Analysts’ Viewpoint on Market Scenario

Industrial wastewater contains a range of pollutants that can be harmful to both human health and the environment. Conventional wastewater treatment methods are often expensive, energy-intensive, and can have negative impact on the environment. Constructed treatment wetlands (CTW) provide a solution to these challenges by utilizing the natural processes of plants, soil, and microorganisms to treat industrial wastewater. This approach eliminates harmful contaminants, while also improving water quality, promoting biodiversity, and conserving energy. Industries can take a step toward reducing their environmental footprint and ensure the maintenance of their wastewater by implementing constructed treatment wetlands.

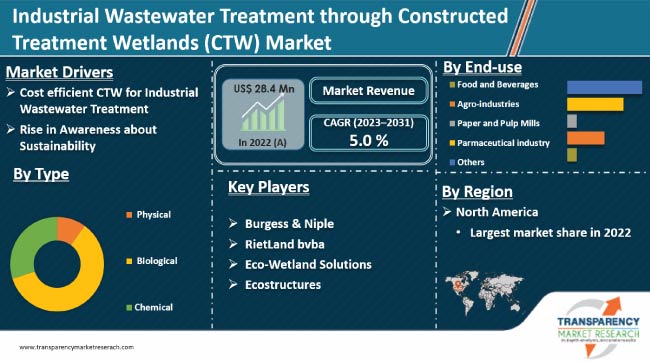

Therefore, key companies are expected to follow the latest global industrial wastewater treatment through constructed treatment wetlands (CTW) market trends and invest more in artificial constructed wetlands owing to their numerous benefits and potential for growth in the near future.

Constructed treatment wetlands (CTW) are engineered systems that use natural processes to treat industrial wastewater. The wastewater is passed through a series of ponds or basins that are designed to mimic the processes that occur in natural wetlands. Constructed wetlands can be used to treat a wide range of industrial wastewater, including wastewater from manufacturing, agriculture, and mining operations. CTW can effectively remove several pollutants associated with municipal and industrial wastewater and storm water.

The global industrial wastewater treatment through constructed treatment wetlands (CTW) industry commonly uses constructed treatment wetlands to treat a range of industrial wastewaters, including those from food and beverage processing, pulp and paper, and pharmaceutical manufacturing. They offer a cost-effective and environment-friendly alternative to traditional industrial wastewater treatment techniques and provide additional benefits such as improving water quality, promoting biodiversity, and conserving energy.

CTWs are gaining popularity for treatment of industrial wastewater due to their cost-effectiveness and environment-friendliness. The low capital costs of constructing a wetland are due to their simple design and the use of locally available materials such as soil, gravel, and vegetation.

Moreover, considering operating costs, wetlands rely on natural processes and require minimal energy and chemical inputs. This results in lower operating costs as compared to traditional treatment methods. In terms of maintenance, wetlands require minimal upkeep and specialized equipment, which helps keep maintenance costs low.

Treated water from wetlands can often be reused for non-potable purposes, such as irrigation, thereby reducing the need for additional water supplies and lowering costs. Wetlands also help reduce the amount of waste that needs to be disposed of by removing pollutants from industrial wastewater, which in turn further reduces waste disposal costs.

The global industrial wastewater treatment through constructed treatment wetlands (CTW) market forecast is highly promising as it offers numerous advantages over conventional wastewater treatment systems, thereby making CTWs cost-efficient, low-tech, and high-energy-saving treatment technology.

Treatment of industrial wastewater is a crucial process in the manufacturing sector, as it affects both the environment and human health. Growing concerns about environment sustainability have been boosting the demand for constructed treatment wetlands (CTW) for the last few years.

Increasing emphasis on sustainable practices and rising stringency of regulations mandating the treatment of industrial wastewater are likely to drive the industrial wastewater treatment through constructed treatment wetlands (CTW) market share in the next few years. Additionally, advancements in technology and increasing awareness about the benefits of CTWs are expected to further boost its adoption.

The CTW method has been demonstrated to be more effective in helping support and sustain ground water and surface water levels, as well as prepare water for reuse. This is contributing to environmental conservation by supplying a home for plants and animals. The rapidly expanding field of built wetlands treats wastewater by simulating the physical, chemical, and biological processes that occur in natural wetlands.

In conclusion, the use of CTWs in industrial wastewater treatment is a step towards a more sustainable future, providing a cost-effective and environment-friendly solution for industries. Thus, constructed wetlands are gaining popularity as an alternative to conventional technologies in the wastewater treatment industry

In terms of type, the industrial wastewater treatment through constructed treatment wetlands (CTW) market segmentation comprises physical treatment, biological treatment and chemical treatment. The industrial wastewater treatment through constructed treatment wetlands (CTW) market share held by the biological treatment segment is anticipated to grow at a CAGR of 7.9% during the forecast period.

In biological treatment, wastewater is introduced into a biological reactor, where it is mixed with microorganisms. The microorganisms consume the organic matter in the wastewater, converting it into carbon dioxide, water, and other by-products.

The various types of biological treatment methods include activated sludge, aerated lagoons, rotating biological contactors, and constructed treatment wetlands. Each of these methods work differently; however, they all rely on the same principle of using microorganisms to break down the pollutants in wastewater.

The flexibility and ease of operation of the biological treatment method make bio conversion more effective and cost-efficient. This, in turn, is anticipated to boost the industrial wastewater treatment through constructed treatment wetlands (CTW) market demand.

According to the regional industrial wastewater treatment through constructed treatment wetlands (CTW) market analysis, In terms of value, the North America market is expected to expand considerably during the forecast period due to high industrial activities and presence of a large number of constructed wetland projects, particularly in the U.S. and Canada. The region has witnessed significant investment in the CTW industry over the last decade, due to governmental initiatives and increase in awareness about wastewater treatment and prevailing notion of sustainability.

Europe is home to a prominent constructed wetland industry and the region held 30% market share in 2022. Germany, U.K., and Austria are driving market growth in the region primarily due to growing investment in manmade wetlands in the region.

The CWT wastewater treatment market outlook for Latin America and Middle East & Africa is promising, and the market in these regions is estimated to grow at a moderate pace in the near future.

The global industrial wastewater treatment through constructed treatment wetlands (CTW) market is highly consolidated, with a small number of large-scale vendors controlling majority share. These companies offer a range of services including design and engineering of constructed wetlands, installation, maintenance, and monitoring. They work with government agencies, developers, utilities, and other organizations to provide sustainable solutions for water management and treatment. Prominent players engage in expansion of product portfolios and mergers and acquisitions in order to consolidate their position and grab market opportunities. Burgess & Niple, RietLand bvba, Eco-Wetland Solutions, Ecostructures, Eco Technics Consulting Ltd., and EcoTec are key entities operating in the market

The industrial wastewater treatment through constructed treatment wetlands (CTW) industry research report contains profiles of key players who have been analyzed on various parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 28.4 Mn |

|

Market Forecast Value in 2031 |

US$ 44.0 Mn |

|

Growth Rate (CAGR) |

5.0 % |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 28.4 Mn in 2022.

It is expected to grow at a CAGR of 5.0% from 2022 to 2031.

Cost-efficient constructed treatment wetlands and rise in awareness about sustainability.

Biological treatment was the largest type segment and its value is anticipated to grow at a CAGR of 5.0% during the forecast period.

North America was the most lucrative region and held 40% share in 2022.

Burgess & Niple, Rietland BVBA, Eco-Wetland Solutions, Ecostructures, Eco Technics Consulting Ltd., and EcoTec.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecasts, 2023-2031

2.6.1. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Microwave Power Transmission

3.2. Impact on the Demand of Microwave Power Transmission– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecast, by Type, 2023–2031

5.1. Key Findings

5.2. Global Microwave Power Transmission Value (US$ Mn) Forecast, by Type, 2023–2031

5.2.1. Physical

5.2.2. Biological

5.2.3. Chemical

5.3. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Type

6. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecast, by Flow Type, 2023–2031

6.1. Key Findings

6.2. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

6.2.1. Free Water Surface flow

6.2.2. Subsurface flow

6.2.3. Floating

6.2.4. Others

6.3. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Flow Type

7. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecast, by Application, 2023–2031

7.1. Key Findings

7.2. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Application, 2023–2031

7.2.1. Carbon sequestration

7.2.2. Landfill leachate treatment

7.2.3. Water quality control

7.2.4. Air pollution control

7.2.5. Others

7.3. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Application

8. Global Sustainable Materials Market for Microwave Power Transmission Analysis and Forecast, by End-use, 2023–2031

8.1. Key Findings

8.2. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Application, 2023–2031

8.2.1. Food and Beverage industries

8.2.2. Paper and Pulp mills

8.2.3. Agro-industries

8.2.4. Pharmaceutical industry

8.2.5. Others

9. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecast, by Region, 2023–2031

9.1. Key Findings

9.2. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Region

10. North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

10.3. North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

10.4. North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

10.4.1. U.S. Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

10.4.2. U.S. Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

10.4.3. Canada Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

10.4.4. Canada Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

10.5. North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness Analysis

11. Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.3. Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

11.4. Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

11.4.1. Germany Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.2. Germany Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

11.4.3. France Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.4. France Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

11.4.5. U.K. Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.6. U.K. Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

11.4.7. Italy Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.8. Italy Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

11.4.9. Russia & CIS Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.10. Russia & CIS Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

11.4.11. Rest of Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.12. Rest of Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

11.5. Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness Analysis

12. Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type

12.3. Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

12.4. Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

12.4.1. China Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.2. China Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

12.4.3. Japan Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.4. Japan Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

12.4.5. India Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.6. India Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

12.4.7. ASEAN Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.8. ASEAN Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

12.4.9. Rest of Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.10. Rest of Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

12.5. Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness Analysis

13. Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

13.3. Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

13.4. Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

13.4.1. Brazil Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

13.4.2. Brazil Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

13.4.3. Mexico Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

13.4.4. Mexico Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

13.4.5. Rest of Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

13.4.6. Rest of Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

13.5. Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness Analysis

14. Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

14.3. Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

14.4. Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

14.4.1. GCC Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

14.4.2. GCC Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

14.4.3. South Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

14.4.4. South Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

14.4.5. Rest of Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

14.4.6. Rest of Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

14.5. Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness Analysis

15. Competition Landscape

15.1. Market Players - Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, 2022

15.3. Market Footprint Analysis

15.3.1. By Type

15.3.2. By Flow Type

15.3.3. By Application

15.3.4. By End-use

15.4. Company Profiles

15.4.1. Burgess & Niple

15.4.1.1. Company Revenue

15.4.1.2. Business Overview

15.4.1.3. Product Segments

15.4.1.4. Geographic Footprint

15.4.1.5. Plant Details, etc. (*As Applicable)

15.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.4.2. RietLand BVBA

15.4.2.1. Company Revenue

15.4.2.2. Business Overview

15.4.2.3. Product Segments

15.4.2.4. Geographic Footprint

15.4.2.5. Plant Details, etc. (*As Applicable)

15.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.4.3. Eco-Wetland Solutions

15.4.3.1. Company Revenue

15.4.3.2. Business Overview

15.4.3.3. Product Segments

15.4.3.4. Geographic Footprint

15.4.3.5. Plant Details, etc. (*As Applicable)

15.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.4.4. Ecostructures

15.4.4.1. Company Revenue

15.4.4.2. Business Overview

15.4.4.3. Product Segments

15.4.4.4. Geographic Footprint

15.4.4.5. Plant Details, etc. (*As Applicable)

15.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.4.5. HydroLogic Solutions and Wetland Solutions

15.4.5.1. Company Revenue

15.4.5.2. Business Overview

15.4.5.3. Product Segments

15.4.5.4. Geographic Footprint

15.4.5.5. Plant Details, etc. (*As Applicable)

15.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc

15.4.6. EcoTec

15.4.6.1. Company Revenue

15.4.6.2. Business Overview

15.4.6.3. Product Segments

15.4.6.4. Geographic Footprint

15.4.6.5. Plant Details, etc. (*As Applicable)

15.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc

15.4.7. Wetlandcare

15.4.7.1. Company Revenue

15.4.7.2. Business Overview

15.4.7.3. Product Segments

15.4.7.4. Geographic Footprint

15.4.7.5. Plant Details, etc. (*As Applicable)

15.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc

15.4.8. HydroScheme

15.4.8.1. Company Revenue

15.4.8.2. Business Overview

15.4.8.3. Product Segments

15.4.8.4. Geographic Footprint

15.4.8.5. Plant Details, etc. (*As Applicable)

15.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc

15.4.9. Naturally Wallace Consulting

15.4.9.1. Company Revenue

15.4.9.2. Business Overview

15.4.9.3. Product Segments

15.4.9.4. Geographic Footprint

15.4.9.5. Plant Details, etc. (*As Applicable)

15.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc

15.4.10. Orbicon

15.4.10.1. Company Revenue

15.4.10.2. Business Overview

15.4.10.3. Product Segments

15.4.10.4. Geographic Footprint

15.4.10.5. Plant Details, etc. (*As Applicable)

15.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc

15.4.11. Sinbio

15.4.11.1. Company Revenue

15.4.11.2. Business Overview

15.4.11.3. Product Segments

15.4.11.4. Geographic Footprint

15.4.11.5. Plant Details, etc. (*As Applicable)

15.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc

15.4.12. Others

15.4.12.1. Company Revenue

15.4.12.2. Business Overview

15.4.12.3. Product Segments

15.4.12.4. Geographic Footprint

15.4.12.5. Plant Details, etc. (*As Applicable)

15.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 2: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 3: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 4: North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 5: North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 6: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 7: North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 8: U.S. Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 9: U.S. Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 10: Canada Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 11: Canada Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 12: Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 13: Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 14: Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 15: Germany Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 16: Germany Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 17: France Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 18: France Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 19: U.K. Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 20: U.K. Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 21: Italy Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 22: Italy Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 23: Spain Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 24: Spain Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 25: Spain Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 26: Russia & CIS Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 27: Russia & CIS Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 28: Rest of Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 29: Rest of Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 30: Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 31: Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 32: Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 33: China Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type 2023–2031

Table 34: China Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 35: Japan Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 36: Japan Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 37: India Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 38: India Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 39: India Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type 2023–2031

Table 40: ASEAN Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 41: ASEAN Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 42: Rest of Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 43: Rest of Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 44: Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 45: Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 46: Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 47: Brazil Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 48: Brazil Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 49: Mexico Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 50: Mexico Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 51: Rest of Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 52: Rest of Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 53: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 54: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 55: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 56: GCC Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 57: GCC Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 58: South Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 59: South Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 60: Rest of Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 61: Rest of Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 62: Mexico Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 63: Mexico Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 64: Rest of Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 65: Rest of Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 66: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 67: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 68: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 69: GCC Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 70: GCC Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 71: South Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 72: South Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

Table 73: Rest of Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 74: Rest of Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value (US$ Mn) Forecast, by Flow Type, 2023–2031

List of Figures

Figure 1: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Type, 2022, 2027, and 2031

Figure 2: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Type

Figure 3: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Flow Type, 2022, 2027, and 2031

Figure 4: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Flow Type

Figure 5: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Region

Figure 7: North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Type, 2022, 2027, and 2031

Figure 8: North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Type

Figure 9: North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Flow Type, 2022, 2027, and 2031

Figure 10: North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Flow Type

Figure 11: North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 12: North America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Country/Sub-region

Figure 13: Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Type, 2022, 2027, and 2031

Figure 14: Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Type

Figure 15: Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Flow Type, 2022, 2027, and 2031

Figure 16: Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Flow Type

Figure 17: Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 18: Europe Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Country/Sub-region

Figure 19: Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Type, 2022, 2027, and 2031

Figure 20: Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Type

Figure 21: Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Flow Type, 2022, 2027, and 2031

Figure 22: Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Flow Type

Figure 23: Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Country/Sub-region

Figure 25: Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Type, 2022, 2027, and 2031

Figure 26: Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Type

Figure 27: Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Flow Type, 2022, 2027, and 2031

Figure 28: Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Flow Type

Figure 29: Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Country/Sub-region

Figure 31: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Type, 2022, 2027, and 2031

Figure 32: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Type

Figure 33: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, By Flow Type, 2022, 2027, and 2031

Figure 34: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Flow Type

Figure 35: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Value Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Industrial Wastewater Treatment through Constructed Treatment Wetlands (CTW) Market Attractiveness, by Country/Sub-region