Analysts’ Viewpoint

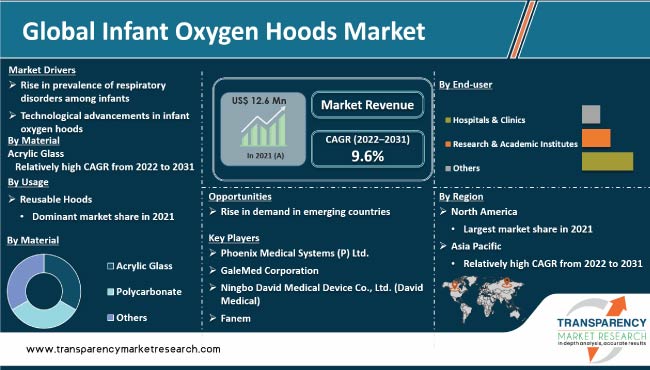

The global infant oxygen hoods market is expected to grow significantly in the next few years owing to the rise in prevalence of respiratory issues among newborns and surge in demand for advanced respiratory treatments. Increase in awareness among parents about the importance of proper respiratory care for infants is also likely to propel market expansion.

Furthermore, rise in number of premature infants and those born with congenital respiratory issues is projected to accelerate market progress in the near future.Increase in demand for effective respiratory care for newborns presents significant opportunities for market players. Leading players are focusing on adopting advanced technologies to increase their market share.

Infant oxygen hoods are medical devices designed to provide oxygen therapy to newborns with respiratory issues. These devices are primarily used to treat premature infants and those born with congenital respiratory issues.

These devices are designed to fit over an infant's head to deliver a flow of oxygen to help breathe more easily. They are typically made from materials such as acrylic glass or polycarbonate, which are strong, durable, and easy to sterilize.

Medical devices, such as neonatal oxygen hood, oxygen hood for infants, and oxygen hood for newborns, are essential in neonatal care, as these provide precise flow of oxygen to the infant, helping to manage respiratory issues and improve overall health.

These devices are used in various medical procedures, including the treatment of respiratory distress in newborns and the management of respiratory issues in premature infants. These devices are also used in digital neonatal care, which involves the usage of advanced technologies to monitor and treat respiratory issues in newborns.

The COVID-19 pandemic has had a significant impact on the business. Outbreak of the virus and the subsequent lockdowns and restrictions on non-essential businesses led to a significant decline in demand for infant oxygen hoods.

Hospitals and neonatal care facilities were forced to reduce capacity or shut down altogether, leading to a decrease in infant oxygen hoods market demand. This was further exacerbated by the reduction in the number of medical procedures performed due to the pandemic.

Several procedures that require the usage of these devices were postponed or canceled due to the pandemic. This led to a decrease in demand for these devices.

However, demand for these devices has been recovering after the lifting of restrictions. Hospitals and neonatal care facilities have begun to reopen, and the demand for medical procedures has increased. Consequently, demand for infant oxygen hoods is expected to recover in the next few years.

Increase in prevalence of respiratory disorders among newborns is a key factor driving the global infant oxygen hoods market. Respiratory issues are common in newborns, particularly premature infants and those born with congenital respiratory disorders.

These issues could range from mild to severe, and require various forms of treatment, including oxygen therapy. According to a report published by the World Health Organization (WHO) in June 2019, respiratory issues are a leading cause of morbidity and mortality in newborns, particularly in low- and middle-income countries.

The report estimates that approximately 16% of neonatal deaths worldwide are due to respiratory issues. Research has shown that premature infants are at an increased risk of respiratory issues.

A study published in September 2018 in the journal Pediatrics revealed that premature infants are more likely to experience respiratory distress syndrome (RDS), a common respiratory disorder that could be life-threatening if left untreated. Furthermore, RDS occurred in around 50% of infants born before 28 weeks of gestation, and in 15% of infants born between 28 and 32 weeks of gestation.

Technological advancements are driving the infant oxygen hoods market by enabling the development of newer, more advanced devices that incorporate advanced technologies and materials. These advancements have led to higher effectiveness and safety of infant oxygen hoods.

In January 2021, Natus Medical Incorporated launched the NeoBLUE Radiant Warmer with NeoBLUE Phototherapy Hood. The device combines advanced temperature control technology with a built-in phototherapy system for treating jaundice, making it a valuable tool for healthcare professionals caring for newborns.

In October 2020, Fisher & Paykel Healthcare released the Bubble CPAP system, which uses a bubble generator to deliver constant positive airway pressure (CPAP) to infants with respiratory distress. The device features a range of customizable settings and alarms to ensure proper usage.

In terms of material, the polycarbonate segment dominated the global infant oxygen hoods market in 2021. This can be ascribed to technological advancements, advantages, and increase in launch of new products.

Polycarbonate is stronger and more durable, making it suitable for usage in oxygen hoods. It is lightweight, shatter-resistant, transparent, and easy to sterilize & maintain compared to other materials.

Launch of new products using polycarbonate, such as the OxyShield Infant Hood by VYAIRE Medical, is anticipated to propel the segment in the next few years.

Based on usage, the reusable hoods segment accounted for the largest infant oxygen hoods market share in 2021. The segment is driven by environmental safety and cost-effectiveness.

Reusable hoods are more environmentally friendly. These devices could be used multiple times, which reduces waste, compared to disposable devices. These hoods are cost-effective in the long-term, as these can be reused multiple time, while disposable hoods must be replaced after single use.

Hence, hospitals and other medical facilities, which strive to reduce costs, prefer reusable infant oxygen hoods. Thus, the reusable hoods segment is expected to dominated the business in the next few years.

In terms of end-user, the hospitals & clinics segment held significant share of the global market in 2021. Demand for medical equipment, including infant oxygen hoods, is high in hospitals and clinics due to the increase in number of patients visiting these settings for treatment.

Healthcare professionals working in hospitals and clinics are highly trained in the usage of infant oxygen hoods. Therefore, large budget and high number of patients are ascribed to the segment's dominance of the industry.

North America accounted for the largest global infant oxygen hoods industry share in 2021. The trend is projected to continue during the forecast period. The market in the region is expected to experience significant growth due to high incidence of premature births and availability of advanced medical facilities.

According to World Health Organization data, the preterm birth rate in the U.S. is around 10.1%, which is one of the highest in the world. Preterm birth is a major cause of respiratory distress in newborns.

High incidence of premature birth has led to an increase in demand for infant oxygen hoods and other neonatal care products.Availability of advanced medical facilities has also contributed to the rise in infant oxygen hoods industry revenue in North America.

The region is home to some of the world's most advanced medical facilities, and has a well-established healthcare system that is equipped to handle the needs of critically ill newborns. Availability of advanced medical technologies, including infant oxygen hoods, has helped improve the outcome for premature and critically ill infants in the region.

Asia Pacific is expected to present significant infant oxygen hoods market opportunities due to the increase in demand for advanced medical devices and rise in awareness about the importance of neonatal care in the region. Surge in investment in healthcare infrastructure and adoption of advanced medical technologies in China and India have led to an increase in specialized neonatal care facilities. This has driven the demand for these devices and other neonatal care products.

Rise in awareness among parents about the potential long-term effects of respiratory distress in newborns has increased the emphasis on early diagnosis and treatment. This has led to increase in the number of premature and critically ill infants treated in NICUs in Asia Pacific.

The infant oxygen hoods market report includes vital information about the key players operating in the global market. Companies are focusing on strategies such as product launches, divestiture, mergers & acquisitions (M&A), and partnerships to strengthen market position.

GE Healthcare, Phoenix Medical Systems (P) Ltd., GaleMed Corporation, Ningbo David Medical Device Co., Ltd. (David Medical), Dräger, Fanem, GINEVRI SRL, nice Neötech Medical Systems Pvt. Ltd., S S Technomed (P) Ltd., Olidef Medical, Utah Medical Products, Inc., and Zhengzhou Dison Instrument and Meter Co., Ltd. are the prominent players operating in the industry.

Each of these players has been profiled in the report based on parameters such as company overview, financial overview, strategies, product portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 12.6 Mn |

|

Market Forecast Value in 2031 |

More than US$ 31.7 Mn |

|

Compound Annual Growth Rate (CAGR) |

9.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 12.6 Mn in 2021

It is projected to reach more than US$ 31.7 Mn by 2031

The CAGR is expected to be 9.6% from 2022 to 2031

Rise in prevalence of respiratory disorders among infants and technological advancements in infant oxygen hoods.

The hospitals & clinics held the largest share in 2021

North America is expected to account for significant share during the forecast period

GE Healthcare, Phoenix Medical Systems (P) Ltd., GaleMed Corporation, Ningbo David Medical Device Co., Ltd. (David Medical), Dräger, Fanem, GINEVRI srl, nice Neötech Medical Systems Pvt. Ltd., S S Technomed (P) Ltd., Olidef Medical, Utah Medical Products, Inc., and Zhengzhou Dison Instrument and Meter Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Infant Oxygen Hoods Market

4. Market Overview

4.1. Introduction

4.1.1. Infant Oxygen Hoods Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Infant Oxygen Hoods Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Disease incidence and prevalence

5.2. Technological Advancements

5.3. Regulatory Scenario across the globe/key countries

5.4. COVID-19 Impact Analysis

6. Global Infant Oxygen Hoods Market Analysis and Forecast, by Material

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Material, 2017–2031

6.3.1. Acrylic Glass

6.3.2. Polycarbonate

6.3.3. Others

6.4. Market Attractiveness Analysis, by Material

7. Global Infant Oxygen Hoods Market Analysis and Forecast, by Usage

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Usage, 2017–2031

7.3.1. Disposable Hoods

7.3.2. Reusable Hoods

7.4. Market Attractiveness Analysis, by Usage

8. Global Infant Oxygen Hoods Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals & Clinics

8.3.2. Research & Academic Institutes

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Infant Oxygen Hoods Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Infant Oxygen Hoods Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Material, 2017–2031

10.2.1. Acrylic Glass

10.2.2. Polycarbonate

10.2.3. Others

10.3. Market Value Forecast, by Usage, 2017–2031

10.3.1. Disposable Hoods

10.3.2. Reusable Hoods

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals & Clinics

10.4.2. Research & Academic Institutes

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Material

10.6.2. By Usage

10.6.3. By End-user

10.6.4. By Country

11. Europe Infant Oxygen Hoods Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Material, 2017–2031

11.2.1. Acrylic Glass

11.2.2. Polycarbonate

11.2.3. Others

11.3. Market Value Forecast, by Usage, 2017–2031

11.3.1. Disposable Hoods

11.3.2. Reusable Hoods

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals & Clinics

11.4.2. Research & Academic Institutes

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. U.K.

11.5.2. Germany

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Material

11.6.2. By Usage

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Infant Oxygen Hoods Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Material, 2017–2031

12.2.1. Acrylic Glass

12.2.2. Polycarbonate

12.2.3. Others

12.3. Market Value Forecast, by Usage, 2017–2031

12.3.1. Disposable Hoods

12.3.2. Reusable Hoods

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals & Clinics

12.4.2. Research & Academic Institutes

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Material

12.6.2. By Usage

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Infant Oxygen Hoods Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Material, 2017–2031

13.2.1. Acrylic Glass

13.2.2. Polycarbonate

13.2.3. Others

13.3. Market Value Forecast, by Usage, 2017–2031

13.3.1. Disposable Hoods

13.3.2. Reusable Hoods

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals & Clinics

13.4.2. Research & Academic Institutes

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Material

13.6.2. By Usage

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Infant Oxygen Hoods Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Material, 2017–2031

14.2.1. Acrylic Glass

14.2.2. Polycarbonate

14.2.3. Others

14.3. Market Value Forecast, by Usage, 2017–2031

14.3.1. Disposable Hoods

14.3.2. Reusable Hoods

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals & Clinics

14.4.2. Research & Academic Institutes

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Material

14.6.2. By Usage

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Phoenix Medical Systems (P) Ltd.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Material Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. GaleMed Corporation

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Material Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Ningbo David Medical Device Co., Ltd. (David Medical)

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Material Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Fanem

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Material Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. GINEVRI srl.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Material Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. nice Neötech Medical Systems Pvt. Ltd.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Material Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. S S Technomed (P) Ltd.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Material Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Olidef Medical

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Material Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Utah Medical Products, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Material Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Zhengzhou Dison Instrument and Meter Co., Ltd.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Material Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. GE Healthcare

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Material Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. Dräger

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Material Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

List of Tables

Table 01: Global Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 02: Global Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Acrylic Glass, 2017–2031

Table 03: Global Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Polycarbonate, 2017–2031

Table 04: Global Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 05: Global Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 08: North America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Acrylic Glass, 2017–2031

Table 09: North America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Polycarbonate, 2017–2031

Table 10: North America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 11: North America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: North America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 13: Europe Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 14: Europe Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Acrylic Glass, 2017–2031

Table 15: Europe Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Polycarbonate, 2017–2031

Table 16: Europe Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 17: Europe Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Europe Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 19: Asia Pacific Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 20: Asia Pacific Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Acrylic Glass, 2017–2031

Table 21: Asia Pacific Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Polycarbonate, 2017–2031

Table 22: Asia Pacific Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 23: Asia Pacific Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Asia Pacific Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 25: Latin America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 26: Latin America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Acrylic Glass, 2017–2031

Table 27: Latin America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Polycarbonate, 2017–2031

Table 28: Latin America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 29: Latin America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 30: Latin America Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 31: Middle East & Africa Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 32: Middle East & Africa Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Acrylic Glass, 2017–2031

Table 33: Middle East & Africa Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Polycarbonate, 2017–2031

Table 34: Middle East & Africa Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Usage, 2017–2031

Table 35: Middle East & Africa Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 36: Middle East & Africa Infant Oxygen Hoods Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Infant Oxygen Hoods Market

Figure 02: Global Infant Oxygen Hoods Market Size (US$ Mn) Forecast, 2017–2031

Figure 03: Global Infant Oxygen Hoods Market Value Share, by Material (2021)

Figure 04: Global Infant Oxygen Hoods Market Value Share, by Usage (2021)

Figure 05: Global Infant Oxygen Hoods Market Value Share, by End-user (2021)

Figure 06: Global Infant Oxygen Hoods Market Value Share, by Region (2021)

Figure 07: Global Infant Oxygen Hoods Market Value Share, by Material, 2021 and 2031

Figure 08 Global Infant Oxygen Hoods Market Attractiveness Analysis, by Material, 2021–2031

Figure 09: Global Infant Oxygen Hoods Market Value Share, by Usage, 2021 and 2031

Figure 10: Global Infant Oxygen Hoods Market Attractiveness Analysis, by Usage, 2021–2031

Figure 11: Global Infant Oxygen Hoods Market Value Share, by End-user, 2021 and 2031

Figure 12: Global Infant Oxygen Hoods Market Attractiveness Analysis, by End-user, 2021–2031

Figure 13: Global Infant Oxygen Hoods Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 14: Global Infant Oxygen Hoods Market Value Share, by Region, 2021–2031

Figure 15: Global Infant Oxygen Hoods Market Attractiveness Analysis, by Region, 2021–2031

Figure 16: North America Infant Oxygen Hoods Market Value Share, by Material, 2021 and 2031

Figure 17: North America Infant Oxygen Hoods Market Attractiveness Analysis, by Material, 2021–2031

Figure 18: North America Infant Oxygen Hoods Market Value Share, by Usage, 2021 and 2031

Figure 19: North America Infant Oxygen Hoods Market Attractiveness Analysis, by Usage, 2021–2031

Figure 20: North America Infant Oxygen Hoods Market Value Share, by End-user, 2021 and 2031

Figure 21: North America Infant Oxygen Hoods Market Attractiveness Analysis, by End-user, 2021–2031

Figure 22: North America Infant Oxygen Hoods Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 23: North America Infant Oxygen Hoods Market Value Share, by Country, 2021–2031

Figure 24: North America Infant Oxygen Hoods Market Attractiveness Analysis, by Country, 2021–2031

Figure 25: Europe Infant Oxygen Hoods Market Value Share, by Material, 2021 and 2031

Figure 26: Europe Infant Oxygen Hoods Market Attractiveness Analysis, by Material, 2021–2031

Figure 27: Europe Infant Oxygen Hoods Market Value Share, by Usage, 2021 and 2031

Figure 28: Europe Infant Oxygen Hoods Market Attractiveness Analysis, by Usage, 2021–2031

Figure 29: Europe Infant Oxygen Hoods Market Value Share, by End-user, 2021 and 2031

Figure 30: Europe Infant Oxygen Hoods Market Attractiveness Analysis, by End-user, 2021–2031

Figure 31: Europe Infant Oxygen Hoods Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 32: Europe Infant Oxygen Hoods Market Value Share, by Country/Sub-region, 2021–2031

Figure 33: Europe Infant Oxygen Hoods Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 34: Asia Pacific Infant Oxygen Hoods Market Value Share, by Material, 2021 and 2031

Figure 35: Asia Pacific Infant Oxygen Hoods Market Attractiveness Analysis, by Material, 2021–2031

Figure 36: Asia Pacific Infant Oxygen Hoods Market Value Share, by Usage, 2021 and 2031

Figure 37: Asia Pacific Infant Oxygen Hoods Market Attractiveness Analysis, by Usage, 2021–2031

Figure 38: Asia Pacific Infant Oxygen Hoods Market Value Share, by End-user, 2021 and 2031

Figure 39: Asia Pacific Infant Oxygen Hoods Market Attractiveness Analysis, by End-user, 2021–2031

Figure 40: Asia Pacific Infant Oxygen Hoods Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 41: Asia Pacific Infant Oxygen Hoods Market Value Share, by Country/Sub-region, 2021–2031

Figure 42: Asia Pacific Infant Oxygen Hoods Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 43: Latin America Infant Oxygen Hoods Market Value Share, by Material, 2021 and 2031

Figure 44: Latin America Infant Oxygen Hoods Market Attractiveness Analysis, by Material, 2021–2031

Figure 45: Latin America Infant Oxygen Hoods Market Value Share, by Usage, 2021 and 2031

Figure 46: Latin America Infant Oxygen Hoods Market Attractiveness Analysis, by Usage, 2021–2031

Figure 47: Latin America Infant Oxygen Hoods Market Value Share, by End-user, 2021 and 2031

Figure 48: Latin America Infant Oxygen Hoods Market Attractiveness Analysis, by End-user, 2021–2031

Figure 49: Latin America Infant Oxygen Hoods Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 50: Latin America Infant Oxygen Hoods Market Value Share, by Country/Sub-region, 2021–2031

Figure 51: Latin America Infant Oxygen Hoods Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 52: Middle East & Africa Infant Oxygen Hoods Market Value Share, by Material, 2021 and 2031

Figure 53: Middle East & Africa Infant Oxygen Hoods Market Attractiveness Analysis, by Material, 2021–2031

Figure 54: Middle East & Africa Infant Oxygen Hoods Market Value Share, by Usage, 2021 and 2031

Figure 55: Middle East & Africa Infant Oxygen Hoods Market Attractiveness Analysis, by Usage, 2021–2031

Figure 56: Middle East & Africa Infant Oxygen Hoods Market Value Share, by End-user, 2021 and 2031

Figure 57: Middle East & Africa Infant Oxygen Hoods Market Attractiveness Analysis, by End-user, 2021–2031

Figure 58: Middle East & Africa Infant Oxygen Hoods Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 59: Middle East & Africa Infant Oxygen Hoods Market Value Share, by Country/Sub-region, 2021–2031

Figure 60: Middle East & Africa Infant Oxygen Hoods Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 61: Global Infant Oxygen Hoods Market Share Analysis, by Company, 2021 (Estimated)

Figure 62: Global Infant Oxygen Hoods Market Performance, by Company, 2021

Figure 63: Competition Matrix