Analysts’ Viewpoint

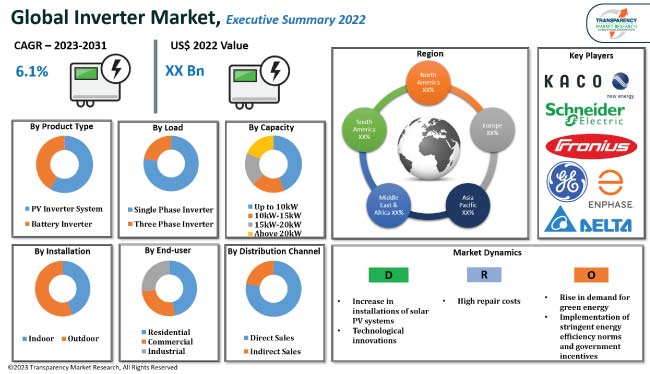

Increase in installation of solar PV systems and technological innovation are major factors driving the growth of the inverter industry.

Inverters are now becoming increasingly popular in the residential market due to their flexibility, reliability, and cost-effectiveness. With improved technology, households are turning to inverters for reliable energy solutions and reduced electricity costs, which is projected to fuel the inverter market size.

In line with current inverter market trends, manufacturers are introducing new inverter models with advanced features such as remote monitoring, surge protection, and energy storage capacity. This is driving down prices and making inverters more accessible to a wider range of households. Future market growth depends on innovation and reducing carbon footprints. Inverter market demand is projected to increase in the next few years due to this trend.

An inverter is a device that converts direct current (DC) to alternating current (AC). Design of the specific device or circuitry determines the input voltage, output voltage and frequency, and overall power handling. Inverters do not produce any power; the power is provided by a DC source. DC-to-AC converter, phase inverter, and voltage changer are the most commonly used types of inverters.

An inverter is used to provide an AC output from a DC source, such as a battery or solar panel. Inverters can also be used to change the voltage of an AC source, such as by stepping up a low voltage to a higher voltage or stepping down a higher voltage to a lower voltage. Inverters are used in a wide variety of applications, from providing power for small electronic devices to large power systems in homes, businesses, and vehicles.

Power inverters convert DC power from renewable energy sources, such as solar and wind power systems, into AC power for home or business use. Voltage inverters also convert AC power from utility-scale power generation plants, such as nuclear, hydroelectric, and natural gas power plants, into DC power for the electric grid.

Solar inverters are an essential part of a solar photovoltaic (PV) system. They convert the direct current (DC) electricity generated by the solar panels into alternating current (AC) electricity, which can then be used to power appliances and lighting. The surge in installation of solar PV systems is fueling inverter market opportunities.

According to the latest data on solar power, 3.2 million US residences have installed solar panels. Approximately 3.7% of U.S. houses and 1.6% of commercial buildings generated electricity from small-scale solar arrays in 2020, as per the Energy Information Administration.

The number of residential battery energy storage systems (BESS) deployed across Europe increased from 650,000 in 2021 to more than 1 million in 2022, according to the most recent statistics from Solar Power Europe.

Overall, the declining cost of solar components is making it easier for consumers to adopt solar energy. As a result, increasing installations of solar PV systems are projected to boost inverter market share in the near future.

Growth of the global inverter market can be ascribed to the recent technological innovations taking place in the industry. Inverters are becoming increasingly popular due to their ability to convert DC power into AC power, which is much more efficient and cost-effective.

With the advancement of technology, inverter manufacturers are now able to provide high-quality inverters with a wide range of features that can be used for various applications. These advantages of inverters include advanced power management, voltage regulation, and energy storage capabilities.

Furthermore, the development of smart grid technology and the introduction of energy storage systems have opened up new opportunities for manufacturers of inverters. These energy storage systems allow consumers to store excess energy generated from renewable sources, which can then be used during peak demand periods. Such developments are expected to further fuel the inverter market forecast in the near future.

Asia Pacific is estimated to hold the largest inverter market share during the forecast period. This is attributed to the increasing demand for power backup solutions in the region. As per the Asia Pacific inverter market overview, rise in investments in solar energy projects, increase in demand for energy-efficient products, and technological advancements are some of the major factors creating lucrative market opportunities for market players in the region.

Inverter market size in North America is anticipated to grow at the fastest rate. As per the latest market analysis in North America, the market is being driven by the growth in number of government initiatives to promote the usage of renewable energy sources.

Inverter business model of prominent manufacturers includes investments in R&D, product expansions, and mergers and acquisitions. Inverter market competitor analysis suggests that product development is a major strategy of top players. The market is highly competitive, with the presence of various global and regional players.

Delta Electronics, Inc., Enphase Energy, Fronius International GmbH, General Electric Company, GoodWe, KACO new energy GmbH, Mitsubishi Electric Corporation, Schneider Electric, SolarEdge, and TMEIC are the prominent entities profiled in the inverter market report.

Each of these players has been profiled in the inverter market research report based on parameters such as company overview, financial overview, business strategies, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 15.0 Bn |

| Market Forecast Value in 2031 | US$ 25.6 Bn |

| Growth Rate (CAGR) | 6.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value & Units for Volume |

| Market Analysis | Includes cross segment analysis at regional as well as country levels. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 15.0 Bn in 2022

It is projected to grow at a CAGR of 6.1% from 2023 to 2031

Increase in installations of solar PV systems and technological innovation

Based on product type, the PV inverter system accounted for a significant share of the global market in 2022

Asia Pacific is estimated to hold the largest share during the forecast period

Delta Electronics, Inc., Enphase Energy, Fronius International GmbH, General Electric Company, GoodWe, KACO new energy GmbH, Mitsubishi Electric Corporation, Schneider Electric, SolarEdge, and TMEIC

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Key Regulatory Framework

5.9. Global Inverter Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Units)

6. Global Inverter Market Analysis and Forecast, By Product Type

6.1. Inverter Market Size (US$ Bn and Units) Forecast, By Product Type, 2017 - 2031

6.1.1. PV Inverter System

6.1.1.1. Central Inverter

6.1.1.2. String Inverter

6.1.2. Battery Inverter

6.2. Incremental Opportunity, By Product Type

7. Global Inverter Market Analysis and Forecast, By Load

7.1. Inverter Market Size (US$ Bn and Units) Forecast, Load, 2017 - 2031

7.1.1. Single Phase Inverter

7.1.2. Three Phase Inverter

7.2. Incremental Opportunity, By Load

8. Global Inverter Market Analysis and Forecast, By Capacity

8.1. Inverter Market Size (US$ Bn and Units) Forecast, Capacity, 2017 - 2031

8.1.1. Up to 10kW

8.1.2. 10kW-15kW

8.1.3. 15kW-20kW

8.1.4. Above 20kW

8.2. Incremental Opportunity, By Capacity

9. Global Inverter Market Analysis and Forecast, By Installation

9.1. Inverter Market Size (US$ Bn and Units) Forecast, Installation, 2017 - 2031

9.1.1. Indoor

9.1.2. Outdoor

9.2. Incremental Opportunity, By Installation

10. Global Inverter Market Analysis and Forecast, By End-user

10.1. Inverter Market Size (US$ Bn and Units) Forecast, End User, 2017 - 2031

10.1.1. Residential

10.1.2. Commercial

10.1.2.1. Offices

10.1.2.2. Institutions

10.1.2.3. Malls

10.1.2.4. Theaters

10.1.2.5. Others

10.1.3. Industrial

10.1.3.1. Renewable Energy

10.1.3.2. Automotive

10.1.3.3. Food & Beverage

10.1.3.4. Others

10.2. Incremental Opportunity, By End-user

11. Global Inverter Market Analysis and Forecast, By Distribution Channel

11.1. Inverter Market Size (US$ Bn and Units) Forecast, Distribution Channel, 2017 - 2031

11.1.1. Direct Sales

11.1.2. Indirect Sales

11.2. Incremental Opportunity, By Distribution Channel

12. Global Inverter Market Analysis and Forecast, By Region

12.1. Inverter Market Size (US$ Bn and Units) Forecast, By Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, By Region

13. North America Inverter Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Macroeconomic Scenario

13.3. Key Brand Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Price

13.5. Key Trends Analysis

13.5.1. Demand Side

13.5.2. Supplier Side

13.6. Inverter Market Size (US$ Bn and Units) Forecast, By Product Type, 2017 - 2031

13.6.1. PV Inverter System

13.6.1.1. Central Inverter

13.6.1.2. String Inverter

13.6.2. Battery Inverter

13.7. Inverter Market Size (US$ Bn and Units) Forecast, Load, 2017 - 2031

13.7.1. Single Phase Inverter

13.7.2. Three Phase Inverter

13.8. Inverter Market Size (US$ Bn and Units) Forecast, Capacity, 2017 - 2031

13.8.1. Up to 10kW

13.8.2. 10kW-15kW

13.8.3. 15kW-20kW

13.8.4. Above 20kW

13.9. Inverter Market Size (US$ Bn and Units) Forecast, Installation, 2017 - 2031

13.9.1. Indoor

13.9.2. Outdoor

13.10. Inverter Market Size (US$ Bn and Units) Forecast, End-user, 2017 - 2031

13.10.1. Residential

13.10.2. Commercial

13.10.2.1. Offices

13.10.2.2. Institutions

13.10.2.3. Malls

13.10.2.4. Theaters

13.10.2.5. Others

13.10.3. Industrial

13.10.3.1. Renewable Energy

13.10.3.2. Automotive

13.10.3.3. Food & Beverage

13.10.3.4. Others

13.11. Inverter Market Size (US$ Bn and Units) Forecast, Distribution Channel, 2017 - 2031

13.11.1. Direct Sales

13.11.2. Indirect Sales

13.12. Inverter Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

13.12.1. U.S

13.12.2. Canada

13.12.3. Rest of North America

13.13. Incremental Opportunity Analysis

14. Europe Inverter Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Macroeconomic Scenario

14.3. Key Brand Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Price

14.5. Key Trends Analysis

14.5.1. Demand Side

14.5.2. Supplier Side

14.6. Inverter Market Size (US$ Bn and Units) Forecast, By Product Type, 2017 - 2031

14.6.1. PV Inverter System

14.6.1.1. Central Inverter

14.6.1.2. String Inverter

14.6.2. Battery Inverter

14.7. Inverter Market Size (US$ Bn and Units) Forecast, Load, 2017 - 2031

14.7.1. Single Phase Inverter

14.7.2. Three Phase Inverter

14.8. Inverter Market Size (US$ Bn and Units) Forecast, Capacity, 2017 - 2031

14.8.1. Up to 10 kW

14.8.2. 10kW-15kW

14.8.3. 15kW-20kW

14.8.4. Above 20kW

14.9. Inverter Market Size (US$ Bn and Units) Forecast, Installation, 2017 - 2031

14.9.1. Indoor

14.9.2. Outdoor

14.10. Inverter Market Size (US$ Bn and Units) Forecast, End-user, 2017 - 2031

14.10.1. Residential

14.10.2. Commercial

14.10.2.1. Offices

14.10.2.2. Institutions

14.10.2.3. Malls

14.10.2.4. Theaters

14.10.2.5. Others

14.10.3. Industrial

14.10.3.1. Renewable Energy

14.10.3.2. Automotive

14.10.3.3. Food & Beverage

14.10.3.4. Others

14.11. Inverter Market Size (US$ Bn and Units) Forecast, Distribution Channel, 2017 - 2031

14.11.1. Direct Sales

14.11.2. Indirect Sales

14.12. Inverter Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

14.12.1. U.K

14.12.2. Germany

14.12.3. France

14.12.4. Rest of Europe

14.13. Incremental Opportunity Analysis

15. Asia Pacific Inverter Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Macroeconomic Scenario

15.3. Key Brand Analysis

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Inverter Market Size (US$ Bn and Units) Forecast, By Product Type, 2017 - 2031

15.5.1. PV Inverter System

15.5.1.1. Central Inverter

15.5.1.2. String Inverter

15.5.2. Battery Inverter

15.6. Inverter Market Size (US$ Bn and Units) Forecast, Load, 2017 - 2031

15.6.1. Single Phase Inverter

15.6.2. Three Phase Inverter

15.7. Inverter Market Size (US$ Bn and Units) Forecast, Capacity, 2017 - 2031

15.7.1. Up to 10kW

15.7.2. 10kW-15 kW

15.7.3. 15kW-20kW

15.7.4. Above 20kW

15.8. Inverter Market Size (US$ Bn and Units) Forecast, Installation, 2017 - 2031

15.8.1. Indoor

15.8.2. Outdoor

15.9. Inverter Market Size (US$ Bn and Units) Forecast, End-user, 2017 - 2031

15.9.1. Residential

15.9.2. Commercial

15.9.2.1. Offices

15.9.2.2. Institutions

15.9.2.3. Malls

15.9.2.4. Theaters

15.9.2.5. Others

15.9.3. Industrial

15.9.3.1. Renewable Energy

15.9.3.2. Automotive

15.9.3.3. Food & Beverage

15.9.3.4. Others

15.10. Inverter Market Size (US$ Bn and Units) Forecast, Distribution Channel, 2017 - 2031

15.10.1. Direct Sales

15.10.2. Indirect Sales

15.11. Inverter Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

15.11.1. India

15.11.2. China

15.11.3. Japan

15.11.4. Rest of Asia Pacific

15.12. Incremental Opportunity Analysis

16. Middle East & Africa Inverter Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Macroeconomic Scenario

16.3. Key Brand Analysis

16.4. Price Trend Analysis

16.4.1. Weighted Average Price

16.5. Key Trends Analysis

16.5.1. Demand Side

16.5.2. Supplier Side

16.6. Inverter Market Size (US$ Bn and Units) Forecast, By Product Type, 2017 - 2031

16.6.1. PV Inverter System

16.6.1.1. Central Inverter

16.6.1.2. String Inverter

16.6.2. Battery Inverter

16.7. Inverter Market Size (US$ Bn and Units) Forecast, Load, 2017 - 2031

16.7.1. Single Phase Inverter

16.7.2. Three Phase Inverter

16.8. Inverter Market Size (US$ Bn and Units) Forecast, Capacity, 2017 - 2031

16.8.1. Up to 10kW

16.8.2. 10kW-15kW

16.8.3. 15kW-20kW

16.8.4. Above 20kW

16.9. Inverter Market Size (US$ Bn and Units) Forecast, Installation, 2017 - 2031

16.9.1. Indoor

16.9.2. Outdoor

16.10. Inverter Market Size (US$ Bn and Units) Forecast, End-user, 2017 - 2031

16.10.1. Residential

16.10.2. Commercial

16.10.2.1. Offices

16.10.2.2. Institutions

16.10.2.3. Malls

16.10.2.4. Theaters

16.10.2.5. Others

16.10.3. Industrial

16.10.3.1. Renewable Energy

16.10.3.2. Automotive

16.10.3.3. Food & Beverage

16.10.3.4. Others

16.11. Inverter Market Size (US$ Bn and Units) Forecast, Distribution Channel, 2017 - 2031

16.11.1. Direct Sales

16.11.2. Indirect Sales

16.12. Inverter Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

16.12.1. GCC

16.12.2. South Africa

16.12.3. Rest of MEA

16.13. Incremental Opportunity Analysis

17. South America Inverter Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Macroeconomic Scenario

17.3. Key Brand Analysis

17.4. Price Trend Analysis

17.4.1. Weighted Average Price

17.5. Key Trends Analysis

17.5.1. Demand Side

17.5.2. Supplier Side

17.6. Inverter Market Size (US$ Bn and Units) Forecast, By Product Type, 2017 - 2031

17.6.1. PV Inverter System

17.6.1.1. Central Inverter

17.6.1.2. String Inverter

17.6.2. Battery Inverter

17.7. Inverter Market Size (US$ Bn and Units) Forecast, Load, 2017 - 2031

17.7.1. Single Phase Inverter

17.7.2. Three Phase Inverter

17.8. Inverter Market Size (US$ Bn and Units) Forecast, Capacity, 2017 - 2031

17.8.1. Up to 10kW

17.8.2. 10kW-15kW

17.8.3. 15kW-20kW

17.8.4. Above 20kW

17.9. Inverter Market Size (US$ Bn and Units) Forecast, Installation, 2017 - 2031

17.9.1. Indoor

17.9.2. Outdoor

17.10. Inverter Market Size (US$ Bn and Units) Forecast, End-user, 2017 - 2031

17.10.1. Residential

17.10.2. Commercial

17.10.2.1. Offices

17.10.2.2. Institutions

17.10.2.3. Malls

17.10.2.4. Theaters

17.10.2.5. Others

17.10.3. Industrial

17.10.3.1. Renewable Energy

17.10.3.2. Automotive

17.10.3.3. Food & Beverage

17.10.3.4. Others

17.11. Inverter Market Size (US$ Bn and Units) Forecast, Distribution Channel, 2017 - 2031

17.11.1. Direct Sales

17.11.2. Indirect Sales

17.12. Inverter Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

17.12.1. Brazil

17.12.2. Rest of South America

17.13. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Share Analysis (%), by Company, (2022)

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. Delta Electronics, Inc.

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.2. Enphase Energy

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.3. Fronius International GmbH

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.4. General Electric Company

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.5. GoodWe

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.6. KACO new energy GmbH

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.7. Mitsubishi Electric Corporation

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.8. Schneider Electric

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.9. SolarEdge

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.10. TMEIC

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

19. Go to Market Strategy

19.1. Identification of Potential Market Spaces

19.1.1. By Product Type

19.1.2. By Load

19.1.3. By Capacity

19.1.4. By Installation

19.1.5. By End-user

19.1.6. By Distribution Channel

19.1.7. By Region

19.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Table 2: Global Inverter Market Volume (Units), by Product Type 2017-2031

Table 3: Global Inverter Market Value (US$ Bn), by Load, 2017-2031

Table 4: Global Inverter Market Volume (Units), by Load 2017-2031

Table 5: Global Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Table 6: Global Inverter Market Volume (Units), by Capacity 2017-2031

Table 7: Global Inverter Market Value (US$ Bn), by Installation, 2017-2031

Table 8: Global Inverter Market Volume (Units), by Installation 2017-2031

Table 9: Global Inverter Market Value (US$ Bn), by End-user, 2017-2031

Table 10: Global Inverter Market Volume (Units), by End-user 2017-2031

Table 11: Global Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 12: Global Inverter Market Volume (Units), by Distribution Channel 2017-2031

Table 13: Global Inverter Market Value (US$ Bn), by Region, 2017-2031

Table 14: Global Inverter Market Volume (Units), by Region 2017-2031

Table 15: North America Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Table 16: North America Inverter Market Volume (Units), by Product Type 2017-2031

Table 17: North America Inverter Market Value (US$ Bn), by Load, 2017-2031

Table 18: North America Inverter Market Volume (Units), by Load 2017-2031

Table 19: North America Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Table 20: North America Inverter Market Volume (Units), by Capacity 2017-2031

Table 21: North America Inverter Market Value (US$ Bn), by Installation, 2017-2031

Table 22: North America Inverter Market Volume (Units), by Installation 2017-2031

Table 23: North America Inverter Market Value (US$ Bn), by End-user, 2017-2031

Table 24: North America Inverter Market Volume (Units), by End-user 2017-2031

Table 25: North America Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 26: North America Inverter Market Volume (Units), by Distribution Channel 2017-2031

Table 27: North America Inverter Market Value (US$ Bn), by Region, 2017-2031

Table 28: North America Inverter Market Volume (Units), by Region 2017-2031

Table 29: Europe Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Table 30: Europe Inverter Market Volume (Units), by Product Type 2017-2031

Table 31: Europe Inverter Market Value (US$ Bn), by Load, 2017-2031

Table 32: Europe Inverter Market Volume (Units), by Load 2017-2031

Table 33: Europe Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Table 34: Europe Inverter Market Volume (Units), by Capacity 2017-2031

Table 35: Europe Inverter Market Value (US$ Bn), by Installation, 2017-2031

Table 36: Europe Inverter Market Volume (Units), by Installation 2017-2031

Table 37: Europe Inverter Market Value (US$ Bn), by End-user, 2017-2031

Table 38: Europe Inverter Market Volume (Units), by End-user 2017-2031

Table 39: Europe Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 40: Europe Inverter Market Volume (Units), by Distribution Channel 2017-2031

Table 41: Europe Inverter Market Value (US$ Bn), by Region, 2017-2031

Table 42: Europe Inverter Market Volume (Units), by Region 2017-2031

Table 43: Asia Pacific Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Table 44: Asia Pacific Inverter Market Volume (Units), by Product Type 2017-2031

Table 45: Asia Pacific Inverter Market Value (US$ Bn), by Load, 2017-2031

Table 46: Asia Pacific Inverter Market Volume (Units), by Load 2017-2031

Table 47: Asia Pacific Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Table 48: Asia Pacific Inverter Market Volume (Units), by Capacity 2017-2031

Table 49: Asia Pacific Inverter Market Value (US$ Bn), by Installation, 2017-2031

Table 50: Asia Pacific Inverter Market Volume (Units), by Installation 2017-2031

Table 51: Asia Pacific Inverter Market Value (US$ Bn), by End-user, 2017-2031

Table 52: Asia Pacific Inverter Market Volume (Units), by End-user 2017-2031

Table 53: Asia Pacific Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 54: Asia Pacific Inverter Market Volume (Units), by Distribution Channel 2017-2031

Table 55: Asia Pacific Inverter Market Value (US$ Bn), by Region, 2017-2031

Table 56: Asia Pacific Inverter Market Volume (Units), by Region 2017-2031

Table 57: Middle East & Africa Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Table 58: Middle East & Africa Inverter Market Volume (Units), by Product Type 2017-2031

Table 59: Middle East & Africa Inverter Market Value (US$ Bn), by Load, 2017-2031

Table 60: Middle East & Africa Inverter Market Volume (Units), by Load 2017-2031

Table 61: Middle East & Africa Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Table 62: Middle East & Africa Inverter Market Volume (Units), by Capacity 2017-2031

Table 63: Middle East & Africa Inverter Market Value (US$ Bn), by Installation, 2017-2031

Table 64: Middle East & Africa Inverter Market Volume (Units), by Installation 2017-2031

Table 65: Middle East & Africa Inverter Market Value (US$ Bn), by End-user, 2017-2031

Table 66: Middle East & Africa Inverter Market Volume (Units), by End-user 2017-2031

Table 67: Middle East & Africa Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 68: Middle East & Africa Inverter Market Volume (Units), by Distribution Channel 2017-2031

Table 69: Middle East & Africa Inverter Market Value (US$ Bn), by Region, 2017-2031

Table 70: Middle East & Africa Inverter Market Volume (Units), by Region 2017-2031

Table 71: South America Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Table 72: South America Inverter Market Volume (Units), by Product Type 2017-2031

Table 73: South America Inverter Market Value (US$ Bn), by Load, 2017-2031

Table 74: South America Inverter Market Volume (Units), by Load 2017-2031

Table 75: South America Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Table 76: South America Inverter Market Volume (Units), by Capacity 2017-2031

Table 77: South America Inverter Market Value (US$ Bn), by Installation, 2017-2031

Table 78: South America Inverter Market Volume (Units), by Installation 2017-2031

Table 79: South America Inverter Market Value (US$ Bn), by End-user, 2017-2031

Table 80: South America Inverter Market Volume (Units), by End-user 2017-2031

Table 81: South America Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 82: South America Inverter Market Volume (Units), by Distribution Channel 2017-2031

Table 83: South America Inverter Market Value (US$ Bn), by Region, 2017-2031

Table 84: South America Inverter Market Volume (Units), by Region 2017-2031

List of Figures

Figure 1: Global Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Figure 2: Global Inverter Market Volume (Units), by Product Type 2017-2031

Figure 3: Global Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 4: Global Inverter Market Value (US$ Bn), by Load, 2017-2031

Figure 5: Global Inverter Market Volume (Units), by Load 2017-2031

Figure 6: Global Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Load, 2023-2031

Figure 7: Global Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Figure 8: Global Inverter Market Volume (Units), by Capacity 2017-2031

Figure 9: Global Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Capacity, 2023-2031

Figure 10: Global Inverter Market Value (US$ Bn), by Installation, 2017-2031

Figure 11: Global Inverter Market Volume (Units), by Installation 2017-2031

Figure 12: Global Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Installation, 2023-2031

Figure 13: Global Inverter Market Value (US$ Bn), by End-user, 2017-2031

Figure 14: Global Inverter Market Volume (Units), by End-user 2017-2031

Figure 15: Global Inverter Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 16: Global Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 17: Global Inverter Market Volume (Units), by Distribution Channel 2017-2031

Figure 18: Global Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 19: Global Inverter Market Value (US$ Bn), by Region, 2017-2031

Figure 20: Global Inverter Market Volume (Units), by Region 2017-2031

Figure 21: Global Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 22: North America Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Figure 23: North America Inverter Market Volume (Units), by Product Type 2017-2031

Figure 24: North America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 25: North America Inverter Market Value (US$ Bn), by Load, 2017-2031

Figure 26: North America Inverter Market Volume (Units), by Load 2017-2031

Figure 27: North America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Load, 2023-2031

Figure 28: North America Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Figure 29: North America Inverter Market Volume (Units), by Capacity 2017-2031

Figure 30: North America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Capacity, 2023-2031

Figure 31: North America Inverter Market Value (US$ Bn), by Installation, 2017-2031

Figure 32: North America Inverter Market Volume (Units), by Installation 2017-2031

Figure 33: North America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Installation, 2023-2031

Figure 34: North America Inverter Market Value (US$ Bn), by End-user, 2017-2031

Figure 35: North America Inverter Market Volume (Units), by End-user 2017-2031

Figure 36: North America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 37: North America Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 38: North America Inverter Market Volume (Units), by Distribution Channel 2017-2031

Figure 39: North America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 40: North America Inverter Market Value (US$ Bn), by Region, 2017-2031

Figure 41: North America Inverter Market Volume (Units), by Region 2017-2031

Figure 42: North America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 43: Europe Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Figure 44: Europe Inverter Market Volume (Units), by Product Type 2017-2031

Figure 45: Europe Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 46: Europe Inverter Market Value (US$ Bn), by Load, 2017-2031

Figure 47: Europe Inverter Market Volume (Units), by Load 2017-2031

Figure 48: Europe Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Load, 2023-2031

Figure 49: Europe Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Figure 50: Europe Inverter Market Volume (Units), by Capacity 2017-2031

Figure 51: Europe Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Capacity, 2023-2031

Figure 52: Europe Inverter Market Value (US$ Bn), by Installation, 2017-2031

Figure 53: Europe Inverter Market Volume (Units), by Installation 2017-2031

Figure 54: Europe Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Installation, 2023-2031

Figure 55: Europe Inverter Market Value (US$ Bn), by End-user, 2017-2031

Figure 56: Europe Inverter Market Volume (Units), by End-user 2017-2031

Figure 57: Europe Inverter Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 58: Europe Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 59: Europe Inverter Market Volume (Units), by Distribution Channel 2017-2031

Figure 60: Europe Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 61: Europe Inverter Market Value (US$ Bn), by Region, 2017-2031

Figure 62: Europe Inverter Market Volume (Units), by Region 2017-2031

Figure 63: Europe Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 64: Asia Pacific Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Figure 65: Asia Pacific Inverter Market Volume (Units), by Product Type 2017-2031

Figure 66: Asia Pacific Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 67: Asia Pacific Inverter Market Value (US$ Bn), by Load, 2017-2031

Figure 68: Asia Pacific Inverter Market Volume (Units), by Load 2017-2031

Figure 69: Asia Pacific Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Load, 2023-2031

Figure 70: Asia Pacific Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Figure 71: Asia Pacific Inverter Market Volume (Units), by Capacity 2017-2031

Figure 72: Asia Pacific Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Capacity, 2023-2031

Figure 73: Asia Pacific Inverter Market Value (US$ Bn), by Installation, 2017-2031

Figure 74: Asia Pacific Inverter Market Volume (Units), by Installation 2017-2031

Figure 75: Asia Pacific Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Installation, 2023-2031

Figure 76: Asia Pacific Inverter Market Value (US$ Bn), by End-user, 2017-2031

Figure 77: Asia Pacific Inverter Market Volume (Units), by End-user 2017-2031

Figure 78: Asia Pacific Inverter Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 79: Asia Pacific Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 80: Asia Pacific Inverter Market Volume (Units), by Distribution Channel 2017-2031

Figure 81: Asia Pacific Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 82: Asia Pacific Inverter Market Value (US$ Bn), by Region, 2017-2031

Figure 83: Asia Pacific Inverter Market Volume (Units), by Region 2017-2031

Figure 84: Asia Pacific Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 85: Middle East & Africa Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Figure 86: Middle East & Africa Inverter Market Volume (Units), by Product Type 2017-2031

Figure 87: Middle East & Africa Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 88: Middle East & Africa Inverter Market Value (US$ Bn), by Load, 2017-2031

Figure 89: Middle East & Africa Inverter Market Volume (Units), by Load 2017-2031

Figure 90: Middle East & Africa Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Load, 2023-2031

Figure 91: Middle East & Africa Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Figure 92: Middle East & Africa Inverter Market Volume (Units), by Capacity 2017-2031

Figure 93: Middle East & Africa Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Capacity, 2023-2031

Figure 94: Middle East & Africa Inverter Market Value (US$ Bn), by Installation, 2017-2031

Figure 95: Middle East & Africa Inverter Market Volume (Units), by Installation 2017-2031

Figure 96: Middle East & Africa Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Installation, 2023-2031

Figure 97: Middle East & Africa Inverter Market Value (US$ Bn), by End-users, 2017-2031

Figure 98: Middle East & Africa Inverter Market Volume (Units), by End-users 2017-2031

Figure 99: Middle East & Africa Inverter Market Incremental Opportunity (US$ Bn), Forecast, by End-users, 2023-2031

Figure 100: Middle East & Africa Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 101: Middle East & Africa Inverter Market Volume (Units), by Distribution Channel 2017-2031

Figure 102: Middle East & Africa Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 103: Middle East & Africa Inverter Market Value (US$ Bn), by Region, 2017-2031

Figure 104: Middle East & Africa Inverter Market Volume (Units), by Region 2017-2031

Figure 105: Middle East & Africa Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 106: South America Inverter Market Value (US$ Bn), by Product Type, 2017-2031

Figure 107: South America Inverter Market Volume (Units), by Product Type 2017-2031

Figure 108: South America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 109: South America Inverter Market Value (US$ Bn), by Load, 2017-2031

Figure 110: South America Inverter Market Volume (Units), by Load 2017-2031

Figure 111: South America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Load, 2023-2031

Figure 112: South America Inverter Market Value (US$ Bn), by Capacity, 2017-2031

Figure 113: South America Inverter Market Volume (Units), by Capacity 2017-2031

Figure 114: South America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Capacity, 2023-2031

Figure 115: South America Inverter Market Value (US$ Bn), by Installation, 2017-2031

Figure 116: South America Inverter Market Volume (Units), by Installation 2017-2031

Figure 117: South America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Installation, 2023-2031

Figure 118: South America Inverter Market Value (US$ Bn), by End-users, 2017-2031

Figure 119: South America Inverter Market Volume (Units), by End-users 2017-2031

Figure 120: South America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by End-users, 2023-2031

Figure 121: South America Inverter Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 122: South America Inverter Market Volume (Units), by Distribution Channel 2017-2031

Figure 123: South America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 124: South America Inverter Market Value (US$ Bn), by Region, 2017-2031

Figure 125: South America Inverter Market Volume (Units), by Region 2017-2031

Figure 126: South America Inverter Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031