Analysts’ Viewpoint

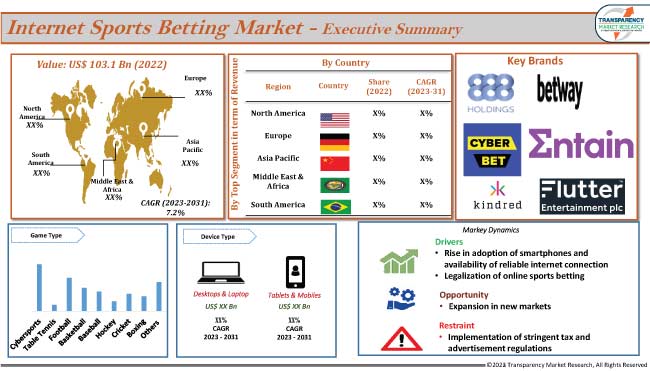

Rise in adoption of smartphones and availability of reliable internet connection is projected to fuel the internet sports betting market size during the forecast period. Various countries across the globe are legalizing online sports betting. Mobile gambling is gaining traction worldwide, with bets placed on mobile wagering, including phones and tablets, surpassing those places with desktops.

Vendors in the global internet sports betting industry are investing significantly in promotional activities to expand their customer base. They are also partnering with various sports leagues to increase their internet sports betting market share.

Internet sports betting involves placing bets on various sports events through online platforms. Bets are widely placed on various sports such as cybersports, football, basketball, baseball, hockey, cricket, and boxing. Internet sports betting is legal in countries such as the U.K., Japan, Spain, France, Australia, China, and Thailand, while Qatar and the UAE prohibit gambling of every kind.

Improvements in technology and rise in penetration of internet have led to the development of various types of online sports betting including moneylines, spreads, totals, parlays, and live betting. Moneyline is the most popular type of sports bet. It involves picking the winning or losing team.

Significant advancements in network technologies have led to an increase in internet speed. Major telecommunications operators are deploying 5G networks worldwide to expand internet access. They are also offering satellite internet services, especially in remote areas that lack the necessary infrastructure for fiber-optic internet.

The number of smartphone users is growing rapidly worldwide. India, one of the major markets for online betting, has over 1.2 billion mobile phone users, according to the I&B Ministry of the Government of India.

The emergence of COVID-19 led to a surge in adoption of digital services. The use of internet services grew from 40% to 100% compared to pre-lockdown levels. Thus, increase in adoption of smartphones and availability of reliable internet connections are projected to spur the internet sports betting market growth in the near future.

Several state and national governments of various countries are legalizing online sports betting. In June 2023, the state government of Vermont in the U.S. signed a bill that authorizes the Department of Liquor and Lottery to set up a betting system.

Such developments are likely to boost engagement in legal sports betting. In the U.S., around 33 states have legalized sports betting. Hence, legalization of online sports betting is anticipated to propel the internet sports betting market expansion in the near future.

Implementation of stringent tax and advertisement regulations is likely to limit the internet sports betting market trajectory. The Government of India is set to introduce stricter advertisement rules for online betting. Earlier, the government had banned several betting apps and asked various app platforms to cease marketing ads for overseas online betting platforms.

According to the latest internet sports betting market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Surge in adoption of smartphones and increase in penetration of internet are driving the market dynamics of the region.

Asia Pacific is home to around 2.3 billion internet users, which accounts for 50.3% of the world's internet user population.

Presence of robust internet infrastructure and rise in legalization of online sports betting are boosting the internet sports betting market statistics in North America. The federal government of the U.S. allows each state to determine its own sports betting laws. Currently, sports betting is legal in over 30 states. New York, Maryland, and New Jersey are some of the states that allow online sports betting. In October 2031, Maine legalized advertising and user registrations for online sports gambling.

Mobile gambling is gaining traction in Europe. Increase in investment in marketing by companies and availability of convenient payment infrastructure are propelling the internet sports betting market revenue in Europe.

A multitude of online betting platforms are available in the market. Internet sports betting companies are focused on offering a user-friendly interface. They are also providing a wide range of sports and events to bet on. Rise in investment in scaling up payment infrastructure is estimated to offer lucrative internet sports betting market opportunities to vendors.

888 Holdings plc, Betway Group, Cyber Bet, Entain plc, Kindred Group, Flutter Entertainment plc, Unibet, and Unikrn Inc. are key players operating in this market. Each of these players has been profiled in the internet sports betting market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 103.1 Bn |

| Market Forecast Value in 2031 | US$ 193.4 Bn |

| Growth Rate (CAGR) | 7.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 103.1 Bn in 2022

It is projected to reach US$ 193.4 Bn by the end of 2031

Rise in adoption of smartphones and availability of reliable internet connection and legalization of online sports betting

Asia Pacific is projected to record the highest demand during the forecast period

888 Holdings plc, Betway Group, Cyber Bet, Entain plc, Kindred Group, Flutter Entertainment plc, Unibet, and Unikrn Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Betting Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Technological Overview

5.9. Global Internet Sports Betting Market Analysis and Forecast, 2023 - 2031

5.9.1. Market Revenue Projection (US$ Bn)

6. Global Internet Sports Betting Market Analysis and Forecast, By Game Type

6.1. Global Internet Sports Betting Market Size (US$ Bn) Forecast, By Game Type, 2023 - 2031

6.1.1. Cybersports

6.1.1.1. Battle Ground

6.1.1.2. Call of Duty (CoD)

6.1.1.3. Counter-Strike

6.1.1.4. Dota 2

6.1.1.5. Hearthstone

6.1.1.6. League of Legends

6.1.1.7. FIFA

6.1.1.8. PES

6.1.1.9. eBasketball

6.1.1.10. Others

6.1.2. Table Tennis

6.1.3. Football

6.1.4. Basketball

6.1.5. Baseball

6.1.6. Hockey

6.1.7. Cricket

6.1.8. Boxing

6.1.9. Others

6.2. Incremental Opportunity, By Game Type

7. Global Internet Sports Betting Market Analysis and Forecast, By Device Type

7.1. Global Internet Sports Betting Market Size (US$ Bn) Forecast, By Device Type, 2023 - 2031

7.1.1. Desktops & Laptops

7.1.2. Tablets & Mobiles

7.2. Incremental Opportunity, By Device Type

8. Global Internet Sports Betting Market Analysis and Forecast, by Region

8.1. Global Internet Sports Betting Market Size (US$ Bn), by Region, 2023 - 2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Global Incremental Opportunity, by Region

9. North America Internet Sports Betting Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Key Trend Analysis

9.3. Demographic Overview

9.4. COVID-19 Impact Analysis

9.5. Brands Analysis

9.6. Consumer Buying Behavior Analysis

9.7. Internet Sports Betting Market Size (US$ Bn) Forecast, By Game Type, 2023 - 2031

9.7.1. Cybersports

9.7.1.1. Battle Ground

9.7.1.2. Call of Duty (CoD)

9.7.1.3. Counter-Strike

9.7.1.4. Dota 2

9.7.1.5. Hearthstone

9.7.1.6. League of Legends

9.7.1.7. FIFA

9.7.1.8. PES

9.7.1.9. eBasketball

9.7.1.10. Others

9.7.2. Table Tennis

9.7.3. Football

9.7.4. Basketball

9.7.5. Baseball

9.7.6. Hockey

9.7.7. Cricket

9.7.8. Boxing

9.8. Internet Sports Betting Market Size (US$ Bn) Forecast, By Device Type, 2023 - 2031

9.8.1. Desktops & Laptops

9.8.2. Tablets & Mobiles

9.9. Internet Sports Betting Market Size (US$ Bn), by Country, 2023 - 2031

9.9.1. U.S.

9.9.2. Canada

9.9.3. Rest of North America

9.10. Incremental Opportunity Analysis

10. Europe Internet Sports Betting Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Trend Analysis

10.3. Demographic Overview

10.4. COVID-19 Impact Analysis

10.5. Brands Analysis

10.6. Consumer Buying Behavior Analysis

10.7. Internet Sports Betting Market Size (US$ Bn) Forecast, By Game Type, 2023 - 2031

10.7.1. Cybersports

10.7.1.1. Battle Ground

10.7.1.2. Call of Duty (CoD)

10.7.1.3. Counter-Strike

10.7.1.4. Dota 2

10.7.1.5. Hearthstone

10.7.1.6. League of Legends

10.7.1.7. FIFA

10.7.1.8. PES

10.7.1.9. eBasketball

10.7.1.10. Others

10.7.2. Table Tennis

10.7.3. Football

10.7.4. Basketball

10.7.5. Baseball

10.7.6. Hockey

10.7.7. Cricket

10.7.8. Boxing

10.8. Internet Sports Betting Market Size (US$ Bn) Forecast, By Device Type, 2023 - 2031

10.8.1. Desktops & Laptops

10.8.2. Tablets & Mobiles

10.9. Internet Sports Betting Market Size (US$ Bn), by Country, 2023 - 2031

10.9.1. Germany

10.9.2. France

10.9.3. U.K.

10.9.4. Rest of Europe

10.10. Incremental Opportunity Analysis

11. Asia Pacific Internet Sports Betting Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trend Analysis

11.3. Demographic Overview

11.4. COVID-19 Impact Analysis

11.5. Brands Analysis

11.6. Consumer Buying Behavior Analysis

11.7. Internet Sports Betting Market Size (US$ Bn) Forecast, By Game Type, 2023 - 2031

11.7.1. Cybersports

11.7.1.1. Battle Ground

11.7.1.2. Call of Duty (CoD)

11.7.1.3. Counter-Strike

11.7.1.4. Dota 2

11.7.1.5. Hearthstone

11.7.1.6. League of Legends

11.7.1.7. FIFA

11.7.1.8. PES

11.7.1.9. eBasketball

11.7.1.10. Others

11.7.2. Table Tennis

11.7.3. Football

11.7.4. Basketball

11.7.5. Baseball

11.7.6. Hockey

11.7.7. Cricket

11.7.8. Boxing

11.8. Internet Sports Betting Market Size (US$ Bn) Forecast, By Device Type, 2023 - 2031

11.8.1. Desktops & Laptops

11.8.2. Tablets & Mobiles

11.9. Internet Sports Betting Market Size (US$ Bn), by Country, 2023 - 2031

11.9.1. China

11.9.2. India

11.9.3. Japan

11.9.4. Southeast Asia

11.9.5. Rest of Asia Pacific

11.10. Incremental Opportunity Analysis

12. Middle East & Africa Internet Sports Betting Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.3. Demographic Overview

12.4. COVID-19 Impact Analysis

12.5. Brands Analysis

12.6. Consumer Buying Behavior Analysis

12.7. Internet Sports Betting Market Size (US$ Bn) Forecast, By Game Type, 2023 - 2031

12.7.1. Cybersports

12.7.1.1. Battle Ground

12.7.1.2. Call of Duty (CoD)

12.7.1.3. Counter-Strike

12.7.1.4. Dota 2

12.7.1.5. Hearthstone

12.7.1.6. League of Legends

12.7.1.7. FIFA

12.7.1.8. PES

12.7.1.9. eBasketball

12.7.1.10. Others

12.7.2. Table Tennis

12.7.3. Football

12.7.4. Basketball

12.7.5. Baseball

12.7.6. Hockey

12.7.7. Cricket

12.7.8. Boxing

12.8. Internet Sports Betting Market Size (US$ Bn) Forecast, By Device Type, 2023 - 2031

12.8.1. Desktops & Laptops

12.8.2. Tablets & Mobiles

12.9. Internet Sports Betting Market Size (US$ Bn), by Country, 2023 - 2031

12.9.1. GCC

12.9.2. South Africa

12.9.3. Rest of Middle East & Africa

12.10. Incremental Opportunity Analysis

13. South America Internet Sports Betting Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.3. Demographic Overview

13.4. COVID-19 Impact Analysis

13.5. Brands Analysis

13.6. Consumer Buying Behavior Analysis

13.7. Internet Sports Betting Market Size (US$ Bn) Forecast, By Game Type, 2023 - 2031

13.7.1. Cybersports

13.7.1.1. Battle Ground

13.7.1.2. Call of Duty (CoD)

13.7.1.3. Counter-Strike

13.7.1.4. Dota 2

13.7.1.5. Hearthstone

13.7.1.6. League of Legends

13.7.1.7. FIFA

13.7.1.8. PES

13.7.1.9. eBasketball

13.7.1.10. Others

13.7.2. Table Tennis

13.7.3. Football

13.7.4. Basketball

13.7.5. Baseball

13.7.6. Hockey

13.7.7. Cricket

13.7.8. Boxing

13.8. Internet Sports Betting Market Size (US$ Bn) Forecast, By Device Type, 2023 - 2031

13.8.1. Desktops & Laptops

13.8.2. Tablets & Mobiles

13.9. Internet Sports Betting Market Size (US$ Bn), by Country, 2023 - 2031

13.9.1. Brazil

13.9.2. Rest of South America

13.10. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Revenue Share Analysis (%), (2022)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. 888 Holdings plc.

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. Betway Group

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. Cyber Bet

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Entain plc

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. Kindred Group

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. Flutter Entertainment plc

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Unibet

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. Unikrn Inc.

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.1.1. By Game Type

15.1.2. By Device Type

15.1.3. By Region

15.2. Understanding Buying Process of Customers

15.3. Preferred Sales & Marketing Strategy

15.4. Prevailing Market Risk

List of Tables

Table 1: Global Internet Sports Betting Market, By Game Type, US$ Bn, 2023-2031

Table 2: Global Internet Sports Betting Market, By Device Type, US$ Bn, 2023-2031

Table 3: Global Internet Sports Betting Market, By Region, US$ Bn, 2023-2031

Table 4: North America Internet Sports Betting Market, By Game Type, US$ Bn, 2023-2031

Table 5: North America Internet Sports Betting Market, By Device Type, US$ Bn, 2023-2031

Table 6: North America Internet Sports Betting Market, By Country, US$ Bn, 2023-2031

Table 7: Europe Internet Sports Betting Market, By Game Type, US$ Bn, 2023-2031

Table 8: Europe Internet Sports Betting Market, By Device Type, US$ Bn, 2023-2031

Table 9: Europe Internet Sports Betting Market, By Country, US$ Bn, 2023-2031

Table 10: Asia Pacific Internet Sports Betting Market, By Game Type, US$ Bn, 2023-2031

Table 11: Asia Pacific Internet Sports Betting Market, By Device Type, US$ Bn, 2023-2031

Table 12: Asia Pacific Internet Sports Betting Market, By Country, US$ Bn, 2023-2031

Table 13: Middle East & Africa Internet Sports Betting Market, By Game Type, US$ Bn, 2023-2031

Table 14: Middle East & Africa Internet Sports Betting Market, By Device Type, US$ Bn, 2023-2031

Table 15: Middle East & Africa Internet Sports Betting Market, By Country, US$ Bn, 2023-2031

Table 16: South America Internet Sports Betting Market, By Game Type, US$ Bn, 2023-2031

Table 17: South America Internet Sports Betting Market, By Device Type, US$ Bn, 2023-2031

Table 18: South America Internet Sports Betting Market, By Country, US$ Bn, 2023-2031

List of Figures

Figure 1: Global Internet Sports Betting Market Projections by Game Type, US$ Bn, 2023-2031

Figure 2: Global Internet Sports Betting Market, Incremental Opportunity, by Game Type, US$ Bn, 2023-2031

Figure 3: Global Internet Sports Betting Market Projections by Device Type, US$ Bn, 2023-2031

Figure 4: Global Internet Sports Betting Market, Incremental Opportunity, by Device Type, US$ Bn, 2023-2031

Figure 5: Global Internet Sports Betting Market Projections by Region, US$ Bn, 2023-2031

Figure 6: Global Internet Sports Betting Market, Incremental Opportunity, by Region, US$ Bn, 2023-2031

Figure 7: North America Internet Sports Betting Market Projections by Game Type, US$ Bn, 2023-2031

Figure 8: North America Internet Sports Betting Market, Incremental Opportunity, by Game Type, US$ Bn, 2023-2031

Figure 9: North America Internet Sports Betting Market Projections by Device Type, US$ Bn, 2023-2031

Figure 10: North America Internet Sports Betting Market, Incremental Opportunity, by Device Type, US$ Bn, 2023-2031

Figure 11: North America Internet Sports Betting Market Projections by Country, US$ Bn, 2023-2031

Figure 12: North America Internet Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2023-2031

Figure 13: Europe Internet Sports Betting Market Projections by Game Type, US$ Bn, 2023-2031

Figure 14: Europe Internet Sports Betting Market, Incremental Opportunity, by Game Type, US$ Bn, 2023-2031

Figure 15: Europe Internet Sports Betting Market Projections by Device Type, US$ Bn, 2023-2031

Figure 16: Europe Internet Sports Betting Market, Incremental Opportunity, by Device Type, US$ Bn, 2023-2031

Figure 17: Europe Internet Sports Betting Market Projections by Country, US$ Bn, 2023-2031

Figure 18: Europe Internet Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2023-2031

Figure 19: Asia Pacific Internet Sports Betting Market Projections by Game Type, US$ Bn, 2023-2031

Figure 20: Asia Pacific Internet Sports Betting Market, Incremental Opportunity, by Game Type, US$ Bn, 2023-2031

Figure 21: Asia Pacific Internet Sports Betting Market Projections by Device Type, US$ Bn, 2023-2031

Figure 22: Asia Pacific Internet Sports Betting Market, Incremental Opportunity, by Device Type, US$ Bn, 2023-2031

Figure 23: Asia Pacific Internet Sports Betting Market Projections by Country, US$ Bn, 2023-2031

Figure 24: Asia Pacific Internet Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2023-2031

Figure 25: Middle East & Africa Internet Sports Betting Market Projections by Game Type, US$ Bn, 2023-2031

Figure 26: Middle East & Africa Internet Sports Betting Market, Incremental Opportunity, by Game Type, US$ Bn, 2023-2031

Figure 27: Middle East & Africa Internet Sports Betting Market Projections by Device Type, US$ Bn, 2023-2031

Figure 28: Middle East & Africa Internet Sports Betting Market, Incremental Opportunity, by Device Type, US$ Bn, 2023-2031

Figure 29: Middle East & Africa Internet Sports Betting Market Projections by Country, US$ Bn, 2023-2031

Figure 30: Middle East & Africa Internet Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2023-2031

Figure 31: South America Internet Sports Betting Market Projections by Game Type, US$ Bn, 2023-2031

Figure 32: South America Internet Sports Betting Market, Incremental Opportunity, by Game Type, US$ Bn, 2023-2031

Figure 33: South America Internet Sports Betting Market Projections by Device Type, US$ Bn, 2023-2031

Figure 34: South America Internet Sports Betting Market, Incremental Opportunity, by Device Type, US$ Bn, 2023-2031

Figure 35: South America Internet Sports Betting Market Projections by Country, US$ Bn, 2023-2031

Figure 36: South America Internet Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2023-2031