Reports

Reports

Over the past couple of decades, due to the growing awareness pertaining to the catastrophic effects of various industrial processes on the environment has played an important role in influencing the operations across the printing industry. While the printing industry adjusts to the new regulatory landscape, the packaging industry is expected to follow a similar path and integrate sustainable and environment-friendly solutions. Printing inks have evolved over the past couple of decades in terms of new formulas and concepts in tune with the evolving requirement of end users. The Southeast Asia ink resins market is set to witness consistent innovations and developments during the forecast period, due to the evolving regulatory landscape and growing demand from the printing sector.

Technological advancements are expected to have a crucial role in the development of new resin technologies particularly related to the food industry. The packaging industry has gained considerable spotlight over the past decade due to fluctuating consumer trends. However, the growing emphasis on enhancing the quality of food products, focus on improving consumer safety, and environment protection norms are some of the factors that have influenced the product development operations across the Southeast Asia ink resins market. Research and development activities are likely to gain considerable momentum across the ink resins market in Southeast Asia – a factor that is expected to provide a massive boost to the production of high printing ink formulations. The growth of the Southeast Asia ink resins market is expected to primarily depend on the growth of the printing industry.

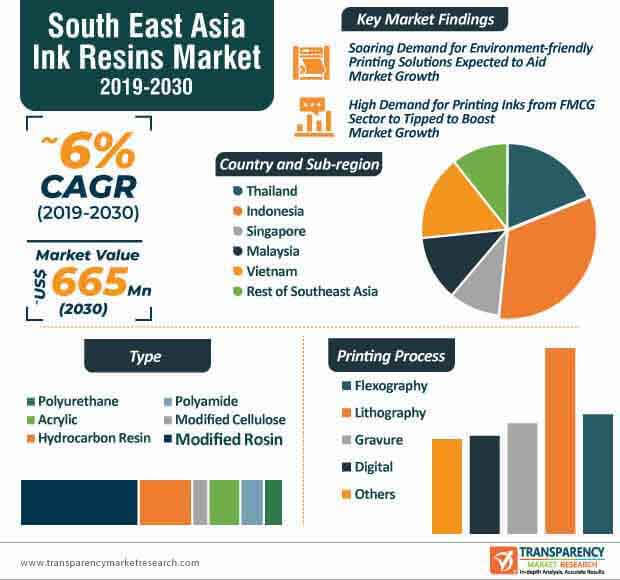

The advent of new printing techniques, the growing use of safe printing formulations, frequent demand for innovative printing inks manufactured using raw materials and other ingredients that comply with the regulatory guidelines, and exponential growth in the demand for flexible packaging solutions are some of the leading factors that are projected to drive the Southeast Asia ink resins market during the assessment period. At the back of these factors, the Southeast Asia ink resins market is expected to attain a market value of ~US$ 700 Mn by the end of 2030.

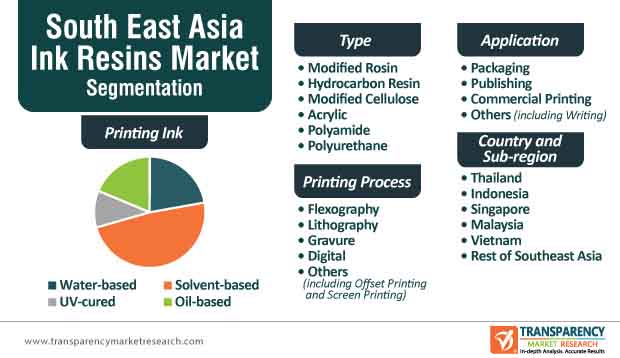

The significant growth in the demand for sustainable and safe printings solutions is expected to drive innovations in the Southeast Asia ink resins market. As modern-day consumers are increasingly opting for “green” products, green packaging is a raging trend that is set to garner immense traction over the assessment period. At present, participants operating in the ink resins market are expected to comply with the various regulatory guidelines and standards and focus on the production of bio-renewable ink resins. The demand for water-based, oil-based, and solvent-based printing inks has experienced considerable growth particularly from the food packaging sector across the Southeast Asian region. The growing demand for different variants of printing inks is expected to provide an impetus to the adoption of ink resins during the forecast period.

Governments of different nations across the Southeast Asian region have laid down guidelines pertaining to the use of printing inks in food packaging applications. For instance, in August 2019, the Bureau of Indian Standards (BIS) released the draft of the new standards for printing inks for applications related to food packaging, which states a complete ban on the usage of toluene and other plasticizers. The exponential growth in the demand for fast-moving consumer goods across Southeast Asia has generated considerable demand for label and packaging printing. Although most international brands that have a presence in this region utilize premium or added value labels, domestic companies are increasingly swaying toward cost-efficient alternatives. However, in recent years, several domestic brands are switching to pressure-sensitive print and shrink sleeves across the food & beverages sector due to which, the demand for ink resins is on the rise.

The COVID-19 pandemic continues to hinder the growth of several key industrial sectors across the world and the storyline is similar in Southeast Asia. Government lockdowns coupled with trade and transportation restrictions have created multiple bottlenecks across the supply chain for ink resins. Apart from the declining demand from the food printing sector, the industrial lockdown in China in the first couple of months of 2020 is likely to hinder the growth of the Southeast Asia ink resins market, as sourcing of raw materials from China proved to be a challenge. While the demand for ink resins from the domestic market is likely to decline in 2020, market players should ideally focus on formulating growth strategies for the post COVID-19 era.

Analysts’ Viewpoint

The Southeast Asia ink resins market is expected to grow at a CAGR of ~6% during the forecast period. The market growth will primarily depend on the growing applications of printing inks across the food & beverages sector. In addition, the growing popularity of flexible packaging solutions is another leading factor that is expected to set the tone for the growth of the ink resins market in Southeast Asia. Manufacturers should focus on introducing products that comply with the standards and focus on expanding their market share by tapping into opportunities for label printing in other industrial sectors.

High Usage of Ink Resins in Packaging

1. Executive Summary

1.1. Southeast Asia Ink Resins Market Snapshot

1.2. Key Market Trends

1.3. Current Market & Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

2.7. Southeast Asia Ink Resins Market Analysis and Forecast, 2019–2030

3. Ink Resins Production Outlook, by Country and Sub-region

4. Ink Resins Price Trend Analysis, 2019–2030

4.1. By Type

4.2. By Country and Sub-region

5. Southeast Asia Ink Resins Market Analysis and Forecast, by Type, 2019–2030

5.1. Introduction & Definition

5.2. Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

5.2.1. Modified Rosin

5.2.2. Hydrocarbon Resin

5.2.3. Modified Cellulose

5.2.4. Acrylic

5.2.5. Polyamide

5.2.6. Polyurethane

5.3. Southeast Asia Ink Resins Market Attractiveness, by Type

6. Southeast Asia Ink Resins Market Analysis and Forecast, by Printing Process

6.1. Key Findings, by Printing Process

6.2. Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Process, 2019–2030

6.2.1. Flexography

6.2.2. Lithography

6.2.3. Gravure

6.2.4. Digital

6.2.5. Others

6.3. Southeast Asia Ink Resins Market Attractiveness Analysis, by Printing Process

7. Southeast Asia Ink Resins Market Analysis and Forecast, by Printing Ink

7.1. Key Findings, by Printing Ink

7.2. Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

7.2.1. Water-based

7.2.2. Solvent-based

7.2.3. UV-cured

7.2.4. Oil-based

7.3. Southeast Asia Ink Resins Market Attractiveness Analysis, by Printing Ink

8. Southeast Asia Ink Resins Market Analysis and Forecast, by Application, 2019–2030

8.1. Introduction & Definitions

8.2. Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.2.1. Packaging

8.2.2. Publishing

8.2.3. Commercial Printing

8.2.4. Others

8.3. Southeast Asia Ink Resins Market Attractiveness, by Application

9. Southeast Asia Ink Resins Market Analysis and Forecast, by Country and Sub-region, 2019–2030

9.1. Key Findings

9.2. Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

9.2.1. Thailand

9.2.2. Indonesia

9.2.3. Singapore

9.2.4. Malaysia

9.2.5. Vietnam

9.2.6. Rest of Southeast Asia

9.3. Southeast Asia Ink Resins Market Attractiveness, by Country and Sub-region

9.4. Thailand Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

9.5. Thailand Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Process, 2019–2030

9.6. Thailand Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

9.7. Thailand Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.8. Indonesia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

9.9. Indonesia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Process, 2019–2030

9.10. Indonesia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

9.11. Indonesia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.12. Singapore Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

9.13. Singapore Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Process, 2019–2030

9.14. Singapore Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

9.15. Singapore Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.16. Malaysia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

9.17. Malaysia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Process, 2019–2030

9.18. Malaysia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

9.19. Malaysia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.20. Vietnam Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

9.21. Vietnam Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Process, 2019–2030

9.22. Vietnam Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

9.23. Vietnam Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.24. Rest of Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

9.25. Rest of Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Process, 2019–2030

9.26. Rest of Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

9.27. Rest of Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10. Competition Landscape

10.1. Southeast Asia Ink Resins Market Share Analysis, by Company (2019)

10.2. Southeast Asia Ink Resins Market Footprint Analysis

10.3. Company Profiles

10.3.1. DIC Graphics (Thailand) Co., Ltd.

10.3.1.1. Company Description

10.3.1.2. Business Overview

10.3.2. BASF SE

10.3.2.1. Company Description

10.3.2.2. Business Overview

10.3.2.3. Financial Overview

10.3.2.4. Strategic Overview

10.3.3. The Dow Chemical Company

10.3.3.1. Company Description

10.3.3.2. Business Overview

10.3.3.3. Financial Overview

10.3.3.4. Strategic Overview

10.3.4. DSM Coating Resins B.V.

10.3.4.1. Company Description

10.3.4.2. Business Overview

10.3.5. Evonik Industries AG

10.3.5.1. Company Description

10.3.5.2. Business Overview

10.3.5.3. Financial Overview

10.3.5.4. Strategic Overview

10.3.6. Lawter Inc.

10.3.6.1. Company Description

10.3.6.2. Business Overview

10.3.7. ALLNEX NETHERLANDS B.V

10.3.7.1. Company Description

10.3.7.2. Business Overview

10.3.8. CASKYD INDUSTRIAL RESINS AND CHEMICALS

10.3.8.1. Company Description

10.3.8.2. Business Overview

10.3.9. Resins and Plastics Limited

10.3.9.1. Company Description

10.3.9.2. Business Overview

11. Primary Research: Key Insights

12. Appendix ?

List of Tables

Table 1: Southeast Asia Ink Resins Market Volume (Kilo Tons) Forecast, by Type, 2019–2030

Table 2: Southeast Asia Ink Resins Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 3: Southeast Asia Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Process, 2019–2030

Table 4: Southeast Asia Ink Resins Market Value (US$ Mn) Forecast, by Printing Process, 2019–2030

Table 5: Southeast Asia Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Ink, 2019–2030

Table 6: Southeast Asia Ink Resins Market Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

Table 7: Southeast Asia Ink Resins Market Volume (Kilo Tons) Forecast, by Application, 2019–2030

Table 8: Southeast Asia Ink Resins Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 9: Southeast Asia Ink Resins Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2019–2030

Table 10: Southeast Asia Ink Resins Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 11: Thailand Ink Resins Market Volume (Kilo Tons) Forecast, by Type, 2019–2030

Table 12: Thailand Ink Resins Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 13: Thailand Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Process, 2019–2030

Table 14: Thailand Ink Resins Market Value (US$ Mn) Forecast, by Printing Process, 2019–2030

Table 15: Thailand Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Ink, 2019–2030

Table 16: Thailand Ink Resins Market Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

Table 17: Thailand Ink Resins Market Volume (Kilo Tons) Forecast, by Application, 2019–2030

Table 18: Thailand Ink Resins Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 19: Indonesia Ink Resins Market Volume (Kilo Tons) Forecast, by Type, 2019–2030

Table 20: Indonesia Ink Resins Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 21: Indonesia Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Process, 2019–2030

Table 22: Indonesia Ink Resins Market Value (US$ Mn) Forecast, by Printing Process, 2019–2030

Table 23: Indonesia Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Ink, 2019–2030

Table 24: Indonesia Ink Resins Market Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

Table 25: Indonesia Ink Resins Market Volume (Kilo Tons) Forecast, by Application, 2019–2030

Table 26: Indonesia Ink Resins Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 27: Singapore Ink Resins Market Volume (Kilo Tons) Forecast, by Type, 2019–2030

Table 28: Singapore Ink Resins Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 29: Singapore Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Process, 2019–2030

Table 30: Singapore Ink Resins Market Value (US$ Mn) Forecast, by Printing Process, 2019–2030

Table 31: Singapore Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Ink, 2019–2030

Table 32: Singapore Ink Resins Market Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

Table 33: Singapore Ink Resins Market Volume (Kilo Tons) Forecast, by Application, 2019–2030

Table 34: Singapore Ink Resins Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 35: Malaysia Ink Resins Market Volume (Kilo Tons) Forecast, by Type, 2019–2030

Table 36: Malaysia Ink Resins Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 37: Malaysia Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Process, 2019–2030

Table 38: Malaysia Ink Resins Market Value (US$ Mn) Forecast, by Printing Process, 2019–2030

Table 39: Malaysia Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Ink, 2019–2030

Table 40: Malaysia Ink Resins Market Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

Table 41: Malaysia Ink Resins Market Volume (Kilo Tons) Forecast, by Application, 2019–2030

Table 42: Malaysia Ink Resins Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 43: Vietnam Ink Resins Market Volume (Kilo Tons) Forecast, by Type, 2019–2030

Table 44: Vietnam Ink Resins Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 45: Vietnam Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Process, 2019–2030

Table 46: Vietnam Ink Resins Market Value (US$ Mn) Forecast, by Printing Process, 2019–2030

Table 47: Vietnam Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Ink, 2019–2030

Table 48: Vietnam Ink Resins Market Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

Table 49: Vietnam Ink Resins Market Volume (Kilo Tons) Forecast, by Application, 2019–2030

Table 50: Vietnam Ink Resins Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 51: Rest of southeast Asia Ink Resins Market Volume (Kilo Tons) Forecast, by Type, 2019–2030

Table 52: Rest of southeast Ink Resins Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 53: Rest of southeast Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Process, 2019–2030

Table 54: Rest of southeast Ink Resins Market Value (US$ Mn) Forecast, by Printing Process, 2019–2030

Table 55: Rest of southeast Ink Resins Market Volume (Kilo Tons) Forecast, by Printing Ink, 2019–2030

Table 56: Rest of southeast Ink Resins Market Value (US$ Mn) Forecast, by Printing Ink, 2019–2030

Table 57: Rest of southeast Ink Resins Market Volume (Kilo Tons) Forecast, by Application, 2019–2030

Table 58: Rest of southeast Ink Resins Market Value (US$ Mn) Forecast, by Application, 2019–2030

List of Figures

Figure 1: Southeast Asia Ink Resins Price Trend, by Type, 2019–2030 (US$/Tons)

Figure 2: Southeast Asia Ink Resins Price Trend, by Country and Sub-region, 2019–2030 (US$/Tons)

Figure 3: Southeast Asia Ink Resins Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–20230

Figure 4: Southeast Asia Ink Resins Market Value Share, by Type, 2019, 2025, and 2030

Figure 5: Southeast Asia Ink Resins Market Attractiveness, by Type

Figure 6: Southeast Asia Ink Resins Market Value Share, by Printing Process, 2019, 2025, and 2030

Figure 7: Southeast Asia Ink Resins Market Attractiveness, by Printing Process

Figure 8: Southeast Asia Ink Resins Market Value Share, by Printing Ink, 2019, 2025, and 2030

Figure 9: Southeast Asia Ink Resins Market Attractiveness, by Printing Ink

Figure 10: Southeast Asia Ink Resins Market Value Share, by Application, 2019, 2025, and 2030

Figure 11: Southeast Asia Ink Resins Market Attractiveness, by Application

Figure 12: Southeast Asia Ink Resins Market Value Share, by Country and Sub-region, 2019, 2025, and 2030

Figure 13: Southeast Asia Ink Resins Market Attractiveness, by Country and Sub-region

Figure 14: Southeast Asia Ink Resins Market, Company Market Share Analysis, 2019