The coronavirus pandemic has created an importance for healthy diet and lifestyle changes. Sales of energy drinks seem to have dipped due to the pandemic among the office-going crowd, as individuals working in offices are now working from home and skipping the usual habit of consuming an energy drink to keep themselves energized throughout the day. However, as more people are becoming health conscious, companies in the India energy supplements market are gauging future growth opportunities.

Brands in the India energy supplements market are bullish on online and digital marketing to boost product sales. eCommerce and social media are becoming the go-to destinations for digital advertising of energy drinks, gummies, and gels. These brands are offering discounts and customer loyalty programs to keep their revenue streams active.

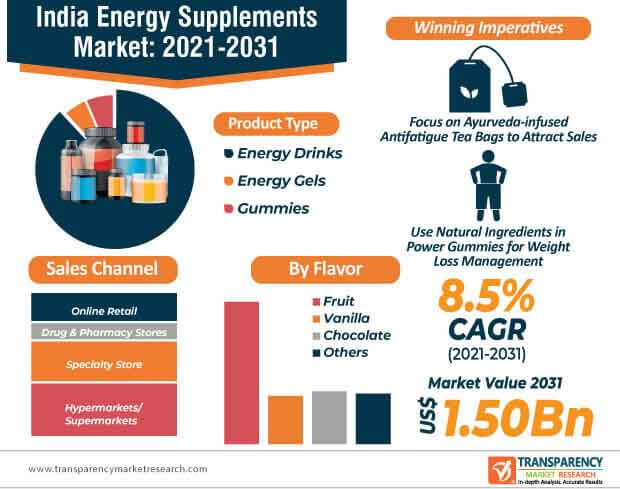

The India energy supplements market is expected to reach US$ 1.5 Bn by 2031. However, energy drinks are notorious for many side effects such as caffeine intoxication, risk of cardiovascular diseases, and issues including trouble in sleeping. Hence, brands are developing innovative product formulations using caffeine naturally occurring in tea to improvise in energy drinks. The V8 energy drinks are gaining popularity on Indian eCommerce platforms, owing to their natural ingredients such as caffeine naturally occurring in tea, along with carrot juice, apple juice, and hints of sweet peach & tropical mango.

The combination of fruits and vegetables from non-GMO (Genetically modified organisms) sweet potatoes, apples, and carrots is being preferred by consumers. Moreover, sugar-free energy drinks are in high demand.

Companies in the India energy supplements market are boosting their production capabilities in ready-to-consume instant energy gels. FastandUp is gaining recognition in India for its comprehensive product portfolio in intelligent nutrition and energy gels. Brands are taking advantage of the Make in India movement to increase the availability for energy gels that deliver an easily digestible and quick supply of carbohydrate for energy during exercise. These energy gels are proving ideal for cyclists, runners, and individuals involved in endurance activities.

Brands in the India energy supplements market are bolstering their output capacities in instant energy gels that are designed to be consumed without water, whilst minimizing the risk of bloating that can sometimes occur with over-drinking. There is a steady demand for energy gels that are light and have a drinkable consistency instead of being thick with a sticky texture.

Apart from the business expansion in eCommerce, companies in the India energy supplements market are focusing on new product development. India’s functional food brand Power Gummies is increasingly focusing on online expansion as well as new product development to reach the right target audiences, especially women aged between 20 and 45. It has been found that Indian brands are receiving funds from other international consumer brands to excel in new product development.

Companies in the India energy supplements market are prioritizing online expansion, as eCommerce has been growing rapidly in India. This explains why the market is predicted to advance at a robust CAGR of 8.5% during the forecast period. As compared to the brick-and-mortar retail, eCommerce is serving as a more viable tool in testing the market response.

Energy drink mixes are being highly publicized in the India energy supplements market. The Herbalife Afresh Energy Drink Mix is gaining popularity in India for improving an individual’s metabolism and rejuvenating the mind & body. Competitor brands are taking cues from such products and offering energy drink mixes that provide enhanced energy and mental alertness. They are developing improved product formulations that are rich in anti-oxidants and help in weight management.

Manufacturers in the India energy supplements market are developing energy drink mixes that help to relieve common health issues like headaches and back pain. The spike in metabolism due to lemon flavored energy drink mixes helps in instant energy boost because of which the body organs function at an optimal level.

Vegan endurance gels are grabbing the attention of consumers, athletes, and runners. The Unived’s vegan endurance gel for runners and athletes is water-based and prevents gastro-intestinal (GI) distress. Innovative flavors such as vanilla orange, dark chocolate mint, and salted caramel, among others, are helping brands to boost product uptake. Companies in the India energy supplements market are boosting their production capabilities in sports energy gels that are being preferred by the running & ultra-running community in India. Such trends are helping brands to gain worldwide recognition, which contributes to the expansion of their revenue streams.

Water-based, fresh, and easy to consume consistency are being preferred in sports energy gels. Manufacturers in the India energy supplements market are mainly focusing in the development of energy gels that can be conveniently carried, along in a hydration pack, waist pouch or short pockets.

Energy booster multivitamin gummies are growing popular among Indian women. Brands such as Hea MaxiMUM are taking advantage of this opportunity to increase the availability of multivitamin gummies suitable for multi-tasker mothers. Manufacturers in the India energy supplements market are developing gummies from premium quality ingredients to suit the energy needs of Indian mothers. Individually packed yummy gummies are being preferred, which are easy to carry and convenient to consume.

Vitamins B 12, A, D, C, E, folic acid, and natural flavors are being preferred in energy booster multivitamin gummies. Artificial colors, gluten, preservatives, GMO, and flavors are being avoided. Manufacturers are aiming for FSSAI approved, scientifically backed, and 100% vegetarian energy gummies.

Analysts’ Viewpoint

Since eCommerce is rapidly growing in India, the coronavirus pandemic has augmented this trend, which has caught the attention of stakeholders in the India energy supplements market. Though sales have fallen from office going-crowd due to work from home norms, the health consciousness wave is anticipated to revive product sales. However, issues such as bloating is being associated with overdrinking energy gels. Hence, companies should increase the availability of water-based energy gels that are easy to consume and prevent GI distress. Brands need to upgrade their marketing strategies that target the convenience and health needs of consumers, as the pandemic has drawn the trend of natural energy drinks that can be made at home.

India Energy Supplements Market: Overview

India Energy Supplement Market: Key Takeaways

India Energy Supplements Market: Major Trends

Due to the widespread promotion of energy gummies for weight loss, the market for energy supplements is expected to grow twofold. Green coffee beans, L-carnitine, and vitamin C are among the ingredients being tested by manufacturers to make antioxidant-rich gummies.

The COVID-19 has highlighted the link between a country's nutritional and economic health. This, in turn, is expected to lead to a greater emphasis on nutrition in public health policies and programs than ever before in order to avoid diseases and address enormous healthcare difficulties, offering the nutraceutical business a distinct advantage.

Energy Supplement Market: Key Players

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

5. India Energy Supplements Demand (in Value or Size in US$ Mn) Analysis 2016–2020and Forecast, 2021–2031

5.1. Historical Market Value (US$ Mn) Analysis, 2016–2020

5.2. Current and Future Market Value (US$ Mn) Projections, 2021–2031

5.2.1. Y-o-Y Growth Trend Analysis

5.2.2. Absolute $ Opportunity Analysis

6. Market Background

6.1. Macro-Economic Factors

6.1.1. GDP Growth Outlook

6.1.2. Urbanization Growth Outlook

6.2. Impact of COVID-19 on Energy Supplements Market

6.2.1. Manufacturer/Processors

6.2.2. Supply Chain and Logistics

6.2.3. Wholesalers/Traders

6.2.4. Retailers

6.3. Impact of COVID-19 on the Economy

6.4. Impact of COVID-19 on the Nutraceuticals Industry

6.5. COVID-19 Risk Assessment/Impact

6.6. Nutraceuticals Industry Outlook

6.7. Dietary Supplement Market Overview

6.8. Opportunities in Nutritional Supplements Industry

6.9. Opportunities for New Market Players in Asia-Pacific Dietary Supplement Market

6.10. Per Capita Expenditure on Health

6.11. Products offered by Key Players

6.12. Industry Value and Supply Chain Analysis

6.12.1. Profit Margin Analysis at each point of sales

6.12.1.1. Supplement Market Processors

6.12.1.2. Distributors/Suppliers/Wholesalers

6.12.1.3. Traders/Retailers

6.12.1.4. End-Users

6.13. Key Certifications/Claims

6.14. Market Dynamics

6.14.1. Drivers

6.14.2. Restraints

6.14.3. Opportunity Analysis

6.15. Forecast Factors - Relevance & Impact

7. India Energy Supplements Analysis 2016–2020and Forecast 2021–2031

7.1. Introduction

7.2. Historical Market Size (US$ Mn) Trend Analysis By Market Taxonomy, 2016–2020

7.3. Market Size (US$ Mn) Forecast By Market Taxonomy, 2021–2031

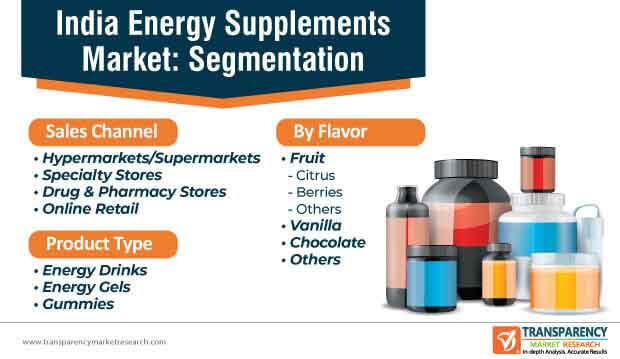

7.3.1. By Product Type

7.3.2. By Flavor

7.3.3. By Sales Channel

7.4. Market Attractiveness Analysis

7.4.1. By Product Type

7.4.2. By Flavor

7.4.3. By Sales Channel

7.5. Drivers and Restraints - Impact Analysis

8. Market Structure Analysis

8.1. Market Analysis by Tier of Companies

8.2. Market Concentration

8.3. Market Presence Analysis

9. Competition Analysis

9.1. Competition Dashboard

9.2. Competition Deep Dive

9.2.1. PepsiCo, Inc.

9.2.1.1. Overview

9.2.1.2. Product Portfolio

9.2.1.3. Sales Footprint

9.2.1.4. Key Developments/ Takeaways

9.2.1.5. Strategy Overview

9.2.2. Monster Beverage Corp.

9.2.2.1. Overview

9.2.2.2. Product Portfolio

9.2.2.3. Sales Footprint

9.2.2.4. Key Developments/ Takeaways

9.2.2.5. Strategy Overview

9.2.3. Boom Nutrition Inc.

9.2.3.1. Overview

9.2.3.2. Product Portfolio

9.2.3.3. Sales Footprint

9.2.3.4. Key Developments/ Takeaways

9.2.3.5. Strategy Overview

9.2.4. Advanced Foods Concepts

9.2.4.1. Overview

9.2.4.2. Product Portfolio

9.2.4.3. Sales Footprint

9.2.4.4. Key Developments/ Takeaways

9.2.4.5. Strategy Overview

9.2.5. Red Bull GmbH

9.2.5.1. Overview

9.2.5.2. Product Portfolio

9.2.5.3. Sales Footprint

9.2.5.4. Key Developments/ Takeaways

9.2.5.5. Strategy Overview

9.2.6. Living Essentials Marketing, LLC

9.2.6.1. Overview

9.2.6.2. Product Portfolio

9.2.6.3. Sales Footprint

9.2.6.4. Key Developments/ Takeaways

9.2.6.5. Strategy Overview

9.2.7. Nestlé S.A

9.2.7.1. Overview

9.2.7.2. Product Portfolio

9.2.7.3. Sales Footprint

9.2.7.4. Key Developments/ Takeaways

9.2.7.5. Strategy Overview

9.2.8. Hype Energy USA

9.2.8.1. Overview

9.2.8.2. Product Portfolio

9.2.8.3. Sales Footprint

9.2.8.4. Key Developments/ Takeaways

9.2.8.5. Strategy Overview

9.2.9. Calleva Limited

9.2.9.1. Overview

9.2.9.2. Product Portfolio

9.2.9.3. Sales Footprint

9.2.9.4. Key Developments/ Takeaways

9.2.9.5. Strategy Overview

9.2.10. Vitrition, LLC

9.2.10.1. Overview

9.2.10.2. Product Portfolio

9.2.10.3. Sales Footprint

9.2.10.4. Key Developments/ Takeaways

9.2.10.5. Strategy Overview

9.2.11. Herbaland Gummies

9.2.11.1. Overview

9.2.11.2. Product Portfolio

9.2.11.3. Sales Footprint

9.2.11.4. Key Developments/ Takeaways

9.2.11.5. Strategy Overview

9.2.12. Unique Energy Drink LLC

9.2.12.1. Overview

9.2.12.2. Product Portfolio

9.2.12.3. Sales Footprint

9.2.12.4. Key Developments/ Takeaways

9.2.12.5. Strategy Overview

9.2.13. Seattle Gummy Company

9.2.13.1. Overview

9.2.13.2. Product Portfolio

9.2.13.3. Sales Footprint

9.2.13.4. Key Developments/ Takeaways

9.2.13.5. Strategy Overview

9.2.14. GU Energy Labs

9.2.14.1. Overview

9.2.14.2. Product Portfolio

9.2.14.3. Sales Footprint

9.2.14.4. Key Developments/ Takeaways

9.2.14.5. Strategy Overview

9.2.15. Melaleuca

9.2.15.1. Overview

9.2.15.2. Product Portfolio

9.2.15.3. Sales Footprint

9.2.15.4. Key Developments/ Takeaways

9.2.15.5. Strategy Overview

9.2.16. Advocare

9.2.16.1. Overview

9.2.16.2. Product Portfolio

9.2.16.3. Sales Footprint

9.2.16.4. Key Developments/ Takeaways

9.2.16.5. Strategy Overview

9.2.17. Nutrilite (Amway)

9.2.17.1. Overview

9.2.17.2. Product Portfolio

9.2.17.3. Sales Footprint

9.2.17.4. Key Developments/ Takeaways

9.2.17.5. Strategy Overview

9.2.18. NuSkin

9.2.18.1. Overview

9.2.18.2. Product Portfolio

9.2.18.3. Sales Footprint

9.2.18.4. Key Developments/ Takeaways

9.2.18.5. Strategy Overview

9.2.19. USANA

9.2.19.1. Overview

9.2.19.2. Product Portfolio

9.2.19.3. Sales Footprint

9.2.19.4. Key Developments/ Takeaways

9.2.19.5. Strategy Overview

9.2.20. Forever Living

9.2.20.1. Overview

9.2.20.2. Product Portfolio

9.2.20.3. Sales Footprint

9.2.20.4. Key Developments/ Takeaways

9.2.20.5. Strategy Overview

9.2.21. Young Living

9.2.21.1. Overview

9.2.21.2. Product Portfolio

9.2.21.3. Sales Footprint

9.2.21.4. Key Developments/ Takeaways

9.2.21.5. Strategy Overview

9.2.22. doTerra

9.2.22.1. Overview

9.2.22.2. Product Portfolio

9.2.22.3. Sales Footprint

9.2.22.4. Key Developments/ Takeaways

9.2.22.5. Strategy Overview

9.2.23. Plexus

9.2.23.1. Overview

9.2.23.2. Product Portfolio

9.2.23.3. Sales Footprint

9.2.23.4. Key Developments/ Takeaways

9.2.23.5. Strategy Overview

9.2.24. Alovea (f/k/a Evolv)

9.2.24.1. Overview

9.2.24.2. Product Portfolio

9.2.24.3. Sales Footprint

9.2.24.4. Key Developments/ Takeaways

9.2.24.5. Strategy Overview

9.2.25. Jeunesse

9.2.25.1. Overview

9.2.25.2. Product Portfolio

9.2.25.3. Sales Footprint

9.2.25.4. Key Developments/ Takeaways

9.2.25.5. Strategy Overview

9.2.26. Isagenix

9.2.26.1. Overview

9.2.26.2. Product Portfolio

9.2.26.3. Sales Footprint

9.2.26.4. Key Developments/ Takeaways

9.2.26.5. Strategy Overview

9.2.27. Arbonne

9.2.27.1. Overview

9.2.27.2. Product Portfolio

9.2.27.3. Sales Footprint

9.2.27.4. Key Developments/ Takeaways

9.2.27.5. Strategy Overview

9.2.28. Herbalife

9.2.28.1. Overview

9.2.28.2. Product Portfolio

9.2.28.3. Sales Footprint

9.2.28.4. Key Developments/ Takeaways

9.2.28.5. Strategy Overview

9.2.29. Shaklee

9.2.29.1. Overview

9.2.29.2. Product Portfolio

9.2.29.3. Sales Footprint

9.2.29.4. Key Developments/ Takeaways

9.2.29.5. Strategy Overview

9.2.30. Nature's Sunshine

9.2.30.1. Overview

9.2.30.2. Product Portfolio

9.2.30.3. Sales Footprint

9.2.30.4. Key Developments/ Takeaways

9.2.30.5. Strategy Overview

10. Assumptions and Acronyms Used

11. Research Methodology

List of Tables

Table 01: India energy supplements Market Value (US$ Mn) Analysis and Forecast By Product Type, 2015-2030

Table 02: India energy supplements Market Value (US$ Mn) Analysis and Forecast By Flavor, 2015-2030

Table 03: India energy supplements Market Value (US$ Mn) Analysis and Forecast By Fruit Segment, 2015-2030

Table 04: India energy supplements Market Value (US$ Mn) Analysis and Forecast By Sales Channel, 2015-2030

List of Figures

Figure 01: India energy supplements Market Value (US$ Mn) Forecast, 2021–2031

Figure 02: India energy supplements Market Value Share Analysis by Product Type, 2020 E

Figure 03: India energy supplements Market Value (US$ Mn) Analysis & Forecast by Product Type, 2021–2031

Figure 04: India energy supplements Market Value Share Analysis By Flavor, 2020 E

Figure 05: India Energy Supplements Market Value (US$ Mn) Analysis & Forecast By Flavor, 2020-2030

Figure 06: India energy supplements Market Value Share Analysis By Sales Channel, 2020 E

Figure 07: India Energy Supplements Market Value (US$ Mn) Analysis & Forecast By Sales Channel, 2020-2030