Analysts’ Viewpoint

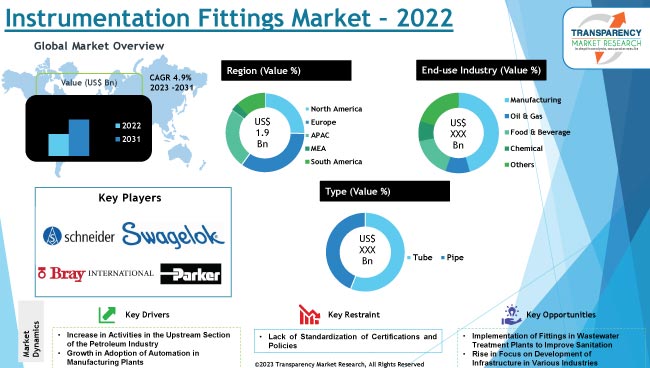

The instrumentation fittings market size is anticipated to grow at a significant pace during the forecast period, primarily driven by the booming oil & gas industry and transportation sector. Surge in investment in industrial facility modernization, and strict safety requirements mandated by various governments is boosting market expansion.

Rise in demand for fittings from chemical, and paper & pulp industries is offering lucrative opportunities for instrumentation fittings and valves vendors. Expanding drilling activities in GCC nations, and rise in energy demand is fueling market progress.

Increased investment in R&D activities by leading instrumentation fittings manufacturers to automate the production of fittings for industrial and pharmaceutical purposes is expected to exert high impact on the market. Furthermore, launch of smart city projects by various governments is likely to drive the instrumentation fittings market value.

Instrumentation fitting products are a crucial component of the production line that help in controlling the flow of liquid or gas. This type of fitting is employed in the chemical industry for a number of purposes, including the control of acid and water flow, and the prevention of backflow. The pressure of media flowing from connected and interconnected pipelines is likewise controlled via valves. Valves and fittings offer benefits such as long lifespan, resistance to corrosion from water and pollutants, and superior protection from adverse weather conditions.

Increased demand from the expanding chemical industry, and healthcare and pharmaceutical sectors, particularly in the wake of the Covid-19 pandemic, and technical advancements in the construction sector are some of the key factors propelling the instrumentation fittings market.

Covid-19 had an influence on all sectors of the economy globally; the lockdown-like conditions that limited people's movement also reduced the demand for valves and fitting items. However, the easing of regulations and the increased demand for healthcare products, both of which call for industrial valves, is likely to augment instrumentation fittings market growth during the forecast period.

One of the most important factors influencing instrumentation fittings market dynamics is the rise in activities in the upstream section of the petroleum industry. The oil & gas industry was the largest end-use industry of the instrumentation fittings market in 2021. This can be attributed to the growth in need for fittings due to process standardization, and stringent safety rules and regulations in the manufacturing process. Instrumentation fittings are also utilized as a part of the oil & gas industry in offshore apparatuses, refinery plants, and gas handling systems.

Increase in oil & gas exploration activities in Middle East & Africa and the APAC region, rise in focus on development of infrastructure, growth of chemical and manufacturing industries across the globe, and safety norms are expected to drive market statistics. Moreover, instrumentation fittings help in reducing leaks, increases service life of equipment, and ensures corrosion resistance, thus ensuring safer and more reliable systems.

Growth in use of automation in manufacturing units across various industries is an important factor boosting instrumentation fittings market opportunities. Modernization of the manufacturing environment is a priority for manufacturers. During the forecast period, instrumentation fittings are anticipated to play a significant role in process industries due to their numerous applications, usability, low cost, and energy-efficient features. Furthermore, rise in demand for fittings across a wide range of sectors due to surge in demand for improved fluid flow control and flow volume regulations is a significant market trend.

Instrumentation fittings market demand is rising primarily due to the increase in investment in upgrading industrial facilities. The manufacturing industry in APAC has expanded over the years, encouraging the establishment of industrial facilities by several foreign investors in the region.

The instrumentation fittings market forecast highlights the fact that majority of sales are anticipated to originate from North America, attributed to the dominance of top instrumentation fittings players in the U.S. and product launch strategies in Canada and Mexico. The market analysis also indicates that the industry in North America is expanding as a result of increased investment in R&D activities and growth in demand for manufacturing automation. Expansion of the regional economy, announcement of financial stimulus packages by governments, and digitization of business processes is projected to contribute to the growth of the regional instrumentation valves and fittings industry during the forecast period.

Rapid rise in population, increase in demand for instrumentation fittings from healthcare and oil & gas industries, as well as increased government initiatives and support for wastewater treatment are augmenting the instrumentation fittings market share in Asia Pacific. Furthermore, instrumentation fittings market development is likely to take place as a result of rise in demand for instrumentation fittings from manufacturing facilities located in Indonesia, South Korea, India, and China, where governments are focusing on developing local manufacturing industries.

Detailed profiles of global instrumentation fittings manufacturing companies have been provided in the market research report to evaluate their financials, key product offerings, market development, and strategies.

Prominent instrumentation fittings market players include Bray International, Waverly Bronall, Alco Valves Group, Brennen Industries, Parker Hannifin, CIRCOR international, AS-Schneider, Hex International, Fuijikin Incorporated, Richard Industries, Ham-Let Group, and Swagelok.

Each of these players have been analyzed in the instrumentation fittings market report based on parameters such as company overview, business strategies, financial overview, business segments, recent developments, and product portfolio.

|

Attribute |

Detail |

|

Market Size Value in 2022 (Base Year) |

US$ 1.9 Bn |

|

Market Forecast in 2031 |

US$ 2.8 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value, Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, technology analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, key supplier analysis, and demographic overview. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 1.9 Bn in 2022

It is projected to reach US$ 2.8 Bn by the end of 2031

It is estimated to be 4.9% from 2023 to 2031

Increase in activities in the upstream section of the petroleum industry and growth in adoption of automation in manufacturing plants

North America is likely to be a highly lucrative region for vendors during the forecast period.

Bray International, Waverly Bronall, Alco Valves Group, Brennen Industries, Parker Hannifin, CIRCOR international, AS-Schneider, Hex International, Fuijikin Incorporated, Dwyer Instruments, SSP Fittings Corporation, Richard Industries, Ham-Let Group, Safelock, and Swagelok.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Technological Overview

5.9. Regulatory Framework Analysis

5.10. Global Instrumentation Fittings Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Million Units)

6. Global Instrumentation Fittings Market Analysis and Forecast, By Type

6.1. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By Type, 2017 - 2031

6.1.1. Tube

6.1.1.1. Compression

6.1.1.2. Cone and Thread

6.1.1.3. Butt Weld

6.1.1.4. Push-To-Connect

6.1.1.5. Swivel

6.1.1.6. Others

6.1.2. Pipe

6.1.2.1. Straight

6.1.2.2. Elbow

6.1.2.3. Tee

6.1.2.4. Cross

6.2. Incremental Opportunity, By Type

7. Global Instrumentation Fittings Market Analysis and Forecast, By End-use Industry

7.1. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By End-use Industry, 2017 - 2031

7.1.1. Manufacturing

7.1.2. Oil & Gas

7.1.3. Food & Beverage

7.1.4. Chemical

7.1.5. Others

7.2. Incremental Opportunity, By End-use Industry

8. Global Instrumentation Fittings Market Analysis and Forecast, By Region

8.1. Overview

8.2. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By Region, 2017 - 2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

8.3. Incremental Opportunity, By Region

9. North America Instrumentation Fittings Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Macroeconomic Factors

9.3. Key Supplier Analysis

9.4. Price Trend Analysis

9.4.1. Weighted Average Price

9.5. Key Trends Analysis

9.5.1. Demand Side Analysis

9.5.2. Supply Side Analysis

9.6. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By Type, 2017 - 2031

9.6.1. Tube

9.6.1.1. Compression

9.6.1.2. Cone and Thread

9.6.1.3. Butt Weld

9.6.1.4. Push-To-Connect

9.6.1.5. Swivel

9.6.1.6. Others

9.6.2. Pipe

9.6.2.1. Straight

9.6.2.2. Elbow

9.6.2.3. Tee

9.6.2.4. Cross

9.7. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By End-use Industry, 2017 - 2031

9.7.1. Manufacturing

9.7.2. Oil & Gas

9.7.3. Food & Beverage

9.7.4. Chemical

9.7.5. Others

9.8. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, by Country/Sub-region, 2017 - 2031

9.8.1. The U.S.

9.8.2. Canada

9.8.3. Rest of North America

9.9. Incremental Opportunity Analysis

10. Europe Instrumentation Fittings Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Macroeconomic Factors

10.3. Key Supplier Analysis

10.4. Price Trend Analysis

10.4.1. Weighted Average Price

10.5. Key Trends Analysis

10.5.1. Demand Side Analysis

10.5.2. Supply Side Analysis

10.6. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By Type, 2017 - 2031

10.6.1. Tube

10.6.1.1. Compression

10.6.1.2. Cone and Thread

10.6.1.3. Butt Weld

10.6.1.4. Push-To-Connect

10.6.1.5. Swivel

10.6.1.6. Others

10.6.2. Pipe

10.6.2.1. Straight

10.6.2.2. Elbow

10.6.2.3. Tee

10.6.2.4. Cross

10.7. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By End-use Industry, 2017 - 2031

10.7.1. Manufacturing

10.7.2. Oil & Gas

10.7.3. Food & Beverage

10.7.4. Chemical

10.7.5. Others

10.8. Instrumentation Fittings Market Size (US$ Bn) () Forecast, by Country/Sub-region, 2017 - 2031

10.8.1. U.K.

10.8.2. Germany

10.8.3. France

10.8.4. Rest of Europe

10.9. Incremental Opportunity Analysis

11. Asia Pacific Instrumentation Fittings Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Macroeconomic Factors

11.3. Key Supplier Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Price

11.5. Key Trends Analysis

11.5.1. Demand Side Analysis

11.5.2. Supply Side Analysis

11.6. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By Type, 2017 - 2031

11.6.1. Tube

11.6.1.1. Compression

11.6.1.2. Cone and Thread

11.6.1.3. Butt Weld

11.6.1.4. Push-To-Connect

11.6.1.5. Swivel

11.6.1.6. Others

11.6.2. Pipe

11.6.2.1. Straight

11.6.2.2. Elbow

11.6.2.3. Tee

11.6.2.4. Cross

11.7. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By End-use Industry, 2017 - 2031

11.7.1. Manufacturing

11.7.2. Oil & Gas

11.7.3. Food & Beverage

11.7.4. Chemical

11.7.5. Others

11.8. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, by Country/Sub-region, 2017 - 2031

11.8.1. China

11.8.2. India

11.8.3. Japan

11.8.4. Rest of Asia Pacific

11.9. Incremental Opportunity Analysis

12. Middle East & Africa Instrumentation Fittings Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Macroeconomic Factors

12.3. Key Supplier Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Key Trends Analysis

12.5.1. Demand Side Analysis

12.5.2. Supply Side Analysis

12.6. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By Type, 2017 - 2031

12.6.1. Tube

12.6.1.1. Compression

12.6.1.2. Cone and Thread

12.6.1.3. Butt Weld

12.6.1.4. Push-To-Connect

12.6.1.5. Swivel

12.6.1.6. Others

12.6.2. Pipe

12.6.2.1. Straight

12.6.2.2. Elbow

12.6.2.3. Tee

12.6.2.4. Cross

12.7. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By End-use Industry, 2017 - 2031

12.7.1. Manufacturing

12.7.2. Oil & Gas

12.7.3. Food & Beverage

12.7.4. Chemical

12.7.5. Others

12.8. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, by Country/Sub-region, 2017 - 2031

12.8.1. GCC

12.8.2. South Africa

12.8.3. Rest of Middle East & Africa

12.9. Incremental Opportunity Analysis

13. South America Instrumentation Fittings Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Macroeconomic Factors

13.3. Key Supplier Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Price

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By Type, 2017 - 2031

13.6.1. Tube

13.6.1.1. Compression

13.6.1.2. Cone and Thread

13.6.1.3. Butt Weld

13.6.1.4. Push-To-Connect

13.6.1.5. Swivel

13.6.1.6. Others

13.6.2. Pipe

13.6.2.1. Straight

13.6.2.2. Elbow

13.6.2.3. Tee

13.6.2.4. Cross

13.7. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, By End-use Industry, 2017 - 2031

13.7.1. Manufacturing

13.7.2. Oil & Gas

13.7.3. Food & Beverage

13.7.4. Chemical

13.7.5. Others

13.8. Instrumentation Fittings Market Size (US$ Bn and Million Units) Forecast, by Country/Sub-region, 2017 - 2031

13.8.1. Brazil

13.8.2. Rest of South America

13.9. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%)-2022

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

14.3.1. Bray International

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.1.5. Go-To-Market Strategy

14.3.2. AS-Schneider

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.2.5. Go-To-Market Strategy

14.3.3. Alco Valves Group

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.3.5. Go-To-Market Strategy

14.3.4. Brennen Industries

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.4.5. Go-To-Market Strategy

14.3.5. Waverly Bronall

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.5.5. Go-To-Market Strategy

14.3.6. CIRCOR international

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.6.5. Go-To-Market Strategy

14.3.7. Hex International

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.7.5. Go-To-Market Strategy

14.3.8. Ham-Let Group

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.8.5. Go-To-Market Strategy

14.3.9. PARKER HANNIFIN CORP

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.9.5. Go-To-Market Strategy

14.3.10. Swagelok Company

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

14.3.10.5. Go-To-Market Strategy

14.3.11. Richard Industries

14.3.11.1. Company Overview

14.3.11.2. Sales Area/Geographical Presence

14.3.11.3. Revenue

14.3.11.4. Strategy & Business Overview

14.3.11.5. Go-To-Market Strategy

14.3.12. Fuijikin Incorporated

14.3.12.1. Company Overview

14.3.12.2. Sales Area/Geographical Presence

14.3.12.3. Revenue

14.3.12.4. Strategy & Business Overview

14.3.12.5. Go-To-Market Strategy

15. Go To Market Strategy

15.1. Identification of Potential Market Spaces

15.1.1. Type

15.1.2. End-Use Industry

15.1.3. Region

15.2. Understanding the Buying Process of Customers

15.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Table 2: Global Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Table 3 Global Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Table 4 Global Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Table 5: Global Instrumentation Fittings Market Projections, by Region, Million Units, 2017-2031

Table 6: Global Instrumentation Fittings Market Projections, by Region, US$ Bn 2017-2031

Table 7: North America Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Table 8: North America Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Table 9: North America Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Table 10: North America Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Table 11: North America Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Table 12: North America Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

Table 13: Europe Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Table 14: Europe Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Table 15: Europe Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Table 16: Europe Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Table 17: Europe Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Table 18: Europe Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

Table 19: Asia Pacific Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Table 20: Asia Pacific Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Table 21: Asia Pacific Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Table 22: Asia Pacific Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Table 23: Asia Pacific Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Table 24: Asia Pacific Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

Table 25: Middle East & Africa Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Table 26: Middle East & Africa Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Table 27: Middle East & Africa Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Table 28: Middle East & Africa Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Table 29: Middle East & Africa Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Table 30: Middle East & Africa Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

Table 31: South America Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Table 32: South America Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Table 33: South America Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Table 34: South America Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Table 35: South America Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Table 36: South America Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

List of Figures

Figure 1: Global Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Figure 2: Global Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Figure 3: Global Instrumentation Fittings Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 4: Global Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 5: Global Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Figure 6: Global Instrumentation Fittings Market, Incremental Opportunity, by End-use Industry, US$ Bn 2023 -2031

Figure 7: Global Instrumentation Fittings Market Projections, by Region, Million Units, 2017-2031

Figure 8: Global Instrumentation Fittings Market Projections, by Region, US$ Bn 2017-2031

Figure 9: Global Instrumentation Fittings Market, Incremental Opportunity, by Region, US$ Bn 2023 -2031

Figure 10: North America Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Figure 11: North America Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Figure 12: North America Instrumentation Fittings Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 13: North America Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 14: North America Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Figure 15: North America Instrumentation Fittings Market, Incremental Opportunity, by End-use Industry, US$ Bn 2023 -2031

Figure 16: North America Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Figure 17: North America Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

Figure 18: North America Instrumentation Fittings Market, Incremental Opportunity, by Country, US$ Bn 2023 -2031

Figure 19: Europe Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Figure 20: Europe Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Figure 21: Europe Instrumentation Fittings Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 22: Europe Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 23: Europe Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Figure 24: Europe Instrumentation Fittings Market, Incremental Opportunity, by End-use Industry, US$ Bn 2023 -2031

Figure 25: Europe Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Figure 26: Europe Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

Figure 27: Europe Instrumentation Fittings Market, Incremental Opportunity, by Country, US$ Bn 2023 -2031

Figure 28: Asia Pacific Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Figure 29: Asia Pacific Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Figure 30: Asia Pacific Instrumentation Fittings Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 31: Asia Pacific Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 32: Asia Pacific Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Figure 33: Asia Pacific Instrumentation Fittings Market, Incremental Opportunity, by End-use Industry, US$ Bn 2023 -2031

Figure 34: Asia Pacific Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Figure 35: Asia Pacific Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

Figure 36: Asia Pacific Instrumentation Fittings Market, Incremental Opportunity, by Country, US$ Bn 2023 -2031

Figure 37: Middle East & Africa Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Figure 38: Middle East & Africa Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Figure 39: Middle East & Africa Instrumentation Fittings Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 40: Middle East & Africa Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 41: Middle East & Africa Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Figure 42: Middle East & Africa Instrumentation Fittings Market, Incremental Opportunity, by End-use Industry, US$ Bn 2023 -2031

Figure 43: Middle East & Africa Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Figure 44: Middle East & Africa Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

Figure 45: Middle East & Africa Instrumentation Fittings Market, Incremental Opportunity, by Country, US$ Bn 2023 -2031

Figure 46: South America Instrumentation Fittings Market Projections, by Type, Million Units, 2017-2031

Figure 47: South America Instrumentation Fittings Market Projections, by Type, US$ Bn 2017-2031

Figure 48: South America Instrumentation Fittings Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 49: South America Instrumentation Fittings Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 50: South America Instrumentation Fittings Market Projections, by End-use Industry, US$ Bn 2017-2031

Figure 51: South America Instrumentation Fittings Market, Incremental Opportunity, by End-use Industry, US$ Bn 2023 -2031

Figure 52: South America Instrumentation Fittings Market Projections, by Country, Million Units, 2017-2031

Figure 53: South America Instrumentation Fittings Market Projections, by Country, US$ Bn 2017-2031

Figure 54: South America Instrumentation Fittings Market, Incremental Opportunity, by Country, US$ Bn 2023 -2031