Analysts’ Viewpoint on Market Scenario

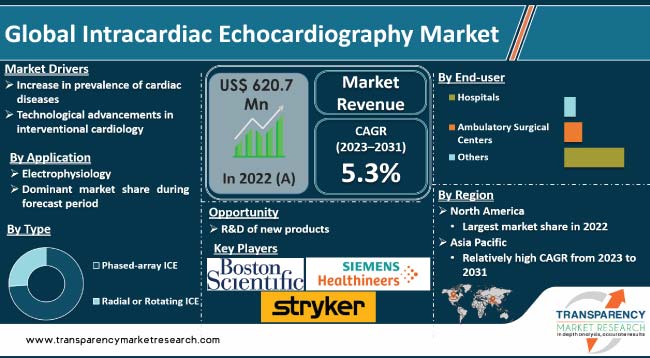

Increase in prevalence of cardiac diseases and rise in geriatric population are projected to fuel the global intracardiac echocardiography market size. Additionally, technological advancements in interventional cardiology are further driving demand for Intracardiac Echocardiography (ICE).

Rise in preference for minimally invasive cardiac surgeries is likely to offer lucrative opportunities to vendors in the global intracardiac echocardiography industry. ICE is widely employed in electrophysiology (EP) labs to guide transseptal punctures due to its excellent patient tolerance, low radiation, and contrast agent exposure. Intracardiac echocardiography manufacturers are investing in the R&D of new products to expand their product portfolio.

Intracardiac Echocardiography (ICE) is a one-of-a-kind imaging modality that allows for high-resolution real-time visualization of cardiac structures, continuous monitoring of catheter location within the heart, and early detection of procedural complications such as pericardial effusion or thrombus formation. It is a potential technique for visualizing intracardiac structures that could replace the transesophageal approach. A three-dimensional (3D) volumetric ICE system has recently been created, with the potential for more anatomic information and a prospective role in structural treatments.

The COVID-19 pandemic has had a significant impact on the intracardiac echocardiography business. Demand for intracardiac echocardiography was impacted by the deferral and cancellation of numerous cardiac procedures due to the outbreak. From April 2020 to August 2020, India experienced a 73% decline in cardiac surgeries and a 74.3% decline in catheterization treatments, according to a study released by Europe PMC in July 2021.

Decline in cardiac procedures had a small detrimental effect on market expansion. However, these delayed surgeries were completed when the lockdown was lifted. The COVID-19 pandemic also influenced the cardiac health of the populace which was evident by the rise in demand for intracardiac echocardiography.

The pandemic highlighted the importance of non-invasive and minimally invasive imaging technologies like ICE, which can help reduce the risk of infection transmission. This has led to surge in interest and adoption of ICE technology in some markets, particularly for diagnostic and therapeutic procedures that can be performed on an outpatient basis.

Sedentary lifestyles among the populace are leading to high burden of heart ailments. Over 7.6 million people in the U.K. had a heart or circulatory ailment in 2021, according to data released by the British Heart Foundation in August 2022. This, in turn, is boosting the need for ICE.

According to the World Health Organization (WHO), geriatric population is expected to reach from 1 billion in 2020 to 1.4 billion by 2050. Moreover, the number of persons aged 80 years or older is projected to triple between 2020 and 2050 to reach 426 million. Thus, rise in geriatric population is anticipated to spur the intracardiac echocardiography market growth in the near future.

According to the Centers for Disease Control and Prevention (CDC), Cardiovascular Diseases (CVDs) are the leading cause of death globally, taking an estimated 17.9 million lives each year. Furthermore, the prevalence of arrhythmias is expected to be 1.5% to 5% in the general population, with atrial fibrillation being the most common leading to more than 454,000 hospitalizations with Atrial Fibrillation (AFib) as the primary diagnosis happen each year in the U.S. Hence, growth in prevalence of cardiac diseases is boosting the intracardiac echocardiography market value.

Advancements in interventional cardiology have transformed ICE imaging capabilities from 2D echo to 3D echo and further to 4D. In 2021, Royal Philips announced the first minimally invasive heart procedure was performed using the company's VeriSight Pro real-time 3D ICE catheter. Thus, R&D in interventional cardiology is augmenting the intracardiac echocardiography market revenue. However, inadequate reimbursement, high cost of ICE devices, and lack of awareness in developing and underdeveloped countries are major factors leading to market limitations.

Intracardiac echocardiography companies are tapping into emerging markets. They are launching new products in developing countries like India to increase their intracardiac echocardiography market share. Rise in population, increase in healthcare investment, and surge in demand for advanced cardiac imaging technologies are boosting demand for intracardiac echocardiography in India.

According to the latest intracardiac echocardiography market trends, the phased-array ICE type segment accounted for largest share in 2022. Phased-array ICE imaging is highly effective in locating pulmonary veins and ensuring ablative lesions are placed on the atrial side. Furthermore, phased array catheters offer a large depth of field and add Doppler imaging capabilities as compared to rotational.

According to the latest intracardiac echocardiography market analysis, the electrophysiology application segment held largest share in 2022. The trend is expected to continue during the forecast period. Adoption of ICE in electrophysiological procedures enables the merging of real-time pictures with electroanatomic maps, which plays a major role in determining arrhythmogenic substrate. It is helpful for mapping features that fluoroscopies cannot see. Thus, ICE is favored over other diagnostic techniques.

Rise in prevalence of arrhythmia is propelling the demand for electrophysiological procedures. According to the CDC, in 2019, AFib led to 183,321 deaths, and around 12.1 million people in the U.S. are expected to suffer from the disease in 2030.

According to the latest intracardiac echocardiography market forecast, North America is anticipated to hold largest share from 2023 to 2031. Growth in prevalence of CVDs and rise in investment in healthcare infrastructure are fueling the market dynamics for the region.

According to the data published by the U.S. Department of Health and Human Services, geriatric population increased by 36%, from 39.6 million in 2009 to 54.1 million in 2019, and is projected to reach 94.7 million in 2060. Hence, surge in the geriatric population is also fueling the intracardiac echocardiography market statistics in North America.

In April 2022, Franklin Mountain Medical received the U.S. Food and Drug Administration's clearance of its patented UltraNav Transseptal Catheter system for controlled access and delivery of cardiovascular catheters ad guidewires to heart chambers. Hence, development and launch of new products is augmenting market progress in the region.

The industry in Asia Pacific is driven by increase in prevalence of heart diseases and rise in geriatric population. Surge in adoption of advanced medical technologies and increase in healthcare expenditure are also boosting the intracardiac echocardiography industry growth in the region.

The intracardiac echocardiography market report concludes with the company profiles section that includes key information about the major players such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

Post the COVID-19 pandemic, intracardiac echocardiography companies are expanding their production capabilities. They are launching new products due to the popularity of non-invasive and minimally invasive imaging technologies. In March 2022, Siemens Healthineers reported the development of AcuNav V, a new ICE system designed to improve image quality and reduce procedure time.

Siemens Healthineers, Koninklijke Philips N.V., Abbott, Johnson & Johnson (Medical Device Business Services, Inc.), Boston Scientific Corporation, GE HealthCare, Stereotaxis, Inc., Shifamed, LLC, and Stryker Corporation are key players in the intracardiac echocardiography market.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 620.7 Mn |

|

Forecast Value in 2031 |

US$ 979.0 Mn |

|

Growth Rate (CAGR) |

5.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 620.7 Mn in 2022

It is projected to reach US$ 979.5 Mn by the end of 2031

It is anticipated to be 5.3% from 2023 to 2031

Increase in prevalence of cardiac diseases and technological advancements in interventional cardiology

The phased-array ICE type segment accounted for major share of 73.3% in 2022

North America is expected to record the highest demand from 2023 to 2031

Siemens Healthineers, Koninklijke Philips N.V., Abbott, Johnson & Johnson (Medical Device Business Services, Inc.), Boston Scientific Corporation, GE HealthCare, Stereotaxis, Inc., Shifamed, LLC, and Stryker Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Intracardiac Echocardiography Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Intracardiac Echocardiography Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence Rate Globally With Key Countries

5.3. Regulatory Scenario by Region/Globally

5.4. Reimbursement Scenario by Region/Globally

5.5. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long Term Impact)

6. Global Intracardiac Echocardiography Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2017-2031

6.3.1. Radial or Rotating ICE

6.3.2. Phased-array ICE

6.4. Market Attractiveness Analysis, by Type

7. Global Intracardiac Echocardiography Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Electrophysiology

7.3.2. Left Atrial Appendage Closure

7.3.3. Transcatheter Aortic Valve Implantation

7.3.4. Atrial Septal Defect

7.3.5. Others (MitraClip Implantation and Mitral Valvuloplasty, etc.)

7.4. Market Attractiveness Analysis, by Application

8. Global Intracardiac Echocardiography Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others (Clinics and Cardiac Centers, etc.)

8.4. Market Attractiveness Analysis, by End-user

9. Global Intracardiac Echocardiography Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Intracardiac Echocardiography Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017-2031

10.2.1. Radial or Rotating ICE

10.2.2. Phased-array ICE

10.3. Market Value Forecast, by Application, 2017-2031

10.3.1. Electrophysiology

10.3.2. Left Atrial Appendage Closure

10.3.3. Transcatheter Aortic Valve Implantation

10.3.4. Atrial Septal Defect

10.3.5. Others (MitraClip Implantation and Mitral Valvuloplasty, etc.)

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others (Clinics and Cardiac Centers, etc.)

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Intracardiac Echocardiography Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017-2031

11.2.1. Radial or Rotating ICE

11.2.2. Phased-array ICE

11.3. Market Value Forecast, by Application, 2017-2031

11.3.1. Electrophysiology

11.3.2. Left Atrial Appendage Closure

11.3.3. Transcatheter Aortic Valve Implantation

11.3.4. Atrial Septal Defect

11.3.5. Others (MitraClip Implantation and Mitral Valvuloplasty, etc.)

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Others (Clinics and Cardiac Centers, etc.)

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Intracardiac Echocardiography Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017-2031

12.2.1. Radial or Rotating ICE

12.2.2. Phased-array ICE

12.3. Market Value Forecast, by Application, 2017-2031

12.3.1. Electrophysiology

12.3.2. Left Atrial Appendage Closure

12.3.3. Transcatheter Aortic Valve Implantation

12.3.4. Atrial Septal Defect

12.3.5. Others (MitraClip Implantation and Mitral Valvuloplasty, etc.)

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Others (Clinics and Cardiac Centers, etc.)

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Intracardiac Echocardiography Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017-2031

13.2.1. Radial or Rotating ICE

13.2.2. Phased-array ICE

13.3. Market Value Forecast, by Application, 2017-2031

13.3.1. Electrophysiology

13.3.2. Left Atrial Appendage Closure

13.3.3. Transcatheter Aortic Valve Implantation

13.3.4. Atrial Septal Defect

13.3.5. Others (MitraClip Implantation and Mitral Valvuloplasty, etc.)

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others (Clinics and Cardiac Centers, etc.)

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Intracardiac Echocardiography Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017-2031

14.2.1. Radial or Rotating ICE

14.2.2. Phased-array ICE

14.3. Market Value Forecast, by Application, 2017-2031

14.3.1. Electrophysiology

14.3.2. Left Atrial Appendage Closure

14.3.3. Transcatheter Aortic Valve Implantation

14.3.4. Atrial Septal Defect

14.3.5. Others (MitraClip Implantation and Mitral Valvuloplasty, etc.)

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Others (Clinics and Cardiac Centers, etc.)

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. Siemens Healthineers

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Type Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Koninklijke Philips N.V.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Type Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Abbott

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Type Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Johnson & Johnson (Medical Device Business Services, Inc.)

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Type Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Boston Scientific Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Type Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. GE HealthCare

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Type Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Stryker Corporation

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Type Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Stereotaxis, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Type Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Shifamed, LLC

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Type Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

List of Tables

Table 01: Global Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 02: Global Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 03: Global Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 04: Global Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 06: North America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 07: North America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 08: North America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 09: Europe Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 10: Europe Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 11: Europe Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 12: Europe Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 13: Asia Pacific Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 14: Asia Pacific Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 15: Asia Pacific Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Latin America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 18: Latin America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 19: Latin America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 20: Latin America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 21: Middle East & Africa Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 22: Middle East & Africa Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 23: Middle East & Africa Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 24: Middle East & Africa Intracardiac Echocardiography Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Intracardiac Echocardiography Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Intracardiac Echocardiography Market Value Share Analysis, by Type, 2022 and 2031

Figure 03: Global Intracardiac Echocardiography Market Attractiveness Analysis, by Type, 2023-2031

Figure 04: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Radial or Rotating ICE, 2017-2031

Figure 05: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Phased-array ICE, 2017-2031

Figure 06: Global Intracardiac Echocardiography Market Value Share Analysis, by Application, 2022 and 2031

Figure 07: Global Intracardiac Echocardiography Market Attractiveness Analysis, by Application, 2023-2031

Figure 08: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Electrophysiology, 2017-2031

Figure 09: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Left Atrial Appendage Closure, 2017-2031

Figure 10: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Transcatheter Aortic Valve Implantation, 2017-2031

Figure 11: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Atrial Septal Defect, 2017-2031

Figure 12: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Others, 2017-2031

Figure 13: Global Intracardiac Echocardiography Market Attractiveness Analysis, by End-user, 2023-2031

Figure 14: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Hospitals, 2017-2031

Figure 15: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017-2031

Figure 16: Global Intracardiac Echocardiography Market Revenue (US$ Mn), by Others, 2017-2031

Figure 17: Global Intracardiac Echocardiography Market Value Share Analysis, by Region, 2022 and 2031

Figure 18: Global Intracardiac Echocardiography Market Attractiveness Analysis, by Region, 2023-2031

Figure 19: North America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, 2017-2031

Figure 20: North America Intracardiac Echocardiography Market Value Share Analysis, by Type, 2022 and 2031

Figure 21: North America Intracardiac Echocardiography Market Attractiveness Analysis, by Type, 2023-2031

Figure 22: North America Intracardiac Echocardiography Market Value Share Analysis, by Application, 2022 and 2031

Figure 23: North America Intracardiac Echocardiography Market Attractiveness Analysis, by Application, 2023-2031

Figure 24: North America Intracardiac Echocardiography Market Value Share Analysis, by End-user, 2022 and 2031

Figure 25: North America Intracardiac Echocardiography Market Attractiveness Analysis, by End-user, 2023-2031

Figure 26: North America Intracardiac Echocardiography Market Value Share Analysis, by Country, 2022 and 2031

Figure 27: North America Intracardiac Echocardiography Market Attractiveness Analysis, by Country, 2023-2031

Figure 28: North America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, 2017-2031

Figure 29: Europe Intracardiac Echocardiography Market Value Share Analysis, by Type, 2022 and 2031

Figure 30: Europe Intracardiac Echocardiography Market Attractiveness Analysis, by Type, 2023-2031

Figure 31: Europe Intracardiac Echocardiography Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: Europe Intracardiac Echocardiography Market Attractiveness Analysis, by Application, 2023-2031

Figure 33: Europe Intracardiac Echocardiography Market Value Share Analysis, by End-user, 2022 and 2031

Figure 34: Europe Intracardiac Echocardiography Market Attractiveness Analysis, by End-user, 2023-2031

Figure 35: Europe Intracardiac Echocardiography Market Value Share Analysis, by Country, 2022 and 2031

Figure 36: Europe Intracardiac Echocardiography Market Attractiveness Analysis, by Country, 2023-2031

Figure 37: Europe Intracardiac Echocardiography Market Value (US$ Mn) Forecast, 2017-2031

Figure 38: Asia Pacific Intracardiac Echocardiography Market Value Share Analysis, by Type, 2022 and 2031

Figure 39: Asia Pacific Intracardiac Echocardiography Market Attractiveness Analysis, by Type, 2023-2031

Figure 40: Asia Pacific Intracardiac Echocardiography Market Value Share Analysis, by Application, 2022 and 2031

Figure 41: Asia Pacific Intracardiac Echocardiography Market Attractiveness Analysis, by Application, 2023-2031

Figure 42: Asia Pacific Intracardiac Echocardiography Market Value Share Analysis, by End-user, 2022 and 2031

Figure 43: Asia Pacific Intracardiac Echocardiography Market Attractiveness Analysis, by End-user, 2023-2031

Figure 44: Asia Pacific Intracardiac Echocardiography Market Value Share Analysis, by Country, 2022 and 2031

Figure 45: Asia Pacific Intracardiac Echocardiography Market Attractiveness Analysis, by Country, 2023-2031

Figure 46: Asia Pacific Intracardiac Echocardiography Market Value (US$ Mn) Forecast, 2017-2031

Figure 47: Latin America Intracardiac Echocardiography Market Value Share Analysis, by Type, 2022 and 2031

Figure 48: Latin America Intracardiac Echocardiography Market Attractiveness Analysis, by Type, 2023-2031

Figure 49: Latin America Intracardiac Echocardiography Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Latin America Intracardiac Echocardiography Market Attractiveness Analysis, by Application, 2023-2031

Figure 51: Latin America Intracardiac Echocardiography Market Value Share Analysis, by End-user, 2022 and 2031

Figure 52: Latin America Intracardiac Echocardiography Market Attractiveness Analysis, by End-user, 2023-2031

Figure 53: Latin America Intracardiac Echocardiography Market Value Share Analysis, by Country, 2022 and 2031

Figure 54: Latin America Intracardiac Echocardiography Market Attractiveness Analysis, by Country, 2023-2031

Figure 55: Latin America Intracardiac Echocardiography Market Value (US$ Mn) Forecast, 2017-2031

Figure 56: Middle East & Africa Intracardiac Echocardiography Market Value Share Analysis, by Type, 2022 and 2031

Figure 57: Middle East & Africa Intracardiac Echocardiography Market Attractiveness Analysis, by Type, 2023-2031

Figure 58: Middle East & Africa Intracardiac Echocardiography Market Value Share Analysis, by Application, 2022 and 2031

Figure 59: Middle East & Africa Intracardiac Echocardiography Market Attractiveness Analysis, by Application, 2023-2031

Figure 60: Middle East & Africa Intracardiac Echocardiography Market Value Share Analysis, by End-user, 2022 and 2031

Figure 61: Middle East & Africa Intracardiac Echocardiography Market Attractiveness Analysis, by End-user, 2023-2031

Figure 62: Middle East & Africa Intracardiac Echocardiography Market Value Share Analysis, by Country, 2022 and 2031

Figure 63: Middle East & Africa Intracardiac Echocardiography Market Attractiveness Analysis, by Country, 2023-2031

Figure 64: Middle East & Africa Intracardiac Echocardiography Market Value (US$ Mn) Forecast, 2017-2031