Analyst Viewpoint

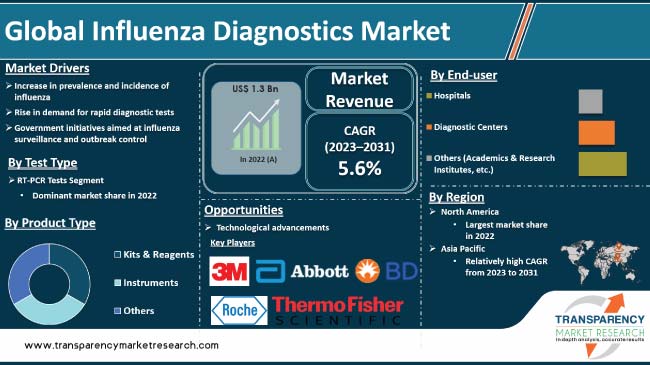

Increase in prevalence and incidence of influenza is driving the global influenza diagnostics market. Persistent threat of seasonal and pandemic influenza outbreaks have been witnessed in the past few years. The global impact of influenza on public health has prompted substantial investments in research & development. Government initiatives aimed at influenza surveillance and outbreak control are the major factors propelling market development. Furthermore, rise in demand for rapid diagnostic tests is expected to bolster the global influenza diagnostics industry size during the forecast period.

Technological advancements and introduction of innovative diagnostic tools offer lucrative opportunities to market players. Manufacturers are focusing on developing user-friendly, portable, and cost-effective diagnostic devices in order to increase market share.

Influenza, commonly known as the flu, is a highly contagious respiratory infection caused by influenza viruses. The impact of influenza on global public health underscores the importance of effective diagnostics for timely and accurate identification of the virus.

Influenza viruses belong to the Orthomyxoviridae family and are classified into types A, B, C, and D. Among these, influenza A and B are the predominant types responsible for seasonal outbreaks and pandemics.

Accurate and rapid influenza diagnostics play a crucial role in patient management, infection control, and public health surveillance. Various diagnostic methods are employed, ranging from traditional laboratory techniques such as viral culture and serological assays to more modern molecular techniques such as polymerase chain reaction (PCR) and rapid antigen tests.

Molecular methods offer high sensitivity and specificity, enabling the detection of viral RNA or DNA within hours, whereas rapid antigen tests provide quick results but may have lower sensitivity.

In the past few years, the global landscape has witnessed a notable surge in the occurrence of influenza, a contagious respiratory infection caused by influenza viruses. This upswing is multifactorial, influenced by various environmental, demographic, and virological factors. High transmission rates, compounded by the evolving nature of influenza viruses, underscore the pressing need for accurate and timely diagnostics. This in turn is fueling the global influenza diagnostics market.

Surge in prevalence of influenza can be ascribed to several factors, including increased globalization, urbanization, and population density. As individuals interact more frequently and over longer distances, the transmission of influenza viruses becomes more efficient.

Rapid urbanization has led to densely populated areas, creating environments conducive to rapid viral spread. These demographic shifts contribute significantly to the increasing burden of influenza on a global scale.

According to the World Health Organization, globally, there are around one billion cases of seasonal influenza annually, with 3 million to 5 million severe cases and 290,000 to 650,000 respiratory deaths. Thus, high disease burden fuels demand for efficient and accurate diagnostic tools.

The U.S. Centers for Disease Control and Prevention (CDC) reported early increase in influenza activity during the 2022–2023 season, particularly among children and adolescents. Hospitalization rates were also higher than in previous years.

The dynamic nature of influenza viruses, characterized by frequent mutations and antigenic drift, further exacerbates the challenge. This continual evolution enables the virus to evade immune responses, rendering previously exposed populations susceptible to reinfection. Consequently, demand for robust diagnostic tools becomes imperative for effective disease management and public health interventions.

In the realm of healthcare, the escalating prevalence of influenza is directly correlated with the rise in incidence of severe respiratory complications, hospitalizations, and mortality. This places a substantial burden on healthcare systems globally, necessitating swift and accurate diagnostic solutions to streamline patient management and implement appropriate preventive measures. This escalating prevalence and incidence of influenza is fueling the global influenza diagnostics market growth.

Surge in demand for Rapid Diagnostic Tests (RDTs) has emerged as a major factor propelling the global influenza diagnostics market demand. The ascendancy of RDTs as a primary diagnostic tool signifies a paradigm shift in influenza diagnostics, redefining the landscape with its inherent advantages. This escalating demand is underpinned by the urgent need for swift and accurate diagnostic outcomes, reflecting a discernible departure from conventional methodologies.

The prominence of RDTs can be ascribed to expeditious results, offering a real-time assessment of influenza infection status. This immediacy is imperative for timely clinical decision-making and initiation of appropriate therapeutic interventions.

Fast-paced lifestyles and the constant need for rapid responses in healthcare settings have increased preference for RDTs, positioning them as indispensable tools in influenza diagnostics.

Moreover, rise in demand for RDTs is intricately linked to their user-friendly nature, which facilitates decentralized testing. The accessibility of RDTs outside traditional laboratory settings ensures that diagnostic capabilities are extended to diverse healthcare settings, including remote and resource-constrained areas. This decentralization is pivotal in enhancing diagnostic reach and efficacy, particularly during influenza outbreaks or pandemics.

Cost-effectiveness of RDTs has further fueled adoption, aligning with the economic considerations of healthcare providers and patients alike. The overall reduction in turnaround time and the concomitant economic benefits associated with rapid diagnostics amplify the attractiveness of RDTs in the influenza diagnostics landscape. Thus, increase in demand for rapid diagnostic tests is likely to bolster the global influenza diagnostics market value.

In terms of test type, the RT-PCR tests segment accounted for the largest global influenza diagnostics market share in 2022. RT-PCR boasts exceptional accuracy, detecting even trace amounts of viral RNA within hours. This rapid turnaround time (TAT) allows for prompt diagnosis and initiation of targeted treatment, improving patient outcomes and curbing transmission.

RT-PCR's ability to differentiate between influenza A and B subtypes is crucial for appropriate antiviral therapy and public health interventions. RT-PCR assays are readily scalable, adapting to high testing demands during outbreaks. Additionally, automation minimizes human error and increases throughput, crucial for managing large-scale testing needs.

Recognizing RT-PCR's advantages, governments worldwide are actively promoting its adoption. India's Integrated Disease Surveillance Programme (IDSP) emphasizes RT-PCR as the primary influenza diagnostic tool. This nationwide push fosters infrastructure development and trained personnel, further solidifying RT-PCR's dominance.

A 2020 study by the Centers for Disease Control and Prevention (CDC) found that RT-PCR had a 98.7% sensitivity and 99.5% specificity for influenza A and B detection, compared to 78.1% and 96.6% for rapid influenza diagnostic tests (RIDTs).

As per influenza diagnostics market analysis, North America dominated the global industry in 2022. This is ascribed to high disease burden, advanced healthcare infrastructure, stringent regulations, robust public health surveillance, and a supportive private and public sector landscape.

The U.S., with an average of 13.5 million annual influenza cases, bears the brunt of the disease in the region. Well-equipped hospitals and laboratories, coupled with widespread adoption of electronic health records, facilitate the use of sophisticated diagnostic tools such as molecular assays and rapid influenza diagnostic tests (RIDTs).

According to influenza diagnostics market forecast, the industry in Asia Pacific is projected to grow at a rapid pace during the forecast period. This is ascribed to rise in influenza burden, increase in healthcare awareness, expanding diagnostic options, aging population, and proactive government initiatives.

This growth trajectory holds immense potential for further development and innovation in influenza diagnostics within the region, ultimately contributing to improved public health outcomes.

Leading players in the global market have adopted strategies such as mergers & acquisitions, strategic collaborations, and new product launches to expand presence and gain market share.

3M, Abbott, F. Hoffmann-La Roche Ltd., Becton, Dickinson and Company, BIOMÉRIEUX, Bio-Rad Laboratories, Inc., Goldsite Diagnostics, Inc., Hologic, Inc., DiaSorin S.p.A., Meridian Bioscience, Inc., QuidelOrtho Corporation, SA Scientific Ltd., Sekisui Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific are the prominent players in the global influenza diagnostics market.

The influenza diagnostics market report profiles the top players based on various factors including company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 1.3 Bn |

| Forecast (Value) in 2031 | More than US$ 2.0 Bn |

| Growth Rate (CAGR) | 5.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.3 Bn in 2022

It is projected to reach more than US$ 2.0 Bn by 2031

The CAGR is anticipated to be 5.6% from 2023 to 2031

The RT-PCR tests segment accounted for the largest share in 2022

North America is anticipated to account for the leading share during the forecast period.

3M, Abbott, F. Hoffmann-La Roche Ltd., Becton, Dickinson and Company, BIOMÉRIEUX, Bio-Rad Laboratories, Inc., Goldsite Diagnostics, Inc., Hologic, Inc., DiaSorin S.p.A., Meridian Bioscience, Inc., QuidelOrtho Corporation, SA Scientific Ltd., Sekisui Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Influenza Diagnostics Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Influenza Diagnostics Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Epidemiology

5.2. Reimbursement Scenario

5.3. COVID-19 Pandemic Impact on Industry

6. Global Influenza Diagnostics Market Analysis and Forecast, by Flu Virus Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Flu Virus Type, 2017–2031

6.3.1. Type A

6.3.2. Type B

6.4. Market Attractiveness Analysis, by Flu Virus Type

7. Global Influenza Diagnostics Market Analysis and Forecast, by Test Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Test Type, 2017–2031

7.3.1. RT-PCR Tests

7.3.2. Rapid Influenza Diagnostic Tests (RIDTs)

7.3.3. Viral Culture

7.3.4. Immunofluorescence Assays

7.3.5. Serological Tests

7.3.6. Others (LAMP, SAMBA, etc.)

7.4. Market Attractiveness Analysis, by Test Type

8. Global Influenza Diagnostics Market Analysis and Forecast, by Product Type

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Product Type, 2017–2031

8.3.1. Kits & Reagents

8.3.2. Instrument

8.3.3. Others

8.4. Market Attractiveness Analysis, by Product Type

9. Global Influenza Diagnostics Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Diagnostic Centers

9.3.3. Others (academics & research institutes, etc.)

9.4. Market Attractiveness Analysis, by End-user

10. Global Influenza Diagnostics Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Influenza Diagnostics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Flu Virus Type, 2017–2031

11.2.1. Type A

11.2.2. Type B

11.3. Market Value Forecast, by Test Type, 2017–2031

11.3.1. RT-PCR Tests

11.3.2. Rapid Influenza Diagnostic Tests (RIDTs)

11.3.3. Viral Culture

11.3.4. Immunofluorescence Assays

11.3.5. Serological Tests

11.3.6. Others (LAMP, SAMBA, etc.)

11.4. Market Value Forecast, by Product Type, 2017–2031

11.4.1. Kits & Reagents

11.4.2. Instrument

11.4.3. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospitals

11.5.2. Diagnostic Centers

11.5.3. Others (academics & research institutes, etc.)

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Flu Virus Type

11.7.2. By Test Type

11.7.3. By Product Type

11.7.4. By End-user

11.7.5. By Country

12. Europe Influenza Diagnostics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Flu Virus Type, 2017–2031

12.2.1. Type A

12.2.2. Type B

12.3. Market Value Forecast, by Test Type, 2017–2031

12.3.1. RT-PCR Tests

12.3.2. Rapid Influenza Diagnostic Tests (RIDTs)

12.3.3. Viral Culture

12.3.4. Immunofluorescence Assays

12.3.5. Serological Tests

12.3.6. Others (LAMP, SAMBA, etc.)

12.4. Market Value Forecast, by Product Type, 2017–2031

12.4.1. Kits & Reagents

12.4.2. Instrument

12.4.3. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospitals

12.5.2. Diagnostic Centers

12.5.3. Others (academics & research institutes, etc.)

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Flu Virus Type

12.7.2. By Test Type

12.7.3. By Product Type

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Influenza Diagnostics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Flu Virus Type, 2017–2031

13.2.1. Type A

13.2.2. Type B

13.3. Market Value Forecast, by Test Type, 2017–2031

13.3.1. RT-PCR Tests

13.3.2. Rapid Influenza Diagnostic Tests (RIDTs)

13.3.3. Viral Culture

13.3.4. Immunofluorescence Assays

13.3.5. Serological Tests

13.3.6. Others (LAMP, SAMBA, etc.)

13.4. Market Value Forecast, by Product Type, 2017–2031

13.4.1. Kits & Reagents

13.4.2. Instrument

13.4.3. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospitals

13.5.2. Diagnostic Centers

13.5.3. Others (academics & research institutes, etc.)

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Flu Virus Type

13.7.2. By Test Type

13.7.3. By Product Type

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Influenza Diagnostics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Flu Virus Type, 2017–2031

14.2.1. Type A

14.2.2. Type B

14.3. Market Value Forecast, by Test Type, 2017–2031

14.3.1. RT-PCR Tests

14.3.2. Rapid Influenza Diagnostic Tests (RIDTs)

14.3.3. Viral Culture

14.3.4. Immunofluorescence Assays

14.3.5. Serological Tests

14.3.6. Others (LAMP, SAMBA, etc.)

14.4. Market Value Forecast, by Product Type, 2017–2031

14.4.1. Kits & Reagents

14.4.2. Instrument

14.4.3. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospitals

14.5.2. Diagnostic Centers

14.5.3. Others (academics & research institutes, etc.)

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Flu Virus Type

14.7.2. By Test Type

14.7.3. By Product Type

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Influenza Diagnostics Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Flu Virus Type, 2017–2031

15.2.1. Type A

15.2.2. Type B

15.3. Market Value Forecast, by Test Type, 2017–2031

15.3.1. RT-PCR Tests

15.3.2. Rapid Influenza Diagnostic Tests (RIDTs)

15.3.3. Viral Culture

15.3.4. Immunofluorescence Assays

15.3.5. Serological Tests

15.3.6. Others (LAMP, SAMBA, etc.)

15.4. Market Value Forecast, by Product Type, 2017–2031

15.4.1. Kits & Reagents

15.4.2. Instrument

15.4.3. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Hospitals

15.5.2. Diagnostic Centers

15.5.3. Others (academics & research institutes, etc.)

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Flu Virus Type

15.7.2. By Test Type

15.7.3. By Product Type

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. 3M

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Abbott

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. F. Hoffmann-La Roche Ltd.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Becton, Dickinson and Company

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. BIOMÉRIEUX

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Bio-Rad Laboratories, Inc.

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Goldsite Diagnostics Inc.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Hologic, Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. DiaSorin S.p.A.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Meridian Bioscience, Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. QuidelOrtho Corporation

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

16.3.12. SA Scientific Ltd.

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Product Portfolio

16.3.12.3. Financial Overview

16.3.12.4. SWOT Analysis

16.3.12.5. Strategic Overview

16.3.13. Sekisui Diagnostics

16.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.13.2. Product Portfolio

16.3.13.3. Financial Overview

16.3.13.4. SWOT Analysis

16.3.13.5. Strategic Overview

16.3.14. Siemens Healthineers

16.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.14.2. Product Portfolio

16.3.14.3. Financial Overview

16.3.14.4. SWOT Analysis

16.3.14.5. Strategic Overview

16.3.15. Thermo Fisher Scientific

16.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.15.2. Product Portfolio

16.3.15.3. Financial Overview

16.3.15.4. SWOT Analysis

16.3.15.5. Strategic Overview

List of Tables

Table 01: Global Influenza Diagnostics Market Value (US$ Mn) Forecast, by Flu Virus Type, 2017-2031

Table 02: Global Influenza Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017-2031

Table 03: Global Influenza Diagnostics Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 04: Global Influenza Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 05: Global Influenza Diagnostics Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Influenza Diagnostics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 07: North America Influenza Diagnostics Market Value (US$ Mn) Forecast, by Flu Virus Type, 2017-2031

Table 08: North America Influenza Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017-2031

Table 09: North America Influenza Diagnostics Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 10: North America Influenza Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 11: Europe Influenza Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Influenza Diagnostics Market Value (US$ Mn) Forecast, by Flu Virus Type, 2017-2031

Table 13: Europe Influenza Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017-2031

Table 14: Europe Influenza Diagnostics Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 15: Europe Influenza Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Forecast, by Flu Virus Type, 2017-2031

Table 18: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017-2031

Table 19: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 20: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Latin America Influenza Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Influenza Diagnostics Market Value (US$ Mn) Forecast, by Flu Virus Type, 2017-2031

Table 23: Latin America Influenza Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017-2031

Table 24: Latin America Influenza Diagnostics Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 25: Latin America Influenza Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 26: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Forecast, by Flu Virus Type, 2017-2031

Table 28: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017-2031

Table 29: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 30: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Influenza Diagnostics Market Size, by Flu Virus Type, 2022

Figure 02: Global Influenza Diagnostics Market Share (%), by Flu Virus Type, 2022

Figure 03: Global Influenza Diagnostics Market Size, by Test Type, 2022

Figure 04: Global Influenza Diagnostics Market Share (%), by Test Type, 2022

Figure 05: Global Influenza Diagnostics Market Size, by Product Type, 2022

Figure 06: Global Influenza Diagnostics Market Share (%), by Product Type, 2022

Figure 07: Global Influenza Diagnostics Market Size, by End-user, 2022

Figure 08: Global Influenza Diagnostics Market Share (%), by End-user, 2022

Figure 09: Global Influenza Diagnostics Market, by Region (2022 and 2031)

Figure 10: Global Influenza Diagnostics Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Flu Virus Type, 2022 and 2031

Figure 12: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Flu Virus Type, 2022

Figure 13: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Flu Virus Type, 2031

Figure 14: Global Influenza Diagnostics Market Attractiveness Analysis, by Flu Virus Type, 2023–2031

Figure 15: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Test Type, 2022 and 2031

Figure 16: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Test Type, 2022

Figure 17: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Test Type, 2031

Figure 18: Global Influenza Diagnostics Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 19: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 20: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Product Type, 2022

Figure 21: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Product Type, 2031

Figure 22: Global Influenza Diagnostics Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 23: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 24: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by End-user, 2022

Figure 25: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by End-user, 2031

Figure 26: Global Influenza Diagnostics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Region, 2022 and 2031

Figure 28: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Region, 2022

Figure 29: Global Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Region, 2031

Figure 30: Global Influenza Diagnostics Market Attractiveness Analysis, by Region, 2023–2031

Figure 31: North America Influenza Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 32: North America Influenza Diagnostics Market Value Share Analysis, by Country, 2022 and 2031

Figure 33: North America Influenza Diagnostics Market Attractiveness Analysis, by Country, 2023–2031

Figure 34: North America Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Flu Virus Type, 2022 and 2031

Figure 35: North America Influenza Diagnostics Market Attractiveness Analysis, by Flu Virus Type, 2023-2031

Figure 36: North America Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Test Type, 2022 and 2031

Figure 37: North America Influenza Diagnostics Market Attractiveness Analysis, by Test Type, 2023-31

Figure 38: North America Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 39: North America Influenza Diagnostics Market Attractiveness Analysis, by Product Type, 2023-31

Figure 40: North America Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 41: North America Influenza Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 42: Europe Influenza Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 43: Europe Influenza Diagnostics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44: Europe Influenza Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 45: Europe Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Flu Virus Type, 2022 and 2031

Figure 46: Europe Influenza Diagnostics Market Attractiveness Analysis, by Flu Virus Type, 2023-2031

Figure 47: Europe Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Test Type, 2022 and 2031

Figure 48: Europe Influenza Diagnostics Market Attractiveness Analysis, by Test Type, 2023-2031

Figure 49: Europe Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 50: Europe Influenza Diagnostics Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 51: Europe Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 52: Europe Influenza Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 53: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 54: Asia Pacific Influenza Diagnostics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 55: Asia Pacific Influenza Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Flu Virus Type, 2022 and 2031

Figure 57: Asia Pacific Influenza Diagnostics Market Attractiveness Analysis, by Flu Virus Type, 2023-2031

Figure 58: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Test Type, 2022 and 2031

Figure 59: Asia Pacific Influenza Diagnostics Market Attractiveness Analysis, by Test Type, 2023-2031

Figure 60: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 61: Asia Pacific Influenza Diagnostics Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 62: Asia Pacific Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 63: Asia Pacific Influenza Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 64: Latin America Influenza Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 65: Latin America Influenza Diagnostics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 66: Latin America Influenza Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 67: Latin America Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Flu Virus Type, 2022 and 2031

Figure 68: Latin America Influenza Diagnostics Market Attractiveness Analysis, by Flu Virus Type, 2023-2031

Figure 69: Latin America Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Test Type, 2022 and 2031

Figure 70: Latin America Influenza Diagnostics Market Attractiveness Analysis, by Test Type, 2023-2031

Figure 71: Latin America Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 72: Latin America Influenza Diagnostics Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 73: Latin America Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 74: Latin America Influenza Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 75: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 76: Middle East & Africa Influenza Diagnostics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 77: Middle East & Africa Influenza Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 78: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Flu Virus Type, 2022 and 2031

Figure 79: Middle East & Africa Influenza Diagnostics Market Attractiveness Analysis, by Flu Virus Type, 2023-2031

Figure 80: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Test Type, 2022 and 2031

Figure 81: Middle East & Africa Influenza Diagnostics Market Attractiveness Analysis, by Test Type, 2023-2031

Figure 82: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 83: Middle East & Africa Influenza Diagnostics Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 84: Middle East & Africa Influenza Diagnostics Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 85: Middle East & Africa Influenza Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031