Analysts’ Viewpoint on Market Scenario

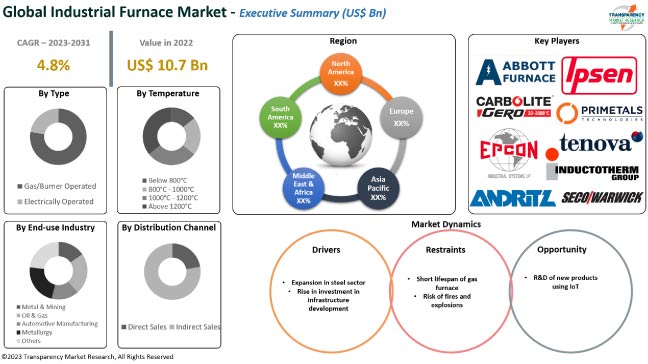

Expansion in the steel sector and rise in investment in infrastructure development are expected to propel the industrial furnace market size in the near future. Rise in adoption of various strategies to reduce pollutant emissions and boost productivity and furnace energy conservation is also boosting market expansion.

Short lifespan of gas furnaces and risk of fires and explosions are likely to hinder the industrial furnace market growth in the next few years. Vendors in the global industrial furnace industry are employing various technologies, such as IoT, to facilitate automation and boost furnace efficiency.

Furnace is an industrial heating equipment that provides direct electric or gas heat for industrial processes that require temperatures of more than 400 ⁰C. Heat treatment of metals for annealing, tempering, carburizing, or pre-treatment of metals for forging is done in an industrial furnace.

Several industrial processes require heating for the preparation of materials for the production or the consummation of an application. Electric and gas industrial furnaces provide the necessary temperature control and dependability to finish a manufacturing process or operation. While an industrial furnace is typically used to treat metal, other materials such as glass and certain kinds of ceramics are also heated to prepare them for shaping.

Metallurgical companies rely on industrial furnaces to purify, heat treat, and treat different types of metals at extremely high temperatures. Expansion in the steel sector is propelling the industrial furnace market value.

According to the American Iron and Steel Institute, the year-to-date production of steel was 37,246,000 net tons, with a capability utilization rate of 75.5% in June 2023. After China, the European Union is the world's second-largest producer of steel. It produces 170 million tons of crude steel annually, which generates € 166 Bn in annual revenue and contributes 1.3% of the EU's GDP.

The steel sector of India has been driven by the domestic availability of raw materials such as iron and cost-effective labor. According to the Ministry of Steel, the production of crude steel and finished steel in India stood at 133.596 MT and 120.01 MT in FY 2022. In April 2023, the World Steel Association predicted that 1.814 billion tons of steel would be consumed worldwide, with China accounting for approximately half that number.

In 2021, the U.S. government announced to invest US$ 1.25 Trn across transportation, energy, water assets, and broadband sectors for the next five to 10 years. In 2022, the Connecting Europe Facility (CEF) selected 135 transport infrastructure projects for EU grants with an investment of € 5.4 Bn in environment-friendly, safe, and effective transportation infrastructure. Thus, surge in investment in infrastructure development is augmenting the industrial furnace market progress.

According to the latest industrial furnace market trends, the electrically operated type segment is expected to dominate the industry during the forecast period. Electric furnaces produce about two-fifths of the steel made in the U.S.

Most steel products are manufactured using electric furnaces. Mini-mills, which are small plants that use scrap charges to produce reinforcing bars, merchant bars (such as angles and channels), and structural sections, use electric furnaces exclusively.

According to the latest industrial furnace market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Growth in the steel sector and rise in investment in infrastructure development are boosting market dynamics in the region.

The industry in North America is anticipated to grow at a significant pace in the near future. Surge in usage of steel and increase in government investment in infrastructure development are driving market statistics in the region.

The global industry is highly fragmented, with the presence of various global and regional players including Abbott Furnace Company, Andritz, Carbolite Gero Ltd., Epcon Industrial System, Inductotherm Corporation, International Thermal System, Ipsen, Primetals Technologies, SECO/WARWICK, and Tenova.

Key players in the industrial furnace market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. Manufacturers are investing in R&D and product expansions to increase their industrial furnace market share.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 10.7 Bn |

|

Market Forecast Value in 2031 |

US$ 18.4 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 10.7 Bn in 2022

It is expected to be 4.8% from 2023 to 2031

Expansion in steel sector and rise in investment in infrastructure development

The electrically operated type segment held largest share in 2022

Asia Pacific is expected to record the highest demand during the forecast period

Abbott Furnace Company, Andritz, Carbolite Gero Ltd., Epcon Industrial System, Inductotherm Corporation, International Thermal System, Ipsen, Primetals Technologies, SECO/WARWICK, and Tenova

1. Preface

1.1. Market Definitions and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Raw Material Analysis

5.8. Technological Overview Analysis

5.9. Global Industrial Furnace Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projection (US$ Bn)

5.9.2. Market Volume Projection (Thousand Units)

6. Global Industrial Furnace Market Analysis and Forecast, by Type

6.1. Industrial Furnace Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

6.1.1. Gas/Burner Operated

6.1.2. Electrically Operated

6.2. Incremental Opportunity, by Type

7. Global Industrial Furnace Market Analysis and Forecast, by Temperature

7.1. Industrial Furnace Market (US$ Bn and Thousand Units), by Temperature, 2017 - 2031

7.1.1. Below 800°C

7.1.2. 800°C - 1000°C

7.1.3. 1000°C - 1200°C

7.1.4. Above 1200°C

7.2. Incremental Opportunity, by Temperature

8. Global Industrial Furnace Market Analysis and Forecast, by End-use Industry

8.1. Industrial Furnace Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

8.1.1. Metal & Mining

8.1.2. Oil & Gas

8.1.3. Automotive Manufacturing

8.1.4. Metallurgy

8.1.5. Others (Chemical, Ceramic, etc.)

8.2. Incremental Opportunity, by End-use Industry

9. Global Industrial Furnace Market Analysis and Forecast, by Distribution Channel

9.1. Industrial Furnace Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, by Distribution Channel

10. Global Industrial Furnace Market Analysis and Forecast, by Region

10.1. Industrial Furnace Market (US$ Bn and Thousand Units), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Industrial Furnace Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trend Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Brand Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Industrial Furnace Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

11.6.1. Gas/Burner Operated

11.6.2. Electrically Operated

11.7. Industrial Furnace Market (US$ Bn and Thousand Units), by Temperature, 2017 - 2031

11.7.1. Below 800°C

11.7.2. 800°C - 1000°C

11.7.3. 1000°C - 1200°C

11.7.4. Above 1200°C

11.8. Industrial Furnace Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

11.8.1. Metal & Mining

11.8.2. Oil & Gas

11.8.3. Automotive Manufacturing

11.8.4. Metallurgy

11.8.5. Others (Chemical, Ceramic, etc.)

11.9. Industrial Furnace Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

11.9.1. Direct Sales

11.9.2. Indirect Sales

11.10. Industrial Furnace Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Industrial Furnace Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Industrial Furnace Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

12.6.1. Gas/Burner Operated

12.6.2. Electrically Operated

12.7. Industrial Furnace Market (US$ Bn and Thousand Units), by Temperature, 2017 - 2031

12.7.1. Below 800°C

12.7.2. 800°C - 1000°C

12.7.3. 1000°C - 1200°C

12.7.4. Above 1200°C

12.8. Industrial Furnace Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

12.8.1. Metal & Mining

12.8.2. Oil & Gas

12.8.3. Automotive Manufacturing

12.8.4. Metallurgy

12.8.5. Others (Chemical, Ceramic, etc.)

12.9. Industrial Furnace Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Industrial Furnace Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Industrial Furnace Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Industrial Furnace Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

13.6.1. Gas/Burner Operated

13.6.2. Electrically Operated

13.7. Industrial Furnace Market (US$ Bn and Thousand Units), by Temperature, 2017 - 2031

13.7.1. Below 800°C

13.7.2. 800°C - 1000°C

13.7.3. 1000°C - 1200°C

13.7.4. Above 1200°C

13.8. Industrial Furnace Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

13.8.1. Metal & Mining

13.8.2. Oil & Gas

13.8.3. Automotive Manufacturing

13.8.4. Metallurgy

13.8.5. Others (Chemical, Ceramic, etc.)

13.9. Industrial Furnace Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Industrial Furnace Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Industrial Furnace Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Industrial Furnace Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

14.6.1. Gas/Burner Operated

14.6.2. Electrically Operated

14.7. Industrial Furnace Market (US$ Bn and Thousand Units), by Temperature, 2017 - 2031

14.7.1. Below 800°C

14.7.2. 800°C - 1000°C

14.7.3. 1000°C - 1200°C

14.7.4. Above 1200°C

14.8. Industrial Furnace Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

14.8.1. Metal & Mining

14.8.2. Oil & Gas

14.8.3. Automotive Manufacturing

14.8.4. Metallurgy

14.8.5. Others (Chemical, Ceramic, etc.)

14.9. Industrial Furnace Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Industrial Furnace Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Industrial Furnace Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trend Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Industrial Furnace Market (US$ Bn and Thousand Units), by Type, 2017 - 2031

15.6.1. Gas/Burner Operated

15.6.2. Electrically Operated

15.7. Industrial Furnace Market (US$ Bn and Thousand Units), by Temperature, 2017 - 2031

15.7.1. Below 800°C

15.7.2. 800°C - 1000°C

15.7.3. 1000°C - 1200°C

15.7.4. Above 1200°C

15.8. Industrial Furnace Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

15.8.1. Metal & Mining

15.8.2. Oil & Gas

15.8.3. Automotive Manufacturing

15.8.4. Metallurgy

15.8.5. Others (Chemical, Ceramic, etc.)

15.9. Industrial Furnace Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Industrial Furnace Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Revenue Share Analysis (%), (2022)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Abbott Furnace Company

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Andritz

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Carbolite Gero Ltd.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Epcon Industrial System

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Inductotherm Corporation

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. International Thermal System

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Ipsen

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Primetals Technologies

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. SECO/WARWICK

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Tenova

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Revenue

16.3.11.4. Strategy & Business Overview

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.1.1. By Type

17.1.2. By Temperature

17.1.3. By End-use Industry

17.1.4. By Distribution Channel

17.1.5. By Region

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Table 4: Global Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Table 5: Global Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 6: Global Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 7: Global Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 8: Global Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 9: Global Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Table 10: Global Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Table 11: North America Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Table 12: North America Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Table 13: North America Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Table 14: North America Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Table 15: North America Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 16: North America Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 17: North America Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 18: North America Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 19: North America Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Table 20: North America Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Table 21: Europe Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Table 22: Europe Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Table 23: Europe Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Table 24: Europe Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Table 25: Europe Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 26: Europe Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 27: Europe Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 28: Europe Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 29: Europe Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Table 30: Europe Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Table 31: Asia Pacific Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Table 32: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Table 33: Asia Pacific Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Table 34: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Table 35: Asia Pacific Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 36: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 37: Asia Pacific Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Asia Pacific Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Table 40: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Table 41: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Table 42: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Table 43: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Table 44: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Table 45: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 46: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 47: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 48: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 49: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Table 50: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Table 51: South America Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Table 52: South America Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Table 53: South America Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Table 54: South America Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Table 55: South America Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 56: South America Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 57: South America Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 58: South America Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 59: South America Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Table 60: South America Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Figure 5: Global Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Figure 6: Global Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 7: Global Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 8: Global Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 9: Global Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 10: Global Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 11: Global Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 12: Global Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Figure 14: Global Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Figure 15: Global Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 16: North America Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Figure 17: North America Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Figure 18: North America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 19: North America Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Figure 20: North America Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Figure 21: North America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 22: North America Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 23: North America Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 24: North America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 25: North America Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 26: North America Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 27: North America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 28: North America Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Figure 29: North America Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Figure 30: North America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 31: Europe Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Figure 32: Europe Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Figure 33: Europe Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 34: Europe Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Figure 35: Europe Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Figure 36: Europe Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 37: Europe Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 38: Europe Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 39: Europe Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 40: Europe Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 41: Europe Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 42: Europe Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Europe Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Europe Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Figure 45: Europe Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: Asia Pacific Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Figure 47: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Figure 48: Asia Pacific Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 49: Asia Pacific Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Figure 50: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Figure 51: Asia Pacific Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 52: Asia Pacific Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 53: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 54: Asia Pacific Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 55: Asia Pacific Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Asia Pacific Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Asia Pacific Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Asia Pacific Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Figure 60: Asia Pacific Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Figure 62: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Figure 63: Middle East & Africa Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 64: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Figure 65: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Figure 66: Middle East & Africa Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Temperature,2023-2031

Figure 67: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 68: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 69: Middle East & Africa Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2017-2031

Figure 70: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 71: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 72: Middle East & Africa Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 73: Middle East & Africa Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Figure 74: Middle East & Africa Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Figure 75: Middle East & Africa Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 76: South America Industrial Furnace Market Value (US$ Bn), by Type, 2017-2031

Figure 77: South America Industrial Furnace Market Volume (Thousand Units), by Type 2017-2031

Figure 78: South America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 79: South America Industrial Furnace Market Value (US$ Bn), by Temperature, 2017-2031

Figure 80: South America Industrial Furnace Market Volume (Thousand Units), by Temperature 2017-2031

Figure 81: South America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 82: South America Industrial Furnace Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 83: South America Industrial Furnace Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 84: South America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 85: South America Industrial Furnace Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 86: South America Industrial Furnace Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 87: South America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 88: South America Industrial Furnace Market Value (US$ Bn), by Region, 2017-2031

Figure 89: South America Industrial Furnace Market Volume (Thousand Units), by Region 2017-2031

Figure 90: South America Industrial Furnace Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031