Analysts’ Viewpoint

Increase in adoption of gas compressors in various end-use industries such as construction, oil & gas, food & beverages, mining, and chemical is driving the global industrial gas compressors market. Industrial expansion in emerging economies is also one of the key factors fueling market statistics. Furthermore, rise in adoption of advanced technologies and implementation of regulations for energy conservation in gas compressors are augmenting market development.

Global gas compressor companies are focusing on integration of technologies in gas compressors such as steam or water injection and lean pre-mixed (LPM) combustion. Industrial gas compressor manufacturers are also offering after-sales services for high-resolution gas compressors in order to increase their market share.

Gas compressor is a mechanical device that lowers the volume of gas while increasing its static pressure. Positive displacement and dynamic gas compressors are the two major types of gas compressors that are commonly used in end-use industries.

Positive displacement compressors, which come in reciprocating and rotational designs, pressurize and compress the gas by confining it in a closed space. The gas is compressed mechanically by revolving vanes or impellers in the dynamic compressor, which consists of an axial and centrifugal compressor. Gases such as ethylene, fluorine, argon, hydrogen, nitrogen, and xenon are often employed in these compressors. Positive displacement compressors are used extensively in various industries such as general manufacturing, building, oil & gas, mining, chemicals, and power production.

Expansion in the oil & gas sector is a key factor contributing to the global industrial gas compressor market growth. Extensive usage of gas compressors in processing and long-distance transportation of renewable energy sources such as natural gas is boosting market dynamics.

Gas compressors are also employed in the healthcare sector, specifically in air filtration duct systems, to preserve air quality and shield patients from pollution and illnesses. Additionally, product developers are creating gas compressors with better gasoline tanks, improved performance capabilities, and low maintenance requirements to gain lucrative revenue opportunities.

Rise in consumer awareness about energy-efficient gas compressors is fueling market expansion. By operating with extreme consistency and adjustability, compressors such as rotary screw compressors ensure that only the necessary amount of air is produced and the required amount of energy is used.

Annual electricity consumption in commercial, residential, and industrial sectors stands at roughly one trillion kilowatt hours. Industries are seeking energy-efficient models that use less energy and emit fewer greenhouse gases. Governments of various countries are enforcing stricter laws to protect the environment and stabilize the number of greenhouse gases in the atmosphere.

83 signatories and 192 member nations have signed the Kyoto Protocol, with the intention of preserving the ozone layer. For instance, the pharmaceutical companies in Asia Pacific are under pressure to reduce production costs without sacrificing quality, productivity, or efficiency. The scenario can only be improved through intelligent automation and product development.

Many countries in Asia Pacific are moving toward domestic manufacturing due to the presence of strong after-sales services. This is augmenting the industrial gas compressor market size in the region.

Integration of industrial automation in various industries is driving the global demand for industrial gas compressors. For instance, General Electric’s local subsidiary in India has entered into a contract with Cochin Shipyard to offer comprehensive digital solutions in order to enhance the capability of the LM2500 marine gas turbines. This move is likely to enable the company to cater to the rise in demand for food, electronics, medicines, and personal care products in the country.

The U.S. Department of Energy has released a pre-publication final rule for industrial and commercial compressor energy conservation standards. According to this rule, outdated energy-inefficient equipment must be replaced. Such requirements and regulations are anticipated to significantly increase the demand for energy-efficient gas compressors.

Implementation of various rules and regulations by several governments across the globe to produce energy-efficient industrial gas compressors in accordance with industry standards are boosting industrial gas compressor market scope.

Based on type, the oil free segment is likely to dominate the global industrial gas compressor market during the forecast period. Oil free industrial gas compressors are widely used in several end-use industries such as construction, oil & gas, chemical, and mining.

Oil free gas compressors are easy to use and require less maintenance. They can operate in various orientations. These compressors are light in weight and smaller in size. Hence, they are easy to transport and can be moved vertically or horizontally, depending on the task.

Oil injected compressors are also preferred by end-users, as they help keep the operating temperature cool.

Asia Pacific is expected to dominate the global industrial gas compressor market during the forecast period. This can be ascribed to the lucrative presence of key players in the industrial gas compressor industry in the region. Growth in industries such as construction, oil & gas, power generation, and mining is likely to boost industrial gas compressor market share of Asia Pacific in the near future.

Demand for industrial gas compressors is rising consistently in Asia Pacific. Companies in the region are increasingly investing in research and development initiatives for technological advancements in compressors. Hence, the market in Asia Pacific is anticipated to grow at a rapid pace during the forecast period.

The global industrial gas compressor industry is fragmented, with the presence of large-scale manufacturers as well as local fabricators. These companies control majority of the market share. Leading players are focusing on strengthening their product portfolios through technological advancements. This is contributing to the development of the industrial gas compressor market.

Key players of the industrial gas compressor industry are Atlas Copco AB, HITACHI Ltd., General Electric, Ingersoll Rand, Siemens Energy AG, KAESER KOMPRESSOREN, Ariel Corporation, Mitsui E&S Holdings Co., LTD., Kobe Steel, Ltd, Bauer Comp Holding GMBH, J.P Sauer & Sohn Maschinenbau GmbH, and Howden Group.

Each of these players has been profiled in the industrial gas compressor market report based on parameters such as business segments, company overview, business strategies, product portfolio, financial overview, recent developments, and market overview.

|

Attribute |

Detail |

|

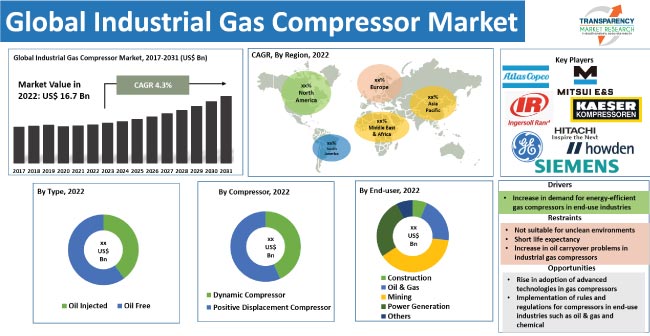

Market Size Value in 2022 |

US$ 16.7 Bn |

|

Forecast Value in 2031 |

US$ 23.4 Bn |

|

Growth Rate (CAGR) |

4.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, market opportunities, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It is expected to reach US$ 23.4 Bn in 2031.

The CAGR is estimated to be 4.3% during 2023 to 2031.

Increase in demand for energy-efficient gas compressors in various end-use industries and growth in industries such as oil & gas and chemical.

The oil free type segment accounted for the maximum share in 2022.

Asia Pacific is likely to be one of the most lucrative regions in the next few years.

Atlas Copco AB, Ingersoll Rand, General Electric, Siemens Energy AG, Mitsui E&S Holdings Co., LTD., KAESER KOMPRESSOREN, HITACHI Ltd., Bauer Comp Holding GmbH, Howden Group, Kobe Steel, Ltd, J.P Sauer & Sohn Maschinenbau Gmbh, and Ariel Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Compressor Market

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Technological Roadmap

5.8. Raw Material Analysis

5.9. Global Industrial Gas Compressor Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Industrial Gas Compressor Market Analysis and Forecast, By Type

6.1. Global Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

6.1.1. Oil Injected

6.1.2. Oil Free

6.2. Incremental Opportunity, By Type

7. Global Industrial Gas Compressor Market Analysis and Forecast, By Compressor

7.1. Global Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Compressor, 2017 - 2031

7.1.1. Dynamic Compressor

7.1.2. Positive Displacement Compressor

7.1.2.1. Piston Compressor

7.1.2.2. Rotary Screw Compressor

7.1.2.3. Others

7.2. Incremental Opportunity, By Compressor

8. Global Industrial Gas Compressor Market Analysis and Forecast, By End-user

8.1. Global Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By End-user, 2017 - 2031

8.1.1. Construction

8.1.2. Oil & Gas

8.1.3. Mining

8.1.4. Power Generation

8.1.5. Others

8.2. Incremental Opportunity, By End-user

9. Global Industrial Gas Compressor Market Analysis and Forecast, Region

9.1. Global Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, By Region

10. North America Industrial Gas Compressor Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Supplier Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Selling Price (US$)

10.4. Key Trends Analysis

10.4.1. Demand Side Analysis

10.4.2. Supply Side Analysis

10.5. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

10.5.1. Oil Injected

10.5.2. Oil Free

10.6. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Compressor, 2017 - 2031

10.6.1. Dynamic Compressor

10.6.2. Positive Displacement Compressor

10.6.2.1. Piston Compressor

10.6.2.2. Rotary Screw Compressor

10.6.2.3. Others

10.7. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By End-user, 2017 - 2031

10.7.1. Construction

10.7.2. Oil & Gas

10.7.3. Mining

10.7.4. Power Generation

10.7.5. Others

10.8. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Country, 2017 - 2031

10.8.1. The U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Industrial Gas Compressor Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Trends Analysis

11.4.1. Demand Side Analysis

11.4.2. Supply Side Analysis

11.5. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

11.5.1. Oil Injected

11.5.2. Oil Free

11.6. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Compressor, 2017 - 2031

11.6.1. Dynamic Compressor

11.6.2. Positive Displacement Compressor

11.6.2.1. Piston Compressor

11.6.2.2. Rotary Screw Compressor

11.6.2.3. Others

11.7. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By End-user, 2017 - 2031

11.7.1. Construction

11.7.2. Oil & Gas

11.7.3. Mining

11.7.4. Power Generation

11.7.5. Others

11.8. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Country, 2017 - 2031

11.8.1. UK

11.8.2. Germany

11.8.3. France

11.8.4. Italy

11.8.5. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Industrial Gas Compressor Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side Analysis

12.4.2. Supply Side Analysis

12.5. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

12.5.1. Oil Injected

12.5.2. Oil Free

12.6. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Compressor, 2017 - 2031

12.6.1. Dynamic Compressor

12.6.2. Positive Displacement Compressor

12.6.2.1. Piston Compressor

12.6.2.2. Rotary Screw Compressor

12.6.2.3. Others

12.7. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By End-user, 2017 - 2031

12.7.1. Construction

12.7.2. Oil & Gas

12.7.3. Mining

12.7.4. Power Generation

12.7.5. Others

12.8. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Country, 2017 - 2031

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & Africa Industrial Gas Compressor Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$ Bn)

13.4. Key Trends Analysis

13.4.1. Demand Side Analysis

13.4.2. Supply Side Analysis

13.5. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

13.5.1. Oil Injected

13.5.2. Oil Free

13.6. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Compressor, 2017 - 2031

13.6.1. Dynamic Compressor

13.6.2. Positive Displacement Compressor

13.6.2.1. Piston Compressor

13.6.2.2. Rotary Screw Compressor

13.6.2.3. Others

13.7. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By End-user, 2017 - 2031

13.7.1. Construction

13.7.2. Oil & Gas

13.7.3. Mining

13.7.4. Power Generation

13.7.5. Others

13.8. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Country, 2017 - 2031

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Industrial Gas Compressor Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

14.5.1. Oil Injected

14.5.2. Oil Free

14.6. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Compressor, 2017 - 2031

14.6.1. Dynamic Compressor

14.6.2. Positive Displacement Compressor

14.6.2.1. Piston Compressor

14.6.2.2. Rotary Screw Compressor

14.6.2.3. Others

14.7. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By End-user, 2017 - 2031

14.7.1. Construction

14.7.2. Oil & Gas

14.7.3. Mining

14.7.4. Power Generation

14.7.5. Others

14.8. Industrial Gas Compressor Market Size (US$ Bn and Thousand Units), By Country, 2017 - 2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis (%), 2022

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

15.3.1. Atlas Copco Ab

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Financial/Revenue

15.3.1.4. Strategy & Business Overview

15.3.1.5. Sales Channel Analysis

15.3.1.6. Size Portfolio

15.3.2. Ingersoll Rand

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Financial/Revenue

15.3.2.4. Strategy & Business Overview

15.3.2.5. Sales Channel Analysis

15.3.2.6. Size Portfolio

15.3.3. General Electric

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Financial/Revenue

15.3.3.4. Strategy & Business Overview

15.3.3.5. Sales Channel Analysis

15.3.3.6. Size Portfolio

15.3.4. Siemens Energy AG

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Financial/Revenue

15.3.4.4. Strategy & Business Overview

15.3.4.5. Sales Channel Analysis

15.3.4.6. Size Portfolio

15.3.5. Mitsui E&S Holdings Co., Ltd.

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Financial/Revenue

15.3.5.4. Strategy & Business Overview

15.3.5.5. Sales Channel Analysis

15.3.5.6. Size Portfolio

15.3.6. KAESER KOMPRESSOREN

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Financial/Revenue

15.3.6.4. Strategy & Business Overview

15.3.6.5. Sales Channel Analysis

15.3.6.6. Size Portfolio

15.3.7. HITACHI Ltd.

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Financial/Revenue

15.3.7.4. Strategy & Business Overview

15.3.7.5. Sales Channel Analysis

15.3.7.6. Size Portfolio

15.3.8. Bauer Comp Holding GmbH

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Financial/Revenue

15.3.8.4. Strategy & Business Overview

15.3.8.5. Sales Channel Analysis

15.3.8.6. Size Portfolio

15.3.9. Howden Group

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Financial/Revenue

15.3.9.4. Strategy & Business Overview

15.3.9.5. Sales Channel Analysis

15.3.9.6. Size Portfolio

15.3.10. Kobe Steel, Ltd

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Financial/Revenue

15.3.10.4. Strategy & Business Overview

15.3.10.5. Sales Channel Analysis

15.3.10.6. Size Portfolio

15.3.11. J.P Sauer & Sohn Maschinenbau GmbH

15.3.11.1. Company Overview

15.3.11.2. Sales Area/Geographical Presence

15.3.11.3. Financial/Revenue

15.3.11.4. Strategy & Business Overview

15.3.11.5. Sales Channel Analysis

15.3.11.6. Size Portfolio

15.3.12. Ariel Corporation

15.3.12.1. Company Overview

15.3.12.2. Sales Area/Geographical Presence

15.3.12.3. Financial/Revenue

15.3.12.4. Strategy & Business Overview

15.3.12.5. Sales Channel Analysis

15.3.12.6. Size Portfolio

16. Key Takeaway

16.1. Identification of Potential Market Spaces

16.1.1. Type

16.1.2. Compressor

16.1.3. End-user

16.1.4. Geography

16.2. Understanding the Buying Process of the Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Gas Compressor Market Value (US$ Bn) Projection by Type 2017-2031

Table 2: Global Industrial Gas Compressor Market Volume (Thousand Units) Projection by Type 2017-2031

Table 3: Global Industrial Gas Compressor Market Value (US$ Bn) Projection by Compressor 2017-2031

Table 4: Global Industrial Gas Compressor Market Volume (Thousand Units) Projection by Compressor 2017-2031

Table 5: Global Industrial Gas Compressor Market Value (US$ Bn) Projection by End-user 2017-2031

Table 6: Global Industrial Gas Compressor Market Volume (Thousand Units) Projection by End-user 2017-2031

Table 7: Global Industrial Gas Compressor Market Value (US$ Bn) Projection by Region 2017-2031

Table 8: Global Industrial Gas Compressor Market Volume (Thousand Units) Projection by Region 2017-2031

Table 9: North America Industrial Gas Compressor Market Value (US$ Bn) Projection by Type 2017-2031

Table 10: North America Industrial Gas Compressor Market Volume (Thousand Units) Projection by Type 2017-2031

Table 11: North America Industrial Gas Compressor Market Value (US$ Bn) Projection by Compressor 2017-2031

Table 12: North America Industrial Gas Compressor Market Volume (Thousand Units) Projection by Compressor 2017-2031

Table 13: North America Industrial Gas Compressor Market Value (US$ Bn) Projection by End-user 2017-2031

Table 14: North America Industrial Gas Compressor Market Volume (Thousand Units) Projection by End-user 2017-2031

Table 15: North America Industrial Gas Compressor Market Value (US$ Bn) Projection by Country 2017-2031

Table 16: North America Industrial Gas Compressor Market Volume (Thousand Units) Projection by Country 2017-2031

Table 17: Europe Industrial Gas Compressor Market Value (US$ Bn) Projection by Type 2017-2031

Table 18: Europe Industrial Gas Compressor Market Volume (Thousand Units) Projection by Type 2017-2031

Table 19: Europe Industrial Gas Compressor Market Value (US$ Bn) Projection by Compressor 2017-2031

Table 20: Europe Industrial Gas Compressor Market Volume (Thousand Units) Projection by Compressor 2017-2031

Table 21: Europe Industrial Gas Compressor Market Value (US$ Bn) Projection by End-user 2017-2031

Table 22: Europe Industrial Gas Compressor Market Volume (Thousand Units) Projection by End-user 2017-2031

Table 23: Europe Industrial Gas Compressor Market Value (US$ Bn) Projection by Country 2017-2031

Table 24: Europe Industrial Gas Compressor Market Volume (Thousand Units) Projection by Country 2017-2031

Table 25: Asia Pacific Industrial Gas Compressor Market Value (US$ Bn) Projection by Type 2017-2031

Table 26: Asia Pacific Industrial Gas Compressor Market Volume (Thousand Units) Projection by Type 2017-2031

Table 27: Asia Pacific Industrial Gas Compressor Market Value (US$ Bn) Projection by Compressor 2017-2031

Table 28: Asia Pacific Industrial Gas Compressor Market Volume (Thousand Units) Projection by Compressor 2017-2031

Table 29: Asia Pacific Industrial Gas Compressor Market Value (US$ Bn) Projection by End-user 2017-2031

Table 30: Asia Pacific Industrial Gas Compressor Market Volume (Thousand Units) Projection by End-user 2017-2031

Table 31: Asia Pacific Industrial Gas Compressor Market Value (US$ Bn) Projection by Country 2017-2031

Table 32: Asia Pacific Industrial Gas Compressor Market Volume (Thousand Units) Projection by Country 2017-2031

Table 33: Middle East & Africa Industrial Gas Compressor Market Value (US$ Bn) Projection by Type 2017-2031

Table 34: Middle East & Africa Industrial Gas Compressor Market Volume (Thousand Units) Projection by Type 2017-2031

Table 35: Middle East & Africa Industrial Gas Compressor Market Value (US$ Bn) Projection by Compressor 2017-2031

Table 36: Middle East & Africa Industrial Gas Compressor Market Volume (Thousand Units) Projection by Compressor 2017-2031

Table 37: Middle East & Africa Industrial Gas Compressor Market Value (US$ Bn) Projection by End-user 2017-2031

Table 38: Middle East & Africa Industrial Gas Compressor Market Volume (Thousand Units) Projection by End-user 2017-2031

Table 39: Middle East & Africa Industrial Gas Compressor Market Value (US$ Bn) Projection by Country 2017-2031

Table 40: Middle East & Africa Industrial Gas Compressor Market Volume (Thousand Units) Projection by Country 2017-2031

Table 41: South America Industrial Gas Compressor Market Value (US$ Bn) Projection by Type 2017-2031

Table 42: South America Industrial Gas Compressor Market Volume (Thousand Units) Projection by Type 2017-2031

Table 43: South America Industrial Gas Compressor Market Value (US$ Bn) Projection by Compressor 2017-2031

Table 44: South America Industrial Gas Compressor Market Volume (Thousand Units) Projection by Compressor 2017-2031

Table 45: South America Industrial Gas Compressor Market Value (US$ Bn) Projection by End-user 2017-2031

Table 46: South America Industrial Gas Compressor Market Volume (Thousand Units) Projection by End-user 2017-2031

Table 47: South America Industrial Gas Compressor Market Value (US$ Bn) Projection by Country 2017-2031

Table 48: South America Industrial Gas Compressor Market Volume (Thousand Units) Projection by Country 2017-2031

List of Figures

Figure 1: Global Industrial Gas Compressor Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 2: Global Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 3: Global Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 4: Global Industrial Gas Compressor Market Value (US$ Bn) Projection, By Compressor 2017-2031

Figure 5: Global Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Compressor 2017-2031

Figure 6: Global Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Compressor 2023-2031

Figure 7: Global Industrial Gas Compressor Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 8: Global Industrial Gas Compressor Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 9: Global Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2023-2031

Figure 10: Global Industrial Gas Compressor Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 11: Global Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 12: Global Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2023-2031

Figure 13: North America Industrial Gas Compressor Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 14: North America Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 15: North America Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 16: North America Industrial Gas Compressor Market Value (US$ Bn) Projection, By Compressor 2017-2031

Figure 17: North America Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Compressor 2017-2031

Figure 18: North America Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Compressor 2023-2031

Figure 19: North America Industrial Gas Compressor Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 20: North America Industrial Gas Compressor Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 21: North America Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2023-2031

Figure 22: North America Industrial Gas Compressor Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 23: North America Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 24: North America Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 25: Europe Industrial Gas Compressor Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 26: Europe Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 27: Europe Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 28: Europe Industrial Gas Compressor Market Value (US$ Bn) Projection, By Compressor 2017-2031

Figure 29: Europe Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Compressor 2017-2031

Figure 30: Europe Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Compressor 2023-2031

Figure 31: Europe Industrial Gas Compressor Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 32: Europe Industrial Gas Compressor Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 33: Europe Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2023-2031

Figure 34: Europe Industrial Gas Compressor Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 35: Europe Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 36: Europe Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 37: Asia Pacific Industrial Gas Compressor Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 38: Asia Pacific Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 39: Asia Pacific Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 40: Asia Pacific Industrial Gas Compressor Market Value (US$ Bn) Projection, By Compressor 2017-2031

Figure 41: Asia Pacific Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Compressor 2017-2031

Figure 42: Asia Pacific Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Compressor 2023-2031

Figure 43: Asia Pacific Industrial Gas Compressor Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 44: Asia Pacific Industrial Gas Compressor Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 45: Asia Pacific Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2023-2031

Figure 46: Asia Pacific Industrial Gas Compressor Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 47: Asia Pacific Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 48: Asia Pacific Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 49: Middle East & Africa Industrial Gas Compressor Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 50: Middle East & Africa Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 51: Middle East & Africa Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 52: Middle East & Africa Industrial Gas Compressor Market Value (US$ Bn) Projection, By Compressor 2017-2031

Figure 53: Middle East & Africa Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Compressor 2017-2031

Figure 54: Middle East & Africa Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Compressor 2023-2031

Figure 55: Middle East & Africa Industrial Gas Compressor Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 56: Middle East & Africa Industrial Gas Compressor Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 57: Middle East & Africa Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2023-2031

Figure 58 Middle East & Africa Industrial Gas Compressor Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 59: Middle East & Africa Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 60: Middle East & Africa Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 61: South America Industrial Gas Compressor Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 62: South America Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Type 2017-2031

Figure 63: South America Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 64: South America Industrial Gas Compressor Market Value (US$ Bn) Projection, By Compressor 2017-2031

Figure 65: South America Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Compressor 2017-2031

Figure 66: South America Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Compressor 2023-2031

Figure 67: South America Industrial Gas Compressor Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 68: South America Industrial Gas Compressor Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 69: South America Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2023-2031

Figure 70: South America Industrial Gas Compressor Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 71: South America Industrial Gas Compressor Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 72: South America Industrial Gas Compressor Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031