Analysts’ Viewpoint

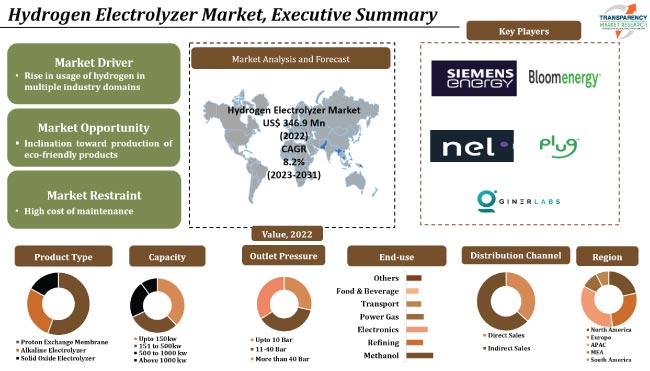

Rise in demand for methanol in various applications, including biofuel, windshield washer fluid, formaldehyde, acetic acid, and fuel cells, is augmenting the hydrogen electrolyzer market. Hydrogen electrolyzer is used to manufacture methanol and is increasingly used in oil refining and ammonia production. This is driving market progress.

Furthermore, the growth in adoption of hydrogen in fuel cells for power generation is expected to positively impact the hydrogen electrolyzer market in the next few years.

Hydrogen electrolyzer manufacturers are shifting toward sustainable hydrogen production, which is more environment-friendly compared to conventional hydrogen electrolyzers. Key players are significantly investing in R&D activities to diversify their product portfolio and broaden their customer base. They are also investing in marketing and branding initiatives to increase their hydrogen electrolyzer market share.

Hydrogen electrolyzer is an apparatus that generates hydrogen using a chemical process (electrolysis). It has the capability to split the oxygen and hydrogen molecules, using electricity. Hydrogen is formed in a sustainable manner through the use of a hydrogen electrolyzer, without releasing carbon dioxide into the atmosphere. This enables the foundation of a decarbonized economy and fuels market progress.

The three major types of hydrogen electrolyzers include polymer electrolyte membrane (PEM), alkaline, and solid oxide. Rise in availability of customizable hydrogen electrolyzer solutions is gaining traction among customers and expanding the electrolytic hydrogen production system.

Manufacturers in the hydrogen electrolyzers market stay ahead of the competitive curve by launching new products with advanced features, higher efficiency, and improved durability.

The oil industry across the world is thriving, which is driving the oil refining sector. Growth of the refining sector is anticipated to play a significant role in augmenting the hydrogen electrolyzer market size, as hydrogen is extensively used in the refining process of oil.

According to the International Energy Agency, in 2023, the global demand for oil is expected to reach 1.9 mb/d. Furthermore, the food processing industry is gaining traction globally. This is expected to fuel the demand for industrial-grade hydrogen electrolyzers, as hydrogen is popularly used to convert unsaturated fats into saturated fats and oils. As per statistical information provided by the Ministry of Food Processing Industries, in 2019-2020, the food processing sector in India generated revenue of US$ 3.02 Mn, which is about 1.69% of Gross Value Added (GVA) in India.

Growth of the chemical industry is anticipated to have a significant impact on hydrogen electrolyzer market development. This can be ascribed to the high demand for hydrogen for the production of chemicals such as ammonia. According to data presented by the American Chemical Society, the U.S. chemical industry witnessed growth of 1.4% in production volume in 2021. Likewise, demand for hydrogen for fertilizer production is expected to offer lucrative opportunities for market expansion. This is driven by the increase in production of fertilizers, thus boosting the hydrogen electrolyzer market demand. As per statistical data released by Fai Delhi.org, in 2021-2022, fertilizer production in India stood at 18.58 million metric tons, which was a growth of 0.5% in comparison with 2020-2021.

On the basis of product type, the hydrogen electrolyzer market has been segmented into proton exchange membrane, alkaline electrolyzer, and solid oxide electrolyzer. Proton exchange membrane is anticipated to be the dominant segment, majorly propelled by the product’s positive attributes, such as its compact design, quick startup, flexibility in input fuel, solidity of the electrolyte, and lightweight nature. These features are driving hydrogen electrolyzer business growth.

According to the latest hydrogen electrolyzer market forecast, Asia Pacific is expected to dominate the global landscape during the forecast period. Thriving growth of different manufacturing industries, which generate high demand for the use of hydrogen, are driving market dynamics in the region.

The hydrogen electrolyzer markets in Europe and North America are projected to witness substantial growth during the forecast period. On the other hand, the Middle East & Africa market has a larger consumer base compared to South America. Nevertheless, the market in South America is expected to experience rapid growth in the next few years owing to the establishment of industrial manufacturing plants in several countries of the region.

The rise in concern for the environment globally is leading to increased adoption of eco-friendly hydrogen electrolyzers and is one of the hydrogen electrolyzer market trends. In August 2021, Ohmium, a US-based company, announced the launch of its first green hydrogen electrolyzer manufacturing unit at Bengaluru, India. Additionally, the increase in production of portable hydrogen electrolyzers is anticipated to spur market development.

Siemens Energy, Nel Hydrogen, Bloom Energy, Giner Inc., Plug Power, McPhy, Pure Energy Centre, Idroenergy, Star Gate Hydrogen, and Enapter are key players operating in this industry.

Key players have been profiled in the hydrogen electrolyzer market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments in the hydrogen electrolyzer.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 346.9 Mn |

|

Market Forecast Value in 2031 |

US$ 702.5 Mn |

|

Growth Rate (CAGR) |

8.2% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 346.9 Mn in 2022.

The CAGR is estimated to be 8.2% during 2023-2031.

Surge in demand for hydrogen in different industry domains and demand for customized products.

Based on product type, the proton exchange membrane segment accounts for leading share.

Asia Pacific is likely to be one of the lucrative regions during the forecast period.

Siemens Energy, Nel Hydrogen, Bloom Energy, Giner Inc., Plug Power, McPhy, Pure Energy Centre, and Idroenergy.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Global Hydrogen Electrolyzer Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projections (US$ Mn)

5.8.2. Market Volume Projections (Thousand Units)

6. Global Hydrogen Electrolyzer Analysis and Forecast, by Product Type

6.1. Global Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

6.1.1. Proton Exchange Membrane

6.1.2. Alkaline Electrolyzer

6.1.3. Solid Oxide Electrolyzer

6.2. Incremental Opportunity, by Product Type

7. Global Hydrogen Electrolyzer Analysis and Forecast, by Capacity

7.1. Global Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Capacity, 2017- 2031

7.1.1. Upto 150 kw

7.1.2. 151 to 500 kw

7.1.3. 500 to 1000 kw

7.1.4. Above 1000 kw

7.2. Incremental Opportunity, by Capacity

8. Global Hydrogen Electrolyzer Analysis and Forecast, by Outlet Pressure

8.1. Global Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), Outlet Pressure, 2017- 2031

8.1.1. Upto 10 Bar

8.1.2. 11-40 Bar

8.1.3. More than 40 Bar

8.2. Incremental Opportunity, by Outlet Pressure

9. Global Hydrogen Electrolyzer Analysis and Forecast, by End-use

9.1. Global Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

9.1.1. Methanol

9.1.2. Refining

9.1.3. Electronics

9.1.4. Power Gas

9.1.5. Transport

9.1.6. Food & Beverage

9.1.7. Others (Fabrication, Metal Production, etc.)

9.2. Incremental Opportunity, by End Use

10. Global Hydrogen Electrolyzer Analysis and Forecast, by Distribution Channel

10.1. Global Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. Global Hydrogen Electrolyzer Analysis and Forecast, by Region

11.1. Global Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Region, 2017- 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America Hydrogen Electrolyzer Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. COVID-19 Impact Analysis

12.4. Key Trends Analysis

12.4.1. Supply side

12.4.2. Demand Side

12.5. Price Trend Analysis

12.5.1. Weighted Average Selling Price (US$)

12.6. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

12.6.1. Proton Exchange Membrane

12.6.2. Alkaline Electrolyzer

12.6.3. Solid Oxide Electrolyzer

12.7. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Capacity, 2017- 2031

12.7.1. Upto 150 kw

12.7.2. 151 to 500 kw

12.7.3. 500 to 1000 kw

12.7.4. Above 1000 kw

12.8. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Outlet Pressure, 2017- 2031

12.8.1. Upto 10 Bar

12.8.2. 11-40 Bar

12.8.3. More than 40 Bar

12.9. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

12.9.1. Methanol

12.9.2. Refining

12.9.3. Electronics

12.9.4. Power Gas

12.9.5. Transport

12.9.6. Food & Beverage

12.9.7. Others (Fabrication, Metal Production, etc.)

12.10. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

12.10.1. Direct Sales

12.10.2. Indirect Sales

12.11. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

12.11.1. U.S.

12.11.2. Canada

12.11.3. Rest of North America

12.12. Incremental Opportunity Analysis

13. Europe Hydrogen Electrolyzer Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. COVID-19 Impact Analysis

13.4. Key Trends Analysis

13.4.1. Supply side

13.4.2. Demand Side

13.5. Price Trend Analysis

13.5.1. Weighted Average Selling Price (US$)

13.6. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

13.6.1. Proton Exchange Membrane

13.6.2. Alkaline Electrolyzer

13.6.3. Solid Oxide Electrolyzer

13.7. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Capacity, 2017- 2031

13.7.1. Upto 150 kw

13.7.2. 151 to 500 kw

13.7.3. 500 to 1000 kw

13.7.4. Above 1000 kw

13.8. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Outlet Pressure, 2017- 2031

13.8.1. Upto 10 Bar

13.8.2. 11-40 Bar

13.8.3. More than 40 Bar

13.9. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

13.9.1. Methanol

13.9.2. Refining

13.9.3. Electronics

13.9.4. Power Gas

13.9.5. Transport

13.9.6. Food & Beverage

13.9.7. Others (Fabrication, Metal Production, etc.)

13.10. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

13.10.1. Direct Sales

13.10.2. Indirect Sales

13.11. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

13.11.1. U.K.

13.11.2. Germany

13.11.3. France

13.11.4. Rest of Europe

13.12. Incremental Opportunity Analysis

14. Asia Pacific Hydrogen Electrolyzer Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. COVID-19 Impact Analysis

14.4. Key Trends Analysis

14.4.1. Supply side

14.4.2. Demand Side

14.5. Price Trend Analysis

14.5.1. Weighted Average Selling Price (US$)

14.6. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

14.6.1. Proton Exchange Membrane

14.6.2. Alkaline Electrolyzer

14.6.3. Solid Oxide Electrolyzer

14.7. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Capacity, 2017- 2031

14.7.1. Upto 150 kw

14.7.2. 151 to 500 kw

14.7.3. 500 to 1000 kw

14.7.4. Above 1000 kw

14.8. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Outlet Pressure, 2017- 2031

14.8.1. Upto 10 Bar

14.8.2. 11-40 Bar

14.8.3. More than 40 Bar

14.9. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

14.9.1. Methanol

14.9.2. Refining

14.9.3. Electronics

14.9.4. Power Gas

14.9.5. Transport

14.9.6. Food & Beverage

14.9.7. Others (Fabrication, Metal Production, etc.)

14.10. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

14.10.1. Direct Sales

14.10.2. Indirect Sales

14.11. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

14.11.1. China

14.11.2. India

14.11.3. Japan

14.11.4. Rest of Asia Pacific

14.12. Incremental Opportunity Analysis

15. Middle East & Africa Hydrogen Electrolyzer Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. COVID-19 Impact Analysis

15.4. Key Trends Analysis

15.4.1. Supply side

15.4.2. Demand Side

15.5. Price Trend Analysis

15.5.1. Weighted Average Selling Price (US$)

15.6. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

15.6.1. Proton Exchange Membrane

15.6.2. Alkaline Electrolyzer

15.6.3. Solid Oxide Electrolyzer

15.7. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Capacity, 2017- 2031

15.7.1. Upto 150 kw

15.7.2. 151 to 500 kw

15.7.3. 500 to 1000 kw

15.7.4. Above 1000 kw

15.8. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Outlet Pressure, 2017- 2031

15.8.1. Upto 10 Bar

15.8.2. 11-40 Bar

15.8.3. More than 40 Bar

15.9. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

15.9.1. Methanol

15.9.2. Refining

15.9.3. Electronics

15.9.4. Power Gas

15.9.5. Transport

15.9.6. Food & Beverage

15.9.7. Others (Fabrication, Metal Production, etc.)

15.10. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

15.10.1. Direct Sales

15.10.2. Indirect Sales

15.11. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

15.11.1. GCC

15.11.2. South Africa

15.11.3. Rest of Middle East & Africa

15.12. Incremental Opportunity Analysis

16. South America Hydrogen Electrolyzer Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. COVID-19 Impact Analysis

16.4. Key Trends Analysis

16.4.1. Supply side

16.4.2. Demand Side

16.5. Price Trend Analysis

16.5.1. Weighted Average Selling Price (US$)

16.6. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

16.6.1. Proton Exchange Membrane

16.6.2. Alkaline Electrolyzer

16.6.3. Solid Oxide Electrolyzer

16.7. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Capacity, 2017- 2031

16.7.1. Upto 150 kw

16.7.2. 151 to 500 kw

16.7.3. 500 to 1000 kw

16.7.4. Above 1000 kw

16.8. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Outlet Pressure, 2017- 2031

16.8.1. Upto 10 Bar

16.8.2. 11-40 Bar

16.8.3. More than 40 Bar

16.9. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by End-use, 2017- 2031

16.9.1. Methanol

16.9.2. Refining

16.9.3. Electronics

16.9.4. Power Gas

16.9.5. Transport

16.9.6. Food & Beverage

16.9.7. Others (Fabrication, Metal Production, etc.)

16.10. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

16.10.1. Direct Sales

16.10.2. Indirect Sales

16.11. Hydrogen Electrolyzer Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

16.11.1. Brazil

16.11.2. Rest of South America

16.12. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2022)

17.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

17.3.1. Siemens Energy

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Financial Information

17.3.1.4. (Subject to Data Availability)

17.3.1.5. Business Strategies / Recent Developments

17.3.2. Nel Hydrogen

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Financial Information

17.3.2.4. (Subject to Data Availability)

17.3.2.5. Business Strategies / Recent Developments

17.3.3. Bloom Energy

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Financial Information

17.3.3.4. (Subject to Data Availability)

17.3.3.5. Business Strategies / Recent Developments

17.3.4. Giner Inc.

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Financial Information

17.3.4.4. (Subject to Data Availability)

17.3.4.5. Business Strategies / Recent Developments

17.3.5. Plug Power

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Financial Information

17.3.5.4. (Subject to Data Availability)

17.3.5.5. Business Strategies / Recent Developments

17.3.6. McPhy

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Financial Information

17.3.6.4. (Subject to Data Availability)

17.3.6.5. Business Strategies / Recent Developments

17.3.7. Pure Energy Centre

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Financial Information

17.3.7.4. (Subject to Data Availability)

17.3.7.5. Business Strategies / Recent Developments

17.3.8. Idroenergy

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Financial Information

17.3.8.4. (Subject to Data Availability)

17.3.8.5. Business Strategies / Recent Developments

17.3.9. Star Gate Hydrogen

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Financial Information

17.3.9.4. (Subject to Data Availability)

17.3.9.5. Business Strategies / Recent Developments

17.3.10. Enapter

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Financial Information

17.3.10.4. (Subject to Data Availability)

17.3.10.5. Business Strategies / Recent Developments

18. Go to Strategy

18.1. Identification of Potential Market Spaces

18.2. Understanding the Procurement Process of End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Table 2: Global Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Table 3: Global Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Table 4: Global Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Table 5: Global Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Table 6: Global Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Table 7: Global Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Table 8: Global Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Table 9: Global Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Table 10: Global Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Table 11: Global Hydrogen Electrolyzer Market, By Region Thousand Units, 2017-2031

Table 12: Global Hydrogen Electrolyzer Market, By Region US$ Mn, 2017-2031

Table 13: North America Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Table 14: North America Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Table 15: North America Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Table 16: North America Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Table 17: North America Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Table 18: North America Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Table 19: North America Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Table 20: North America Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Table 21: North America Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Table 22: North America Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Table 23: North America Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Table 24: North America Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

Table 25: Europe Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Table 26: Europe Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Table 27: Europe Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Table 28: Europe Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Table 29: Europe Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Table 30: Europe Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Table 31: Europe Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Table 32: Europe Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Table 33: Europe Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Table 34: Europe Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Table 35: Europe Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Table 36: Europe Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

Table 37: Asia Pacific Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Table 38: Asia Pacific Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Table 39: Asia Pacific Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Table 40: Asia Pacific Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Table 41: Asia Pacific Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Table 42: Asia Pacific Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Table 43: Asia Pacific Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Table 44: Asia Pacific Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Table 45: Asia Pacific Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Table 46: Asia Pacific Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Table 47: Asia Pacific Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Table 48: Asia Pacific Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

Table 49: Middle East & Africa Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Table 50: Middle East & Africa Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Table 51: Middle East & Africa Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Table 52: Middle East & Africa Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Table 53: Middle East & Africa Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Table 54: Middle East & Africa Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Table 55: Middle East & Africa Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Table 56: Middle East & Africa Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Table 57: Middle East & Africa Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Table 58: Middle East & Africa Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Table 59: Middle East & Africa Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Table 60: Middle East & Africa Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

Table 61: South America Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Table 62: South America Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Table 63: South America Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Table 64: South America Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Table 65: South America Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Table 66: South America Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Table 67: South America Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Table 68: South America Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Table 69: South America Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Table 70: South America Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Table 71: South America Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Table 72: South America Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

List of Figures

Figure 1: Global Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Figure 2: Global Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Figure 3: Global Hydrogen Electrolyzer Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 4: Global Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Figure 5: Global Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Figure 6: Global Hydrogen Electrolyzer Market Incremental Opportunity, By Capacity, US$ Mn, 2017-2031

Figure 7: Global Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Figure 8: Global Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Figure 9: Global Hydrogen Electrolyzer Market Incremental Opportunity, By Outlet Pressure, US$ Mn, 2017-2031

Figure 10: Global Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Figure 11: Global Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Figure 12: Global Hydrogen Electrolyzer Market Incremental Opportunity, By End Use, US$ Mn, 2017-2031

Figure 13: Global Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 14: Global Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 15: Global Hydrogen Electrolyzer Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 16: Global Hydrogen Electrolyzer Market, By Region Thousand Units, 2017-2031

Figure 17: Global Hydrogen Electrolyzer Market, By Region US$ Mn, 2017-2031

Figure 18: Global Hydrogen Electrolyzer Market Incremental Opportunity, By Region US$ Mn, 2017-2031

Figure 19: North America Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Figure 20: North America Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Figure 21: North America Hydrogen Electrolyzer Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 22: North America Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Figure 23: North America Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Figure 24: North America Hydrogen Electrolyzer Market Incremental Opportunity, By Capacity, US$ Mn, 2017-2031

Figure 25: North America Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Figure 26: North America Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Figure 27: North America Hydrogen Electrolyzer Market Incremental Opportunity, By Outlet Pressure, US$ Mn, 2017-2031

Figure 28: North America Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Figure 29: North America Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Figure 30: North America Hydrogen Electrolyzer Market Incremental Opportunity, By End Use, US$ Mn, 2017-2031

Figure 31: North America Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 32: North America Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 33: North America Hydrogen Electrolyzer Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 34: North America Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Figure 35: North America Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

Figure 36: North America Hydrogen Electrolyzer Market Incremental Opportunity, By Country US$ Mn, 2017-2031

Figure 37: Europe Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Figure 38: Europe Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Figure 39: Europe Hydrogen Electrolyzer Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 40: Europe Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Figure 41: Europe Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Figure 42: Europe Hydrogen Electrolyzer Market Incremental Opportunity, By Capacity, US$ Mn, 2017-2031

Figure 43: Europe Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Figure 44: Europe Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Figure 45: Europe Hydrogen Electrolyzer Market Incremental Opportunity, By Outlet Pressure, US$ Mn, 2017-2031

Figure 46: Europe Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Figure 47: Europe Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Figure 48: Europe Hydrogen Electrolyzer Market Incremental Opportunity, By End Use, US$ Mn, 2017-2031

Figure 49: Europe Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 50: Europe Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 51: Europe Hydrogen Electrolyzer Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 52: Europe Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Figure 53: Europe Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

Figure 54: Europe Hydrogen Electrolyzer Market Incremental Opportunity, By Country US$ Mn, 2017-2031

Figure 55: Asia Pacific Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Figure 56: Asia Pacific Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Figure 57: Asia Pacific Hydrogen Electrolyzer Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 58: Asia Pacific Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Figure 59: Asia Pacific Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Figure 60: Asia Pacific Hydrogen Electrolyzer Market Incremental Opportunity, By Capacity, US$ Mn, 2017-2031

Figure 61: Asia Pacific Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Figure 62: Asia Pacific Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Figure 63: Asia Pacific Hydrogen Electrolyzer Market Incremental Opportunity, By Outlet Pressure, US$ Mn, 2017-2031

Figure 64: Asia Pacific Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Figure 65: Asia Pacific Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Figure 66: Asia Pacific Hydrogen Electrolyzer Market Incremental Opportunity, By End Use, US$ Mn, 2017-2031

Figure 67: Asia Pacific Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 68: Asia Pacific Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 69: Asia Pacific Hydrogen Electrolyzer Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 70: Asia Pacific Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Figure 71: Asia Pacific Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

Figure 72: Asia Pacific Hydrogen Electrolyzer Market Incremental Opportunity, By Country US$ Mn, 2017-2031

Figure 73: Middle East & Africa Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Figure 75: Middle East & Africa Hydrogen Electrolyzer Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 76: Middle East & Africa Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Figure 77: Middle East & Africa Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Figure 78: Middle East & Africa Hydrogen Electrolyzer Market Incremental Opportunity, By Capacity, US$ Mn, 2017-2031

Figure 79: Middle East & Africa Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Figure 80: Middle East & Africa Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Figure 81: Middle East & Africa Hydrogen Electrolyzer Market Incremental Opportunity, By Outlet Pressure, US$ Mn, 2017-2031

Figure 82: Middle East & Africa Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Figure 83: Middle East & Africa Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Figure 84: Middle East & Africa Hydrogen Electrolyzer Market Incremental Opportunity, By End Use, US$ Mn, 2017-2031

Figure 85: Middle East & Africa Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 86: Middle East & Africa Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 87: Middle East & Africa Hydrogen Electrolyzer Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 88: Middle East & Africa Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Figure 89: Middle East & Africa Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

Figure 90: Middle East & Africa Hydrogen Electrolyzer Market Incremental Opportunity, By Country US$ Mn, 2017-2031

Figure 91: South America Hydrogen Electrolyzer Market, By Product Type, Thousand Units, 2017-2031

Figure 92: South America Hydrogen Electrolyzer Market, By Product Type, US$ Mn, 2017-2031

Figure 93: South America Hydrogen Electrolyzer Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 94: South America Hydrogen Electrolyzer Market, By Capacity, Thousand Units, 2017-2031

Figure 95: South America Hydrogen Electrolyzer Market, By Capacity, US$ Mn, 2017-2031

Figure 96: South America Hydrogen Electrolyzer Market Incremental Opportunity, By Capacity, US$ Mn, 2017-2031

Figure 97: South America Hydrogen Electrolyzer Market, By Outlet Pressure, Thousand Units, 2017-2031

Figure 98: South America Hydrogen Electrolyzer Market, By Outlet Pressure, US$ Mn, 2017-2031

Figure 99: South America Hydrogen Electrolyzer Market Incremental Opportunity, By Outlet Pressure, US$ Mn, 2017-2031

Figure 100: South America Hydrogen Electrolyzer Market, By End-use, Thousand Units, 2017-2031

Figure 101: South America Hydrogen Electrolyzer Market, By End-use, US$ Mn, 2017-2031

Figure 102: South America Hydrogen Electrolyzer Market Incremental Opportunity, By End Use, US$ Mn, 2017-2031

Figure 103: South America Hydrogen Electrolyzer Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 104: South America Hydrogen Electrolyzer Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 105: South America Hydrogen Electrolyzer Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 106: South America Hydrogen Electrolyzer Market, By Country Thousand Units, 2017-2031

Figure 107: South America Hydrogen Electrolyzer Market, By Country US$ Mn, 2017-2031

Figure 108: South America Hydrogen Electrolyzer Market Incremental Opportunity, By Country US$ Mn, 2017-2031