Analysts’ Viewpoint on Inductor Market Scenario

Inductor is a passive component that is used in most power electronic circuits to store energy in the form of magnetic energy when electricity is applied to it. One of the key properties of an inductor is that it impedes or opposes any change in the amount of current flowing through it. Increase in demand for smartphones, tablets, laptops, and other consumer electronic devices in Asia Pacific and North America is a major factor driving the market. Several major manufacturers in Asia Pacific are increasing their R&D investments for miniaturized design of inductors, which in turn is fueling the market in the region. The region is emerging as the manufacturing hub for several applications in consumer electronics and automotive industries, thus the region is expected to dominate the global inductor market during forecast period. Strong demand for inductors from consumer electronics devices and electric vehicles in developing countries, such as India, propels the market. Presently, the global inductor market is fragmented between several large and local vendors who have presence across different regions. Most players are engaged in the development of small-sized inductors to penetrate the growing market. Market consolidation (mergers & acquisition) and a rise in investment in the market are expected to increase during the forecast period, with limited large players having strong hold on the market by 2031.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.9 Bn |

|

Market Forecast Value in 2031 |

US$ 7.2 Bn |

|

Growth Rate (CAGR) |

3.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

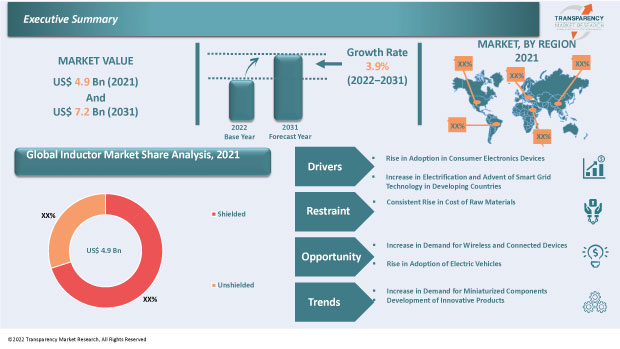

The inductor market stood at US$ 4.9 Bn in 2021

The inductor market is expected to grow at a CAGR of 3.9% by 2031

The inductor market is estimated to reach US$ 7.2 Bn in 2031

ABC Taiwan Electronics Corporation, API Delevan, Inc., Bourns, Inc., Chilisin Electronics Corp., Coilcraft, Inc., Delta Electronics, Inc., ICE Components, Inc., KYOCERA AVX Components Corporation, Murata Manufacturing Co., Ltd., Pulse Electronics Corporation, Shenzhen Sunlord Electronics Co., Ltd., Sumida Corporation, Taiyo Yuden Co., Ltd., TDK Corporation, Vishay Intertechnology Inc., Inpaq Technology Co., Ltd., Mag.Layers International Co.,Ltd., Prosperity Dielectrics Co. Ltd., Tai-Tech Advanc

The U.S. accounted for 22.54% share of the global inductor market in 2021

The surface mount inductor segment is expected to hold 65.21% of share of the global inductor market

Rise in demand for miniaturized components and development of innovative products

Asia Pacific is more lucrative region of the global inductor market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Inductor Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Passive Electronics Component Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Global Inductor Market Analysis, by Inductance

5.1. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Inductance, 2017–2031

5.1.1. Fixed Inductors

5.1.2. Variable Inductors

5.2. Market Attractiveness Analysis, by Inductance

6. Global Inductor Market Analysis, by Type

6.1. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

6.1.1. Film Type

6.1.2. Multilayered

6.1.3. Wire Wound

6.1.4. Bobbin

6.1.5. Toroidal

6.1.6. Molded

6.1.7. Other

6.2. Market Attractiveness Analysis, by Type

7. Global Inductor Market Analysis, by Core Type

7.1. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Core Type, 2017–2031

7.1.1. Air Core

7.1.2. Ceramic Core

7.1.3. Ferrite Core

7.1.4. Iron Core

7.1.5. Other

7.2. Market Attractiveness Analysis, by Core Type

8. Global Inductor Market Analysis, by Shield Type

8.1. Inductor Market Size (US$ Bn) Analysis & Forecast, by Shield Type, 2017–2031

8.1.1. Shielded

8.1.2. Unshielded

8.2. Market Attractiveness Analysis, by Shield Type

9. Global Inductor Market Analysis, by Mounting

9.1. Inductor Market Size (US$ Bn) Analysis & Forecast, by Mounting, 2017–2031

9.1.1. Surface Mount

9.1.2. Through Hole

9.2. Market Attractiveness Analysis, by Mounting

10. Global Inductor Market Analysis, by Application

10.1. Inductor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

10.1.1. Tuning Circuit

10.1.2. Energy Storage Devices

10.1.3. Induction Motors

10.1.4. Transformers

10.1.5. Power Supply

10.1.6. Others

10.2. Market Attractiveness Analysis, by Application

11. Global Inductor Market Analysis, by End-use Industry

11.1. Inductor Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

11.1.1. Automotive and Transportation

11.1.2. Industrial

11.1.3. Aerospace and Defense

11.1.4. Electronics and Semiconductor

11.1.5. Energy and Utility

11.1.6. Healthcare

11.1.7. Others

11.2. Market Attractiveness Analysis, by End-use Industry

12. Global Inductor Market Analysis and Forecast, by Region

12.1. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Market Attractiveness Analysis, by Region

13. North America Inductor Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Inductance, 2017–2031

13.3.1. Fixed Inductors

13.3.2. Variable Inductors

13.4. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

13.4.1. Film Type

13.4.2. Multilayered

13.4.3. Wire Wound

13.4.4. Bobbin

13.4.5. Toroidal

13.4.6. Molded

13.4.7. Other

13.5. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Core Type, 2017–2031

13.5.1. Air Core

13.5.2. Ceramic Core

13.5.3. Ferrite Core

13.5.4. Iron Core

13.5.5. Other

13.6. Inductor Market Size (US$ Bn) Analysis & Forecast, by Shield Type, 2017–2031

13.6.1. Shielded

13.6.2. Unshielded

13.7. Inductor Market Size (US$ Bn) Analysis & Forecast, by Mounting, 2017–2031

13.7.1. Surface Mount

13.7.2. Through Hole

13.8. Inductor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

13.8.1. Tuning Circuit

13.8.2. Energy Storage Devices

13.8.3. Induction Motors

13.8.4. Transformers

13.8.5. Power Supply

13.8.6. Others

13.9. Inductor Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

13.9.1. Automotive and Transportation

13.9.2. Industrial

13.9.3. Aerospace and Defense

13.9.4. Electronics and Semiconductor

13.9.5. Energy and Utility

13.9.6. Healthcare

13.9.7. Others

13.10. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.10.1. U.S.

13.10.2. Canada

13.10.3. Rest of North America

13.11. Market Attractiveness Analysis

13.11.1. By Inductance

13.11.2. By Type

13.11.3. By Core Type

13.11.4. By Shield Type

13.11.5. By Mounting

13.11.6. By Application

13.11.7. By End-use Industry

13.11.8. By Country and Sub-region

14. Europe Inductor Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Inductance, 2017–2031

14.3.1. Fixed Inductors

14.3.2. Variable Inductors

14.4. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

14.4.1. Film Type

14.4.2. Multilayered

14.4.3. Wire Wound

14.4.4. Bobbin

14.4.5. Toroidal

14.4.6. Molded

14.4.7. Other

14.5. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Core Type, 2017–2031

14.5.1. Air Core

14.5.2. Ceramic Core

14.5.3. Ferrite Core

14.5.4. Iron Core

14.5.5. Other

14.6. Inductor Market Size (US$ Bn) Analysis & Forecast, by Shield Type, 2017–2031

14.6.1. Shielded

14.6.2. Unshielded

14.7. Inductor Market Size (US$ Bn) Analysis & Forecast, by Mounting, 2017–2031

14.7.1. Surface Mount

14.7.2. Through Hole

14.8. Inductor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

14.8.1. Tuning Circuit

14.8.2. Energy Storage Devices

14.8.3. Induction Motors

14.8.4. Transformers

14.8.5. Power Supply

14.8.6. Others

14.9. Inductor Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

14.9.1. Automotive and Transportation

14.9.2. Industrial

14.9.3. Aerospace and Defense

14.9.4. Electronics and Semiconductor

14.9.5. Energy and Utility

14.9.6. Healthcare

14.9.7. Others

14.10. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.10.1. U.K.

14.10.2. Germany

14.10.3. France

14.10.4. Rest of Europe

14.11. Market Attractiveness Analysis

14.11.1. By Inductance

14.11.2. By Type

14.11.3. By Core Type

14.11.4. By Shield Type

14.11.5. By Mounting

14.11.6. By Application

14.11.7. By End-use Industry

14.11.8. By Country and Sub-region

15. Asia Pacific Inductor Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Inductance, 2017–2031

15.3.1. Fixed Inductors

15.3.2. Variable Inductors

15.4. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

15.4.1. Film Type

15.4.2. Multilayered

15.4.3. Wire Wound

15.4.4. Bobbin

15.4.5. Toroidal

15.4.6. Molded

15.4.7. Other

15.5. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Core Type, 2017–2031

15.5.1. Air Core

15.5.2. Ceramic Core

15.5.3. Ferrite Core

15.5.4. Iron Core

15.5.5. Other

15.6. Inductor Market Size (US$ Bn) Analysis & Forecast, by Shield Type, 2017–2031

15.6.1. Shielded

15.6.2. Unshielded

15.7. Inductor Market Size (US$ Bn) Analysis & Forecast, by Mounting, 2017–2031

15.7.1. Surface Mount

15.7.2. Through Hole

15.8. Inductor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

15.8.1. Tuning Circuit

15.8.2. Energy Storage Devices

15.8.3. Induction Motors

15.8.4. Transformers

15.8.5. Power Supply

15.8.6. Others

15.9. Inductor Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

15.9.1. Automotive and Transportation

15.9.2. Industrial

15.9.3. Aerospace and Defense

15.9.4. Electronics and Semiconductor

15.9.5. Energy and Utility

15.9.6. Healthcare

15.9.7. Others

15.10. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

15.10.1. China

15.10.2. Japan

15.10.3. India

15.10.4. South Korea

15.10.5. ASEAN

15.10.6. Rest of Asia Pacific

15.11. Market Attractiveness Analysis

15.11.1. By Inductance

15.11.2. By Type

15.11.3. By Core Type

15.11.4. By Shield Type

15.11.5. By Mounting

15.11.6. By Application

15.11.7. By End-use Industry

15.11.8. By Country and Sub-region

16. Middle East & Africa Inductor Market Analysis and Forecast

16.1. Market Snapshot

16.2. Drivers and Restraints: Impact Analysis

16.3. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Inductance, 2017–2031

16.3.1. Fixed Inductors

16.3.2. Variable Inductors

16.4. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

16.4.1. Film Type

16.4.2. Multilayered

16.4.3. Wire Wound

16.4.4. Bobbin

16.4.5. Toroidal

16.4.6. Molded

16.4.7. Other

16.5. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Core Type, 2017–2031

16.5.1. Air Core

16.5.2. Ceramic Core

16.5.3. Ferrite Core

16.5.4. Iron Core

16.5.5. Other

16.6. Inductor Market Size (US$ Bn) Analysis & Forecast, by Shield Type, 2017–2031

16.6.1. Shielded

16.6.2. Unshielded

16.7. Inductor Market Size (US$ Bn) Analysis & Forecast, by Mounting, 2017–2031

16.7.1. Surface Mount

16.7.2. Through Hole

16.8. Inductor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

16.8.1. Tuning Circuit

16.8.2. Energy Storage Devices

16.8.3. Induction Motors

16.8.4. Transformers

16.8.5. Power Supply

16.8.6. Others

16.9. Inductor Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

16.9.1. Automotive and Transportation

16.9.2. Industrial

16.9.3. Aerospace and Defense

16.9.4. Electronics and Semiconductor

16.9.5. Energy and Utility

16.9.6. Healthcare

16.9.7. Others

16.10. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

16.10.1. GCC

16.10.2. South Africa

16.10.3. Rest of Middle East & Africa

16.11. Market Attractiveness Analysis

16.11.1. By Inductance

16.11.2. By Type

16.11.3. By Core Type

16.11.4. By Shield Type

16.11.5. By Mounting

16.11.6. By Application

16.11.7. By End-use Industry

16.11.8. By Country and Sub-region

17. South America Inductor Market Analysis and Forecast

17.1. Market Snapshot

17.2. Drivers and Restraints: Impact Analysis

17.3. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Inductance, 2017–2031

17.3.1. Fixed Inductors

17.3.2. Variable Inductors

17.4. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

17.4.1. Film Type

17.4.2. Multilayered

17.4.3. Wire Wound

17.4.4. Bobbin

17.4.5. Toroidal

17.4.6. Molded

17.4.7. Other

17.5. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Core Type, 2017–2031

17.5.1. Air Core

17.5.2. Ceramic Core

17.5.3. Ferrite Core

17.5.4. Iron Core

17.5.5. Other

17.6. Inductor Market Size (US$ Bn) Analysis & Forecast, by Shield Type, 2017–2031

17.6.1. Shielded

17.6.2. Unshielded

17.7. Inductor Market Size (US$ Bn) Analysis & Forecast, by Mounting, 2017–2031

17.7.1. Surface Mount

17.7.2. Through Hole

17.8. Inductor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

17.8.1. Tuning Circuit

17.8.2. Energy Storage Devices

17.8.3. Induction Motors

17.8.4. Transformers

17.8.5. Power Supply

17.8.6. Others

17.9. Inductor Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

17.9.1. Automotive and Transportation

17.9.2. Industrial

17.9.3. Aerospace and Defense

17.9.4. Electronics and Semiconductor

17.9.5. Energy and Utility

17.9.6. Healthcare

17.9.7. Others

17.10. Inductor Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

17.10.1. Brazil

17.10.2. Rest of South America

17.11. Market Attractiveness Analysis

17.11.1. By Inductance

17.11.2. By Type

17.11.3. By Core Type

17.11.4. By Shield Type

17.11.5. By Mounting

17.11.6. By Application

17.11.7. By End-use Industry

17.11.8. By Country and Sub-region

18. Competition Assessment

18.1. Global Inductor Market Competition Matrix - a Dashboard View

18.1.1. Global Inductor Market Company Share Analysis, by Value (2021)

18.1.2. Technological Differentiator

19. Company Profiles (Global Manufacturers/Suppliers)

19.1. ABC Taiwan Electronics Corporation

19.1.1. Overview

19.1.2. Product Portfolio

19.1.3. Sales Footprint

19.1.4. Key Subsidiaries or Distributors

19.1.5. Strategy and Recent Developments

19.1.6. Key Financials

19.2. API Delevan, Inc.

19.2.1. Overview

19.2.2. Product Portfolio

19.2.3. Sales Footprint

19.2.4. Key Subsidiaries or Distributors

19.2.5. Strategy and Recent Developments

19.2.6. Key Financials

19.3. Bourns, Inc.

19.3.1. Overview

19.3.2. Product Portfolio

19.3.3. Sales Footprint

19.3.4. Key Subsidiaries or Distributors

19.3.5. Strategy and Recent Developments

19.3.6. Key Financials

19.4. Chilisin Electronics Corp

19.4.1. Overview

19.4.2. Product Portfolio

19.4.3. Sales Footprint

19.4.4. Key Subsidiaries or Distributors

19.4.5. Strategy and Recent Developments

19.4.6. Key Financials

19.5. Coilcraft, Inc.

19.5.1. Overview

19.5.2. Product Portfolio

19.5.3. Sales Footprint

19.5.4. Key Subsidiaries or Distributors

19.5.5. Strategy and Recent Developments

19.5.6. Key Financials

19.6. Delta Electronics, Inc.

19.6.1. Overview

19.6.2. Product Portfolio

19.6.3. Sales Footprint

19.6.4. Key Subsidiaries or Distributors

19.6.5. Strategy and Recent Developments

19.6.6. Key Financials

19.7. ICE Components, Inc.

19.7.1. Overview

19.7.2. Product Portfolio

19.7.3. Sales Footprint

19.7.4. Key Subsidiaries or Distributors

19.7.5. Strategy and Recent Developments

19.7.6. Key Financials

19.8. KYOCERA AVX Components Corporation.

19.8.1. Overview

19.8.2. Product Portfolio

19.8.3. Sales Footprint

19.8.4. Key Subsidiaries or Distributors

19.8.5. Strategy and Recent Developments

19.8.6. Key Financials

19.9. Murata Manufacturing Co., Ltd

19.9.1. Overview

19.9.2. Product Portfolio

19.9.3. Sales Footprint

19.9.4. Key Subsidiaries or Distributors

19.9.5. Strategy and Recent Developments

19.9.6. Key Financials

19.10. Pulse Electronics Corporation

19.10.1. Overview

19.10.2. Product Portfolio

19.10.3. Sales Footprint

19.10.4. Key Subsidiaries or Distributors

19.10.5. Strategy and Recent Developments

19.10.6. Key Financials

19.11. Shenzhen Sunlord Electronics Co., Ltd.

19.11.1. Overview

19.11.2. Product Portfolio

19.11.3. Sales Footprint

19.11.4. Key Subsidiaries or Distributors

19.11.5. Strategy and Recent Developments

19.11.6. Key Financials

19.12. Sumida Corporation

19.12.1. Overview

19.12.2. Product Portfolio

19.12.3. Sales Footprint

19.12.4. Key Subsidiaries or Distributors

19.12.5. Strategy and Recent Developments

19.12.6. Key Financials

19.13. Taiyo Yuden Co., Ltd

19.13.1. Overview

19.13.2. Product Portfolio

19.13.3. Sales Footprint

19.13.4. Key Subsidiaries or Distributors

19.13.5. Strategy and Recent Developments

19.13.6. Key Financials

19.14. TDK Corporation

19.14.1. Overview

19.14.2. Product Portfolio

19.14.3. Sales Footprint

19.14.4. Key Subsidiaries or Distributors

19.14.5. Strategy and Recent Developments

19.14.6. Key Financials

19.15. Vishay Intertechnology Inc.

19.15.1. Overview

19.15.2. Product Portfolio

19.15.3. Sales Footprint

19.15.4. Key Subsidiaries or Distributors

19.15.5. Strategy and Recent Developments

19.15.6. Key Financials

19.16. Inpaq Technology Co., Ltd.

19.16.1. Overview

19.16.2. Product Portfolio

19.16.3. Sales Footprint

19.16.4. Key Subsidiaries or Distributors

19.16.5. Strategy and Recent Developments

19.16.6. Key Financials

19.17. Mag.Layers International Co.,Ltd.

19.17.1. Overview

19.17.2. Product Portfolio

19.17.3. Sales Footprint

19.17.4. Key Subsidiaries or Distributors

19.17.5. Strategy and Recent Developments

19.17.6. Key Financials

19.18. Prosperity Dielectrics Co. Ltd.

19.18.1. Overview

19.18.2. Product Portfolio

19.18.3. Sales Footprint

19.18.4. Key Subsidiaries or Distributors

19.18.5. Strategy and Recent Developments

19.18.6. Key Financials

19.19. Tai-Tech Advanced Electronics Co

19.19.1. Overview

19.19.2. Product Portfolio

19.19.3. Sales Footprint

19.19.4. Key Subsidiaries or Distributors

19.19.5. Strategy and Recent Developments

19.19.6. Key Financials

19.20. Walsin Technology Corp.

19.20.1. Overview

19.20.2. Product Portfolio

19.20.3. Sales Footprint

19.20.4. Key Subsidiaries or Distributors

19.20.5. Strategy and Recent Developments

19.20.6. Key Financials

19.21. Microgate

19.21.1. Overview

19.21.2. Product Portfolio

19.21.3. Sales Footprint

19.21.4. Key Subsidiaries or Distributors

19.21.5. Strategy and Recent Developments

19.21.6. Key Financials

19.22. Fenghua Hitech

19.22.1. Overview

19.22.2. Product Portfolio

19.22.3. Sales Footprint

19.22.4. Key Subsidiaries or Distributors

19.22.5. Strategy and Recent Developments

19.22.6. Key Financials

19.23. Texas Instruments Incorporated

19.23.1. Overview

19.23.2. Product Portfolio

19.23.3. Sales Footprint

19.23.4. Key Subsidiaries or Distributors

19.23.5. Strategy and Recent Developments

19.23.6. Key Financials

20. Recommendation

20.1. Opportunity Assessment

20.1.1. By Inductance

20.1.2. By Type

20.1.3. By Core Type

20.1.4. By Shield Type

20.1.5. By Mounting

20.1.6. By Application

20.1.7. By End-use Industry

20.1.8. By Region

List of Tables

Table 1: Global Inductor Market Value (US$ Mn) & Forecast, by Inductance, 2017‒2031

Table 2: Global Inductor Market Volume (Million Units) & Forecast, by Inductance, 2017‒2031

Table 3: Global Inductor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 4: Global Inductor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 5: Global Inductor Market Value (US$ Mn) & Forecast, by Core Type, 2017‒2031

Table 6: Global Inductor Market Volume (Million Units) & Forecast, by Core Type, 2017‒2031

Table 7: Global Inductor Market Value (US$ Mn) & Forecast, by Shield Type, 2017‒2031

Table 8: Global Inductor Market Value (US$ Mn) & Forecast, by Mounting, 2017‒2031

Table 9: Global Inductor Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 10: Global Inductor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 11: Global Inductor Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 12: Global Inductor Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 13: North America Inductor Market Value (US$ Mn) & Forecast, by Inductance, 2017‒2031

Table 14: North America Inductor Market Volume (Million Units) & Forecast, by Inductance, 2017‒2031

Table 15: North America Inductor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 16: North America Inductor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 17: North America Inductor Market Value (US$ Mn) & Forecast, by Core Type, 2017‒2031

Table 18: North America Inductor Market Volume (Million Units) & Forecast, by Core Type, 2017‒2031

Table 19: North America Inductor Market Value (US$ Mn) & Forecast, by Shield Type, 2017‒2031

Table 20: North America Inductor Market Value (US$ Mn) & Forecast, by Mounting, 2017‒2031

Table 21: North America Inductor Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 22: North America Inductor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 23: North America Inductor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 24: North America Inductor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 25: Europe Inductor Market Value (US$ Mn) & Forecast, by Inductance, 2017‒2031

Table 26: Europe Inductor Market Volume (Million Units) & Forecast, by Inductance, 2017‒2031

Table 27: Europe Inductor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 28: Europe Inductor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 29: Europe Inductor Market Value (US$ Mn) & Forecast, by Core Type, 2017‒2031

Table 30: Europe Inductor Market Volume (Million Units) & Forecast, by Core Type, 2017‒2031

Table 31: Europe Inductor Market Value (US$ Mn) & Forecast, by Shield Type, 2017‒2031

Table 32: Europe Inductor Market Value (US$ Mn) & Forecast, by Mounting, 2017‒2031

Table 33: Europe Inductor Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 34: Europe Inductor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 35: Europe Inductor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 36: Europe Inductor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 37: Asia Pacific Inductor Market Value (US$ Mn) & Forecast, by Inductance, 2017‒2031

Table 38: Asia Pacific Inductor Market Volume (Million Units) & Forecast, by Inductance, 2017‒2031

Table 39: Asia Pacific Inductor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 40: Asia Pacific Inductor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 41: Asia Pacific Inductor Market Value (US$ Mn) & Forecast, by Core Type, 2017‒2031

Table 42: Asia Pacific Inductor Market Volume (Million Units) & Forecast, by Core Type, 2017‒2031

Table 43: Asia Pacific Inductor Market Value (US$ Mn) & Forecast, by Shield Type, 2017‒2031

Table 44: Asia Pacific Inductor Market Value (US$ Mn) & Forecast, by Mounting, 2017‒2031

Table 45: Asia Pacific Inductor Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 46: Asia Pacific Inductor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 47: Asia Pacific Inductor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 48: Asia Pacific Inductor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 49: Middle East & Africa Inductor Market Value (US$ Mn) & Forecast, by Inductance, 2017‒2031

Table 50: Middle East & Africa Inductor Market Volume (Million Units) & Forecast, by Inductance, 2017‒2031

Table 51: Middle East & Africa Inductor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 52: Middle East & Africa Inductor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 53: Middle East & Africa Inductor Market Value (US$ Mn) & Forecast, by Core Type, 2017‒2031

Table 54: Middle East & Africa Inductor Market Volume (Million Units) & Forecast, by Core Type, 2017‒2031

Table 55: Middle East & Africa Inductor Market Value (US$ Mn) & Forecast, by Shield Type, 2017‒2031

Table 56: Middle East & Africa Inductor Market Value (US$ Mn) & Forecast, by Mounting, 2017‒2031

Table 57: Middle East & Africa Inductor Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 58: Middle East & Africa Inductor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 59: Middle East & Africa Inductor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 60: Middle East & Africa Inductor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 61: South America Inductor Market Value (US$ Mn) & Forecast, by Inductance, 2017‒2031

Table 62: South America Inductor Market Volume (Million Units) & Forecast, by Inductance, 2017‒2031

Table 63: South America Inductor Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 64: South America Inductor Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 65: South America Inductor Market Value (US$ Mn) & Forecast, by Core Type, 2017‒2031

Table 66: South America Inductor Market Volume (Million Units) & Forecast, by Core Type, 2017‒2031

Table 67: South America Inductor Market Value (US$ Mn) & Forecast, by Shield Type, 2017‒2031

Table 68: South America Inductor Market Value (US$ Mn) & Forecast, by Mounting, 2017‒2031

Table 69: South America Inductor Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 70: South America Inductor Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 71: South America Inductor Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 72: South America Inductor Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Global Inductor Price Trend Analysis (Average Price, US$)

Figure 02: Global Inductor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 03: Global Inductor Market Size & Forecast, Volume (Million Units), 2017‒2031

Figure 04: Global Inductor Market Size & Forecast, Y-O-Y, and Value (US$ Mn), 2017‒2031

Figure 05: Global Inductor Market Projections by Inductance, Value (US$ Mn), 2017‒2031

Figure 06: Global Inductor Market Share Analysis, by Inductance, 2022 and 2031

Figure 07: Global Inductor Market, Incremental Opportunity, by Inductance, 2021‒2031

Figure 08: Global Inductor Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 09: Global Inductor Market Share Analysis, by Type, 2022 and 2031

Figure 10: Global Inductor Market, Incremental Opportunity, by Type, 2021‒2031

Figure 11: Global Inductor Market Projections by Core Type, Value (US$ Mn), 2017‒2031

Figure 12: Global Inductor Market Share Analysis, by Core Type, 2022 and 2031

Figure 13: Global Inductor Market, Incremental Opportunity, by Core Type, 2021‒2031

Figure 14: Global Inductor Market Projections by Shield Type, Value (US$ Mn), 2017‒2031

Figure 15: Global Inductor Market Share Analysis, by Shield Type, 2022 and 2031

Figure 16: Global Inductor Market, Incremental Opportunity, by Shield Type, 2021‒2031

Figure 17: Global Inductor Market Projections by Mounting, Value (US$ Mn), 2017‒2031

Figure 18: Global Inductor Market Share Analysis, by Mounting, 2022 and 2031

Figure 19: Global Inductor Market, Incremental Opportunity, by Mounting, 2021‒2031

Figure 20: Global Inductor Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 21: Global Inductor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 22: Global Inductor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 23: Global Inductor Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 24: Global Inductor Market Share Analysis, by Region, 2022 and 2031

Figure 25: Global Inductor Market, Incremental Opportunity, by Region, 2021‒2031

Figure 26: North America Inductor Market Projections by Inductance, Value (US$ Mn), 2017‒2031

Figure 27: North America Inductor Market Share Analysis, by Inductance, 2022 and 2031

Figure 28: North America Inductor Market, Incremental Opportunity, by Inductance, 2021‒2031

Figure 29: North America Inductor Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 30: North America Inductor Market Share Analysis, by Type, 2022 and 2031

Figure 31: North America Inductor Market, Incremental Opportunity, by Type, 2021‒2031

Figure 32: North America Inductor Market Projections by Core Type, Value (US$ Mn), 2017‒2031

Figure 33: North America Inductor Market Share Analysis, by Core Type, 2022 and 2031

Figure 34: North America Inductor Market, Incremental Opportunity, by Core Type, 2021‒2031

Figure 35: North America Inductor Market Projections by Shield Type, Value (US$ Mn), 2017‒2031

Figure 36: North America Inductor Market Share Analysis, by Shield Type, 2022 and 2031

Figure 37: North America Inductor Market, Incremental Opportunity, by Shield Type, 2021‒2031

Figure 38: North America Inductor Market Projections by Mounting, Value (US$ Mn), 2017‒2031

Figure 39: North America Inductor Market Share Analysis, by Mounting, 2022 and 2031

Figure 40: North America Inductor Market, Incremental Opportunity, by Mounting, 2021‒2031

Figure 41: North America Inductor Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 42: North America Inductor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 43: North America Inductor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 44: North America Inductor Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 45: North America Inductor Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 46: North America Inductor Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 47: Europe Inductor Market Projections by Inductance, Value (US$ Mn), 2017‒2031

Figure 48: Europe Inductor Market Share Analysis, by Inductance, 2022 and 2031

Figure 49: Europe Inductor Market, Incremental Opportunity, by Inductance, 2021‒2031

Figure 50: Europe Inductor Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 51: Europe Inductor Market Share Analysis, by Type, 2022 and 2031

Figure 52: Europe Inductor Market, Incremental Opportunity, by Type, 2021‒2031

Figure 53: Europe Inductor Market Projections by Core Type, Value (US$ Mn), 2017‒2031

Figure 54: Europe Inductor Market Share Analysis, by Core Type, 2022 and 2031

Figure 55: Europe Inductor Market, Incremental Opportunity, by Core Type, 2021‒2031

Figure 56: Europe Inductor Market Projections by Shield Type, Value (US$ Mn), 2017‒2031

Figure 57: Europe Inductor Market Share Analysis, by Shield Type, 2022 and 2031

Figure 58: Europe Inductor Market, Incremental Opportunity, by Shield Type, 2021‒2031

Figure 59: Europe Inductor Market Projections by Mounting, Value (US$ Mn), 2017‒2031

Figure 60: Europe Inductor Market Share Analysis, by Mounting, 2022 and 2031

Figure 61: Europe Inductor Market, Incremental Opportunity, by Mounting, 2021‒2031

Figure 62: Europe Inductor Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 63: Europe Inductor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 64: Europe Inductor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 65: Europe Inductor Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 66: Europe Inductor Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 67: Europe Inductor Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 68: Asia Pacific Inductor Market Projections by Inductance, Value (US$ Mn), 2017‒2031

Figure 69: Asia Pacific Inductor Market Share Analysis, by Inductance, 2022 and 2031

Figure 70: Asia Pacific Inductor Market, Incremental Opportunity, by Inductance, 2021‒2031

Figure 71: Asia Pacific Inductor Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 72: Asia Pacific Inductor Market Share Analysis, by Type, 2022 and 2031

Figure 73: Asia Pacific Inductor Market, Incremental Opportunity, by Type, 2021‒2031

Figure 74: Asia Pacific Inductor Market Projections by Core Type, Value (US$ Mn), 2017‒2031

Figure 75: Asia Pacific Inductor Market Share Analysis, by Core Type, 2022 and 2031

Figure 76: Asia Pacific Inductor Market, Incremental Opportunity, by Core Type, 2021‒2031

Figure 77: Asia Pacific Inductor Market Projections by Shield Type, Value (US$ Mn), 2017‒2031

Figure 78: Asia Pacific Inductor Market Share Analysis, by Shield Type, 2022 and 2031

Figure 79: Asia Pacific Inductor Market, Incremental Opportunity, by Shield Type, 2021‒2031

Figure 80: Asia Pacific Inductor Market Projections by Mounting, Value (US$ Mn), 2017‒2031

Figure 81: Asia Pacific Inductor Market Share Analysis, by Mounting, 2022 and 2031

Figure 82: Asia Pacific Inductor Market, Incremental Opportunity, by Mounting, 2021‒2031

Figure 83: Asia Pacific Inductor Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 84: Asia Pacific Inductor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 85: Asia Pacific Inductor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 86: Asia Pacific Inductor Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 87: Asia Pacific Inductor Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 88: Asia Pacific Inductor Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 89: Middle East & Africa Inductor Market Projections by Inductance, Value (US$ Mn), 2017‒2031

Figure 90: Middle East & Africa Inductor Market Share Analysis, by Inductance, 2022 and 2031

Figure 91: Middle East & Africa Inductor Market, Incremental Opportunity, by Inductance, 2021‒2031

Figure 92: Middle East & Africa Inductor Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 93: Middle East & Africa Inductor Market Share Analysis, by Type, 2022 and 2031

Figure 94: Middle East & Africa Inductor Market, Incremental Opportunity, by Type, 2021‒2031

Figure 95: Middle East & Africa Inductor Market Projections by Core Type, Value (US$ Mn), 2017‒2031

Figure 96: Middle East & Africa Inductor Market Share Analysis, by Core Type, 2022 and 2031

Figure 97: Middle East & Africa Inductor Market, Incremental Opportunity, by Core Type, 2021‒2031

Figure 98: Middle East & Africa Inductor Market Projections by Shield Type, Value (US$ Mn), 2017‒2031

Figure 99: Middle East & Africa Inductor Market Share Analysis, by Shield Type, 2022 and 2031

Figure 100: Middle East & Africa Inductor Market, Incremental Opportunity, by Shield Type, 2021‒2031

Figure 101: Middle East & Africa Inductor Market Projections by Mounting, Value (US$ Mn), 2017‒2031

Figure 102: Middle East & Africa Inductor Market Share Analysis, by Mounting, 2022 and 2031

Figure 103: Middle East & Africa Inductor Market, Incremental Opportunity, by Mounting, 2021‒2031

Figure 104: Middle East & Africa Inductor Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 105: Middle East & Africa Inductor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 106: Middle East & Africa Inductor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 107: Middle East & Africa Inductor Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 108: Middle East & Africa Inductor Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 109: Middle East & Africa Inductor Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 110: South America Inductor Market Projections by Inductance, Value (US$ Mn), 2017‒2031

Figure 111: South America Inductor Market Share Analysis, by Inductance, 2022 and 2031

Figure 112: South America Inductor Market, Incremental Opportunity, by Inductance, 2021‒2031

Figure 113: South America Inductor Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 114: South America Inductor Market Share Analysis, by Type, 2022 and 2031

Figure 115: South America Inductor Market, Incremental Opportunity, by Type, 2021‒2031

Figure 116: South America Inductor Market Projections by Core Type, Value (US$ Mn), 2017‒2031

Figure 117: South America Inductor Market Share Analysis, by Core Type, 2022 and 2031

Figure 118: South America Inductor Market, Incremental Opportunity, by Core Type, 2021‒2031

Figure 119: South America Inductor Market Projections by Shield Type, Value (US$ Mn), 2017‒2031

Figure 120: South America Inductor Market Share Analysis, by Shield Type, 2022 and 2031

Figure 121: South America Inductor Market, Incremental Opportunity, by Shield Type, 2021‒2031

Figure 122: South America Inductor Market Projections by Mounting, Value (US$ Mn), 2017‒2031

Figure 123: South America Inductor Market Share Analysis, by Mounting, 2022 and 2031

Figure 124: South America Inductor Market, Incremental Opportunity, by Mounting, 2021‒2031

Figure 125: South America Inductor Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 126: South America Inductor Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 127: South America Inductor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 128: South America Inductor Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 129: South America Inductor Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 130: South America Inductor Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 131: Company Share Analysis (2021)