The automotive steering wheel market in India is anticipated to experience steady growth during the forecast period of 2015 to 2023. The rapid expansion of the automotive sector in India is the primary factor responsible for the robust growth of the automotive steering wheel market.

The automotive sector in the country is presently driven by the increasing disposable income of the middle-class populationand the rising investment on automobiles by manufacturers. Initiatives taken by the government under the “Make in India” campaign has also encouraged the development of the automotive sector. Considering the direct impact of the growth of the automotive sector in Indiaon the demand for automotive steering wheels, the market is poised for a stable future ahead.

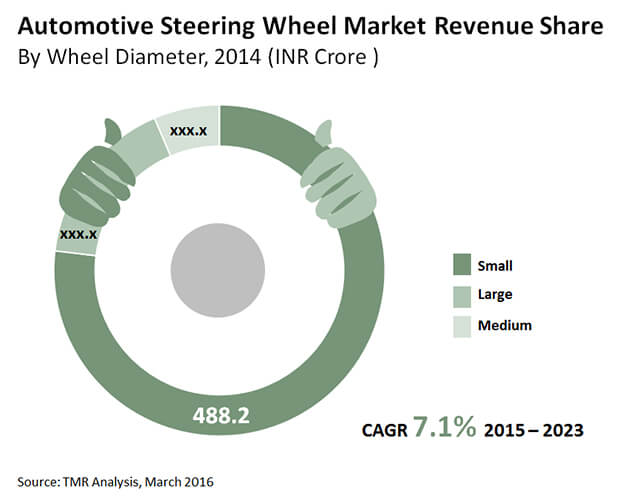

The value of the automotive steering wheel market in India was pegged at INR 634.9 Cr in 2014 and this is expected to rise to INR 1,214.6 Cr by 2023. The market is expected to record a 7.1% CAGR from 2015 to 2023.

Depending on the diameter of the steering wheel, themarket in India is led by the small diameter steering wheel and this segment accounted for a share of 77% in 2014.The surging demand for smaller passenger cars is the key factor driving this segment.

Among the variousmaterials used for making steering wheels, polyurethane led the automotive steering wheel market in India in 2014. The demand for polyurethane from various steering wheel manufacturers in the country stems from the fact that it is cheaper than other materials and also highly durable. The leather segment in the India automotive steering wheel market is anticipated to record the highest growth during the forecast period owing to the increasing demand for steering wheels with better grip and a sleek look.

By application, the automotive steering wheel market in India is driven by the passenger car segment. The dynamic outlook of the Indian economy and the growing purchasing power of the consumer are two of the most important factors responsible for the rising demand for passenger cars in India. This, in turn, is predicted to drive the automotive steering wheel market at an exponential growth rate during the forecast period.

Controls-embedded steering wheels and normal steering wheels are the two main types based on technology. Normal steering wheels without airbags led the automotive steering wheel market in India in 2014 owing to extensive demand from the light and medium commercial vehicles segment.Controls-embedded steering wheels with airbags present a highly lucrative option for players owing to the rising demand for high-end passenger cars and the increasing awareness of vehicle safety among drivers in India.

Some of the key players in the India automotive steering wheel market are Emdet Engineers Private Limited, Autoliv, Toyoda Gosei co. Ltd., Takata Corporation, and Rane TRW.

1. Preface

1.1. Report Description

1.2. Research Scope

1.3. Key Take

1.4. Research Methodology

2. Executive Summary

2.1. Automotive Steering Wheel Industry Market Snapshot

3. India Automotive Steering Wheel Industry Market Overview

3.1. Introduction

3.2. Market Dynamics

3.2.1. Market Drivers

3.2.2. Market Restraints

3.2.3. Market Opportunities

3.3. Competitive Strategies Adopted by Leading Players

3.4. Market Attractiveness Analysis for Automotive Steering Wheel Industry Market

4. India Automotive Steering Wheel Industry Market Revenue, By Wheel Diameter, 2014 – 2023 (INR Crore)

4.1. Overview

4.2. Small Diameter Steering Wheel

4.3. Medium Diameter Steering Wheel

4.4. Large Diameter Steering Wheel

5. India Automotive Steering Wheel Industry Market Revenue, By Material, 2014 – 2023 (INR Crore)

5.1. Overview

5.2. Polyurethane Steering Wheel

5.3. Leather Steering Wheel

5.4. Wooden Steering Wheel

6. India Automotive Steering Wheel Industry Market Revenue, By Technology, 2014 – 2023 (INR Crore)

6.1. Overview

6.2. Normal Steering Wheel

6.2.1. Automotive Steering Wheel Market, 2014-2023: Revenue forecast, by Normal Steering Wheel

6.3. Controls Embedded Steering Wheel

6.3.1 Automotive Steering Wheel Market, 2014-2023: Revenue forecast, by Controls Embedded Steering Wheel

7. India Automotive Steering Wheel Industry Market Revenue, By Application, 2014 – 2023 (INR Crore)

7.1. Overview

7.2. Passenger Car

7.3. Light Commercial Vehicle (LCV)

7.4. Heavy Commercial Vehicle (HCV)

7.5. Farm Vehicle

8. Company Profiles

8.1. Toyoda Gosei Co. Ltd.

8.1.1. Company Details (Headquarter, Foundation Year, Employee Strength)

8.1.2. Market Presence, By Segment and Geography

8.1.3. Key Developments

8.1.4. Strategy and Historical Roadmap

8.1.5. Revenue and Operating Profits

8.2 TRW Sun Steering Wheels Pvt. Ltd.

8.2.1. Company Details (Headquarter, Foundation Year, Employee Strength)

8.2.2. Market Presence, By Segment and Geography

8.2.3. Key Developments

8.2.4. Strategy and Historical Roadmap

8.2.5. Revenue and Operating Profits

8.3. Autoliv

8.3.1. Company Details (Headquarter, Foundation Year, Employee Strength)

8.3.2. Market Presence, By Segment and Geography

8.3.3. Key Developments

8.3.4. Strategy and Historical Roadmap

8.3.5. Revenue and Operating Profits

8.4. Emdet Engineers Private Limited Company

8.4.1. Company Details (Headquarter, Foundation Year, Employee Strength)

8.4.2. Market Presence, By Segment and Geography

8.4.3. Key Developments

8.4.4. Strategy and Historical Roadmap

8.4.5. Revenue and Operating Profits

8.5. Takata Corporation

8.5.1. Company Details (Headquarter, Foundation Year, Employee Strength)

8.5.2. Market Presence, By Segment and Geography

8.5.3. Key Developments

8.5.4. Strategy and Historical Roadmap

8.5.5. Revenue and Operating Profits

8.6. Rane TRW

8.6.1. Company Details (Headquarter, Foundation Year, Employee Strength)

8.6.2. Market Presence, By Segment and Geography

8.6.3. Key Developments

8.6.4. Strategy and Historical Roadmap

8.6.5. Revenue and Operating Profits

8.7. KSS Abhishek Safety Systems Pvt. Ltd.

8.7.1. Company Details (Headquarter, Foundation Year, Employee Strength)

8.7.2. Market Presence, By Segment and Geography

8.7.3. Key Developments

8.7.4. Strategy and Historical Roadmap

8.7.5. Revenue and Operating Profits

List of Tables

Table 1 Automotive Steering Wheel Market, 2014-2023: Revenue Forecast, By Normal Steering Wheel

Table 2 Automotive Steering Wheel Market, 2014-2023: Revenue Forecast, By Controls Embedded Steering Wheel

List of Figures

Fig. 1 Market Segmentation of Automotive Steering Wheel Market

Fig. 2 Snapshot: Automotive Steering Wheel Market

Fig. 3 Market Attractiveness Analysis, By Material, 2014

Fig. 4 Automotive Steering Wheel, by Wheel Diameter: Overview

Fig. 5 Small Diameter Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 6 Medium Diameter Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 7 Large Diameter Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 8 Automotive Steering Wheel, by Material: Overview

Fig. 9 Polyurethane Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 10 Leather Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 11 Wooden Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 12 Automotive Steering Wheel, by Technology: Overview

Fig. 13 Normal Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 14 Controls Embedded Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 15 Automotive Steering Wheel, by Application: Overview

Fig. 16 Passenger Car Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 17 Light Commercial Vehicle (LCV) Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 18 Heavy Commercial Vehicle (HCV) Steering Wheel Market, 2014-2023: Revenue Forecast

Fig. 19 Farm Vehicle Steering Wheel Market, 2014-2023: Revenue Forecast