Analysts’ Viewpoint

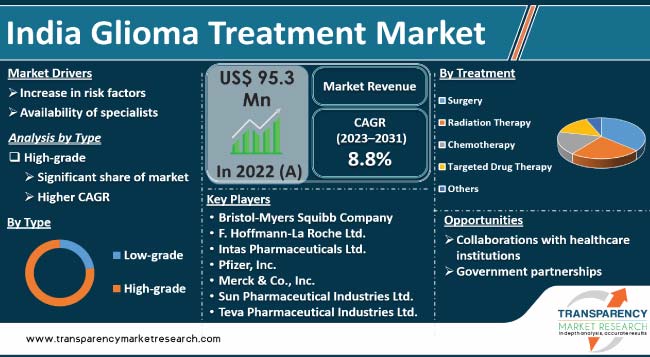

Rise in prevalence of brain tumors, including gliomas, is a major factor driving India glioma treatment market. Aging population, exposure to environmental toxins, and genetic predisposition are some of the factors contributing to increase in incidence of gliomas in India. Improvement in efficacy of glioma treatment due to advancements in technology and development of innovative treatments is likely to propel market expansion.

Availability of specialized medical professionals, including neurosurgeons, radiation oncologists, and medical oncologists, and establishment of specialized departments for the treatment of brain tumors in leading hospitals have made glioma treatment more accessible and effective in the country.

Surge in investment in research & development on new and innovative therapies for glioma treatment offers lucrative opportunities to market players. Biotechnology companies and research institutions are focusing on developing targeted therapies and immunotherapy drugs that can improve the survival rate of glioma patients.

Glioma treatment includes medications, devices, and therapies used to treat gliomas, a type of brain tumor. Gliomas are a serious health concern in India, with a high prevalence and mortality rate. The market includes a range of products and services, including glioma surgery, radiation therapy, glioma chemotherapy, and targeted therapy drugs.

Rise in prevalence of brain tumor, advancements in technology & treatments, growing availability of specialized medical professionals, and increase in investment in research & development are driving India glioma treatment market size.

Leading hospitals in India, such as the All India Institute of Medical Sciences (AIIMS), Tata Memorial Centre, and Apollo Hospitals, have specialized departments for the treatment of brain tumors, including gliomas.

Glioma, a type of brain tumor, can be caused by various factors. Genetic mutations resulting from conditions such as retinoblastoma, Li-Fraumeni syndrome, tuberous sclerosis, neurofibromatosis 1&2, and Turcot syndrome are known to cause low-grade gliomas, but only a small percentage of glioma patients have a known genetic condition.

Exposure of the central nervous system to radiation, particularly therapeutic or high-dose radiation, has also been linked to increased incidence of subsequent brain tumors, including glioma.

N-nitroso compounds found in some cured meats, cigarette smoke, cosmetics, and nitrites or nitrates in the body have been linked to increased risk of developing glioma. Additionally, exposure to hazardous chemicals such as solvents, pesticides, oil products, rubber, and vinyl chloride during work can increase the risk of developing a brain tumor.

Age and gender are also factors, with glioma being more common in older adults and males. Dysfunction in the immune system may also play a role in the development of glioma. While limited, some studies have suggested that lifestyle factors such as smoking and poor diet may increase the risk of developing glioma.

India has witnessed a steady increase in the availability of medical professionals who specialize in the treatment of glioma. According to the National Health Profile, the number of registered allopathic doctors in the country increased from 720,801 in 2015 to 785,386 in 2019. As of June 2022, the National Medical Commission reported that there are 1,308,009 allopathic doctors registered with State Medical Councils and the National Medical Commission, indicating a further increase in the availability of medical professionals in the country.

India has witnessed a rise in the number of highly skilled neurosurgeons, radiation oncologists, and medical oncologists who specialize in the treatment of glioma. Leading hospitals in the country, such as the All India Institute of Medical Sciences (AIIMS), Tata Memorial Centre, and Apollo Hospitals, have established specialized departments for the treatment of brain tumors, including glioma. These hospitals have cutting-edge facilities and experienced teams of specialists who provide comprehensive care to patients with glioma.

The country has witnessed increase in the number of medical colleges and institutions that offer specialized training in neurosurgery, radiation oncology, and medical oncology. This has resulted in a larger pool of highly qualified specialists who can provide specialized care for patients with glioma.

In terms of type, the high-grade segment accounted for the largest India glioma market share in 2022. This is ascribed to extensive treatment required for grade III and IV gliomas. A study published in the Indian Journal of Cancer revealed that grade III and grade IV gliomas make up the majority of all gliomas in India, with grade IV gliomas being the most prevalent. High-grade gliomas are aggressive and require immediate and comprehensive treatment, including surgery, radiation therapy, and chemotherapy.

The infiltrative and invasive nature of these tumors often makes complete surgical removal difficult. Hence, post-surgery radiation and chemotherapy are necessary to kill any remaining cancer cells and prevent the tumor from recurring. Advances in technology and development of targeted therapies have improved the efficacy of these treatments, leading to better outcomes for Indian patients with high-grade gliomas.

Based on treatment, the surgery segment dominated the glioma treatment market in India in 2022. Surgery is a key aspect of the treatment of gliomas in India. The number of glioma surgeries is expected to increase in the country in the next few years.

Major advancements have been made in surgical techniques for gliomas, including the use of minimally invasive procedures, laser therapy, and neuro-navigational systems.

Minimally invasive procedures involve smaller incisions, less tissue damage, and quicker recovery times, making them a more appealing option for patients. Laser therapy uses heat to kill cancer cells and can be used for removing tumors located in hard-to-reach areas. Neuro-navigational systems use imaging technology to create a real-time map of the brain, helping surgeons to precisely locate and remove tumors while minimizing the risk of damage to healthy brain tissue.

These advancements in surgical techniques have led to improved surgical outcomes, reduced recovery times, and lower risk of complications, making surgery an increasingly attractive option for patients seeking treatment for gliomas in India.

The glioma treatment market in India is fragmented, with the presence of large number of players. Leading companies in the country are focusing on investing in R&D on advanced treatments for glioma.

Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd., Intas Pharmaceuticals Ltd., Pfizer, Inc., Merck & Co., Inc., Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd. are the prominent players in the market.

Each of the prominent players has been profiled in India glioma treatment market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 95.3 Mn |

|

Forecast Value in 2031 |

More than US$ 207.0 Mn |

|

CAGR - 2022-2031 |

8.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Companies Profiled |

|

It was valued at US$ 95.3 Mn in 2022

It is projected to reach more than US$ 207.0 Mn by 2031

It is anticipated to expand at a CAGR of 8.8% from 2023 to 2031

Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd., Intas Pharmaceuticals Ltd., Pfizer, Inc., Merck & Co., Inc., Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: India Glioma Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. India Glioma Treatment Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events

5.2. Pipeline Analysis

5.3. Low-grade Glioma: Overview

5.4. Disease Prevalence & Incidence Rate

5.5. COVID-19 Pandemic Impact on the Glioma Treatment Market

6. India Glioma Treatment Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017-2031

6.3.1. Low-grade

6.3.1.1. Grade I

6.3.1.2. Grade II

6.3.2. High-grade

6.3.2.1. Grade III

6.3.2.2. Grade IV

6.4. Market Attractiveness Analysis, by Type

7. India Glioma Treatment Market Analysis and Forecast, by Treatment

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Treatment, 2017-2031

7.3.1. Surgery

7.3.2. Radiation Therapy

7.3.3. Chemotherapy

7.3.4. Targeted Drug Therapy

7.3.5. Others

7.4. Market Attractiveness Analysis, by Treatment

8. Competition Landscape

8.1. Market Player - Competition Matrix (by tier and size of companies)

8.2. Market Share Analysis, by Company, 2022

8.3. Company Profiles

8.3.1. Bristol-Myers Squibb Company

8.3.1.1. Company Overview

8.3.1.2. Financial Overview

8.3.1.3. Product Portfolio

8.3.1.4. Business Strategies

8.3.1.5. Recent Developments

8.3.2. F. Hoffmann-La Roche Ltd.

8.3.2.1. Company Overview

8.3.2.2. Financial Overview

8.3.2.3. Product Portfolio

8.3.2.4. Business Strategies

8.3.2.5. Recent Developments

8.3.3. Intas Pharmaceuticals Ltd.

8.3.3.1. Company Overview

8.3.3.2. Financial Overview

8.3.3.3. Product Portfolio

8.3.3.4. Business Strategies

8.3.3.5. Recent Developments

8.3.4. Pfizer, Inc.

8.3.4.1. Company Overview

8.3.4.2. Financial Overview

8.3.4.3. Product Portfolio

8.3.4.4. Business Strategies

8.3.4.5. Recent Developments

8.3.5. Merck & Co., Inc.

8.3.5.1. Company Overview

8.3.5.2. Financial Overview

8.3.5.3. Product Portfolio

8.3.5.4. Business Strategies

8.3.5.5. Recent Developments

8.3.6. Sun Pharmaceutical Industries Ltd.

8.3.6.1. Company Overview

8.3.6.2. Financial Overview

8.3.6.3. Product Portfolio

8.3.6.4. Business Strategies

8.3.6.5. Recent Developments

8.3.7. Teva Pharmaceutical Industries Ltd.

8.3.7.1. Company Overview

8.3.7.2. Financial Overview

8.3.7.3. Product Portfolio

8.3.7.4. Business Strategies

8.3.7.5. Recent Developments

List of Tables

Table 01: India Glioma Treatment Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 02: India Glioma Treatment Market Value (US$ Mn) Forecast, by Low-grade, 2017-2031

Table 03: India Glioma Treatment Market Value (US$ Mn) Forecast, by High-grade, 2017-2031

Table 04: India Glioma Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017-2031

List of Figures

Figure 01: India Glioma Treatment Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: India Glioma Treatment Market Value Share, by Type, 2022

Figure 03: India Glioma Treatment Market Value Share, by Treatment, 2022

Figure 04: India Glioma Treatment Market, by Type, 2022 and 2031

Figure 05: India Glioma Treatment Market Attractiveness Analysis, by Type, 2023-2031

Figure 06: India Glioma Treatment Market (US$ Mn), by Low-grade, 2017-2031

Figure 07: India Glioma Treatment Market (US$ Mn), by High-grade, 2017-2031

Figure 08: India Glioma Treatment Market, by Treatment, 2022 and 2031

Figure 09: India Glioma Treatment Market Attractiveness Analysis, by Treatment, 2023-2031

Figure 10: India Glioma Treatment Market (US$ Mn), by Surgery, 2017-2031

Figure 11: India Glioma Treatment Market (US$ Mn), by Radiation Therapy, 2017-2031

Figure 12: India Glioma Treatment Market (US$ Mn), by Chemotherapy, 2017-2031

Figure 13: India Glioma Treatment Market (US$ Mn), by Targeted Drug Therapy, 2017-2031

Figure 14: India Glioma Treatment Market (US$ Mn), by Others, 2017-2031