Modern patients have expressed their beliefs in prevention, rather than cure, in a bid to minimize healthcare expenses and boost overall health. Owing to this, most bioengineering efforts need to be directed to the level of prevention, thereby enhancing patient care. Another factor driving the need for the prevention of diseases and infections is antibiotic resistance, which is a globally-rising issue. Moreover, the slow-paced and complex development of new antibiotics is decreasing the healthcare sector’s arsenal of existing drugs, posing a severe threat as ordinary infections become difficult to treat.

As the fight for endurance continues, infection prevention is becoming a vital aspect. With the escalating aggregation of antimicrobial resistance, the healthcare sector has to revert back to the very basics of infection control; develop, evaluate, and implement sets of prevention methods. Transparency Market Research (TMR), in its recent publication on the infection prevention devices market, uncovers the essentials of the industry, with focus on the indications showcasing developments in the market.

Scientific study of nosocomial or hospital cross-infection commenced in the early 18th century, followed by the start of the 'Bacteriological Era', which marked the development of new methods of investigating disease outbreaks. The actual understanding of hospital infection was with the discoveries of Pasteur, Koch, and Lister, along with the beginning of the Bacteriological Era. The 19th century seemed to herald the final victory over hospital cross-infection, and witnessed the successes of hospital asepsis and reform. However, this victory was momentary, as it was discovered that, the occurrence of infections was not only in surgical and obstetric patients but also in medical patients, and that air could be a source of infection. Followed by this, the causes of hospital infections along with antibiotic-resistant organisms garnered attention.

Infection prevention and control evolved over time, bringing modern practices into the spotlight. Modern healthcare underwent significant transformations over the years, adopting a proactive approach over the conventionally in-practice, reactive approach. Infection prevention and control took a quantum leap with the emergence of infection control devices, further supported by continued developments and improvisations. The infection prevention devices market is expected to hold a value of ~ US$ 16.9 Bn in 2019, with gains banking on the increasing number of surgical procedures and growing incidents of chronic diseases.

Rising Geriatric Population to Create Opportunities

The rising geriatric population and increasing incidences of chronic diseases among the older population are creating opportunities for infection prevention devices market players, as hospital admissions continue to rise. Combating hospital-associated infections is becoming a crucial part of patient care, directing attention towards next-gen infection prevention devices.

Growing Antibiotic Resistance to Bolster Demand

Although healthcare continues to develop, emerging organisms are becoming stronger and more immune to antibiotics. Antibiotic resistance is emerging as a global health issue. Alternative measures include innovative antibiotics, which would be expensive, or the usage of phage therapy. On account of this, infection prevention and control remains the most sought-after way to combat this health concern.

Evolving Hospital-level Care in Other Environments

The emergence of personalized patient care, and establishment of urgent care clinics and primary care clinics are reflecting the expansion of patient-care across hospital levels. Organizations following this path require infection prevention supplies and equipment to minimize or eradicate the spread of pathogens. The establishment of such mobile and efficient clinical care centers is likely to create major demand for infection prevention devices.

Infection prevention devices continue to gain momentum across a number of end uses, and the increasing number of surgeries continues to offer growth potential for this business. However, as the healthcare sector continues to develop, next-gen therapeutics and treatments are being provided to patients, resulting in reduced hospital stay, thereby minimizing the need for infection prevention devices. This could hinder the growth of the infection prevention devices market.

Leverage Ultraviolet Technology

With the rise in antibiotic-resistant bacteria and virulent viruses over the last couple of years, healthcare professionals are analyzing their infection prevention methods and adopting newer, improved alternatives that promote better methods of disinfection. One such technique is the ultraviolet infection prevention technology. A new study shows that, ultraviolet disinfection technology eliminates nearly 98 percent of pathogens in the operating room, and might also help defeat superbugs. The implementation of this technique in next-gen infection prevention devices would help providers gain greater margins in sales.

Introduce Advanced Products

Research and development remains a vital strategy for key infection prevention devices market players. Key investments are made for enhancing R&D capabilities in a bid to introduce newer and advanced products to gain a strong market position. Moreover, key research activities are being focused primarily on improving patient outcomes and minimizing failure rates in patients with infectious diseases.

Strengthen Distribution in the U.S.

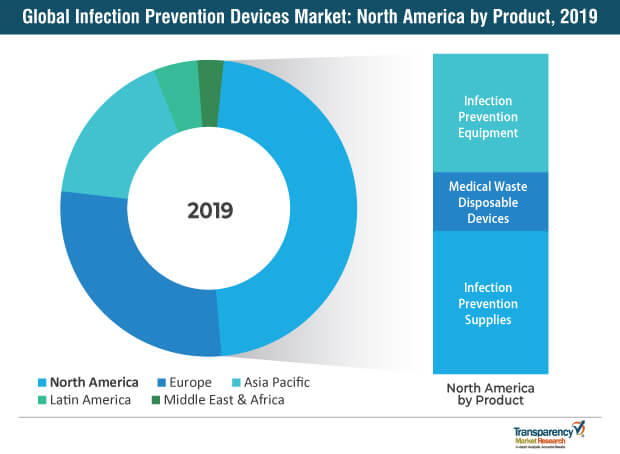

North America has showcased major growth opportunities for the injection prevention devices market. Continued developments in healthcare and advancements in technologies that support enhanced patient care witnessed across the U.S. are creating major demand for infection prevention and control techniques. Strengthening distribution across North America could allow companies to churn greater profits.

In 2018, Coloplast A/S acquired IncoCare Gunhild Vieler GmbH, a German direct-to-consumer homecare company, to strengthen its position in Germany. Coloplast and IncoCare plan to bring innovative products and services to more consumers across the country.

In 2019, Hollister Incorporated launched the Infyna Chic intermittent catheter, the latest in its line of female hydrophilic catheter offerings. This new catheter is designed to help provide women who use catheters with a high level of discretion. This product would be added to the complete Infyna portfolio, offering women a variety of options to meet their individual needs.

Mölnlycke Health Care AB and Zuellig Pharma entered into a partnership to focus on offering advanced wound care products and solutions to healthcare practitioners and patients across Southeast Asia.

Companies operating in the infection prevention devices market continue to invest in research and development to offer end users with advanced infection prevention supplies. With the support of infection tracking software and AI-enabled systems, infection prevention devices market players are able to offer improved product capabilities. Collaborations and partnerships in a bid to expand both, product portfolio and distribution, are majorly considered.

Analysts’ Perspective on the Market

TMR analysts have a positive perspective on the infection prevention devices market on account of various factors driving the applicability of these devices. According to the analysts, the launch of specifically-designed and advanced infection prevention supplies will push the infection prevention devices market onto a growth trajectory in the coming years. North America remains a prominent market for infection prevention devices, offering sales opportunities for leading market players. Companies aiming geographical expansions could consider business avenues in the U.S. The demand for infection prevention devices continues to grow in hospitals, especially in developed countries, where patient care remains a point of focus for healthcare professionals. Owing to this, hospitals, along with emerging clinical care centers, continue to offer significant sales opportunities for market players. New market entrants could capitalize on this opportunity by offering specifically-designed infection prevention devices for hospitals.

Global Infection Prevention Devices Market: Overview

The global infection prevention devices market was valued at ~ US$ 15.4 Bn in 2018. It is projected to expand at a CAGR of 6.0% from 2019 to 2027. Increase in the global geriatric population, rise in hospital admissions and outpatient visits, and increased demand for infection prevention products due to surgical procedures are key factors that are fueling the global infection prevention devices market.

Drivers & Restraints: Global Infection Prevention Devices Market

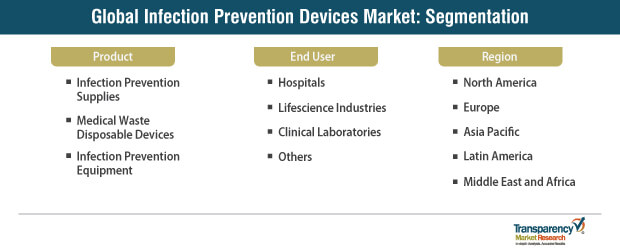

Market Segmentation: Global Infection Prevention Devices Market

Regional Segmentation: Global Infection Prevention Devices Market

Major Players: Global Infection Prevention Devices Market

Key players operating in the global infection prevention devices market include

These players are adopting strategies such as new product development, partnerships, and acquisitions to remain competitive in the global infection prevention devices market.

Infection prevention devices market to Reach ~US$ 25.7 Bn by 2027

Infection prevention devices market is projected to expand at a CAGR of 6.0% from 2019 to 2027

Infection prevention devices market is driven by increase in the global geriatric population and rise in hospital admissions and outpatient visits

North America accounted for a major share of the global infection prevention devices market

Key players in the infection prevention devices market include Johnson & Johnson (DePuy Synthes), Cardinal Health, PAUL HARTMANN AG, Mölnlycke Health Care AB, 3M Healthcare

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Infection Prevention Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Infection Prevention Devices Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn

5. Market Outlook

5.1. Regulatory Scenario by Region/Globally

5.2. Reimbursement Scenario by Region/Globally

6. Global Infection Prevention Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Infection Prevention Devices Market Forecast, by Product, 2017–2027

6.3.1. Infection Prevention Supplies

6.3.2. Infection Prevention Services

6.3.3. Infection Prevention Equipment

6.4. Global Infection Prevention Devices Market Attractiveness, by Type

7. Global Infection Prevention Devices Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Infection Prevention Devices Market Forecast, by End-user, 2017–2027

7.3.1. Hospitals

7.3.2. Lifescience Industries

7.3.3. Clinical Laboratories

7.3.4. Others

7.4. Global Infection Prevention Devices Market Attractiveness, by End-user

8. Global Infection Prevention Devices Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Infection Prevention Devices Market Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Infection Prevention Devices Market Attractiveness, by Region

9. North America Infection Prevention Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. North America Infection Prevention Devices Market Forecast, by Product, 2017–2027

9.2.1. Infection Prevention Supplies

9.2.2. Infection Prevention Services

9.2.3. Infection Prevention Equipment

9.3. North America Infection Prevention Devices Market Forecast, by End-user, 2017–2027

9.3.1. Hospitals

9.3.2. Lifescience Industries

9.3.3. Clinical Laboratories

9.3.4. Others

9.4. North America Infection Prevention Devices Market Forecast, by Country, 2017–2027

9.4.1. U.S.

9.4.2. Canada

9.5. North America Infection Prevention Devices Market Attractiveness Analysis

9.5.1. By Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Infection Prevention Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Europe Infection Prevention Devices Market Forecast, by Product, 2017–2027

10.2.1. Infection Prevention Supplies

10.2.2. Infection Prevention Services

10.2.3. Infection Prevention Equipment

10.3. Europe Infection Prevention Devices Market Forecast, by End-user, 2017–2027

10.3.1. Hospitals

10.3.2. Lifescience Industries

10.3.3. Clinical Laboratories

10.3.4. Others

10.4. Europe Infection Prevention Devices Market Forecast, by Country/Sub-region, 2017–2027

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Europe Infection Prevention Devices Market Attractiveness Analysis

10.5.1. By Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Infection Prevention Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Asia Pacific Infection Prevention Devices Market Forecast, by Product, 2017–2027

11.2.1. Infection Prevention Supplies

11.2.2. Infection Prevention Services

11.2.3. Infection Prevention Equipment

11.3. Asia Pacific Infection Prevention Devices Market Forecast, by End-user, 2017–2027

11.3.1. Hospitals

11.3.2. Lifescience Industries

11.3.3. Clinical Laboratories

11.3.4. Others

11.4. Asia Pacific Infection Prevention Devices Market Forecast, by Country/Sub-region, 2017–2027

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Asia Pacific Infection Prevention Devices Market Attractiveness Analysis

11.5.1. By Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Infection Prevention Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Latin America Infection Prevention Devices Market Forecast, by Product, 2017–2027

12.2.1. Infection Prevention Supplies

12.2.2. Infection Prevention Services

12.2.3. Infection Prevention Equipment

12.3. Latin America Infection Prevention Devices Market Forecast, by End-user, 2017–2027

12.3.1. Hospitals

12.3.2. Lifescience Industries

12.3.3. Clinical Laboratories

12.3.4. Others

12.4. Latin America Infection Prevention Devices Market Forecast, by Country, 2017–2027

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Latin America Infection Prevention Devices Market Attractiveness Analysis

12.5.1. By Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Infection Prevention Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Middle East & Africa Infection Prevention Devices Market Forecast, by Product, 2017–2027

13.2.1. Infection Prevention Supplies

13.2.2. Infection Prevention Services

13.2.3. Infection Prevention Equipment

13.3. Middle East & Africa Infection Prevention Devices Market Forecast, by End-user, 2017–2027

13.3.1. Hospitals

13.3.2. Lifescience Industries

13.3.3. Clinical Laboratories

13.3.4. Others

13.4. Middle East & Africa Infection Prevention Devices Market Forecast, by Country/Sub-region, 2017–2027

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Israel

13.4.4. Rest of Middle East & Africa

13.5. Middle East & Africa Infection Prevention Devices Market Attractiveness Analysis

13.5.1. By Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2019)

14.3. Company Profiles

14.3.1. Johnson & Johnson

14.3.2. Cardinal Health

14.3.3. PAUL HARTMANN AG

14.3.4. Mölnlycke Health Care AB

14.3.5. 3M Healthcare

14.3.6. B. Braun Melsungen AG

14.3.7. Coloplast Group

14.3.8. Ethicon, Inc.

14.3.9. Medline Industries, Inc.

14.3.10. C. R. Bard, Inc.

14.3.11. Hollister Incorporated

14.3.12. Danaher Corporation

14.3.13. Other Prominent Key Players

15. Assumptions and Acronyms Used

16. Research Methodology

List of Tables

Table 01: Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 02: Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 03: Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 04: North America Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 05: North America Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 06: North America Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 07: U.S. Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 08: U.S. Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 09: Canada Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 10: Canada Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 11: Europe Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 12: Europe Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 13: Europe Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 14: U.K. Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 15: U.K. Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 16: Germany Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 17: Germany Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 18: France Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 19: France Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 20: Italy Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 21: Italy Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 22: Spain Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 23: Spain Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 24: Asia Pacific Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 25: Asia Pacific Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 26: Asia Pacific Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 27: China Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 28: China Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 29: India Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 30: India Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 31: Japan Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 32: Japan Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 33: Australia & New Zealand Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 34: Australia & New Zealand Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 35: Latin America Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 36: Latin America Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 37: Latin America Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 38: Brazil Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 39: Brazil Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 40: Mexico Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 41: Mexico Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 42: Middle East & Africa Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 43: Middle East & Africa Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 44: Middle East & Africa Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 45: GCC Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 46: GCC Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 47: South Africa Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 48: South Africa Global Infection Prevention Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Infection Prevention Devices Market Snapshot

Figure 02: Global Infection Prevention Devices Market Segments with Leading Market Share (%), 2017

Figure 03: Global Infection Prevention Devices Market Value (US$ Mn) Forecast, 2017?2027

Figure 04: Global Infection Prevention Devices Market Value Share (%), by Product (2019)

Figure 05: Global Infection Prevention Devices Market Value Share (%), by End-user (2019)

Figure 06: Global Infection Prevention Devices Market Value Share (%), by Region (2019)

Figure 07: Global Infection Prevention Devices Market Value Share Analysis, by Product, 2019 and 2027

Figure 08: Global Infection Prevention Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Infection Prevention Supplies, 2017–2027

Figure 09: Global Infection Prevention Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Medical Waste Disposable Devices, 2017–2027

Figure 10: Global Infection Prevention Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Infection Prevention Equipment, 2017–2027

Figure 11: Global Infection Prevention Devices Market Attractiveness, by Product, 2019–2027

Figure 12: Global Infection Prevention Devices Market Value Share (%), by End-user, 2017 and 2027

Figure 13: Global Infection Prevention Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals, 2017–2027

Figure 14: Global Infection Prevention Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Lifescience Industries, 2017–2027

Figure 15: Global Infection Prevention Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Clinical Laboratories, 2017–2027

Figure 16: Global Infection Prevention Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2027

Figure 17: Global Infection Prevention Devices Market Attractiveness, by End-user, 2019–2027

Figure 18: Global Infection Prevention Devices Market Value Share Analysis, by Region 2019 and 2027

Figure 19: Global Infection Prevention Devices Market Attractiveness, by Region, 2019–2027

Figure 20: North America Infection Prevention Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 201–2027

Figure 21: North America Infection Prevention Devices Market Value Share (%), by Product, 2019 and 2027

Figure 22: North America Infection Prevention Devices Market Attractiveness, by Product, 2019–2027

Figure 23: North America Infection Prevention Devices Market Value Share (%), by End-user, 2019 and 2027

Figure 24: North America Infection Prevention Devices Market Attractiveness, by End-user, 2019–2027

Figure 25: North America Infection Prevention Devices Market Value Share (%), by Country/Sub-region, 2019 and 2027

Figure 26: North America Infection Prevention Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 27: Europe Infection Prevention Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 28: Europe Infection Prevention Devices Market Value Share (%), by Product, 2017 and 2027

Figure 29: Europe Infection Prevention Devices Market Attractiveness, by Product, 2019–2027

Figure 30: Europe Infection Prevention Devices Market Value Share (%), by End-user, 2019–2027

Figure 31: Europe Infection Prevention Devices Market Attractiveness, by End-user, 2019–2027

Figure 32: Europe Infection Prevention Devices Market Value Share (%), by Country/Sub-region, 2019 and 2027

Figure 33: Europe Infection Prevention Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 34: Asia Pacific Infection Prevention Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 35: Asia Pacific Infection Prevention Devices Market Value Share (%), by Product, 2019 and 2027

Figure 36: Asia Pacific Infection Prevention Devices Market Attractiveness, by Product, 2019–2027

Figure 37: Asia Pacific Portable Oxygen Concentrators Share (%), by End-user, 2019 and 2027

Figure 38: Asia Pacific Infection Prevention Devices Market Attractiveness, by End-user, 2019–2027

Figure 39: Asia Pacific Infection Prevention Devices Market Value Share (%), by Country/Sub-region, 2019 and 2027

Figure 40: Asia Pacific Infection Prevention Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 41: Latin America Infection Prevention Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 42: Latin America Infection Prevention Devices Market Value Share (%), by Product, 2019 and 2027

Figure 43: Latin America Infection Prevention Devices Market Attractiveness, by Product, 2019–2027

Figure 44: Latin America Infection Prevention Devices Market Share (%), by End-user, 2019 and 2027

Figure 45: Latin America Infection Prevention Devices Market Attractiveness, by End-user, 2019–2027

Figure 46: Latin America Infection Prevention Devices Market Value Share (%), by Country/Sub-region, 2017 and 2027

Figure 47: Latin America Infection Prevention Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 48: Middle East & Africa Infection Prevention Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 49: Middle East & Africa Infection Prevention Devices Market Value Share (%), by Product, 2019 and 2027

Figure 50: Middle East & Africa Infection Prevention Devices Market Attractiveness, by Product, 2019–2027

Figure 51: Middle East & Africa Infection Prevention Devices Market Share (%), by End-user, 2017 and 2027

Figure 52: Middle East & Africa Infection Prevention Devices Market Attractiveness, by End-user, 2019–2027

Figure 53: Middle East & Africa Infection Prevention Devices Market Value Share (%), by Country/Sub-region, 2019 and 2027

Figure 54: Middle East & Africa Infection Prevention Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 55: Global Infection Prevention Devices Market Share Analysis, by Company (2019)