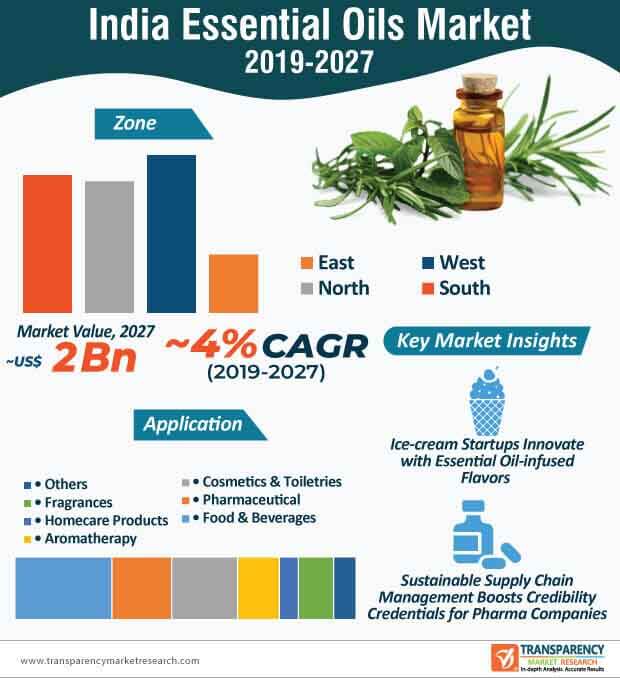

Innovations in essential oil-infused ice cream flavors are grabbing the attention of consumers. For instance, Minnesota-based ice cream startup, Moody’s Ice Cream, revealed that the startup is crafting essential oil-infused ice cream flavors with specific sensory benefits. Mood-boosting properties of essential oil ingredients are replacing the sugar in ice creams, which are otherwise responsible for spiking blood sugar levels and fatigue. Hence, companies in the India essential oils market should innovate in special ingredients, since the revenue of F&B application is estimated for aggressive growth during the forecast period.

The India essential oils market is expected to reach an output of ~50,400 tons by the end of 2030. Startups are experimenting with coconut milk-based vegan flavors such as Mexican chocolate with cinnamon essential oils. Thus, the growing demand for natural and organic products is catalyzing innovations in food items. In order to meet these demands, startups are tying up with local co-ops to expand their distribution chains and grow on a national level.

Essential oils hold promising potential as drug candidates in the India essential oils market. A research team at the VIB-KU Leuven Center for Microbiology and the KU Leuven Department of Biology, Belgium, revealed that essential oil components can be obtained by dry or steam distillation processes. However, essential oil components are complex mixtures of plant metabolites, which are relatively hydrophobic and volatile in nature, thus causing interference during high throughput screening and created challenges for researchers. Hence, researchers are increasing their efficacy in technical developments coupled with restrictions on the use of chemicals for drug discovery.

Companies in the India essential oils market should collaborate with researchers for innovating in drug discovery to produce natural products. They are boosting production capacities to develop dietary supplements. This is evident since pharmaceutical applications are estimated to dictate the second-highest revenue in the market, where the market is expected to reach a value of US$ 1.5 Bn by the end of 2030.

Cosmetics and toiletries companies are turning toward packaging companies to accelerate their filler speed and improve yield. For instance, Young Living— a Utah-based specialist in therapeutic-grade oils, revealed that the company is setting its collaboration wheels in motion with Syntegon, a specialist in processing and packaging, to achieve pharma-grade filling of essential oils with increased speed and reliability. Thus, companies in the India essential oils market should adopt such collaborative strategies to triple their filler speed.

Companies in the India essential oils market should explore opportunities with stainless steel filling machines that are easy to clean and do not corrode after contact with cleaning agents or even essential oils. Since the India essential oils market is largely fragmented in nature with tier 3 emerging players accounting to ~45%-50% of the market stake, manufacturers can gain a competitive edge by investing in the novel stainless steel machinery that improves yield. The market is rapidly growing in domains of aromatherapy pick-me-ups and relaxation, thus creating value-grab opportunities.

The novel coronavirus (COVID-19) is causing distress among individuals worldwide. Hence, pharma and healthcare companies are increasing their R&D activities to develop vaccines and drugs that minimize the severity of the virus. As suggested by the FDA on March 6, 2020, essential oils hold promising potential to combat Coronavirus. Such revelations are creating incremental opportunities for companies in the India essential oils market. The U.S. being severely hit by to the COVID-19 crisis is using essential oils, owing to their proven antiviral properties.

Due to a surge in the number of COVID-19 patients in India, companies in the India essential oils market are increasing their production capabilities to manufacture essential oils made from basil, clove, and eucalyptus globulus, amongst others. They are raising awareness about effective anti-virus synergies that deliver protection against coronavirus. On the other hand, eucalyptus radiata is being highly publicized for powerful antibacterial and anti-infection properties.

Analysts’ Viewpoint

Increased awareness about essential oil blends has become one of the key focus points for companies in the India essential oils market, to offer protection against coronavirus. Striking the right balance between health and indulgence is helping F&B startups to meet niche requirements of consumers. Startups should tap opportunities in online sales and rotating pop-up events, as consumers in India are gradually opening up to experimentation with F&B items.

Moreover, value-grab opportunities in nutritional and dietary supplements are benefitting companies in the market landscape. However, new drug discovery associated with essential oil components is a time consuming and expensive process. Hence, companies should focus on in silico drug discovery filters capable of predicting drug disposition based on specific calculated parameters.

Essential Oils Market: Overview

Citrus Oil to Witness Rise in Demand

West Zone to Dominate India Essential Oils Market

India Essential Oils Market: Competition Landscape

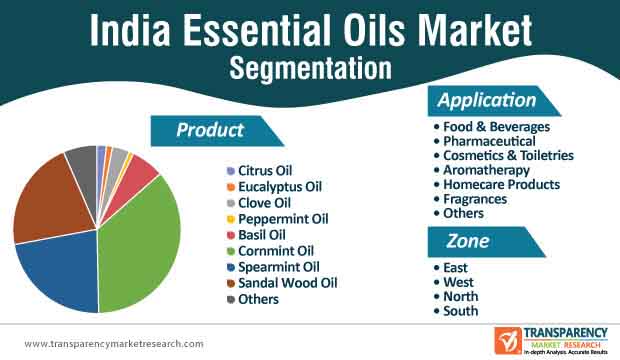

India Essential Oils Market – Segmentation

This report on the India essential oils market segments the market based on product, application, and zone.

|

Product |

|

|

Application |

|

|

Zone |

|

1. Executive Summary: India Essential Oils Market

1.1. India Essential Oils Market Volume (Tons) Forecast, 2019–2030

1.2. Market Outlook

1.3. India Essential Oils Market Value (US$ Mn) Forecast, by Zone, 2019–2030

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

3. India Essential Oils Production Output, 2019

4. India Essential Oils Market Pricing Analysis (US$/Ton), by Zone, 2019–2030

5. India Essential Oils Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2019–2030

5.1. Key Findings

5.2. India Essential Oils Market Volume (Tons) Forecast, by Product, 2019–2030

5.2.1. Citrus Oil

5.2.2. Eucalyptus Oil

5.2.3. Clove Oil

5.2.4. Peppermint Oil

5.2.5. Basil Oil

5.2.6. Cornmint Oil

5.2.7. Spearmint Oil

5.2.8. Sandal Wood Oil

5.2.9. Others

5.3. India Essential Oils Market Value (US$ Mn) Forecast, by Product, 2019–2030

5.3.1. Citrus Oil

5.3.2. Eucalyptus Oil

5.3.3. Clove Oil

5.3.4. Peppermint Oil

5.3.5. Basil Oil

5.3.6. Cornmint Oil

5.3.7. Spearmint Oil

5.3.8. Sandal Wood Oil

5.3.9. Others

5.4. India Essential Oils Market Volume Share Analysis, by Product

5.5. India Essential Oils Market Attractiveness Analysis, by Product

6. India Essential Oils Market Analysis, by Application, 2019–2030

6.1. Key Findings

6.2. India Essential Oils Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

6.2.1. Food & Beverages

6.2.2. Pharmaceutical

6.2.3. Cosmetics & Toiletries

6.2.4. Aromatherapy

6.2.5. Homecare Products

6.2.6. Fragrances

6.2.7. Others

6.3. India Essential Oils Market Volume Share Analysis, by Application

6.4. India Essential Oils Market Attractiveness Analysis, by Application

7. India Essential Oils Market Analysis, by Zone, 2019–2030

7.1. Key Findings

7.2. India Essential Oils Market Volume (Tons) Forecast, by Zone, 2019–2030

7.2.1. East

7.2.2. West

7.2.3. North

7.2.4. East

7.3. India Essential Oils Market Value (US$ Mn) Forecast, by Zone, 2019–2030

7.3.1. East

7.3.2. West

7.3.3. North

7.3.4. East

7.4. India Essential Oils Market Volume Share Analysis, by Zone

7.5. India Essential Oils Market Attractiveness Analysis, by Zone

7.6. India Essential Oils Market Value (US$ Mn) and Volume (Tons), by East Zone, 2020–2030

7.7. India Essential Oils Market Value (US$ Mn) and Volume (Tons), by West Zone, 2020–2030

7.8. India Essential Oils Market Value (US$ Mn) and Volume (Tons), by North Zone, 2020–2030

7.9. India Essential Oils Market Value (US$ Mn) and Volume (Tons), by South Zone, 2020–2030

8. Competition Landscape

8.1. India Essential Oils Market Share Analysis, by Company, 2018

8.2. Competition Matrix

8.2.1. Product Mapping

8.3. Company Profiles

8.3.1. Bo International

8.3.1.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

8.3.1.2. Business Overview

8.3.1.3. Product Segments/Products

8.3.2. Kanta Enterprises Private Limited

8.3.2.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

8.3.2.2. Business Overview

8.3.2.3. Product Segments/Products

8.3.3. Falcon Essential Oils

8.3.3.1. Company Details (HQ, Year of Establishment, Revenue, Employee Strength)

8.3.3.2. Business Overview

8.3.3.3. Product Segments/Products

8.3.4. Indian Aroma Exports

8.3.4.1. Company Details (HQ, Year of Establishment)

8.3.4.2. Business Overview

8.3.4.3. Product Segments/Products

8.3.5. India Essential Oils

8.3.5.1. Company Details (HQ, Year of Establishment, Employee Strength)

8.3.5.2. Business Overview

8.3.5.3. Product Segments/Products

8.3.6. Shiv Sales Corporation

8.3.6.1. Company Details (HQ, Year of Establishment, Employee Strength)

8.3.6.2. Business Overview

8.3.6.3. Product Segments/Products

8.3.7. AG Industries

8.3.7.1. Company Details (HQ, Year of Establishment, Employees Strength)

8.3.7.2. Business Overview

8.3.7.3. Product Segments/Products

8.3.8. BMV Fragrances Pvt. Ltd.

8.3.8.1. Company Details (HQ, Year of Establishment)

8.3.8.2. Business Overview

8.3.8.3. Product Segments/Products

8.3.9. Moksha Lifestyle Products

8.3.9.1. Company Details (HQ, Year of Establishment, Employees Strength)

8.3.9.2. Business Overview

8.3.9.3. Product Segments/Products

8.3.10. Kush Aroma Exports

8.3.10.1. Company Details (HQ, Year of Establishment)

8.3.10.2. Business Overview

8.3.10.3. Product Segments/Products

8.3.11. Veda Oils

8.3.11.1. Company Details (HQ, Year of Establishment, Employee Strength)

8.3.11.2. Business Overview

8.3.11.3. Product Segments/Products

9. Primary Research - Key Insights

10. Appendix

10.1. Research Methodology and Assumptions

List of Tables

Table 01: India Essential Oils Market Volume (Tons), by Product, 2019–2030

Table 02: India Essential Oils Market Value (US$ Mn) Forecast, by Product, 2019–2030

Table 03: India Essential Oils Market Volume (Tons), by Application, 2019–2030

Table 04: India Essential Oils Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 05: India Essential Oils Market Volume (Tons), by Zone, 2019–2030

Table 06: India Essential Oils Market Value (US$ Mn) Forecast, by Zone, 2019–2030

List of Figures

Figure 01: India Essential Oils Market Volume Share Analysis, by Product

Figure 02: India Essential Oils Market Volume Share Analysis, by Application

Figure 03: India Essential Oils Market Attractiveness Analysis, by Application

Figure 04: India Essential Oils Market Value (US$ Mn) and Volume (Tons), by East Zone, 2020–2030

Figure 05: India Essential Oils Market Value (US$ Mn) and Volume (Tons), by West Zone, 2020–2030

Figure 06: India Essential Oils Market Value (US$ Mn) and Volume (Tons), by North Zone, 2020–2030

Figure 07: India Essential Oils Market Value (US$ Mn) and Volume (Tons), by South Zone, 2020–2030

Figure 08: India Essential Oils Market Volume Share Analysis, by Zone

Figure 09: India Essential Oils Market Attractiveness Analysis, by Zone

Figure 10: Company Market Share Analysis, 2019