Analysts’ Viewpoint on Hyperpigmentation Disorder Treatment Market Scenario

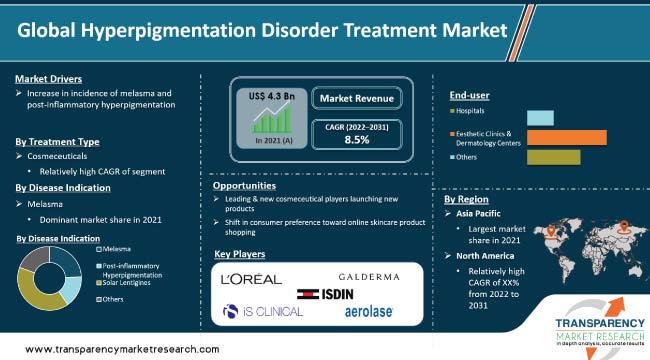

Increase in investment in R&D of novel advanced technologies, decrease in social taboo surrounding pigmentation, rise in prevalence of hyperpigmentation-related disorders, and surge in awareness about skin rejuvenation and treatment options are expected to drive the global hyperpigmentation disorder treatment market during the forecast period. Technological advancements in cosmeceuticals and the subsequent increase in usage of cosmeceuticals in skincare is providing lucrative opportunities for companies operating in the global market. Key players are increasingly investing in nanotechnology to introduce new and innovative products to increase their market share.

Pigmentation refers to areas of the skin that have darkened in color compared to the surrounding skin, often resulting in a patchy or uneven appearance. Pigmentation can appear as freckles and sunspots, melasma or chloasma, seborrheric keratosis, and birthmarks. It can be exacerbated by the usage of inappropriate skin care products as well as continued sun exposure and heat trauma. Hyperpigmentation occurs when melanocytes in the deeper layers of the skin produce melanin, a skin-darkening pigment. Melanin overproduction can result in darker skin patches on the skin's surface. Skin hypopigmentation is caused by a decrease in melanin production. Hyperpigmentation disorders can be treated with cosmeceuticals, laser treatment, and chemical peels. Furthermore, rise in prevalence of melasma and increase in awareness about hyperpigmentation treatment are driving the global hyperpigmentation disorders treatment market size.

Hyperpigmentation is quite common and relatively harmless. It could be a source of embarrassment for those who suffer from it. Hyperpigmentation, or a dark pigmentation patch on the face, causes an abnormally high concentration of skin pigments responsible for the production of melanocytes. Hyperpigmentation is most common in Mediterranean, Asian, African, and Latino populations.

Hyperpigmentation is a widespread and serious skin condition that affects people of all skin types. Despite the availability of various depigmentation active ingredients for skin hyperpigmentation disorders, none are completely satisfactory due to poor permeability through the skin layer and significant toxicity, resulting in severe side effects such as irritant dermatitis, erythema, itching, and skin flaking. Nanotechnology plays an important role in advancing cosmeceutical formulation by improving active ingredient solubility, stability, safety, loading efficiency, and dermal permeability.

Scientists have been investigating how nanotechnology can improve active ingredient delivery and absorption to the skin in addition to focusing on improving the efficacy of individual active agents. Nanotechnology has become a promising addition to the cosmetic industry due to its ability to improve the properties of cosmetic products in general. Nanotechnology has the potential to manipulate and improve features such as absorption, texture, active ingredient protection, and overall efficiency.

Depigmentation active ingredients such as hydroquinone, arbutin, kojic acid, azelaic acid, and retinoic acid; and new approaches in nanotechnology could improve the efficacy of hyperpigmentation treatments. Nanotechnology is a promising approach for topical hydroquinone administration to overcome hyperpigmentation with adequate skin penetration and low systemic absorption to reduce hydroquinone's adverse effects.

In terms of treatment type, the cosmeceuticals segment held significant market share in 2021. Cosmeceuticals are topical cosmetic-pharmaceutical blends that contain biologically active ingredients. They can enhance skin appearance. Cosmeceuticals are rapidly substituting conventional agents. Phytochemicals, or compounds derived from plants, are cosmeceuticals that have been shown to have a range of cellular effects for a number of dermatological diseases. Furthermore, cosmeceuticals are regularly used to treat hyperpigmentation. Hyperpigmentation disorders are generally difficult to treat, which necessitates the usage of skin lightening agents such as cosmeceuticals. These target hyperplastic melanocytes and inhibit key regulatory steps in melanin synthesis. Cosmeceuticals are the commonly preferred treatment measures in facial hyperpigmentation disorders due to high absorption and penetration in the skin.

Based on disease indication, the melasma segment accounted for the largest global hyperpigmentation disorder treatment market share in 2021. Melasma is a typically acquired condition of symmetric hyperpigmentation that usually affects the face. It is more common in women and people with darker skin types. Skin conditions such as melasma are quite prevalent, especially in pregnant women. Melasma affects 15% to 50% of pregnant mothers. Melasma can affect 1.5% to 33% of people, and it typically appears during a woman's reproductive years and infrequently during puberty. It typically begins between the age of 20 and 40. Rise in prevalence of melasma and increase in preference for cosmeceutical treatment have led to high demand for dermatological care. Melasma was significantly widespread in 2020, affecting more than 5 million people in the U.S. Asian women of childbearing age have melasma prevalence of up to 30%. It frequently recurs and is challenging to treat. The pathogenesis, clinical staging & classification, and clinical management of melasma have advanced significantly in the past few years. As per global hyperpigmentation disorders treatment market trends, rise in prevalence of melasma and increase in treatment options are expected to drive the segment in the next few years.

In terms of end-user, the esthetic clinics & dermatology centers segment is projected to account for major share of the global hyperpigmentation disorder treatment market during the forecast period. Increase in number of esthetic clinics & dermatological centers is expected to drive the segment in the near future. Manufacturers and retailers of hyperpigmentation cosmeceutical products are improving their supply chains to meet the growing demand for hyperpigmentation disorder treatment products. Other global players and retailers are encouraging several brands to adopt an omnichannel supply model for products to reach final customers.

Patients experience significant social and emotional stress due to hyperpigmentary disorders, particularly melasma and post-inflammatory hyperpigmentation (PIH). Despite the development of several treatment modalities for melasma and PIH, management of these conditions is difficult due to recurrent and refractory nature. Lasers have revolutionized the treatment of a number of dermatological conditions, particularly dermal or mixed melasma; pigmentary disorders are one of these. Lasers have been widely used to treat pigmented conditions such as Becker's nevus, cafe-au-lait macules, Nevus of Ota, nevocellular nevi, lentigines, tattoos, melasma, and post-inflammatory hyperpigmentation, with varying degrees of success.

Asia Pacific accounted for the largest share of around 35% of the global hyperpigmentation disorder treatment market in 2021. The market in the region is projected to be highly lucrative during the forecast period. Rise in adoption of laser treatment for several skin diseases, decrease in social taboos & increase in acceptance of pigmentation disorders treatment measures, surge in prevalence of numerous skin disorders, rise in awareness about skin rejuvenation, improvement in lifestyle, and increase in disposable income are expected to drive the market in the region.

Different geographic regions of the world, skin races, and age groups have different epidemiologies for pigmentary disorders. Around 6.9% of the patients in a Northern Indian study on childhood and adolescent dermatoses had pigmentary disorders. According to a study published in the International Journal of Molecular Sciences in 2018, dark-skinned people (South/Southeast Asian, Hispanic/Latin American, and African descent) have a higher prevalence of pigmentary disorders. These are also the third and fourth most common dermatoses in African Americans and Hispanics, respectively. Hence, the market in the region is expected to be driven by high prevalence of pigmentation disorders.

The global hyperpigmentation disorder treatment market is consolidated, with the presence of small number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the major players in the global hyperpigmentation disorder treatment market. Aerolase Corporation, Candela Corporation, Cynosure, Galderma S.A., iSCLINICAL, ISDIN, L'Oréal (SkinCeuticals, Skin betterscience & La Roche-Posay), LumenisBe Ltd., Mesoestetics, Obagi Cosmeceuticals LLC, PCA Skin, Scientis, Senté, and Skin Medica (AbbVie) are the prominent players operating in the global hyperpigmentation disorder treatment market and the hyperpigmentation treatment devices market.

Each of these players has been profiled in the hyperpigmentation disorder treatment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.3 Bn |

|

Market Forecast Value in 2031 |

More than US$ 9.5 Bn |

|

Growth Rate (CAGR) |

8.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global hyperpigmentation disorder treatment market was valued at US$ 4.3 Bn in 2021

The global hyperpigmentation disorder treatment market is projected to reach more than US$ 9.5 Bn by 2031

The global hyperpigmentation disorder treatment market is anticipated to grow at a CAGR of 8.5% from 2022 to 2031

Increase in incidence of melisma & post-inflammatory hyperpigmentation is driving the global hyperpigmentation disorders treatment market.

Asia Pacific is expected to account for major share of the global market during the forecast period.

Aerolase Corporation, Candela Corporation, Cynosure, Galderma S.A., iSCLINICAL, ISDIN, L'Oréal (SkinCeuticals, Skinbetterscience & La Roche-Posay), Lumenis Be Ltd., Mesoestetics, Obagi Cosmeceuticals LLC, PCA Skin, Scientis, Senté, and SkinMedica (AbbVie).

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Hyperpigmentation Disorder Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hyperpigmentation Disorder Treatment Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Key Market Trends

5.2. Merger and Acquisition

5.3. Strategies of Top Five Players Operating in the Market

5.4. Incidence of Orthopedic Disorder, by Key Countries

5.5. Regulatory and Reimbursement Scenario, by Key Countries

6. Global Hyperpigmentation Disorder Treatment Market Analysis and Forecast, by Treatment Type

6.1. Introduction & Definition

6.2. Market Value Forecast, by Treatment Type, 2017–2031

6.2.1. Cosmeceuticals

6.2.2. Laser Therapy

6.2.3. Chemical Peels

6.2.4. Microdermabrasion

6.2.5. Phototherapy

6.2.6. Others

6.3. Market Attractiveness, by Treatment Type

7. Global Hyperpigmentation Disorder Treatment Market Analysis and Forecast, by Disease Indication

7.1. Introduction & Definition

7.2. Market Value Forecast, by Disease Indication, 2017–2031

7.2.1. Melasma

7.2.2. Post-inflammatory Hyperpigmentation

7.2.3. Solar Lentigines

7.2.4. Others

7.3. Market Attractiveness Analysis, by Disease Indication

8. Global Hyperpigmentation Disorder Treatment Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Market Value Forecast, by End-user, 2017–2031

8.2.1. Hospitals

8.2.2. Esthetic Clinics & Dermatology Centers

8.2.3. Others

8.3. Market Attractiveness Analysis, by End-user

9. Global Hyperpigmentation Disorder Treatment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Hyperpigmentation Disorder Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Treatment Type, 2017–2031

10.2.1. Cosmeceuticals

10.2.2. Laser Therapy

10.2.3. Chemical Peels

10.2.4. Microdermabrasion

10.2.5. Phototherapy

10.2.6. Others

10.3. Market Value Forecast, by Disease Indication, 2017–2031

10.3.1. Melasma

10.3.2. Post-inflammatory Hyperpigmentation

10.3.3. Solar Lentigines

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Esthetic Clinics & Dermatology Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Treatment Type

10.6.2. By Disease Indication

10.6.3. By End-user

10.6.4. By Country

11. Europe Hyperpigmentation Disorder Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Treatment Type, 2017–2031

11.2.1. Cosmeceuticals

11.2.2. Laser Therapy

11.2.3. Chemical Peels

11.2.4. Microdermabrasion

11.2.5. Phototherapy

11.2.6. Others

11.3. Market Value Forecast, by Disease Indication, 2017–2031

11.3.1. Melasma

11.3.2. Post-inflammatory Hyperpigmentation

11.3.3. Solar Lentigines

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Esthetic Clinics & Dermatology Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Treatment Type

11.6.2. By Disease Indication

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Hyperpigmentation Disorder Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Treatment Type, 2017–2031

12.2.1. Cosmeceuticals

12.2.2. Laser Therapy

12.2.3. Chemical Peels

12.2.4. Microdermabrasion

12.2.5. Phototherapy

12.2.6. Others

12.3. Market Value Forecast, by Disease Indication, 2017–2031

12.3.1. Melasma

12.3.2. Post-inflammatory Hyperpigmentation

12.3.3. Solar Lentigines

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Esthetic Clinics & Dermatology Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Treatment Type

12.6.2. By Disease Indication

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Hyperpigmentation Disorder Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Treatment Type, 2017–2031

13.2.1. Cosmeceuticals

13.2.2. Laser Therapy

13.2.3. Chemical Peels

13.2.4. Microdermabrasion

13.2.5. Phototherapy

13.2.6. Others

13.3. Market Value Forecast, by Disease Indication, 2017–2031

13.3.1. Melasma

13.3.2. Post-inflammatory Hyperpigmentation

13.3.3. Solar Lentigines

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Esthetic Clinics & Dermatology Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Treatment Type

13.6.2. By Disease Indication

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Hyperpigmentation Disorder Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Treatment Type, 2017–2031

14.2.1. Cosmeceuticals

14.2.2. Laser Therapy

14.2.3. Chemical Peels

14.2.4. Microdermabrasion

14.2.5. Phototherapy

14.2.6. Others

14.3. Market Value Forecast, by Disease Indication, 2017–2031

14.3.1. Melasma

14.3.2. Post-inflammatory Hyperpigmentation

14.3.3. Solar Lentigines

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Esthetic Clinics & Dermatology Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Treatment Type

14.6.2. By Disease Indication

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. Aerolase Corporation

15.3.1.1. Company Overview

15.3.1.2. Treatment Type Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Candela Corporation

15.3.2.1. Company Overview

15.3.2.2. Treatment Type Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Cynosure

15.3.3.1. Company Overview

15.3.3.2. Treatment Type Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.4. Galderma S.A.

15.3.4.1. Company Overview

15.3.4.2. Treatment Type Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. iSCLINICAL

15.3.5.1. Company Overview

15.3.5.2. Treatment Type Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. ISDIN

15.3.6.1. Company Overview

15.3.6.2. Treatment Type Portfolio

15.3.6.3. SWOT Analysis

15.3.7. L'Oréal (SkinCeuticals, Skinbetterscience & La Roche-Posay)

15.3.7.1. Company Overview

15.3.7.2. Treatment Type Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Lumenis Be Ltd.

15.3.8.1. Company Overview

15.3.8.2. Treatment Type Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Mesoestetics

15.3.9.1. Company Overview

15.3.9.2. Treatment Type Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Obagi Cosmeceuticals LLC

15.3.10.1. Company Overview

15.3.10.2. Treatment Type Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. PCA Skin

15.3.11.1. Company Overview

15.3.11.2. Treatment Type Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. Scientis

15.3.12.1. Company Overview

15.3.12.2. Treatment Type Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

15.3.13. Senté Labs

15.3.13.1. Company Overview

15.3.13.2. Treatment Type Portfolio

15.3.13.3. SWOT Analysis

15.3.13.4. Financial Overview

15.3.13.5. Strategic Overview

15.3.14. SkinMedica (AbbVie)

15.3.14.1. Company Overview

15.3.14.2. Treatment Type Portfolio

15.3.14.3. SWOT Analysis

15.3.14.4. Financial Overview

15.3.14.5. Strategic Overview

15.3.15. ZO Skin Health, Inc.

15.3.15.1. Company Overview

15.3.15.2. Treatment Type Portfolio

15.3.15.3. SWOT Analysis

15.3.15.4. Financial Overview

15.3.15.5. Strategic Overview

List of Tables

Table 01: Global Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 02: Global Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 03: Global Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 07: North America Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 08: North America Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 11: Europe Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 12: Europe Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 15: Asia Pacific Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 16: Asia Pacific Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 19: Latin America Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 20: Latin America Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 23: Middle East & Africa Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 24: Middle East & Africa Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Hyperpigmentation Disorder Treatment Market Size (US$ Mn) and Distribution (%), by Region, 2018 and 2031

Figure 02: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn), by Treatment Type, 2021

Figure 03: Global Hyperpigmentation Disorder Treatment Market Value Share, by Treatment Type, 2021

Figure 04: Global Hyperpigmentation Disorder Treatment Market Value Share, by Disease Indication, 2021

Figure 05: Global Hyperpigmentation Disorder Treatment Market Value Share, by End-user, 2021

Figure 06: Global Hyperpigmentation Disorder Treatment Market Value Share, by Region, 2021

Figure 07: Global Hyperpigmentation Disorder Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 08: Global Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Treatment Type, 2017 and 2031

Figure 09: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Phototherapy, 2017–2031

Figure 10: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cosmeceuticals, 2017–2031

Figure 11: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Chemical Peels, 2017–2031

Figure 12: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Microdermabrasion, 2017–2031

Figure 13: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Laser Therapy, 2017–2031

Figure 14: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 15: Global Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Treatment Type, 2022-2031

Figure 16: Global Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 17: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Melasma, 2017–2031

Figure 18: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Post-inflammatory Hyperpigmentation, 2017–2031

Figure 19: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Restorative Surgery, 2017–2031

Figure 20: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 21: Global Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Disease Indication, 2022-2031

Figure 22: Global Hyperpigmentation Disorder Treatment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 23: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2017–2031

Figure 24: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Esthetic Clinics & Dermatology Centers, 2017–2031

Figure 25: Global Hyperpigmentation Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 26: Global Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by End-user, 2022-2031

Figure 27: Global Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Region, 2017 and 2031

Figure 28: Global Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Region, 2022-2031

Figure 29: North America Hyperpigmentation Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 30: North America Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Country, 2017–2031

Figure 31: North America Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Country, 2017 and 2031

Figure 32: North America Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Treatment Type, 2017 and 2031

Figure 33: North America Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 34: North America Hyperpigmentation Disorder Treatment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 35: North America Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 36: North America Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 37:North America Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by End-user, 2022–2031

Figure 38: Europe Hyperpigmentation Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 39: Europe Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 40: Europe Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 41: Europe Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Treatment Type, 2017 and 2031

Figure 42: Europe Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 43: Europe Hyperpigmentation Disorder Treatment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 44: Europe Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 45: Europe Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 46: Europe Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by End-user, 2022–2031

Figure 47: Asia Pacific Hyperpigmentation Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 48: Asia Pacific Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 49: Asia Pacific Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 50: Asia Pacific Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Treatment Type, 2017 and 2031

Figure 51: Asia Pacific Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 52: Asia Pacific Hyperpigmentation Disorder Treatment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 53: Asia Pacific Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 54: Asia Pacific Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 55: Asia Pacific Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by End-user, 2022–2031

Figure 56: Latin America Hyperpigmentation Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 57: Latin America Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 58: Latin America Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 59: Latin America Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Treatment Type, 2017 and 2031

Figure 60: Latin America Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 61: Latin America Hyperpigmentation Disorder Treatment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 62: Latin America Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 63: Latin America Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 64: Latin America Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by End-user, 2022–2031

Figure 65: Middle East & Africa Hyperpigmentation Disorder Treatment Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 66: Middle East & Africa Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 67: Middle East & Africa Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 68: Middle East & Africa Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Treatment Type, 2017 and 2031

Figure 69: Middle East & Africa Hyperpigmentation Disorder Treatment Market Value Share Analysis, by Disease Indication, 2017 and 2031

Figure 70: Middle East & Africa Hyperpigmentation Disorder Treatment Market Value Share Analysis, by End-user, 2017 and 2031

Figure 71: Middle East & Africa Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 72: Middle East & Africa Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 73: Middle East & Africa Hyperpigmentation Disorder Treatment Market Attractiveness Analysis, by End-user, 2022–2031