Analysts’ Viewpoint on Industrial Brake Caliper Market Scenario

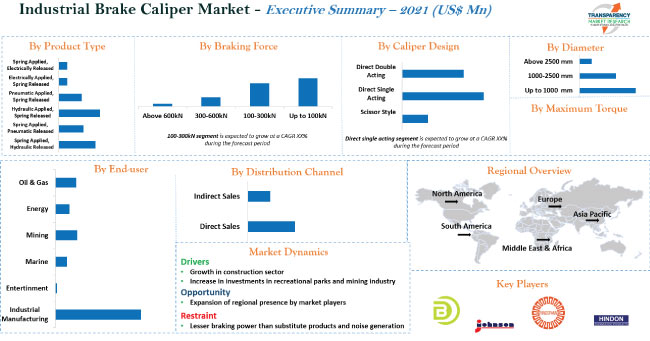

Increase in demand for industrial caliper brakes in the construction sector and rise in investments in manufacture of advanced products are driving the global industrial brake caliper market. Electrically applied, spring released brake calipers are gaining traction in the market, as they offer fast response time and high torque output. They are also able to produce a range of torque values from their externally adjustable air gaps. Players in the global industrial brake caliper market are collaborating with businesses to maintain competitive advantage and increase their global reach and portfolio. Companies are also focusing on long-term growth through effective integration, continuous improvement, and innovation in industrial brake calipers.

Industrial brake calipers are used in various industries such as manufacturing, mining, and energy. They stop or significantly slow down moving parts with the help of kinetic energy produced by friction between surfaces. Industrial brakes and brake systems offer a safer way to stop or slow down machinery in construction and manufacturing industries. Industrial brake calipers are suitable for applications, wherein high torque, high energy stopping, and/or tensioning is required. These brake calipers absorb the energy generated by the braking process, and then dissipate that energy as heat.

Growth in the global construction sector has led to a rise in investments in various types of machinery, which rely on industrial disc brake calipers for proper functioning. Increase in GDP is expected to fuel the construction sector, thereby driving the demand for industrial brakes and clutches in developing economies such as China and India. According to the World Bank, China's GDP per capita increased to US$ 12,556 in 2021 from US$ 10,408.7 in 2020. Furthermore, the GDP per person in India rose from US$ 1933.1 in 2020 to US$ 2,277.4 in 2021.

Rise in number of recreational parks is driving the global industrial brake caliper market. Equipment used in recreational parks regularly need industrial braking systems to function smoothly. Brake calipers are highly crucial in controlling wind turbines. Increase in investment in renewable energy is anticipated to create lucrative opportunities for players operating in the market. According to the World Wind Energy Association, the global wind industry installed a record 93 GW of new capacity in 2020 – a 53% year-on-year increase.

Countries across the globe are increasingly investing in the mining industry. This is favorably impacting expenses made on mining equipment (including brake calipers). According to the 2021 data by the Mining Council of Australia, the mining sector received capital investment of US$ 250 Bn in the past 10 years. Thus, growth in investments in the mining sector is propelling the market.

In terms of product type, the global industrial brake caliper market has been segmented into spring applied, hydraulic released; spring applied, pneumatic released; hydraulic applied, spring released; pneumatic applied, spring released; electrically applied, spring released; and spring applied, electrically released. The electrically applied, spring released segment is expected to dominate the market in terms of value during the forecast period. Growth of the segment can be ascribed to the rise in adoption of electrically applied, spring released brake calipers in the industrial sector for minimizing speed of motion by acting as clamps that squeeze the brake pads of a disc. Electrically applied, spring released brake calipers are also ideal for stopping, holding, and locking out equipment control during maintenance.

Asia Pacific is expected to dominate the global industrial brake caliper market during the forecast period, followed by Europe. The region is home to manufacturing-driven economies such as China and India. The market in Asia Pacific is anticipated to grow at the fastest rate during the forecast period, as various companies across the globe are shifting their manufacturing facilities to the region. Rise in government initiatives and increase in investment associated with manufacturing are further contributing to the growth of the market in the region. Asia Pacific has a robust business ecosystem, a lenient regulatory environment, low taxes and duties, and competitive currency practices, which are expected to drive the manufacturing industry. This is estimated to boost the demand for industrial brake calipers in the region. Rapid industrialization in Asia Pacific is likely to fuel the demand for electric and mechanical brake calipers for industrial work. Industrial brake calipers are used in mining, heavy machinery, manufacturing, and power generation industries.

The global industrial brake caliper market is consolidated, with a small number of large-scale vendors controlling majority of the share. Key players are investing significantly in research and development activities. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by players. In December 2021, Hayes Performance Systems, the U.S.-based brake clipper company, launched Sovren Calipers for usage in high-power machinery and equipment. Hongqiao Brakes By Shares Co., Ltd., Kobelt Manufacturing Co. Ltd., KTR Systems GmbH, Hilliard Corporation, Hindon, LLC, RINGSPANN GmbH, Johnson Industries Ltd., DELLNER BUBENZER, Altra Industrial Motion Corp., Stromag, Twiflex, Svendborg Brakes, and others (Industrial Clutch, Wichita Clutch, etc.) are prominent entities operating in this market.

Each of these players has been profiled in the global industrial brake caliper market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 313.6 Mn |

|

Market Forecast Value in 2031 |

US$ 428.6 Mn |

|

Growth Rate (CAGR) |

3.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value & Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industrial brake caliper market is expected to reach US$ 428.6 Mn by 2031

The industrial brake caliper market is estimated to grow at a CAGR of 3.2% during the forecast period

Growth in construction sector and increase in investments in recreational parks and mining industry

The hydraulic applied, spring released segment accounted for 29% share of the industrial brake caliper market in 2021

Asia Pacific is more attractive for vendors in the industrial brake caliper market

Hongqiao Brakes By Shares Co., Ltd., Kobelt Manufacturing Co. Ltd., KTR Systems GmbH, Hilliard Corporation, Hindon, LLC, RINGSPANN GmbH, Johnson Industries Ltd., DELLNER BUBENZER, Altra Industrial Motion Corp., Stromag, Twiflex, Svendborg Brakes, and others (Industrial Clutch, Wichita Clutch, etc.)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Industrial Brakes Overview

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Technological Overview

5.8. COVID-19 Impact Analysis

5.9. Global Industrial Brake Caliper Market Analysis and Forecast, 2017- 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Industrial Brake Caliper Market Analysis and Forecast, by Product Type

6.1. Global Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

6.1.1. Spring Applied, Hydraulic Released

6.1.2. Spring Applied, Pneumatic Released

6.1.3. Hydraulic Applied, Spring Released

6.1.4. Pneumatic Applied, Spring Released

6.1.5. Electrically Applied, Spring Released

6.1.6. Spring Applied, Electrically Released

6.2. Incremental Opportunity, by Product Type

7. Global Industrial Brake Caliper Market Analysis and Forecast, by Caliper Design

7.1. Global Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Caliper Design, 2017- 2031

7.1.1. Scissor Style

7.1.2. Direct Single Acting

7.1.3. Direct Double Acting

7.2. Incremental Opportunity, by Caliper Design

8. Global Industrial Brake Caliper Market Analysis and Forecast, by Braking Force

8.1. Global Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Braking Force , 2017- 2031

8.1.1. Up to 100kN

8.1.2. 100-300kN

8.1.3. 300-600kN

8.1.4. Above 600kN

8.2. Incremental Opportunity, by Braking Force

9. Global Industrial Brake Caliper Market Analysis and Forecast, by Diameter

9.1. Global Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Diameter, 2017- 2031

9.1.1. Up to 1000 mm

9.1.2. 1000-2500 mm

9.1.3. Above 2500 mm

9.2. Incremental Opportunity, by Diameter

10. Global Industrial Brake Caliper Market Analysis and Forecast, by Maximum Torque

10.1. Global Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Maximum Torque, 2017- 2031

10.1.1. Up to 30,000 Nm

10.1.2. 30,000- 40,000 Nm

10.1.3. Above 40,000 Nm

10.2. Incremental Opportunity, by Maximum Torque

11. Global Industrial Brake Caliper Market Analysis and Forecast, by End-Users

11.1. Global Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by End-Users, 2017- 2031

11.1.1. Oil & Gas

11.1.2. Energy

11.1.3. Mining

11.1.4. Marine

11.1.5. Entertainment

11.1.6. Industrial Manufacturing

11.1.6.1. Discrete Manufacturing

11.1.6.2. Process Manufacturing

11.2. Incremental Opportunity, by End-Users

12. Global Industrial Brake Caliper Market Analysis and Forecast, by Distribution Channel

12.1. Global Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

12.1.1. Direct

12.1.2. Indirect

12.2. Incremental Opportunity, by Distribution Channel

13. Global Industrial Brake Caliper Market Analysis and Forecast, by Region

13.1. Global Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Region, 2017- 2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, by Region

14. North America Industrial Brake Caliper Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

14.5.1. Spring Applied, Hydraulic Released

14.5.2. Spring Applied, Pneumatic Released

14.5.3. Hydraulic Applied, Spring Released

14.5.4. Pneumatic Applied, Spring Released

14.5.5. Electrically Applied, Spring Released

14.5.6. Spring Applied, Electrically Released

14.6. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Caliper Design, 2017- 2031

14.6.1. Scissor Style

14.6.2. Direct Single Acting

14.6.3. Direct Double Acting

14.7. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Braking Force , 2017- 2031

14.7.1. Up to 100kN

14.7.2. 100-300kN

14.7.3. 300-600kN

14.7.4. Above 600kN

14.8. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Diameter, 2017- 2031

14.8.1. Up to 1000 mm

14.8.2. 1000-2500 mm

14.8.3. Above 2500 mm

14.9. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Maximum Torque, 2017- 2031

14.9.1. Up to 30,000 Nm

14.9.2. 30,000- 40,000 Nm

14.9.3. Above 40,000 Nm

14.10. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by End-Users, 2017- 2031

14.10.1. Oil & Gas

14.10.2. Energy

14.10.3. Mining

14.10.4. Marine

14.10.5. Entertainment

14.10.6. Industrial Manufacturing

14.10.6.1. Discrete Manufacturing

14.10.6.2. Process Manufacturing

14.11. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

14.11.1. Direct

14.11.2. Indirect

14.12. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

14.12.1. U.S.

14.12.2. Canada

14.12.3. Rest of North America

14.13. Incremental Opportunity Analysis

15. Europe Industrial Brake Caliper Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

15.5.1. Spring Applied, Hydraulic Released

15.5.2. Spring Applied, Pneumatic Released

15.5.3. Hydraulic Applied, Spring Released

15.5.4. Pneumatic Applied, Spring Released

15.5.5. Electrically Applied, Spring Released

15.5.6. Spring Applied, Electrically Released

15.6. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Caliper Design, 2017- 2031

15.6.1. Scissor Style

15.6.2. Direct Single Acting

15.6.3. Direct Double Acting

15.7. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Braking Force , 2017- 2031

15.7.1. Up to 100kN

15.7.2. 100-300kN

15.7.3. 300-600kN

15.7.4. Above 600kN

15.8. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Diameter, 2017- 2031

15.8.1. Up to 1000 mm

15.8.2. 1000-2500 mm

15.8.3. Above 2500 mm

15.9. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Maximum Torque, 2017- 2031

15.9.1. Up to 30,000 Nm

15.9.2. 30,000- 40,000 Nm

15.9.3. Above 40,000 Nm

15.10. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by End-Users, 2017- 2031

15.10.1. Oil & Gas

15.10.2. Energy

15.10.3. Mining

15.10.4. Marine

15.10.5. Entertainment

15.10.6. Industrial Manufacturing

15.10.6.1. Discrete Manufacturing

15.10.6.2. Process Manufacturing

15.11. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

15.11.1. Direct

15.11.2. Indirect

15.12. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

15.12.1. U.K.

15.12.2. Germany

15.12.3. France

15.12.4. Rest of Europe

15.13. Incremental Opportunity Analysis

16. Asia Pacific Industrial Brake Caliper Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Supply side

16.3.2. Demand Side

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

16.5.1. Spring Applied, Hydraulic Released

16.5.2. Spring Applied, Pneumatic Released

16.5.3. Hydraulic Applied, Spring Released

16.5.4. Pneumatic Applied, Spring Released

16.5.5. Electrically Applied, Spring Released

16.5.6. Spring Applied, Electrically Released

16.6. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Caliper Design, 2017- 2031

16.6.1. Scissor Style

16.6.2. Direct Single Acting

16.6.3. Direct Double Acting

16.7. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Braking Force , 2017- 2031

16.7.1. Up to 100kN

16.7.2. 100-300kN

16.7.3. 300-600kN

16.7.4. Above 600kN

16.8. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Diameter, 2017- 2031

16.8.1. Up to 1000 mm

16.8.2. 1000-2500 mm

16.8.3. Above 2500 mm

16.9. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Maximum Torque, 2017- 2031

16.9.1. Up to 30,000 Nm

16.9.2. 30,000- 40,000 Nm

16.9.3. Above 40,000 Nm

16.10. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by End-Users, 2017- 2031

16.10.1. Oil & Gas

16.10.2. Energy

16.10.3. Mining

16.10.4. Marine

16.10.5. Entertainment

16.10.6. Industrial Manufacturing

16.10.6.1. Discrete Manufacturing

16.10.6.2. Process Manufacturing

16.11. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

16.11.1. Direct

16.11.2. Indirect

16.12. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

16.12.1. China

16.12.2. India

16.12.3. Japan

16.12.4. Rest of Asia Pacific

16.13. Incremental Opportunity Analysis

17. Middle East & Africa Industrial Brake Caliper Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Supplier Analysis

17.3. Key Trends Analysis

17.3.1. Supply side

17.3.2. Demand Side

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

17.5.1. Spring Applied, Hydraulic Released

17.5.2. Spring Applied, Pneumatic Released

17.5.3. Hydraulic Applied, Spring Released

17.5.4. Pneumatic Applied, Spring Released

17.5.5. Electrically Applied, Spring Released

17.5.6. Spring Applied, Electrically Released

17.6. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Caliper Design, 2017- 2031

17.6.1. Scissor Style

17.6.2. Direct Single Acting

17.6.3. Direct Double Acting

17.7. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Braking Force , 2017- 2031

17.7.1. Up to 100kN

17.7.2. 100-300kN

17.7.3. 300-600kN

17.7.4. Above 600kN

17.8. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Diameter, 2017- 2031

17.8.1. Up to 1000 mm

17.8.2. 1000-2500 mm

17.8.3. Above 2500 mm

17.9. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Maximum Torque, 2017- 2031

17.9.1. Up to 30,000 Nm

17.9.2. 30,000- 40,000 Nm

17.9.3. Above 40,000 Nm

17.10. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by End-Users, 2017- 2031

17.10.1. Oil & Gas

17.10.2. Energy

17.10.3. Mining

17.10.4. Marine

17.10.5. Entertainment

17.10.6. Industrial Manufacturing

17.10.6.1. Discrete Manufacturing

17.10.6.2. Process Manufacturing

17.11. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

17.11.1. Direct

17.11.2. Indirect

17.12. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

17.12.1. GCC

17.12.2. South Africa

17.12.3. Rest of Middle East & Africa

17.13. Incremental Opportunity Analysis

18. South America Industrial Brake Caliper Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Key Supplier Analysis

18.3. Key Trends Analysis

18.3.1. Supply side

18.3.2. Demand Side

18.4. Price Trend Analysis

18.4.1. Weighted Average Selling Price (US$)

18.5. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

18.5.1. Spring Applied, Hydraulic Released

18.5.2. Spring Applied, Pneumatic Released

18.5.3. Hydraulic Applied, Spring Released

18.5.4. Pneumatic Applied, Spring Released

18.5.5. Electrically Applied, Spring Released

18.5.6. Spring Applied, Electrically Released

18.6. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Caliper Design, 2017- 2031

18.6.1. Scissor Style

18.6.2. Direct Single Acting

18.6.3. Direct Double Acting

18.7. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Braking Force , 2017- 2031

18.7.1. Up to 100kN

18.7.2. 100-300kN

18.7.3. 300-600kN

18.7.4. Above 600kN

18.8. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Diameter, 2017- 2031

18.8.1. Up to 1000 mm

18.8.2. 1000-2500 mm

18.8.3. Above 2500 mm

18.9. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Maximum Torque, 2017- 2031

18.9.1. Up to 30,000 Nm

18.9.2. 30,000- 40,000 Nm

18.9.3. Above 40,000 Nm

18.10. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by End-Users, 2017- 2031

18.10.1. Oil & Gas

18.10.2. Energy

18.10.3. Mining

18.10.4. Marine

18.10.5. Entertainment

18.10.6. Industrial Manufacturing

18.10.6.1. Discrete Manufacturing

18.10.6.2. Process Manufacturing

18.11. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

18.11.1. Direct

18.11.2. Indirect

18.12. Industrial Brake Caliper Market Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

18.12.1. Brazil

18.12.2. Rest of South America

18.13. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Competition Dashboard

19.2. Market Share Analysis % (2021)

19.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

19.3.1. Hongqiao Brakes By Shares Co., Ltd.

19.3.1.1. Company Overview

19.3.1.2. Product Portfolio

19.3.1.3. Financial Information, (Subject to Data Availability)

19.3.1.4. Business Strategies / Recent Developments

19.3.2. Kobelt Manufacturing Co. Ltd.

19.3.2.1. Company Overview

19.3.2.2. Product Portfolio

19.3.2.3. Financial Information, (Subject to Data Availability)

19.3.2.4. Business Strategies / Recent Developments

19.3.3. KTR Systems GmbH

19.3.3.1. Company Overview

19.3.3.2. Product Portfolio

19.3.3.3. Financial Information, (Subject to Data Availability)

19.3.3.4. Business Strategies / Recent Developments

19.3.4. Hilliard Corporation

19.3.4.1. Company Overview

19.3.4.2. Product Portfolio

19.3.4.3. Financial Information, (Subject to Data Availability)

19.3.4.4. Business Strategies / Recent Developments

19.3.5. Hindon, LLC.

19.3.5.1. Company Overview

19.3.5.2. Product Portfolio

19.3.5.3. Financial Information, (Subject to Data Availability)

19.3.5.4. Business Strategies / Recent Developments

19.3.6. RINGSPANN GmbH

19.3.6.1. Company Overview

19.3.6.2. Product Portfolio

19.3.6.3. Financial Information, (Subject to Data Availability)

19.3.6.4. Business Strategies / Recent Developments

19.3.7. Johnson Industries Ltd.

19.3.7.1. Company Overview

19.3.7.2. Product Portfolio

19.3.7.3. Financial Information, (Subject to Data Availability)

19.3.7.4. Business Strategies / Recent Developments

19.3.8. DELLNER BUBENZER.

19.3.8.1. Company Overview

19.3.8.2. Product Portfolio

19.3.8.3. Financial Information, (Subject to Data Availability)

19.3.8.4. Business Strategies / Recent Developments

19.3.9. Altra Industrial Motion Corp.

19.3.9.1. Company Overview

19.3.9.2. Product Portfolio

19.3.9.3. Financial Information, (Subject to Data Availability)

19.3.9.4. Business Strategies / Recent Developments

19.3.10. Stromag

19.3.10.1. Company Overview

19.3.10.2. Product Portfolio

19.3.10.3. Financial Information, (Subject to Data Availability)

19.3.10.4. Business Strategies / Recent Developments

19.3.9.11. Twiflex

19.3.11.1. Company Overview

19.3.11.2. Product Portfolio

19.3.11.3. Financial Information, (Subject to Data Availability)

19.3.11.4. Business Strategies / Recent Developments

19.3.9.12. Svendborg Brakes

19.3.9.1. Company Overview

19.3.9.2. Product Portfolio

19.3.9.3. Financial Information, (Subject to Data Availability)

19.3.9.4. Business Strategies / Recent Developments

19.3.9.13. Others (Industrial Clutch, Wichita Clutch, etc.)

20. Key Takeaways

20.1. Identification of Potential Market Spaces

20.1.1. Product Type

20.1.2. Braking Force

20.1.3. Diameter

20.1.4. Maximum Torque

20.1.5. Caliper Design

20.1.6. End-users

20.1.7. Distribution Channel

20.1.8. Geography

20.2. Understanding the Procurement Process of the End Users

20.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Brake Caliper By Product, Thousand Units 2017-2031

Table 2: Global Industrial Brake Caliper By Product, US$ Mn 2017-2031

Table 3: Global Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Table 4: Global Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Table 5: Global Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Table 6: Global Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Table 7: Global Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Table 8: Global Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Table 9: Global Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Table 10: Global Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Table 11: Global Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Table 12: Global Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Table 13: Global Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Table 14: Global Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Table 15: Global Industrial Brake Caliper Region, Thousand Units 2017-2031

Table 16: Global Industrial Brake Caliper Region, US$ Mn 2017-2031

Table 17: North America Industrial Brake Caliper By Product, Thousand Units 2017-2031

Table 18: North America Industrial Brake Caliper By Product, US$ Mn 2017-2031

Table 19: North America Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Table 20: North America Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Table 21: North America Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Table 22: North America Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Table 23: North America Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Table 24: North America Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Table 25: North America Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Table 26: North America Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Table 27: North America Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Table 28: North America Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Table 29: North America Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Table 30: North America Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Table 31: North America Industrial Brake Caliper Region, Thousand Units 2017-2031

Table 32: North America Industrial Brake Caliper Region, US$ Mn 2017-2031

Table 33: Europe Industrial Brake Caliper By Product, Thousand Units 2017-2031

Table 34: Europe Industrial Brake Caliper By Product, US$ Mn 2017-2031

Table 35: Europe Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Table 36: Europe Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Table 37: Europe Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Table 38: Europe Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Table 39: Europe Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Table 40: Europe Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Table 41: Europe Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Table 42: Europe Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Table 43: Europe Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Table 44: Europe Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Table 45: Europe Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Table 46: Europe Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Table 47: Europe Industrial Brake Caliper Region, Thousand Units 2017-2031

Table 48: Europe Industrial Brake Caliper Region, US$ Mn 2017-2031

Table 49: Asia Pacific Industrial Brake Caliper By Product, Thousand Units 2017-2031

Table 50: Asia Pacific Industrial Brake Caliper By Product, US$ Mn 2017-2031

Table 51: Asia Pacific Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Table 52: Asia Pacific Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Table 53: Asia Pacific Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Table 54: Asia Pacific Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Table 55: Asia Pacific Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Table 56: Asia Pacific Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Table 57: Asia Pacific Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Table 58: Asia Pacific Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Table 59: Asia Pacific Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Table 60: Asia Pacific Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Table 61: Asia Pacific Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Table 62: Asia Pacific Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Table 63: Asia Pacific Industrial Brake Caliper Region, Thousand Units 2017-2031

Table 64: Asia Pacific Industrial Brake Caliper Region, US$ Mn 2017-2031

Table 65: Middle East & Africa Industrial Brake Caliper By Product, Thousand Units 2017-2031

Table 66: Middle East & Africa Industrial Brake Caliper By Product, US$ Mn 2017-2031

Table 67: Middle East & Africa Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Table 68: Middle East & Africa Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Table 69: Middle East & Africa Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Table 70: Middle East & Africa Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Table 71: Middle East & Africa Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Table 72: Middle East & Africa Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Table 73: Middle East & Africa Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Table 74: Middle East & Africa Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Table 75: Middle East & Africa Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Table 76: Middle East & Africa Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Table 77: Middle East & Africa Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Table 78: Middle East & Africa Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Table 79: Middle East & Africa Industrial Brake Caliper Region, Thousand Units 2017-2031

Table 80: Middle East & Africa Industrial Brake Caliper Region, US$ Mn 2017-2031

Table 81: South America Industrial Brake Caliper By Product, Thousand Units 2017-2031

Table 82: South America Industrial Brake Caliper By Product, US$ Mn 2017-2031

Table 83: South America Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Table 84: South America Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Table 85: South America Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Table 86: South America Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Table 87: South America Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Table 88: South America Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Table 89: South America Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Table 90: South America Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Table 91: South America Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Table 92: South America Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Table 93: South America Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Table 94: South America Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Table 95: South America Industrial Brake Caliper Region, Thousand Units 2017-2031

Table 96: South America Industrial Brake Caliper Region, US$ Mn 2017-2031

List of Figures

Figure 1: Global Industrial Brake Caliper By Product, Thousand Units 2017-2031

Figure 2: Global Industrial Brake Caliper By Product, US$ Mn 2017-2031

Figure 3: Global Industrial Brake Caliper Incremental Opportunity, By Product, 2017-2031

Figure 4: Global Industrial Brake Caliper Design, Thousand Units 2017-2031

Figure 5: Global Industrial Brake Caliper Design, US$ Mn 2017-2031

Figure 6: Global Industrial Brake Caliper Incremental Opportunity, Caliper Design, 2017-2031

Figure 7: Global Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Figure 8: Global Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Figure 9: Global Industrial Brake Caliper Incremental Opportunity, Braking Force, 2017-2031

Figure 10: Global Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Figure 11: Global Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Figure 12: Global Industrial Brake Caliper Incremental Opportunity, Maximum Torque, 2017-2031

Figure 13: Global Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Figure 14: Global Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Figure 15: Global Industrial Brake Caliper Incremental Opportunity, Diameter, 2017-2031

Figure 16: Global Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Figure 17: Global Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Figure 18: Global Industrial Brake Caliper Incremental Opportunity, End-Use Industries, 2017-2031

Figure 19: Global Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Figure 20: Global Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Figure 21: Global Industrial Brake Caliper Incremental Opportunity, Distribution Channel, 2017-2031

Figure 22: Global Industrial Brake Caliper Region, Thousand Units 2017-2031

Figure 23: Global Industrial Brake Caliper Region, US$ Mn 2017-2031

Figure 24: Global Industrial Brake Caliper Incremental Opportunity, Region, 2017-2031

Figure 25: North America Industrial Brake Caliper By Product, Thousand Units 2017-2031

Figure 26: North America Industrial Brake Caliper By Product, US$ Mn 2017-2031

Figure 27: North America Industrial Brake Caliper Incremental Opportunity, By Product, 2017-2031

Figure 28: North America Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Figure 29: North America Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Figure 30: North America Industrial Brake Caliper Incremental Opportunity, Caliper Design, 2017-2031

Figure 31: North America Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Figure 32: North America Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Figure 33: North America Industrial Brake Caliper Incremental Opportunity, Braking Force, 2017-2031

Figure 34: North America Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Figure 35: North America Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Figure 36: North America Industrial Brake Caliper Incremental Opportunity, Maximum Torque, 2017-2031

Figure 37: North America Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Figure 38: North America Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Figure 39: North America Industrial Brake Caliper Incremental Opportunity, Diameter, 2017-2031

Figure 40: North America Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Figure 41: North America Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Figure 42: North America Industrial Brake Caliper Incremental Opportunity, End-Use Industries, 2017-2031

Figure 43: North America Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Figure 44: North America Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Figure 45: North America Industrial Brake Caliper Incremental Opportunity, Distribution Channel, 2017-2031

Figure 46: North America Industrial Brake Caliper Region, Thousand Units 2017-2031

Figure 47: North America Industrial Brake Caliper Region, US$ Mn 2017-2031

Figure 48: North America Industrial Brake Caliper Incremental Opportunity, Region, 2017-2031

Figure 49: Europe Industrial Brake Caliper By Product, Thousand Units 2017-2031

Figure 50: Europe Industrial Brake Caliper By Product, US$ Mn 2017-2031

Figure 51: Europe Industrial Brake Caliper Incremental Opportunity, By Product, 2017-2031

Figure 52: Europe Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Figure 53: Europe Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Figure 54: Europe Industrial Brake Caliper Incremental Opportunity, Caliper Design, 2017-2031

Figure 55: Europe Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Figure 56: Europe Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Figure 57: Europe Industrial Brake Caliper Incremental Opportunity, Braking Force, 2017-2031

Figure 58: Europe Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Figure 59: Europe Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Figure 60: Europe Industrial Brake Caliper Incremental Opportunity, Maximum Torque, 2017-2031

Figure 61: Europe Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Figure 62: Europe Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Figure 63: Europe Industrial Brake Caliper Incremental Opportunity, Diameter, 2017-2031

Figure 64: Europe Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Figure 65: Europe Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Figure 66: Europe Industrial Brake Caliper Incremental Opportunity, End-Use Industries, 2017-2031

Figure 67: Europe Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Figure 68: Europe Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Figure 69: Europe Industrial Brake Caliper Incremental Opportunity, Distribution Channel, 2017-2031

Figure 70: Europe Industrial Brake Caliper Region, Thousand Units 2017-2031

Figure 71: Europe Industrial Brake Caliper Region, US$ Mn 2017-2031

Figure 72: Europe Industrial Brake Caliper Incremental Opportunity, Region, 2017-2031

Figure 73: Asia Pacific Industrial Brake Caliper By Product, Thousand Units 2017-2031

Figure 74: Asia Pacific Industrial Brake Caliper By Product, US$ Mn 2017-2031

Figure 75: Asia Pacific Industrial Brake Caliper Incremental Opportunity, By Product, 2017-2031

Figure 76: Asia Pacific Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Figure 77: Asia Pacific Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Figure 78: Asia Pacific Industrial Brake Caliper Incremental Opportunity, Caliper Design, 2017-2031

Figure 79: Asia Pacific Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Figure 80: Asia Pacific Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Figure 81: Asia Pacific Industrial Brake Caliper Incremental Opportunity, Braking Force, 2017-2031

Figure 82: Asia Pacific Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Figure 83: Asia Pacific Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Figure 84: Asia Pacific Industrial Brake Caliper Incremental Opportunity, Maximum Torque, 2017-2031

Figure 85: Asia Pacific Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Figure 86: Asia Pacific Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Figure 87: Asia Pacific Industrial Brake Caliper Incremental Opportunity, Diameter, 2017-2031

Figure 88: Asia Pacific Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Figure 89: Asia Pacific Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Figure 90: Asia Pacific Industrial Brake Caliper Incremental Opportunity, End-Use Industries, 2017-2031

Figure 91: Asia Pacific Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Figure 92: Asia Pacific Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Figure 93: Asia Pacific Industrial Brake Caliper Incremental Opportunity, Distribution Channel, 2017-2031

Figure 94: Asia Pacific Industrial Brake Caliper Region, Thousand Units 2017-2031

Figure 95: Asia Pacific Industrial Brake Caliper Region, US$ Mn 2017-2031

Figure 96: Asia Pacific Industrial Brake Caliper Incremental Opportunity, Region, 2017-2031

Figure 97: Middle East & Africa Industrial Brake Caliper By Product, Thousand Units 2017-2031

Figure 98: Middle East & Africa Industrial Brake Caliper By Product, US$ Mn 2017-2031

Figure 99: Middle East & Africa Industrial Brake Caliper Incremental Opportunity, By Product, 2017-2031

Figure 100: Middle East & Africa Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Figure 101: Middle East & Africa Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Figure 102: Middle East & Africa Industrial Brake Caliper Incremental Opportunity, Caliper Design, 2017-2031

Figure 103: Middle East & Africa Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Figure 104: Middle East & Africa Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Figure 105: Middle East & Africa Industrial Brake Caliper Incremental Opportunity, Braking Force, 2017-2031

Figure 106: Middle East & Africa Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Figure 107: Middle East & Africa Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Figure 108: Middle East & Africa Industrial Brake Caliper Incremental Opportunity, Maximum Torque, 2017-2031

Figure 109: Middle East & Africa Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Figure 110: Middle East & Africa Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Figure 111: Middle East & Africa Industrial Brake Caliper Incremental Opportunity, Diameter, 2017-2031

Figure 112: Middle East & Africa Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Figure 113: Middle East & Africa Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Figure 114: Middle East & Africa Industrial Brake Caliper Incremental Opportunity, End-Use Industries, 2017-2031

Figure 115: Middle East & Africa Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Figure 116: Middle East & Africa Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Figure 117: Middle East & Africa Industrial Brake Caliper Incremental Opportunity, Distribution Channel, 2017-2031

Figure 118: Middle East & Africa Industrial Brake Caliper Region, Thousand Units 2017-2031

Figure 119: Middle East & Africa Industrial Brake Caliper Region, US$ Mn 2017-2031

Figure 120: Middle East & Africa Industrial Brake Caliper Incremental Opportunity, Region, 2017-2031

Figure 121: South America Industrial Brake Caliper By Product, Thousand Units 2017-2031

Figure 122: South America Industrial Brake Caliper By Product, US$ Mn 2017-2031

Figure 123: South America Industrial Brake Caliper Incremental Opportunity, By Product, 2017-2031

Figure 124: South America Industrial Brake Caliper Caliper Design, Thousand Units 2017-2031

Figure 125: South America Industrial Brake Caliper Caliper Design, US$ Mn 2017-2031

Figure 126: South America Industrial Brake Caliper Incremental Opportunity, Caliper Design, 2017-2031

Figure 127: South America Industrial Brake Caliper Braking Force, Thousand Units 2017-2031

Figure 128: South America Industrial Brake Caliper Braking Force, US$ Mn 2017-2031

Figure 129: South America Industrial Brake Caliper Incremental Opportunity, Braking Force, 2017-2031

Figure 130: South America Industrial Brake Caliper Maximum Torque, Thousand Units 2017-2031

Figure 131: South America Industrial Brake Caliper Maximum Torque, US$ Mn 2017-2031

Figure 132: South America Industrial Brake Caliper Incremental Opportunity, Maximum Torque, 2017-2031

Figure 133: South America Industrial Brake Caliper Diameter, Thousand Units 2017-2031

Figure 134: South America Industrial Brake Caliper Diameter, US$ Mn 2017-2031

Figure 135: South America Industrial Brake Caliper Incremental Opportunity, Diameter, 2017-2031

Figure 136: South America Industrial Brake Caliper End-Use Industries, Thousand Units 2017-2031

Figure 137: South America Industrial Brake Caliper End-Use Industries, US$ Mn 2017-2031

Figure 138: South America Industrial Brake Caliper Incremental Opportunity, End-Use Industries, 2017-2031

Figure 139: South America Industrial Brake Caliper Distribution Channel, Thousand Units 2017-2031

Figure 140: South America Industrial Brake Caliper Distribution Channel, US$ Mn 2017-2031

Figure 141: South America Industrial Brake Caliper Incremental Opportunity, Distribution Channel, 2017-2031

Figure 142: South America Industrial Brake Caliper Region, Thousand Units 2017-2031

Figure 143: South America Industrial Brake Caliper Region, US$ Mn 2017-2031

Figure 144: South America Industrial Brake Caliper Incremental Opportunity, Region, 2017-2031