Analysts’ Viewpoint

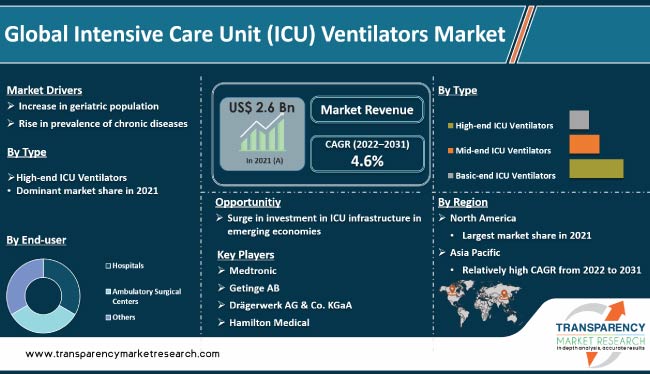

Increase in geriatric population, rise in prevalence of chronic diseases, and growth in number of ICU admissions are fueling global Intensive Care Unit ventilators market expansion. COVID-19 pandemic has had a major impact on the demand for ventilators, as the number of patients requiring ICU care for COVID-19-related complications witnessed rapid growth during the peak of the pandemic.

Governments of countries around the world are investing significantly in ICU infrastructure. This is likely to offer lucrative opportunities for vendors. Key players are launching new products to increase their ICU ventilators market share.

Intensive Care Unit (ICU) ventilators assist breathing in patients suffering from chronic diseases. These ventilators aid in the treatment and management of various diseases such as pneumonia, brain injury, and stroke. They deliver a controlled, therapeutic dose of compressed gases, such as oxygen and air, to the lungs of patients who have difficulty breathing on their own.

ICU ventilators are available in a variety of models and designs, depending on patient needs. Pressure-controlled ventilation and volume-controlled ventilation are some of the methods of delivering a controlled volume of air or oxygen to the lungs.

ICU ventilators deliver Positive End-expiratory Pressure (PEEP), which can help prevent atelectasis (collapse of the lung tissue). These ventilators also offer high-frequency ventilation, which can help improve oxygenation in patients with lung injuries. They can deliver nebulized medications to reduce inflammation and improve airway clearance.

Some ICU ventilators can be connected to a variety of interfaces, such as face masks, nasal cannulas, or tracheostomy tubes, while others are designed to be used only with a specific type of interface. New models of ICU ventilators are portable and can be used outside of the hospital setting.

The COVID-19 pandemic has significantly impacted the Intensive Care Unit (ICU) ventilators industry. The outbreak led to a rapid increase in demand for ICU ventilators due to the rise in cases of COVID-19 infections. High demand led to a significant shortage in some countries, prompting key manufacturers to ramp up their ICU ventilator production capacities. Vendors also launched advanced ventilators specifically tailored for COVID-19 patients.

The COVID-19 pandemic adversely affected the supply chain of ICU ventilators. Some manufacturers faced challenges in procuring raw materials and components needed to produce ventilators. This led to delays in the production of ventilators and a surge in the cost of these devices.

Elderly people are at high risk of respiratory disorders, cardiovascular diseases, neurological disorders, and other chronic diseases. Effective treatment and management of chronic diseases often require ICU care and ventilator support. This is likely to contribute to Intensive Care Unit (ICU) ventilators market growth in the near future.

According to the United Nations, the global population of people aged 60 and above is projected to nearly double from 900 million in 2015 to about 1.5 billion by 2050. The proportion of older people in the overall population is as high as 20% in developed countries such as the U.S. Japan, and Italy.

A surge in the geriatric population is expected to increase the number of hospital admissions for older people. In the U.S., the number of hospital stays for people aged 65 and above rose by 34%, from 11.2 million in 2000 to 15.1 million in 2014. Similarly, in Japan, the number of hospital stays for people aged 75 and above increased from 2.8 million in 2000 to 4.3 million in 2014, recording a rise of 54%. Thus, the surge in the geriatric population is estimated to propel the ICU ventilators market dynamics in the next few years.

Chronic diseases require the usage of ventilators to support breathing. COPD is a chronic lung condition that makes it difficult to breathe. According to the World Health Organization (WHO), COPD is among the top 10 causes of death worldwide and is projected to become the third leading cause of death by 2030. Around 16 million adults suffer from COPD in the U.S.

According to the WHO, around 339 million people worldwide have asthma. Asthma is a leading cause of hospitalization and ICU admissions. Asthma patients often rely on ICU ventilators for breathing. Thus, an increase in cases of chronic diseases is projected to drive market progress in the near future.

According to the latest Intensive Care Unit (ICU) ventilators market trends, the high-end ICU ventilators type segment is anticipated to dominate the industry during the forecast period. High-end ICU ventilators provide advanced features that help improve patient outcomes. These ventilators offer real-time monitoring of pressure, volume, and flow.

Leading manufacturers are launching new high-end ICU ventilators with improved mobility & portability, intelligent algorithms, and a wide range of settings. In May 2019, Hamilton Medical launched the V600 ventilator. Similarly, in April 2020, GE Healthcare introduced the Stellar 150 ventilator.

According to the latest Intensive Care Unit ventilators market analysis, the hospital end-user segment is estimated to hold the largest share during the forecast period. Hospitals are the primary end-users of ICU ventilators, as many critically ill patients are admitted to hospitals for ICU care.

According to the WHO, an estimated 80% of all patients who require ICU care are hospitalized. Additionally, the high patient volume in hospitals allows for economies of scale in the procurement and usage of ICU ventilators.

Hospitals witness high demand for advanced respiratory care equipment to meet the needs of critically ill patients. They tend to have more resources, such as highly-trained personnel, specialized departments, and state-of-the-art facilities, than other healthcare settings.

According to the latest Intensive Care Unit (ICU) ventilators market forecast, North America is expected to dominate the industry from 2022 to 2031. The presence of well-established healthcare infrastructure and major vendors is likely to fuel market statistics in the region.

The high prevalence of chronic diseases is also anticipated to boost the demand for ICU ventilators in North America in the near future. According to the American Lung Association, asthma affects around 26 million people in the U.S., including 7 million children. Asthma is responsible for around 14.2 million missed school days and 14.2 million missed work days annually.

The Intensive Care Unit (ICU) ventilators business in Europe is driven by the presence of robust healthcare infrastructure, the surge in healthcare expenditure, and the high prevalence of chronic diseases. Germany, France, and the U.K. are growth engines of the business in Europe.

The market in Asia Pacific is likely to grow at a rapid pace during the forecast period. The increase in the geriatric population and the rise in the prevalence of chronic diseases are augmenting market revenue in the region. The surge in investment in the healthcare sector is also projected to drive the demand for ICU ventilators in Asia Pacific in the next few years.

The Intensive Care Unit (ICU) ventilators market report includes vital information about key vendors such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Medtronic, Getinge AB, Drägerwerk AG & Co. KGaA, Hamilton Medical, GE HealthCare, Fresenius Medical Care AG & Co. KGaA, Koninklijke Philips N.V., Abbott, Siemens Healthcare GmbH, and Stryker are prominent entities operating in the market. These companies are focusing on strategies such as product launches, divestiture, mergers & acquisitions (M&A), and partnerships to strengthen their position in the market.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.6 Bn |

|

Market Forecast Value in 2031 |

More than US$ 3.9 Bn |

|

Compound Annual Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.6 Bn in 2021

It is projected to reach more than US$ 3.9 Bn by 2031

The CAGR is anticipated to be 4.6% from 2022 to 2031

Increase in geriatric population and rise in prevalence of chronic diseases

The high-end ICU ventilators segment held the largest share in 2021

North America is expected to account for major share from 2022 to 2031

Medtronic, Getinge AB, Drägerwerk AG & Co. KGaA, Hamilton Medical, GE HealthCare, Fresenius Medical Care AG & Co. KGaA, Koninklijke Philips N.V., Abbott, Siemens Healthcare GmbH, and Stryker

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Intensive Care Unit (ICU) Ventilators Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Intensive Care Unit (ICU) Ventilators Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Overview of Disease Incidence and Prevalence

5.3. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long-term Impact)

6. Global Intensive Care Unit (ICU) Ventilators Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. High-end ICU Ventilators

6.3.2. Mid-end ICU Ventilators

6.3.3. Basic-end ICU Ventilators

6.4. Market Attractiveness Analysis, by Type

7. Global Intensive Care Unit (ICU) Ventilators Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Intensive Care Unit (ICU) Ventilators Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Intensive Care Unit (ICU) Ventilators Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Type, 2017–2031

9.2.1. High-end ICU Ventilators

9.2.2. Mid-end ICU Ventilators

9.2.3. Basic-end ICU Ventilators

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Intensive Care Unit (ICU) Ventilators Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. High-end ICU Ventilators

10.2.2. Mid-end ICU Ventilators

10.2.3. Basic-end ICU Ventilators

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Ambulatory Surgical Centers

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Intensive Care Unit (ICU) Ventilators Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. High-end ICU Ventilators

11.2.2. Mid-end ICU Ventilators

11.2.3. Basic-end ICU Ventilators

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Ambulatory Surgical Centers

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Intensive Care Unit (ICU) Ventilators Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. High-end ICU Ventilators

12.2.2. Mid-end ICU Ventilators

12.2.3. Basic-end ICU Ventilators

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Ambulatory Surgical Centers

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. High-end ICU Ventilators

13.2.2. Mid-end ICU Ventilators

13.2.3. Basic-end ICU Ventilators

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Ambulatory Surgical Centers

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2021)

14.3. Company Profiles

14.3.1. Medtronic

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Getinge AB

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Drägerwerk AG & Co. KGaA

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Hamilton Medical

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. GE HealthCare

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.6. Fresenius Medical Care AG & Co. KGaA

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.7. Koninklijke Philips N.V.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.8. Abbott

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.9. Siemens Healthcare GmbH

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.10. Stryker

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 01: Global Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 02: Global Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 05: North America Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: North America Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 08: Europe Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 11: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 14: Latin America Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Latin America Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 17: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Type, 2021 and 2031

Figure 03: Global Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Type, 2022–2031

Figure 04: Global Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by End-user, 2021 and 2031

Figure 05: Global Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by End-user, 2022–2031

Figure 06: Global Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Region, 2021 and 2031

Figure 07: Global Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Region, 2022–2031

Figure 08: North America Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Type, 2021 and 2031

Figure 10: North America Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Type, 2022–2031

Figure 11: North America Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by End-user, 2021 and 2031

Figure 12: North America Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by End-user, 2022–2031

Figure 13: North America Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Country, 2021 and 2031

Figure 14: North America Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Country, 2022–2031

Figure 15: Europe Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Type, 2021 and 2031

Figure 17: Europe Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Type, 2022–2031

Figure 18: Europe Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by End-user, 2021 and 2031

Figure 19: Europe Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by End-user, 2022–2031

Figure 20: Europe Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 21: Europe Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 22: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Type, 2021 and 2031

Figure 24: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Type, 2022–2031

Figure 25: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by End-user, 2021 and 2031

Figure 26: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by End-user, 2022–2031

Figure 27: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 28: Asia Pacific Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 29: Latin America Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Type, 2021 and 2031

Figure 31: Latin America Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Type, 2022–2031

Figure 32: Latin America Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by End-user, 2021 and 2031

Figure 33: Latin America Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by End-user, 2022–2031

Figure 34: Latin America Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Latin America Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Type, 2021 and 2031

Figure 38: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Type, 2022–2031

Figure 39: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by End-user, 2021 and 2031

Figure 40: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by End-user, 2022–2031

Figure 41: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 42: Middle East & Africa Intensive Care Unit (ICU) Ventilators Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Global Intensive Care Unit (ICU) Ventilators Market Share Analysis, by Company, 2021