Analyst Viewpoint

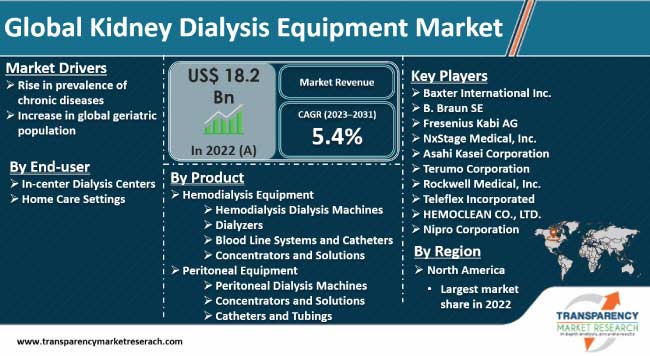

Rise in the prevalence of chronic diseases is boosting the kidney dialysis equipment market share. Chronic kidney diseases, hypertension, and diabetes-related nephropathy are common renal issues that are prevalent in recent times. Lifestyle factors, dietary habits, and genetic issues are reasons for this prevalence.

Increase in the global geriatric population is augmenting the kidney dialysis equipment market size. Elderly people have specific concerns and are more likely to have chronic kidney issues which require better renal care technologies. Prominent players in the landscape are investing substantially in home kidney dialysis equipment to cater to elderly patients.

Kidneys are vital organs that maintain the body’s overall health and well-being by filtering blood waste, maintaining a pH balance, and regulating blood pressure. Common kidney illnesses include Chronic Kidney Disease (CKD), kidney stones, and End-stage Kidney Disease (ESKD).

Dialysis is a medical process utilized when kidneys stop functioning normally and need assistance to perform their daily functions such as filtration, fluid balance, and electrolyte regulation. It is a life-sustaining and highly intrusive process. It usually only sustains patients until they are eligible for a kidney transplantation. Hemodialysis equipment and peritoneal equipment are two major types of kidney dialysis equipment.

Rise in elderly population is boosting the prevalence of kidney diseases, thereby driving the kidney dialysis equipment market progress. Unhealthy eating habits and a general passive lifestyle are also leading to complex nephrology issues. Chronic issues degrade a patient’s quality of life immensely while also reducing their life expectancy. The healthcare sector is investing significantly in advancements in dialysis technologies to make the dialysis process less intrusive and more efficient.

High incidence of CKD, diabetes-related nephropathy, and hypertension-induced renal disorders are boosting demand for dialysis equipment. Dialysis is a critical medical intervention that effectively extends a patient’s life by substituting for an ailing kidney. The process filters toxins, excess fluids, and electrolytes to ensure the body’s survival.

Lifestyle factors, dietary habits, and genetic predispositions significantly impact the prevalence of chronic diseases related to kidneys. The estimated prevalence of CKD, impaired kidney function, and albuminuria were 8.2%, 2.2%, and 6.7%, respectively, in China, according to a February 2023 study in the JAMA Internal Medicine. Moreover, as per the research paper titled, ‘Epidemiology of Chronic Kidney Disease: An Update 2022’, nearly 10% of the global population have some form of CKD accounting for a total of more than 800 million adult individuals. Thus, high prevalence of chronic kidney diseases is augmenting the kidney dialysis equipment industry growth.

In recent times, there has been a notable increase in the global geriatric population. Demographic shifts all over the world mean that age-related kidney disorders are also on the rise. Chronic kidney disease and general deterioration of kidneys are common with old age. This has led to rise in investment in the R&D of advanced renal care solutions, which is driving the kidney dialysis equipment market value.

As per data by the Centers for Disease Control and Prevention (CDC), nearly half of the adult population in the U.S. suffers from at least one chronic disease. Moreover, geriatric population in the country is set to make up 40% of the population by 2040, enhancing the burden on the healthcare system.

The healthcare system worldwide has to adapt and expand to meet the needs of the elderly by investing in innovative technologies and custom designs to ensure safe, accessible, and affordable renal care solutions. This, in turn, is propelling the demand for kidney dialysis equipment.

According to the recent kidney dialysis equipment industry analysis, North America held largest share in 2022. Presence of a well-established healthcare sector, rise in awareness about chronic kidney issues, and R&D of dialysis technologies are augmenting the kidney dialysis equipment market dynamics of the region.

As per the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), 37 million people in the U.S. have kidney disease, which is more than 1 in 7 adults in the country. According to the United States Renal Data System 2020 Annual Data Report, nearly 808,000 people in the U.S. are living with ESKD, with 69% on dialysis and 31% with a kidney transplant.

According to the latest kidney dialysis equipment market forecast, Asia Pacific is a lucrative sector due to high prevalence of kidney issues, surge in the elderly population, and worsening sedentary lifestyle. According to an article published by Pace Hospital, the rate of CKD in India is 800 per 1 million people, while the occurrence of End-stage Renal Disease (ESRD) is 150–200 per 1 million.

According to recent kidney dialysis equipment market trends, prominent manufacturers are investing significantly in the development of home dialysis machines and peritoneal dialysis devices. They are developing advanced kidney replacement therapy devices for elderly patients as the global geriatric population is rising significantly.

Baxter International Inc., B. Braun SE, Fresenius Kabi AG, NxStage Medical, Inc., Asahi Kasei Corporation, Terumo Corporation, Rockwell Medical, Inc., Teleflex Incorporated, HEMOCLEAN CO., LTD. and Nipro Corporation are key manufacturers of kidney dialysis equipment.

These companies have been profiled in the kidney dialysis equipment market report based on various parameters such as company overview, product portfolio, business strategies, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 18.2 Bn |

| Market Forecast Value in 2031 | US$ 29.3 Bn |

| Growth Rate (CAGR) | 5.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 18.2 Bn in 2022

It is projected to advance at a CAGR of 5.4% from 2023 to 2031

Rise in prevalence of chronic diseases and increase in global geriatric population

North America was the leading region in 2022

Baxter International Inc., B. Braun SE, Fresenius Kabi AG, NxStage Medical, Inc., Asahi Kasei Corporation, Terumo Corporation, Rockwell Medical, Inc., Teleflex Incorporated, HEMOCLEAN CO., LTD. and Nipro Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Kidney Dialysis Equipment Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Kidney Dialysis Equipment Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Kidney Dialysis Equipment Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Hemodialysis Equipment

6.3.1.1. Hemodialysis Dialysis Machines

6.3.1.2. Dialyzers

6.3.1.3. Blood Line Systems and Catheters

6.3.1.4. Concentrators and Solutions

6.3.2. Peritoneal Equipment

6.3.2.1. Peritoneal Dialysis Machines

6.3.2.2. Concentrators and Solutions

6.3.2.3. Catheters and Tubings

6.4. Market Attractiveness Analysis, by Product

7. Global Kidney Dialysis Equipment Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. In-center Dialysis Centers

7.3.2. Home Care Settings

7.4. Market Attractiveness Analysis, by End-user

8. Global Kidney Dialysis Equipment Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Kidney Dialysis Equipment Market Analysis and Forecast

9.1. Introduction

9.2. Key Findings

9.3. Market Value Forecast, by Product, 2017–2031

9.3.1. Hemodialysis Equipment

9.3.1.1. Hemodialysis Dialysis Machines

9.3.1.2. Dialyzers

9.3.1.3. Blood Line Systems and Catheters

9.3.1.4. Concentrators and Solutions

9.3.2. Peritoneal Equipment

9.3.2.1. Peritoneal Dialysis Machines

9.3.2.2. Concentrators and Solutions

9.3.2.3. Catheters and Tubings

9.4. Market Value Forecast, by End-user, 2017–2031

9.4.1. In-center Dialysis Centers

9.4.2. Home Care Settings

9.5. Market Value Forecast, by Country, 2017–2031

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Product

9.6.2. By End-user

9.6.3. By Country

10. Europe Kidney Dialysis Equipment Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Product, 2017–2031

10.3.1. Hemodialysis Equipment

10.3.1.1. Hemodialysis Dialysis Machines

10.3.1.2. Dialyzers

10.3.1.3. Blood Line Systems and Catheters

10.3.1.4. Concentrators and Solutions

10.3.2. Peritoneal Equipment

10.3.2.1. Peritoneal Dialysis Machines

10.3.2.2. Concentrators and Solutions

10.3.2.3. Catheters and Tubings

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. In-center Dialysis Centers

10.4.2. Home Care Settings

10.5. Market Value Forecast, by Country/Sub-region, 2017–2031

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By End-user

10.6.3. By Country/Sub-region

11. Asia Pacific Kidney Dialysis Equipment Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Product, 2017–2031

11.3.1. Hemodialysis Equipment

11.3.1.1. Hemodialysis Dialysis Machines

11.3.1.2. Dialyzers

11.3.1.3. Blood Line Systems and Catheters

11.3.1.4. Concentrators and Solutions

11.3.2. Peritoneal Equipment

11.3.2.1. Peritoneal Dialysis Machines

11.3.2.2. Concentrators and Solutions

11.3.2.3. Catheters and Tubings

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. In-center Dialysis Centers

11.4.2. Home Care Settings

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By End-user

11.6.3. By Country/Sub-region

12. Latin America Kidney Dialysis Equipment Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Product, 2017–2031

12.3.1. Hemodialysis Equipment

12.3.1.1. Hemodialysis Dialysis Machines

12.3.1.2. Dialyzers

12.3.1.3. Blood Line Systems and Catheters

12.3.1.4. Concentrators and Solutions

12.3.2. Peritoneal Equipment

12.3.2.1. Peritoneal Dialysis Machines

12.3.2.2. Concentrators and Solutions

12.3.2.3. Catheters and Tubings

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. In-center Dialysis Centers

12.4.2. Home Care Settings

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By End-user

12.6.3. By Country/Sub-region

13. Middle East & Africa Kidney Dialysis Equipment Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Product, 2017–2031

13.3.1. Hemodialysis Equipment

13.3.1.1. Hemodialysis Dialysis Machines

13.3.1.2. Dialyzers

13.3.1.3. Blood Line Systems and Catheters

13.3.1.4. Concentrators and Solutions

13.3.2. Peritoneal Equipment

13.3.2.1. Peritoneal Dialysis Machines

13.3.2.2. Concentrators and Solutions

13.3.2.3. Catheters and Tubings

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. In-center Dialysis Centers

13.4.2. Home Care Settings

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By End-user

13.6.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Baxter International Inc.

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Financial Overview

14.3.1.5. Strategic Overview

14.3.2. B. Braun SE

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Financial Overview

14.3.2.5. Strategic Overview

14.3.3. Fresenius Kabi AG

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Financial Overview

14.3.3.5. Strategic Overview

14.3.4. NxStage Medical, Inc.

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Financial Overview

14.3.4.5. Strategic Overview

14.3.5. Asahi Kasei Corporation

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Financial Overview

14.3.5.5. Strategic Overview

14.3.6. Terumo Corporation

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Financial Overview

14.3.6.5. Strategic Overview

14.3.7. Rockwell Medical, Inc.

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Financial Overview

14.3.7.5. Strategic Overview

14.3.8. Teleflex Incorporated

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Financial Overview

14.3.8.5. Strategic Overview

14.3.9. HEMOCLEAN CO., LTD.

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Financial Overview

14.3.9.5. Strategic Overview

14.3.10. Nipro Corporation

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Financial Overview

14.3.10.5. Strategic Overview

List of Tables

Table 01: Global Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 06: North America Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Europe Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 09: Europe Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: Asia Pacific Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 12: Asia Pacific Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Latin America Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Latin America Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Middle East & Africa Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Middle East & Africa Kidney Dialysis Equipment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Kidney Dialysis Equipment Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Kidney Dialysis Equipment Market Revenue (US$ Mn), by Product, 2022

Figure 03: Global Kidney Dialysis Equipment Market Value Share, by Product, 2022

Figure 04: Global Kidney Dialysis Equipment Market Revenue (US$ Mn), by End-user, 2022

Figure 05: Global Kidney Dialysis Equipment Market Value Share, by End-user, 2022

Figure 06: Global Kidney Dialysis Equipment Market Value Share, by Region, 2022

Figure 07: Global Kidney Dialysis Equipment Market Value (US$ Mn) Forecast, 2023–2031

Figure 08: Global Kidney Dialysis Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 09: Global Kidney Dialysis Equipment Market Attractiveness Analysis, by Product, 2023-2031

Figure 10: Global Kidney Dialysis Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 11: Global Kidney Dialysis Equipment Market Attractiveness Analysis, by End-user, 2023-2031

Figure 12: Global Kidney Dialysis Equipment Market Value Share Analysis, by Region, 2022 and 2031

Figure 13: Global Kidney Dialysis Equipment Market Attractiveness Analysis, by Region, 2023-2031

Figure 14: North America Kidney Dialysis Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 15: North America Kidney Dialysis Equipment Market Attractiveness Analysis, by Country, 2023–2031

Figure 16: North America Kidney Dialysis Equipment Market Value Share Analysis, by Country, 2022 and 2031

Figure 17: North America Kidney Dialysis Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 18: North America Kidney Dialysis Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 19: North America Kidney Dialysis Equipment Market Attractiveness Analysis, by Product, 2023–2031

Figure 20: North America Kidney Dialysis Equipment Market Attractiveness Analysis, by End-user, 2023–2031

Figure 21: Europe Kidney Dialysis Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 22: Europe Kidney Dialysis Equipment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 23: Europe Kidney Dialysis Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 24: Europe Kidney Dialysis Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 25: Europe Kidney Dialysis Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26: Europe Kidney Dialysis Equipment Market Attractiveness Analysis, by Product, 2023–2031

Figure 27: Europe Kidney Dialysis Equipment Market Attractiveness Analysis, by End-user, 2023–2031

Figure 28: Asia Pacific Kidney Dialysis Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 29: Asia Pacific Kidney Dialysis Equipment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 30: Asia Pacific Kidney Dialysis Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 31: Asia Pacific Kidney Dialysis Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 32: Asia Pacific Kidney Dialysis Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Asia Pacific Kidney Dialysis Equipment Market Attractiveness Analysis, by Product, 2023–2031

Figure 34: Asia Pacific Kidney Dialysis Equipment Market Attractiveness Analysis, by End-user, 2023–2031

Figure 35: Latin America Kidney Dialysis Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 36: Latin America Kidney Dialysis Equipment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Latin America Kidney Dialysis Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 38: Latin America Kidney Dialysis Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 39: Latin America Kidney Dialysis Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Latin America Kidney Dialysis Equipment Market Attractiveness Analysis, by Product, 2023–2031

Figure 41: Latin America Kidney Dialysis Equipment Market Attractiveness Analysis, by End-user, 2023–2031

Figure 42: Middle East & Africa Kidney Dialysis Equipment Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 43: Middle East & Africa Kidney Dialysis Equipment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 44: Middle East & Africa Kidney Dialysis Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Middle East & Africa Kidney Dialysis Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 46: Middle East & Africa Kidney Dialysis Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 47: Middle East & Africa Kidney Dialysis Equipment Market Attractiveness Analysis, by Product, 2023–2031

Figure 48: Middle East & Africa Kidney Dialysis Equipment Market Attractiveness Analysis, by End-user, 2023–2031