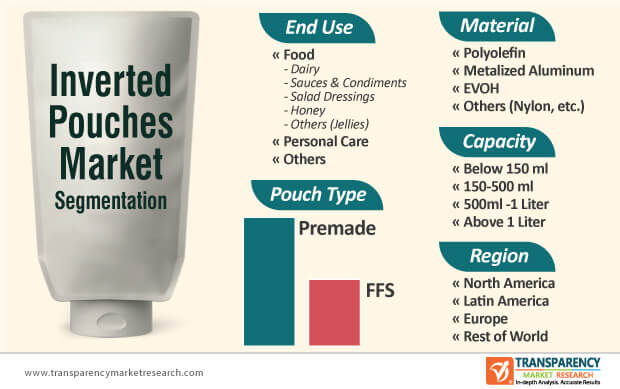

Inverted pouches have high preference in the rapidly growing F&B industry. The demand for gluten-free and GMO-free sauces has catalyzed the growth of ready-to-use pre-made pouches. As such, pre-made pouch type segment of the inverted pouches market is estimated to reach an output of ~9,800 units by the end of 2021. Hence, companies are increasingly focusing on developing pre-made pouches.

On the other hand, manufacturers in the inverted pouches market are increasing research activities to decipher whether inverted pouches are environment friendly. For instance, producer of clean-label sauces, Uncle Dougie’s, collaborated with leading flexible packaging solutions provider Glenroy, to measure the environmental footprint and sustainability of inverted pouches. Manufacturers are using industry standard environment impact measuring software to demonstrate eco-friendly attributes of inverted pouches.

Moreover, growing awareness about organic products is boosting the demand for ready-to-use inverted pouches. In order to cut through the clutter of health claims, companies are manufacturing eco-friendly pouches that are pervasively gaining the trust and faith of consumers.

Inverted pouches are a game-changing solution for companies looking to boost the uptake of their products. Traditional plastic tubs for dips are now being pervasively replaced with inverted pouches. This has led to the rise in the usage of the product, resulting in high product sales.

Another leader in flexible packaging, ProAmpac, has entered the competition in the inverted pouches market by tapping into opportunities in the personal care segment and other categories with the introduction of PRO POUCH Squeeze inverted pouch. As such, the personal care end use segment of the inverted pouches market is projected to reach a volume of ~2,100 units by 2027. Hence, companies are increasing efficacy in consumer-centric formats of inverted pouches to innovate in cosmetics packaging.

Innovative squeeze inverted pouches are increasingly replacing traditional squeeze bottles, convenient for both food and non-food packaging solutions. Apart from food and personal care, manufacturers are leveraging opportunities in industrial chemicals by strengthening supply chain of squeeze inverted pouches.

The inverted pouches market is largely consolidated with major players, with Glenroy alone accounting for ~72-75% of the market share. Another challenge that emerging players have to overcome is the difficulty of dispensing through conventional formats of packaging. As consumers are becoming increasingly aware about various packaging formats, manufacturers are introducing child-friendly dispensing spouts and closures to improve user experience.

On the other hand, manufacturers are increasing production capabilities to optimize the shelf life of food products. As such, food end use segment of the inverted pouches market is estimated to reach a production of ~20,100 units by 2027. Hence, manufacturers are focusing on shelf life optimization of food products to cater to unmet needs of consumers.

Companies are gaining competitive edge over other players by introducing inverted pouches with one-way valves to prevent oxygen intake in the pouch, and this eventually extends the shelf life of products. They are adding more value to pouches by developing customizable valves that maintain viscosity and quality of squeezable food products.

Flexible packaging solutions have led to innovation in the inverted pouches market. Manufacturers are aiming to gain long-term business stability by increasing the availability of novel inverted pouches for ultra-high temperature processing and pasteurized dairy products. Inverted pouches are growing increasingly popular as a real asset for merchandising. Easy storage of inverted pouches is another key factor driving the inverted pouches market.

Additionally, companies are undertaking research to understand consumer psychology. Manufacturers are spreading awareness about advantages of inverted pouches among food manufacturers to boost product uptake.

Analysts’ Viewpoint

Focus on product uptake has helped manufacturers in the inverted pouches market to establish harmonious business relations with food manufacturers. The new technology’s upright design makes it door-appropriate and an important asset for merchandising to boost visibility at retail stores.

Eco-friendly attributes, such as reduced fossil fuel and overall water usage in the production of inverted pouches as compared to glass bottles, are gaining widespread popularity in the market landscape. However, there is a need to improve dispensing of food and cosmetic products to cater to sanitary needs of consumers. Thus, companies should develop customizable valves and dispensing spouts to enhance consumer convenience.

The Inverted Pouches Market is studied from 2019 - 2027.

The Inverted Pouches market is projected to reach the valuation of US$ 19.3 Mn by 2031

The Inverted Pouches market is expected to grow at a CAGR of 7% during 2019-2030

U.S., Germany, and the U.K

Glenroy Inc., Polymer Packaging Inc., ProAmpac & Semco S.A.M are the key vendors in the Inverted Pouches market.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Opportunity Analysis

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Inverted Pouches Market Background

3.1. Packaging Market Overview

3.2. Macro-economic Factors

3.3. Forecast Factors – Relevance and Impact

3.4. Inverted Pouches Market Value Chain Analysis

3.4.1. Profitability Margins

3.4.2. List of Active Participants

3.4.2.1. Raw Material Suppliers

3.4.2.2. Manufacturers

3.4.2.3. Distributors/Retailers

3.5. Market Dynamics

3.5.1. Drivers

3.5.2. Restraints

3.5.3. Opportunity

3.5.4. Trends

4. Inverted Pouches Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Global Inverted Pouches Market Analysis and Forecast, By Material Type

5.1. Introduction

5.1.1. Market share and Basis Points (BPS) Analysis By Material Type

5.1.2. Y-o-Y Growth Projections By Material Type

5.2. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Material Type

5.2.1. Polyolefin

5.2.2. Metalized Aluminum

5.2.3. EVOH

5.2.4. Others (Nylon, Etc.)

5.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Material Type

5.3.1. Polyolefin

5.3.2. Metalized Aluminum

5.3.3. EVOH

5.3.4. Others (Nylon, Etc.)

5.4. Market Attractiveness Analysis By Material Type

5.5. Prominent Trends

6. Global Inverted Pouches Market Analysis and Forecast, By Capacity

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis By Capacity

6.1.2. Y-o-Y Growth Projections By Capacity

6.2. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Capacity

6.2.1. Below 150 ml

6.2.2. 150-500 ml

6.2.3. 500ml -1 Liter

6.2.4. Above 1 Liter

6.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Capacity

6.3.1. Below 150 ml

6.3.2. 150-500 ml

6.3.3. 500ml -1 Liter

6.3.4. Above 1 Liter

6.4. Market Attractiveness Analysis By Capacity

7. Global Inverted Pouches Market Analysis and Forecast, By End Use

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis By End Use

7.1.2. Y-o-Y Growth Projections By End Use

7.2. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By End Use

7.2.1. Food

7.2.1.1. Dairy

7.2.1.2. Sauces & Cond.

7.2.1.3. Salad Dressings

7.2.1.4. Honey

7.2.1.5. Others (Jellies)

7.2.2. Personal Care

7.2.3. Others

7.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By End Use

7.3.1. Food

7.3.1.1. Dairy

7.3.1.2. Sauces & Cond.

7.3.1.3. Salad Dressings

7.3.1.4. Honey

7.3.1.5. Others (Jellies)

7.3.2. Personal Care

7.3.2.1.1. Others

7.4. Market Attractiveness Analysis By End Use

8. Global Inverted Pouches Market Analysis and Forecast, By Region

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis By Region

8.1.2. Y-o-Y Growth Projections By Region

8.2. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Latin America

8.2.4. ROW (Asia Pacific & Middle East and Africa (MEA))

8.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 By Region

8.3.1. North America

8.3.2. Europe

8.3.3. Latin America

8.3.4. ROW (Asia Pacific & Middle East and Africa (MEA))

8.4. Market Attractiveness Analysis By Region

9. North America Inverted Pouches Market Analysis and Forecast

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis By Country

9.1.2. Y-o-Y Growth Projections By Country

9.2. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Country

9.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027, By Country

9.3.1. U.S.

9.3.2. Canada

9.4. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Material Type

9.4.1. Polyolefin

9.4.2. Metalized Aluminum

9.4.3. EVOH

9.4.4. Others (Nylon, Etc.)

9.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Material Type

9.5.1. Polyolefin

9.5.2. Metalized Aluminum

9.5.3. EVOH

9.5.4. Others (Nylon, Etc.)

9.6. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Capacity

9.6.1. Below 150 ml

9.6.2. 150-500 ml

9.6.3. 500ml -1 Liter

9.6.4. Above 1 Liter

9.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Capacity

9.7.1. Below 150 ml

9.7.2. 150-500 ml

9.7.3. 500ml -1 Liter

9.7.4. Above 1 Liter

9.8. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By End Use

9.8.1. Food

9.8.1.1. Dairy

9.8.1.2. Sauces & Cond.

9.8.1.3. Salad Dressings

9.8.1.4. Honey

9.8.1.5. Others (Jellies)

9.8.2. Personal Care

9.8.3. Others

9.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By End Use

9.9.1. Food

9.9.1.1. Dairy

9.9.1.2. Sauces & Cond.

9.9.1.3. Salad Dressings

9.9.1.4. Honey

9.9.1.5. Others (Jellies)

9.9.2. Personal Care

9.9.2.1.1. Others

9.10. Market Attractiveness Analysis

9.10.1. By Material Type

9.10.2. By Capacity

9.10.3. By End Use

9.11. Prominent Trends

10. Latin America Inverted Pouches Market Analysis and Forecast

10.1. Introduction

10.2. $ Mn) and Volume (Tons), 2014-2018, By Material Type

10.2.1. Polyolefin

10.2.2. Metalized Aluminum

10.2.3. EVOH

10.2.4. Others (Nylon, Etc.)

10.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Material Type

10.3.1. Polyolefin

10.3.2. Metalized Aluminum

10.3.3. EVOH

10.3.4. Others (Nylon, Etc.)

10.4. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Capacity

10.4.1. Below 150 ml

10.4.2. 150-500 ml

10.4.3. 500ml -1 Liter

10.4.4. Above 1 Liter

10.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Capacity

10.5.1. Below 150 ml

10.5.2. 150-500 ml

10.5.3. 500ml -1 Liter

10.5.4. Above 1 Liter

10.6. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By End Use

10.6.1. Food

10.6.1.1. Dairy

10.6.1.2. Sauces & Cond.

10.6.1.3. Salad Dressings

10.6.1.4. Honey

10.6.1.5. Others (Jellies)

10.6.2. Personal Care

10.6.3. Others

10.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By End Use

10.7.1. Food

10.7.1.1. Dairy

10.7.1.2. Sauces & Cond.

10.7.1.3. Salad Dressings

10.7.1.4. Honey

10.7.1.5. Others (Jellies)

10.7.2. Personal Care

10.7.2.1.1. Others

10.8. Market Attractiveness Analysis

10.8.1. By Material Type

10.8.2. By Capacity

10.8.3. By End Use

10.9. Drivers and Restraints: Impact Analysis

11. Europe Inverted Pouches Market Analysis and Forecast

11.1. Introduction

11.2. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Material Type

11.2.1. Polyolefin

11.2.2. Metalized Aluminum

11.2.3. EVOH

11.2.4. Others (Nylon, Etc.)

11.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Material Type

11.3.1. Polyolefin

11.3.2. Metalized Aluminum

11.3.3. EVOH

11.3.4. Others (Nylon, Etc.)

11.4. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Capacity

11.4.1. Below 150 ml

11.4.2. 150-500 ml

11.4.3. 500ml -1 Liter

11.4.4. Above 1 Liter

11.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Capacity

11.5.1. Below 150 ml

11.5.2. 150-500 ml

11.5.3. 500ml -1 Liter

11.5.4. Above 1 Liter

11.6. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By End Use

11.6.1. Food

11.6.1.1. Dairy

11.6.1.2. Sauces & Cond.

11.6.1.3. Salad Dressings

11.6.1.4. Honey

11.6.1.5. Others (Jellies)

11.6.2. Personal Care

11.6.3. Others

11.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By End Use

11.7.1. Food

11.7.1.1. Dairy

11.7.1.2. Sauces & Cond.

11.7.1.3. Salad Dressings

11.7.1.4. Honey

11.7.1.5. Others (Jellies)

11.7.2. Personal Care

11.7.2.1.1. Others

11.8. Market Attractiveness Analysis

11.8.1. By Material Type

11.8.2. By Capacity

11.8.3. By End Use

11.9. Drivers and Restraints: Impact Analysis

12. ROW Inverted Pouches Market Analysis and Forecast

12.1. Introduction

12.2. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Material Type

12.2.1. Polyolefin

12.2.2. Metalized Aluminum

12.2.3. EVOH

12.2.4. Others (Nylon, Etc.)

12.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Material Type

12.3.1. Polyolefin

12.3.2. Metalized Aluminum

12.3.3. EVOH

12.3.4. Others (Nylon, Etc.)

12.4. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By Capacity

12.4.1. Below 150 ml

12.4.2. 150-500 ml

12.4.3. 500ml -1 Liter

12.4.4. Above 1 Liter

12.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By Capacity

12.5.1. Below 150 ml

12.5.2. 150-500 ml

12.5.3. 500ml -1 Liter

12.5.4. Above 1 Liter

12.6. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, By End Use

12.6.1. Food

12.6.1.1. Dairy

12.6.1.2. Sauces & Cond.

12.6.1.3. Salad Dressings

12.6.1.4. Honey

12.6.1.5. Others (Jellies)

12.6.2. Personal Care

12.6.3. Others

12.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2019-2027 , By End Use

12.7.1. Food

12.7.1.1. Dairy

12.7.1.2. Sauces & Cond.

12.7.1.3. Salad Dressings

12.7.1.4. Honey

12.7.1.5. Others (Jellies)

12.7.2. Personal Care

12.7.2.1.1. Others

12.8. Market Attractiveness Analysis

12.8.1. By Material Type

12.8.2. By Capacity

12.8.3. By End Use

12.9. Drivers and Restraints: Impact Analysis

13. Competitive Landscape

13.1. Competition Dashboard

13.2. Company Market Share Analysis

13.3. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

13.4. Global Players

13.4.1. Glenroy Inc.

13.4.1.1. Overview

13.4.1.2. Financials

13.4.1.3. Strategy

13.4.1.4. Recent Developments

13.4.1.5. SWOT Analysis

13.4.2. Polymer Packaging Inc

13.4.2.1. Overview

13.4.2.2. Financials

13.4.2.3. Strategy

13.4.2.4. Recent Developments

13.4.2.5. SWOT Analysis

13.4.3. Semco S.A.M

13.4.3.1. Overview

13.4.3.2. Financials

13.4.3.3. Strategy

13.4.3.4. Recent Developments

13.4.3.5. SWOT Analysis

13.4.4. ProAmpac

13.4.4.1. Overview

13.4.4.2. Financials

13.4.4.3. Strategy

13.4.4.4. Recent Developments

13.4.4.5. SWOT Analysis

14. Assumptions and Acronyms Used

15. Research Methodology

List of Tables

Table 01: Global Inverted Poucheses Market Volume (‘000 Units) 2014H-2027F, by Material

Table 02: Global Inverted Poucheses Market Value (US$ Thousands) 2014H-2027F, by Material

Table 03: Global Inverted Poucheses Market Volume (‘000 Units) 2014H-2027F, by Capacity

Table 04: Global Inverted Poucheses Market Value (US$ Thousands) 2014H-2027F, by Capacity

Table 05: Global Inverted Poucheses Market Volume (‘000 Units) 2014H-2027F, by Pouch Type

Table 06: Global Inverted Poucheses Market Value (US$ Thousands) 2014H-2027F, by Pouch Type

Table 07: Global Inverted Poucheses Market Volume (‘000 Units) 2014H-2027F, by Region

Table 08: Global Inverted Poucheses Market Value (‘000 USD) 2014H-2027F, by End Use

Table 10: Global Inverted Poucheses Market Volume (‘000 Units) 2014H-2027F, by Region

Table 11: Global Inverted Poucheses Market Value (US$ Thousands) 2014H-2027F, by Region

Table 12: North America Inverted Poucheses Market Volume (‘000 Units) 2014H-2027F, by Capacity, Material, Pouch Type End Use & Country

Table 13: North America Inverted Poucheses Market Value (US$ Thousands) 2014H-2027F, by Capacity, Material, Pouch Type End Use & Country

Table 14: North America Inverted Poucheses Market Volume (‘000 Units) 2014H-2027F, by Capacity, Material, Pouch Type and End Use

Table 15: North America Inverted Poucheses Market Value (US$ Thousands) 2014H-2027F, by Capacity, Material, Pouch Type & End Use

Table 16: Europe Inverted Poucheses Market Volume (‘000 Units) 2014H-2027F, by Capacity, Material, Pouch Type End Use

Table 17: Europe Inverted Poucheses Market Value (US$ Thousands) 2014H-2027F, by Capacity, Material, Pouch Type End Use

Table 18: ROW Inverted Poucheses Market Volume (‘000 Units) 2014H-2027F, by Capacity, Material, Pouch Type End Use

Table 19: ROW Inverted Poucheses Market Value (US$ Thousands) 2014H-2027F, by Capacity, Material, Pouch Type End Use

List of Figures

Figure 01: Global Inverted Poucheses Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 02: Global Inverted Poucheses Market Attractiveness Index, by Material (2019 – 2027)

Figure 03: Global Inverted Poucheses Market Share Analysis, by Capacity, 2019 (E) – 2027 (F)

Figure 04: Global Inverted Poucheses Market Attractiveness Index, by Capacity (2019 – 2027)

Figure 05: Global Inverted Poucheses Market Share Analysis, Pouch Type, 2019 (E) – 2027 (F)

Figure 06: Global Inverted Poucheses Market Attractiveness Index, by Pouch Type (2019 – 2027)

Figure 07: Global Inverted Poucheses Market Share Analysis, by End Use, 2019 (E) – 2027 (F)

Figure 08: Global Inverted Poucheses Market Attractiveness Index, by End Use (2019 – 2027)

Figure 09: North America Inverted Poucheses Market Share Analysis, by Capacity, 2019 (E) – 2027 (F)

Figure 10: North America Inverted Poucheses Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 11: North America Inverted Poucheses Market Attractiveness Index, by Pouch Type (2019 – 2027)

Figure 12: North America Inverted Poucheses Market Attractiveness Index, by Food segment (2019 – 2027)

Figure 13: Latin America Inverted Poucheses Market Share Analysis, by Capacity, 2019 (E) – 2027 (F)

Figure 14: Latin America Inverted Poucheses Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 15: Latin America Inverted Poucheses Market Attractiveness Index, by Pouch Type (2019 – 2027)

Figure 16 Latin America Inverted Poucheses Market Attractiveness Index, by Food segment (2019 – 2027)

Figure 17: Europe Inverted Poucheses Market Share Analysis, by Capacity, 2019 (E) – 2027 (F)

Figure 18: Europe Inverted Poucheses Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 19: Europe Inverted Poucheses Market Attractiveness Index, by Pouch Type (2019 – 2027)

Figure 20: Europe Inverted Poucheses Market Attractiveness Index, by Food segment (2019 – 2027)

Figure 21: ROW Inverted Poucheses Market Share Analysis, by Capacity, 2019 (E) – 2027 (F)

Figure 22: ROW Inverted Poucheses Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 23: ROW Inverted Poucheses Market Attractiveness Index, by Pouch Type (2019 – 2027)

Figure 24: ROW Inverted Poucheses Market Attractiveness Index, by Food segment (2019 – 2027)