the segment. Several companies focus on the development of novel and targeted drugs in order to gain a competitive edge in the highly fragmented industry.

North America accounted for major share of the global label-free array systems market in 2021. The region is expected to emerge as a market leader in label-free array systems in the next few years. This can be ascribed to the increase in drug discovery programs in the U.S. owing to the rise in incidence of chronic and life-threatening diseases. In turn, this is likely to drive the demand for label-free array systems in the country. Label-free cell-based systems are also being introduced by companies for early drug discovery.

The market in Asia Pacific is expected to grow at a rapid pace during the forecast period. This can be ascribed to the growth in focus on new therapy development, availability of funds, increase in number of drug discovery projects, and rise in demand for monoclonal antibodies.

The global label-free array systems market is consolidated, with the presence of small number of leading players. Most of the companies are investing significantly in research & development activities, primarily to introduce advanced label-free array systems products. Key players are entering into strategic alliances to increase revenue and market share. Furthermore, diversification of product portfolios and mergers & acquisitions are the prominent strategies adopted by the leading players. GE Healthcare, Attana AB, Agilent Technologies, Inc., Danaher Corporation, F. Hoffmann-La Roche AG, Bio-Rad Laboratories, GWC Technologies, PerkinElmer, Inc., and BiOptix, Inc. are the key players operating in the global label-free array systems market.

Each of these players has been profiled in the label-free array systems market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.3 Bn |

|

Market Forecast Value in 2031 |

More than US$ 2.4 Bn |

|

Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global label-free array systems market was valued at US$ 1.3 Bn in 2021

The global label-free array systems market is projected to reach more than US$ 2.4 Bn by 2031

The global label-free array systems market is anticipated to grow at a CAGR of 6.4% from 2022 to 2031

Increase in investment in surface plasmon resonance technology and rise in demand for atomic force microscopy

The surface plasmon resonance segment held more than 31% share of the global label-free array systems market in 2021

GE Healthcare, Attana AB, Agilent Technologies, Inc., Danaher Corporation, F. Hoffmann-La Roche AG, Bio-Rad Laboratories, GWC Technologies, PerkinElmer, Inc., and BiOptix, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Label-free Array Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Label-free Array Systems Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Key Mergers & Acquisitions

5.2. Technological Advancements

5.3. Healthcare Industry Overview

5.4. Regulatory Scenario, by Region/globally

6. Global Label-free Array Systems Market Analysis and Forecast, by Technique

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Surface Plasmon Resonance

6.3.2. Microcantilever

6.3.3. Scanning Kelvin Nanoprobe

6.3.4. Enthalpy Array

6.3.5. Atomic Force Microscopy

6.3.6. Electrochemical Impedance Spectroscopy

6.3.7. Interference-based Technique

6.3.8. Ellipsometry Technique

6.3.9. Others

6.4. Market Attractiveness Analysis, by Technique

7. Global Label-free Array Systems Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Drug Discovery

7.3.2. Biomolecular Interactions

7.3.3. Detection of Disease Biomarkers

7.3.4. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Label-free Array Systems Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Contract Research Organizations

8.3.2. Academic & Research Institutes

8.3.3. Pharmaceutical & Biotechnology Industries

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Label-free Array Systems Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Label-free Array Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Technique, 2017–2031

10.2.1. Surface Plasmon Resonance

10.2.2. Microcantilever

10.2.3. Scanning Kelvin Nanoprobe

10.2.4. Enthalpy Array

10.2.5. Atomic Force Microscopy

10.2.6. Electrochemical Impedance Spectroscopy

10.2.7. Interference-based Technique

10.2.8. Ellipsometry Technique

10.2.9. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Drug Discovery

10.3.2. Biomolecular Interactions

10.3.3. Detection of Disease Biomarkers

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Contract Research Organizations

10.4.2. Academic & Research Institutes

10.4.3. Pharmaceutical & Biotechnology Industries

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Technique

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Label-free Array Systems Market Analysis and Forecast

11.1. Introduction

11.2. Market Value Forecast, by Technique, 2017–2031

11.2.1. Surface Plasmon Resonance

11.2.2. Microcantilever

11.2.3. Scanning Kelvin Nanoprobe

11.2.4. Enthalpy Array

11.2.5. Atomic Force Microscopy

11.2.6. Electrochemical Impedance Spectroscopy

11.2.7. Interference-based Technique

11.2.8. Ellipsometry Technique

11.2.9. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Drug Discovery

11.3.2. Biomolecular Interactions

11.3.3. Detection of Disease Biomarkers

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Contract Research Organizations

11.4.2. Academic & Research Institutes

11.4.3. Pharmaceutical & Biotechnology Industries

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Technique

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Label-free Array Systems Market Analysis and Forecast

12.1. Introduction

12.2. Market Value Forecast, by Technique, 2017–2031

12.2.1. Surface Plasmon Resonance

12.2.2. Microcantilever

12.2.3. Scanning Kelvin Nanoprobe

12.2.4. Enthalpy Array

12.2.5. Atomic Force Microscopy

12.2.6. Electrochemical Impedance Spectroscopy

12.2.7. Interference-based Technique

12.2.8. Ellipsometry Technique

12.2.9. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Drug Discovery

12.3.2. Biomolecular Interactions

12.3.3. Detection of Disease Biomarkers

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Contract Research Organizations

12.4.2. Academic & Research Institutes

12.4.3. Pharmaceutical & Biotechnology Industries

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Technique

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Label-free Array Systems Market Analysis and Forecast

13.1. Introduction

13.2. Market Value Forecast, by Technique, 2017–2031

13.2.1. Surface Plasmon Resonance

13.2.2. Microcantilever

13.2.3. Scanning Kelvin Nanoprobe

13.2.4. Enthalpy Array

13.2.5. Atomic Force Microscopy

13.2.6. Electrochemical Impedance Spectroscopy

13.2.7. Interference-based Technique

13.2.8. Ellipsometry Technique

13.2.9. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Drug Discovery

13.3.2. Biomolecular Interactions

13.3.3. Detection of Disease Biomarkers

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Contract Research Organizations

13.4.2. Academic & Research Institutes

13.4.3. Pharmaceutical & Biotechnology Industries

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Technique

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Label-free Array Systems Market Analysis and Forecast

14.1. Introduction

14.2. Market Value Forecast, by Technique, 2017–2031

14.2.1. Surface Plasmon Resonance

14.2.2. Microcantilever

14.2.3. Scanning Kelvin Nanoprobe

14.2.4. Enthalpy Array

14.2.5. Atomic Force Microscopy

14.2.6. Electrochemical Impedance Spectroscopy

14.2.7. Interference-based Technique

14.2.8. Ellipsometry Technique

14.2.9. Others

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Drug Discovery

14.3.2. Biomolecular Interactions

14.3.3. Detection of Disease Biomarkers

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Contract Research Organizations

14.4.2. Academic & Research Institutes

14.4.3. Pharmaceutical & Biotechnology Industries

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Israel

14.5.4. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Technique

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2018)

15.3. Company Profiles

15.3.1. GE Healthcare

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Company Financials

15.3.1.3. Growth Strategies

15.3.1.4. SWOT Analysis

15.3.2. Attana AB

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Company Financials

15.3.2.3. Growth Strategies

15.3.2.4. SWOT Analysis

15.3.3. Agilent Technologies, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Company Financials

15.3.3.3. Growth Strategies

15.3.3.4. SWOT Analysis

15.3.4. Danaher Corporation

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Company Financials

15.3.4.3. Growth Strategies

15.3.4.4. SWOT Analysis

15.3.5. F. Hoffmann-La Roche AG

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Company Financials

15.3.5.3. Growth Strategies

15.3.5.4. SWOT Analysis

15.3.6. Bio-Rad Laboratories

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Company Financials

15.3.6.3. Growth Strategies

15.3.6.4. SWOT Analysis

15.3.7. GWC Technologies

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Company Financials

15.3.7.3. Growth Strategies

15.3.7.4. SWOT Analysis

15.3.8. PerkinElmer, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Company Financials

15.3.8.3. Growth Strategies

15.3.8.4. SWOT Analysis

15.3.9. BiOptix, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Company Financials

15.3.9.3. Growth Strategies

15.3.9.4. SWOT Analysis

List of Tables

Table 01: Global Label-free Array Systems Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 02: Global Label-free Array Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Label-free Array Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Label-free Array Systems Market value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Label-free Array Systems Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 06: North America Label-free Array Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 07: North America Label-free Array Systems Market Value (US$ Mn) Forecast, by End-user, 2017-2027

Table 08: North America Label-free Array Systems Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Label-free Array Systems Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 10: Europe Label-free Array Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: Europe Label-free Array Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Europe Label-free Array Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Label-free Array Systems Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 14: Asia Pacific Label-free Array Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Asia Pacific Label-free Array Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Label-free Array Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Label-free Array Systems Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 18: Latin America Label-free Array Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 19: Latin America Label-free Array Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Latin America Label-free Array Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Label-free Array Systems Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 22: Middle East & Africa Label-free Array Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Middle East & Africa Label-free Array Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Middle East & Africa Label-free Array Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure: 01 Global Label-free Array Systems Market Snapshot

Figure 02: Global Label-free Array Systems Market Revenue (US$ Mn), by Application, 2021

Figure 03: Global Label-free Array Systems Market Revenue (US$ Mn), by End-user, 2021

Figure 04: Global Label-free Array Systems Market Value Share (%), by End-user, 2021

Figure 05: Global Label-free Array Systems Market Value Share (%), by Technique, 2021

Figure 06: Global Label-free Array Systems Market Value Share (%), by Application, 2021

Figure 07: Global Label-free Array Systems Market Value Share (%), by Region, 2021

Figure 08: U.S. Regulatory Approval Process

Figure 09: Europe Regulatory Approval Process

Figure 10: Latin America Regulatory Approval Process

Figure 11: Global Label-free Array Systems Market Value Share Analysis, by Technique, 2021 and 2031

Figure 12: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Surface Plasmon Resonance, 2017–2031

Figure 13: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Microcantilever, 2017–2031

Figure 14: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Scanning Kelvin Nanoprobe, 2017–2031

Figure 15: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Enthalpy Array, 2017–2031

Figure 16: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Interference-based Technique, 2017–2031

Figure 17: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Ellipsometry Technique, 2017–2031

Figure 18: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Atomic Force Microscopy, 2017–2031

Figure 19: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Electrochemical Impedance Spectroscopy, 2017–2031

Figure 20: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2031

Figure 21: Global Label-free Array Systems Market Attractiveness Analysis, by Technique, 2022‒2031

Figure 22: Global Label-free Array Systems Market Value Share Analysis, by Application, 2021 and 2031

Figure 23: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Drug Discovery, 2017–2031

Figure 24: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Biomolecular Interactions, 2017–2031

Figure 25: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Detection of Disease Biomarkers, 2017–2031

Figure 26: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2031

Figure 27: Global Label-free Array Systems Market Attractiveness Analysis, by Application, 2022‒2031

Figure 28: Global Label-free Array Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 29: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Contract Research Organizations, 2017–2031

Figure 30: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Academic & Research Institutes, 2017–2031

Figure 31: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Pharmaceutical & Biotechnology Industries, 2017–2031

Figure 32: Global Label-free Array Systems Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2031

Figure 33: Global Label-free Array Systems Market Attractiveness Analysis, by End-user, 2022‒2031

Figure 34: Global Label-free Array Systems Market Value Share Analysis, by Region, 2021 and 2031

Figure 35: Global Label-free Array Systems Market Attractiveness Analysis, by Region, 2019-2027

Figure 36: North America Label-free Array Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: North America Label-free Array Systems Market Attractiveness Analysis, by Country, 2021–2031

Figure 38: North America Label-free Array Systems Market Value Share Analysis, by Technique, 2021 and 2031

Figure 39: North America Label-free Array Systems Market Value Share, by Application, 2021 and 2031

Figure 40: North America Label-free Array Systems Market Value Share, by End-user, 2021 and 2031

Figure 41: North America Label-free Array Systems Market Value Share Analysis, by Country, 2021 and 2031

Figure 42: North America Label-free Array Systems Market Attractiveness Analysis, by Technique, 2022‒2031

Figure 43: North America Label-free Array Systems Market Attractiveness Analysis, by Application, 2022‒2031

Figure 44: North America Label-free Array Systems Market Attractiveness Analysis, by End-user, 2022‒2031

Figure 45: Europe Label-free Array Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Europe Label-free Array Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 47: Europe Label-free Array Systems Market Value Share Analysis, by Technique, 2021 and 2031

Figure 48: Europe Label-free Array Systems Market Value Share, by Application, 2021 and 2031

Figure 49: Europe Label-free Array Systems Market Value Share, by End-user, 2021 and 2031

Figure 50: Europe Label-free Array Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 51: Europe Label-free Array Systems Market Attractiveness Analysis, by Technique, 2022‒2031

Figure 52: Europe Label-free Array Systems Market Attractiveness Analysis, by Application, 2022‒2031

Figure 53: Europe Label-free Array Systems Market Attractiveness Analysis, by End-user, 2022‒2031

Figure 54: Asia Pacific Label-free Array Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 55: Asia Pacific Label-free Array Systems Market Attractiveness Analysis, by Country/Sub-region, 2022‒2031

Figure 56: Asia Pacific Label-free Array Systems Market Value Share Analysis, by Technique, 2021 and 2031

Figure 57: Asia Pacific Label-free Array Systems Market Value Share, by Application, 2021 and 2031

Figure 58: Asia Pacific Label-free Array Systems Market Value Share, by End-user, 2021 and 2031

Figure 59: Asia Pacific Label-free Array Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 60: Asia Pacific Label-free Array Systems Market Attractiveness Analysis, by Technique, 2022‒2031

Figure 61: Asia Pacific Label-free Array Systems Market Attractiveness Analysis, by Application, 2022‒2031

Figure 62: Asia Pacific Label-free Array Systems Market Attractiveness Analysis, by End-user, 2022‒2031

Figure 63: Latin America Label-free Array Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 64: Latin America Label-free Array Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 65: Latin America Label-free Array Systems Market Value Share Analysis, by Technique, 2021 and 2031

Figure 66: Latin America Label-free Array Systems Market Value Share, by Application, 2021 and 2031

Figure 67: Latin America Label-free Array Systems Market Value Share, by End-user, 2021 and 2031

Figure 68: Latin America Label-free Array Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 69: Latin America Label-free Array Systems Market Attractiveness Analysis, by Technique, 2022‒2031

Figure 70: Latin America Label-free Array Systems Market Attractiveness Analysis, by Application, 2022‒2031

Figure 71: Latin America Label-free Array Systems Market Attractiveness Analysis, by End-user, 2022‒2031

Figure 72: Middle East & Africa Label-free Array Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 73: Middle East & Africa Label-free Array Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 74: Middle East & Africa Label-free Array Systems Market Value Share Analysis, by Technique, 2021 and 2031

Figure 75: Middle East & Africa Label-free Array Systems Market Value Share, by Application, 2021 and 2031

Figure 76: Middle East & Africa Label-free Array Systems Market Value Share, by End-user, 2021 and 2031

Figure 77: Middle East & Africa Label-free Array Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 78: Middle East & Africa Label-free Array Systems Market Attractiveness Analysis, by Technique, 2022‒2031

Figure 79: Middle East & Africa Label-free Array Systems Market Attractiveness Analysis, by Application, 2022‒2031

Figure 80: Middle East & Africa Label-free Array Systems Market Attractiveness Analysis, by End-user, 2022‒2031