IT Spending on Clinical Analytics: Global Snapshot

Over the past few decades, there has been a significant transition in the healthcare industry. It has witnessed tremendous growth due to the high demand of value-based care for population health in all parts of the globe and has transformed from a manually-operated sector to a digitally managed one. This synchronization of digital and physical worlds has started generating mammoth volumes of patient data, proper analysis of which can lead to bountiful benefits such as reduction in the numbers of patient readmission in hospitals and improved clinical outcomes, to name a few. Vast improvements in financial and clinical decision support management are also made possible by critical analysis of data generated by healthcare systems.

A greater understanding of these factors, coupled with the rising adoption of digital data management tools in healthcare settings is leading to a vast rise in expenditure on clinical analytics systems and solutions. Transparency Market Research (TMR) estimates that the global IT spending on clinical analytics will rise manifolds in the years to come. According to this report by TMR, IT spending on clinical analytics across the globe valued at US$11,650 mn in 2015. Expanding at a remarkable 12.3% CAGR over the period between 2016 and 2024, this is projected to reach US$32,422 mn by 2024.

Integrated Systems to Dominate Thanks to Flexibility and Capability to Sync with Other Systems

In the report, the IT spending on clinical analytics is segmented on the basis of platform into stand-alone and integrated. Of these, the segment of integrated clinical analytics solutions acquired the dominant chunk of revenues of the global market in 2015 and is expected to maintain dominance over the forecast period as well.

The integrated clinical analytics segment is also expected to exhibit a higher CAGR of 13.1% compared to the segment of stand-alone clinical analytics solutions, which is expected to expand at an 11.0% CAGR, over the period between 2016 and 2024. Of the overall global spending on clinical analytics solutions, spending on integrated solutions is expected to account for a 63% of the global market by 2024.

Integrated clinical analytics solutions observe higher demand owing to their highly dynamic nature and ability to extract data from clinical documents synched with the system, such as (electronic health records) EHR, utilizing the data to generate key insights. The relatively lower level of competency of stand-alone systems in terms of ability to integrate well with other data processing or managing systems will lead to their relatively lower adoption on a global front.

Digitization of Healthcare Infrastructure to Keep North America Ahead in Clinical Analytics Spending

In terms of geography, the market is dominated by North America and the region will continue to constitute the bulk of share in the global market by the end of the forecast period as well. The region leads in terms of IT spending on clinical analytics owing chiefly to the technologically advanced healthcare infrastructure, favorable government policies, and increased incentives. The IT spending on clinical analytics in North America is estimated to be valued at US$5,349 mn by the end of 2016 and is expected to expand at a CAGR of 10.8% to reach US$12,110 mn by 2024.

However, North America is expected to lose to Asia Pacific in terms of rate of growth over the forecast period; IT spending on clinical analytics in Asia Pacific is expected to expand at a remarkable 16.9% by 2024. The region will see the adoption of clinical analytics at such a rapid pace owing to vast technological advancements, enhancement and rapid digitization of healthcare infrastructure, and increased adoption big data and analytics in healthcare. Japan is a highly attractive market in the region, followed by China and India. Other APAC countries are also expected to emerge as highly promising markets for clinical analytics in the next few years owing to similar factors.

Some of the key players in clinical analytics are McKesson Corporation, Cerner Corporation, IBM Corporation, Optum, Inc., Allscripts Healthcare Solutions, Inc., Oracle Financial Services Software Limited, CareCloud Corporation, Medical Information Technology, Inc., Hewlett-Packard Enterprise Development LP and ArborMetrix, Inc.

Advent of Digital Data Analytics to Boost Growth of IT Spending on Clinical Analytics Market

The healthcare sector has witnessed a notable growth in the past few years on account of the advent of digitally managed patient data analytics. It has witnessed enormous development because of the high interest of significant worth based consideration for population wellbeing in all pieces of the globe and has changed from a physically worked area to a digitally oversaw one. This synchronization of digital and physical universes has begun generating mammoth volumes of patient information, legitimate analysis of which can prompt bountiful benefits like reduction in the quantities of patient readmission in hospitals and improved clinical results, to give some examples. Immense improvements in financial and clinical decision support the executives are additionally made possible by critical analysis of information created by medical care frameworks.

Integrated clinical analytics solutions notice higher interest owing to their highly dynamic nature and ability to remove information from clinical reports synchronized with the framework, for example, (electronic wellbeing records) EHR, utilizing the information to create key insights. The relatively lower level of competency of independent frameworks regarding ability to integrate well with other information processing or managing frameworks will prompt their relatively lower adoption on a worldwide front.

Clinical analytics has created groundswell of interest among medical services enterprises in various countries for underpinning the rapid digital transformation in medical care industry in the course of recent years. Rising interest has for some converted into enormous innovation spend. This is a key factor driving the worldwide IT spending on clinical analytics market. Rapid digitization of wellbeing IT infrastructures in created countries has sped up spending on IT spending on clinical analytics.

Growing adoption of medical care enterprises of electronic wellbeing records (EHRs) in various regions across the globe is boosting the IT spending on clinical analytics. EHRs have shown promising potential in reducing medication mistakes, bring significant expense savings, and in improving population wellbeing. Medical services providers have additionally been leveraging the potential of clinical analytics to bring down hospital readmission rates.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global IT Spending on Clinical Analytics

4. Market Overview

4.1. Introduction

4.1.1. Platform Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Key Market Indicators

4.4. Key Industry Developments

4.5. Market Opportunity Map

4.6. Market Dynamics

4.6.1. Drivers

4.6.2. Restraints

4.6.3. Opportunity

4.7. Global IT Spending on Clinical Analytics Analysis and Forecasts, 2016–2024

4.7.1. Market Revenue Projections (US$ Mn)

4.8. Porter’s Five Force Analysis

4.9. Clinical Analytics Process Workflow

4.10. Market Outlook

5. Global IT Spending on Clinical Analytics Analysis and Forecasts, By Platform

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Value Forecast By Platform, 2016–2024

5.4.1. Stand-alone

5.4.2. Integrated

5.5. Platform Comparison Matrix

5.6. Market Attractiveness By Platform

6. Global IT Spending on Clinical Analytics Analysis and Forecasts, By End User

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Value Forecast By End User, 2016–2024

6.4.1. Payer

6.4.1.1. Insurance Companies

6.4.1.2. Government

6.4.1.3. Others

6.4.2. Provider

6.4.2.1. Hospitals

6.4.2.2. Clinics

6.5. End User Comparison Matrix

6.6. Market Attractiveness By End User

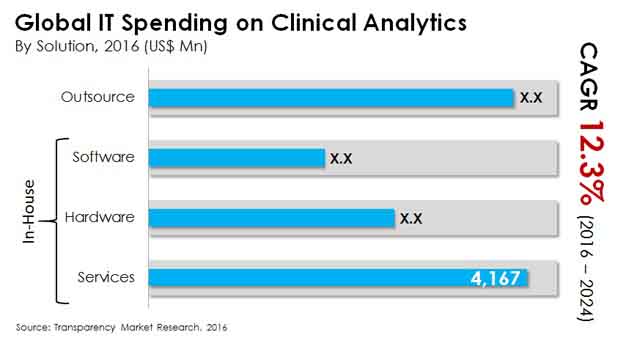

7. Global IT Spending on Clinical Analytics Analysis and Forecasts, By Solution

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Value Forecast By Solution, 2016–2024

7.4.1. In-House

7.4.1.1. Hardware

7.4.1.2. Software

7.4.1.3. Services

7.4.2. Outsource

7.5. Solution Comparison Matrix

7.6. Market Attractiveness By Solution

8. Global IT Spending on Clinical Analytics Analysis and Forecasts, By Deployment

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Key Trends

8.4. Market Value Forecast By Deployment, 2016–2024

8.4.1. Cloud-based

8.4.2. On-premise

8.5. Deployment Comparison Matrix

8.6. Market Attractiveness By Deployment

9. Global IT Spending on Clinical Analytics Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Policies and Regulations

9.3. Market Value Forecast By Region

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Latin America

9.3.5. Middle East and Africa

9.4. Market Attractiveness By Country/Region

10. North America IT Spending on Clinical Analytics Analysis and Forecast

10.1.Introduction

10.1.1. Key Findings

10.1.2. Policies and Regulations

10.1.3. Price Trend Analysis

10.1.4. Key Trends

10.2. Market Value Forecast By Platform, 2016–2024

10.2.1. Stand-alone

10.2.2. Integrated

10.3. Market Value Forecast By End User, 2016–2024

10.3.1. Payer

10.3.1.1. Insurance Companies

10.3.1.2. Government

10.3.1.3. Others

10.3.2. Provider

10.3.2.1. Hospitals

10.3.2.2. Clinics

10.4. Market Value Forecast By Solution, 2016–2024

10.4.1. In-House

10.4.1.1. Hardware

10.4.1.2. Software

10.4.1.3. Services

10.4.2. Outsource

10.5. Market Value Forecast By Deployment, 2016–2024

10.5.1. Cloud-based

10.5.2. On-premise

10.6. Market Value Forecast By Country, 2016–2024

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Platform

10.7.2. By End User

10.7.3. By Solution

10.7.4. By Deployment

10.7.5. By Country

11. Europe IT Spending on Clinical Analytics Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.1.2. Policies and Regulations

11.1.3. Price Trend Analysis

11.1.4. Key Trends

11.2. Market Value Forecast By Platform, 2016–2024

11.2.1. Stand-alone

11.2.2. Integrated

11.3. Market Value Forecast By End User, 2016–2024

11.3.1. Payer

11.3.1.1. Insurance Companies

11.3.1.2. Government

11.3.1.3. Others

11.3.2. Provider

11.3.2.1. Hospitals

11.3.2.2. Clinics

11.4. Market Value Forecast By Solution, 2016–2024

11.4.1. In-House

11.4.1.1. Hardware

11.4.1.2. Software

11.4.1.3. Services

11.4.2. Outsource

11.5. Market Value Forecast By Deployment, 2016–2024

11.5.1. Cloud-based

11.5.2. On-premise

11.6. Market Value Forecast By Country, 2016–2024

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Platform

11.7.2. By End User

11.7.3. By Solution

11.7.4. By Deployment

11.7.5. By Country

12. Asia Pacific IT Spending on Clinical Analytics Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.1.2. Policies and Regulations

12.1.3. Price Trend Analysis

12.1.4. Key Trends

12.2. Market Value Forecast By Platform, 2016–2024

12.2.1. Stand-alone

12.2.2. Integrated

12.3. Market Value Forecast By End User, 2016–2024

12.3.1. Payer

12.3.1.1. Insurance Companies

12.3.1.2. Government

12.3.1.3. Others

12.3.2. Provider

12.3.2.1. Hospitals

12.3.2.2. Clinics

12.4. Market Value Forecast By Solution, 2016–2024

12.4.1. In-House

12.4.1.1. Hardware

12.4.1.2. Software

12.4.1.3. Services

12.4.2. Outsource

12.5. Market Value Forecast By Deployment, 2016–2024

12.5.1. Cloud-based

12.5.2. On-premise

12.6. Market Value Forecast By Country, 2016–2024

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia

12.6.5. New Zealand

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Platform

12.7.2. By End User

12.7.3. By Solution

12.7.4. By Deployment

12.7.5. By Country

13. Latin America IT Spending on Clinical Analytics Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.1.2. Policies and Regulations

13.1.3. Price Trend Analysis

13.1.4. Key Trends

13.2. Market Value Forecast By Platform, 2016–2024

13.2.1. Stand-alone

13.2.2. Integrated

13.3. Market Value Forecast By End User, 2016–2024

13.3.1. Payer

13.3.1.1. Insurance Companies

13.3.1.2. Government

13.3.1.3. Others

13.3.2. Provider

13.3.2.1. Hospitals

13.3.2.2. Clinics

13.4. Market Value Forecast By Solution, 2016–2024

13.4.1. In-House

13.4.1.1. Hardware

13.4.1.2. Software

13.4.1.3. Services

13.4.2. Outsource

13.5. Market Value Forecast By Deployment, 2016–2024

13.5.1. Cloud-based

13.5.2. On-premise

13.6. Market Value Forecast By Country, 2016–2024

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Platform

13.7.2. By End User

13.7.3. By Solution

13.7.4. By Deployment

13.7.5. By Country

14. Middle East and Africa IT Spending on Clinical Analytics Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.1.2. Policies and Regulations

14.1.3. Price Trend Analysis

14.1.4. Key Trends

14.2. Market Value Forecast By Platform, 2016–2024

14.2.1. Stand-alone

14.2.2. Integrated

14.3. Market Value Forecast By End User, 2016–2024

14.3.1. Payer

14.3.1.1. Insurance Companies

14.3.1.2. Government

14.3.1.3. Others

14.3.2. Provider

14.3.2.1. Hospitals

14.3.2.2. Clinics

14.4. Market Value Forecast By Solution, 2016–2024

14.4.1. In-House

14.4.1.1. Hardware

14.4.1.2. Software

14.4.1.3. Services

14.4.2. Outsource

14.5. Market Value Forecast By Deployment, 2016–2024

14.5.1. Cloud-based

14.5.2. On-premise

14.6. Market Value Forecast By Country, 2016–2024

14.6.1. Saudi Arabia

14.6.2. U.A.E

14.6.3. South Africa

14.6.4. Rest of Middle East and Africa

14.7. Market Attractiveness Analysis

14.7.1. By Platform

14.7.2. By End User

14.7.3. By Solution

14.7.4. By Deployment

14.7.5. By Country

15. Competition Landscape

15.1. Major Licenses and Contracts

15.2. Market Player – Competition Matrix (By Tier and Size of companies)

15.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

15.3.1. McKesson Corporation

15.3.1.1. Company Overview

15.3.1.2. Financials

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Cerner Corporation

15.3.2.1. Company Overview

15.3.2.2. Financials

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. IBM Corporation

15.3.3.1. Company Overview

15.3.3.2. Financials

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Optum, Inc.

15.3.4.1. Company Overview

15.3.4.2. Financials

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Allscripts Healthcare Solutions, Inc.

15.3.5.1. Company Overview

15.3.5.2. Financials

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Oracle Financial Services Software Limited

15.3.6.1. Company Overview

15.3.6.2. Financials

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Medical Information Technology, Inc.

15.3.7.1. Company Overview

15.3.7.2. Financials

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Hewlett-Packard Enterprise Development LP

15.3.8.1. Company Overview

15.3.8.2. Financials

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Arbormetrix, Inc.

15.3.9.1. Company Overview

15.3.9.2. Financials

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. CareCloud Corporation

15.3.10.1. Company Overview

15.3.10.2. Financials

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

List of Tables

Table 01: Global IT Spending on Clinical Analytics (US$ Mn) Forecast: by Platform, 2016–2024

Table 02: Global IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User, 2016–2024

Table 03: Global IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User (Payer), 2016–2024

Table 04: Global IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User (Provider), 2016–2024

Table 05: Global IT Spending on Clinical Analytics (US$ Mn) Forecast: by Solution, 2016–2024

Table 06: Global IT Spending on Clinical Analytics (US$ Mn) Forecast: by Solution, 2016–2024

Table 07: Global IT Spending on Clinical Analytics (US$ Mn) Forecast: by Deployment, 2016–2024

Table 08: Global IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Region, 2016-2024

Table 09: North America IT Spending on Clinical Analytics (US$ Mn) Forecast: by Platform, 2016-2024

Table 10: North America IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User, 2016–2024

Table 11: North America IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User (Payer), 2016–2024

Table 12: North America IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User (Provider), 2016–2024

Table 13: North America IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Solution, 2016-2024

Table 14: North America IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Solution, 2016-2024

Table 15: North America IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Deployment, 2016-2024

Table 16: North America IT Spending on Clinical Analytics (US$ Mn) Forecast: by Country, 2016-2024

Table 17: Europe IT Spending on Clinical Analytics (US$ Mn) Forecast: by Platform, 2016-2024

Table 18: Europe IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by End User, 2016–2024

Table 19: Europe IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by End User (Payer), 2016–2024

Table 20: Europe IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by End User (Provider), 2016–2024

Table 21: Europe IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Solution, 2016–2024

Table 22: Europe IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Solution (In-House), 2016–2024

Table 23: Europe IT Spending on Clinical Analytics (US$ Mn) Forecast: by Deployment, 2016–2024

Table 24: Europe IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Country, 2016-2024

Table 25: Asia Pacific IT Spending on Clinical Analytics (US$ Mn) Forecast: by Platform, 2016-2024

Table 26: Asia Pacific IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User, 2016–2024

Table 27: Asia Pacific IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User (Payer), 2016–2024

Table 28: Asia Pacific IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User (Provider), 2016–2024

Table 29: Asia Pacific IT Spending on Clinical Analytics (US$ Mn) Forecast: by Solution, 2016–2024

Table 30: Asia Pacific IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Solution, 2016–2024

Table 31: Asia Pacific IT Spending on Clinical Analytics (US$ Mn) Forecast: by Deployment, 2016–2024

Table 32: Asia Pacific IT Spending on Clinical Analytics (US$ Mn) Forecast: by Country, 2016-2024

Table 33: Latin America IT Spending on Clinical Analytics (US$ Mn) Forecast: by Platform, 2016-2024

Table 34: Asia Pacific IT Spending on Clinical Analytics (US$ Mn) Forecast: by Solution, 2016–2024

Table 35: Latin America IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Solution, 2016–2024

Table 36: Asia Pacific IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by End User, 2016–2024

Table 37: Asia Pacific IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by End User, 2016–2024

Table 38: Asia Pacific IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User, 2016–2024

Table 39: Latin America IT Spending on Clinical Analytics (US$ Mn) Forecast: by deployment, 2016–2024

Table 40: Latin America IT Spending on Clinical Analytics Size (US$ Mn) by Country, 2016–2024

Table 41: Middle East and Africa IT Spending on Clinical Analytics (US$ Mn) Forecast: by Platform, 2016-2024

Table 42: Middle East and Africa IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by Solution, 2016–2024

Table 43: Middle East and Africa IT Spending on Clinical Analytics (US$ Mn) Forecast: by Solution (In-House), 2016–2024

Table 44: Middle East and Africa IT Spending on Clinical Analytics Size (US$ Mn) Forecast: by End User, 2016–2024

Table 45: Middle East and Africa IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User (Payer), 2016–2024

Table 46: Middle East and Africa IT Spending on Clinical Analytics (US$ Mn) Forecast: by End User (Provider), 2016–2024

Table 47: Middle East and Africa IT Spending on Clinical Analytics (US$ Mn) Forecast: by Deployment, 2016–2024

Table 48: Middle East & Africa IT Spending on Clinical Analytics (US$ Mn) Forecast: by Country, 2016–2024

List of Figures

Figure 01: IT Spending On Clinical Analytics Globally, (US$ Mn) Forecast, 2016–2024

Figure 02: IT Spending On Clinical Analytics Globally, Absolute $ Opportunity (US$ Mn), 2016?2024

Figure 03: Global IT Spending on Clinical Analytics Value Share Analysis: by Platform, 2016 and 2024

Figure 04: Global IT Spending on Stand-Alone Clinical Analytics Platform Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 05: Global IT Spending on Integrated Clinical Analytics Platform Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 06: Global IT Spending on Clinical Analytics Attractiveness Analysis: by Platform

Figure 07: Global IT Spending on Clinical Analytics Value Share Analysis: by End User, 2016 and 2024

Figure 08: Global IT Spending on Payer (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 09: Global IT Spending on Provider (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 10: Global IT Spending on Clinical Analytics Attractiveness Analysis: by End User

Figure 11: Global IT Spending on Insurance Companies (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 12: Global IT Spending on Government (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 13: Global IT Spending on Others (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 14: Global IT Spending on Clinical Analytics Attractiveness Analysis: by End User (Payer)

Figure 15: Global IT Spending on Hospitals (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 16: Global IT Spending on Clinics (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 17: Global IT Spending on Clinical Analytics Attractiveness Analysis: by End Users (Provider)

Figure 18: Global IT Spending on Clinical Analytics Value Share Analysis: by Solution, 2016 and 2024

Figure 19: Global IT Spending on In-House (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 20: Global IT Spending on Outsource (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 21: Global IT Spending on Clinical Analytics Attractiveness Analysis: by Solution

Figure 22: Global IT Spending on Hardware (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 23: Global IT Spending on Software (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 24: Global IT Spending on Services (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 25: Global IT Spending on Clinical Analytics Attractiveness Analysis: by Solution (In-House)

Figure 26: Global IT Spending on Clinical Analytics Value Share Analysis: by Deployment, 2016 and 2024

Figure 27: Global IT Spending on cloud-based (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 28: Global IT Spending on on-premise (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 29: Global IT Spending on Clinical Analytics Attractiveness Analysis: by Deployment

Figure 30: Global IT Spending on Clinical Analytics Value Share Analysis: by Region, 2016 and 2024

Figure 31: Global IT Spending on Clinical Analytics Attractiveness Analysis: by Region

Figure 32: North America IT Spending on Clinical Analytics (US$ Mn) Forecast, 2016-2024

Figure 33: North America IT Spending on Clinical Analytics & Y-o-Y Growth Projections, 2016-2024

Figure 34: North America IT Spending on Clinical Analytics Attractiveness Analysis: by Country

Figure 35: North America IT Spending on Clinical Analytics Value Share Analysis: by Platform, 2016 and 2024

Figure 36: North America IT Spending on Clinical Analytics Value Share Analysis: by End User, 2016 and 2024

Figure 37: North America IT Spending on Clinical Analytics Value Share Analysis: by Solution, 2016 and 2024

Figure 38: North America IT Spending on Clinical Analytics Value Share Analysis: by Deployment, 2016 and 2024

Figure 39: North America IT Spending on Clinical Analytics Value Share Analysis: by Country, 2016 and 2024

Figure 40: U.S. IT Spending on Clinical Analytics (US$ Mn) Forecast, 2016-2024

Figure 41: U.S. IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 42: Canada IT Spending on Clinical Analytics (US$ Mn) Forecast, 2016-2024

Figure 43: Canada IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 44: North America IT Spending on Clinical Analytics Attractiveness Analysis: by Platform, 2016–2024

Figure 45: North America IT Spending on Clinical Analytics Attractiveness Analysis: by Solution, 2016–2024

Figure 46: North America IT Spending on Clinical Analytics Attractiveness Analysis: by Deployment, 2016–2024

Figure 47: North America IT Spending on Clinical Analytics Attractiveness Analysis: By End user, 2016-2024

Figure 48: Europe IT Spending on Clinical Analytics (US$ Mn) Forecast, 2016-2024

Figure 49: Europe IT Spending on Clinical Analytics Y-o-Y Growth Projections, 2016-2024

Figure 50: Europe IT Spending on Clinical Analytics Attractiveness Analysis: by Country

Figure 51: Europe IT Spending on Clinical Analytics Value Share Analysis: by Platform, 2016 and 2024

Figure 52: Europe IT Spending on Clinical Analytics Value Share Analysis: by End User, 2016 and 2024

Figure 53: Europe IT Spending on Clinical Analytics Value Share Analysis: by Solution, 2016 and 2024

Figure 54: Europe IT Spending on Clinical Analytics Value Share Analysis: by Deployment, 2016 and 2024

Figure 55: Europe IT Spending on Clinical Analytics Value Share Analysis: by Country, 2016 and 2024

Figure 56: Germany IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 57: Germany IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 58: U.K. IT Spending on Clinical Analytics (US$ Mn) Forecast, 2016-2024

Figure 59: U.K. IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 60: France IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 61: France IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 62: Italy IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 63: Italy IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 64: Spain IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 65: Spain IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 66: Rest of Europe IT Spending on Clinical Analytics (US$ Mn) Forecast, 2016-2024

Figure 67: Rest of Europe IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 68: Europe IT Spending on Clinical Analytics Attractiveness Analysis: by Platform, 2016–2024

Figure 69: Europe IT Spending on Clinical Analytics Attractiveness Analysis: by Solution, 2016–2024

Figure 70: Europe IT Spending on Clinical Analytics Attractiveness Analysis: by Deployment, 2016–2024

Figure 71: Europe IT Spending on Clinical Analytics Attractiveness Analysis: by end user, 2016–2024

Figure 72: IT Spending on Clinical Analytics in Asia Pacific (US$ Mn) Forecast, 2016-2024

Figure 73: IT Spending on Clinical Analytics in Asia Pacific and Y-o-Y Growth Projections, 2016-2024

Figure 74: IT Spending on Clinical Analytics in Asia Pacific Attractiveness Analysis: by Country, 2016-2024

Figure 75: Asia Pacific IT Spending on Clinical Analytics Value Share Analysis: by Platform, 2016 and 2024

Figure 76: Asia Pacific IT Spending on Clinical Analytics Value Share Analysis: by End User, 2016 and 2024

Figure 77: Asia Pacific IT Spending on Clinical Analytics Value Share Analysis: by Solution, 2016 and 2024

Figure 78: Asia Pacific IT Spending on Clinical Analytics Value Share Analysis: by Deployment, 2016 and 2024

Figure 79: Asia Pacific IT Spending on Clinical Analytics Value Share Analysis: by Country, 2016 and 2024

Figure 80: China IT Spending on Clinical Analytics (US$ Mn) Forecast, 2016-2024

Figure 81: China IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 82: Japan IT Spending on Clinical Analytics (US$ Mn) Forecast, 2016-2024

Figure 83: Japan IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 84: India IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 85: India IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 86: Australia IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 87: Australia IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 88: New Zealand IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 89: New Zealand IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 90: Rest of APAC IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 91: Rest of APAC IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 92: Asia Pacific IT Spending on Clinical Analytics Attractiveness Analysis: by Platform, 2016–2024

Figure 93: Asia Pacific IT Spending on Clinical Analytics Attractiveness Analysis: by Solution, 2016–2024

Figure 94: Asia Pacific IT Spending on Clinical Analytics Attractiveness Analysis: by Deployment, 2016–2024

Figure 95: Asia Pacific IT Spending on Clinical Analytics Attractiveness Analysis: by end user, 2016–2024

Figure 96: Latin America IT Spending on Clinical Analytics (US$ Mn) Forecast, 2016–2024

Figure 97: Latin America IT Spending on Clinical Analytics & Y-o-Y Growth Projections, 2016–2024

Figure 98: Latin America Market Attractiveness Analysis: by Country

Figure 99: Latin America IT Spending on Clinical Analytics Value Share Analysis: by Platform, 2016 and 2024

Figure 100: Latin America IT Spending on Clinical Analytics Value Share Analysis: by Solution, 2016 and 2024

Figure 101: Latin America IT Spending on Clinical Analytics Value Share Analysis: by End User, 2016 and 2024

Figure 102: Latin America IT Spending on Clinical Analytics Value Share Analysis: by Deployment, 2016 and 2024

Figure 103: Latin America Market Value Share Analysis: by Country, 2016 and 2024

Figure 104: Brazil IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 105: Brazil IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 106: Mexico IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 107: Mexico IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 108: Rest of LATAM IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 109: Rest of LATAM IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 110: Latin America IT Spending on Clinical Analytics Attractiveness Analysis:by Platform, 2016–2024

Figure 111: Latin America IT Spending on Clinical Analytics Attractiveness Analysis: by Deployment, 2016–2024

Figure 112: Latin America IT Spending on Clinical Analytics Attractiveness Analysis: by Solution, 2016–2024

Figure 113: Latin America IT Spending on Clinical Analytics Attractiveness Analysis: by end user, 2016–2024

Figure 114: MEA Clinical Analytics Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 115: MEA Clinical Analytics Market Size and Y-o-Y Growth Projections, 2016–2024

Figure 116: MEA Clinical Analytics Market Attractiveness Analysis: by Country

Figure 117: Middle East and Africa IT Spending on Clinical Analytics Value Share Analysis: by Product,2016 and 2024

Figure 118: Middle East and Africa IT Spending on Clinical Analytics Value Share Analysis: by Solution,2016 and 2024

Figure 119: Middle East and Africa IT Spending on Clinical Analytics Value Share Analysis: by End User,2016 and 2024

Figure 120: Middle East and Africa IT Spending on Clinical Analytics Value Share Analysis: by Deployment, 2016 and 2024

Figure 121: Middle East and Africa Market Value Share Analysis: by Country, 2016 and 2024

Figure 122: Saudi Arabia IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 123: Saudi Arabia IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 124: UAE IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 125: UAE IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 126: RSA IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 127: RSA IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 128: Rest of MEA IT Spending on Clinical Analytics Size (US$ Mn) Forecast, 2016-2024

Figure 129: Rest of MEA IT Spending on Clinical Analytics Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 130: MEA IT Spending on Clinical Analytics Attractiveness Analysis: by Platform, 2016–2024

Figure 131: MEA IT Spending on Clinical Analytics Attractiveness Analysis: by Solution, 2016–2024

Figure 132: MEA IT Spending on Clinical Analytics Attractiveness Analysis: by Deployment, 2016–2024

Figure 133: MEA IT Spending on Clinical Analytics Attractiveness Analysis: by end user, 2016–2024