Patient suffering from either type of diabetes mellitus require insulin to regulate adequate glucose level in the blood. Technological innovations in medical field have enabled patients to self-administer insulin in required amount. This avoids the need to visit medical professionals every now and then.

Meanwhile, increasing incidence of diabetes has been driving demand for minimal invasive devices for intravenous delivery of insulin in the body. This, in turn, is boosting insulin delivery devices market.

Obesity, sedentary lifestyles, and aging are few causes of diabetes across the globe. Among all, obesity is the leading factor resulting in development of diabetes in individuals. As per a report published by the World Health Organization (WHO), in 2014, around 1.9 billion people were categorized as overweight. Further, 600 million were identified as obese. Obesity and overweight are few risk factors highly associated with diabetes. Growing prevalence of diabetes across the globe contribute to expansion of global insulin delivery devices market.

Some of the commonly used insulin delivery devices include- insulin pens, insulin syringes, and insulin pumps among other. Compatibility of these devices is underpinning the adoption rate of insulin deliver devices at sturdy rate.

Among all the devices, insulin pens accounts for maximum share in the global market. Prominence of the device is attributed to its user-friendly feature. Rising popularity about the device is pushing its adoption rate. Further, manufacturers are registering the adoption rate, and thus, focusing on consistent advancement of the device.

However, enforcement of strict regulations for approval of such products along with rising cost of insulin analogs in diabetes care management may hinder growth of the market in forthcoming years.

In a fragmented and intensely competitive market landscape, most players in the global insulin delivery devices market are focused on uncovering new methods that help patients in better control of glycemia. Transparency Market Research (TMR) notes that many manufacturers of insulin delivery devices points toward reduction of the cost of healthcare through adoption of competitive pricing strategies. Existing players are entering into strategic alliances and also collaborating with diabetes associations and providers of microfluidic technology providers. Rising number of partnerships amongst several firms in the last few years to develop cutting-edge technologies are likely to up the ante in the global insulin delivery devices market, notes TMR. Presence of several big multinational players and small regional players in the market is likely to keep the intensity of competition up in the next few years.

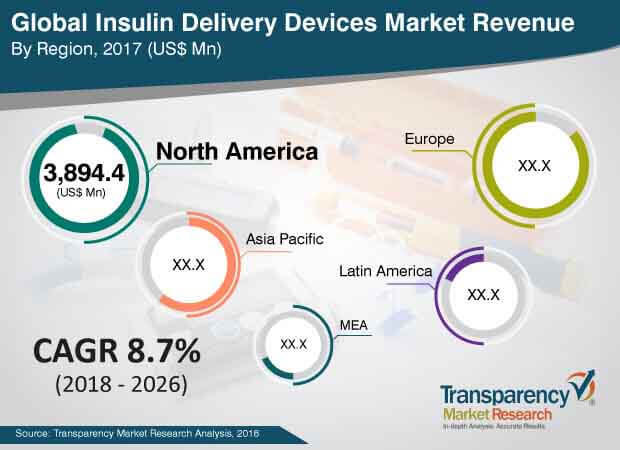

Expanding at 8.7% CAGR, the global insulin delivery devices market is projected to reach market valuation of US$ 21,783.3 Mn through 2026.

Amongst the different types of delivery systems available in the insulin delivery devices market, insulin pens have emerged as an extremely popular option over the last few years. It is likely to continue its dominant demand in coming years as well, thanks to its increased safety, efficacy, and adherence to insulin therapy.

Regionally, North America has been contributing the major share of global revenues in the last few years and is likely to retain its dominance over the tenure of assessment. High prevalence of diabetes, particularly type-1 diabetes mellitus in the U.S, is estimated to influence the growth of the insulin delivery devices market in North America.

Worldwide Prevalence of Diabetes underpins Need for better Subcutaneous Insulin Delivery

Delivery devices for insulin have come a long way since its initial days. Now, it has become a popular non-invasive way of administration of insulin in patients with type-1 diabetes mellitus and in certain cases of type 2 diabetes mellitus. The insulin delivery devices market has made continuous strides pushed by the need for effective and safe devices for the management of type-1 diabetes, which has been on rise across the globe.

In the developed markets of Europe and North America and elsewhere, both the types of diabetes have affected millions of people and have been one of the leading causes of death. In addition, there has been a rise in the number of people of diabetes in Latin America and Asia Pacific as well. Insulin delivery devices have become more of a standard method for the management of long-term glycemic control. It also lessens the number of episodes of hypoglycemia, and minimize complications related to diabetes. This has further paved way for more comfortable and technologically advanced methods of insulin administration in global insulin delivery devices market.

Novel Approaches in Superior Glycemic Control to pave way to Innovations

Over the last few years, the global insulin delivery market has increasingly benefitted from the advancement made in the devices subcutaneous insulin delivery technologies, notably insulin pens. Pharmaceutical companies and other market players in the global insulin delivery devices market have made coordinated efforts to come up with products that are more friendly toward and convenient for patients. Furthermore, these devices are also minimally invasive and safer.

On the other hand, shortage of favorable reimbursement frameworks in many countries has restricted the growth of the global insulin delivery market. The vast latent opportunities that lie ahead for the market remain unutilized due to absence of reimbursement frameworks.

In addition to that, changing preference of patients in the last few years has triggered product developments in the global insulin delivery devices market. New therapies have come up in the global insulin delivery devices market. In addition, technological progress in insulin needles and syringes has assisted patients needing insulin injections get over the phobia and achieve long-term control of glycaemia.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

3. Executive Summary

3.1. Global Insulin Delivery Devices Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Key Industry Events

4.3. Global Insulin Delivery Devices Market Size (US$ Mn) Forecast, 2016–2026

4.4. Market Opportunity Map

4.5. Porter’s Five Forces Analysis

4.6. Value Chain Analysis

4.7. Insulin Delivery Devices Product Pricing Analysis

4.8. Global Insulin Delivery Devices Market Outlook

4.9. Patient Pool/users of Insulin Delivery Devices in the US, 2017

4.10. Patient Pool for Insulin Delivery Devices, by Diabetes Type I & Type II in the U.S.

5. Insulin Delivery Device Technology Trends

5.1. Advanced Insulin Delivery Devices – Insulin Pens

5.2. Advanced Insulin Delivery Devices – Insulin Pumps

5.3. Advanced Insulin Delivery Devices – Wearable Insulin Devices

5.4. Other Advanced Insulin Delivery Devices

5.5. Latest Software Related to Insulin Delivery Devices

5.6. Smart Insulin Pen Caps

5.7. Future of Connected Devices in Blood Glucose Monitoring

5.8. Prominent Future Innovators in Connected Insulin Delivery Devices

5.9. Prominent Future Innovators in Insulin Delivery Devices

6. Market Dynamics

6.1. Drivers and Restraints Snapshot Analysis

6.2. Drivers

6.3. Restraints

6.4. Opportunities

7. Global Insulin Delivery Devices Market Analysis, by Product Type

7.1. Introduction

7.2. Key Findings

7.3. Global Insulin Delivery Devices Market Value Share Analysis, by Product Type

7.4. Global Insulin Delivery Devices Market Forecast, by Product Type

7.4.1. Insulin Syringes

7.4.2. Insulin Pens

7.4.3. Insulin Pumps

7.4.4. Others (Insulin Patches & Needle-free Injection Jet)

7.5. Global Insulin Delivery Devices Market Analysis, by Product Type

7.6. Global Insulin Delivery Devices Market Attractiveness Analysis, by Product Type

7.7. Key Trends

8. Global Insulin Delivery Devices Market Analysis, by Distribution Channel

8.1. Introduction

8.2. Key Findings

8.3. Global Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel

8.4. Global Insulin Delivery Devices Market Forecast, by Distribution Channel

8.4.1. Hospital Pharmacy

8.4.2. Retail Pharmacy

8.4.3. Online Sales

8.4.4. Diabetes Clinics/Centers

8.5. Global Insulin Delivery Devices Market Analysis, by Distribution Channel

8.6. Global Insulin Delivery Devices Market Attractiveness Analysis, by Distribution Channel

8.7. Key Trends

9. Global Insulin Delivery Devices Market Analysis, by Region

9.1. Global Market Scenario, by Country

9.2. Global Insulin Delivery Devices Market Value Share Analysis, by Region

9.3. Market Insulin Delivery Devices Forecast, by Region

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Latin America

9.3.5. Middle East and Africa

9.4. Global Insulin Delivery Devices Market Attractiveness Analysis, by Region

10. North America Insulin Delivery Devices Market Analysis

10.1. Key Findings

10.2. North America Insulin Delivery Devices Market Overview

10.3. North America Insulin Delivery Devices Market Value Share Analysis, by Country

10.4. North America Insulin Delivery Devices Market Forecast, by Country

10.4.1. U.S.

10.4.2. Canada

10.5. North America Insulin Delivery Devices Market Value Share Analysis, by Product

10.6. North America Insulin Delivery Devices Market Forecast, by Product Type

10.6.1. Insulin Syringes

10.6.2. Insulin Pens

10.6.3. Insulin Pumps

10.6.4. Others (Insulin Patches & Needle-free Injection Jet)

10.7. North America Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel

10.8. North America Insulin Delivery Devices Market Forecast, by Distribution Channel

10.8.1. Hospital Pharmacy

10.8.2. Retail Pharmacy

10.8.3. Online Sales

10.8.4. Diabetes Clinics/ Centers

10.9. North America Insulin Delivery Devices Market Attractiveness Analysis

10.10. North America Insulin Delivery Devices Market Trends

11. Europe Insulin Delivery Devices Analysis

11.1. Key Findings

11.2. Europe Insulin Delivery Devices Market Overview

11.3. Europe Insulin Delivery Devices Market Value Share Analysis, by Country

11.4. Europe Insulin Delivery Devices Market Forecast, by Country

11.4.1. Germany

11.4.2. France

11.4.3. Italy

11.4.4. Spain

11.4.5. U.K.

11.4.6. Russia

11.4.7. Rest of Europe

11.5. Europe Insulin Delivery Devices Market Value Share Analysis, by Product Type

11.6. Europe Insulin Delivery Devices Market Forecast, by Product Type

11.6.1. Insulin Syringes

11.6.2. Insulin Pens

11.6.3. Insulin Pumps

11.6.4. Others (Insulin Patches & Needle-free Injection Jet)

11.7. Europe Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel

11.8. Europe Insulin Delivery Devices Market Forecast, by Distribution Channel

11.8.1. Hospital Pharmacy

11.8.2. Retail Pharmacy

11.8.3. Online Sales

11.8.4. Diabetes Clinics/Centers

11.9. Europe Insulin Delivery Devices Market Attractiveness Analysis

11.10. Europe Market Trends

12. Asia Pacific Insulin Delivery Devices Analysis

12.1. Key Findings

12.2. Asia Pacific Insulin Delivery Devices Market Overview

12.3. Asia Pacific Insulin Delivery Devices Market Value Share Analysis, by Country

12.4. Asia Pacific Insulin Delivery Devices Market Forecast, by Country

12.4.1. China

12.4.2. Japan

12.4.3. India

12.4.4. Australia & New Zealand

12.4.5. Rest of Asia Pacific

12.5. Asia Pacific Insulin Delivery Devices Market Value Share Analysis, by Product Type

12.6. Asia Pacific Insulin Delivery Devices Market Forecast, by Product Type

12.6.1. Insulin Syringes

12.6.2. Insulin Pens

12.6.3. Insulin Pumps

12.6.4. Others (Insulin Patches & Needle-free Injection Jet)

12.7. Asia Pacific Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel

12.8. Asia Pacific Insulin Delivery Devices Market Forecast, by Distribution Channel

12.8.1. Hospital Pharmacy

12.8.2. Retail Pharmacy

12.8.3. Online Sales

12.8.4. Diabetes Clinics/Centers

12.9. Asia Pacific Insulin Delivery Devices Market Attractiveness Analysis

12.10. Asia Pacific Insulin Delivery Devices Market Trends

13. Latin America Insulin Delivery Devices Analysis

13.1. Key Findings

13.2. Latin America Insulin Delivery Devices Market Overview

13.3. Latin America Insulin Delivery Devices Market Value Share Analysis, by Country

13.4. Latin America Insulin Delivery Devices Market Forecast, by Country

13.4.1. Brazil

13.4.2. Mexico

13.4.3. Rest of Latin America

13.5. Latin America Insulin Delivery Devices Market Value Share Analysis, by Product Type

13.6. Latin America Insulin Delivery Devices Market Forecast, by Product Type

13.6.1. Insulin Syringes

13.6.2. Insulin Pens

13.6.3. Insulin Pumps

13.6.4. Others (Insulin Patches & Needle-free Injection Jet)

13.7. Latin America Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel

13.8. Latin America Insulin Delivery Devices Market Forecast, by Distribution Channel

13.8.1. Hospital Pharmacy

13.8.2. Retail Pharmacy

13.8.3. Online Sales

13.8.4. Diabetes Clinics/Centers

13.9. Latin America Insulin Delivery Devices Market Attractiveness Analysis

13.10. Latin America Insulin Delivery Devices Market Trends

14. Middle East and Africa Insulin Delivery Devices Analysis

14.1. Key Findings

14.2. Middle East and Africa Insulin Delivery Devices Market Overview

14.3. Middle East and Africa Insulin Delivery Devices Market Value Share Analysis, by Country

14.4. Middle East and Africa Insulin Delivery Devices Market Forecast, by Country

14.4.1. GCC Countries

14.4.2. South Africa

14.4.3. Rest of Middle East and Africa

14.5. Middle East and Africa Insulin Delivery Devices Market Value Share Analysis, by Product Type

14.6. Middle East and Africa Insulin Delivery Devices Market Forecast, by Product Type

14.6.1. Insulin Syringes

14.6.2. Insulin Pens

14.6.3. Insulin Pumps

14.6.4. Others (Insulin Patches & Needle-free Injection Jet)

14.7. Middle East and Africa Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel

14.8. Middle East and Africa Insulin Delivery Devices Market Forecast, by Distribution Channel

14.8.1. Hospital Pharmacy

14.8.2. Retail Pharmacy

14.8.3. Online Sales

14.8.4. Diabetes Clinics/Centers

14.9. Middle East and Africa Insulin Delivery Devices Market Attractiveness Analysis

14.10. Middle East and Africa Insulin Delivery Devices Market Trends

15. Competition Landscape

15.1. Insulin Delivery Devices Market Share Analysis, by Company

15.2. Competition Matrix

15.3. Company Profiles

15.3.1. Becton, Dickinson and Company

15.3.1.1. Company Profiles

15.3.1.2. Business Overview

15.3.1.3. Strategic Overview

15.3.1.4. SWOT Analysis

15.3.2. Sanofi S.A.

15.3.2.1. Company Profiles

15.3.2.2. Business Overview

15.3.2.3. Strategic Overview

15.3.2.4. SWOT Analysis

15.3.3. Medtronic plc

15.3.3.1. Company Profiles

15.3.3.2. Business Overview

15.3.3.3. Strategic Overview

15.3.3.4. SWOT Analysis

15.3.4. B. Braun Melsungen AG

15.3.4.1. Company Profiles

15.3.4.2. Business Overview

15.3.4.3. Strategic Overview

15.3.4.4. SWOT Analysis

15.3.5. Novo Novardisk A/S

15.3.5.1. Company Profiles

15.3.5.2. Business Overview

15.3.5.3. Strategic Overview

15.3.5.4. SWOT Analysis

15.3.6. Eli Lilly and Company

15.3.6.1. Company Profiles

15.3.6.2. Business Overview

15.3.6.3. Strategic Overview

15.3.6.4. SWOT Analysis

15.3.7. Biocon Ltd.

15.3.7.1. Company Profiles

15.3.7.2. Business Overview

15.3.7.3. Strategic Overview

15.3.7.4. SWOT Analysis

15.3.8. Owen Mumford Ltd.

15.3.8.1. Company Profiles

15.3.8.2. Business Overview

15.3.8.3. Strategic Overview

15.3.8.4. SWOT Analysis

15.3.9. Cellnova Group SA

15.3.9.1. Company Profiles

15.3.9.2. Business Overview

15.3.9.3. Strategic Overview

15.3.9.4. SWOT Analysis

15.3.10. Yepsomed Holding AG

15.3.10.1. Company Profiles

15.3.10.2. Business Overview

15.3.10.3. Strategic Overview

15.3.10.4. SWOT Analysis

15.3.11. F. Hoffmann-La Roche Ltd.

15.3.11.1. Company Profiles

15.3.11.2. Business Overview

15.3.11.3. Strategic Overview

15.3.11.4. SWOT Analysis

15.3.12. Valeritas Inc.

15.3.12.1. Company Profiles

15.3.12.2. Business Overview

15.3.12.3. Strategic Overview

15.3.12.4. SWOT Analysis

15.3.13. Tandem Diabetes Care, Inc.

15.3.13.1. Company Profiles

15.3.13.2. Business Overview

15.3.13.3. Strategic Overview

15.3.13.4. SWOT Analysis

15.3.14. Insulet Corporation

15.3.14.1. Company Profiles

15.3.14.2. Business Overview

15.3.14.3. Strategic Overview

15.3.14.4. SWOT Analysis

15.3.15. SOOIL Development Co., Ltd

15.3.15.1. Company Profiles

15.3.15.2. Business Overview

15.3.15.3. Strategic Overview

15.3.15.4. SWOT Analysis

15.3.16. Mannkind Corporation

15.3.16.1. Company Profiles

15.3.16.2. Business Overview

15.3.16.3. Strategic Overview

15.3.16.4. SWOT Analysis

List of Tables

Table 01: Global Insulin Delivery Devices Average Selling Price/Product, 2017

Table 02: Global Insulin Delivery Devices Average Selling Price/Product, 2017

Table 03: Global Insulin Delivery Devices Average Selling Price/Product, 2017

Table 04: Patient Pool/users of Insulin Delivery Devices in the US, 2017

Table 05: Patient Pool for Insulin Delivery Devices, by Diabetes Type I & Type II in the US, 2017

Table 06: Global Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Product Type, 2016–2026

Table 07: Global Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pens, 2016–2026

Table 08: Global Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pumps, 2016–2026

Table 09: Global Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2026

Table 10: Global Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Region, 2016–2026

Table 11: North America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Country, 2016–2026

Table 12: North America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Product Type, 2016–2026

Table 13: North America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pens, 2016–2026

Table 14: North America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pumps, 2016–2026

Table 15: North America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2026

Table 16: Europe Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 17: Europe Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 18: Europe Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pens, 2016–2026

Table 19: Europe Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pumps, 2016–2026

Table 20: Europe Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2026

Table 21: Asia Pacific Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 22: Asia Pacific Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Product Type, 2016–2026

Table 23: Asia Pacific Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pens, 2016–2026

Table 24: Asia Pacific Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pumps, 2016–2026

Table 25: Asia Pacific Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2026

Table 26: Latin America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 27: Latin America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Product Type, 2016–2026

Table 28: Latin America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Product Type – Insulin Pens, 2016–2026

Table 29: Latin America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Product Type – Insulin Pumps, 2016–2026

Table 30: Latin America Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2026

Table 31: Middle East & Africa Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 32: Middle East & Africa Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 33: Middle East & Africa Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pens, 2016–2026

Table 34: Middle East & Africa Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Insulin Pumps, 2016–2026

Table 35: Middle East & Africa Insulin Delivery Devices Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2026

List of Figures

Figure 01: Global Insulin Delivery Devices Market Size (US$ Mn) Forecast, 2016–2026

Figure 02: Market Value Share, by Product Type (2017)

Figure 03: Market Value Share, by Region (2017)

Figure 04: Market Value Share, by Distribution Channel (2017)

Figure 05: Global Insulin Delivery Devices Market Value Share Analysis, by Product Type, 2018 and 2026

Figure 06: Global Insulin Delivery Devices Market Revenue (US$ Mn), by Insulin Syringes, 2016–2026

Figure 07: Global Insulin Delivery Devices Market Revenue (US$ Mn), by Insulin Pens, 2016–2026

Figure 08: Global Insulin Delivery Devices Market Revenue (US$ Mn), by Insulin Pumps, 2016–2026

Figure 09: Global Insulin Delivery Devices Market Revenue (US$ Mn), by Others, 2016–2026

Figure 10: Global Insulin Delivery Devices Market Attractiveness Analysis, by Product Type, 2018–2026

Figure 11: Global Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel, 2018 and 2026

Figure 12: Global Insulin Delivery Devices Market Revenue (US$ Mn), by Hospital Pharmacy, 2016-2026

Figure 13: Global Insulin Delivery Devices Market Revenue (US$ Mn), by Retail Pharmacy, 2016-2026

Figure 14: Global Insulin Delivery Devices Market Revenue (US$ Mn), by Online Sales, 2016–2026

Figure 15: Global Insulin Delivery Devices Market Revenue (US$ Mn), by Diabetes Clinics/Centers, 2016–2026

Figure 16: Global Insulin Delivery Devices Market Attractiveness, by Distribution Channel, 2018–2026

Figure 17: Global Insulin Delivery Devices Market Value Share Analysis, by Region, 2018 and 2026

Figure 18: Global Insulin Delivery Devices Market Attractiveness, by Region, 2018–2026

Figure 19: North America Insulin Delivery Devices Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2016–2026

Figure 20: North America Insulin Delivery Devices Market Attractiveness Analysis, by Country, 2018–2026

Figure 21: North America Insulin Delivery Devices Market Value Share Analysis, by Country, 2016 and 2025

Figure 22: North America Insulin Delivery Devices Market Value Share Analysis, by Product Type, 2018 and 2026

Figure 23: North America Insulin Delivery Devices Market Value Share Analysis, by Insulin Pens, 2018 and 2026

Figure 24: North America Insulin Delivery Devices Market Value Share Analysis, by Insulin Pumps, 2018 and 2026

Figure 25: North America Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel, 2018 and 2026

Figure 26: North America Insulin Delivery Devices Market Attractiveness Analysis, by Product Type, 2018–2026

Figure 27: North America Insulin Delivery Devices Market Attractiveness Analysis, by Distribution Channel, 2018–2026

Figure 28: Europe Insulin Delivery Devices Market Size (US$ Mn) Forecast, 2016–2026

Figure 29: Europe Insulin Delivery Devices Market Attractiveness Analysis, by Country/Sub-region, 2018–2026

Figure 30: Europe Insulin Delivery Devices Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 31: Europe Insulin Delivery Devices Market Value Share Analysis, by Product, 2018 and 2026

Figure 32: Europe Insulin Delivery Devices Market Value Share Analysis, by Insulin Pens, 2018 and 2026

Figure 33: Europe Insulin Delivery Devices Market Value Share Analysis, by Insulin Pumps, 2018 and 2026

Figure 34: Europe Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel, 2018 and 2026

Figure 35: Europe Insulin Delivery Devices Market Attractiveness Analysis, by Product, 2018–2026

Figure 36: Europe Insulin Delivery Devices Market Attractiveness Analysis, by Distribution Channel, 2018–2026

Figure 37: Asia Pacific Insulin Delivery Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2026

Figure 38: Asia Pacific Insulin Delivery Devices Market Attractiveness Analysis, by Country/Sub-region, 2018–2026

Figure 39: Asia Pacific Market Insulin Delivery Devices Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 40: Asia Pacific Insulin Delivery Devices Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 41: Asia Pacific Insulin Delivery Devices Market Value Share Analysis, by Insulin Pens, 2018 and 2026

Figure 42: Asia Pacific Insulin Delivery Devices Market Value Share Analysis, by Insulin Pumps, 2016 and 2025

Figure 43: Asia Pacific Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel, 2018 and 2026

Figure 44: Asia Pacific Insulin Delivery Devices Market Attractiveness Analysis, by Product Type, 2018–2026

Figure 45: Asia Pacific Insulin Delivery Devices Market Attractiveness Analysis, by Distribution Channel, 2018–2026

Figure 46: Latin America Insulin Delivery Devices Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2016–2026

Figure 47: Latin America Insulin Delivery Devices Market Attractiveness Analysis, by Country/Sub-region, 2016–2026

Figure 48: Latin America Insulin Delivery Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 49: Latin America Insulin Delivery Devices Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 50: Latin America Insulin Delivery Devices Market Value Share Analysis, by Product Type – Insulin Pens, 2016 and 2025

Figure 51: Latin America Insulin Delivery Devices Market Value Share Analysis, by Product Type – Insulin Pumps, 2018 and 2026

Figure 52: Latin America Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel, 2018 and 2026

Figure 53: Latin America Insulin Delivery Devices Market Attractiveness Analysis, by Product Type, 2018–2026

Figure 54: Latin America Insulin Delivery Devices Market Attractiveness Analysis, by Distribution Channel, 2018–2026

Figure 55: Middle East & Africa Insulin Delivery Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 56: Middle East & Africa Insulin Delivery Devices Market Attractiveness Analysis, by Country/Sub-region, 2018–2026

Figure 57: Middle East & Africa Insulin Delivery Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 58: Middle East & Africa Insulin Delivery Devices Market Value Share Analysis, by Product, 2018 and 2026

Figure 59: Middle East & Africa Insulin Delivery Devices Market Value Share Analysis, by Insulin Pens, 2018 and 2026

Figure 60: Middle East & Africa Insulin Delivery Devices Market Value Share Analysis, by Insulin Pumps, 2018 and 2026

Figure 61: Middle East & Africa Insulin Delivery Devices Market Value Share Analysis, by Distribution Channel, 2018 and 2026

Figure 62: Middle East & Africa Insulin Delivery Devices Market Attractiveness Analysis, by Product, 2017–2025

Figure 63: Middle East & Africa Insulin Delivery Devices Market Attractiveness Analysis, by Distribution Channel, 2017–2025

Figure 64: Global Insulin Delivery Devices Market Share Analysis, by Company 2017 (Estimated)

Figure 65: Breakdown of Net Sales, by Region, 2017 (Becton, Dickinson and Company)

Figure 66: Revenue (US$ Bn) & Y-o-Y Growth (%), 2014–2017 (Becton, Dickinson and Company)

Figure 67: Breakdown of Net Sales, by Business Segment, 2017(Becton, Dickinson and Company)

Figure 68: R&D Intensity (%) – Company Level or Segment Level, 2015–2017 (Becton, Dickinson and Company)

Figure 69: Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2017 (Sanofi S.A.)

Figure 70: Breakdown of Net Sales, by Region, 2017 (Sanofi S.A.)

Figure 71: R&D Intensity (%) – Company Level or Segment Level, 2015–2017 (Sanofi S.A.)

Figure 72: Revenue (US$ Bn) & Y-o-Y Growth (%), 2014–2017 (Medtronic Plc)

Figure 73: Breakdown of Net Sales, by Region, 2017 (Medtronic Plc)

Figure 74: R&D Intensity (%) – Company Level or Segment Level, 2015–2017 (Medtronic Plc)

Figure 75: Revenue (US$ Mn) & Y-o-Y Growth (%), 2014–2017 (B. Braun Melsungen AG)

Figure 76: Breakdown of Net Sales, by Region, 2017 (B. Braun Melsungen AG)

Figure 77: R&D Intensity (%) – Company Level or Segment Level, 2015–2017 (B. Braun Melsungen AG)

Figure 78: Breakdown of Net Sales, by Region, 2017 (Novo Nordisk A/S)

Figure 79: Breakdown of Net Sales, by Business Segment, 2017 (Novo Nordisk A/S)

Figure 80: Revenue (US$ Bn) & Y-o-Y Growth (%), 2014–2017 (Novo Nordisk A/S)

Figure 81: R&D Intensity (%) – Company Level or Segment Level, 2015–2017 (Novo Nordisk A/S)

Figure 82: Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017 (Eli Lilly and Company)

Figure 83: Breakdown of Net Sales, by Region, 2017 (Eli Lilly and Company)

Figure 84: R&D Intensity (%) - Company Level or Segment Level, 2015–2017 (Eli Lilly and Company)

Figure 85: Breakdown of Net Sales, by Region, 2017 (Biocon Ltd.)

Figure 86: Breakdown of Net Sales, by Business Segment, 2017 (Biocon Ltd.)

Figure 87: Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2017 (Biocon Ltd.)

Figure 88: Breakdown of Net Sales, by Segment, 2017 (Ypsomed Holding AG)

Figure 89: Breakdown of Net Sales, by Region, 2017 (Ypsomed Holding AG)

Figure 90: Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2017 (Ypsomed Holding AG)

Figure 91: Revenue (US$ Bn) & Y-o-Y Growth (%), 2014–2017 (F. Hoffmann-La Roche Ltd.)

Figure 92: Breakdown of Net Sales, by Business Segment, 2017 (F. Hoffmann-La Roche Ltd.)

Figure 93: R&D Intensity (%) – Company Level or Segment Level, 2015–2017 (F. Hoffmann-La Roche Ltd.)

Figure 94: R&D Intensity (%) – Company Level or Segment Level, 2015–2017(Tandem Diabetes Care, Inc.)

Figure 95: Revenue (US$ Bn) & Y-o-Y Growth (%), 2014–2017(Tandem Diabetes Care, Inc.)

Figure 96: Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2017 (Insulet Corporation)

Figure 97: Breakdown of Net Sales, by Business Segment, 2017 (Insulet Corporation)

Figure 98: R&D Intensity (%) – Company Level, 2014–2017(Insulet Corporation)