Analysts’ Viewpoint

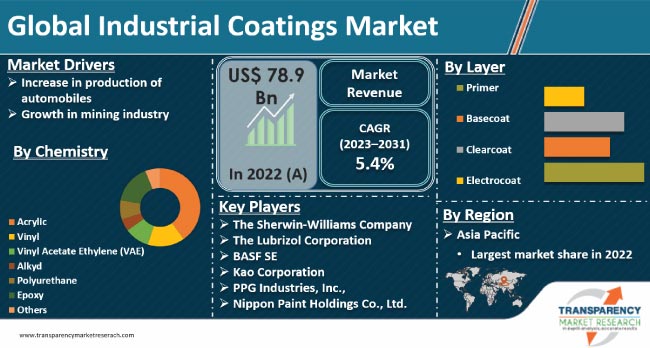

Increase in production of automobiles and growth in mining industry are the major factors fueling industrial coatings market value. Moreover, increase in manufacturing activities along with infrastructure development is likely to drive industrial coatings market demand during the forecast period.

Industrial coatings manufacturers are engaged in developing durable and protective coatings for various industries including automotive, aerospace, construction, oil & gas, and marine. Increase in demand for polyurethane coatings is also driving market expansion. Market participants are actively enhancing their strategies to stay competitive. They are investing in research and development to innovate and meet evolving customer needs. Sustainability and the development of eco-friendly coatings are key focus areas to comply with stringent environmental regulations.

Industrial coatings are specialized coatings used to protect and enhance the surfaces of various industrial products and structures. These protective coatings provide a range of properties, including corrosion resistance, chemical resistance, abrasion resistance, and heat resistance. Applications of industrial coatings are rising in the automotive, aerospace, oil & gas, construction, and manufacturing sectors.

Increase in demand for durable and high-performance coatings to extend the lifespan of industrial equipment and structures is a significant driver of the global market. Additionally, stringent environmental regulations and rise in focus on sustainability have led to the development of eco-friendly and low-VOC coatings.

The global automobile industry has been experiencing steady growth. According to the European Automobile Manufacturers' Association, around 85.4 million vehicles were produced in 2022. The level of activity within automobile and vehicle manufacturing industries plays a crucial role in determining the demand for automotive coatings. Increase in production of automobiles boosts the need for high-quality industrial coatings. Cars, trucks, and other vehicles require automotive coatings as part of the painting and manufacturing process.

Rise in production of motor vehicles is a key driver fueling the demand for coil coatings worldwide. Industrial coatings play a crucial role in enhancing the durability and esthetics of automotive components by providing excellent paint adherence, chemical resistance, and water resistance.

Moreover, rise in disposable income of consumers has contributed to the surge in demand for industrial coatings at the commercial level. Increase in purchasing power has led to a higher demand for personal vehicles, resulting in a notable impact on global automobile production. The need for industrial coatings in the automobile industry has become more pronounced with the increase in personal vehicle ownership.

The automotive industry's reliance on industrial coatings is driven by their unique chemical characteristics, including their ability to adhere well to surfaces and offer resistance against chemicals and water. These properties ensure that automotive components and transportation vehicles maintain their visual appeal and longevity, even in demanding environments.

Increase in mining activities and rise in demand for efficient mining equipment have led to a corresponding surge in the demand for industrial coatings. Growth in mining industry, specifically in Saudi Arabia, is also contributing to the market progress.

Mining equipment used in surface and underground operations, such as drilling, crushing, milling, and loading, faces significant challenges from dust, dirt, and moisture. These harsh environmental conditions can lead to corrosion and wear of metal parts, necessitating the use of protective coatings.

Industrial coatings play a pivotal role in mining and ore processing industries, providing essential wear protection for metal equipment. The mining industry commonly faces issues such as abrasion and corrosion, which can result in costly equipment replacement and downtime. Polyuria and polyurethane-based coatings have emerged as popular choices, to combat these challenges, offering maximum protection against friction and corrosion. These coatings not only extend the lifespan of mining equipment but also lead to significant cost savings by minimizing replacement expenses and reducing downtime.

Based on chemistry, the global market has been segmented into acrylic, vinyl, vinyl acetate ethylene (VAE), alkyd, polyurethane, epoxy, and others. According to the latest industrial coatings market report, the polyurethane chemistry segment is likely to lead the global industry in the near future.

Polyurethane coatings offer exceptional durability, chemical resistance, and versatility, making them suitable for various applications across end-use industries. Polyurethane coatings provide excellent protection against abrasion, impact, and weathering. They also offer a high level of flexibility and can be formulated to different levels of hardness, from soft and flexible to rigid and tough. This versatility enables their use in diverse sectors such as automotive, aerospace, construction, and industrial equipment.

Furthermore, demand for eco-friendly coatings is rising across the globe due to the increase in emphasis on sustainability and environmental regulations. Polyurethane coatings can be formulated to be water-based, reducing volatile organic compound (VOC) emissions and environmental impact. Hence, their demand is anticipated to rise in the next few years.

According to the latest industrial coatings market forecast, Asia Pacific is anticipated to dominate the global industry during the forecast period. This region held major share of the global market in 2022. Increase in industrial activities and rise in presence of large-scale OEM plants in China, India, and Japan are augmenting industrial coatings market growth in Asia Pacific.

The industrial coatings market size in Europe is projected to increase during the forecast period, owing to growth in the automotive industry.

The global landscape is highly consolidated, with the presence of a few prominent manufacturers that control majority of the industrial coatings market share. According to the industrial coatings market research analysis, companies are investing significantly in comprehensive research and development activities, primarily to create environment-friendly products. Companies are collaborating strategically to accelerate product innovation and expand their business lines in regional and international markets.

The Sherwin-Williams Company, The Lubrizol Corporation, BASF SE, Kao Corporation, PPG Industries, Inc., Hempel A/S, Jotun A/S, Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., KANSAI HELIOS Group, Carboline, and SilcoTek are the key players operating in this market. These players are following the industrial coatings business trends to avail lucrative revenue opportunities.

Each of these players has been profiled in the industrial coatings market research report based on parameters such as business segments, company overview, latest developments, financial overview, business strategies, and product portfolio.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 78.9 Bn |

|

Market Forecast Value in 2031 |

US$ 118.4 Bn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Bn for Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 78.9 Bn in 2022

It is expected to grow at a CAGR of 5.4% from 2023 to 2031

Increase in automobile production and growth in mining industry

The acrylic chemistry segment accounted for major share in 2022

Asia Pacific accounted for major share in 2022

The Sherwin-Williams Company, The Lubrizol Corporation, BASF SE, Kao Corporation, PPG Industries, Inc., Hempel A/S, Jotun A/S, Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., KANSAI HELIOS Group, Carboline, and SilcoTek

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Industrial Coatings Market Analysis and Forecasts, 2022-2031

2.6.1. Global Industrial Coatings Market Volume (Kilo Tons)

2.6.2. Global Industrial Coatings Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Manufacturers

2.9.2. List of Dealers/Distributors

2.9.3. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of Industrial Coatings

3.2. Impact on the Demand for Industrial Coatings - Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Kilo Tons)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2022-2031

6.1. Price Comparison Analysis by Chemistry

6.2. Price Comparison Analysis by Region

7. Global Industrial Coatings Market Analysis and Forecast, by Chemistry, 2022-2031

7.1. Introduction and Definitions

7.2. Global Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

7.2.1. Acrylic

7.2.2. Vinyl

7.2.3. Vinyl Acetate Ethylene (VAE)

7.2.4. Alkyd

7.2.5. Polyurethane

7.2.6. Epoxy

7.2.7. Others

7.3. Global Industrial Coatings Market Attractiveness, by Chemistry

8. Global Industrial Coatings Market Analysis and Forecast, by Layer, 2022-2031

8.1. Introduction and Definitions

8.2. Global Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

8.2.1. Primer

8.2.2. Basecoat

8.2.3. Clearcoat

8.2.4. Electrocoat

8.3. Global Industrial Coatings Market Attractiveness, by Layer

9. Global Industrial Coatings Market Analysis and Forecast, Technology, 2022-2031

9.1. Introduction and Definitions

9.2. Global Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

9.2.1. Liquid Coatings

9.2.1.1. Water-based Coatings

9.2.1.2. Solvent-based Coatings

9.2.2. Powder Coatings

9.3. Global Industrial Coatings Market Attractiveness, by Technology

10. Global Industrial Coatings Market Analysis and Forecast, End-use, 2022-2031

10.1. Introduction and Definitions

10.2. Global Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

10.2.1. Automotive & Transportation

10.2.2. Metal & Mining

10.2.3. Industrial & Heavy Equipment

10.2.4. Aerospace

10.2.5. Oil & Gas

10.2.6. Marine

10.2.7. Others

10.3. Global Industrial Coatings Market Attractiveness, by End-use

11. Global Industrial Coatings Market Analysis and Forecast, by Region, 2022-2031

11.1. Key Findings

11.2. Global Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2022-2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Global Industrial Coatings Market Attractiveness, by Region

12. North America Industrial Coatings Market Analysis and Forecast, 2022-2031

12.1. Key Findings

12.2. North America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

12.3. North America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

12.4. North America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

12.5. North America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

12.6. North America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2022-2031

12.6.1. U.S. Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

12.6.2. U.S. Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

12.6.3. U.S. Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

12.6.4. U.S. Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

12.6.5. Canada Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry Layer, 2022-2031

12.6.6. Canada Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

12.6.7. Canada Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

12.6.8. Canada Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

12.7. North America Industrial Coatings Market Attractiveness Analysis

13. Europe Industrial Coatings Market Analysis and Forecast, 2022-2031

13.1. Key Findings

13.2. Europe Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

13.3. Europe Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

13.4. Europe Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

13.5. Europe Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

13.6. Europe Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

13.6.1. Germany Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

13.6.2. Germany Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

13.6.3. Germany Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

13.6.4. Germany Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

13.6.5. France Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

13.6.6. France Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

13.6.7. France Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

13.6.8. France. Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

13.6.9. U.K. Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

13.6.10. U.K. Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

13.6.11. U.K. Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

13.6.12. U.K. Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

13.6.13. Italy Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

13.6.14. Italy Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

13.6.15. Italy Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

13.6.16. Italy Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

13.6.17. Russia & CIS Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

13.6.18. Russia & CIS Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

13.6.19. Russia & CIS Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

13.6.20. Russia & CIS Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

13.6.21. Rest of Europe Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

13.6.22. Rest of Europe Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

13.6.23. Rest of Europe Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

13.6.24. Rest of Europe Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

13.7. Europe Industrial Coatings Market Attractiveness Analysis

14. Asia Pacific Industrial Coatings Market Analysis and Forecast, 2022-2031

14.1. Key Findings

14.2. Asia Pacific Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry

14.3. Asia Pacific Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

14.4. Asia Pacific Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

14.5. Asia Pacific Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

14.6. Asia Pacific Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

14.6.1. China Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

14.6.2. China Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

14.6.3. China Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

14.6.4. China Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

14.6.5. Japan Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

14.6.6. Japan Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

14.6.7. Japan Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

14.6.8. Japan Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

14.6.9. India Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

14.6.10. India Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

14.6.11. India Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

14.6.12. India Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

14.6.13. ASEAN Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

14.6.14. ASEAN Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

14.6.15. ASEAN Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

14.6.16. ASEAN Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

14.6.17. Rest of Asia Pacific Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

14.6.18. Rest of Asia Pacific Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

14.6.19. Rest of Asia Pacific Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

14.6.20. Rest of Asia Pacific Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

14.7. Asia Pacific Industrial Coatings Market Attractiveness Analysis

15. Latin America Industrial Coatings Market Analysis and Forecast, 2022-2031

15.1. Key Findings

15.2. Latin America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry Layer, 2022-2031

15.3. Latin America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

15.4. Latin America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

15.5. Latin America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

15.6. Latin America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

15.6.1. Brazil Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

15.6.2. Brazil Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

15.6.3. Brazil Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

15.6.4. Brazil Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

15.6.5. Mexico Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

15.6.6. Mexico Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

15.6.7. Mexico Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

15.6.8. Mexico Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

15.6.9. Rest of Latin America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

15.6.10. Rest of Latin America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

15.6.11. Rest of Latin America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

15.6.12. Rest of Latin America Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

15.7. Latin America Industrial Coatings Market Attractiveness Analysis

16. Middle East & Africa Industrial Coatings Market Analysis and Forecast, 2022-2031

16.1. Key Findings

16.2. Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

16.3. Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

16.4. Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

16.5. Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2022-2031

16.6. Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

16.6.1. GCC Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

16.6.2. GCC Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

16.6.3. GCC Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

16.6.4. GCC Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

16.6.5. South Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

16.6.6. South Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

16.6.7. South Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

16.6.8. South Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

16.6.9. Rest of Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Chemistry, 2022-2031

16.6.10. Rest of Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Layer, 2022-2031

16.6.11. Rest of Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Technology, 2022-2031

16.6.12. Rest of Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, End-use, 2022-2031

16.7. Middle East & Africa Industrial Coatings Market Attractiveness Analysis

17. Competition Landscape

17.1. Market Players - Competition Matrix (by Tier and Size of Companies)

17.2. Market Share Analysis, 2021

17.3. Market Footprint Analysis

17.3.1. By Chemistry

17.3.2. By End-use

17.4. Company Profiles

17.4.1. The Sherwin-Williams Company

17.4.1.1. Company Revenue

17.4.1.2. Business Overview

17.4.1.3. Product Segments

17.4.1.4. Geographic Footprint

17.4.1.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.1.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.2. The Lubrizol Corporation

17.4.2.1. Company Revenue

17.4.2.2. Business Overview

17.4.2.3. Product Segments

17.4.2.4. Geographic Footprint

17.4.2.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.2.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.3. BASF SE

17.4.3.1. Company Revenue

17.4.3.2. Business Overview

17.4.3.3. Product Segments

17.4.3.4. Geographic Footprint

17.4.3.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.3.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.4. PPG Industries, Inc.

17.4.4.1. Company Revenue

17.4.4.2. Business Overview

17.4.4.3. Product Segments

17.4.4.4. Geographic Footprint

17.4.4.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.4.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.5. KANSAI HELIOS Group

17.4.5.1. Company Revenue

17.4.5.2. Business Overview

17.4.5.3. Product Segments

17.4.5.4. Geographic Footprint

17.4.5.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.5.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.6. Hempel A/S

17.4.6.1. Company Revenue

17.4.6.2. Business Overview

17.4.6.3. Product Segments

17.4.6.4. Geographic Footprint

17.4.6.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.6.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.7. KAO Corporation

17.4.7.1. Company Revenue

17.4.7.2. Business Overview

17.4.7.3. Product Segments

17.4.7.4. Geographic Footprint

17.4.7.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.7.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.8. Jotun A/S

17.4.8.1. Company Revenue

17.4.8.2. Business Overview

17.4.8.3. Product Segments

17.4.8.4. Geographic Footprint

17.4.8.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.8.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.9. Akzo Nobel N.V.

17.4.9.1. Company Revenue

17.4.9.2. Business Overview

17.4.9.3. Product Segments

17.4.9.4. Geographic Footprint

17.4.9.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.9.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.10. Carboline

17.4.10.1. Company Revenue

17.4.10.2. Business Overview

17.4.10.3. Product Segments

17.4.10.4. Geographic Footprint

17.4.10.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.10.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.11. Nippon Paint Holdings Co., Ltd.

17.4.11.1. Company Revenue

17.4.11.2. Business Overview

17.4.11.3. Product Segments

17.4.11.4. Geographic Footprint

17.4.11.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.11.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

17.4.12. SilcoTek

17.4.12.1. Company Revenue

17.4.12.2. Business Overview

17.4.12.3. Product Segments

17.4.12.4. Geographic Footprint

17.4.12.5. Production Layer/Plant Details, etc. (*As Applicable)

17.4.12.6. Strategic Partnership, Layer Expansion, New Product Innovation etc.

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 1: Global Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 2: Global Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 3: Global Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 4: Global Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 5: Global Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 6: Global Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 7: Global Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 8: Global Industrial Coatings Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 9: Global Industrial Coatings Market Volume (Kilo Tons) Forecast, by Region, 2022-2031

Table 10: Global Industrial Coatings Market Value (US$ Bn) Forecast, by Region, 2022-2031

Table 11: North America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 12: North America Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 13: North America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 14: North America Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 15: North America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 16: North America Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 17: North America Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 18: North America Industrial Coatings Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 19: North America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Country, 2022-2031

Table 20: North America Industrial Coatings Market Value (US$ Bn) Forecast, by Country, 2022-2031

Table 21: U.S. Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 22: U.S. Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 23: U.S. Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 24: U.S. Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 25: U.S. Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 26: U.S. Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 27: U.S. Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 28: U.S. Industrial Coatings Market Value (US$ Bn) Forecast, by End-use, 2022-2031

Table 29: Canada Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 30: Canada Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 31: Canada Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 32: Canada Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 33: Canada Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 34: Canada Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 35: Canada Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 36: Canada Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 37: Europe Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 38: Europe Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 39: Europe Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 40: Europe Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 41: Europe Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 42: Europe Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 43: Europe Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 44: Europe Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 45: Europe Industrial Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 46: Europe Industrial Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 47: Germany Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 48: Germany Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 49: Germany Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 50: Germany Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 51: Germany Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 52: Germany Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 53: Germany Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 54: Germany Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 55: France Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 56: France Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 57: France Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 58: France Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 59: France Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 60: France Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 61: France Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 62: France Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 63: U.K. Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 64: U.K. Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 65: U.K. Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 66: U.K. Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 67: U.K. Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 68: U.K. Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 69: U.K. Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 70: U.K. Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 71: Italy Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 72: Italy Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 73: Italy Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 74: Italy Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 75: Italy Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 76: Italy Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 77: Italy Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 78: Italy Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 79: Spain Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 80: Spain Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 81: Spain Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 82: Spain Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 83: Spain Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 84: Spain Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 85: Spain Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 86: Spain Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 87: Russia & CIS Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 88: Russia & CIS Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 89: Russia & CIS Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 90: Russia & CIS Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 91: Russia & CIS Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 92: Russia & CIS Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 93: Russia & CIS Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 94: Russia & CIS Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 95: Rest of Europe Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 96: Rest of Europe Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 97: Rest of Europe Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 98: Rest of Europe Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 99: Rest of Europe Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 100: Rest of Europe Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 101: Rest of Europe Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 102: Rest of Europe Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 103: Asia Pacific Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 104: Asia Pacific Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 105: Asia Pacific Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 106: Asia Pacific Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 107: Asia Pacific Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 108: Asia Pacific Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 109: Asia Pacific Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 110: Asia Pacific Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 111: Asia Pacific Industrial Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 112: Asia Pacific Industrial Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 113: China Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 114: China Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry 2022-2031

Table 115: China Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 116: China Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 117: China Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 118: China Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 119: China Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 120: China Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 121: Japan Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 122: Japan Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 123: Japan Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 124: Japan Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 125: Japan Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 126: Japan Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 127: Japan Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 128: Japan Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 129: India Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 130: India Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 131: India Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 132: India Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 133: India Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 134: India Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 135: India Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 136: India Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 137: ASEAN Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 138: ASEAN Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 139: ASEAN Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 140: ASEAN Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 141: ASEAN Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 142: ASEAN Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 143: ASEAN Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 144: ASEAN Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 145: Rest of Asia Pacific Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 146: Rest of Asia Pacific Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 147: Rest of Asia Pacific Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 148: Rest of Asia Pacific Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 149: Rest of Asia Pacific Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 150: Rest of Asia Pacific Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 151: Rest of Asia Pacific Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 152: Rest of Asia Pacific Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 153: Latin America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 154: Latin America Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 155: Latin America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 156: Latin America Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 157: Latin America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 158: Latin America Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 159: Latin America Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 160: Latin America Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 161: Latin America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 162: Latin America Industrial Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 163: Brazil Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 164: Brazil Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 165: Brazil Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 166: Brazil Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 167: Brazil Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 168: Brazil Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 169: Brazil Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 170: Brazil Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 171: Mexico Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 172: Mexico Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 173: Mexico Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 174: Mexico Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 175: Mexico Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 176: Mexico Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 177: Mexico Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 178: Mexico Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 179: Rest of Latin America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 180: Rest of Latin America Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 181: Rest of Latin America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 182: Rest of Latin America Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 183: Rest of Latin America Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 184: Rest of Latin America Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 185: Rest of Latin America Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 186: Rest of Latin America Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 187: Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 188: Middle East & Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 189: Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 190: Middle East & Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 191: Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 192: Middle East & Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 193: Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 194: Middle East & Africa Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 195: Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 196: Middle East & Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

Table 197: GCC Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 198: GCC Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 199: GCC Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 200: GCC Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 201: GCC Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 202: GCC Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 203: GCC Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 204: GCC Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 205: South Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 206: South Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 207: South Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 208: South Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 209: South Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 210: South Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 211: South Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 212: South Africa Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

Table 213: Rest of Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Chemistry, 2022-2031

Table 214: Rest of Middle East & Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Chemistry, 2022-2031

Table 215: Rest of Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Layer, 2022-2031

Table 216: Rest of Middle East & Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Layer, 2022-2031

Table 217: Rest of Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2022-2031

Table 218: Rest of Middle East & Africa Industrial Coatings Market Value (US$ Bn) Forecast, by Technology, 2022-2031

Table 219: Rest of Middle East & Africa Industrial Coatings Market Volume (Kilo Tons) Forecast, by End-use, 2022-2031

Table 220: Rest of Middle East & Africa Industrial Coatings Market Value (US$ Bn) Forecast, by End-use 2022-2031

List of Figures

Figure 1: Global Industrial Coatings Market Volume Share Analysis, by Chemistry, 2021, 2027, and 2031

Figure 2: Global Industrial Coatings Market Attractiveness, by Chemistry

Figure 3: Global Industrial Coatings Market Volume Share Analysis, by Layer, 2021, 2027, and 2031

Figure 4: Global Industrial Coatings Market Attractiveness, by Layer

Figure 5: Global Industrial Coatings Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 6: Global Industrial Coatings Market Attractiveness, by Technology

Figure 7: Global Industrial Coatings Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 8: Global Industrial Coatings Market Attractiveness, by End-use

Figure 9: Global Industrial Coatings Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 10: Global Industrial Coatings Market Attractiveness, by Region

Figure 11: North America Industrial Coatings Market Volume Share Analysis, by Chemistry, 2021, 2027, and 2031

Figure 12: North America Industrial Coatings Market Attractiveness, by Chemistry

Figure 13: North America Industrial Coatings Market Attractiveness, by Chemistry

Figure 14: North America Industrial Coatings Market Volume Share Analysis, by Layer, 2021, 2027, and 2031

Figure 15: North America Industrial Coatings Market Attractiveness, by Layer

Figure 16: North America Industrial Coatings Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 17: North America Industrial Coatings Market Attractiveness, by Technology

Figure 18: North America Industrial Coatings Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 19: North America Industrial Coatings Market Attractiveness, by End-use

Figure 20: North America Industrial Coatings Market Attractiveness, by Country and Sub-region

Figure 21: Europe Industrial Coatings Market Volume Share Analysis, by Chemistry, 2021, 2027, and 2031

Figure 22: Europe Industrial Coatings Market Attractiveness, by Chemistry

Figure 23: Europe Industrial Coatings Market Volume Share Analysis, by Layer, 2021, 2027, and 2031

Figure 24: Europe Industrial Coatings Market Attractiveness, by Layer

Figure 25: Europe Industrial Coatings Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 26: Europe Industrial Coatings Market Attractiveness, by Technology

Figure 27: Europe Industrial Coatings Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 28: Europe Industrial Coatings Market Attractiveness, by End-use

Figure 29: Europe Industrial Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 30: Europe Industrial Coatings Market Attractiveness, by Country and Sub-region

Figure 31: Asia Pacific Industrial Coatings Market Volume Share Analysis, by Chemistry, 2021, 2027, and 2031

Figure 32: Asia Pacific Industrial Coatings Market Attractiveness, by Chemistry

Figure 33: Asia Pacific Industrial Coatings Market Volume Share Analysis, by Layer, 2021, 2027, and 2031

Figure 34: Asia Pacific Industrial Coatings Market Attractiveness, by Layer

Figure 35: Asia Pacific Industrial Coatings Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 36: Asia Pacific Industrial Coatings Market Attractiveness, by Technology

Figure 33: Asia Pacific Industrial Coatings Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 34: Asia Pacific Industrial Coatings Market Attractiveness, by End-use

Figure 35: Asia Pacific Industrial Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 36: Asia Pacific Industrial Coatings Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Industrial Coatings Market Volume Share Analysis, by Chemistry, 2021, 2027, and 2031

Figure 34: Latin America Industrial Coatings Market Attractiveness, by Chemistry

Figure 35: Latin America Industrial Coatings Market Volume Share Analysis, by Layer, 2021, 2027, and 2031

Figure 36: Latin America Industrial Coatings Market Attractiveness, by Layer

Figure 33: Latin America Industrial Coatings Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 34: Latin America Industrial Coatings Market Attractiveness, by Technology

Figure 35: Latin America Industrial Coatings Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 36: Latin America Industrial Coatings Market Attractiveness, by End-use

Figure 36: Latin America Industrial Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 37: Latin America Industrial Coatings Market Attractiveness, by Country and Sub-region

Figure 38: Middle East & Africa Industrial Coatings Market Volume Share Analysis, by Chemistry, 2021, 2027, and 2031

Figure 39: Middle East & Africa Industrial Coatings Market Attractiveness, by Chemistry

Figure 40: Middle East & Africa Industrial Coatings Market Volume Share Analysis, by Layer, 2021, 2027, and 2031

Figure 41: Middle East & Africa Industrial Coatings Market Attractiveness, by Layer

Figure 42: Middle East & Africa Industrial Coatings Market Volume Share Analysis, by Technology, 2021, 2027, and 2031

Figure 43: Middle East & Africa Industrial Coatings Market Attractiveness, by Technology

Figure 44: Middle East & Africa Industrial Coatings Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 45: Middle East & Africa Industrial Coatings Market Attractiveness, by End-use

Figure 46: Middle East & Africa Industrial Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 47: Middle East & Africa Industrial Coatings Market Attractiveness, by Country and Sub-region