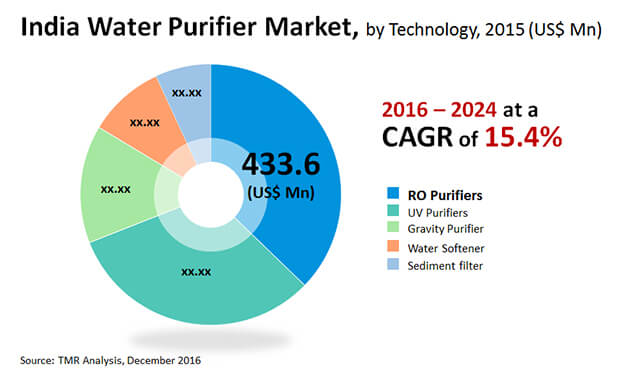

The growing awareness about the water-borne diseases has augmented the demand for water purifiers across India. The uptake of water purifying technology is also expected to increase as growing number of consumers are expected to realize the benefits of consuming cleaner water. Owing to these reasons, the India water purifier market is expected to reach a valuation of US$4.1 bn by the end of 2024 as against US$1.1 bn in 2015. During the forecast years of 2016 and 2024, the overall market is expected to register a CAGR of 15.4%.

India water purifier market is being fuelled by increasing awareness about the benefits of pure water, rampant urbanization, booming industrialization, and government initiatives through various policies and campaign about advantages of consuming clean water. Despite the strong market drivers, the challenge of educating the masses about the efficiency of these purifying technologies across rural India is expected to restrain the market. A huge chunk of the population still relies on boiling water to ensure purification. However, the rising adoption of water purifier in urban areas of India is anticipated to open up lucrative opportunities in the market.

The various technologies available in the India water purifier market are gravity purifier, RO purifier, UV purifier, sediment purifier and water softener. The RO technology held a lion’s share of about 37% of the total market in terms of revenue, in 2015. Analysts anticipate that the gravity purifier is expected to exhibit a steady growth rate during the forecast period as the rural areas of India will incline towards using this technology. On the other hand, the water softener technology will register continuous growth as growing number of consumers are investing in RO and UV technology.

The various accessories sold in the market are faucet mount, water dispenser, under sink filter, pitcher filter, and shower filter. In 2015, water dispenser held a leading share in the overall market, accounting for nearly 30% of it. In the coming few years, the pitcher filter and under sink filter are also projected to show a noticeable growth rate.

The three end users of water purifier technologies are the household, industrial, and commercial sector. In 2015, the household segment accounted for a share of 55% of the overall end-user segment. This segment is expected to retain its dominance in the coming years as the demand for affordable and clean water in India household continues to be on the rise. Additionally, the demand for commercial water purifier technologies and solutions will also gain momentum as several small shops, cafés, and public places in India are complying to government initiatives of creating an availability of purified water across the country.

The key players operating in the India water purifier market are Whirlpool India Ltd. Hi-Tech RO Systems, Essel Nasaka, Eureka Forbes, Kent Ro system Ltd., Godrej Industries Ltd., Panasonic India Pvt. Ltd., Brita GmbH and Kaz USA, Inc. The market is quite consolidated due to the presence few leading players. However, in the coming years, the competition is expected to get stiffer due to the introduction of several small and local players.

The outbreak of the COVID-19 pandemic has had a profound effect on the overall growth of the India water purifier market. Initially, the market was hit by the nationwide curfew and strict lockdowns. With restriction on movement and other activities, the demand for the product went down considerably. However, with new information coming out from the regulatory authorities and sudden spike in demand for improved hygiene across the nation has helped the development of water purifier market in India.

With the growing number of cases, detection and treatment of the COVID-19 virus took a greater precedence over other diseases. Regulatory and healthcare authorities advised and urged the nation to stay indoors and maintain high levels of hygiene. This prompted the end users to install new water purifiers or upgrade the new ones. Naturally, the growing demand helped drive the market development in the peak months of the COVID-19. The situation is about to resume back to the normal as there are hopes of vaccine. Gradual opening up of the economy in India is projected help the current growth of the India water purifier market. The companies in the India water purifier market are projected to benefit from the gradual economic recovery and the end user industry demand. Moreover, with gradual ramping up of production, the growth of the market in the coming months is expected to be on the positive side.

India water purifier market is being fuelled by increasing awareness about the benefits of pure water, rampant urbanization, booming industrialization, and government initiatives through various policies and campaign about advantages of consuming clean water. Despite the strong market drivers, the challenge of educating the masses about the efficiency of these purifying technologies across rural India is expected to restrain the market. A huge chunk of the population still relies on boiling water to ensure purification. However, the rising adoption of water purifier in urban areas of India is anticipated to open up lucrative opportunities in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Key Market Indicators

4.2.1. Water-borne Disease

4.2.2. Water and Sanitation Infrastructure

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. G India Water Purifier Market Analysis and Forecasts, 2014 – 2024

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Water Purifier Market – India Supply Demand Scenario

4.6. Porter’s Five Force Analysis

4.6.1. Value Chain Analysis : List of Manufacturers, Distributor, Service Provider

4.6.2. List of Active Market Participants (suppliers/distributors/manufacturers/vendors)

4.7. Market Outlook

5. India Water Purifier Market Analysis and Forecasts, By Technology

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Size (US$ Mn) forecast By Technology, 2014 – 2024

5.4.1. Gravity Purifier

5.4.2. RO Purifier

5.4.3. UV Purifier

5.4.4. Sediment Purifier

5.4.5. Water Softener

5.5. Market Attractiveness By Technology

6. India Water Purifier Market Analysis and Forecasts, By Accessories

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Size (US$ Mn) Forecast By Accessories, 2014 – 2024

6.4.1. Pitcher Filter

6.4.2. Under Sink Filter

6.4.3. Shower Filter

6.4.4. Faucet Mount

6.4.5. Water Dispenser

6.5. Market Attractiveness By Machine Size

7. India Water Purifier Market Analysis and Forecasts, By End-User

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.3.1. India Water Purifier Market Analysis and Forecasts, By End-User

7.3.1.1. Industrial

7.3.1.2. Commercial

7.3.1.3. Household

7.3.2. Exotic Metal and Non-traditional Material Cutting, 2014 – 2024 (US$ Mn & Million Units)

7.4. Market Attractiveness By Application

8. Competition Landscape

8.1. Market Player – Competition Matrix (By Tier and Size of companies)

8.2. Market Share Analysis By Company (2015)

8.3. Company Profiles

8.3.1. Hindustan Unilever Ltd.

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.2. Kent RO System Ltd.

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.3. Ion Exchange

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.4. Tata Chemicals Ltd.

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.5. Whirlpool India Ltd.

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.6. Hi-Tech RO Systems

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.7. Essel Nasaka

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.8. Godrej Industries Ltd.

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.9. Panasonic Corporation

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.10. Livpure Private Ltd.

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.11. Brita GmBH

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

8.3.12. Kaz USA, Inc.

Overview

Financials

Recent Developments

Strategy

SWOT Analysis

9. Key Takeaways

List of Tables

Table 1: India Water Purifier Market Forecast, By Technology 2014–2024 (US$ Mn)

Table 2: India Water Purifier Market Forecast, By Accessories, 2014–2024 (US$ Mn)

Table 3: India Water Purifier Market Forecast, By End-user, 2014–2024 (US$ Mn)

List of Figures

Figure 1: Market Revenue Projections, 2014 - 2024 (US$ Mn)

Figure 2: Market Value Share by Technology (2016)

Figure 3: Market Value Share by End User (2016)

Figure 4: Market Value Share by Accessories (2016)

Figure 5: India Water Purifier Market Value Share Analysis, By Technology, 2016 and 2024

Figure 6: India Water Purifier Market Revenue, Gravity Purifier

Figure 7: India Water Purifier Market Revenue, Ro Purifier

Figure 8: India Water Purifier Market Revenue, UV Purifier

Figure 9: India Water Purifier Market Revenue, Sediment Purifier

Figure 10: India Water Purifier Market Revenue, Water Softener

Figure 11: India Water Purifier Attractiveness Analysis, By Technology

Figure 12: India Water Purifier Market Value Share Analysis, By Accessories, 2016 and 2024

Figure 13: India Water Purifier Market Revenue, Pitcher Filter

Figure 14: India Water Purifier Market Revenue, Under Sink Filter

Figure 15: India Water Purifier Market Revenue, Shower Filter

Figure 16: India Water Purifier Market Revenue,, Faucet Mount

Figure 17: India Water Purifier Market Revenue, Water Dispenser

Figure 18: India Water Purifier Market Attractiveness Analysis, By Accessories

Figure 19: India Water Purifier Market Value Share Analysis, By End-User, 2016 and 2024

Figure 20: India Water Purifier Market Revenue, Industrial

Figure 21: India Water Purifier Market Revenue Commercial

Figure 22: India Water Purifier Market Revenue, Household

Figure 23: India Water Purifier Market Attractiveness Analysis, By End User