Analysts’ Viewpoint

Growth in awareness among end-use industries, such as automotive and construction, about the cost savings and return on investments achieved by repairing damaged parts rather than purchasing a new unit is driving the market. Industries, such as automotive and oil refineries, use aftermarket and machine repair services to fix and replace old damaged parts of their machines.

Furthermore, machines used in automotive industries require frequent maintenance. This is expected to lead to industrial machinery repair/aftermarket services market growth. Large number of international vendors with R&D capabilities and internet platform resources are set to enter the market to gain maximum share. This is expected to increase product diversity and drive the industrial machinery repair/aftermarket services market value in the next few years.

Industrial machinery repair/aftermarket services involve installing, troubleshooting, and maintaining machinery and fixing problems manually and/or using computerized diagnostic equipment. Machinery maintenance involves routine checks, regular servicing of equipment, and replacement of worn or nonfunctional parts. A brief downtime can result in significant loss due to halted productivity. Hence, maintenance is regularly performed in order to make sure each asset performs as needed.

Preventive maintenance also helps by resolving potential issues before they result in an expensive-to-fix breakdown. Industrial machine repair service and maintenance can be performed on engines & farm machinery; elevators and conveying equipment; mining, and oil field machinery; industrial trucks and tractors; general industrial machinery; on office machinery; and service industry machinery.

In terms of market development, cloud-based and Internet of Things technologies are likely to create a competitive advantage and new revenue opportunities to companies in this sector.

The development of industries across the globe on a large scale is increasing the industrial machinery aftermarket services demand in order to prevent downtime and increase efficiency.

According to UNIDO (United Nations Industrial Development Organization), in a year-over-year comparison, global manufacturing production increased by 3.6% in the third quarter of 2022. Manufacturing production in Asia and Oceania achieved an output growth of 4.4%. This result is primarily linked to the manufacturing activity in China, where production expanded by 4.5%.

North America’s manufacturing output continued to grow at a moderate rate of 3.5%. Production in Europe grew by only 1.7 %, owing to the proximity to the conflict in Ukraine. However, some European manufacturers remained in a positive territory; Germany reported growth of 2.0%, France 2.7%, Spain 3.0%, and Switzerland 6.5%.

Motor vehicles manufacturing appeared as the top industrial sector with the highest performance on an annual basis, continuing its recovery and exceeding 15% increase in production at a global level.

Industrialization can be driven by a combination of factors such as government policies, labor-saving inventions, entrepreneurial ambitions, and demand for goods and services. With the rise in usage of machinery, the demand for improved, uninterrupted performance is likely to increase. This is one of the primary factors boosting market development.

Increase in demand for machinery maintenance is driving the demand for aftermarket service.

Aftermarket services is a critical component of many manufacturing and industrial sectors. As global requirements for new industrial equipment have slowed down, the demand for aftermarket service increased as it proves to be economically beneficial for industries to opt for a repair and maintenance plan than investing in a new machinery.

The average operating margin from the aftermarket business globally is 2.5 times the operating margin from new equipment sales. For companies in industries, such as aerospace & defense, construction, and medical manufacturing, aftermarket services account approximately 40% of their total revenue and 50% of the profits.

Focus on industrial aftermarket services has brought manufacturers consistent revenues and stabilized profits through past economic downturns. Adopting aftermarket services capabilities has become imperative, not only to offset impacts from the pandemic and current downturn, but to capitalize on long-term changes in customer needs.

Original equipment manufacturers are exploring untapped industrial machinery repair/aftermarket services market opportunities by strengthening their core business in parts repair and maintenance. The aftermarket service provides stable revenue and often high margins compared to sale of new equipment, thereby adding to the global industrial machinery repair/aftermarket services industry growth.

North America is projected to dominate the global industry during the forecast period. This growth is attributed to the increasing demand for repair and service machineries in booming industries, such as automotive, aerospace, and construction.

Asia Pacific is anticipated to be the fastest growing market as industrial machinery aftermarket services demand is substantially increasing owing to expanding end-use industries. Moreover, presence of numerous manufacturers and technological advancements in Asia Pacific are some additional factors providing substantial opportunities to boost the industrial machinery repair/aftermarket services market size in the region.

As per the industrial machinery repair/aftermarket services market analysis, industry players are investing significantly in comprehensive R&D activities, primarily to introduce innovative products. Expansion of product portfolios and mergers and acquisitions are the main strategies adopted by leading companies in the market.

ABB, ACRA Machinery, Astro Machine Works, ATS Advanced Technology Services, Inc., Caterpillar, Exline, Inc., IndufitMachine Industrial Projects Company, Kiefer Tool and Mold, Inc., Les Entreprises HARtech Inc., and TAVENGINEERING, etc. are the prominent entities accounting for significant industrial machinery repair/aftermarket services market share.

Each of these players has been profiled in the industrial machinery repair/aftermarket services market research report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 213.5 Bn |

|

Market Forecast Value in 2031 |

US$ 405.6 Bn |

|

Growth Rate (CAGR) |

7.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

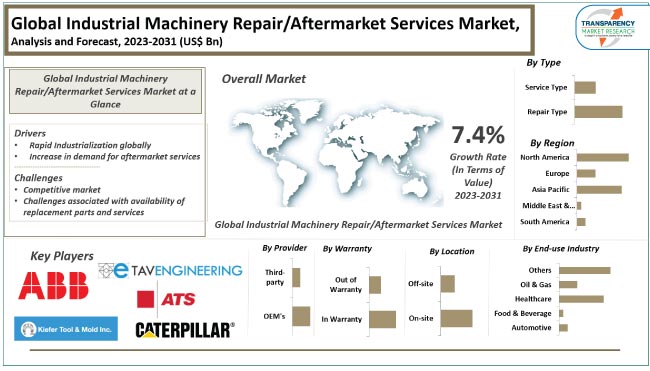

It was valued at US$ 213.5 Bn in 2022.

It is projected to grow at a CAGR of 7.4% from 2023 to 2031

Rapid industrialization globally and increase in demand for aftermarket services

The service type segment accounted for a significant share in 2022

Asia Pacific is likely to be one of the lucrative regions

ABB, ACRA Machinery, Astro Machine Works, ATS Advanced Technology Services, Inc., Caterpillar, Exline, Inc., IndufitMachine Industrial Projects Company, Kiefer Tool and Mold, Inc., Les Entreprises HARtech inc., and TAVENGINEERING

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Technology Development

5.8. Global Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Revenue Projections (US$ Mn)

6. Global Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast, By Type

6.1. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

6.1.1. Repair Type

6.1.1.1. Hydraulic Repair

6.1.1.2. Robotic Repair

6.1.1.3. Spindle Repair

6.1.1.4. Ball Screw Repair

6.1.1.5. Others

6.1.2. Service Type

6.1.2.1. Corrective Maintenance

6.1.2.2. Preventive Maintenance

6.1.2.3. Condition-based Maintenance

6.2. Incremental Opportunity, By Type

7. Global Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast, By Provider

7.1. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Provider, 2017 - 2031

7.1.1. OEM’s

7.1.2. Third-party

7.2. Incremental Opportunity, By Provider

8. Global Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast, By Location

8.1. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Location, 2017 - 2031

8.1.1. On-site

8.1.2. Off-site

8.2. Incremental Opportunity, By Location

9. Global Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast, By Warranty

9.1. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Warranty, 2017 - 2031

9.1.1. In Warranty

9.1.2. Out of Warranty

9.2. Incremental Opportunity, By Warranty

10. Global Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast, By End-use Industry

10.1. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By End-use Industry, 2017 – 2031

10.1.1. Automotive

10.1.2. Food & Beverage

10.1.3. Healthcare

10.1.4. Oil & Gas

10.1.5. Others

10.2. Incremental Opportunity, By End-use Industry

11. Global Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast, by Region

11.1. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn), by Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Global Incremental Opportunity, by Region

12. North America Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trend Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

12.5.1. Repair Type

12.5.1.1. Hydraulic Repair

12.5.1.2. Robotic Repair

12.5.1.3. Spindle Repair

12.5.1.4. Ball Screw Repair

12.5.1.5. Others

12.5.2. Service Type

12.5.2.1. Corrective Maintenance

12.5.2.2. Preventive Maintenance

12.5.2.3. Condition-based Maintenance

12.6. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Provider, 2017 - 2031

12.6.1. OEM’s

12.6.2. Third-party

12.7. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Warranty, 2017 - 2031

12.7.1. In Warranty

12.7.2. Out of Warranty

12.8. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Location, 2017 - 2031

12.8.1. On-site

12.8.2. Off-site

12.9. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By End-use Industry, 2017 – 2031

12.9.1. Automotive

12.9.2. Food & Beverage

12.9.3. Healthcare

12.9.4. Oil & Gas

12.9.5. Others

12.10. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn), by Country/Sub-region, 2017 - 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trend Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Price

13.5. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

13.5.1. Repair Type

13.5.1.1. Hydraulic Repair

13.5.1.2. Robotic Repair

13.5.1.3. Spindle Repair

13.5.1.4. Ball Screw Repair

13.5.1.5. Others

13.5.2. Service Type

13.5.2.1. Corrective Maintenance

13.5.2.2. Preventive Maintenance

13.5.2.3. Condition-based Maintenance

13.6. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Provider, 2017 - 2031

13.6.1. OEM’s

13.6.2. Third-party

13.7. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Warranty, 2017 - 2031

13.7.1. In Warranty

13.7.2. Out of Warranty

13.8. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Location, 2017 - 2031

13.8.1. On-site

13.8.2. Off-site

13.9. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By End-use Industry, 2017 – 2031

13.9.1. Automotive

13.9.2. Food & Beverage

13.9.3. Healthcare

13.9.4. Oil & Gas

13.9.5. Others

13.10. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn), by Country/Sub-region, 2017 - 2031

13.10.1. U.K.

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trend Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Price

14.5. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

14.5.1. Repair Type

14.5.1.1. Hydraulic Repair

14.5.1.2. Robotic Repair

14.5.1.3. Spindle Repair

14.5.1.4. Ball Screw Repair

14.5.1.5. Others

14.5.2. Service Type

14.5.2.1. Corrective Maintenance

14.5.2.2. Preventive Maintenance

14.5.2.3. Condition-based Maintenance

14.6. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Provider, 2017 - 2031

14.6.1. OEM’s

14.6.2. Third-party

14.7. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Warranty, 2017 - 2031

14.7.1. In Warranty

14.7.2. Out of Warranty

14.8. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Location, 2017 - 2031

14.8.1. On-site

14.8.2. Off-site

14.9. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By End-use Industry, 2017 – 2031

14.9.1. Automotive

14.9.2. Food & Beverage

14.9.3. Healthcare

14.9.4. Oil & Gas

14.9.5. Others

14.10. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn), by Country/Sub-region, 2017 - 2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trend Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Price

15.5. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

15.5.1. Repair Type

15.5.1.1. Hydraulic Repair

15.5.1.2. Robotic Repair

15.5.1.3. Spindle Repair

15.5.1.4. Ball Screw Repair

15.5.1.5. Others

15.5.2. Service Type

15.5.2.1. Corrective Maintenance

15.5.2.2. Preventive Maintenance

15.5.2.3. Condition-based Maintenance

15.6. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Provider, 2017 - 2031

15.6.1. OEM’s

15.6.2. Third-party

15.7. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Warranty, 2017 - 2031

15.7.1. In Warranty

15.7.2. Out of Warranty

15.8. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Location, 2017 - 2031

15.8.1. On-site

15.8.2. Off-site

15.9. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By End-use Industry, 2017 – 2031

15.9.1. Automotive

15.9.2. Food & Beverage

15.9.3. Healthcare

15.9.4. Oil & Gas

15.9.5. Others

15.10. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn), by Country/Sub-region, 2017 - 2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Industrial Machinery Repair/Aftermarket Services Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trend Analysis

16.4. Price Trend Analysis

16.4.1. Weighted Average Price

16.5. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

16.5.1. Repair Type

16.5.1.1. Hydraulic Repair

16.5.1.2. Robotic Repair

16.5.1.3. Spindle Repair

16.5.1.4. Ball Screw Repair

16.5.1.5. Others

16.5.2. Service Type

16.5.2.1. Corrective Maintenance

16.5.2.2. Preventive Maintenance

16.5.2.3. Condition-based Maintenance

16.6. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Provider, 2017 - 2031

16.6.1. OEM’s

16.6.2. Third-party

16.7. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Warranty, 2017 - 2031

16.7.1. In Warranty

16.7.2. Out of Warranty

16.8. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By Location, 2017 - 2031

16.8.1. On-site

16.8.2. Off-site

16.9. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn) Forecast, By End-use Industry, 2017 – 2031

16.9.1. Automotive

16.9.2. Food & Beverage

16.9.3. Healthcare

16.9.4. Oil & Gas

16.9.5. Others

16.10. Industrial Machinery Repair/Aftermarket Services Market Size (US$ Mn), by Country/Sub-region, 2017 - 2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share Analysis (%)-2022

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Manufacturing Location, Revenue, Strategy & Business Process Overview)

17.3.1. ABB

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Manufacturing Location

17.3.1.4. Revenue

17.3.1.5. Strategy & Business Process Overview

17.3.2. ACRA Machinery

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Manufacturing Location

17.3.2.4. Revenue

17.3.2.5. Strategy & Business Process Overview

17.3.3. Astro Machine Works

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Manufacturing Location

17.3.3.4. Revenue

17.3.3.5. Strategy & Business Process Overview

17.3.4. ATS Advanced Technology Services, Inc.

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Manufacturing Location

17.3.4.4. Revenue

17.3.4.5. Strategy & Business Process Overview

17.3.5. Caterpillar

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Manufacturing Location

17.3.5.4. Revenue

17.3.5.5. Strategy & Business Process Overview

17.3.6. Exline, Inc.

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Manufacturing Location

17.3.6.4. Revenue

17.3.6.5. Strategy & Business Process Overview

17.3.7. IndufitMachine Industrial Projects Company

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Manufacturing Location

17.3.7.4. Revenue

17.3.7.5. Strategy & Business Process Overview

17.3.8. Kiefer Tool and Mold, Inc.

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Manufacturing Location

17.3.8.4. Revenue

17.3.8.5. Strategy & Business Process Overview

17.3.9. Les Entreprises HARtech inc.

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Manufacturing Location

17.3.9.4. Revenue

17.3.9.5. Strategy & Business Process Overview

17.3.10. TAVENGINEERING

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Manufacturing Location

17.3.10.4. Revenue

17.3.10.5. Strategy & Business Process Overview

17.3.11. Other Key Players

17.3.11.1. Company Overview

17.3.11.2. Sales Area/Geographical Presence

17.3.11.3. Manufacturing Location

17.3.11.4. Revenue

17.3.11.5. Strategy & Business Process Overview

18. Go to Market Strategy

18.1. Identification of Potential Market Spaces

18.1.1. By Type

18.1.2. By Provider

18.1.3. By Warranty

18.1.4. By Location

18.1.5. By End-use Industry

18.1.6. By Region

18.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Table 2: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Table 3: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Table 4: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Table 5: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 6: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Region, 2017-2031

Table 7: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Table 8: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Table 9: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Table 10: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Table 11: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 12: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Table 13: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Table 14: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Table 15: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Table 16: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Table 17: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 18: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Table 19: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Table 20: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Table 21: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Table 22: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Table 23: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 24: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Table 25: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Table 26: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Table 27: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Table 28: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Table 29: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 30: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country, 2017-2031

Table 31: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Table 32: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Table 33: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Table 34: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Table 35: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 36: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country, 2017-2031

List of Figures

Figure 1: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Figure 2: Global Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 3: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Figure 4: Global Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Provider, 2023-2031

Figure 5: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Figure 6: Global Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Warranty, 2023-2031

Figure 7: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Figure 8: Global Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Location, 2023-2031

Figure 9: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 10: Global Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 11: Global Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Region, 2017-2031

Figure 12: Global Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 13: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Figure 14: North America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 15: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Figure 16: North America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Provider, 2023-2031

Figure 17: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Figure 18: North America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Warranty, 2023-2031

Figure 19: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Figure 20: North America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Location, 2023-2031

Figure 21: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 22: North America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 23: North America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 24: North America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031

Figure 25: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Figure 26: Europe Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 27: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Figure 28: Europe Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Provider, 2023-2031

Figure 29: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Figure 30: Europe Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Warranty, 2023-2031

Figure 31: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Figure 32: Europe Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Location, 2023-2031

Figure 33: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 34: Europe Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 35: Europe Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 36: Europe Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031

Figure 37: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Figure 38: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 39: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Figure 40: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Provider, 2023-2031

Figure 41: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Figure 42: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Warranty, 2023-2031

Figure 43: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Figure 44: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Location, 2023-2031

Figure 45: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 46: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 47: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 48: Asia Pacific Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031

Figure 49: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Figure 50: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 51: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Figure 52: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Provider, 2023-2031

Figure 53: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Figure 54: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Warranty, 2023-2031

Figure 55: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Figure 56: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Location, 2023-2031

Figure 57: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 58: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 59: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 60: Middle East & Africa Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031

Figure 61: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Type, 2017-2031

Figure 62: South America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 63: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Provider, 2017-2031

Figure 64: South America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Provider, 2023-2031

Figure 65: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Warranty, 2017-2031

Figure 66: South America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Warranty, 2023-2031

Figure 67: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Location, 2017-2031

Figure 68: South America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Location, 2023-2031

Figure 69: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 70: South America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 71: South America Industrial Machinery Repair/Aftermarket Services Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 72: South America Industrial Machinery Repair/Aftermarket Services Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031