As nanoscience and technology pave the way for faster, more flexible, and more powerful electronics than ever before, scientists and researchers are constantly working on advanced techniques to speed up the development of such technologies. In recent years, the ion beam technology market has garnered substantial interest, for application of this technology in nanomaterials synthesis and the fabrication of nanoscale devices with unique optical and magnetic properties. In addition to modulating the physical-chemical properties of materials, ion beam technology allows the controlled incorporation of impurities or dopants on semiconductor wafers.

A new era of electronic-integrated systems, in general, and ion beam technology, in particular, warrant an in-depth understanding and unbiased assessment of the ion beam technology market. Transparency Market Research, in its new report, offers a detailed viewpoint on the ion beam technology market, for a wide range of applications of this ion beam technology in the semiconductor, material science, and engineering spaces. It also identifies the headwinds and tailwinds of the market to arm stakeholders with the necessary information for critical decision-making.

Ion beam technology wasn’t used until the 1970s, thereafter providing a superior doping technology for the emerging semiconductor industry. With the development of microelectronics and wide acceptance of the term – nanoscience, ion beam technology has attracted great interest from the research community, and has gained broader applications in the modern industry. In 2018, the ion beam technology market exceeded a valuation of US$ 400 million, and continues to witness a growing number of players entering the market.

Ion beam lithography has been gaining higher preference over electron beam lithography; however, it has incurred a few limitations - high design costs and time-consuming process to pattern an entire semiconductor wafer. With the lack of standardization in the design processes and increased time-to-market for ion beam technologies, key stakeholders remained focused on leveraging new opportunities in the emerging applications of this technology.

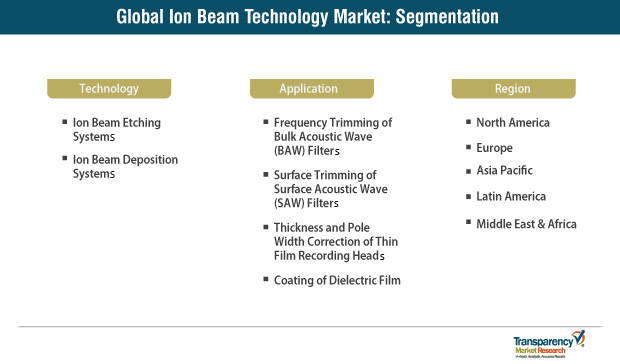

Ion beam etching systems continue to account for higher demand as compared to ion beam deposition systems. With potential application in micro electro mechanical system (MEMS) devices and the nano-machining of magnetic transducers, ion beam etching systems have also witnessed higher investments and innovation. Further, sensing the need for semiconductor manufacturers to develop devices with improved density, tight tolerance, and high yield, key market players are focused on providing systems that allow flexible configuration for both, advanced research and production applications.

The application of ion beam technology in the coating of dielectric films has increased rapidly in recent years, and its use in the frequency trimming of BAW (bulk acoustic wave) filters is likely to boost the ion beam technology market, estimated to witness 8.5% CAGR over the next five years. Considering the broader evolution of technologies and their applications, ion beam system providers are forced to innovate. Focus has been mainly shifted towards developing technologically-advanced ion beam etching equipment, due to the spike in the adoption of thinned wafers across various sectors, especially in modern-day smartphones, and the rapidly emerging trend of the miniaturization of semiconductor and electronic components.

As miniaturization has been proven to remarkably improve the performance of integrated circuits (ICs), and at the same time reduce the cost per information unit, the development of ion beam technologies has grown continuously. Constant evolution of the technology has also been observed, as highly-precise ion beam implantations are necessary for manufacturing miniaturized devices with improved performance. With the increasing intensity of competition in the ion beam technology market, product innovation and development, along with filing patents of the technology remained the key strategies of the market players. These aspects came into play when Hitachi High-Technologies Corporation patented its ion beam system and focused ion beam apparatus, in December 2018 and January 2019, respectively. Such strategic moves will continue to influence other stakeholders to take new initiatives and build effective growth strategies.

Ion beam technology market players have been on a strategic partnership spree to strengthen their technical expertise and bring new products into the global market. For instance, in 2017, Meyer Burger Technology Ltd. signed a major contract with REC group for its existing and next-generation cell or module technologies. The company was also awarded a contract for the delivery and installation of its industry-leading DW 288 Series 3 diamond wire cutting platform. Further, product innovation through consistent R&D investments in the existing technology also remains a key focus area of market stakeholders.

The ion beam technology market shows moderate consolidation, with leading players such as Veeco Instruments Inc., Hitachi High-Technologies Corporation, Canon Anelva Corporation, Scia Systems GmbH collectively accounting for nearly 55% of the revenue share. A range of R&D activities, expansion of operations and product offerings, and acquisitions of other players in the same line of business continue to define the competitive landscape, while the involvement of a large number of global and local players in the market rapidly increases the degree of competition.

Industry-institution collaborations have remained a staple for research activities and product analysis; however, in some cases, institutions become the buyers, which has worked to the advantage of key players in the ion beam technology market.

In February 2019, Veeco Instruments Inc. received orders for its Spectrum Ion beam Sputtering (IBS) system and Sirius Optical Monitor system from the Fraunhofer Institute for Telecommunications (HHI), to develop and manufacture laser facet coatings and other micro-optical devices. In January 2019, Scia Systems GmbH won orders from the Institute of Precision Optical Engineering (IPOE) for its scia Trim 200 and scia Coat 500.

The Analyst Viewpoint

Report authors maintain an optimistic view of the ion beam technology market, which is projected to register a CAGR of over 7% during the period of 2019-2027. This predictive growth of the market is expected to attract the entry of new players, which will intensify the degree of competition as well as rivalry in terms of technology upgrades and new product development. As a number of players are investing a large share of their profits in R&D activities, analysts feel that, standardization of design processes will be improved and design cost will be reduced in the coming years.

Ion Beam Technology: Definition/Overview

Global Ion Beam Technology Market: Regional Overview

Global Ion Beam Technology Market: Trends

Global Ion Beam Technology Market: Drivers, Opportunities, and Restraints

Global Ion Beam Technology Market: Key Segments

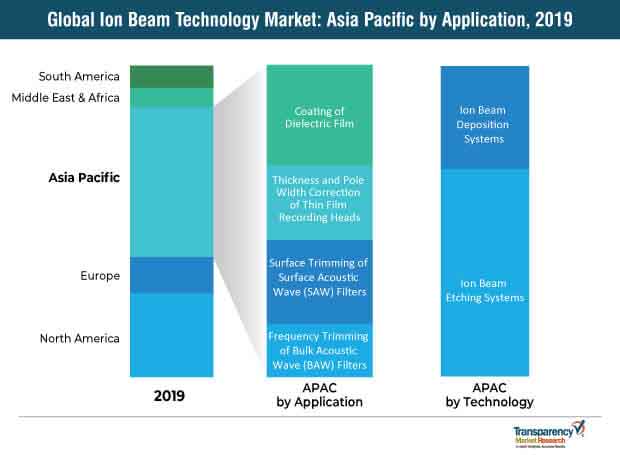

The global ion beam technology market has been segmented based on technology, application, and region.

Global Ion Beam Technology Market: Competition Landscape

Product innovation and development is a key strategy being adopted by several leading players operating in the global ion beam technology market. New product innovation is necessary to face the intense competition in the ion beam technology market. Companies in the ion beam technology market are involved in R&D activities in order to develop innovative products, which helps them to gain a higher market share in the ion beam technology market than their competitors. Key companies operating in the global ion beam technology market and profiled in the research report include

Companies operating in the global market are also focusing on expanding their businesses through strategic acquisitions and partnerships with other ion beam technology providers.

Key companies operating in the global ion beam technology market and profiled in the research report include Meyer Burger Technology AG, Carl Zeiss AG, Veeco Instruments Inc., Scia Systems GmbH, 4Wave Incorporated, Hitachi High-Technologies Corporation, Plasma-Therm, FEI, Canon Anelva Corporation, Raith GmbH.

The market is projected to grow at a CAGR of 7.0% between 2019 and 2027.

The application of ion beam technology in the coating of dielectric films has increased rapidly in recent years, and its use in the frequency trimming of BAW (bulk acoustic wave) filters is likely to boost the ion beam technology market.

Global ion beam technology market has been categorized into frequency trimming of BAW filters, surface trimming of SAW filters, thickness and pole width correction of thin film recording heads, and coating of dielectric film.

The Ion Beam Technology Market is studied from 2019 - 2027.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Ion Beam Technology Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Market Indicators

4.4. Global Ion Beam Technology Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projection (US$ Mn)

4.5. Porter’s Five Forces Analysis - Global Ion Beam Technology Market

4.6. Market Outlook

5. Global Ion Beam Technology Market Analysis and Forecast, by Technology

5.1. Overview & Definitions

5.2. Global Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

5.2.1. Ion Beam Etching System

5.2.2. Ion Beam Deposition System

5.3. Technology Comparison Matrix

5.4. Market Attractiveness, by Technology

6. Global Ion Beam Technology Market Analysis and Forecast, by Application

6.1. Overview & Definitions

6.2. Global Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

6.2.1. Frequency Trimming of BAW Filter

6.2.2. Surface Trimming of SAW Filter

6.2.3. Thickness and Pole Width Correction of Thin Film Recording Head

6.2.4. Coating of Dielectric Film

6.3. Application Comparison Matrix

6.4. Market Attractiveness, by Application

7. Global Ion Beam Technology Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Global Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Region, 2017–2027

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

7.3. Market Attractiveness, by Region

8. North America Ion Beam Technology Market Analysis and Forecast

8.1. Key Findings

8.2. Key Trends

8.3. North America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

8.3.1. Ion Beam Etching System

8.3.2. Ion Beam Deposition System

8.4. North America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

8.4.1. Frequency Trimming of BAW Filter

8.4.2. Surface Trimming of SAW Filter

8.4.3. Thickness and Pole Width Correction of Thin Film Recording Head

8.4.4. Coating of Dielectric Film

8.5. North America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

8.5.1. U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. North America Ion Beam Technology Market Attractiveness Analysis

8.6.1. By Technology

8.6.2. By Application

8.6.3. By Country/Sub-region

9. Europe Ion Beam Technology Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Europe Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

9.3.1. Ion Beam Etching System

9.3.2. Ion Beam Deposition System

9.4. Europe Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

9.4.1. Frequency Trimming of BAW Filter

9.4.2. Surface Trimming of SAW Filter

9.4.3. Thickness and Pole Width Correction of Thin Film Recording Head

9.4.4. Coating of Dielectric Film

9.5. Europe Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

9.5.1. Germany

9.5.2. U.K.

9.5.3. Italy

9.5.4. Eastern Europe including Russia

9.5.5. Rest of Europe

9.6.Europe Ion Beam Technology Market Attractiveness Analysis

9.6.1. By Technology

9.6.2. By Application

9.6.3. By Country/Sub-region

10. Asia Pacific Ion Beam Technology Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Asia Pacific Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

10.3.1. Ion Beam Etching System

10.3.2. Ion Beam Deposition System

10.4. Asia Pacific Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

10.4.1. Frequency Trimming of BAW Filter

10.4.2. Surface Trimming of SAW Filter

10.4.3. Thickness and Pole Width Correction of Thin Film Recording Head

10.4.4. Coating of Dielectric Film

10.5. Asia Pacific Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

10.5.1. China

10.5.2. Korea

10.5.3. Taiwan

10.5.4. Rest of Asia Pacific

10.6. Asia Pacific Ion Beam Technology Market Attractiveness Analysis

10.6.1. By Technology

10.6.2. By Application

10.6.3. By Country/Sub-region

11. Middle East & Africa Ion Beam Technology Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Middle East & Africa Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

11.3.1. Ion Beam Etching System

11.3.2. Ion Beam Deposition System

11.4. Middle East & Africa Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

11.4.1. Frequency Trimming of BAW Filter

11.4.2. Surface Trimming of SAW Filter

11.4.3. Thickness and Pole Width Correction of Thin Film Recording Head

11.4.4. Coating of Dielectric Film

11.5. Middle East & Africa Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

11.5.1. UAE

11.5.2. Israel

11.5.3. Rest of MEA

11.6. Middle East & Africa Ion Beam Technology Market Attractiveness Analysis

11.6.1. By Technology

11.6.2. By Application

11.6.3. By Country/Sub-region

12. South America Ion Beam Technology Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. South America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

12.3.1. Ion Beam Etching System

12.3.2. Ion Beam Deposition System

12.4. South America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

12.4.1. Frequency Trimming of BAW Filter

12.4.2. Surface Trimming of SAW Filter

12.4.3. Thickness and Pole Width Correction of Thin Film Recording Head

12.4.4. Coating of Dielectric Film

12.5. South America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.5.1. Brazil

12.5.2. Rest of South America

12.6. South America Ion Beam Technology Market Attractiveness Analysis

12.6.1. By Technology

12.6.2. By Application

12.6.3. By Country/Sub-region

13. Competition Landscape

13.1. Market Players – Competition Matrix

13.2. Global Ion Beam Technology Market Share Analysis, by Company (2018)

13.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Recent Developments, Strategy)

13.3.1. Meyer Burger Technology

13.3.1.1. Overview

13.3.1.2. Financials

13.3.1.3. SWOT

13.3.1.4. Strategy

13.3.2. Carl Zeiss AG

13.3.2.1. Overview

13.3.2.2. Financials

13.3.2.3. SWOT

13.3.2.4. Strategy

13.3.3. Veeco Instruments Inc.

13.3.3.1. Overview

13.3.3.2. Financials

13.3.3.3. SWOT

13.3.3.4. Strategy

13.3.4. Scia Systems GmbH

13.3.4.1. Overview

13.3.4.2. Financials

13.3.4.3. SWOT

13.3.4.4. Strategy

13.3.5. 4Wave Incorporated

13.3.5.1. Overview

13.3.5.2. Financials

13.3.5.3. SWOT

13.3.5.4. Strategy

13.3.6. Hitachi High-Technologies Corporation

13.3.6.1. Overview

13.3.6.2. Financials

13.3.6.3. SWOT

13.3.6.4. Strategy

13.3.7. Plasma-Therm

13.3.7.1. Overview

13.3.7.2. Financials

13.3.7.3. SWOT

13.3.7.4. Strategy

13.3.8. Raith GmbH

13.3.8.1. Overview

13.3.8.2. Financials

13.3.8.3. SWOT

13.3.8.4. Strategy

13.3.9. FEI

13.3.9.1. Overview

13.3.9.2. Financials

13.3.9.3. SWOT

13.3.9.4. Strategy

13.3.10. Canon Anelva Corporation

13.3.10.1. Overview

13.3.10.2. Financials

13.3.10.3. SWOT

13.3.10.4. Strategy

14. Key Takeaways

List of Table

Table 1: Global Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 2: Global Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 3: Global Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Region, 2019–2027

Table 4: North America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2019–2027

Table 5: North America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 6: North America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 7: Europe Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 8: Europe Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 9: Europe Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 10: Asia Pacific Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 11: Asia Pacific Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 12: Asia Pacific Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 13: MEA Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 14: MEA Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 15: MEA Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: South America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 17: South America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 18: South America Ion Beam Technology Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 19: Meyer Burger Technology AG Business Overview

Table 20: Carl Zeiss AG Business Overview

Table 21: Veeco Instruments Inc. Business Overview

Table 22: Scia Systems GmbH Business Overview

Table 23: 4Wave Incorporated Business Overview

Table 24: Hitachi High-Technologies Corporation Business Overview

Table 25: Plasma-Therm Business Overview

Table 26: Raith GmbH Business Overview

Table 27: FEI Business Overview

List of Figures

Figure 1: Global Ion Beam Technology Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 2: Global CAGR Analysis

Figure 3: Regional Outline

Figure 4: Porter’s Five Forces Analysis (1/3)

Figure 5: Global Ion Beam Technology Market Value Share Analysis, by Technology, 2019 and 2027

Figure 6: Global Ion Beam Technology Market Comparison Matrix, by Technology

Figure 7: Segment Revenue Contribution, 2019–2027 (%)

Figure 8: Segment Compounded Growth Matrix (CAGR %, 2019–2027)

Figure 9: Global Ion Beam Technology Market Attractiveness Analysis, by Technology

Figure 10: Global Ion Beam Technology Market Value Share Analysis, by Application, 2019 and 2027

Figure 11: Global Ion Beam Technology Market Comparison Matrix, by Application

Figure 12: Segment Revenue Contribution, 2019–2027 (%)

Figure 13: Segment Compounded Growth Matrix (CAGR %, 2019–2027)

Figure 14: Global Ion Beam Technology Market Attractiveness Analysis, by Application

Figure 15: Geographical Scenario

Figure 16: Global Ion Beam Technology Market Value Share Analysis, by Region, 2019 and 2027

Figure 17: Global Ion Beam Technology Market Comparison Matrix, by Region

Figure 18: Segment Revenue Contribution, 2019–2027 (%)

Figure 19: Segment Compounded Growth Matrix (CAGR %, 2019–2027)

Figure 20: Global Ion Beam Technology Market Attractiveness Analysis, by Region

Figure 21: North America Ion Beam Technology Market Value Share Analysis, by Technology (2019)

Figure 22: North America Ion Beam Technology Market Value Share Analysis, by Technology (2027)

Figure 23: North America Ion Beam Technology Market, by Application (2019)

Figure 24: North America Ion Beam Technology Market, by Application (2027)

Figure 25: North America Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2019)

Figure 26: North America Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2027)

Figure 27: North America Ion Beam Technology Market Attractiveness Analysis, by Technology

Figure 28: North America Ion Beam Technology Market Attractiveness Analysis, by Application

Figure 29: North America Ion Beam Technology Market Attractiveness Analysis, by Country/Sub-region

Figure 30: Europe Ion Beam Technology Market Value Share Analysis, by Technology (2019)

Figure 31: Europe Ion Beam Technology Market Value Share Analysis, by Technology (2027)

Figure 32: Europe Ion Beam Technology Market, by Application (2019)

Figure 33: Europe Ion Beam Technology Market, by Application (2027)

Figure 34: Europe Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2019)

Figure 35: Europe Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2027)

Figure 36: Europe Ion Beam Technology Market Attractiveness Analysis, by Technology

Figure 37: Europe Ion Beam Technology Market Attractiveness Analysis, by Application

Figure 38: Europe Ion Beam Technology Market Attractiveness Analysis, by Country/Sub-region

Figure 39: Asia Pacific Ion Beam Technology Market Value Share Analysis, by Technology (2019)

Figure 40: Asia Pacific Ion Beam Technology Market Value Share Analysis, by Technology (2027)

Figure 41: Asia Pacific Ion Beam Technology Market, by Application (2019)

Figure 42: Asia Pacific Ion Beam Technology Market, by Application (2027)

Figure 43: Asia Pacific Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2019)

Figure 44: Asia Pacific Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2027)

Figure 45: Asia Pacific Ion Beam Technology Market Attractiveness Analysis, by Technology

Figure 46: Asia Pacific Ion Beam Technology Market Attractiveness Analysis, by Application

Figure 47: Asia Pacific Ion Beam Technology Market Attractiveness Analysis, by Country/Sub-region

Figure 48: MEA Ion Beam Technology Market Value Share Analysis, by Technology (2019)

Figure 49: MEA Ion Beam Technology Market Value Share Analysis, by Technology (2027)

Figure 50: MEA Ion Beam Technology Market, by Application (2019)

Figure 51: MEA Ion Beam Technology Market, by Application (2027)

Figure 52: MEA Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2019)

Figure 53: MEA Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2027)

Figure 54: MEA Ion Beam Technology Market Attractiveness Analysis, by Technology

Figure 55: MEA Ion Beam Technology Market Attractiveness Analysis, by Application

Figure 56: MEA Ion Beam Technology Market Attractiveness Analysis, by Country/Sub-region

Figure 57: South America Ion Beam Technology Market Value Share Analysis, by Technology (2019)

Figure 58: South America Ion Beam Technology Market Value Share Analysis, by Technology (2027)

Figure 59: South America Ion Beam Technology Market, by Application (2019)

Figure 60: South America Ion Beam Technology Market, by Application (2027)

Figure 61: South America Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2019)

Figure 62: South America Ion Beam Technology Market Value Share Analysis, by Country/Sub-region (2027)

Figure 63: South America Ion Beam Technology Market Attractiveness Analysis, by Technology

Figure 64: South America Ion Beam Technology Market Attractiveness Analysis, by Application

Figure 65: South America Ion Beam Technology Market Attractiveness Analysis, by Country/Sub-region

Figure 66: Market Share of Key Players, 2018 (%)

Figure 67: Meyer Burger Technology AG Revenue (US$ Bn), 2016–2018

Figure 68: Meyer Burger Technology AG Geographical Revenue (2018)

Figure 69: Carl Zeiss AG Revenue (US$ Bn), 2016–2018

Figure 70: Carl Zeiss AG Geographical Revenue (2018)

Figure 71: Veeco Instruments Inc. Revenue (US$ Bn), 2016–2018

Figure 72: Veeco Instruments Inc. Geographical Revenue (2018)

Figure 73: Hitachi High-Technologies Corporation Revenue (US$ Bn), 2016–2018

Figure 74: Hitachi High-Technologies Corporation Geographical Revenue (2018)

Figure 75: FEI Revenue (US$ Bn), 2016–2018

Figure 76: FEI Geographical Revenue (2018)

Figure 77: FEI Geographical Revenue (2018)