When it comes to the printing sector, innovations and advancements have come at a modest pace over the past few decades. However, the tectonic shift from traditional printing including screen printing and offset printing toward digital printing was one of the most astounding changes within the sector, which in turn, transformed the graphical art space. The advent of digital printing technology paved the way for niche printing segments due to which, self-adhesive vinyl films came under the spotlight. The digital printing sector is experiencing a considerable amount of growth worldwide and with it, the demand for self-adhesive vinyl films is also moving in the upward trajectory.

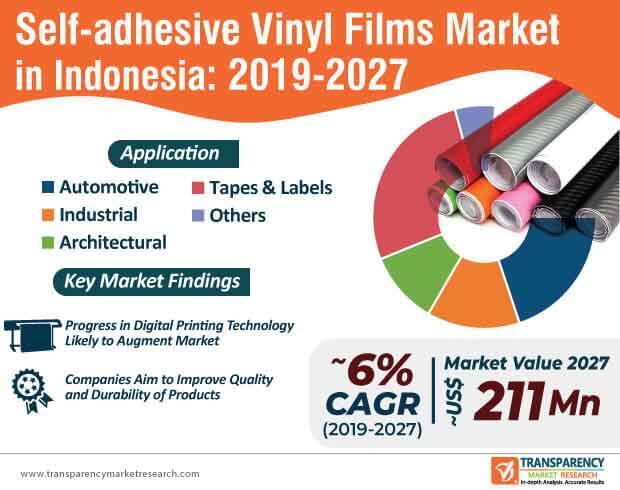

Self-adhesive vinyl films have emerged as one of the most cost-effective advertising tools in recent times. Self-adhesive vinyl films are increasingly being used for short-term promotional campaigns, window decoration, vehicle advertising, graphics & signage, glass stickers, and point of sales advertising, among others. The uptake of customized self-adhesive vinyl films is expected to augment the self-adhesive vinyl films market in Indonesia during the forecast period. Companies in the current self-adhesive vinyl films market in Indonesia landscape are likely to focus on improving the quality of their products and work on their pricing strategies to gain an edge over their competitors. With more number of companies in the self-adhesive vinyl films market in Indonesia inclining toward expanding their product portfolio and innovations, the market is expected to reach ~US$ 211 Mn by the end of 2027.

The advertising industry has evolved at a rapid pace during the past decade. The slow and gradual transformation of the advertising sector offered companies tremendous scope to create captivating outdoor and indoor marketing campaigns. Due to the fast-paced urbanization of cities across the world particularly in the Asia Pacific region, infrastructure development projects have gained considerable momentum. The rise in the number of shopping malls and other commercial spaces has compelled manufacturers operating in the self-adhesive vinyl films market in Indonesia to improve the flexibility of their printed materials that adapt to various architectural elements.

Over the past decade, the car wrapping technique has emerged as one of the most effective techniques to conceal scratches– a trend that has triggered the customization wave in vehicles worldwide. In addition, the growth of the digital printing sector has augmented the demand for self-adhesive vinyl films and also opened up the possibilities for limitless innovations in the graphic space. Significant developments in the sign making tools over the past few years have had a direct impact on the demand for self-adhesive vinyl films in recent times– a trend that will continue over the entirety of the forecast period. Within the Indonesia self-adhesive vinyl films market, applications in the automotive sector and development of tapes & labels will remain higher than other applications such as industrial, architectural, etc.

While applications of self-adhesive vinyl films continue to expand at a steady pace, companies involved in the self-adhesive vinyl films market in Indonesia are inclined toward developing eco-friendly self-adhesive vinyl films.

The self-adhesive vinyl films market in Indonesia is largely dominated by tier 1 and tier 3 companies that account for ~ 70-80 percent of the total market share. While product pricing and improving the quality of their products continues to remain some of the key areas of focus for most market players, on the flipside, several companies are increasingly inclining toward expanding their product portfolio and launching new products to strengthen their foothold in the current market landscape.

The soaring demand for outdoor and indoor signage presents abundant opportunities for market players involved in the current market for self-adhesive vinyl films in Indonesia. Innovations and the launch of new products are expected to gain momentum periodically during the forecast period. Recently, in May 2019, HP expanded its product portfolio by launching the HP Adhesive Vinyl for print and cut applications. Companies are expected to improve the durability of their products and launch self-adhesive vinyl films that are easy to install.

Analysts’ Viewpoint

The self-adhesive vinyl films market in Indonesia is expected to grow at a healthy CAGR of ~6%, in terms of value, during the forecast period. The market growth can be attributed to a host of factors, including growing popularity of digital printing, automotive warping, and innovations in advertisement strategies. Companies involved in the current self-adhesive vinyl films market in Indonesia should focus on improving the quality of their products and expanding their product portfolio. With indoor and outdoor digital signage set to gain worldwide popularity, companies should tap into opportunities within the industrial sector.

Self-adhesive Vinyl Films Market in Indonesia: Key Drivers and Restraints

Self-adhesive Vinyl Films Market in Indonesia: Key Type Segments

Self-adhesive Vinyl Films Market in Indonesia: Key Application Segments

Self-adhesive Vinyl Films Market in Indonesia: Competition Landscape

Indonesia Self-adhesive Vinyl Films Market is expected to reach US$ 211 Mn By 2027

Indonesia Self-adhesive Vinyl Films Market is estimated to rise at a CAGR of 6% during forecast period

Increasing demand for self-adhesive vinyl films for use in tapes and labels is anticipated to drive the Self-adhesive Vinyl Films Market in Indonesia during the forecast period

Major players operating in the self-adhesive vinyl films market in Indonesia are LINTEC Corporation, 3M, Avery Dennison Corporation, ORAFOL Europe GmbH, PT Multiyasa Swadaya, Signapex Technology Co., Ltd., Guangdong New Vision Film Co. Ltd., Shenzhen Sealtape Security Technik Co., Ltd.

Automotive, Industrial, Architectural, Tapes & Labels, Protective Overlaminates, Reflectives, Luggage Tags, and Stickers are the application segments in the Indonesia Self-adhesive Vinyl Films Market

1. Executive Summary

1.1. Indonesia Self-adhesive Vinyl Films Market Snapshot

1.2. Key Market Trends

1.3. Current Market & Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Definitions

2.3. Market Indicators

2.4. Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Market Outlook

2.7. Porter’s Five Forces Analysis

2.8. Value Chain Analysis

2.8.1. List of Potential Customers

2.8.2. List of Manufacturers of Tapes and Labels

2.8.3. List of Digital Printer Manufacturers

3. Indonesia Self-adhesive Vinyl Films Market: Production Output Analysis

4. Indonesia Self-adhesive Vinyl Films Market: Price Trend Analysis, 2018–2027

4.1. By Type

4.2. By Application

5. Indonesia Self-adhesive Vinyl Films Market Analysis and Forecast, by Type

5.1. Key Findings, by Type

5.2. Indonesia Self-adhesive Vinyl Films Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Type, 2018–2027

5.2.1. Printable

5.2.2. Non-printable

5.3. Indonesia Self-adhesive Vinyl Films Market Attractiveness Analysis, by Type

6. Indonesia Self-adhesive Vinyl Films Market Analysis and Forecast, by Application

6.1. Key Findings, by Application

6.2. Indonesia Self-adhesive Vinyl Films Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.2.1. Automotive

6.2.1.1. Vehicle Wrap

6.2.1.2. Paint Protection

6.2.1.3. Automotive Decals

6.2.2. Industrial

6.2.2.1. Signage

6.2.2.2. Appliance Wrapping

6.2.3. Architectural

6.2.3.1. Window Films

6.2.3.2. Flooring

6.2.3.3. Wall Coverings

6.2.3.4. Furniture

6.2.4. Tapes & Labels

6.2.5. Others

6.3. Indonesia Self-adhesive Vinyl Films Market Attractiveness Analysis, by Application

7. Competition Landscape

7.1. Indonesia Self-adhesive Vinyl Films Market Share Analysis, by Company, 2018

7.2. Competition Matrix, by Key Players

7.3. Indonesia Self-adhesive Vinyl Films Market Footprint Analysis, by Application

7.4. Company Profiles

7.4.1. LINTEC Corporation

7.4.1.1. Company Description

7.4.1.2. Business Overview

7.4.1.3. Financial Overview

7.4.1.4. Strategic Overview

7.4.2. 3M

7.4.2.1. Company Description

7.4.2.2. Business Overview

7.4.2.3. Financial Overview

7.4.2.4. Strategic Overview

7.4.3. Avery Dennison Corporation

7.4.3.1. Company Description

7.4.3.2. Business Overview

7.4.3.3. Financial Overview

7.4.3.4. Strategic Overview

7.4.4. ORAFOL Europe GmbH

7.4.4.1. Company Description

7.4.4.2. Business Overview

7.4.5. Guangdong New Vision Film Co. Ltd.

7.4.5.1. Company Description

7.4.5.2. Business Overview

7.4.6. PT Multiyasa Swadaya

7.4.6.1. Company Description

7.4.6.2. Business Overview

7.4.7. Signapex Technology Co., Ltd.

7.4.7.1. Company Description

7.4.7.2. Business Overview

7.4.8. Yiwu Rjsign New Material Co. Ltd.

7.4.8.1. Company Description

7.4.8.2. Business Overview

7.4.9. Shenzhen Sealtape Security Technik Co., Ltd.

7.4.9.1. Company Description

7.4.9.2. Business Overview

7.4.10. Shanghai Crossrain Craft Gift Co. Ltd.

7.4.10.1. Company Description

7.4.10.2. Business Overview

7.4.11. Guangzhou Idealmax Decoration Material Co. Ltd.

7.4.11.1. Company Description

7.4.11.2. Business Overview

8. Key Primary Insights

List of Tables

Table 01: Indonesia Self-adhesive Vinyl Films Market Volume (Million Square Meters) Forecast, by Type, 2018–2027

Table 02: Indonesia Self-adhesive Vinyl Films Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 03: Indonesia Self-adhesive Vinyl Films Market Volume (Million Square Meters) Forecast, by Application, 2018–2027

Table 04: Indonesia Self-adhesive Vinyl Films Market Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 01: Indonesia Self-adhesive Vinyl Films Market Volume (Million Square Meters) and Value (US$ Mn), 2018–2027

Figure 02: Indonesia Self-adhesive Vinyl Films Market, Absolute $ Opportunity (US$ Mn), 2018–2027

Figure 03: Production Output, 2018

Figure 04: Indonesia Tapes & Labels Industry Value (US$ Mn) and Volume (Million Square Meters) Analysis, 2018–2027

Figure 05: Indonesia Vinyl Films Industry Value (US$ Mn) and Volume (Million Square Meters) Analysis, 2018–2027

Figure 06: Indonesia Self-adhesive Vinyl Films Market Volume Share Analysis, by Type

Figure 07: Indonesia Self-adhesive Vinyl Films Market Attractiveness Analysis, by Type

Figure 08: Indonesia Self-adhesive Vinyl Films Market Volume Share Analysis, by Application

Figure 09: Indonesia Self-adhesive Vinyl Films Market Attractiveness Analysis, by Application

Figure 10: Indonesia Self-adhesive Vinyl Films Market Share Analysis, by Company, 2018