Analysts’ Viewpoint

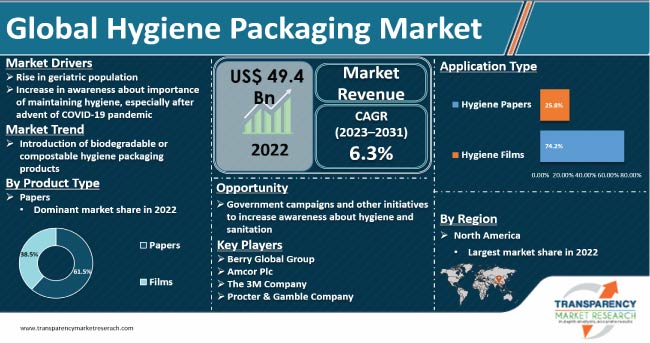

Increase in geriatric population and rise in awareness about the importance of maintaining hygiene, especially after the advent of the COVID-19 pandemic, are the key hygiene packaging market drivers. Growth in disposable income of consumers is also boosting market progress.

Benefits of hygiene packaging such as easy disposability and convenient usage are providing lucrative hygiene packaging market opportunities to manufacturers. Leading players in the global market are adopting the latest technologies to manufacture high-quality hygiene packaging products to expand their global footprint.

Growth in aging population across the globe, especially in Japan, is driving the demand for products related to hygiene. Thus, the sale of tissue paper, which is one of the most common forms of hygiene products, is rising across the globe.

Demand for healthcare products designed for incontinence is high in mature and emerging markets. For instance, the frequency of incontinence among the population over 65 years of age ranges from 15% to 20%. This is leading to a rise in tissue paper consumption to maintain a proper level of sanitation. Thus, the hygiene packaging market assessment appears positive across the globe.

The COVID-19 pandemic has provided significant opportunities for market development. Demand for antibacterial hygiene packaging products increased substantially after the advent of COVID-19, as these products help in reducing the risk of infections and diseases.

Global hygiene packaging films market outlook appears bright in the post-pandemic era owing to the rise in awareness about the importance of maintaining hygiene practices among the people.

Governments of various countries across the globe are taking steps to instill the practice of maintaining hygiene among the population. The COVID-19 pandemic led to an unprecedented rise in demand for hygiene products across the globe.

Thus, according to hygiene packaging market demand analysis, the sales of products such as napkins, kitchen rolls, wipes, tissues, and diapers rose significantly worldwide. Rise in purchasing power of the people, especially in emerging economies such as those in Asia and Latin America, led to an increase in demand for hygiene products. This, in turn, is fueling market expansion.

Companies in the packaging sector are becoming increasingly aware of the detrimental effects of contaminated or unhygienic packaging on their businesses. They are witnessing noticeable changes in the physical and chemical integrity of products. These unfavorable changes affect product quality.

Deterioration in quality of end-products is encouraging such companies to use products that help maintain a high level of hygiene. As per hygiene packaging market sales analysis, major players are adopting innovative solutions with newer product designs that help maintain hygiene practices more effectively.

Increase in usage of antibacterial materials such as triclosan, silver nanoparticles, and chitosan in the manufacture of hygiene packaging products is boosting hygiene packaging market aspects. These materials are designed to inhibit the growth of bacteria and other microorganisms, thus reducing the risk of contamination and infection.

In healthcare settings, antibacterial materials are used in hygiene packaging for medical devices, surgical equipment, and other products that require a high level of sterility. Antibacterial packaging materials help maintain a clean and sterile environment, thus reducing the risk of infection for both patients and medical staff.

In the food and beverages industry, antibacterial packaging materials are used to prevent the growth of bacteria and other microorganisms that can cause spoilage and contamination. These materials help extend the shelf life of products, thus improving their quality and safety. Thus, the beverage napkins market outlook appears positive.

Asia Pacific is anticipated to spearhead the demand for hygiene packaging products across the globe. The business in the region is likely to expand at a CAGR of 8.1% during the forecast period. Thus, Asia Pacific is projected to be the fastest-growing regional market for hygiene packaging products.

Significant increase in awareness about sanitation and hygiene is anticipated to fuel market dynamics of Asia Pacific. Market players in the region are striving to introduce new packaging solutions to further increase their industry share.

China is projected to be the leading country in the market in Asia Pacific in the near future. The country is likely to account for 32.0% share of the business in the region by the end of 2023. China is estimated to be closely followed by India, which is predicted to exhibit a CAGR of 8.4% from 2023 to 2031.

A large number of players operate in the global hygiene packaging sector. Key players are adopting advanced technologies to manufacture products with more moisture absorption, softness, smoothness, and less water consumption qualities.

Companies are also focusing on providing a wider range of products to increase their market share. For instance, Jeesr Industries (Novatis Group), a Morocco-based company that manufactures and converts 100% virgin pulp to tissue paper, offers an extensive range of paper products such as toilet papers, kitchen towels, table napkins, and facial tissues under brand names such as Dalaa, Sany, and Calin.

Leading players in the global hygiene packaging market include Amcor Plc, Essity Aktiebolag (publ), SOFIDEL Group, Georgia-Pacific LLC, Kimberly-Clark Corporation, Amerplast Ltd., Kris Flexipacks Pvt Ltd, Wepa Hygieneprodukte GmbH, Procter & Gamble Company, and Kruger Products L.P.

These companies have been profiled in this research report based on parameters such as financial overview, company overview, business strategies, business segments, application portfolio, and recent developments.

|

Attribute |

Detail |

|---|---|

|

Market Value in 2022 |

US$ 49.4 Bn |

|

Market Forecast Value in 2031 |

US$ 85.5 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 49.4 Bn in 2022

It is expected to expand at a CAGR of 6.3% during 2023 to 2031

It is likely to reach US$ 85.5 Bn by the end of 2031

Rise in geriatric population and increase in awareness about the importance of maintaining hygiene, especially after the advent of the COVID-19 pandemic

Hygiene papers are primarily preferred by consumers

Asia Pacific is estimated to showcase high demand for hygiene packaging during the forecast period

Amcor Limited, Berry Global Group, The 3M Company, Essity Aktiebolag (publ), Sofidel Group, Georgia Pacific LLC, Kimberly-Clark Corporation, Amerplast Ltd., Kris Flexipacks Pvt. Ltd., Wepa Hygieneprodukte GmbH, and Procter & Gamble Company

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Hygiene Packaging Market Overview

3.1. Introduction

3.2. Global Cosmetic Market Overview

3.3. Macroeconomic Factors - Correlation Analysis

3.4. Forecast Factors - Relevance & Impact

3.5. Hygiene Packaging Market Value Chain Analysis

3.5.1. Exhaustive List of Active Participants

3.5.1.1. Manufacturers

3.5.1.2. Distributors & Suppliers

3.5.1.3. End-users

3.5.2. Profitability Margins

3.6. Market Dynamics

3.6.1. Drivers

3.6.2. Restraints

3.6.3. Trends

3.6.4. Opportunities

4. Global Hygiene Packaging Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Size (US$ Bn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Global Hygiene Packaging Market Analysis and Forecast, By Product Type

5.1. Introduction

5.1.1. Market share and Basis Points (BPS) Analysis, By Product Type

5.1.2. Y-o-Y Growth Projections, By Product Type

5.2. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Product Type

5.2.1. Papers

5.2.1.1. At Home

5.2.1.2. Away from Home

5.2.2. Films

5.2.2.1. Microporous

5.2.2.2. Non-porous

5.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

5.3.1. Papers

5.3.1.1. At Home

5.3.1.2. Away from Home

5.3.2. Films

5.3.2.1. Microporous

5.3.2.2. Non-porous

5.4. Market Attractiveness Analysis, By Product Type

6. Global Hygiene Packaging Market Analysis and Forecast, By Application Type

6.1. Introduction

6.1.1. Market Share and Basis Points (BPS) Analysis, By Application Type

6.1.2. Y-o-Y Growth Projections, By Application Type

6.2. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Application Type

6.2.1. Hygiene Papers

6.2.1.1. Folded Tissues

6.2.1.2. Napkins

6.2.1.3. Toilet Rolls

6.2.1.4. Kitchen Rolls

6.2.2. Hygiene Films

6.2.2.1. Diapers

6.2.2.1.1. Baby

6.2.2.1.2. Adult

6.2.2.2. Sanitary Napkins

6.2.2.3. Surgical Clothing

6.2.2.4. Tapes and Laminates

6.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Application Type

6.3.1. Hygiene Papers

6.3.1.1. Folded Tissues

6.3.1.2. Napkins

6.3.1.3. Toilet Rolls

6.3.1.4. Kitchen Rolls

6.3.2. Hygiene Films

6.3.2.1. Diapers

6.3.2.1.1. Baby

6.3.2.1.2. Adult

6.3.2.2. Sanitary Napkins

6.3.2.3. Surgical Clothing

6.3.2.4. Tapes and Laminates

6.4. Market Attractiveness Analysis, By Application Type

7. Global Hygiene Packaging Market Analysis, by Region

7.1. Introduction

7.1.1. Market Share and Basis Points (BPS) Analysis By Region

7.1.2. Y-o-Y Growth Projections By Region

7.2. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Region

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. Asia Pacific

7.2.5. Middle East & Africa (MEA)

7.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031 By Region

7.3.1. North America

7.3.2. Latin America

7.3.3. Europe

7.3.4. Asia Pacific

7.3.5. Middle East & Africa (MEA)

7.4. Market Attractiveness Analysis By Region

8. North America Hygiene Packaging Market Analysis and Forecast

8.1. Introduction

8.1.1. Market Share and Basis Points (BPS) Analysis, By Country

8.1.2. Y-o-Y Growth Projections, By Country

8.2. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Country

8.2.1. U.S.

8.2.2. Canada

8.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Country

8.3.1. U.S.

8.3.2. Canada

8.4. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Product Type

8.4.1. Papers

8.4.1.1. At Home

8.4.1.2. Away from Home

8.4.2. Films

8.4.2.1. Microporous

8.4.2.2. Non-porous

8.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

8.5.1. Papers

8.5.1.1. At Home

8.5.1.2. Away from Home

8.5.2. Films

8.5.2.1. Microporous

8.5.2.2. Non-porous

8.6. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Application Type

8.6.1. Hygiene Papers

8.6.1.1. Folded Tissues

8.6.1.2. Napkins

8.6.1.3. Toilet Rolls

8.6.1.4. Kitchen Rolls

8.6.2. Hygiene Films

8.6.2.1. Diapers

8.6.2.1.1. Baby

8.6.2.1.2. Adult

8.6.2.2. Sanitary Napkins

8.6.2.3. Surgical Clothing

8.6.2.4. Tapes and Laminates

8.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Application Type

8.7.1. Hygiene Papers

8.7.1.1. Folded Tissues

8.7.1.2. Napkins

8.7.1.3. Toilet Rolls

8.7.1.4. Kitchen Rolls

8.7.2. Hygiene Films

8.7.2.1. Diapers

8.7.2.1.1. Baby

8.7.2.1.2. Adult

8.7.2.2. Sanitary Napkins

8.7.2.3. Surgical Clothing

8.7.2.4. Tapes and Laminates

8.8. Market Attractiveness Analysis

8.8.1. By Product Type

8.8.2. By Application Type

9. Latin America Hygiene Packaging Market Analysis and Forecast

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By Country

9.1.2. Y-o-Y Growth Projections, By Country

9.2. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Country

9.2.1. Brazil

9.2.2. Mexico

9.2.3. Argentina

9.2.4. Rest of Latin America

9.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031 By Country

9.3.1. Brazil

9.3.2. Mexico

9.3.3. Argentina

9.3.4. Rest of Latin America

9.4. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Product Type

9.4.1. Papers

9.4.1.1. At Home

9.4.1.2. Away from Home

9.4.2. Films

9.4.2.1. Microporous

9.4.2.2. Non-porous

9.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

9.5.1. Papers

9.5.1.1. At Home

9.5.1.2. Away from Home

9.5.2. Films

9.5.2.1. Microporous

9.5.2.2. Non-porous

9.6. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Application Type

9.6.1. Hygiene Papers

9.6.1.1. Folded Tissues

9.6.1.2. Napkins

9.6.1.3. Toilet Rolls

9.6.1.4. Kitchen Rolls

9.6.2. Hygiene Films

9.6.2.1. Diapers

9.6.2.1.1. Baby

9.6.2.1.2. Adult

9.6.2.2. Sanitary Napkins

9.6.2.3. Surgical Clothing

9.6.2.4. Tapes and Laminates

9.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Application Type

9.7.1. Hygiene Papers

9.7.1.1. Folded Tissues

9.7.1.2. Napkins

9.7.1.3. Toilet Rolls

9.7.1.4. Kitchen Rolls

9.7.2. Hygiene Films

9.7.2.1. Diapers

9.7.2.1.1. Baby

9.7.2.1.2. Adult

9.7.2.2. Sanitary Napkins

9.7.2.3. Surgical Clothing

9.7.2.4. Tapes and Laminates

9.8. Market Attractiveness Analysis

9.8.1. By Product Type

9.8.2. By Application Type

10. Europe Hygiene Packaging Market Analysis and Forecast

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Country

10.2.1. Germany

10.2.2. Spain

10.2.3. Italy

10.2.4. France

10.2.5. U.K.

10.2.6. BENELUX

10.2.7. Nordic

10.2.8. Russia

10.2.9. Poland

10.2.10. Rest of Europe

10.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031 By Country

10.3.1. Germany

10.3.2. Spain

10.3.3. Italy

10.3.4. France

10.3.5. U.K.

10.3.6. BENELUX

10.3.7. Nordic

10.3.8. Russia

10.3.9. Poland

10.3.10. Rest of Europe

10.4. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Product Type

10.4.1. Papers

10.4.1.1. At Home

10.4.1.2. Away from Home

10.4.2. Films

10.4.2.1. Microporous

10.4.2.2. Non-porous

10.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

10.5.1. Papers

10.5.1.1. At Home

10.5.1.2. Away from Home

10.5.2. Films

10.5.2.1. Microporous

10.5.2.2. Non-porous

10.6. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Application Type

10.6.1. Hygiene Papers

10.6.1.1. Folded Tissues

10.6.1.2. Napkins

10.6.1.3. Toilet Rolls

10.6.1.4. Kitchen Rolls

10.6.2. Hygiene Films

10.6.2.1. Diapers

10.6.2.1.1. Baby

10.6.2.1.2. Adult

10.6.2.2. Sanitary Napkins

10.6.2.3. Surgical Clothing

10.6.2.4. Tapes and Laminates

10.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Application Type

10.7.1. Hygiene Papers

10.7.1.1. Folded Tissues

10.7.1.2. Napkins

10.7.1.3. Toilet Rolls

10.7.1.4. Kitchen Rolls

10.7.2. Hygiene Films

10.7.2.1. Diapers

10.7.2.1.1. Baby

10.7.2.1.2. Adult

10.7.2.2. Sanitary Napkins

10.7.2.3. Surgical Clothing

10.7.2.4. Tapes and Laminates

10.8. Market Attractiveness Analysis

10.8.1. By Product Type

10.8.2. By Application Type

11. Asia Pacific Hygiene Packaging Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Country

11.2.1. China

11.2.2. India

11.2.3. Japan

11.2.4. ASEAN

11.2.5. Australia and New Zealand

11.2.6. Rest of APAC

11.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031 By Country

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. ASEAN

11.3.5. Australia and New Zealand

11.3.6. Rest of APAC

11.4. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Product Type

11.4.1. Papers

11.4.1.1. At Home

11.4.1.2. Away from Home

11.4.2. Films

11.4.2.1. Microporous

11.4.2.2. Non-porous

11.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

11.5.1. Papers

11.5.1.1. At Home

11.5.1.2. Away from Home

11.5.2. Films

11.5.2.1. Microporous

11.5.2.2. Non-porous

11.6. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Application Type

11.6.1. Hygiene Papers

11.6.1.1. Folded Tissues

11.6.1.2. Napkins

11.6.1.3. Toilet Rolls

11.6.1.4. Kitchen Rolls

11.6.2. Hygiene Films

11.6.2.1. Diapers

11.6.2.1.1. Baby

11.6.2.1.2. Adult

11.6.2.2. Sanitary Napkins

11.6.2.3. Surgical Clothing

11.6.2.4. Tapes and Laminates

11.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Application Type

11.7.1. Hygiene Papers

11.7.1.1. Folded Tissues

11.7.1.2. Napkins

11.7.1.3. Toilet Rolls

11.7.1.4. Kitchen Rolls

11.7.2. Hygiene Films

11.7.2.1. Diapers

11.7.2.1.1. Baby

11.7.2.1.2. Adult

11.7.2.2. Sanitary Napkins

11.7.2.3. Surgical Clothing

11.7.2.4. Tapes and Laminates

11.8. Market Attractiveness Analysis

11.8.1. By Product Type

11.8.2. By Application Type

12. Middle East & Africa Hygiene Packaging Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Country

12.2.1. North Africa

12.2.2. GCC Countries

12.2.3. South Africa

12.2.4. Turkey

12.2.5. Rest of MEA

12.3. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Country

12.3.1. North Africa

12.3.2. GCC countries

12.3.3. South Africa

12.3.4. Turkey

12.3.5. Rest of MEA

12.4. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Product Type

12.4.1. Papers

12.4.1.1. At Home

12.4.1.2. Away from Home

12.4.2. Films

12.4.2.1. Microporous

12.4.2.2. Non-porous

12.5. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Product Type

12.5.1. Papers

12.5.1.1. At Home

12.5.1.2. Away from Home

12.5.2. Films

12.5.2.1. Microporous

12.5.2.2. Non-porous

12.6. Historical Market Value (US$ Bn) and Volume (Tons), 2017-2022, By Application Type

12.6.1. Hygiene Papers

12.6.1.1. Folded Tissues

12.6.1.2. Napkins

12.6.1.3. Toilet Rolls

12.6.1.4. Kitchen Rolls

12.6.2. Hygiene Films

12.6.2.1. Diapers

12.6.2.1.1. Baby

12.6.2.1.2. Adult

12.6.2.2. Sanitary Napkins

12.6.2.3. Surgical Clothing

12.6.2.4. Tapes and Laminates

12.7. Market Size (US$ Bn) and Volume (Tons) Forecast Analysis 2023-2031, By Application Type

12.7.1. Hygiene Papers

12.7.1.1. Folded Tissues

12.7.1.2. Napkins

12.7.1.3. Toilet Rolls

12.7.1.4. Kitchen Rolls

12.7.2. Hygiene Films

12.7.2.1. Diapers

12.7.2.1.1. Baby

12.7.2.1.2. Adult

12.7.2.2. Sanitary Napkins

12.7.2.3. Surgical Clothing

12.7.2.4. Tapes and Laminates

12.8. Market Attractiveness Analysis

12.8.1. By Product Type

12.8.2. By Application Type

13. Competition Landscape

13.1. Competition Dashboard

13.2. Company Market Share Analysis

13.3. Company Profiles (Details - Overview, Financials, Strategy, Recent Developments, SWOT analysis)

13.4. Competition Deep Dive

13.4.1. Amcor Limited

13.4.1.1. Overview

13.4.1.2. Financials

13.4.1.3. Strategy

13.4.1.4. Recent Developments

13.4.1.5. SWOT Analysis

13.4.2. Berry Global Group

13.4.2.1. Overview

13.4.2.2. Financials

13.4.2.3. Strategy

13.4.2.4. Recent Developments

13.4.2.5. SWOT Analysis

13.4.3. The 3M Company

13.4.3.1. Overview

13.4.3.2. Financials

13.4.3.3. Strategy

13.4.3.4. Recent Developments

13.4.3.5. SWOT Analysis

13.4.4. Essity Aktiebolag (publ)

13.4.4.1. Overview

13.4.4.2. Financials

13.4.4.3. Strategy

13.4.4.4. Recent Developments

13.4.4.5. SWOT Analysis

13.4.5. Sofidel Group

13.4.5.1. Overview

13.4.5.2. Financials

13.4.5.3. Strategy

13.4.5.4. Recent Developments

13.4.5.5. SWOT Analysis

13.4.6. Georgia Pacific LLC

13.4.6.1. Overview

13.4.6.2. Financials

13.4.6.3. Strategy

13.4.6.4. Recent Developments

13.4.6.5. SWOT Analysis

13.4.7. Kimberly-Clark Corporation

13.4.7.1. Overview

13.4.7.2. Financials

13.4.7.3. Strategy

13.4.7.4. Recent Developments

13.4.7.5. SWOT Analysis

13.4.8. Amerplast Ltd.

13.4.8.1. Overview

13.4.8.2. Financials

13.4.8.3. Strategy

13.4.8.4. Recent Developments

13.4.8.5. SWOT Analysis

13.4.9. Kris Flexipacks Pvt. Ltd.

13.4.9.1. Overview

13.4.9.2. Financials

13.4.9.3. Strategy

13.4.9.4. Recent Developments

13.4.9.5. SWOT Analysis

13.4.10. Wepa Hygieneprodukte GmbH

13.4.10.1. Overview

13.4.10.2. Financials

13.4.10.3. Strategy

13.4.10.4. Recent Developments

13.4.10.5. SWOT Analysis

13.4.11. Procter & Gamble Company

13.4.11.1. Overview

13.4.11.2. Financials

13.4.11.3. Strategy

13.4.11.4. Recent Developments

13.4.11.5. SWOT Analysis

13.4.12. Krugar Products L.P.

13.4.12.1. Overview

13.4.12.2. Financials

13.4.12.3. Strategy

13.4.12.4. Recent Developments

13.4.12.5. SWOT Analysis

13.4.13. UFlex Ltd.

13.4.13.1. Overview

13.4.13.2. Financials

13.4.13.3. Strategy

13.4.13.4. Recent Developments

13.4.13.5. SWOT Analysis

13.4.14. Pioneer Hygiene Sales Pvt. Ltd.

13.4.14.1. Overview

13.4.14.2. Financials

13.4.14.3. Strategy

13.4.14.4. Recent Developments

13.4.14.5. SWOT Analysis

13.4.15. Napco National

13.4.15.1. Overview

13.4.15.2. Financials

13.4.15.3. Strategy

13.4.15.4. Recent Developments

13.4.15.5. SWOT Analysis

13.4.16. Henkel Corporation

13.4.16.1. Overview

13.4.16.2. Financials

13.4.16.3. Strategy

13.4.16.4. Recent Developments

13.4.16.5. SWOT Analysis

13.4.17. S.B. Packaging

13.4.17.1. Overview

13.4.17.2. Financials

13.4.17.3. Strategy

13.4.17.4. Recent Developments

13.4.17.5. SWOT Analysis

13.4.18. Trioworld

13.4.18.1. Overview

13.4.18.2. Financials

13.4.18.3. Strategy

13.4.18.4. Recent Developments

13.4.18.5. SWOT Analysis

13.4.19. Polifilm Group

13.4.19.1. Overview

13.4.19.2. Financials

13.4.19.3. Strategy

13.4.19.4. Recent Developments

13.4.19.5. SWOT Analysis

13.4.20. GRANITOL akciová společnost

13.4.20.1. Overview

13.4.20.2. Financials

13.4.20.3. Strategy

13.4.20.4. Recent Developments

13.4.20.5. SWOT Analysis

13.4.21. Cascades Inc.

13.4.21.1. Overview

13.4.21.2. Financials

13.4.21.3. Strategy

13.4.21.4. Recent Developments

13.4.21.5. SWOT Analysis

13.4.22. GDM S.p.A.

13.4.22.1. Overview

13.4.22.2. Financials

13.4.22.3. Strategy

13.4.22.4. Recent Developments

13.4.22.5. SWOT Analysis

13.4.23. Metsä Tissue

13.4.23.1. Overview

13.4.23.2. Financials

13.4.23.3. Strategy

13.4.23.4. Recent Developments

13.4.23.5. SWOT Analysis

13.4.24. Seventh Generation Inc.

13.4.24.1. Overview

13.4.24.2. Financials

13.4.24.3. Strategy

13.4.24.4. Recent Developments

13.4.24.5. SWOT Analysis

13.4.25. Kao Corporation

13.4.25.1. Overview

13.4.25.2. Financials

13.4.25.3. Strategy

13.4.25.4. Recent Developments

13.4.25.5. SWOT Analysis

13.4.26. Ontex Gr

13.4.26.1. Overview

13.4.26.2. Financials

13.4.26.3. Strategy

13.4.26.4. Recent Developments

13.4.26.5. SWOT Analysis

13.4.27. Hengan International Group Company Ltd.

13.4.27.1. Overview

13.4.27.2. Financials

13.4.27.3. Strategy

13.4.27.4. Recent Developments

13.4.27.5. SWOT Analysis

13.4.28. Unicharm Corporation

13.4.28.1. Overview

13.4.28.2. Financials

13.4.28.3. Strategy

13.4.28.4. Recent Developments

13.4.28.5. SWOT Analysis

13.4.29. First Quality Enterprises Inc.

13.4.29.1. Overview

13.4.29.2. Financials

13.4.29.3. Strategy

13.4.29.4. Recent Developments

13.4.29.5. SWOT Analysis

13.4.30. Lohmann GmbH & Co. AG

13.4.30.1. Overview

13.4.30.2. Financials

13.4.30.3. Strategy

13.4.30.4. Recent Developments

13.4.30.5. SWOT Analysis

14. Assumptions and Acronyms Used

15. Research Methodology

List of Tables

Table 01: Global Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Product Type

Table 02: Global Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Product Type

Table 03: Global Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Application Type

Table 04: Global Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Application Type

Table 05: Global Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Region

Table 06: Global Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Region

Table 07: North America Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Country

Table 08: North America Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Country

Table 09: North America Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Product Type and Application Type

Table 10: North America Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Product Type and Application Type

Table 11: Latin America Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Country

Table 12: Latin America Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Country

Table 13: Latin America Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Product Type and Application Type

Table 14: Latin America Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Product Type and Application Type

Table 15: Europe Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Country

Table 16: Europe Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Country

Table 17: Europe Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Product Type and Application Type

Table 18: Europe Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Product Type and Application Type

Table 19: Asia Pacific Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Country

Table 20: Asia Pacific Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Country

Table 21: Asia Pacific Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Product Type and Application Type

Table 22: Asia Pacific Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Product Type and Application Type

Table 23: Middle East & Africa Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Country

Table 24: Middle East & Africa Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Country

Table 25: Middle East & Africa Hygiene Packaging Market Volume (Tons) 2017H-2031F, by Product Type and Application Type

Table 26: Middle East & Africa Hygiene Packaging Market Value (US$ Bn) 2017H-2031F, by Product Type and Application Type

List of Figures

Figure 01: Global Hygiene Packaging Market Share Analysis, Product Type, 2023 (E) - 2031 (F)

Figure 02: Global Hygiene Packaging Market Attractiveness Index, by Product Type (2023 - 2031)

Figure 03: Global Hygiene Packaging Market Share Analysis, Application Type, 2023 (E) - 2031 (F)

Figure 04: Global Hygiene Packaging Market Attractiveness Index, by Application Type (2023 - 2031)

Figure 05: North America Hygiene Packaging Market Share Analysis, Product Type, 2023 (E) - 2031 (F)

Figure 06: North America Hygiene Packaging Market Attractiveness Index, by Product Type (2023 - 2031)

Figure 07: North America Hygiene Packaging Market Share Analysis, Application Type, 2023 (E) - 2031 (F)

Figure 08: North America Hygiene Packaging Market Attractiveness Index, by Application Type (2023 - 2031)

Figure 09: Latin America Hygiene Packaging Market Share Analysis, Product Type, 2023 (E) - 2031 (F)

Figure 10: Latin America Hygiene Packaging Market Attractiveness Index, by Product Type (2023 - 2031)

Figure 11: Latin America Hygiene Packaging Market Share Analysis, Application Type, 2023 (E) - 2031 (F)

Figure 12: Latin America Hygiene Packaging Market Attractiveness Index, by Application Type (2023 - 2031)

Figure 13: Europe Hygiene Packaging Market Share Analysis, Product Type, 2023 (E) - 2031 (F)

Figure 14: Europe Hygiene Packaging Market Attractiveness Index, by Product Type (2023 - 2031)

Figure 15: Europe Hygiene Packaging Market Share Analysis, Application Type, 2023 (E) - 2031 (F)

Figure 16: Europe Hygiene Packaging Market Attractiveness Index, by Application Type (2023 - 2031)

Figure 17: Asia Pacific Hygiene Packaging Market Share Analysis, Product Type, 2023 (E) - 2031 (F)

Figure 18: Asia Pacific Hygiene Packaging Market Attractiveness Index, by Product Type (2023 - 2031)

Figure 19: Asia Pacific Hygiene Packaging Market Share Analysis, Application Type, 2023 (E) - 2031 (F)

Figure 20: Asia Pacific Hygiene Packaging Market Attractiveness Index, by Application Type (2023 - 2031)

Figure 21: Middle East and Africa Hygiene Packaging Market Share Analysis, Product Type, 2023 (E) - 2031 (F)

Figure 22: Middle East and Africa Hygiene Packaging Market Attractiveness Index, by Product Type (2023 - 2031)

Figure 23: Middle East and Africa Hygiene Packaging Market Share Analysis, Application Type, 2023 (E) - 2031 (F)

Figure 24: Middle East and Africa Hygiene Packaging Market Attractiveness Index, by Application Type (2023 - 2031)