Analysts’ Viewpoint

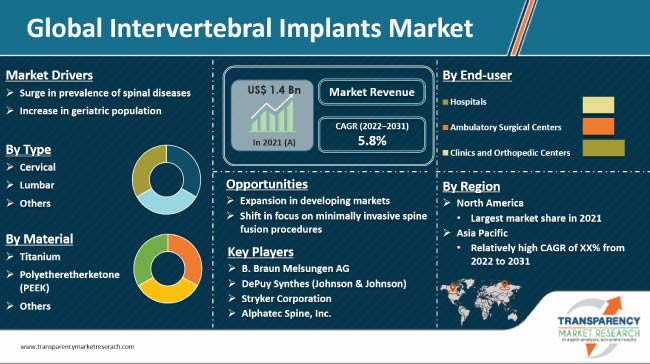

High prevalence of spine-related diseases that require spinal implant procedures and rise in launch of technologically advanced intervertebral implants are driving the global intervertebral implants landscape. Intervertebral implants are used as stabilizers for force distribution between vertebral bodies. They are also used to restore the height of the intervertebral and foramina space.

Increase in geriatric population and surge in cases of obesity are projected to augment market statistics during the forecast period. Market players are investing significantly in 3D printing of implants to expand their product portfolio. They are also engaged in the development of interbody implants for spinal fusion to broaden their revenue streams.

Spinal implants are used to stabilize an unstable spine caused by trauma or slid vertebrae produced by degenerative intervertebral discs. Adoption of anterior or posterior techniques may provide surgical stability. Plates or rods with screws implanted into the vertebral bodies join and fix adjacent vertebral bodies from the anterior approach. Rods and pedicle screws are used to support the spine from the back.

Titanium alloys and polyetheretherketone (PEEK) are employed in the manufacture of spinal implants. PEEK spacer, also known as an intervertebral disc spacer, is inserted into the body to treat spinal stenosis and other painful disc conditions. Cobalt-chromium (CoCr) alloys are also used in making spinal implants. Spinal implants aid in the treatment of symptomatic intervertebral disc and facet joint degeneration that does not respond to conservative treatment. They also aid in the management of vertebral fractures and spinal abnormalities such as adolescent and adult scoliosis.

Intervertebral implants are placed at any level of the spine, including thoracic, lumbar, and cervical. Spinal fusion is performed to relieve back pain and pressure caused due to the wearing out of the cartilage or disc (degenerative disc disease). Other conditions in which spinal fusion is performed include spinal fractures, spinal stenosis, spondylosis, scoliosis, spondylolisthesis, and kyphosis.

According to a study, 266 million individuals worldwide are diagnosed with degenerative spine disease and low back pain every year. The highest and lowest estimated incidences were found in Europe (5.7%) and Africa (2.4%), respectively. Thus, high prevalence of degenerative spine conditions is anticipated to boost the intervertebral implants market share in the next few years.

According to the U.S. Census Bureau, the population of people aged over 65 years is likely to account for more than 16.7% of the total population in 2050. Elderly people are at high risk of spine issues such as cervical spondylotic myelopathy, degenerative deformities, and lumbar spinal stenosis.

Increase in adoption of surgical treatments in addressing degenerative spinal issues is likely to fuel market expansion during the forecast period. The U.S. witnessed 62.3% rise in elective lumbar fusions between 2004 and 2015.

The lumbar type segment dominated the global industry with 50.0% market share in 2021. Increase in cases of degenerative disc diseases and chronic back pain is driving the segment. Together, cervical and lumbar segments held major share of the industry in 2021, owing to the rise in cases of cervical issues and surge in number of surgeons trained to perform cervical procedures.

According to the latest intervertebral implants market trends, the polyetheretherketone (PEEK) material segment is projected to account for dominant share from 2022 to 2031. Growth of the segment can be ascribed to the increase in need for improved treatments for chronic low back pain. PEEK allows viewing of crucial soft tissue structures such as the spinal cord near implant components.

High availability, radiolucency, and biomechanical performance of PEEK in spinal fusion applications have sparked interest in employing it in posterior dynamic stabilizing devices. The titanium segment is anticipated to grow at a high CAGR during the forecast period.

The hospitals end-user segment is estimated to hold the largest share during the forecast period. However, the clinics and orthopedic centers segment is anticipated to grow at a high CAGR from 2022 to 2031. Increase in demand for orthopedic specialists and growth in number of minimally invasive procedures are propelling the segment.

North America accounted for the largest share of around 38.0% of the global business in 2021. The market in the region is projected to grow at a CAGR of more than 5.6% from 2022 to 2031. This can be ascribed to the expansion in the microelectronic medical implants market, rise in prevalence of spinal diseases and obesity, and increase in number of spinal implant procedures in North America.

Asia Pacific also recorded significant market development in 2021. The market in the region is expected to grow at a CAGR of 6.5% during the forecast period, driven by the large patient population in countries such as India and China, improvement in healthcare facilities, and rise in awareness about spinal diseases and treatments. Additionally, surge in geriatric population is fueling the demand for intervertebral implants in Asia Pacific.

The global intervertebral implants sector is consolidated, with a few key players accounting for majority of the share. Most of the companies are investing significantly in R&D to expand their product portfolio. Collaborations, partnerships, and mergers & acquisitions are key strategies adopted by manufacturers.

Prominent players operating in the global market include Alphatec Spine, Inc., B. Braun Melsungen AG, Companion Spine LLC, DePuy Synthes (Johnson & Johnson), Globus Medical, Inc., LASAK s.r.o., NuVasive, Inc., Spineology Inc., Stryker Corporation, and Xtant Medical.

The market report outlines key companies based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.4 Bn |

|

Market Forecast Value in 2031 |

US$ 2.5 Bn |

|

Growth Rate |

5.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

Market share analysis by company (2021) Company profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, and key financials. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.4 Bn in 2021.

It is projected to reach US$ 2.5 Bn by 2031.

The market grew at a CAGR of 2.7% from 2017 to 2021.

The business is anticipated to grow at a CAGR of 5.8% from 2022 to 2031.

Surge in prevalence of spinal diseases and increase in geriatric population.

The lumbar segment held around 50.0% share in 2021.

North America accounted for major share during the forecast period.

Alphatec Spine, Inc., B. Braun Melsungen AG, Companion Spine LLC, DePuy Synthes (Johnson & Johnson), Globus Medical, Inc., LASAK s.r.o., NuVasive, Inc., Spineology Inc., Stryker Corporation, and Xtant Medical.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Intervertebral Implants Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Intervertebral Implants Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence Rate globally

5.3. Pricing Analysis

5.4. Key Industry Events (Mergers, Acquisitions, Partnerships, Collaborations, etc.)

5.5. COVID-19 Pandemic Impact on Industry

6. Global Intervertebral Implants Market Analysis and Forecast, By Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast By Type, 2017–2031

6.3.1. Cervical

6.3.2. Lumbar

6.3.3. Others

6.4. Market Attractiveness By Type

7. Global Intervertebral Implants Market Analysis and Forecast, By Material

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast By Material, 2017–2031

7.3.1. Titanium

7.3.2. Polyetheretherketone (PEEK)

7.3.3. Others

7.4. Market Attractiveness By Material

8. Global Intervertebral Implants Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast By End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Clinics and Orthopedic Centers

8.4. Market Attractiveness By End-user

9. Global Intervertebral Implants Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Intervertebral Implants Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Type, 2017–2031

10.2.1. Cervical

10.2.2. Lumbar

10.2.3. Others

10.3. Market Value Forecast By Material, 2017–2031

10.3.1. Titanium

10.3.2. Polyetheretherketone (PEEK)

10.3.3. Others

10.4. Market Value Forecast By End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Clinics and Orthopedic Centers

10.5. Market Value Forecast By Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Material

10.6.3. By End-user

10.6.4. By Country

11. Europe Intervertebral Implants Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Type, 2017–2031

11.2.1. Cervical

11.2.2. Lumbar

11.2.3. Others

11.3. Market Value Forecast By Material, 2017–2031

11.3.1. Titanium

11.3.2. Polyetheretherketone (PEEK)

11.3.3. Others

11.4. Market Value Forecast By End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Clinics and Orthopedic Centers

11.5. Market Value Forecast By Country/Sub-Region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Material

11.6.3. By End-user

11.6.4. By Country/Sub-Region

12. Asia Pacific Intervertebral Implants Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Type, 2017–2031

12.2.1. Cervical

12.2.2. Lumbar

12.2.3. Others

12.3. Market Value Forecast By Material, 2017–2031

12.3.1. Titanium

12.3.2. Polyetheretherketone (PEEK)

12.3.3. Others

12.4. Market Value Forecast By End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Clinics and Orthopedic Centers

12.5. Market Value Forecast By Country/Sub-Region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Material

12.6.3. By End-user

12.6.4. By Country/Sub-Region

13. Latin America Intervertebral Implants Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Type, 2017–2031

13.2.1. Cervical

13.2.2. Lumbar

13.2.3. Others

13.3. Market Value Forecast By Material, 2017–2031

13.3.1. Titanium

13.3.2. Polyetheretherketone (PEEK)

13.3.3. Others

13.4. Market Value Forecast By End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Clinics and Orthopedic Centers

13.5. Market Value Forecast By Country/Sub-Region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Material

13.6.3. By End-user

13.6.4. By Country/Sub-Region

14. Middle East & Africa Intervertebral Implants Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Type, 2017–2031

14.2.1. Cervical

14.2.2. Lumbar

14.2.3. Others

14.3. Market Value Forecast By Material, 2017–2031

14.3.1. Titanium

14.3.2. Polyetheretherketone (PEEK)

14.3.3. Others

14.4. Market Value Forecast By End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Clinics and Orthopedic Centers

14.5. Market Value Forecast By Country/Sub-Region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Material

14.6.3. By End-user

14.6.4. By Country/Sub-Region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Company Profiles

15.2.1. Alphatec Spine, Inc.

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Product Portfolio

15.2.1.3. Financial Overview

15.2.1.4. SWOT Analysis

15.2.1.5. Strategic Overview

15.2.2. B. Braun Melsungen AG

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Product Portfolio

15.2.2.3. Financial Overview

15.2.2.4. SWOT Analysis

15.2.2.5. Strategic Overview

15.2.3. Companion Spine LLC

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Product Portfolio

15.2.3.3. Financial Overview

15.2.3.4. SWOT Analysis

15.2.3.5. Strategic Overview

15.2.4. DePuy Synthes (Johnson & Johnson)

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Product Portfolio

15.2.4.3. Financial Overview

15.2.4.4. SWOT Analysis

15.2.4.5. Strategic Overview

15.2.5. Globus Medical, Inc.

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Product Portfolio

15.2.5.3. Financial Overview

15.2.5.4. SWOT Analysis

15.2.5.5. Strategic Overview

15.2.6. LASAK s.r.o.

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Product Portfolio

15.2.6.3. Financial Overview

15.2.6.4. SWOT Analysis

15.2.6.5. Strategic Overview

15.2.7. NuVasive, Inc.

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2. Product Portfolio

15.2.7.3. Financial Overview

15.2.7.4. SWOT Analysis

15.2.7.5. Strategic Overview

15.2.8. Spineology Inc.

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Product Portfolio

15.2.8.3. Financial Overview

15.2.8.4. SWOT Analysis

15.2.8.5. Strategic Overview

15.2.9. Stryker Corporation

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Product Portfolio

15.2.9.3. Financial Overview

15.2.9.4. SWOT Analysis

15.2.9.5. Strategic Overview

15.2.10. Xtant Medical

15.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.10.2. Product Portfolio

15.2.10.3. Financial Overview

15.2.10.4. SWOT Analysis

15.2.10.5. Strategic Overview

List of Tables

Table 01: Global Intervertebral Implants Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 02: Global Intervertebral Implants Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 03: Global Intervertebral Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Intervertebral Implants Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Intervertebral Implants Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Intervertebral Implants Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 07: North America Intervertebral Implants Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 08: North America Intervertebral Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Intervertebral Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Intervertebral Implants Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 11: Europe Intervertebral Implants Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 12: Europe Intervertebral Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Intervertebral Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Intervertebral Implants Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 15: Asia Pacific Intervertebral Implants Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 16: Asia Pacific Intervertebral Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Intervertebral Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Intervertebral Implants Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 19: Latin America Intervertebral Implants Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 20: Latin America Intervertebral Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Intervertebral Implants Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 22: Middle East & Africa Intervertebral Implants Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 23: Middle East & Africa Intervertebral Implants Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 24: Middle East & Africa Intervertebral Implants Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Intervertebral Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Intervertebral Implants Market Value Share, by Type, 2021

Figure 03: Intervertebral Implants Market Value Share, by Material, 2021

Figure 04: Intervertebral Implants Market Value Share, by End-user 2021

Figure 05: Global Intervertebral Implants Market Value Share Analysis, by Type, 2021 and 2031

Figure 06: Global Intervertebral Implants Market Attractiveness Analysis, by Type, 2022–2031

Figure 07: Global Intervertebral Implants Market Value (US$ Mn), by Cervical, 2017‒2031

Figure 08: Global Intervertebral Implants Market Value (US$ Mn), by Lumbar, 2017‒2031

Figure 09: Global Intervertebral Implants Market Value (US$ Mn), by Others, 2017‒2031

Figure 10: Global Intervertebral Implants Market Value Share Analysis, by Material, 2021 and 2031

Figure 11: Global Intervertebral Implants Market Attractiveness Analysis, by Material, 2022–2031

Figure 12: Global Intervertebral Implants Market Revenue (US$ Mn), by Titanium, 2017–2031

Figure 13: Global Intervertebral Implants Market Revenue (US$ Mn), by Polyetheretherketone (PEEK), 2017–2031

Figure 14: Global Intervertebral Implants Market Revenue (US$ Mn), by Others, 2017–2031

Figure 15: Global Intervertebral Implants Market Value Share Analysis, by End-user, 2021 and 2031

Figure 16: Global Intervertebral Implants Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: Global Intervertebral Implants Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 18: Global Intervertebral Implants Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 19: Global Intervertebral Implants Market Revenue (US$ Mn), by Clinics and Orthopedic Centers, 2017–2031

Figure 20: Global Intervertebral Implants Market Value Share Analysis, by Region, 2021 and 2031

Figure 21: Global Intervertebral Implants Market Attractiveness Analysis, by Region, 2022–2031

Figure 22: North America Intervertebral Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: North America Intervertebral Implants Market Value Share Analysis, by Country, 2021 and 2031

Figure 24: North America Intervertebral Implants Market Attractiveness Analysis, by Country, 2022–2031

Figure 25: North America Intervertebral Implants Market Value Share Analysis, by Type, 2021 and 2031

Figure 26: North America Intervertebral Implants Market Attractiveness Analysis, by Type, 2022–2031

Figure 27: North America Intervertebral Implants Market Value Share Analysis, by Material, 2021 and 2031

Figure 28: North America Intervertebral Implants Market Attractiveness Analysis, by Material, 2022–2031

Figure 29: North America Intervertebral Implants Market Value Share Analysis, by End-user, 2021 and 2031

Figure 30: North America Intervertebral Implants Market Attractiveness Analysis, by End-user, 2022–2031

Figure 31: Europe Intervertebral Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Europe Intervertebral Implants Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 33: Europe Intervertebral Implants Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Europe Intervertebral Implants Market Value Share Analysis, by Type, 2021 and 2031

Figure 35: Europe Intervertebral Implants Market Attractiveness Analysis, by Type, 2022–2031

Figure 36: Europe Intervertebral Implants Market Value Share Analysis, by Material, 2021 and 2031

Figure 37: Europe Intervertebral Implants Market Attractiveness Analysis, by Material, 2022–2031

Figure 38: Europe Intervertebral Implants Market Value Share Analysis, by End-user, 2021 and 2031

Figure 39: Europe Intervertebral Implants Market Attractiveness Analysis, by End-user, 2022–2031

Figure 40: Asia Pacific Intervertebral Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 41: Asia Pacific Intervertebral Implants Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 42: Asia Pacific Intervertebral Implants Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Asia Pacific Intervertebral Implants Market Value Share Analysis, by Type, 2021 and 2031

Figure 44: Asia Pacific Intervertebral Implants Market Attractiveness Analysis, by Type, 2022–2031

Figure 45: Asia Pacific Intervertebral Implants Market Value Share Analysis, by Material, 2021 and 2031

Figure 46: Asia Pacific Intervertebral Implants Market Attractiveness Analysis, by Material, 2022–2031

Figure 47: Asia Pacific Intervertebral Implants Market Value Share Analysis, by End-user, 2021 and 2031

Figure 48: Asia Pacific Intervertebral Implants Market Attractiveness Analysis, by End-user, 2022–2031

Figure 49: Latin America Intervertebral Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Latin America Intervertebral Implants Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 51: Latin America Intervertebral Implants Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 52: Latin America Intervertebral Implants Market Value Share Analysis, by Type, 2021 and 2031

Figure 53: Latin America Intervertebral Implants Market Attractiveness Analysis, by Type, 2022–2031

Figure 54: Latin America Intervertebral Implants Market Value Share Analysis, by Material, 2021 and 2031

Figure 55: Latin America Intervertebral Implants Market Attractiveness Analysis, by Material, 2022–2031

Figure 56: Latin America Intervertebral Implants Market Value Share Analysis, by End-user, 2021 and 2031

Figure 57: Latin America Intervertebral Implants Market Attractiveness Analysis, by End-user, 2022–2031

Figure 58: Middle East & Africa Intervertebral Implants Market Value (US$ Mn) Forecast, 2017–2031

Figure 59: Middle East & Africa Intervertebral Implants Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 60: Middle East & Africa Intervertebral Implants Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 61: Middle East & Africa Intervertebral Implants Market Value Share Analysis, by Type, 2021 and 2031

Figure 62: Middle East & Africa Intervertebral Implants Market Attractiveness Analysis, by Type, 2022–2031

Figure 63: Middle East & Africa Intervertebral Implants Market Value Share Analysis, by Material, 2021 and 2031

Figure 64: Middle East & Africa Intervertebral Implants Market Attractiveness Analysis, by Material, 2022–2031

Figure 65: Middle East & Africa Intervertebral Implants Market Value Share Analysis, by End-user, 2021 and 2031

Figure 66: Middle East & Africa Intervertebral Implants Market Attractiveness Analysis, by End-user, 2022–2031