Worldwide the COVID-19 (coronavirus) outbreak has created major challenges for clinicians. Lack of proven pharmacological therapies for the treatment of COVID-19 has resulted in increased mortality rates. Corticosteroids were extensively used during outbreaks of Severe Acute Respiratory Syndrome (SARS)-CoV as well as the Middle East Respiratory Syndrome (MERS)-CoV. This technique has led to the application of corticosteroids for COVID-19 patient, in combination with other therapeutic agents. However, the WHO (World Health Organization) advises against the use of corticosteroids due to the lack of reliable clinical evidence. Thus, companies in the hydrocortisone market are unable to capitalize on the needs of COVID-19 patients when actually there is an unprecedented demand for drugs that fight off the infection.

Companies in the hydrocortisone market are increasing efforts to identify the harm and benefits caused by corticosteroids for the treatment of coronavirus.

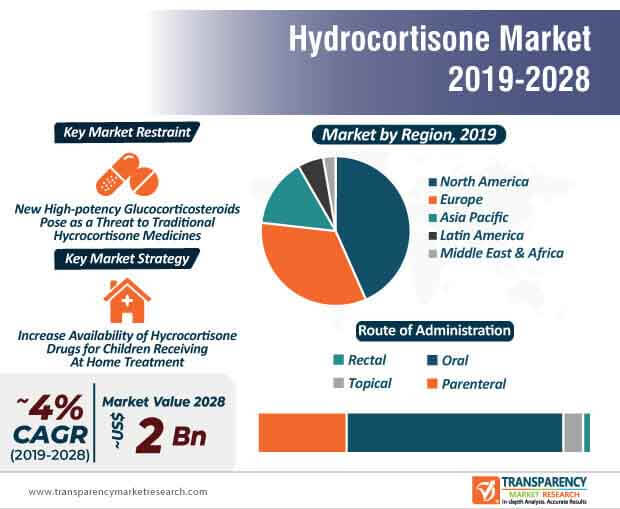

Several children are prone to the risks of adrenal insufficiency, since they are unable to mount an endogenous cortisol response to stress. Such children usually receive treatment at home by seeking telephone advices from doctors. Thus, companies in the hydrocortisone market should tap into opportunities in child care to broaden their revenue streams. As such, adrenocortical insufficiency is one of the key medical indications that demand hydrocortisone drugs and the market is predicted to reach a value of ~US$ 2 Bn by the end of 2028.

Many children are administered oral corticosteroids such as hydrocortisone, dexamethasone, and prednisolone on a daily basis since adrenocortical insufficiency is potentially life threatening. Problems arising from such medical conditions have fueled the demand for steroid medicines that are generally administered intramuscularly or intravenously, depending on the severity of the clinical situation. Companies in the hydrocortisone market are increasing the availability of hydrocortisone sodium succinate and hydrocortisone sodium phosphate for treatment of children that require extra steroids.

Companies in the hydrocortisone market are introducing medicines that do not require a prescription. For instance, in May 2019, Aflofarm— a supplier of Over the Counter drugs (OTC) and medical devices, announced the launch of Maxicortan, a medicine with double dose of hydrocortisone that can be applied locally on skin inflammations and caters to individuals with atopic dermatitis. As such, dermatitis is one the key medical indications that is creating incremental opportunities for companies in the hydrocortisone market. Therapeutic indications such as allergic contact dermatitis, urticarial, and skin reactions after insect bites are also creating revenue streams for pharmaceutical companies.

On the other hand, dual release hydrocortisone is becoming popular as a metabolism improver agent for patients with adrenal insufficiency. Healthcare professionals are recommending once daily dual release hydrocortisone to provide adequate cortisol exposure time. Since conventional GC (Glucocorticoid) therapy is associated with increased morbidity and mortality, gradual increase in the dosage of dual release hydrocortisone has helped to improve hypoadrenalism patient quality of life.

Septic shock is a life-threatening condition that has led to high mortality rates. Hence, clinicians recommend corticosteroids such as hydrocortisone to reduce the severity of trauma caused in patients. As such, hydrocortisone medicines are subject to intensive investigation in several clinical trials. Currently, low-dose hydrocortisone is being highly publicized for shock reversal, resulting in lesser adverse events among patients. This has led to better clinical outcomes as compared to placebo.

Although hydrocortisone aids in faster resolution of shock than placebo, the optimal dosage for hemodynamic support during septic shock is still unclear. This explains why the hydrocortisone market is progressing at a modest CAGR of ~4% during the forecast period, due to lack of reliable clinical evidence. However, growing awareness about the lowest initial dose of hydrocortisone in adults is helping to revive growth for the hydrocortisone market. This awareness is increasing as a result of the rise in the number of randomized clinical trials.

Analysts’ Viewpoint

The evidences of harm and benefits of corticosteroids have gained prime importance for companies in the hydrocortisone market amidst the coronavirus outbreak. Hydrocortisone medicines are being increasingly used as adjunctive treatment to septic shock.

The glucocorticoid treatment is being combined with hydrocortisone or cortisone acetate for the treatment of adrenal insufficiency (AI) patients. However, this combination treatment has led to overexposure toward GCs, resulting in metabolic dysfunction. Hence, companies should increase awareness of once daily dual release hydrocortisone dose that gradually increases dosage content among AI patients. Companies should gain efficacy in no prescription medicines to increase product uptake among individuals with therapeutic indications such as dermatitis.

The global hydrocortisone market was worth US$ 1 Bn and is projected to reach a value of US$ 2 Bn by the end of 2028

Hydrocortisone market is anticipated to grow at a CAGR of 4% during the forecast period

North America accounted for a major share of the global hydrocortisone market

Hydrocortisone market is driven by rise in cases of adrenocortical insufficiency and increase in investment in research & development are projected to drive the global market during the forecast period

Key players in the global hydrocortisone market include Pfizer, Inc., Novartis AG, Mylan N.V., Hikma Pharmaceuticals Plc, GlaxoSmithKline plc, Cipla Inc., Sun Pharmaceutical Industries Ltd., Abbott Laboratories, and Bayer AG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Hydrocortisone Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hydrocortisone Market Analysis and Forecast, 2018–2028

5. Key Insights

5.1. Regulatory Scenario, by Region/globally

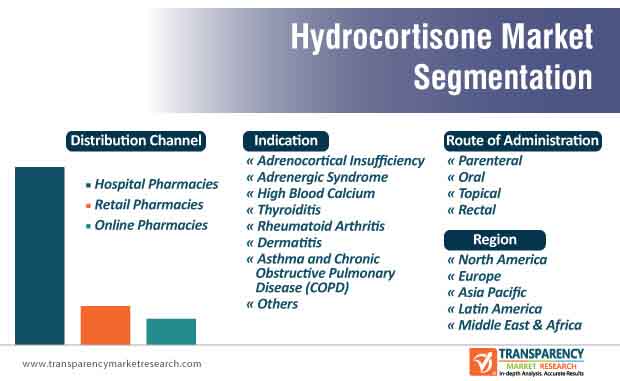

6. Global Hydrocortisone Market Analysis and Forecast, by Indication

6.1. Introduction

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Indication, 2018–2028

6.3.1. Adrenocortical Insufficiency

6.3.2. Adrenergic Syndrome

6.3.3. High Blood Calcium

6.3.4. Thyroiditis

6.3.5. Rheumatoid Arthritis

6.3.6. Dermatitis

6.3.7. Asthma and Chronic Obstructive Pulmonary Disease (COPD)

6.3.8. Others

6.4. Market Attractiveness, by Indication

7. Global Hydrocortisone Market Analysis and Forecast, by Route of Administration

7.1. Introduction

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Route of Administration, 2018–2028

7.3.1. Parenteral

7.3.2. Oral

7.3.3. Topical

7.3.4. Rectal

7.4. Market Attractiveness, by Route of Administration

8. Global Hydrocortisone Market Analysis and Forecast, by Distribution Channel

8.1. Introduction

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2018–2028

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness, by Distribution Channel

9. Global Hydrocortisone Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Hydrocortisone Market Analysis and Forecast

10.1. Introduction

10.2. Market Value Forecast, by Indication, 2018–2028

10.2.1. Adrenocortical Insufficiency

10.2.2. Adrenergic Syndrome

10.2.3. High Blood Calcium

10.2.4. Thyroiditis

10.2.5. Rheumatoid Arthritis

10.2.6. Dermatitis

10.2.7. Asthma and Chronic Obstructive Pulmonary Disease (COPD)

10.2.8. Others

10.3. Market Value Forecast, by Route of Administration, 2018–2028

10.3.1. Parenteral

10.3.2. Oral

10.3.3. Topical

10.3.4. Rectal

10.4. Market Value Forecast, by Distribution Channel, 2018–2028

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2018–2028

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Indication

10.6.2. By Route of Administration

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Hydrocortisone Market Analysis and Forecast

11.1. Introduction

11.2. Market Value Forecast, by Indication, 2018–2028

11.2.1. Adrenocortical Insufficiency

11.2.2. Adrenergic Syndrome

11.2.3. High Blood Calcium

11.2.4. Thyroiditis

11.2.5. Rheumatoid Arthritis

11.2.6. Dermatitis

11.2.7. Asthma and Chronic Obstructive Pulmonary Disease (COPD)

11.2.8. Others

11.3. Market Value Forecast, by Route of Administration, 2018–2028

11.3.1. Parenteral

11.3.2. Oral

11.3.3. Topical

11.3.4. Rectal

11.4. Market Value Forecast, by Distribution Channel, 2018–2028

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2018–2028

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Indication

11.6.2. By Route of Administration

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Hydrocortisone Market Analysis and Forecast

12.1. Introduction

12.2. Market Value Forecast, by Indication, 2018–2028

12.2.1. Adrenocortical Insufficiency

12.2.2. Adrenergic Syndrome

12.2.3. High Blood Calcium

12.2.4. Thyroiditis

12.2.5. Rheumatoid Arthritis

12.2.6. Dermatitis

12.2.7. Asthma and Chronic Obstructive Pulmonary Disease (COPD)

12.2.8. Others

12.3. Market Value Forecast, by Route of Administration, 2018–2028

12.3.1. Parenteral

12.3.2. Oral

12.3.3. Topical

12.3.4. Rectal

12.4. Market Value Forecast, by Distribution Channel, 2018–2028

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2018–2028

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Indication

12.6.2. By Route of Administration

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Hydrocortisone Market Analysis and Forecast

13.1. Introduction

13.2. Market Value Forecast, by Indication, 2018–2028

13.2.1. Adrenocortical Insufficiency

13.2.2. Adrenergic Syndrome

13.2.3. High Blood Calcium

13.2.4. Thyroiditis

13.2.5. Rheumatoid Arthritis

13.2.6. Dermatitis

13.2.7. Asthma and Chronic Obstructive Pulmonary Disease (COPD)

13.2.8. Others

13.3. Market Value Forecast, by Route of Administration, 2018–2028

13.3.1. Parenteral

13.3.2. Oral

13.3.3. Topical

13.3.4. Rectal

13.4. Market Value Forecast, by Distribution Channel, 2018–2028

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2018–2028

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Indication

13.6.2. By Route of Administration

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Hydrocortisone Market Analysis and Forecast

14.1. Introduction

14.2. Market Value Forecast, by Indication, 2018–2028

14.2.1. Adrenocortical Insufficiency

14.2.2. Adrenergic Syndrome

14.2.3. High Blood Calcium

14.2.4. Thyroiditis

14.2.5. Rheumatoid Arthritis

14.2.6. Dermatitis

14.2.7. Asthma and Chronic Obstructive Pulmonary Disease (COPD)

14.2.8. Others

14.3. Market Value Forecast, by Route of Administration, 2018–2028

14.3.1. Parenteral

14.3.2. Oral

14.3.3. Topical

14.3.4. Rectal

14.4. Market Value Forecast, by Distribution Channel, 2018–2028

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2018–2028

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Indication

14.6.2. By Route of Administration

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Company Profiles

15.1. Pfizer, Inc.

15.1.1.1. Company Overview

15.1.1.2. Company Financials

15.1.1.3. Growth Strategies

15.1.1.4. SWOT Analysis

15.2. Novartis AG

15.2.1.1. Company Overview

15.2.1.2. Company Financials

15.2.1.3. Growth Strategies

15.2.1.4. SWOT Analysis

15.3. Mylan N.V.

15.3.1.1. Company Overview

15.3.1.2. Company Financials

15.3.1.3. Growth Strategies

15.3.1.4. SWOT Analysis

15.4. Hikma Pharmaceuticals Plc

15.4.1.1. Company Overview

15.4.1.2. Company Financials

15.4.1.3. Growth Strategies

15.4.1.4. SWOT Analysis

15.5. GlaxoSmithKline plc

15.5.1.1. Company Overview

15.5.1.2. Company Financials

15.5.1.3. Growth Strategies

15.5.1.4. SWOT Analysis

15.6. Cipla Inc.

15.6.1.1. Company Overview

15.6.1.2. Company Financials

15.6.1.3. Growth Strategies

15.6.1.4. SWOT Analysis

15.7. Sun Pharmaceutical Industries Ltd.

15.7.1.1. Company Overview

15.7.1.2. Company Financials

15.7.1.3. Growth Strategies

15.7.1.4. SWOT Analysis

15.8. Abbott Laboratories

15.8.1.1. Company Overview

15.8.1.2. Company Financials

15.8.1.3. Growth Strategies

15.8.1.4. SWOT Analysis

15.9. Bayer AG

15.9.1.1. Company Overview

15.9.1.2. Company Financials

15.9.1.3. Growth Strategies

15.9.1.4. SWOT Analysis

List of Tables

Table 01: Comparison of Regulatory Requirements for Generic Drugs Dossier Submission in the U.S. and Canada

Table 02: Global Hydrocortisone Market Value (US$ Mn) Forecast, by Indication, 2018–2028

Table 03: Global Hydrocortisone Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2028

Table 04: Global Hydrocortisone Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2028

Table 05: Global Hydrocortisone Market Value (US$ Mn) Forecast, by Region, 2018–2028

Table 06: North America Hydrocortisone Market Value (US$ Mn) Forecast, by Indication, 2018–2028

Table 07: North America Hydrocortisone Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2028

Table 08: North America Hydrocortisone Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2028

Table 09: North America Hydrocortisone Market Value (US$ Mn) Forecast, by Country, 2018–2028

Table 10: Europe Hydrocortisone Market Value (US$ Mn) Forecast, by Indication, 2018–2028

Table 11: Europe Hydrocortisone Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2028

Table 12: Europe Hydrocortisone Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2028

Table 13: Europe Hydrocortisone Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 14: Asia Pacific Hydrocortisone Market Value (US$ Mn) Forecast, by Indication, 2018–2028

Table 15: Asia Pacific Hydrocortisone Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2028

Table 16: Asia Pacific Hydrocortisone Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2028

Table 17: Asia Pacific Hydrocortisone Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 18: Latin America Hydrocortisone Market Value (US$ Mn) Forecast, by Indication, 2018–2028

Table 19: Latin America Hydrocortisone Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2028

Table 20: Latin America Hydrocortisone Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2028

Table 21: Latin America Hydrocortisone Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

Table 22: Middle East & Africa Hydrocortisone Market Value (US$ Mn) Forecast, by Indication, 2018–2028

Table 23: Middle East & Africa Hydrocortisone Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2028

Table 24: Middle East & Africa Hydrocortisone Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2028

Table 25: Middle East & Africa Hydrocortisone Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2028

List of Figures

Figure 01: Global Hydrocortisone Market Snapshot

Figure 02: Global Hydrocortisone Market Value (US$ Mn) and Distribution (%), by Region, 2019 and 2028

Figure 03: Global Hydrocortisone Market Value (US$ Mn) Forecast, 2018–2028

Figure 04: Regulatory Approval Process - The U.S.

Figure 05: Regulatory Approval Process - Europe

Figure 06: Regulatory Approval Process - Japan

Figure 07: Drug Development

Figure 08: Global Hydrocortisone Market Value Share Analysis, by Indication, 2019 and 2028

Figure 09: Global Hydrocortisone Market Attractiveness Analysis, by Indication, 2020–2028

Figure 10: Global Hydrocortisone Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Adrenocortical Insufficiency, 2018–2028

Figure 11: Global Hydrocortisone Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Adrenogenital Disorder, 2018–2028

Figure 12: Global Hydrocortisone Market Revenue (US$ Mn) and Y-o-Y Growth (%), by High Blood Calcium, 2018–2028

Figure 13: Global Hydrocortisone Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Thyroiditis, 2018–2028

Figure 14: Global Hydrocortisone Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Rheumatoid Arthritis, 2018–2028

Figure 15: Global Hydrocortisone Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Dermatitis, 2018–2028

Figure 16: Global Hydrocortisone Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Asthma and Chronic Obstructive Pulmonary Disease (COPD), 2018–2028

Figure 17: Global Hydrocortisone Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2018–2028

Figure 18: Global Hydrocortisone Market Value Share Analysis, by Route of Administration, 2019 and 2028

Figure 19: Global Hydrocortisone Market Attractiveness Analysis, by Route of Administration, 2020–2028

Figure 20: Global Hydrocortisone Market Value (US$ Mn) and Y-o-Y Growth, by Parenteral, 2018–2028

Figure 21: Global Hydrocortisone Market Value (US$ Mn) and Y-o-Y Growth, by Oral, 2018–2028

Figure 22: Global Hydrocortisone Market Value (US$ Mn) and Y-o-Y Growth, by Topical, 2018–2028

Figure 23: Global Hydrocortisone Market Value (US$ Mn) and Y-o-Y Growth, by Rectal, 2018–2028

Figure 24: Global Hydrocortisone Market Value Share Analysis, by Distribution Channel, 2019 and 2028

Figure 25: Global Hydrocortisone Market Attractiveness Analysis, by Distribution Channel, 2020–2028

Figure 26: Global Hydrocortisone Market Value (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2018–2028

Figure 27: Global Hydrocortisone Market Value (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies, 2018–2028

Figure 28: Global Hydrocortisone Market Value (US$ Mn) and Y-o-Y Growth, by Online Pharmacies, 2018–2028

Figure 29: Global Hydrocortisone Market Value Share Analysis, by Region, 2019 and 2028

Figure 30: Global Hydrocortisone Market Attractiveness Analysis, by Region, 2020–2028

Figure 31: North America Hydrocortisone Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 32: North America Hydrocortisone Market Value Share Analysis, by Indication, 2019 and 2028

Figure 33: North America Hydrocortisone Market Attractiveness Analysis, by Indication, 2020–2028

Figure 34: North America Hydrocortisone Market Value Share Analysis, by Route of Administration, 2019 and 2028

Figure 35: North America Hydrocortisone Market Attractiveness Analysis, by Route of Administration, 2020–2028

Figure 36: North America Hydrocortisone Market Value Share Analysis, by Distribution Channel, 2019 and 2028

Figure 37: North America Hydrocortisone Market Attractiveness Analysis, by Distribution Channel, 2020–2028

Figure 38: North America Hydrocortisone Market Value Share Analysis, by Country, 2019 and 2028

Figure 39: North America Hydrocortisone Market Attractiveness Analysis, by Country, 2020–2028

Figure 40: Europe Hydrocortisone Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 41: Europe Hydrocortisone Market Value Share Analysis, by Indication, 2019 and 2028

Figure 42: Europe Hydrocortisone Market Attractiveness Analysis, by Indication, 2020–2028

Figure 43: Europe Hydrocortisone Market Value Share Analysis, by Route of Administration, 2019 and 2028

Figure 44: Europe Hydrocortisone Market Attractiveness Analysis, by Route of Administration, 2020–2028

Figure 45: Europe Hydrocortisone Market Value Share Analysis, by Distribution Channel, 2019 and 2028

Figure 46: Europe Hydrocortisone Market Attractiveness Analysis, by Distribution Channel, 2020–2028

Figure 47: Europe Hydrocortisone Market Value Share Analysis, by Country/Sub-region, 2019 and 2028

Figure 48: Europe Hydrocortisone Market Attractiveness Analysis, by Country/Sub-region, 2020–2028

Figure 49: Asia Pacific Hydrocortisone Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 50: Asia Pacific Hydrocortisone Market Value Share Analysis, by Indication, 2019 and 2028

Figure 51: Asia Pacific Hydrocortisone Market Attractiveness Analysis, by Indication, 2020–2028

Figure 52: Asia Pacific Hydrocortisone Market Value Share Analysis, by Route of Administration, 2019 and 2028

Figure 53: Asia Pacific Hydrocortisone Market Attractiveness Analysis, by Route of Administration, 2020–2028

Figure 54: Asia Pacific Hydrocortisone Market Value Share Analysis, by Distribution Channel, 2019 and 2028

Figure 55: Asia Pacific Hydrocortisone Market Attractiveness Analysis, by Distribution Channel, 2020–2028

Figure 56: Asia Pacific Hydrocortisone Market Value Share Analysis, by Country/Sub-region, 2019 and 2028

Figure 57: Asia Pacific Hydrocortisone Market Attractiveness Analysis, by Country/Sub-region, 2020–2028

Figure 58: Latin America Hydrocortisone Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 59: Latin America Hydrocortisone Market Value Share Analysis, by Indication, 2019 and 2028

Figure 60: Latin America Hydrocortisone Market Attractiveness Analysis, by Indication, 2020–2028

Figure 61: Latin America Hydrocortisone Market Value Share Analysis, by Route of Administration, 2019 and 2028

Figure 62: Latin America Hydrocortisone Market Attractiveness Analysis, by Route of Administration, 2020–2028

Figure 63: Latin America Hydrocortisone Market Value Share Analysis, by Distribution Channel, 2019 and 2028

Figure 64: Latin America Hydrocortisone Market Attractiveness Analysis, by Distribution Channel, 2020–2028

Figure 65: Latin America Hydrocortisone Market Value Share Analysis, by Country/Sub-region, 2019 and 2028

Figure 66: Latin America Hydrocortisone Market Attractiveness Analysis, by Country/Sub-region, 2020–2028

Figure 67: Middle East & Africa Hydrocortisone Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2028

Figure 68: Middle East & Africa Hydrocortisone Market Value Share Analysis, by Indication, 2019 and 2028

Figure 69: Middle East & Africa Hydrocortisone Market Attractiveness Analysis, by Indication, 2020–2028

Figure 70: Middle East & Africa Hydrocortisone Market Value Share Analysis, by Route of Administration, 2019 and 2028

Figure 71: Middle East & Africa Hydrocortisone Market Attractiveness Analysis, by Route of Administration, 2020–2028

Figure 72: Middle East & Africa Hydrocortisone Market Value Share Analysis, by Distribution Channel, 2019 and 2028

Figure 73: Middle East & Africa Hydrocortisone Market Attractiveness Analysis, by Distribution Channel, 2020–2028

Figure 74: Middle East & Africa Hydrocortisone Market Value Share Analysis, by Country/Sub-region, 2019 and 2028

Figure 75: Middle East & Africa Hydrocortisone Market Attractiveness Analysis, by Country/Sub-region, 2020–2028