Analysts’ Viewpoint

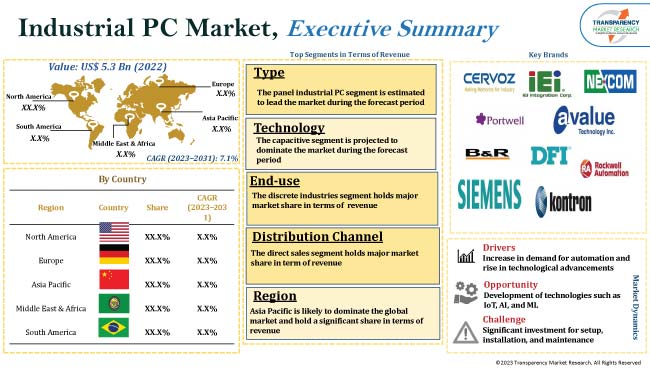

Rapid growth in several industries, such as automation, manufacturing, and aerospace, is projected to drive the global industrial PC market size. Industrial PC is a computing system that manages industrial and factory workloads for manufacturing equipment, machine automation, and new-age autonomous robotics.

Governments of various countries across the globe are taking initiatives to promote the adoption of advanced technologies in manufacturing. This is leading to market expansion. Key players in the market are introducing new technologies, such as Artificial Intelligence, Machine Learning, and Internet of Things (IoT), to strengthen their global footprint.

Industrial PC is a heavy engineering equipment, which is designed for usage in industrial environments such as wide operating temperature ranges and airborne particulates. It consists of a hardshell design and industrial grade components built for high reliability. Industrial PC can run 24x7, even in extreme environments where a consumer desktop PC would fail.

Industrial PC is widely used in manufacturing facilities, process control systems, data acquisition, and several industries. It is primarily employed in the automation industry to enhance and improve automation technologies. Additionally, industrial PC is utilized in the manufacture of goods and construction of automation and logistics centers.

Industrial PC offers several advantages over consumer PC. These include reliability, compatibility, and expansion options. It is also easy to maintain. Therefore, it is primarily used in industrial areas. However, the cost of industrial PC is significantly higher than that of office PC and consumer PC.

The need for automation in several industries, such as automotive, aerospace, manufacturing, is driving the demand for industrial PC. Industrial PC is used to control and monitor automated systems, thus resulting in increased efficiency and productivity.

Industrial PC is employed in the development of new technologies such as Artificial Intelligence, Machine Learning, and Internet of Things (IoT), as these technologies require high performance computing capabilities. Furthermore, IoT can be integrated with big data analytics and cloud computing into industrial automation processes, which in turn are integrated with industrial PCs.

Industrial PC is designed to operate in harsh environments, including extreme temperatures and humidity. Durable industrial PC is used extensively in mining, oil & gas, and aerospace industries. This is driving the global industrial PC market growth.

Durable industrial PC has a flexible design to control, activate, and observe systems and machines on the plant floor. It also provides a controlled environment for installed electronics, so that they are able to survive the typical conditions of the plant floor for a longer lifecycle.

Based on type, the global industrial PC market segmentation comprises panel industrial PC, embedded industrial PC, box industrial PC, rack mount industrial PC, DIN rail industrial PC, thin client industrial PC, and others. Demand for industrial panel PC is expected to be higher than that for others during the forecast period owing to the rise in usage of the PC in several applications, such as vision systems, factory automation systems, and material handling.

Attached to an LCD, panel industrial PC is integrated into the same enclosure as that of motherboard and other electronic components. it is employed in several industries such as automation, manufacturing, transportation, food & beverage, gaming, medical, and communication. Growth in these industries and business networks is primarily boosting the panel industrial PC segment.

As per the global industrial PC market forecast, the discrete end-use industry segment is likely to lead the global landscape during the forecast period owing to the increase in need for efficiency and enhanced process flexibility in these industries.

Rise in need to lower operational and maintenance costs, and increase in demand for comprehensive integration of quality and regulatory requirements in production processes for supply chain management are some of the key factors boosting the industrial PC market demand.

According to the global industrial PC market analysis, Asia Pacific is likely to record significant market progress during the forecast period owing to the growth in industrialization and rise in energy and power infrastructure investments in the region.

Increase in demand for healthcare services, rise in prevalence of health-related concerns, and surge in R&D investments are augmenting market development in the region. Growth in infrastructure activities and rise in government initiatives related to infrastructure development are also driving market statistics.

Europe and North America are anticipated to record moderate market growth rate during the forecast period.

The global industry is fragmented, with the presence of many local and international players. Competition is expected to intensify in the next few years due to the entry of local players. Key players are adopting various marketing strategies such as mergers and acquisitions to increase their global industrial PC market share in the near future.

Global industrial PC market trends suggest that prominent players are focusing on product developments in order to introduce highly efficient industrial PCs at reasonable prices. Furthermore, manufacturers are emphasizing on R&D activities to tap into lucrative global industrial PC market opportunities.

Leading players operating in the market are Cervoz Technology Co., Ltd., IEI Integration Corp, Nexcom International, Avalue Technology, American Portwell Technology Inc., B&R Industrial Automation GmbH, Kontron AG, Siemens AG, Diamond Flower Inc. and Rockwell Automation Inc.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 5.3 Bn |

|

Market Value in 2031 |

US$ 10.6 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, technological overview, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 5.3 Bn in 2022

It is anticipated to reach US$ 10.6 Bn by 2031

It is estimated to grow at a CAGR of 7.1% by 2031

Increase in demand for automation and rise in technological advancements, and growth in demand for durable industrial PCs

The panel industrial PC segment holds the major share

Asia Pacific is a more attractive region for vendors, followed by North America and Europe

Cervoz Technology Co. Ltd., IEI Integration Corp, Nexcom International, Avalue Technology, American Portwell Technology, Inc., B&R Industrial Automation GmbH, Kontron AG, Siemens AG, Diamond Flower Inc., and Rockwell Automation Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Technology Analysis

5.7. COVID-19 Impact Analysis

5.8. Value Chain Analysis

5.9. Global Industrial PC Market Analysis and Forecast, 2017- 2031

5.9.1. Market Value Projection (US$ Bn)

5.9.2. Market Volume Projection (Thousand Units)

6. Global Industrial PC Market Analysis and Forecast, by Type

6.1. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

6.1.1. Panel Industrial PC

6.1.2. Embedded Industrial PC

6.1.3. Box Industrial PC

6.1.4. Rack Mount Industrial PC

6.1.5. DIN Rail Industrial PC

6.1.6. Thin Client Industrial PC

6.1.7. Others

6.2. Incremental Opportunity, by type

7. Global Industrial PC Market Analysis and Forecast, by Technology

7.1. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

7.1.1. Resistive

7.1.2. Capacitive

7.1.3. Others

7.2. Incremental Opportunity, by Technology

8. Global Industrial PC Market Analysis and Forecast, by End-use

8.1. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by End-use, 2017- 2031

8.1.1. Discrete Industries

8.1.2. Automotive

8.1.3. Electronics

8.1.4. Medical Devices

8.1.5. Aerospace & Defense

8.1.6. Others

8.1.7. Process Industries

8.1.8. Chemicals

8.1.9. Food & Beverage

8.1.10. Oil & Gas

8.1.11. Energy & Power

8.1.12. Pharmaceuticals

8.1.13. Others

8.2. Incremental Opportunity, by End-use

9. Global Industrial PC Market Analysis and Forecast, by Distribution Channel

9.1. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, by Distribution Channel

10. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by Region, 2017- 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Industrial PC Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply Side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Industrial PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

11.5.1. Panel Industrial PC

11.5.2. Embedded Industrial PC

11.5.3. Box Industrial PC

11.5.4. Rack Mount Industrial PC

11.5.5. DIN Rail Industrial PC

11.5.6. Thin Client Industrial PC

11.5.7. Others

11.6. Industrial PC Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

11.6.1. Resistive

11.6.2. Capacitive

11.6.3. Others

11.7. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by End-use, 2017- 2031

11.7.1. Discrete Industries

11.7.2. Automotive

11.7.3. Electronics

11.7.4. Medical Devices

11.7.5. Aerospace & Defense

11.7.6. Others

11.7.7. Process Industries

11.7.8. Chemicals

11.7.9. Food & Beverage

11.7.10. Oil & Gas

11.7.11. Energy & Power

11.7.12. Pharmaceuticals

11.7.13. Others

11.8. Industrial PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

11.8.1. Direct Sales

11.8.2. Indirect Sales

11.9. Industrial PC Market Size (US$ Bn) (Thousand Units), by Country, 2017- 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Industrial PC Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply Side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Industrial PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

12.5.1. Panel Industrial PC

12.5.2. Embedded Industrial PC

12.5.3. Box Industrial PC

12.5.4. Rack Mount Industrial PC

12.5.5. DIN Rail Industrial PC

12.5.6. Thin Client Industrial PC

12.5.7. Others

12.6. Industrial PC Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

12.6.1. Resistive

12.6.2. Capacitive

12.6.3. Others

12.7. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by End-use, 2017- 2031

12.7.1. Discrete Industries

12.7.2. Automotive

12.7.3. Electronics

12.7.4. Medical Devices

12.7.5. Aerospace & Defense

12.7.6. Others

12.7.7. Process Industries

12.7.8. Chemicals

12.7.9. Food & Beverage

12.7.10. Oil & Gas

12.7.11. Energy & Power

12.7.12. Pharmaceuticals

12.7.13. Others

12.8. Industrial PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. Industrial PC Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017- 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Industrial PC Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply Side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Industrial PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

13.5.1. Panel Industrial PC

13.5.2. Embedded Industrial PC

13.5.3. Box Industrial PC

13.5.4. Rack Mount Industrial PC

13.5.5. DIN Rail Industrial PC

13.5.6. Thin Client Industrial PC

13.5.7. Others

13.6. Industrial PC Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

13.6.1. Resistive

13.6.2. Capacitive

13.6.3. Others

13.7. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by End-use, 2017- 2031

13.7.1. Discrete Industries

13.7.2. Automotive

13.7.3. Electronics

13.7.4. Medical Devices

13.7.5. Aerospace & Defense

13.7.6. Others

13.7.7. Process Industries

13.7.8. Chemicals

13.7.9. Food & Beverage

13.7.10. Oil & Gas

13.7.11. Energy & Power

13.7.12. Pharmaceuticals

13.7.13. Others

13.8. Industrial PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. Industrial PC Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017- 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Industrial PC Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply Side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Industrial PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

14.5.1. Panel Industrial PC

14.5.2. Embedded Industrial PC

14.5.3. Box Industrial PC

14.5.4. Rack Mount Industrial PC

14.5.5. DIN Rail Industrial PC

14.5.6. Thin Client Industrial PC

14.5.7. Others

14.6. Industrial PC Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

14.6.1. Resistive

14.6.2. Capacitive

14.6.3. Others

14.7. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by End-use, 2017- 2031

14.7.1. Discrete Industries

14.7.2. Automotive

14.7.3. Electronics

14.7.4. Medical Devices

14.7.5. Aerospace & Defense

14.7.6. Others

14.7.7. Process Industries

14.7.8. Chemicals

14.7.9. Food & Beverage

14.7.10. Oil & Gas

14.7.11. Energy & Power

14.7.12. Pharmaceuticals

14.7.13. Others

14.8. Industrial PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. Industrial PC Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017- 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Industrial PC Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply Side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Industrial PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

15.5.1. Panel Industrial PC

15.5.2. Embedded Industrial PC

15.5.3. Box Industrial PC

15.5.4. Rack Mount Industrial PC

15.5.5. DIN Rail Industrial PC

15.5.6. Thin Client Industrial PC

15.5.7. Others

15.6. Industrial PC Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

15.6.1. Resistive

15.6.2. Capacitive

15.6.3. Others

16. Global Industrial PC market Analysis and Forecast, by End-use

16.1. Global Industrial PC Market Size (US$ Bn) (Thousand Units), by End-use, 2017- 2031

16.1.1. Discrete Industries

16.1.2. Automotive

16.1.3. Electronics

16.1.4. Medical Devices

16.1.5. Aerospace & Defense

16.1.6. Others

16.1.7. Process Industries

16.1.8. Chemicals

16.1.9. Food & Beverage

16.1.10. Oil & Gas

16.1.11. Energy & Power

16.1.12. Pharmaceuticals

16.1.13. Others

16.2. Industrial PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

16.2.1. Direct Sales

16.2.2. Indirect Sales

16.3. Industrial PC Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017- 2031

16.3.1. Brazil

16.3.2. Rest of South America

16.4. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2022)

17.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

17.3.1. Cervoz Technology Co., Ltd.

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Financial Information, (Subject to Data Availability)

17.3.1.4. Business Strategies / Recent Developments

17.3.2. IEI Integration Corp

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Financial Information, (Subject to Data Availability)

17.3.2.4. Business Strategies / Recent Developments

17.3.3. Nexcom International

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Financial Information, (Subject to Data Availability)

17.3.3.4. Business Strategies / Recent Developments

17.3.4. Avalue Technology

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Financial Information, (Subject to Data Availability)

17.3.4.4. Business Strategies / Recent Developments

17.3.5. American Portwell Technology, Inc.

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Financial Information, (Subject to Data Availability)

17.3.5.4. Business Strategies / Recent Developments

17.3.6. B&R Industrial Automation GmbH

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Financial Information, (Subject to Data Availability)

17.3.6.4. Business Strategies / Recent Developments

17.3.7. Kontron AG

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Financial Information, (Subject to Data Availability)

17.3.7.4. Business Strategies / Recent Developments

17.3.8. Siemens AG

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Financial Information, (Subject to Data Availability)

17.3.8.4. Business Strategies / Recent Developments

17.3.9. Diamond Flower Inc.

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Financial Information, (Subject to Data Availability)

17.3.9.4. Business Strategies / Recent Developments

17.3.10. Rockwell Automation Inc.

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Financial Information, (Subject to Data Availability)

17.3.10.4. Business Strategies / Recent Developments

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. Type

18.1.2. Technology

18.1.3. End-use

18.1.4. Distribution Channel

18.1.5. Region

18.2. Understanding the Procurement Process of the End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial PC Market, by Type, Thousand Units, 2017-2031

Table 2: Global Industrial PC Market, by Type, US$ Bn, 2017-2031

Table 3: Global Industrial PC Market, by Technology, Thousand Units, 2017-2031

Table 4: Global Industrial PC Market, by Technology, US$ Bn, 2017-2031

Table 5: Global Industrial PC Market, by End-use, Thousand Units, 2017-2031

Table 6: Global Industrial PC Market, by End-use, US$ Bn, 2017-2031

Table 7: Global Industrial PC Market, by Distribution Channel, Thousand Units, 2017-2031

Table 8: Global Industrial PC Market, by Distribution Channel, US$ Bn, 2017-2031

Table 9: Global Industrial PC Market, by Region, Thousand Units, 2017-2031

Table 10: Global Industrial PC Market, by Region, US$ Bn, 2017-2031

Table 11: North America Industrial PC Market, by Type, Thousand Units, 2017-2031

Table 12: North America Industrial PC Market, by Type, US$ Bn, 2017-2031

Table 13: North America Industrial PC Market, by Technology, Thousand Units, 2017-2031

Table 14: North America Industrial PC Market, by Technology, US$ Bn, 2017-2031

Table 15: North America Industrial PC Market, by End-use, Thousand Units, 2017-2031

Table 16: North America Industrial PC Market, by End-use, US$ Bn, 2017-2031

Table 17: North America Industrial PC Market, by Distribution Channel, Thousand Units, 2017-2031

Table 18: North America Industrial PC Market, by Distribution Channel, US$ Bn, 2017-2031

Table 19: Europe Industrial PC Market, by Type, Thousand Units, 2017-2031

Table 20: Europe Industrial PC Market, by Type, US$ Bn, 2017-2031

Table 21: Europe Industrial PC Market, by Technology, Thousand Units, 2017-2031

Table 22: Europe Industrial PC Market, by Technology, US$ Bn, 2017-2031

Table 23: Europe Industrial PC Market, by End-use, Thousand Units, 2017-2031

Table 24: Europe Industrial PC Market, by End-use, US$ Bn, 2017-2031

Table 25: Europe Industrial PC Market, by Distribution Channel, Thousand Units, 2017-2031

Table 26: Europe Industrial PC Market, by Distribution Channel, US$ Bn, 2017-2031

Table 27: Asia Pacific Industrial PC Market, by Type, Thousand Units, 2017-2031

Table 28: Asia Pacific Industrial PC Market, by Type, US$ Bn, 2017-2031

Table 29: Asia Pacific Industrial PC Market, by Technology, Thousand Units, 2017-2031

Table 30: Asia Pacific Industrial PC Market, by Technology, US$ Bn, 2017-2031

Table 31: Asia Pacific Industrial PC Market, by End-use, Thousand Units, 2017-2031

Table 32: Asia Pacific Industrial PC Market, by End-use, US$ Bn, 2017-2031

Table 33: Asia Pacific Industrial PC Market, by Distribution Channel, Thousand Units, 2017-2031

Table 34: Asia Pacific Industrial PC Market, by Distribution Channel, US$ Bn, 2017-2031

Table 35: Middle East & Africa Industrial PC Market, by Type, Thousand Units, 2017-2031

Table 36: Middle East & Africa Industrial PC Market, by Type, US$ Bn, 2017-2031

Table 37: Middle East & Africa Industrial PC Market, by Technology, Thousand Units, 2017-2031

Table 38: Middle East & Africa Industrial PC Market, by Technology, US$ Bn, 2017-2031

Table 39: Middle East & Africa Industrial PC Market, by End-use, Thousand Units, 2017-2031

Table 40: Middle East & Africa Industrial PC Market, by End-use, US$ Bn, 2017-2031

Table 41: Middle East & Africa Industrial PC Market, by Distribution Channel, Thousand Units, 2017-2031

Table 42: Middle East & Africa Industrial PC Market, by Distribution Channel, US$ Bn, 2017-2031

Table 43: South America Industrial PC Market, by Type, Thousand Units, 2017-2031

Table 44: South America Industrial PC Market, by Type, US$ Bn, 2017-2031

Table 45: South America Industrial PC Market, by Technology, Thousand Units, 2017-2031

Table 46: South America Industrial PC Market, by Technology, US$ Bn, 2017-2031

Table 47: South America Industrial PC Market, by End-use, Thousand Units, 2017-2031

Table 48: South America Industrial PC Market, by End-use, US$ Bn, 2017-2031

Table 49: South America Industrial PC Market, by Distribution Channel, Thousand Units, 2017-2031

Table 50: South America Industrial PC Market, by Distribution Channel, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Industrial PC Market Projection, by Type, Thousand Units, 2017-2031

Figure 2: Global Industrial PC Market Projection, by Type, US$ Bn, 2017-2031

Figure 3: Global Industrial PC Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 4: Global Industrial PC Market Projection, by Technology, Thousand Units, 2017-2031

Figure 5: Global Industrial PC Market Projection, by Technology, US$ Bn, 2017-2031

Figure 6: Global Industrial PC Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 7: Global Industrial PC Market Projection, by End-use, Thousand Units, 2017-2031

Figure 8: Global Industrial PC Market Projection, by End-use, US$ Bn, 2017-2031

Figure 9: Global Industrial PC Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 10: Global Industrial PC Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 11: Global Industrial PC Market Projection, by Distribution Channel, US$ Bn, 2017-2031

Figure 12: Global Industrial PC Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 13: Global Industrial PC Market Projection, by Region, Thousand Units, 2017-2031

Figure 14: Global Industrial PC Market Projection, by Region, US$ Bn, 2017-2031

Figure 15: Global Industrial PC Market, Incremental Opportunity, by Region, US$ Bn 2023 -2031

Figure 16: North America Industrial PC Market Projection, by Type, Thousand Units, 2017-2031

Figure 17: North America Industrial PC Market Projection, by Type, US$ Bn, 2017-2031

Figure 18: North America Industrial PC Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 19: North America Industrial PC Market Projection, by Technology, Thousand Units, 2017-2031

Figure 20: North America Industrial PC Market Projection, by Technology, US$ Bn, 2017-2031

Figure 21: North America Industrial PC Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 22: North America Industrial PC Market Projection, by End-use, Thousand Units, 2017-2031

Figure 23: North America Industrial PC Market Projection, by End-use, US$ Bn, 2017-2031

Figure 24: North America Industrial PC Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 25: North America Industrial PC Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 26: North America Industrial PC Market Projection, by Distribution Channel, US$ Bn, 2017-2031

Figure 27: North America Industrial PC Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 28: Europe Industrial PC Market Projection, by Type, Thousand Units, 2017-2031

Figure 29: Europe Industrial PC Market Projection, by Type, US$ Bn, 2017-2031

Figure 30: Europe Industrial PC Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 31: Europe Industrial PC Market Projection, by Technology, Thousand Units, 2017-2031

Figure 32: Europe Industrial PC Market Projection, by Technology, US$ Bn, 2017-2031

Figure 33: Europe Industrial PC Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 34: Europe Industrial PC Market Projection, by End-use, Thousand Units, 2017-2031

Figure 35: Europe Industrial PC Market Projection, by End-use, US$ Bn, 2017-2031

Figure 36: Europe Industrial PC Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 37: Europe Industrial PC Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 38: Europe Industrial PC Market Projection, by Distribution Channel, US$ Bn, 2017-2031

Figure 39: Europe Industrial PC Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 40: Asia Pacific Industrial PC Market Projection, by Type, Thousand Units, 2017-2031

Figure 41: Asia Pacific Industrial PC Market Projection, by Type, US$ Bn, 2017-2031

Figure 42: Asia Pacific Industrial PC Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 43: Asia Pacific Industrial PC Market Projection, by Technology, Thousand Units, 2017-2031

Figure 44: Asia Pacific Industrial PC Market Projection, by Technology, US$ Bn, 2017-2031

Figure 45: Asia Pacific Industrial PC Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 46: Asia Pacific Industrial PC Market Projection, by End-use, Thousand Units, 2017-2031

Figure 47: Asia Pacific Industrial PC Market Projection, by End-use, US$ Bn, 2017-2031

Figure 48: Asia Pacific Industrial PC Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 49: Asia Pacific Industrial PC Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 50: Asia Pacific Industrial PC Market Projection, by Distribution Channel, US$ Bn, 2017-2031

Figure 51: Asia Pacific Industrial PC Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 52: Middle East & Africa Industrial PC Market Projection, by Type, Thousand Units, 2017-2031

Figure 53: Middle East & Africa Industrial PC Market Projection, by Type, US$ Bn, 2017-2031

Figure 54: Middle East & Africa Industrial PC Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 55: Middle East & Africa Industrial PC Market Projection, by Technology, Thousand Units, 2017-2031

Figure 56: Middle East & Africa Industrial PC Market Projection, by Technology, US$ Bn, 2017-2031

Figure 57: Middle East & Africa Industrial PC Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 58: Middle East & Africa Industrial PC Market Projection, by End-use, Thousand Units, 2017-2031

Figure 59: Middle East & Africa Industrial PC Market Projection, by End-use, US$ Bn, 2017-2031

Figure 60: Middle East & Africa Industrial PC Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 61: Middle East & Africa Industrial PC Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 62: Middle East & Africa Industrial PC Market Projection, by Distribution Channel, US$ Bn, 2017-2031

Figure 63: Middle East & Africa Industrial PC Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 64: South America Industrial PC Market Projection, by Type, Thousand Units, 2017-2031

Figure 65: South America Industrial PC Market Projection, by Type, US$ Bn, 2017-2031

Figure 66: South America Industrial PC Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 67: South America Industrial PC Market Projection, by Technology, Thousand Units, 2017-2031

Figure 68: South America Industrial PC Market Projection, by Technology, US$ Bn, 2017-2031

Figure 69: South America Industrial PC Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 70: South America Industrial PC Market Projection, by End-use, Thousand Units, 2017-2031

Figure 71: South America Industrial PC Market Projection, by End-use, US$ Bn, 2017-2031

Figure 72: South America Industrial PC Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 73: South America Industrial PC Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 74: South America Industrial PC Market Projection, by Distribution Channel, US$ Bn, 2017-2031

Figure 75: South America Industrial PC Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031