Analysts’ Viewpoint on Inspection Drone Market Scenario

Defense organizations and tech-savvy consumers have been using the drone technology since quite some time. Rise in need for remotely operated inspection equipment is propelling the inspection drone market. Usage of sustainable energy solutions, such as wind farms, tidal power generators, as well as solar installations, has been increasing since the last few years. Renewable energy farms, which are spread across several acres, are being established across the globe. Inspection of these farms is a difficult and time consuming process. Furthermore, equipment used in renewable energy farms requires frequent inspection. Drones play an important role in carrying out inspection of solar panels and wind farms. Prominent players in the inspection drone market are engaged in R&D activities to launch innovative drones for inspection applications in various industries such as chemical, telecommunications, and oil & gas.

Inspection drones are automating the manual inspection process and enabling inspectors to enhance their inspection speed for collection of data, while eliminating the slower manual steps of labor and extra time that place them in hazardous situations. The rapidly-growing agriculture industry is fueling the market, as drones are proving to be beneficial for the inspection of livestock and crops. Drones are used to create 3D maps of the farmland. These images offer insights about crop condition at regular intervals so that preventive measures can be taken. Furthermore, inspection drones are employed in surveillance and disaster management. Drones equipped with thermal imaging provide emergency response teams with an ideal solution to identify victims who are difficult to spot with the naked eye. These factors are propelling the inspection drone market.

Industrial inspection drones are being widely used in several application areas such as security management, forest fire monitoring, traffic monitoring, oil & gas pipeline monitoring, solar panel, power line and windmill inspections, critical infrastructure inspections, railway, roadways, and bridge inspections. On the other hand, popularity and competition have been increasing in the commercial drone service market since the last few years. This is anticipated to drive the market during the forecast period. However, regulatory challenges, lack of technical maturity, as well as operational constraints may hamper the inspection drone market.

Drones are used in well sites, pipelines, storage tanks, as well as offshore platforms. Furthermore, they are employed in large industrial plants consisting of boilers, reactors, and other mega structures. Drones detect threats that can reduce the time as well as the cost of inspection. Advancements in inspection drones and their functionalities, such as AI/ML, high-resolution cameras, thermal imaging, GPS, and LIDAR, enhance their efficiency.

Key market players are launching innovative drones for inspection applications in the oil & gas industry and emphasizing the expansion of their product portfolio to gain competitive edge. For instance, DJI offers Matrice 300 RTK inspection drone for the oil & gas industry to provide real-time data, enabling teams to make quick decisions about maintenance. The M300 RTK is equipped with an omnidirectional obstacle avoidance system. It reduces the risk of collision in the most challenging environment. It is also integrated with the M300 RTK, which is equipped with an omnidirectional obstacle avoidance system. These cutting-edge drones are augmenting the market for drone inspection and monitoring.

Telecommunication and transmission lines pose a high risk for crews who inspect cell towers and transmission towers. Drones have the capability to move at heights and enable inspection of towers with cameras as well as laser techniques. This reduces the risk of the crew involved in tower inspection. The telecommunication industry has been witnessing rapid transformation, as network operators are transitioning toward the 5G platform. This is estimated to further fuel the inspection drone market. However, regulatory challenges and operational constraints are likely to hamper the market.

Demand for inspection drones has been rising at a steady pace owing to the expansion of infrastructure of transmission lines and telecommunication towers. Several governments are deploying drones for the inspection of power lines and towers. For instance, in November 2021, the Telangana (India) state government announced that it had successfully completed a pilot project to use unmanned aerial vehicles (UAVs) or drones for the inspection of power lines and towers. This is encouraging innovation in utility inspection drones.

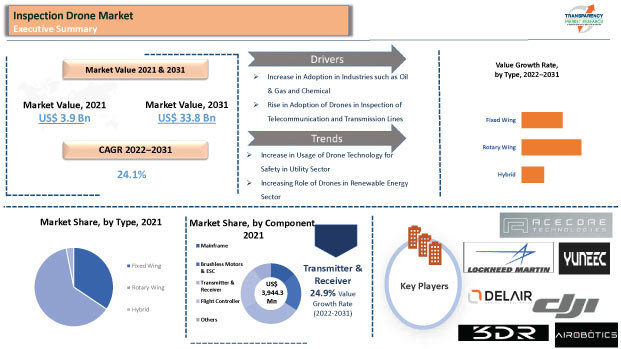

In terms of component, the global inspection drone market has been segmented into mainframe, brushless motors & ESC, transmitter & receiver, flight controller, and others. The transmitter & receiver segment held major share of 32.8% of the inspection drone market in 2021. The segment is projected to advance at a CAGR of 24.9% during the forecast period.

The drone transmitter receives inputs from the stick and transmits them through the air to the receiver in near real-time. Once the receiver receives inputs, it passes them to the drone’s flight controller, which steers the drone accordingly. Thus, drone inspection companies are capitalizing on this opportunity to innovate in drones for solar panel inspection applications.

In terms of type, the global inspection drone market has been classified into fixed wing, rotary wing, and hybrid. The rotary wing segment dominated the global inspection drone market with 62.5% share in 2021. The segment is expected to advance at a CAGR of 24.7% during the forecast period.

Rotary drones offer vertical take-off and landing; hence, they are deployed in applications requiring line of sight inspection. The regulatory framework of most countries across the globe allows the operation of drones in the line of sight of the operator. This has significantly propelled the demand for rotary inspection drones. Furthermore, these types of drones are extensively used for shorter fight times and shorter distances. Thus, rise in adoption of rotary wing drones for commercial and industrial applications is boosting the market for drone infrastructure inspection.

North America dominated the global inspection drone market with 41.3% share in 2021. Early penetration of the technology is the primary factor augmenting the market in the region. Moreover, the number of companies using inspection drone technology for visual inspection is increasing, as it is a cost-effective way to carry out inspections at heights and inaccessible areas. This is also driving the market in the region.

Key market players are adopting strategic initiatives to remain competitive in the market. For instance, in May 2019, 3D Robotics, Inc. entered into a distribution partnership with Wingtra, a Europe-based manufacturer of VTOL (vertical take-off and landing) drones. This agreement was estimated to enable both the companies to distribute aerial surveying drones across a wide range of industries, particularly mining and construction industries.

Asia Pacific and Europe are also major markets for inspection drones. These regions held shares of 31.6% and 15.2%, respectively, in 2021. The inspection drone market in Asia Pacific is estimated to grow at a significant CAGR owing to the expansion of infrastructure, economic growth, rise in population, and increase in urbanization and industrialization. Utility companies in Europe with large infrastructure such are looking to deploy drones for inspection instead of conventional workers. This is giving rise to oil and gas drone inspection. Governments are also working on formulating regulations for drones, which can facilitate beyond visual line-of-sight (BVLOS) drone operations in the region. Manufacturers in countries such as Italy, Germany, and France have started deploying drones for inspection in the utility sector.

Middle East & Africa is a larger market for inspection drones than South America. The market in Middle East & Africa is projected to grow at a CAGR of 18% during the forecast period. Companies in Middle East & Africa are increasing the availability of the best drones for home inspection applications.

The global inspection drone market is highly consolidated, with numerous large-scale and small-scale vendors controlling a majority of the share. Most of the firms are spending significantly on comprehensive research and development activities. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. 3D Robotics, Inc., Acecore Technologies, AeroVironment, Inc., Airobotics Ltd., Teledyne FLIR LLC, American Robotics, Inc., Lockheed Martin Corporation, SZ DJI Technology Co., Ltd., Yuneec International Co. Ltd., and Delair are prominent entities operating in the market.

Each of these players has been profiled in the inspection drone market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.9 Bn |

|

Market Forecast Value in 2031 |

US$ 33.8 Bn |

|

Growth Rate (CAGR) |

24.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The inspection drone market stood at US$ 3.9 Bn in 2021.

The inspection drone market estimated to grow at a CAGR of 24.1% during the forecast period.

The inspection drone market is expected to reach US$ 33.8 Bn by 2031.

3D Robotics, Inc., Acecore Technologies, AeroVironment, Inc., Airobotics Ltd., Teledyne FLIR LLC, American Robotics, Inc., Lockheed Martin Corporation, SZ DJI Technology Co., Ltd., Yuneec International Co. Ltd., and Delair.

The U.S. accounted for around 31% share of the global inspection drone market in 2021.

The rotary wing segment dominated the market with 62.5% share in 2021.

Rise in usage of drone technology for safety in the utility sector and increasing role of drones in the renewable energy sector are key trends in the global inspection drone market.

North America is a highly lucrative region of the global inspection drone market.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Inspection Drone Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.4. Market Restraints and Opportunities

3.5. Market Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.2. Supply Chain Analysis

4.3. Sales Channel Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

5. Global Inspection Drone Market Analysis, by Component

5.1. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Component, 2017‒2031

5.1.1. Mainframe

5.1.2. Brushless Motors & ESC

5.1.3. Transmitter & Receiver

5.1.4. Flight Controller

5.1.5. Others

5.2. Market Attractiveness Analysis, by Component

6. Global Inspection Drone Market Analysis, by Sales Channel

6.1. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Sales Channel, 2017‒2031

6.1.1. Online

6.1.2. Offline

6.2. Market Attractiveness Analysis, by Sales Channel

7. Global Inspection Drone Market Analysis, by Type

7.1. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

7.1.1. Rotary Wing

7.1.2. Fixed Wing

7.1.3. Hybrid

7.2. Market Attractiveness Analysis, by Type

8. Global Inspection Drone Market Analysis, by Application

8.1. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

8.1.1. Oil & Gas Pipeline Inspection

8.1.2. Solar Panel, Power Line and Windmill

8.1.3. Critical Infrastructure Inspections

8.1.4. Commercial Farms

8.1.5. Built Railway, Roadways and Bridge Inspection

8.1.6. Border Security

8.1.7. Others

8.2. Market Attractiveness Analysis, by Application,

9. Global Inspection Drone Market Analysis, by End-use Industry

9.1. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

9.1.1. Oil, Gas & Petroleum

9.1.2. Energy & Utilities

9.1.3. Agriculture

9.1.4. Aerospace & Defense

9.1.5. Mining

9.1.6. Construction

9.1.7. Others (Automotive and Transportation, logistics, etc.,)

9.2. Market Attractiveness Analysis, by End-use Industry

10. Global Inspection Drone Market Analysis and Forecast, by Region

10.1. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, by Region

11. North America Inspection Drone Market Analysis and Forecast

11.1. Market Snapshot

11.2. Key Trends Analysis

11.3. Drivers and Restraints: Impact Analysis

11.4. Pricing Analysis

11.5. Key Regulations

11.6. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Component, 2017‒2031

11.6.1. Mainframe

11.6.2. Brushless Motors & ESC

11.6.3. Transmitter & Receiver

11.6.4. Flight Controller

11.6.5. Others

11.7. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Sales Channel, 2017–2031

11.7.1. Online

11.7.2. Offline

11.8. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

11.8.1. Rotary Wing

11.8.2. Fixed Wing

11.8.3. Hybrid

11.9. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

11.9.1. Oil & Gas Pipeline Inspection

11.9.2. Solar Panel, Power Line and Windmill

11.9.3. Critical Infrastructure Inspections

11.9.4. Commercial Farms

11.9.5. Built Railway, Roadways and Bridge Inspection

11.9.6. Border Security

11.9.7. Others

11.10. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

11.10.1. Oil, Gas & Petroleum

11.10.2. Energy & Utilities

11.10.3. Agriculture

11.10.4. Aerospace & Defense

11.10.5. Mining

11.10.6. Construction

11.10.7. Others (Automotive and Transportation, logistics, etc.,)

11.11. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.11.1. U.S.

11.11.2. Canada

11.11.3. Rest of North America

11.12. Market Attractiveness Analysis

11.12.1. By Component

11.12.2. By Sales Channel

11.12.3. By Type

11.12.4. By Application

11.12.5. By End-use Industry

11.12.6. By Country and Sub-region

12. Europe Inspection Drone Market Analysis and Forecast

12.1. Market Snapshot

12.2. Key Trends Analysis

12.3. Drivers and Restraints: Impact Analysis

12.4. Pricing Analysis

12.5. Key Regulations

12.6. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Component, 2017‒2031

12.6.1. Mainframe

12.6.2. Brushless Motors & ESC

12.6.3. Transmitter & Receiver

12.6.4. Flight Controller

12.6.5. Others

12.7. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Sales Channel, 2017–2031

12.7.1. Online

12.7.2. Offline

12.8. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

12.8.1. Rotary Wing

12.8.2. Fixed Wing

12.8.3. Hybrid

12.9. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

12.9.1. Oil & Gas Pipeline Inspection

12.9.2. Solar Panel, Power Line and Windmill

12.9.3. Critical Infrastructure Inspections

12.9.4. Commercial Farms

12.9.5. Built Railway, Roadways and Bridge Inspection

12.9.6. Border Security

12.9.7. Others

12.10. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

12.10.1. Oil, Gas & Petroleum

12.10.2. Energy & Utilities

12.10.3. Agriculture

12.10.4. Aerospace & Defense

12.10.5. Mining

12.10.6. Construction

12.10.7. Others (Automotive and Transportation, logistics, etc.,)

12.11. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017‒2031

12.11.1. U.K.

12.11.2. Germany

12.11.3. France

12.11.4. Italy

12.11.5. Russia

12.11.6. Rest of Europe

12.12. Market Attractiveness Analysis

12.12.1. By Component

12.12.2. By Sales Channel

12.12.3. By Type

12.12.4. By Application

12.12.5. By End-use Industry

12.12.6. By Country and Sub-region

13. Asia Pacific Inspection Drone Market Analysis and Forecast

13.1. Market Snapshot

13.2. Key Trends Analysis

13.3. Drivers and Restraints: Impact Analysis

13.4. Pricing Analysis

13.5. Key Regulations

13.6. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Component, 2017‒2031

13.6.1. Mainframe

13.6.2. Brushless Motors & ESC

13.6.3. Transmitter & Receiver

13.6.4. Flight Controller

13.6.5. Others

13.7. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Sales Channel, 2017‒2031

13.7.1. Online

13.7.2. Offline

13.8. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

13.8.1. Rotary Wing

13.8.2. Fixed Wing

13.8.3. Hybrid

13.9. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

13.9.1. Oil & Gas Pipeline Inspection

13.9.2. Solar Panel, Power Line and Windmill

13.9.3. Critical Infrastructure Inspections

13.9.4. Commercial Farms

13.9.5. Built Railway, Roadways and Bridge Inspection

13.9.6. Border Security

13.9.7. Others

13.10. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

13.10.1. Oil, Gas & Petroleum

13.10.2. Energy & Utilities

13.10.3. Agriculture

13.10.4. Aerospace & Defense

13.10.5. Mining

13.10.6. Construction

13.10.7. Others (Automotive and Transportation, logistics, etc.,)

13.11. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017‒2031

13.11.1. China

13.11.2. India

13.11.3. Japan

13.11.4. South Korea

13.11.5. ASEAN

13.11.6. Rest of Asia Pacific

13.12. Market Attractiveness Analysis

13.12.1. By Component

13.12.2. By Sales Channel

13.12.3. By Type

13.12.4. By Application

13.12.5. By End-use Industry

13.12.6. By Country and Sub-region

14. Middle East & Africa (MEA) Inspection Drone Market Analysis and Forecast

14.1. Market Snapshot

14.2. Key Trends Analysis

14.3. Drivers and Restraints: Impact Analysis

14.4. Pricing Analysis

14.5. Key Regulations

14.6. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Component, 2017‒2031

14.6.1. Mainframe

14.6.2. Brushless Motors & ESC

14.6.3. Transmitter & Receiver

14.6.4. Flight Controller

14.6.5. Others

14.7. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Sales Channel, 2017‒2031

14.7.1. Online

14.7.2. Offline

14.8. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

14.8.1. Rotary Wing

14.8.2. Fixed Wing

14.8.3. Hybrid

14.9. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

14.9.1. Oil & Gas Pipeline Inspection

14.9.2. Solar Panel, Power Line and Windmill

14.9.3. Critical Infrastructure Inspections

14.9.4. Commercial Farms

14.9.5. Built Railway, Roadways and Bridge Inspection

14.9.6. Border Security

14.9.7. Others

14.10. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

14.10.1. Oil, Gas & Petroleum

14.10.2. Energy & Utilities

14.10.3. Agriculture

14.10.4. Aerospace & Defense

14.10.5. Mining

14.10.6. Construction

14.10.7. Others (Automotive and Transportation, logistics, etc.,)

14.11. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017‒2031

14.11.1. GCC

14.11.2. South Africa

14.11.3. North Africa

14.11.4. Rest of Middle East & Africa

14.12. Market Attractiveness Analysis

14.12.1. By Component

14.12.2. By Sales Channel

14.12.3. By Type

14.12.4. By Application

14.12.5. By End-use Industry

14.12.6. By Country and Sub-region

15. South America Inspection Drone Market Analysis and Forecast

15.1. Market Snapshot

15.2. Key Trends Analysis

15.3. Drivers and Restraints: Impact Analysis

15.4. Pricing Analysis

15.5. Key Regulations

15.6. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Component, 2017‒2031

15.6.1. Mainframe

15.6.2. Brushless Motors & ESC

15.6.3. Transmitter & Receiver

15.6.4. Flight Controller

15.6.5. Others

15.7. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Sales Channel, 2017‒2031

15.7.1. Online

15.7.2. Offline

15.8. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

15.8.1. Rotary Wing

15.8.2. Fixed Wing

15.8.3. Hybrid

15.9. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

15.9.1. Oil & Gas Pipeline Inspection

15.9.2. Solar Panel, Power Line and Windmill

15.9.3. Critical Infrastructure Inspections

15.9.4. Commercial Farms

15.9.5. Built Railway, Roadways and Bridge Inspection

15.9.6. Border Security

15.9.7. Others

15.10. Inspection Drone Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

15.10.1. Oil, Gas & Petroleum

15.10.2. Energy & Utilities

15.10.3. Agriculture

15.10.4. Aerospace & Defense

15.10.5. Mining

15.10.6. Construction

15.10.7. Others (Automotive and Transportation, logistics, etc.,)

15.11. Inspection Drone Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017‒2031

15.11.1. Brazil

15.11.2. Argentina

15.11.3. Rest of South America

15.12. Market Attractiveness Analysis

15.12.1. By Component

15.12.2. By Sales Channel

15.12.3. By Type

15.12.4. By Application

15.12.5. By End-use Industry

15.12.6. By Country and Sub-region

16. Competition Assessment

16.1. Global Inspection Drone Market Competition Matrix - a Dashboard View

16.1.1. Global Inspection Drone Market Company Share Analysis, by Value (2020) and Volume

16.1.2. Technological Differentiator

17. Company Profiles (Manufacturers/Suppliers)

17.1. 3D Robotics, Inc.

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Financial Analysis

17.2. Acecore Technologies

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Financial Analysis

17.3. AeroVironment, Inc.

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Financial Analysis

17.4. Airobotics Ltd.

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Financial Analysis

17.5. Teledyne FLIR

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Financial Analysis

17.6. American Robotics, Inc.

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Financial Analysis

17.7. Lockheed Martin Corporation

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Financial Analysis

17.8. SZ DJI Technology Co., Ltd.

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Financial Analysis

17.9. Yuneec International Co. Ltd.

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Financial Analysis

17.10. Delair

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Financial Analysis

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Component

18.1.2. By Sales Channel

18.1.3. By Type

18.1.4. By Application

18.1.5. By End-use Industry

18.1.6. By Region

List of Tables

Table 1: Global Inspection Drone Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 2: Global Inspection Drone Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 3: Global Inspection Drone Market Volume (Thousand Units) Forecast, by Sales Channel 2017‒2031

Table 4: Global Inspection Drone Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 5: Global Inspection Drone Market Volume (Thousand Units) Forecast, by Type, 2017‒2031

Table 6: Global Inspection Drone Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 7: Global Inspection Drone Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 8: Global Inspection Drone Market Value (US$ Mn) Forecast, by End use Industry 2017‒2031

Table 9: Global Inspection Drone Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Table 10: Global Inspection Drone Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 11: North America Inspection Drone Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 12: North America Inspection Drone Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 13: North America Inspection Drone Market Volume (Thousand Units) Forecast, by Sales Channel 2017‒2031

Table 14: North America Inspection Drone Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 15: North America Inspection Drone Market Volume (Thousand Units) Forecast, by Type, 2017‒2031

Table 16: North America Inspection Drone Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 17: North America Inspection Drone Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 18: North America Inspection Drone Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 19: North America Inspection Drone Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017‒2031

Table 20: North America Inspection Drone Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 21: Europe Inspection Drone Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 22: Europe Inspection Drone Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 23: Europe Inspection Drone Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 24: Europe Inspection Drone Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 25: Europe Inspection Drone Market Volume (Thousand Units) Forecast, by Type, 2017‒2031

Table 26: Europe Inspection Drone Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 27: Europe Inspection Drone Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 28: Europe Inspection Drone Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 29: Europe Inspection Drone Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017‒2031

Table 30: Europe Inspection Drone Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 31: Asia Pacific Inspection Drone Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 32: Asia Pacific Inspection Drone Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 33: Asia Pacific Inspection Drone Market Volume (Thousand Units) Forecast, by Sales Channel, 2017‒2031

Table 34: Asia Pacific Inspection Drone Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 35: Asia Pacific Inspection Drone Market Volume (Thousand Units) Forecast, by Type, 2017‒2031

Table 36: Asia Pacific Inspection Drone Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 37: Asia Pacific Inspection Drone Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 38: Asia Pacific Inspection Drone Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 39: Asia Pacific Inspection Drone Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017‒2031

Table 40: Asia Pacific Inspection Drone Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 41: Middle East & Africa Inspection Drone Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 42: Middle East & Africa Inspection Drone Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 43: Middle East & Africa Inspection Drone Market Volume (Thousand Units) Forecast, by Sales Channel 2017‒2031

Table 44: Middle East & Africa Inspection Drone Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 45: Middle East & Africa Inspection Drone Market Volume (Thousand Units) Forecast, by Type, 2017‒2031

Table 46: Middle East & Africa Inspection Drone Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 47: Middle East & Africa Inspection Drone Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 48: Middle East & Africa Inspection Drone Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 49: Middle East & Africa Inspection Drone Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017‒2031

Table 50: Middle East & Africa Inspection Drone Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

Table 51: South America Inspection Drone Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 52: South America Inspection Drone Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 53: South America Inspection Drone Market Volume (Thousand Units) Forecast, by Sales Channel, 2017–2031

Table 54: South America Inspection Drone Market Value (US$ Mn) Forecast, by Sales Channel, 2017–2031

Table 55: South America Inspection Drone Market Volume (Thousand Units) Forecast, by Type, 2017‒2031

Table 56: South America Inspection Drone Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 57: South America Inspection Drone Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 58: South America Inspection Drone Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 59: South America Inspection Drone Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017‒2031

Table 60: South America Inspection Drone Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 1: Global Inspection Drone Market Value & Forecast, 2017‒2031

Figure 2: Global Incremental Opportunity Analysis, by Component

Figure 3: Global Incremental Opportunity Analysis, by Sales Channel

Figure 4: Global Incremental Opportunity Analysis, by Type

Figure 5: Global Incremental Opportunity Analysis, by Application

Figure 6: Global Incremental Opportunity Analysis, by End-use Industry

Figure 7: Global Incremental Opportunity Analysis, by Region

Figure 8: North America Inspection Drone Market Value & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 9: North America Inspection Drone Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 10: North America Inspection Drone Market Value & Forecast, by Sales Channel , Value (US$ Mn), 2017‒2031

Figure 11: North America Inspection Drone Market Attractiveness, by Sales Channel , Value (US$ Mn), 2022‒2031

Figure 12: North America Inspection Drone Market Value & Forecast, by Type, Value (US$ Mn), 2017‒2031

Figure 13: North America Inspection Drone Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 14: North America Inspection Drone Market Value & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 15: North America Inspection Drone Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 16: North America Inspection Drone Market Value & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 17: North America Inspection Drone Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 18: North America Inspection Drone Market Value & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 19: North America Inspection Drone Market Attractiveness, by country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 20: Europe Inspection Drone Market Value & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 21: Europe Inspection Drone Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 22: Europe Inspection Drone Market Value & Forecast, by Sales Channel, Value (US$ Mn), 2017‒2031

Figure 23: Europe Inspection Drone Market Attractiveness, by Sales Channel, Value (US$ Mn), 2022‒2031

Figure 24: Europe Inspection Drone Market Value & Forecast, by Type, Value (US$ Mn), 2017‒2031

Figure 25: Europe Inspection Drone Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 26: Europe Inspection Drone Market Value & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 27: Europe Inspection Drone Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 28: Europe Inspection Drone Market Value & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 29: Europe Inspection Drone Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 30: Europe Inspection Drone Market Value & Forecast, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 31: Europe Inspection Drone Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 32: Asia Pacific Inspection Drone Market Value & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 33: Asia Pacific Inspection Drone Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 34: Asia Pacific Inspection Drone Market Value & Forecast, by Sales Channel, Value (US$ Mn), 2017‒2031

Figure 35: Asia Pacific Inspection Drone Market Attractiveness, by Sales Channel, Value (US$ Mn), 2022‒2031

Figure 36: Asia Pacific Inspection Drone Market Value & Forecast, by Type, Value (US$ Mn), 2017‒2031

Figure 37: Asia Pacific Inspection Drone Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 38: Asia Pacific Inspection Drone Market Value & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 39: Asia Pacific Inspection Drone Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 40: Asia Pacific Inspection Drone Market Value & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 41: Asia Pacific Inspection Drone Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 42: Asia Pacific Inspection Drone Market Value & Forecast, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 43: Asia Pacific Inspection Drone Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 44: Middle East & Africa Inspection Drone Market Value & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 45: Middle East & Africa Inspection Drone Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 46: Middle East & Africa Inspection Drone Market Value & Forecast, by Sales Channel, Value (US$ Mn), 2017‒2031

Figure 47: Middle East & Africa Inspection Drone Market Attractiveness, by Sales Channel, Value (US$ Mn), 2022‒2031

Figure 48: Middle East & Africa Inspection Drone Market Value & Forecast, by Type, Value (US$ Mn), 2017‒2031

Figure 49: Middle East & Africa Inspection Drone Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 50: Middle East & Africa Inspection Drone Market Value & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 51: Middle East & Africa Inspection Drone Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 52: Middle East & Africa Inspection Drone Market Value & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 53: Middle East & Africa Inspection Drone Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 54: Middle East & Africa Inspection Drone Market Value & Forecast, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 55: Middle East & Africa Inspection Drone Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 56: South America Inspection Drone Market Value & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 57: South America Inspection Drone Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 58: South America Inspection Drone Market Value & Forecast, by Sales Channel , Value (US$ Mn), 2017‒2031

Figure 59: South America Inspection Drone Market Attractiveness, by Sales Channel , Value (US$ Mn), 2022‒2031

Figure 60: South America Inspection Drone Market Value & Forecast, by Type, Value (US$ Mn), 2017‒2031

Figure 61: South America Inspection Drone Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 62: South America Inspection Drone Market Value & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 63: South America Inspection Drone Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 64: South America Inspection Drone Market Value & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 65: South America Inspection Drone Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 66: South America Inspection Drone Market Value & Forecast, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 67: South America Inspection Drone Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 68: Global Inspection Drone Market Share Analysis, by Company