The much-dreaded coronavirus (COVID-19) has turned once-bustling offices into ghost towns. This phenomenon is actually opening doors for improvements at physical workplaces in the integrated workplace management system (IWMS) market. Since employees are practicing mandatory isolation, companies can evaluate current space use, plan entire departments, and optimize workplace technology. Novel integrated workplace management systems provide valuable tools for space optimization and asset management.

COVID-19 is giving facility professionals in the integrated workplace management system (IWMS) market the opportunity to plan new designs and maximize on underutilized space to fit activity-based options for employees. Employers can rely on integrated workplace management systems to enhance the productivity of employees with the help of enterprise-wide data and analytics. Move management software is one of the growing trends in big and mid-sized enterprises. This software allows employers to spot potential gaps and identify the need for new equipment that could build a suitable workplace ecosystem for employees.

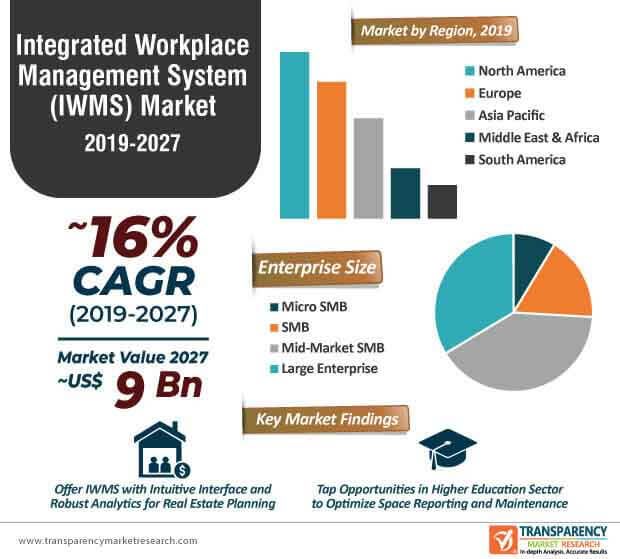

There is a growing demand for robust analytics for real estate and capital planning in the market for integrated workplace management systems. As such, the real estate industry dominates the highest revenue in the market landscape where the market is estimated to be valued at ~US$ 9 Bn by the end of 2027. Vendors who are offering functions for real estate management in their integrated workplace management systems are acquiring global recognition.

Companies in the integrated workplace management system (IWMS) market are increasing their focus in digital workplace platforms that are instrumental in improving employee effectiveness. Maintenance management, sustainability & energy management, and capital project management are becoming the key focus points for vendors in the integrated workplace management system (IWMS) market.

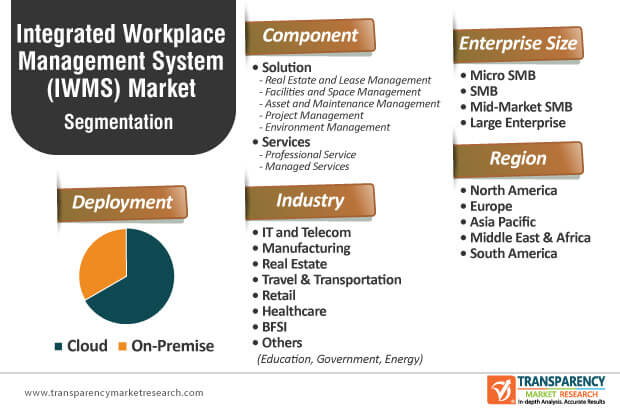

Integrated workplace management systems are deployed either on-premises or via the SaaS (Software-as-a-Service) approach. For budget-strapped employers, integrated workplace management systems incorporated with SaaS is a suitable option. The SaaS approach helps in faster recovery from disaster or other business interruptions. However, in some cases, the SaaS approach can be more expensive than the on-premises approach with mandatory handling of all IT through in-house resources.

The integrated workplace management system (IWMS) market is advancing at a lightning CAGR of ~16% during the forecast period. Thus, the on-premises approach is a suitable option if an employer already has an IT staff and infrastructure in place for IWMS deployment. Such business practices help in cost reduction instead of switching to the SaaS model. However, it is challenging to ensure the reliability of the systems if the employer’s IT infrastructure is not backed-up with a professional staff. Hence, employers in the integrated workplace management system (IWMS) market are weighing their choices between capital, scalability, and security to use IWMS with its full potential.

There is a need for improved and efficient operational solutions to steer growth for the integrated workplace management system (IWMS) market. Hence, vendors are focusing on developing integrated workplace management systems that deploy data exchange and real-time process integration. This is being achieved by innovating in cloud-based models that deliver real-time application dashboards and reporting. As such, the cloud-based deployment segment is estimated to account for ~76% in 2027. Hence, vendors are tapping into incremental opportunities in multi-tenant cloud architectures to support IWMS.

Since enterprise resource planning (ERP) and HR applications are inevitable in workplace ecosystems, vendors in the integrated workplace management system (IWMS) market are offering sophisticated financial calculation functions that manage all accounting needs. Real-time process integration ensures that all employees have access to same information. Thus, companies in the market landscape are targeting end users that are looking to automate and manage a broad set of real estate and facilities operations.

Analysts’ Viewpoint

The COVID-19 pandemic is a silver lining for workplace managers to reduce the financial burden by maximizing existing space to introduce activity-driven practices that fill the workplace with fresh ideas post the pandemic. Proving tools for corporate real estate management is creating value-grab opportunities for vendors.

On-premises IWMS solutions are cheaper and easier to incorporate in a workplace as opposed to SaaS. However, targeting aggressive growth and scaling up in business with conventional on-premises model could be a challenge with IWMS. Hence, companies in the integrated workplace management system (IWMS) market should increase their focus in cloud-based models that deliver real-time applications dashboards and reporting.

Integrated Workplace Management System Market Predicted to 16% CAGR during the Forecast Period.

Integrated Workplace Management System Market Forecast Till 2027

The Players Involved in the Integrated Workplace Management System Market are Accruent, LLC, Archibus, Inc, AssetWorks, LLC, Facilio Inc., FASEAS NV (Spacewell) others.

North America Will Lead Integrated Workplace Management System Market

The Integrated Workplace Management System Market Would be of US$ 9 Bn By 2027.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Integrated Workplace Management System (IWMS) Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macroeconomic Factors Overview

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Mn), 2012, 2018, 2026, 2027

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PESTEL Analysis

4.4.3. Value Chain/Ecosystem Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.5. Regulations and Policies

4.6. Impact Analysis Based on Technology

4.6.1. Internet of Things (IoT)

4.6.2. Cloud Computing

4.6.3. Artificial Intelligence (AI)

4.7. Case Studies

4.8. Global Integrated Workplace Management System (IWMS) Market Analysis and Forecast, 2015 - 2027

4.8.1. Market Revenue Analysis (US$ Mn)

4.8.1.1. Historic Growth Trends, 2015-2018

4.8.1.2. Forecast Trends, 2019-2027

4.9. Market Opportunity Assessment – By Region/ Country (Global/ North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.9.1. By Region/Country

4.9.2. By Component

4.9.3. By Deployment

4.9.4. By Enterprise Size

4.9.5. By Industry

4.10. Competitive Scenario and Trends

4.10.1. Integrated Workplace Management System (IWMS) Market Concentration Rate

4.10.1.1. List of Emerging, Prominent and Leading Players

4.10.2. Mergers & Acquisitions, Expansions

4.11. Market Outlook

5. Global Integrated Workplace Management System (IWMS) Market Analysis and Forecast, by Component

5.1. Overview and Definition

5.2. Key Segment Analysis

5.3. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

5.3.1. Solution

5.3.1.1. Real Estate and Lease Management

5.3.1.2. Facilities and Space Management

5.3.1.3. Asset and Maintenance Management

5.3.1.4. Project Management

5.3.1.5. Environment Management

5.3.2. Services

5.3.2.1. Professional Service

5.3.2.2. Managed Services

6. Global Integrated Workplace Management System (IWMS) Market Analysis and Forecast, by Deployment

6.1. Overview & Definition

6.2. Key Segment Analysis

6.3. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

6.3.1. Cloud

6.3.2. On-premise

7. Global Integrated Workplace Management System (IWMS) Market Analysis and Forecast, by Enterprise Size

7.1. Key Segment Analysis

7.2. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

7.2.1. Micro SMB

7.2.2. SMB

7.2.3. Mid-Market SMB

7.2.4. Large Enterprise

8. Global Integrated Workplace Management System (IWMS) Market Analysis and Forecast, by Industry

8.1. Key Segment Analysis

8.2. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

8.2.1. IT and Telecom

8.2.2. Manufacturing

8.2.3. Real Estate

8.2.4. Travel & Transportation

8.2.5. Retail

8.2.6. Healthcare

8.2.7. BFSI

8.2.8. Others (Education, Government, Energy)

9. Global Integrated Workplace Management System (IWMS) Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Integrated Workplace Management System (IWMS) Market Analysis and Forecast

10.1. Regional Outlook

10.2. Key Findings

10.3. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

10.3.1. Solution

10.3.1.1. Real Estate and Lease Management

10.3.1.2. Facilities and Space Management

10.3.1.3. Asset and Maintenance Management

10.3.1.4. Project Management

10.3.1.5. Environment Management

10.3.2. Services

10.3.2.1. Professional Service

10.3.2.2. Managed Services

10.4. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

10.4.1. Cloud

10.4.2. On-premise

10.5. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

10.5.1. Micro SMB

10.5.2. SMB

10.5.3. Mid-Market SMB

10.5.4. Large Enterprise

10.6. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

10.6.1. IT and Telecom

10.6.2. Manufacturing

10.6.3. Real Estate

10.6.4. Travel & Transportation

10.6.5. Retail

10.6.6. Healthcare

10.6.7. BFSI

10.6.8. Others (Education, Government, Energy)

10.7. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

11. Europe Integrated Workplace Management System (IWMS) Market Analysis and Forecast

11.1. Regional Outlook

11.2. Key Findings

11.3. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

11.3.1. Solution

11.3.1.1. Real Estate and Lease Management

11.3.1.2. Facilities and Space Management

11.3.1.3. Asset and Maintenance Management

11.3.1.4. Project Management

11.3.1.5. Environment Management

11.3.2. Services

11.3.2.1. Professional Service

11.3.2.2. Managed Services

11.4. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

11.4.1. Cloud

11.4.2. On-premise

11.5. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

11.5.1. Micro SMB

11.5.2. SMB

11.5.3. Mid-Market SMB

11.5.4. Large Enterprise

11.6. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

11.6.1. IT and Telecom

11.6.2. Manufacturing

11.6.3. Real Estate

11.6.4. Travel & Transportation

11.6.5. Retail

11.6.6. Healthcare

11.6.7. BFSI

11.6.8. Others (Education, Government, Energy)

11.7. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

11.7.1. Germany

11.7.2. U.K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Rest of Europe

12. Asia Pacific Integrated Workplace Management System (IWMS) Market Analysis and Forecast

12.1. Regional Outlook

12.2. Key Findings

12.3. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

12.3.1. Solution

12.3.1.1. Real Estate and Lease Management

12.3.1.2. Facilities and Space Management

12.3.1.3. Asset and Maintenance Management

12.3.1.4. Project Management

12.3.1.5. Environment Management

12.3.2. Services

12.3.2.1. Professional Service

12.3.2.2. Managed Services

12.4. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

12.4.1. Cloud

12.4.2. On-premise

12.5. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

12.5.1. Micro SMB

12.5.2. SMB

12.5.3. Mid-Market SMB

12.5.4. Large Enterprise

12.6. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

12.6.1. IT and Telecom

12.6.2. Manufacturing

12.6.3. Real Estate

12.6.4. Travel & Transportation

12.6.5. Retail

12.6.6. Healthcare

12.6.7. BFSI

12.6.8. Others (Education, Government, Energy)

12.7. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. Australia

12.7.5. Rest of Asia Pacific

13. Middle East & Africa (MEA) Integrated Workplace Management System (IWMS) Market Analysis and Forecast

13.1. Regional Outlook

13.2. Key Findings

13.3. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

13.3.1. Solution

13.3.1.1. Real Estate and Lease Management

13.3.1.2. Facilities and Space Management

13.3.1.3. Asset and Maintenance Management

13.3.1.4. Project Management

13.3.1.5. Environment Management

13.3.2. Services

13.3.2.1. Professional Service

13.3.2.2. Managed Services

13.4. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

13.4.1. Cloud

13.4.2. On-premise

13.5. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

13.5.1. Micro SMB

13.5.2. SMB

13.5.3. Mid-Market SMB

13.5.4. Large Enterprise

13.6. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

13.6.1. IT and Telecom

13.6.2. Manufacturing

13.6.3. Real Estate

13.6.4. Travel & Transportation

13.6.5. Retail

13.6.6. Healthcare

13.6.7. BFSI

13.6.8. Others (Education, Government, Energy)

13.7. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of MEA

14. South America Integrated Workplace Management System (IWMS) Market Analysis and Forecast

14.1. Regional Outlook

14.2. Key Findings

14.3. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

14.3.1. Solution

14.3.1.1. Real Estate and Lease Management

14.3.1.2. Facilities and Space Management

14.3.1.3. Asset and Maintenance Management

14.3.1.4. Project Management

14.3.1.5. Environment Management

14.3.2. Services

14.3.2.1. Professional Service

14.3.2.2. Managed Services

14.4. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Deployment, 2017 - 2027

14.4.1. Cloud

14.4.2. On-premise

14.5. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

14.5.1. Micro SMB

14.5.2. SMB

14.5.3. Mid-Market SMB

14.5.4. Large Enterprise

14.6. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

14.6.1. IT and Telecom

14.6.2. Manufacturing

14.6.3. Real Estate

14.6.4. Travel & Transportation

14.6.5. Retail

14.6.6. Healthcare

14.6.7. BFSI

14.6.8. Others (Education, Government, Energy)

14.7. Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

14.7.1. Brazil

14.7.2. Rest of South America

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Revenue Share Analysis (%), by Company (2018)

15.3. Company Mapping by Module

16. Company Profiles (Details – Business Overview, Financials, Recent Developments, and Business Strategy)

16.1. Accruent, LLC

16.1.1. Business Overview

16.1.2. Financials

16.1.3. Recent Developments

16.1.4. Business Strategy

16.2. Archibus, Inc.

16.2.1. Business Overview

16.2.2. Financials

16.2.3. Recent Developments

16.2.4. Business Strategy

16.3. AssetWorks, LLC

16.3.1. Business Overview

16.3.2. Financials

16.3.3. Recent Developments

16.3.4. Business Strategy

16.4. Facilio Inc.

16.4.1. Business Overview

16.4.2. Financials

16.4.3. Recent Developments

16.4.4. Business Strategy

16.5. FASEAS NV (Spacewell)

16.5.1. Business Overview

16.5.2. Financials

16.5.3. Recent Developments

16.5.4. Business Strategy

16.6. FM:Systems Group, LLC

16.6.1. Business Overview

16.6.2. Financials

16.6.3. Recent Developments

16.6.4. Business Strategy

16.7. FSI (FM Solutions) Limited

16.7.1. Business Overview

16.7.2. Financials

16.7.3. Recent Developments

16.7.4. Business Strategy

16.8. IBM Corporation

16.8.1. Business Overview

16.8.2. Financials

16.8.3. Recent Developments

16.8.4. Business Strategy

16.9. Indus Systems, Inc.

16.9.1. Business Overview

16.9.2. Financials

16.9.3. Recent Developments

16.9.4. Business Strategy

16.10. Ioffice Corporation

16.10.1. Business Overview

16.10.2. Financials

16.10.3. Recent Developments

16.10.4. Business Strategy

16.11. MCS Corp

16.11.1. Business Overview

16.11.2. Financials

16.11.3. Recent Developments

16.11.4. Business Strategy

16.12. MRI Software LLC

16.12.1. Business Overview

16.12.2. Financials

16.12.3. Recent Developments

16.12.4. Business Strategy

16.13. Nuvolo Technologies Corp

16.13.1. Business Overview

16.13.2. Financials

16.13.3. Recent Developments

16.13.4. Business Strategy

16.14. Oracle Corporation

16.14.1. Business Overview

16.14.2. Financials

16.14.3. Recent Developments

16.14.4. Business Strategy

16.15. Planon Group

16.15.1. Business Overview

16.15.2. Financials

16.15.3. Recent Developments

16.15.4. Business Strategy

16.16. Qube Global Software Ltd.

16.16.1. Business Overview

16.16.2. Financials

16.16.3. Recent Developments

16.16.4. Business Strategy

16.17. SAP SE

16.17.1. Business Overview

16.17.2. Financials

16.17.3. Recent Developments

16.17.4. Business Strategy

16.18. Trimble Navigation Limited (Manhattan)

16.18.1. Business Overview

16.18.2. Financials

16.18.3. Recent Developments

16.18.4. Business Strategy

16.19. Visual Lease, LLC

16.19.1. Business Overview

16.19.2. Financials

16.19.3. Recent Developments

16.19.4. Business Strategy

16.20. zLink, Inc

16.20.1. Business Overview

16.20.2. Financials

16.20.3. Recent Developments

16.20.4. Business Strategy

17. Key Takeaways

List of Tables

Table 1: Global Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 2: Global Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

Table 3: Global Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table 4: Global Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Region, 2017 - 2027

Table 5: North America Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 6: North America Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Deployment, 2017 - 2027

Table 7: North America Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

Table 8: North America Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table 9: North America Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 10: Europe Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 11: Europe Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Deployment, 2017 - 2027

Table 12: Europe Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

Table 13: Europe Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table 14: Europe Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 15: Asia Pacific Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 16: Asia Pacific Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Deployment, 2017 - 2027

Table 17: Asia Pacific Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

Table 18: Asia Pacific Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table 19: Asia Pacific Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 20: Middle East & Africa Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 21: Middle East & Africa Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Deployment, 2017 - 2027

Table 22: Middle East & Africa Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

Table 23: Middle East & Africa Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table 24: Middle East & Africa Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 25: South America Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 26: South America Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Deployment, 2017 - 2027

Table 27: South America Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

Table 28: South America Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Industry, 2017 - 2027

Table 29: Middle East & Africa Integrated Workplace Management System (IWMS) Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

List of Figures

Figure 1: Global Integrated Workplace Management System (IWMS) Market Size (US$ Mn) Forecast, 2017–2027

Figure 2: Global Integrated Workplace Management System (IWMS) Market Revenue Forecast, by Region, 2019–2027

Figure 3: Regional Outline - CAGR, by Region, 2019-2027

Figure 4: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 5: Top Economies GDP Landscape, 2018

Figure 6: Global ICT Spending

Figure 7: Global ICT Spending (%), by Region, 2019

Figure 8: Global ICT Spending (US$ Bn), Regional Contribution, 2019

Figure 9: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019

Figure 10: Global ICT Spending (%), by Type, 2019

Figure 12: Global Integrated Workplace Management System (IWMS) Market Historic Growth Trends (US$ Mn), 2015 – 2018

Figure 13: Global Integrated Workplace Management System (IWMS) Market Y-o-Y Growth (Value %), 2015 – 2018

Figure 14: Global Integrated Workplace Management System (IWMS) Market Forecast Trends (US$ Mn), 2019 - 2027

Figure 15: Global Integrated Workplace Management System (IWMS) Market Y-o-Y Growth (Value %), 2019 - 2027

Figure 16: Global Integrated Workplace Management System (IWMS) Market Opportunity Analysis, by Component (2019)

Figure 17: Global Integrated Workplace Management System (IWMS) Market Opportunity Analysis, by Deployment (2019)

Figure 18: Global Integrated Workplace Management System (IWMS) Market Opportunity Analysis, by Enterprise Size (2019)

Figure 19: Global Integrated Workplace Management System (IWMS) Market Opportunity Analysis, by Industry (2019)

Figure 20: Global Integrated Workplace Management System (IWMS) Market Opportunity Analysis, by Region (2019)

Figure 21: Global Integrated Workplace Management System (IWMS) Market, by Component CAGR (%) (2019 – 2027)

Figure 22: Global Integrated Workplace Management System (IWMS) Market, by Deployment CAGR (%) (2019 – 2027)

Figure 23: Global Integrated Workplace Management System (IWMS) Market, by Enterprise Size CAGR (%) (2019 – 2027)

Figure 24: Global Integrated Workplace Management System (IWMS) Market, by Industry CAGR (%) (2019 – 2027)

Figure 25: Global Integrated Workplace Management System (IWMS) Market, by Region CAGR (%) (2019 – 2027)

Figure 26: Global Integrated Workplace Management System (IWMS) Market, by Major Countries CAGR (%) (2019 – 2027)

Figure 27: Global Integrated Workplace Management System (IWMS) Market, by Component, 2019

Figure 28: Global Integrated Workplace Component System (IWMS) Market, by Deployment, 2027

Figure 29: Global Integrated Workplace Management System (IWMS) Market, by Deployment, 2019

Figure 30: Global Integrated Workplace Management System (IWMS) Market, by Deployment, 2027

Figure 31: Global Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2019

Figure 32: Global Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2027

Figure 33: Global Integrated Workplace Management System (IWMS) Market, by Industry, 2019

Figure 34: Global Integrated Workplace Management System (IWMS) Market, by Industry, 2027

Figure 35: Global Integrated Workplace Management System (IWMS) Market, by Region, 2019

Figure 36: Global Integrated Workplace Management System (IWMS) Market, by Region, 2027

Figure 37: North America Integrated Workplace Management System (IWMS) Market, by Component, 2019

Figure 38: North America Integrated Workplace Management System (IWMS) Market, by Component, 2027

Figure 39: North America Integrated Workplace Management System (IWMS) Market, by Deployment, 2019

Figure 40: North America Integrated Workplace Management System (IWMS) Market, by Deployment, 2027

Figure 41: North America Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2019

Figure 42: North America Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2027

Figure 43: North America Integrated Workplace Management System (IWMS) Market, by Industry, 2019

Figure 44: North America Integrated Workplace Management System (IWMS) Market, by Industry, 2027

Figure 45: North America Integrated Workplace Management System (IWMS) Market, by Country, 2019

Figure 46: North America Integrated Workplace Management System (IWMS) Market, by Country, 2027

Figure 47: Europe Integrated Workplace Management System (IWMS) Market, by Component, 2019

Figure 48: Europe Integrated Workplace Management System (IWMS) Market, by Component, 2027

Figure 49: Europe Integrated Workplace Management System (IWMS) Market, by Deployment, 2019

Figure 50: Europe Integrated Workplace Management System (IWMS) Market, by Deployment, 2027

Figure 51: Europe Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2019

Figure 52: Europe Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2027

Figure 53: Europe Integrated Workplace Management System (IWMS) Market, by Industry, 2019

Figure 54: Europe Integrated Workplace Management System (IWMS) Market, by Industry, 2027

Figure 55: Europe Integrated Workplace Management System (IWMS) Market, by Country, 2019

Figure 56: Europe Integrated Workplace Management System (IWMS) Market, by Country, 2027

Figure 57: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Component, 2019

Figure 58: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Component, 2027

Figure 59: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Deployment, 2019

Figure 60: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Deployment, 2027

Figure 61: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2019

Figure 62: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2027

Figure 63: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Industry, 2019

Figure 64: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Industry, 2027

Figure 65: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Country, 2019

Figure 66: Asia Pacific Integrated Workplace Management System (IWMS) Market, by Country, 2027

Figure 67: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Component, 2019

Figure 68: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Component, 2027

Figure 69: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Deployment, 2019

Figure 70: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Deployment, 2027

Figure 71: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2019

Figure 72: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2027

Figure 73: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Industry, 2019

Figure 74: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Industry, 2027

Figure 75: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Country, 2019

Figure 76: Middle East & Africa Integrated Workplace Management System (IWMS) Market, by Country, 2027

Figure 77: South America Integrated Workplace Management System (IWMS) Market, by Component, 2019

Figure 78: South America Integrated Workplace Management System (IWMS) Market, by Component, 2027

Figure 79: South America Integrated Workplace Management System (IWMS) Market, by Deployment, 2019

Figure 80: South America Integrated Workplace Management System (IWMS) Market, by Deployment, 2027

Figure 81: South America Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2019

Figure 82: South America Integrated Workplace Management System (IWMS) Market, by Enterprise Size, 2027

Figure 83: South America Integrated Workplace Management System (IWMS) Market, by Industry, 2019

Figure 84: South America Integrated Workplace Management System (IWMS) Market, by Industry, 2027

Figure 85: South America Integrated Workplace Management System (IWMS) Market, by Country, 2019

Figure 86: South America Integrated Workplace Management System (IWMS) Market, by Country, 2027