Analysts’ Viewpoint

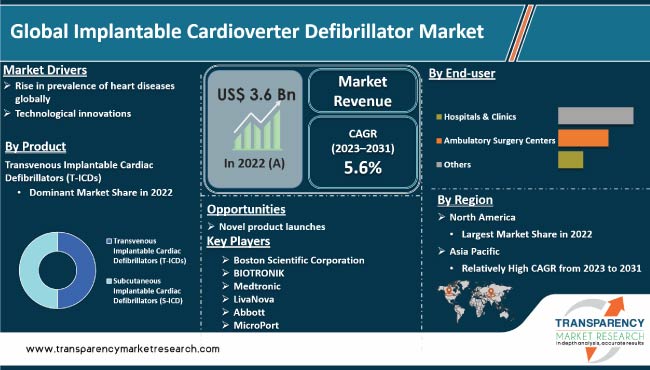

Rise in prevalence of cardiovascular diseases and associated risk factors, such as hypertension and heart failure, is expected to drive the global implantable cardioverter defibrillator market during the forecast period. Surge in demand for effective cardiac rhythm management devices, such as implantable cardioverter defibrillators (ICDs) owing to aging global population and increase in incidence of these conditions, is likely to propel the global implantable cardioverter defibrillators industry. Furthermore, rise in adoption of remote monitoring and telehealth solutions in healthcare are expected to bolster global implantable cardioverter defibrillators market growth.

Technological advancements and product innovation are anticipated to offer lucrative opportunities to market players. Manufacturers are focusing on improving battery longevity, miniaturization of devices, and enhancing sensing & detection algorithms which can make ICDs more reliable, efficient, and patient-friendly.

Implantable cardioverter defibrillator is a small electronic device that is surgically implanted beneath the skin, typically near the collarbone. It is designed to monitor the heart's electrical activity continuously and deliver therapeutic interventions when needed.

The primary function of an ICD is to detect and treat potentially fatal arrhythmias, such as ventricular fibrillation and ventricular tachycardia, by delivering a precisely calibrated electrical shock to restore the heart's normal rhythm.

The implantation procedure for an ICD is generally safe and well-tolerated, performed under local anesthesia with sedation. A small incision is made, and the device's leads are threaded through veins into the heart chambers, allowing for accurate sensing of the heart's electrical signals.

The ICD's generator, containing a battery and electronic circuitry, is then placed under the skin and connected to the leads. Once implanted, the ICD continuously monitors the heart's activity, ensuring prompt detection of any abnormal rhythms.

When an arrhythmia is detected, the ICD responds by delivering an electrical shock to restore the heart's normal rhythm, a process known as defibrillation. The device utilizes advanced sensing algorithms to differentiate between benign and life-threatening arrhythmias, minimizing unnecessary interventions.

In addition to defibrillation, ICDs may provide pacing therapy, wherein they emit small electrical pulses to regulate the heart rate and ensure optimal cardiac function.

ICDs have proven to be highly effective in preventing sudden cardiac death, particularly in patients with a history of life-threatening arrhythmias or those at high risk. These devices offer a remarkable level of protection by swiftly terminating dangerous rhythms and restoring the heart's stability.

ICDs can be programmed and customized to meet individual patient needs, allowing healthcare professionals to tailor therapy parameters and optimize device performance.

Implantable cardioverter defibrillator represents a remarkable advancement in cardiovascular medicine. By continuously monitoring the heart's electrical activity and delivering timely interventions, ICDs have significantly improved patient outcomes, reducing mortality rates associated with severe arrhythmias.

As technology continues to evolve, the capabilities and features of ICDs are expected to further enhance, offering even greater benefits to individuals at risk of life-threatening cardiac conditions.

Prevalence of sudden cardiac arrest (SCA) has been rising globally, leading to increased demand for implantable cardioverter defibrillators (ICDs) in the healthcare market.

SCA is a life-threatening condition characterized by an abrupt loss of heart function, often resulting from an electrical malfunction in the heart. It can occur suddenly and without warning, leading to cardiac death if not treated promptly.

Several factors contribute to increase in prevalence of SCA. Aging population is a significant driver of SCA cases. As the world's population continues to age, so is the incidence of cardiovascular diseases and associated risk factors, such as hypertension and coronary artery disease, increasing. These conditions can predispose individuals to develop life-threatening arrhythmias, making them more susceptible to SCA.

Unhealthy lifestyles and rise in risk factors, such as sedentary behavior, poor diet, and smoking, contribute to the increasing burden of cardiovascular diseases.

These modifiable risk factors can lead to the development of cardiac conditions, including arrhythmias, which could ultimately result in SCA. As awareness about the importance of a healthy lifestyle grows, more individuals may seek medical interventions such as ICDs to mitigate their risk of SCA.

Growing recognition of the effectiveness of ICDs in preventing SCA and positive outcomes associated with their use contribute to the rising demand.

Clinical studies and evidence-based guidelines have demonstrated the significant reduction in mortality rates and improvement in survival rates for individuals with ICDs. These compelling outcomes, coupled with increasing prevalence of SCA, have led to greater acceptance and adoption of ICDs by both healthcare providers and patients.

In conclusion, rise in prevalence of sudden cardiac arrest, driven by factors such as aging population, unhealthy lifestyles, and improved access to healthcare, is expected to fuel the demand for implantable cardioverter defibrillators in the global market.

Rise in awareness about the benefits of ICDs increases their usage as a life-saving intervention, which, in turn, is likely to contribute to improved patient outcomes and reduced mortality rates associated with SCA.

Technological advancements have played a significant role in the evolution and widespread adoption of implantable cardioverter defibrillators (ICDs), potentially accelerating their demand in the global market. These advancements have enhanced the capabilities, safety, and convenience of ICDs, making them more effective in preventing sudden cardiac death and improving patient outcomes.

Technological advancement has led to miniaturization of ICD devices. Over the years, ICDs have become smaller and more compact while maintaining their functionality. This miniaturization allows for less invasive implantation procedures and increased patient comfort. Smaller devices also offer greater flexibility in device placement, allowing healthcare providers to choose the most optimal location for each patient.

Another significant advancement is the improvement in battery technology. Early ICD models required frequent surgical procedures to replace the device's battery. However, modern ICDs are equipped with long-lasting batteries, some lasting up to 10 years or more. This extended battery life reduces the frequency of device replacement surgeries, minimizing risks and burdens for patients. It also contributes to cost-effectiveness and overall patient satisfaction.

Advancements in sensing and detection algorithms have also been instrumental in improving ICD performance. These algorithms enable ICDs to accurately differentiate between normal heart rhythms and potentially life-threatening arrhythmias.

By minimizing false positives, ICDs can deliver appropriate therapies more precisely, avoiding unnecessary shocks and ensuring timely intervention when needed. Enhanced sensing capabilities also enable ICDs to detect and respond to a wider range of arrhythmias, expanding their utility in various clinical scenarios.

Wireless communication and remote monitoring capabilities have revolutionized the management of patients with ICDs. Modern ICDs can wirelessly transmit data, such as device diagnostics and patient-specific information, to healthcare providers.

Remote monitoring enables proactive surveillance, early detection of issues, and timely intervention without the need for frequent in-person clinic visits. It enhances patient convenience, reduces healthcare costs, and improves overall device management and patient safety.

Advancements in ICD programming and customization options have allowed for personalized therapy. Healthcare providers can tailor the device settings to match individual patient needs, optimizing therapy delivery and reducing the likelihood of adverse events. Customization options also accommodate changes in a patient's condition over time, providing flexibility and ensuring the device's effectiveness throughout its lifespan.

Thus, major technological advancements have accelerated the development and adoption of implantable cardioverter defibrillators in the global market. Miniaturization of devices, improved battery technology, advanced sensing & detection algorithms, wireless communication, remote monitoring capabilities, and customization options have collectively contributed to the effectiveness, safety, and convenience of ICDs.

As technology continues to advance, the potential for further innovations in ICDs is promising, further driving demand and improving outcomes for individuals at risk of sudden cardiac death.

In terms of product, the transvenous implantable cardiac defibrillators (T-ICDs) segment accounted for the largest global implantable cardioverter defibrillator market share in 2022. T-ICDs are the traditional and most commonly used type of implantable defibrillators, offering a reliable and proven approach to managing life-threatening arrhythmias.

The segment's dominance is ascribed to long-standing history and extensive clinical experience. T-ICDs have been used for several decades and have a robust track record in effectively treating and preventing sudden cardiac death. This established reputation has instilled confidence in healthcare providers and patients alike, making T-ICDs the go-to choice for many cardiac rhythm management professionals.

T-ICDs are implanted using transvenous leads, which are threaded through the veins into the heart. These leads enable accurate sensing of cardiac electrical activity and delivery of electrical shocks when necessary.

The transvenous approach allows for precise lead placement, ensuring optimal detection and therapy delivery for various arrhythmias. This reliability and accuracy in therapy delivery have contributed to widespread adoption of T-ICDs.

Another advantage of T-ICDs is the ability to provide dual-chamber therapy. Unlike subcutaneous implantable cardioverter defibrillators (S-ICDs) that primarily monitor and treat ventricular arrhythmias, T-ICDs can monitor both ventricular and atrial rhythms. This capability is particularly valuable for patients with certain types of arrhythmias, as it allows for more comprehensive monitoring and treatment options.

T-ICDs also offer additional features such as cardiac resynchronization therapy (CRT). CRT is used in patients with heart failure and impaired cardiac function to synchronize the contractions of the heart's chambers, improving overall cardiac performance. This combination of defibrillation and CRT in a single device provides a comprehensive treatment solution for patients with both arrhythmias and heart failure.

Based on end-user, hospitals & clinics is projected to be a lucrative segment of the global implantable cardioverter defibrillator market during the forecast period.

The segment's dominance is ascribed to specialized infrastructure and expertise in cardiac care. These healthcare facilities house dedicated cardiology departments with state-of-the-art equipment and experienced healthcare professionals who specialize in the management of cardiac conditions. This expertise allows for accurate diagnosis and appropriate patient selection for ICD implantation, ensuring optimal outcomes.

Hospitals and clinics also have the necessary resources to perform ICD implantation procedures. The implantation of ICDs requires surgical intervention, which is typically performed in specialized cardiac catheterization labs or operating rooms within these healthcare facilities. They provide the necessary sterile environment, advanced imaging technologies, and monitoring equipment to ensure safe and successful implantation procedures.

Hospitals and clinics have established referral networks and collaborations with other healthcare providers. This enables them to receive referrals from primary care physicians, electrophysiologists, and other specialists who identify patients at risk of sudden cardiac death or who require ICD therapy. The robust network of healthcare professionals working together ensures a comprehensive approach to patient care and facilitates the timely access to ICD implantation services.

Follow-up care and device management also contribute to the hospitals & clinics segment's dominance of the global market. After the implantation procedure, patients require regular monitoring, device programming, and check-ups to ensure proper functioning of the ICD and evaluate any potential issues. Hospitals and clinics have specialized cardiac rehabilitation programs and outpatient clinics that offer these services, allowing for ongoing care and maintenance of ICDs.

Hospitals and clinics serve as centers for research and innovation in the field of cardiac care. These participate in clinical trials and research studies aimed at advancing the understanding of cardiac conditions and improving ICD technology. Their involvement in research activities strengthens their expertise and helps in shaping future advancements in ICD therapy.

According to implantable cardioverter defibrillator market trends, North America dominated the global market in 2022, with the U.S. being the largest contributor to market revenue.

Rise in prevalence of SCA across the region is one of the key drivers of the implantable cardioverter defibrillator market size in North America. As per a report published by American Heart Association, cardiac arrest continues to present a significant public health challenge. Around 356,000+ out-of-hospital cardiac arrests (OHCA) occur in heart patients in the U.S. annually, in which 90% of them are fatal.

Strong presence of prominent players, including Medtronic, Boston Scientific, BIOTRONIK, and Abbott Laboratories, and their effective strategies are expected to drive the market in the region.

In August 2022, Medtronic announced that its investigational extravascular implantable cardioverter defibrillator met trial endpoints. The device aims to avoid several risks of traditional (transvenous) ICDs as its lead is placed outside the heart as well as veins, under the sternum/breastbone using a minimally invasive procedure.

The market in Asia Pacific is projected to expand at the fastest CAGR during the forecast period. Expansion of the market in the region can be attributed to high disease prevalence, emergence of local companies, and presence of a large patient pool.

Multiple strategic initiatives implemented by innovative companies are projected to bolster market expansion in Asia Pacific. In May 2022, MicroPort Scientific Corporation, an innovative medical device company, gained official grant for its ‘Platinium implantable cardioverter defibrillator’ from National Medical Products Administration, the Chinese agency for regulating drugs and medical devices. With an anticipated lifespan of 13-14 years, the ‘Platinium implantable cardioverter defibrillator’ offers an extended duration of reliable life support, mitigating the potential risks associated with repeated ICD replacement and providing individuals with greater longevity and dependability.

This report provides profiles of leading players operating in the global market. These include Boston Scientific Corporation, BIOTRONIK., Medtronic, LivaNova, Abbott, and MicroPort. These players engage in merger & acquisition, strategic collaborations, and new product launches to expand presence and gain market share.

The implantable cardioverter defibrillator market report profiles top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 3.6 Bn |

|

Forecast (Value) in 2031 |

More than US$ 5.8 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 3.6 Bn in 2022

It is projected to reach more than US$ 5.8 Bn by 2031

It is anticipated to expand at a CAGR of 5.6% from 2023 to 2031

The transvenous implantable cardiac defibrillators (T-ICDs) segment accounted for the largest market share in 2022

North America is expected to account for the leading market share during the forecast period.

Boston Scientific Corporation, BIOTRONIK., Medtronic, LivaNova, Abbott, and MicroPort are the leading players in the global market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Implantable Cardioverter Defibrillator Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Implantable Cardioverter Defibrillator Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with key countries

5.2. Regulatory Scenario by Region/globally

5.3. Key Product/Brand Analysis

5.4. COVID-19 Pandemics Impact on Industry

6. Global Implantable Cardioverter Defibrillator Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Transvenous Implantable Cardiac Defibrillators (T-ICDs)

6.3.1.1. Cardiac Resynchronization Therapy (CRT)

6.3.1.2. Dual Chamber ICDs

6.3.1.3. Single Chamber ICDs

6.3.2. Subcutaneous Implantable Cardiac Defibrillators (S-ICD)

6.4. Market Attractiveness Analysis, by Product

7. Global Implantable Cardioverter Defibrillator Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017-2031

7.3.1. Hospitals & Clinics

7.3.2. Ambulatory Surgery Centers

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Implantable Cardioverter Defibrillator Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Implantable Cardioverter Defibrillator Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017-2031

9.2.1. Transvenous Implantable Cardiac Defibrillators (T-ICDs)

9.2.1.1. Cardiac Resynchronization Therapy (CRT)

9.2.1.2. Dual Chamber ICDs

9.2.1.3. Single Chamber ICDs

9.2.2. Subcutaneous Implantable Cardiac Defibrillators (S-ICD)

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Hospitals & Clinics

9.3.2. Ambulatory Surgery Centers

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Implantable Cardioverter Defibrillator Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Transvenous Implantable Cardiac Defibrillators (T-ICDs)

10.2.1.1. Cardiac Resynchronization Therapy (CRT)

10.2.1.2. Dual Chamber ICDs

10.2.1.3. Single Chamber ICDs

10.2.2. Subcutaneous Implantable Cardiac Defibrillators (S-ICD)

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Hospitals & Clinics

10.3.2. Ambulatory Surgery Centers

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Implantable Cardioverter Defibrillator Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Transvenous Implantable Cardiac Defibrillators (T-ICDs)

11.2.1.1. Cardiac Resynchronization Therapy (CRT)

11.2.1.2. Dual Chamber ICDs

11.2.1.3. Single Chamber ICDs

11.2.2. Subcutaneous Implantable Cardiac Defibrillators (S-ICD)

11.3. Market Value Forecast, by End-user, 2017-2031

11.3.1. Hospitals & Clinics

11.3.2. Ambulatory Surgery Centers

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Implantable Cardioverter Defibrillator Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Transvenous Implantable Cardiac Defibrillators (T-ICDs)

12.2.1.1. Cardiac Resynchronization Therapy (CRT)

12.2.1.2. Dual Chamber ICDs

12.2.1.3. Single Chamber ICDs

12.2.2. Subcutaneous Implantable Cardiac Defibrillators (S-ICD)

12.3. Market Value Forecast, by End-user, 2017-2031

12.3.1. Hospitals & Clinics

12.3.2. Ambulatory Surgery Centers

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Implantable Cardioverter Defibrillator Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. Transvenous Implantable Cardiac Defibrillators (T-ICDs)

13.2.1.1. Cardiac Resynchronization Therapy (CRT)

13.2.1.2. Dual Chamber ICDs

13.2.1.3. Single Chamber ICDs

13.2.2. Subcutaneous Implantable Cardiac Defibrillators (S-ICD)

13.3. Market Value Forecast, by End-user, 2017-2031

13.3.1. Hospitals & Clinics

13.3.2. Ambulatory Surgery Centers

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Boston Scientific Corporation

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. BIOTRONIK

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Medtronic

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. LivaNova

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Abbott

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. MicroPort

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

List of Tables

Table 01: Global Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 02: Global Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 03: Global Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 04: North America Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 05: North America Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 06: North America Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 07: Europe Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 08: Europe Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 09: Europe Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Asia Pacific Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 11: Asia Pacific Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 12: Asia Pacific Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 13: Latin America Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 14: Latin America Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 15: Latin America Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Middle East & Africa Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Product, 2017-2031

Table 17: Middle East & Africa Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 18: Middle East & Africa Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, 2017-2031

Figure 02: Global Implantable Cardioverter Defibrillator Market Value Share Analysis, by Product, 2022 and 2031

Figure 03: Global Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Product, 2023-2031

Figure 04: Global Implantable Cardioverter Defibrillator Market Value Share Analysis, by End-user, 2022 and 2031

Figure 05: Global Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by End-user, 2023-2031

Figure 06: Global Implantable Cardioverter Defibrillator Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Region, 2023-2031

Figure 08: North America Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, 2017-2031

Figure 09: North America Implantable Cardioverter Defibrillator Market Value Share Analysis, by Product, 2022 and 2031

Figure 10: North America Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Product, 2023-2031

Figure 11: North America Implantable Cardioverter Defibrillator Market Value Share Analysis, by End-user, 2022 and 2031

Figure 12: North America Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by End-user, 2023-2031

Figure 13: North America Implantable Cardioverter Defibrillator Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Country, 2023-2031

Figure 15: Europe Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, 2017-2031

Figure 16: Europe Implantable Cardioverter Defibrillator Market Value Share Analysis, by Product, 2022 and 2031

Figure 17: Europe Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Product, 2023-2031

Figure 18: Europe Implantable Cardioverter Defibrillator Market Value Share Analysis, by End-user, 2022 and 2031

Figure 19: Europe Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by End-user, 2023-2031

Figure 20: Europe Implantable Cardioverter Defibrillator Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 22: Asia Pacific Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, 2017-2031

Figure 23: Asia Pacific Implantable Cardioverter Defibrillator Market Value Share Analysis, by Product, 2022 and 2031

Figure 24: Asia Pacific Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Product, 2023-2031

Figure 25: Asia Pacific Implantable Cardioverter Defibrillator Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26: Asia Pacific Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by End-user, 2023-2031

Figure 27: Asia Pacific Implantable Cardioverter Defibrillator Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 29: Latin America Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, 2017-2031

Figure 30: Latin America Implantable Cardioverter Defibrillator Market Value Share Analysis, by Product, 2022 and 2031

Figure 31: Latin America Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Product, 2023-2031

Figure 32: Latin America Implantable Cardioverter Defibrillator Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Latin America Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by End-user, 2023-2031

Figure 34: Latin America Implantable Cardioverter Defibrillator Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 36: Middle East & Africa Implantable Cardioverter Defibrillator Market Value (US$ Bn) Forecast, 2017-2031

Figure 37: Middle East & Africa Implantable Cardioverter Defibrillator Market Value Share Analysis, by Product, 2022 and 2031

Figure 38: Middle East & Africa Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Product, 2023-2031

Figure 39: Middle East & Africa Implantable Cardioverter Defibrillator Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Middle East & Africa Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by End-user, 2023-2031

Figure 41: Middle East & Africa Implantable Cardioverter Defibrillator Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Implantable Cardioverter Defibrillator Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 43: Global Implantable Cardioverter Defibrillator Market Share Analysis, by Company, 2022