Analysts’ Viewpoint on IVIG Market Scenario

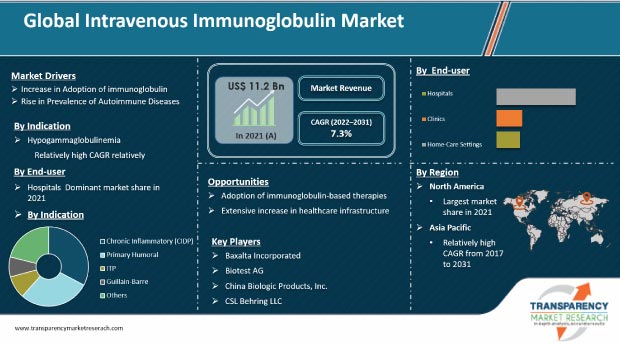

The global intravenous immunoglobulin market is driven by the rise in the global prevalence of autoimmune diseases such as multiple sclerosis, immune thrombocytopenia purpura (ITP), autoimmune hemolytic anemia, and Kawasaki syndrome. The global market for intravenous immunoglobulin is projected to witness significant growth over the next few years due to technological advancements leading to the development of new production and purification methods. Rapid increase in the number of neurological disorders, rise in the global geriatric population, and expansion of patient pool have fueled the demand for quick and reliable treatment measures. Furthermore, all companies should increase their R&D efforts in the development of novel products to broaden their revenue streams.

Immunoglobulins are highly purified, sterile-specific medical therapy solutions containing gamma globulin G (IgG) in a concentration of 95% or more. These are manufactured from a highly refined pool of human plasma collected from at least 100 donors or more. Immunoglobulins can be administered through three different routes such as intramuscular, intravenous, and subcutaneous. The intramuscular route of administration is a relatively older method and is not preferred presently, as it is painful. Intravenous immunoglobulin has emerged as a boon in the last few decades for patients with compromised immune systems.

Increasing adoption of immunoglobulin, along with a surge in the frequency of product launches and prompt approval from government regulatory bodies across the world is expected to fuel the demand during the forecast period. According to an October 2020 update by the National Institutes of Health, a clinical trial to test the safety, tolerability, and efficacy of a combination treatment regimen for coronavirus disease 2019 (COVID-19) consisting of the antiviral Remdesivir plus, a highly concentrated solution of antibodies that neutralize SARS-CoV-2, the virus that causes COVID-19, was initiated in 2020. The study was performed on hospitalized adults with COVID-19 in the U.S., Mexico, and 16 other countries on five continents.

The National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health, sponsored and funded the phase 3 trial, called Inpatient Treatment with Anti-Coronavirus Immunoglobulin, or ITAC. The antibody solution that was tested in the ITAC trial is anti-coronavirus hyperimmune intravenous immunoglobulin or IVIG. Moreover, the rise in the number of government initiatives supporting the usage of the intravenous mode of delivery for some medications propels the global market. For instance, in June 2021, the Ministry of Health and Family Welfare of Karnataka, India, decided to procure an intravenous immunoglobulin (IVIG) drug worth more than INR 10 Cr for emergency use among children.

In terms of indication, the global intravenous immunoglobulin market has been classified into chronic inflammatory demyelinating polyneuropathy (CIDP), primary humoral immunodeficiency, idiopathic thrombocytopenic purpura (ITP), Guillain-Barre syndrome, myasthenia gravis, multifocal motor neuropathy (MMN), Kawasaki disease, hypogammaglobulinemia, chronic lymphocytic leukemia, and others. The hypogammaglobinemia segment dominated the global market in 2021. This can be attributed to the increase in the incidence of primary immunodeficiency diseases (PID) across the globe. It is the most common chronic immune defect in patients with lymphoproliferative disorders (LPDs).

Based on end-user, the global intravenous immunoglobulin (IVIG) market has been divided into hospitals, clinics, and home care. The hospital's segment dominated the global intravenous immunoglobulin market in 2021, owing to a rise in the number of patients opting for hospital treatment rather than standalone clinics. Moreover, patients receiving IVIG infusions at home have improved their quality of life, as they get better control over day-to-day activities. For instance, IVIG infusions at-home care have reduced scheduling clashes for patients.

The COVID-19 pandemic in its later phase is more likely to propel the growth of the global intravenous immunoglobulin Industry. December 2020 published article titled, 'COVID-19 in patients with primary and secondary immunodeficiency: The United Kingdom experience', stated that out of 100 individuals with primary immunodeficiency (PID), symptomatic secondary immunodeficiency (SID), autoinflammatory diseases, and C1 inhibitor deficiency, 70% were infected with the SARS-CoV-2 virus and 59% were admitted to hospitals, with 8% admitted to intensive care units. Therefore, an increase in immune-deficient individuals who are at higher risk of being infected with COVID-19 is likely to propel the global intravenous immunoglobulin market during the pandemic.

According to an October 2020 published article titled, 'The uSAGE of Intravenous Immunoglobulin Gamma for the treatment of severe coronavirus disease 2019: a randomized placebo-controlled double-blind clinical trial', the administration of intravenous immunoglobulin in patients with severe COVID-19 infection was expected to enhance the clinical outcome and aid in a significant reduction of the mortality rate due to SARS-CoV2 viral infection. Hence, the global market is likely to witness strong growth during the pandemic.

This report profiles key players in the global intravenous immunoglobulin market based on various attributes such as company overview, financial overview, product portfolio, business strategies, and recent developments. The global intravenous immunoglobulin (IVIG) market is highly fragmented, with the presence of several international as well as regional players. Leading players operating in the global intravenous immunoglobulin business are Baxalta Incorporated, Biotest AG, China Biologic Products, Inc., CSL Behring LLC, Grifols S.A., Kedrion S.p.A., LFB Biomedicaments S.A., Octapharma AG, and Sanquin Plasma Products B.V., among others.

The growing burden of target diseases such as primary immunodeficiency diseases is expected to fuel the growth of the market in the region. According to the National Institute of Allergy and Infectious Diseases, in 2020, more than 400 types of PIDs were diagnosed in the U.S., with more than 500,000 people affected by PIDs.

According to the USIDNET Registry, 2020, the frequency of severe combined immunodeficiency (SCID) among the population of the U.S. stood at 355. Moreover, an increase in research & development activities and rapid product approvals are projected to fuel the growth of intravenous immunoglobulin in North America.

Key players in the global intravenous immunoglobulin industry are expanding their market position by adopting various strategies such as mergers & acquisitions and research collaborations with other companies to launch innovative products and consolidate their market positions across the world. A few expansion strategies adopted by players operating in the global market for intravenous immunoglobulin are:

The report on the global intravenous immunoglobulin (IVIG) market discusses individual strategies, followed by company profiles of manufacturers of intravenous immunoglobulin market products. The competitive landscape section has been included in the report to provide readers with a dashboard view and a company market share analysis of key players operating in the global intravenous immunoglobulin industry.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 11.2 Bn |

|

Market Forecast Value in 2031 |

US$ 20.5 Bn |

|

Growth Rate (CAGR) |

7.3% from Year-to-Year |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global IVIG market was valued at US$ 11.2 Bn in 2021.

The global intravenous immunoglobulin market will surpass US$ 20.5 Bn by 2031.

The global market is anticipated to record a CAGR of 7.3% from 2022 to 2031.

The rise in the prevalence of autoimmune diseases is expected to drive the global IVIG market.

North America is expected to be a potential revenue generator for vendors during the forecast period.

Prominent players in the global market for intravenous immunoglobulin include Baxalta Incorporated, Biotest AG, China Biologic Products, Inc., CSL Behring LLC, Grifols S.A., Kedrion S.p.A., LFB Biomedicaments S.A., Octapharma AG, and Sanquin Plasma Products B.V., among others.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

3. Executive Summary

3.1. Global Intravenous Immunoglobulin (IVIG): Market Snapshot

3.2. Market Share Analysis, by Region, 2017

3.3. Global Intravenous Immunoglobulin (IVIG) Market: Opportunity Map

4. Market Overview

4.1. Indication Overview

4.2. Global Intravenous Immunoglobulin (IVIG) Market: Key Industry Developments

4.3. Global Intravenous Immunoglobulin (IVIG) Market: Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.2.1. Rise in prevalence of autoimmune disorders

5.2.2. Increase in global geriatric population

5.2.3. Growing usage in off-label indications

5.2.4. Improved technology for production and purification methods

5.2.5. Favorable government initiatives and approvals

5.2.6. Increase in health care spending & improving health care infrastructure

5.2.7. Rise in incidence of hematological, neurological disorders

5.3. Restraints

5.3.1. High cost of treatment

5.3.2. Chronic side effects

5.3.3. Supply demand gaps

5.3.4. Alternate therapies such as subcutaneous infusion IG (SCIG) and recombinant Indications

5.4. Global Intravenous Immunoglobulin (IVIG) Market: Opportunity Analysis

5.5. Opportunities

5.5.1. Application in newer indications

5.5.2. Increasing global plasma yield to offer significant opportunities to new entrants

5.6. Key Trends

5.7. Global Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, 2017–2031

5.8. Value Chain Analysis

5.9. Global Intravenous Immunoglobulin (IVIG) Market Outlook

6. Global Intravenous Immunoglobulin (IVIG) Market Analysis, by Indication

6.1. Key Findings

6.2. Introduction

6.3. Global Intravenous Immunoglobulin (IVIG) Market Value Share Analysis, by Indication

6.4. Global Intravenous Immunoglobulin (IVIG) Market Analysis, by Indication

6.4.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

6.4.2. Primary Humoral Immunodeficiency

6.4.3. Idiopathic Thrombocytopenic Purpura (ITP)

6.4.4. Guillain-Barre Syndrome

6.4.5. Myasthenia Gravis

6.4.6. Multifocal Motor Neuropathy (MMN)

6.4.7. Kawasaki Disease

6.4.8. Hypogammaglobulinemia

6.4.9. Chronic Lymphocytic Leukemia

6.4.10. Others

6.5. Market Attractiveness Analysis, by Indication

6.6. Key Trends

7. Global Intravenous Immunoglobulin (IVIG) Market Analysis, by End-user

7.1. Key Findings

7.2. Introduction

7.3. Global Intravenous Immunoglobulin (IVIG) Market Value Share Analysis, by End-user

7.4. Global Intravenous Immunoglobulin (IVIG) Market Analysis, by End-user

7.4.1. Hospitals

7.4.2. Clinics

7.4.3. Home Care

7.5. Market Attractiveness Analysis, by End-user

7.6. Key Trends

8. Global Intravenous Immunoglobulin (IVIG) Market Analysis, by Region

8.1. Global Intravenous Immunoglobulin (IVIG) Market Snapshot, by Country

8.2. Global Intravenous Immunoglobulin (IVIG) Market Value Share Analysis, by Region

8.3. Intravenous Immunoglobulin (IVIG) Market Forecast, by Region

8.4. Market Attractiveness Analysis, by Region

9. North America Intravenous Immunoglobulin (IVIG) Market Analysis

9.1. Key Findings

9.2. Market Overview

9.3. Market Analysis, by Indication

9.3.1. Market Value Share Analysis, by Indication

9.3.2. Market Size (US$ Mn) Forecast, by Indication

9.3.2.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

9.3.2.2. Primary Humoral Immunodeficiency

9.3.2.3. Idiopathic Thrombocytopenic Purpura (ITP)

9.3.2.4. Guillain-Barre Syndrome

9.3.2.5. Myasthenia Gravis

9.3.2.6. Multifocal Motor Neuropathy (MMN)

9.3.2.7. Kawasaki Disease

9.3.2.8. Hypogammaglobulinemia

9.3.2.9. Chronic Lymphocytic Leukemia

9.3.2.10. Others

9.4. Market Analysis, by End-user

9.4.1. Market Value Share Analysis, by End-user

9.4.2. Market Size (US$ Mn) Forecast, by End-user

9.4.2.1. Hospitals

9.4.2.2. Clinics

9.4.2.3. Home Care

9.5. Market Analysis, by Country

9.5.1. Market Value Share Analysis, by Country

9.5.2. Market Size (US$ Mn) Forecast, by Country, 2017–2031

9.5.2.1. U.S.

9.5.2.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Indication

9.6.2. By End-user

9.6.3. By Country

9.7. U.S. Intravenous Immunoglobulin (IVIG) Market Analysis

9.7.1. Market Size (US$ Mn) Forecast, by Indication

9.7.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

9.7.1.2. Primary Humoral Immunodeficiency

9.7.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

9.7.1.4. Guillain-Barre Syndrome

9.7.1.5. Myasthenia Gravis

9.7.1.6. Multifocal Motor Neuropathy (MMN)

9.7.1.7. Kawasaki Disease

9.7.1.8. Hypogammaglobulinemia

9.7.1.9. Chronic Lymphocytic Leukemia

9.7.1.10. Others

9.7.2. Market Size (US$ Mn) Forecast, by End-user

9.7.2.1. Hospitals

9.7.2.2. Clinics

9.7.2.3. Home Care Settings

9.8. Canada Intravenous Immunoglobulin (IVIG) Market Analysis

9.8.1. Market Size (US$ Mn) Forecast, by Indication

9.8.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

9.8.1.2. Primary Humoral Immunodeficiency

9.8.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

9.8.1.4. Guillain-Barre Syndrome

9.8.1.5. Myasthenia Gravis

9.8.1.6. Multifocal Motor Neuropathy (MMN)

9.8.1.7. Kawasaki Disease

9.8.1.8. Hypogammaglobulinemia

9.8.1.9. Chronic Lymphocytic Leukemia

9.8.1.10. Others

9.8.2. Market Size (US$ Mn) Forecast, by End-user

9.8.2.1. Hospitals

9.8.2.2. Clinics

9.8.2.3. Home Care Settings

10. Europe Intravenous Immunoglobulin (IVIG) Market Analysis

10.1. Key Findings

10.2. Market Overview

10.3. Market Analysis, by Indication

10.3.1. Market Value Share Analysis, by Indication

10.3.2. Market Size (US$ Mn) Forecast, by Indication

10.3.2.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

10.3.2.2. Primary Humoral Immunodeficiency

10.3.2.3. Idiopathic Thrombocytopenic Purpura (ITP)

10.3.2.4. Guillain-Barre Syndrome

10.3.2.5. Myasthenia Gravis

10.3.2.6. Multifocal Motor Neuropathy (MMN)

10.3.2.7. Kawasaki Disease

10.3.2.8. Hypogammaglobulinemia

10.3.2.9. Chronic Lymphocytic Leukemia

10.3.2.10. Others

10.4. Market Analysis, by End-user

10.4.1. Market Value Share Analysis, by End-user

10.4.2. Market Size (US$ Mn) Forecast, by End-user

10.4.2.1. Hospitals

10.4.2.2. Clinics

10.4.2.3. Home Care

10.5. Market Analysis, by Country/Sub-region

10.5.1. Market Value Share Analysis, by Country/Sub-region

10.5.2. Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

10.5.2.1. U.K.

10.5.2.2. Germany

10.5.2.3. France

10.5.2.4. Spain

10.5.2.5. Italy

10.5.2.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Indication

10.6.2. By End-user

10.6.3. By Country/Sub-region

10.7. U.K. Intravenous Immunoglobulin (IVIG) Market Analysis

10.7.1. Market Size (US$ Mn) Forecast, by Indication

10.7.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

10.7.1.2. Primary Humoral Immunodeficiency

10.7.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

10.7.1.4. Guillain-Barre Syndrome

10.7.1.5. Myasthenia Gravis

10.7.1.6. Multifocal Motor Neuropathy (MMN)

10.7.1.7. Kawasaki Disease

10.7.1.8. Hypogammaglobulinemia

10.7.1.9. Chronic Lymphocytic Leukemia

10.7.1.10. Others

10.7.2. Market Size (US$ Mn) Forecast, by End-user

10.7.2.1. Hospitals

10.7.2.2. Clinics

10.7.2.3. Home Care Settings

10.8. Germany Intravenous Immunoglobulin (IVIG) Market Analysis

10.8.1. Market Size (US$ Mn) Forecast, by Indication

10.8.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

10.8.1.2. Primary Humoral Immunodeficiency

10.8.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

10.8.1.4. Guillain-Barre Syndrome

10.8.1.5. Myasthenia Gravis

10.8.1.6. Multifocal Motor Neuropathy (MMN)

10.8.1.7. Kawasaki Disease

10.8.1.8. Hypogammaglobulinemia

10.8.1.9. Chronic Lymphocytic Leukemia

10.8.1.10. Others

10.8.2. Market Size (US$ Mn) Forecast, by End-user

10.8.2.1. Hospitals

10.8.2.2. Clinics

10.8.2.3. Home Care Settings

10.9. France Intravenous Immunoglobulin (IVIG) Market Analysis

10.9.1. Market Size (US$ Mn) Forecast, by Indication

10.9.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

10.9.1.2. Primary Humoral Immunodeficiency

10.9.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

10.9.1.4. Guillain-Barre Syndrome

10.9.1.5. Myasthenia Gravis

10.9.1.6. Multifocal Motor Neuropathy (MMN)

10.9.1.7. Kawasaki Disease

10.9.1.8. Hypogammaglobulinemia

10.9.1.9. Chronic Lymphocytic Leukemia

10.9.1.10. Others

10.9.2. Market Size (US$ Mn) Forecast, by End-user

10.9.2.1. Hospitals

10.9.2.2. Clinics

10.9.2.3. Home Care Settings

10.10. Spain Intravenous Immunoglobulin (IVIG) Market Analysis

10.10.1. Market Size (US$ Mn) Forecast, by Indication

10.10.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

10.10.1.2. Primary Humoral Immunodeficiency

10.10.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

10.10.1.4. Guillain-Barre Syndrome

10.10.1.5. Myasthenia Gravis

10.10.1.6. Multifocal Motor Neuropathy (MMN)

10.10.1.7. Kawasaki Disease

10.10.1.8. Hypogammaglobulinemia

10.10.1.9. Chronic Lymphocytic Leukemia

10.10.1.10. Others

10.10.2. Market Size (US$ Mn) Forecast, by End-user

10.10.2.1. Hospitals

10.10.2.2. Clinics

10.10.2.3. Home Care Settings

10.11. Italy Intravenous Immunoglobulin (IVIG) Market Analysis

10.11.1. Market Size (US$ Mn) Forecast, by Indication

10.11.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

10.11.1.2. Primary Humoral Immunodeficiency

10.11.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

10.11.1.4. Guillain-Barre Syndrome

10.11.1.5. Myasthenia Gravis

10.11.1.6. Multifocal Motor Neuropathy (MMN)

10.11.1.7. Kawasaki Disease

10.11.1.8. Hypogammaglobulinemia

10.11.1.9. Chronic Lymphocytic Leukemia

10.11.1.10. Others

10.11.2. Market Size (US$ Mn) Forecast, by End-user

10.11.2.1. Hospitals

10.11.2.2. Clinics

10.11.2.3. Home Care Settings

10.12. Rest of Europe Intravenous Immunoglobulin (IVIG) Market Analysis

10.12.1. Market Size (US$ Mn) Forecast, by Indication

10.12.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

10.12.1.2. Primary Humoral Immunodeficiency

10.12.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

10.12.1.4. Guillain-Barre Syndrome

10.12.1.5. Myasthenia Gravis

10.12.1.6. Multifocal Motor Neuropathy (MMN)

10.12.1.7. Kawasaki Disease

10.12.1.8. Hypogammaglobulinemia

10.12.1.9. Chronic Lymphocytic Leukemia

10.12.1.10. Others

10.12.2. Market Size (US$ Mn) Forecast, by End-user

10.12.2.1. Hospitals

10.12.2.2. Clinics

10.12.2.3. Home Care Settings

11. Asia Pacific Intravenous Immunoglobulin (IVIG) Market Analysis

11.1. Key Findings

11.2. Market Overview

11.3. Market Analysis, by Indication

11.3.1. Market Value Share Analysis, by Indication

11.3.2. Market Size (US$ Mn) Forecast, by Indication

11.3.2.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

11.3.2.2. Primary Humoral Immunodeficiency

11.3.2.3. Idiopathic Thrombocytopenic Purpura (ITP)

11.3.2.4. Guillain-Barre Syndrome

11.3.2.5. Myasthenia Gravis

11.3.2.6. Multifocal Motor Neuropathy (MMN)

11.3.2.7. Kawasaki Disease

11.3.2.8. Hypogammaglobulinemia

11.3.2.9. Chronic Lymphocytic Leukemia

11.3.2.10. Others

11.4. Market Analysis, by End-user

11.4.1. Market Value Share Analysis, by End-user

11.4.2. Market Size (US$ Mn) Forecast, by End-user

11.4.2.1. Hospitals

11.4.2.2. Clinics

11.4.2.3. Home Care

11.5. Market Analysis, by Country/Sub-region

11.5.1. Market Value Share Analysis, by Country/Sub-region

11.5.2. Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

11.5.2.1. China

11.5.2.2. Japan

11.5.2.3. Australia

11.5.2.4. India

11.5.2.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Indication

11.6.2. By End-user

11.6.3. By Country/Sub-region

11.7. China Intravenous Immunoglobulin (IVIG) Market Analysis

11.7.1. Market Size (US$ Mn) Forecast, by Indication

11.7.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

11.7.1.2. Primary Humoral Immunodeficiency

11.7.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

11.7.1.4. Guillain-Barre Syndrome

11.7.1.5. Myasthenia Gravis

11.7.1.6. Multifocal Motor Neuropathy (MMN)

11.7.1.7. Kawasaki Disease

11.7.1.8. Hypogammaglobulinemia

11.7.1.9. Chronic Lymphocytic Leukemia

11.7.1.10. Others

11.7.2. Market Size (US$ Mn) Forecast, by End-user

11.7.2.1. Hospitals

11.7.2.2. Clinics

11.7.2.3. Home Care Settings

11.8. Japan Intravenous Immunoglobulin (IVIG) Market Analysis

11.8.1. Market Size (US$ Mn) Forecast, by Indication

11.8.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

11.8.1.2. Primary Humoral Immunodeficiency

11.8.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

11.8.1.4. Guillain-Barre Syndrome

11.8.1.5. Myasthenia Gravis

11.8.1.6. Multifocal Motor Neuropathy (MMN)

11.8.1.7. Kawasaki Disease

11.8.1.8. Hypogammaglobulinemia

11.8.1.9. Chronic Lymphocytic Leukemia

11.8.1.10. Others

11.8.2. Market Size (US$ Mn) Forecast, by End-user

11.8.2.1. Hospitals

11.8.2.2. Clinics

11.8.2.3. Home Care Settings

11.9. Australia Intravenous Immunoglobulin (IVIG) Market Analysis

11.9.1. Market Size (US$ Mn) Forecast, by Indication

11.9.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

11.9.1.2. Primary Humoral Immunodeficiency

11.9.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

11.9.1.4. Guillain-Barre Syndrome

11.9.1.5. Myasthenia Gravis

11.9.1.6. Multifocal Motor Neuropathy (MMN)

11.9.1.7. Kawasaki Disease

11.9.1.8. Hypogammaglobulinemia

11.9.1.9. Chronic Lymphocytic Leukemia

11.9.1.10. Others

11.9.2. Market Size (US$ Mn) Forecast, by End-user

11.9.2.1. Hospitals

11.9.2.2. Clinics

11.9.2.3. Home Care Settings

11.10. India Intravenous Immunoglobulin (IVIG) Market Analysis

11.10.1. Market Size (US$ Mn) Forecast, by Indication

11.10.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

11.10.1.2. Primary Humoral Immunodeficiency

11.10.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

11.10.1.4. Guillain-Barre Syndrome

11.10.1.5. Myasthenia Gravis

11.10.1.6. Multifocal Motor Neuropathy (MMN)

11.10.1.7. Kawasaki Disease

11.10.1.8. Hypogammaglobulinemia

11.10.1.9. Chronic Lymphocytic Leukemia

11.10.1.10. Others

11.10.2. Market Size (US$ Mn) Forecast, by End-user

11.10.2.1. Hospitals

11.10.2.2. Clinics

11.10.2.3. Home Care Settings

11.11. Rest of Asia Pacific Intravenous Immunoglobulin (IVIG) Market Analysis

11.11.1. Market Size (US$ Mn) Forecast, by Indication

11.11.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

11.11.1.2. Primary Humoral Immunodeficiency

11.11.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

11.11.1.4. Guillain-Barre Syndrome

11.11.1.5. Myasthenia Gravis

11.11.1.6. Multifocal Motor Neuropathy (MMN)

11.11.1.7. Kawasaki Disease

11.11.1.8. Hypogammaglobulinemia

11.11.1.9. Chronic Lymphocytic Leukemia

11.11.1.10. Others

11.11.2. Market Size (US$ Mn) Forecast, by End-user

11.11.2.1. Hospitals

11.11.2.2. Clinics

11.11.2.3. Home Care Settings

12. Latin America Intravenous Immunoglobulin (IVIG) Market Analysis

12.1. Key Findings

12.2. Market Overview

12.3. Market Analysis, by Indication

12.3.1. Market Value Share Analysis, by Indication

12.3.2. Market Size (US$ Mn) Forecast, by Indication

12.3.2.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

12.3.2.2. Primary Humoral Immunodeficiency

12.3.2.3. Idiopathic Thrombocytopenic Purpura (ITP)

12.3.2.4. Guillain-Barre Syndrome

12.3.2.5. Myasthenia Gravis

12.3.2.6. Multifocal Motor Neuropathy (MMN)

12.3.2.7. Kawasaki Disease

12.3.2.8. Hypogammaglobulinemia

12.3.2.9. Chronic Lymphocytic Leukemia

12.3.2.10. Others

12.4. Market Analysis, by End-user

12.4.1. Market Value Share Analysis, by End-user

12.4.2. Market Size (US$ Mn) Forecast, by End-user

12.4.2.1. Hospitals

12.4.2.2. Clinics

12.4.2.3. Home Care

12.5. Market Analysis, by Country/Sub-region

12.5.1. Market Value Share Analysis, by Country/Sub-region

12.5.2. Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

12.5.2.1. Brazil

12.5.2.2. Mexico

12.5.2.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Indication

12.6.2. By End-user

12.6.3. By Country/Sub-region

12.7. Brazil Intravenous Immunoglobulin (IVIG) Market Analysis

12.7.1. Market Size (US$ Mn) Forecast, by Indication

12.7.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

12.7.1.2. Primary Humoral Immunodeficiency

12.7.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

12.7.1.4. Guillain-Barre Syndrome

12.7.1.5. Myasthenia Gravis

12.7.1.6. Multifocal Motor Neuropathy (MMN)

12.7.1.7. Kawasaki Disease

12.7.1.8. Hypogammaglobulinemia

12.7.1.9. Chronic Lymphocytic Leukemia

12.7.1.10. Others

12.7.2. Market Size (US$ Mn) Forecast, by End-user

12.7.2.1. Hospitals

12.7.2.2. Clinics

12.7.2.3. Home Care Settings

12.8. Mexico Intravenous Immunoglobulin (IVIG) Market Analysis

12.8.1. Market Size (US$ Mn) Forecast, by Indication

12.8.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

12.8.1.2. Primary Humoral Immunodeficiency

12.8.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

12.8.1.4. Guillain-Barre Syndrome

12.8.1.5. Myasthenia Gravis

12.8.1.6. Multifocal Motor Neuropathy (MMN)

12.8.1.7. Kawasaki Disease

12.8.1.8. Hypogammaglobulinemia

12.8.1.9. Chronic Lymphocytic Leukemia

12.8.1.10. Others

12.8.2. Market Size (US$ Mn) Forecast, by End-user

12.8.2.1. Hospitals

12.8.2.2. Clinics

12.8.2.3. Home Care Settings

12.9. Rest of Latin America Intravenous Immunoglobulin (IVIG) Market Analysis

12.9.1. Market Size (US$ Mn) Forecast, by Indication

12.9.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

12.9.1.2. Primary Humoral Immunodeficiency

12.9.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

12.9.1.4. Guillain-Barre Syndrome

12.9.1.5. Myasthenia Gravis

12.9.1.6. Multifocal Motor Neuropathy (MMN)

12.9.1.7. Kawasaki Disease

12.9.1.8. Hypogammaglobulinemia

12.9.1.9. Chronic Lymphocytic Leukemia

12.9.1.10. Others

12.9.2. Market Size (US$ Mn) Forecast, by End-user

12.9.2.1. Hospitals

12.9.2.2. Clinics

12.9.2.3. Home Care Settings

13. Middle East & Africa Intravenous Immunoglobulin (IVIG) Market Analysis

13.1. Key Findings

13.2. Market Overview

13.3. Market Analysis, by Indication

13.3.1. Market Value Share Analysis, by Indication

13.3.2. Market Size (US$ Mn) Forecast, by Indication

13.3.2.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

13.3.2.2. Primary Humoral Immunodeficiency

13.3.2.3. Idiopathic Thrombocytopenic Purpura (ITP)

13.3.2.4. Guillain-Barre Syndrome

13.3.2.5. Myasthenia Gravis

13.3.2.6. Multifocal Motor Neuropathy (MMN)

13.3.2.7. Kawasaki Disease

13.3.2.8. Hypogammaglobulinemia

13.3.2.9. Chronic Lymphocytic Leukemia

13.3.2.10. Others

13.4. Market Analysis, by End-user

13.4.1. Market Value Share Analysis, by End-user

13.4.2. Market Size (US$ Mn) Forecast, by End-user

13.4.2.1. Hospitals

13.4.2.2. Clinics

13.4.2.3. Home Care

13.5. Market Analysis, by Country/Sub-region

13.5.1. Market Value Share Analysis, by Country/Sub-region

13.5.2. Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

13.5.2.1. GCC Countries

13.5.2.2. South Africa

13.5.2.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Indication

13.6.2. By End-user

13.6.3. By Country/Sub-region

13.7. GCC Countries Intravenous Immunoglobulin (IVIG) Market Analysis

13.7.1. Market Size (US$ Mn) Forecast, by Indication

13.7.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

13.7.1.2. Primary Humoral Immunodeficiency

13.7.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

13.7.1.4. Guillain-Barre Syndrome

13.7.1.5. Myasthenia Gravis

13.7.1.6. Multifocal Motor Neuropathy (MMN)

13.7.1.7. Kawasaki Disease

13.7.1.8. Hypogammaglobulinemia

13.7.1.9. Chronic Lymphocytic Leukemia

13.7.1.10. Others

13.7.2. Market Size (US$ Mn) Forecast, by End-user

13.7.2.1. Hospitals

13.7.2.2. Clinics

13.7.2.3. Home Care Settings

13.8. South Africa Intravenous Immunoglobulin (IVIG) Market Analysis

13.8.1. Market Size (US$ Mn) Forecast, by Indication

13.8.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

13.8.1.2. Primary Humoral Immunodeficiency

13.8.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

13.8.1.4. Guillain-Barre Syndrome

13.8.1.5. Myasthenia Gravis

13.8.1.6. Multifocal Motor Neuropathy (MMN)

13.8.1.7. Kawasaki Disease

13.8.1.8. Hypogammaglobulinemia

13.8.1.9. Chronic Lymphocytic Leukemia

13.8.1.10. Others

13.8.2. Market Size (US$ Mn) Forecast, by End-user

13.8.2.1. Hospitals

13.8.2.2. Clinics

13.8.2.3. Home Care Settings

13.9. Rest of Middle East & Africa Intravenous Immunoglobulin (IVIG) Market Analysis

13.9.1. Market Size (US$ Mn) Forecast, by Indication

13.9.1.1. Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

13.9.1.2. Primary Humoral Immunodeficiency

13.9.1.3. Idiopathic Thrombocytopenic Purpura (ITP)

13.9.1.4. Guillain-Barre Syndrome

13.9.1.5. Myasthenia Gravis

13.9.1.6. Multifocal Motor Neuropathy (MMN)

13.9.1.7. Kawasaki Disease

13.9.1.8. Hypogammaglobulinemia

13.9.1.9. Chronic Lymphocytic Leukemia

13.9.1.10. Others

13.9.2. Market Size (US$ Mn) Forecast, by End-user

13.9.2.1. Hospitals

13.9.2.2. Clinics

13.9.2.3. Home Care Settings

14. Company Profiles

14.1. Intravenous Immunoglobulin (IVIG) Market Share Analysis, by Company (2021)

14.2. Competition Matrix

14.3. Company Profiles

14.3.1. Baxalta Incorporated

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Financial Overview

14.3.1.3. Product Portfolio

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Biotest AG

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Financial Overview

14.3.2.3. Product Portfolio

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. China Biologic Products, Inc.

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Financial Overview

14.3.3.3. Product Portfolio

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. CSL Behring LLC

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Financial Overview

14.3.4.3. Product Portfolio

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Grifols S.A.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Financial Overview

14.3.5.3. Product Portfolio

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Kedrion S.p.A.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Financial Overview

14.3.6.3. Product Portfolio

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. LFB Biomedicaments S.A.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Financial Overview

14.3.7.3. Product Portfolio

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Octapharma AG

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Financial Overview

14.3.8.3. Product Portfolio

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Sanquin Plasma Products B.V.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Financial Overview

14.3.9.3. Product Portfolio

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

List of Tables

Table 01: Global Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 02: Global Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 05: North America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: North America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 07: U.S. Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 08: U.S. Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Canada Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 10: Canada Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 12: Europe Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: U.K. Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 15: U.K. Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Germany Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 17: Germany Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: France Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 19: France Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Spain Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 21: Spain Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 22: Italy Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 23: Italy Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Rest of Europe Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 25: Rest of Europe Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Asia Pacific Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 27: Asia Pacific Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 28: Asia Pacific Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 29: China Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 30: China Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Japan Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 32: Japan Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 33: India Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 34: India Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 35: Australia & New Zealand Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 36: Australia & New Zealand Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 37: Rest of Asia Pacific Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 38: Rest of Asia Pacific Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 39: Latin America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 40: Latin America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 41: Latin America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 42: Brazil Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 43: Brazil Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 44: Mexico Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 45: Mexico Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 46: Rest of Latin America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 47: Rest of Latin America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 48: Middle East & Africa Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication Type, 2017–2031

Table 49: Middle East & Africa Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 50: Middle East & Africa Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 51: GCC Countries Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 52: GCC Countries Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 53: South Africa Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 54: South Africa Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 55: Rest of Middle East & Africa Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 56: Rest of Middle East & Africa Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, 2017–2031

Figure 02: Global Intravenous Immunoglobulin (IVIG) Market Value Share Analysis, by Indication, 2017 and 2031

Figure 03: Global Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Market Revenue, US$ Mn, 2017–2031

Figure 04: Global Primary Humoral Immunodeficiency Market Revenue, US$ Mn, 2017–2031

Figure 05: Global Idiopathic Thrombocytopenic Purpura (ITP) Market Revenue, US$ Mn, 2017–2031

Figure 06: Global Guillain-Barre Syndrome Market Revenue, US$ Mn, 2017–2031

Figure 07: Global Myasthenia Gravis Market Revenue, US$ Mn, 2017–2031

Figure 08: Global Multifocal Motor Neuropathy (MMN) Market Revenue, US$ Mn, 2017–2031

Figure 09: Global Kawasaki Disease Market Revenue, US$ Mn, 2017–2031

Figure 10: Global Hypogammaglobulinemia Market Revenue, US$ Mn, 2017–2031

Figure 11: Global Chronic Lymphocytic Leukemia Market Revenue, US$ Mn, 2017–2031

Figure 12: Global Other Indications Market Revenue, US$ Mn, 2017–2031

Figure 13: Intravenous Immunoglobulin (IVIG) Market Attractiveness Analysis, by Indication

Figure 14: Global Intravenous Immunoglobulin (IVIG) Market Value Share Analysis, by End-user, 2017 and 2031

Figure 15: Global Hospitals Market Revenue, US$ Mn,

Figure 16: Global Clinics Market Revenue, US$ Mn,

Figure 17: Global Home Care Market Revenue, US$ Mn, 2017–2031

Figure 18: Intravenous Immunoglobulin (IVIG) Market Attractiveness Analysis, by End-user

Figure 19: Global Intravenous Immunoglobulin (IVIG) Market Value Share Analysis, by Region, 2017 and 2031

Figure 20: Intravenous Immunoglobulin (IVIG) Market Attractiveness Analysis, by Region

Figure 21: North America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, 2017–2031

Figure 22: North America Market Attractiveness Analysis, by Country

Figure 23: North America Market Value Share Analysis, by Indication, 2017 and 2031

Figure 24: North America Market Value Share Analysis, by End-user, 2017 and 2031

Figure 25: North America Market Value Share Analysis, by Country, 2017 and 2031

Figure 26: North America Market Attractiveness Analysis, by Indication

Figure 27: North America Market Attractiveness Analysis, by End-user

Figure 28: Europe Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, 2017–2031

Figure 29: Europe Market Attractiveness Analysis, by Country/Sub-region

Figure 30: Europe Market Value Share Analysis, by Indication, 2017 and 2031

Figure 31: Europe Market Value Share Analysis, by End-user, 2017 and 2031

Figure 32: Europe Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 33: Europe Market Attractiveness Analysis, by Indication

Figure 34: Europe Market Attractiveness Analysis, by End-user

Figure 35: Asia Pacific Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, 2017–2031

Figure 36: Asia Pacific Market Attractiveness Analysis, by Country/Sub-region

Figure 37: Asia Pacific Market Value Share Analysis, by Indication, 2017 and 2031

Figure 38: Asia Pacific Market Value Share Analysis, by End-user, 2017 and 2031

Figure 39: Asia Pacific Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 40: Asia Pacific Market Attractiveness Analysis, by Indication

Figure 41: Asia Pacific Market Attractiveness Analysis, by End-user

Figure 42: Latin America Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, 2017–2031

Figure 43: Latin America Market Attractiveness Analysis, by Country/Sub-region

Figure 44: Latin America Market Value Share Analysis, by Indication, 2017 and 2031

Figure 45: Latin America Market Value Share Analysis, by End-user, 2017 and 2031

Figure 46: Latin America Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 47: Latin America Market Attractiveness Analysis, by Indication

Figure 48: Latin America Market Attractiveness Analysis, by End-user

Figure 49: Middle East & Africa Intravenous Immunoglobulin (IVIG) Market Size (US$ Mn) Forecast, 2017–2031

Figure 50: Middle East & Africa Market Attractiveness Analysis, by Country/Sub-region

Figure 51: Middle East & Africa Market Value Share Analysis, by Indication, 2017 and 2031

Figure 52: Middle East & Africa Market Value Share Analysis, by End-user, 2017 and 2031

Figure 53: Middle East & Africa Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 54: Middle East & Africa Market Attractiveness Analysis, by Indication

Figure 55: Middle East & Africa Market Attractiveness Analysis, by End-user

Figure 56: Global Intravenous Immunoglobulin (IVIG) Market Share Analysis, by Company (2021)