Companies in the hydrocarbon waxes market are expecting a mix of temporary and permanent impacts of the COVID-19 pandemic on various end markets. Lubricants, being a major application of hydrocarbon waxes, are susceptible to changing consumer sentiment. Analysts at the Transparency Market Research (TMR) anticipate that the demand for lubricants will inevitably rise again, as consumption patterns are returning to normal with the beginning of 2021. The surging business of industrial production and freight applications is helping to replenish revenue growth in the global hydrocarbon waxes market.

The pent-up demand for travel is anticipated to stimulate the maintenance of passenger vehicles, especially since many individuals are still hesitant to travel by airplane. New car sales incentives from OEMs (Original Equipment Manufacturer) and dealers in order to clear inventory and boost production are predicted to accelerate economic recovery.

Formation damage induced by wax deposition during production in oil fields is one of the most challenging complications faced by manufacturers. It has been found that the use of WAT measurement technique in an open measuring system is potentially insufficient to control wax deposition in the reservoir pore volume. Hence, companies in the hydrocarbon waxes market are increasing awareness about the flooding technique and micro-computed tomography method that allows to simulate fluid flow in the porous medium of the core before and after formation damage.

Hydrocarbon wax and paraffin wax are interchangeably used in various end-use cases. This has led to value grab opportunities for companies in the hydrocarbon waxes market within the cosmetics industry.

The ever-increasing demand for premium beauty and skincare products has led to incremental opportunities for manufacturers in the hydrocarbon waxes market. Personal care product manufacturers are running marketing campaigns on digital media and traditional media to highlight the advantages of hydrocarbon waxes. Paraffin wax, which is derived from hydrocarbons, is found to have a melting point close to natural human body temperature, implying that products made with this wax easily spread upon contact with the skin.

Ongoing trend of paraffin and hydrocarbon wax baths is helping to expand business streams for manufacturers in the hydrocarbon waxes market. Even salons and spas are offering paraffin and hydrocarbon wax manicures and pedicures to soothe achy joints.

Industrial applications of hydrocarbon wax, such as lubricants for prevention of wear and corrosion of equipment and machines are generating stable revenue streams for manufacturers in the hydrocarbon waxes market. Klüber Lubrication— a supplier of innovative specialty lubricants is increasing the availability of wax emulsions to reduce boundary and mixed lubrication friction in components and machines. Manufacturers are making use of high molecular synthetic hydrocarbons, additives, and mineral oils to innovate in wax emulsions.

There is a growing demand for wax emulsions that deliver a ready-to-handle surface. Companies in the in the hydrocarbon waxes market are increasing their production capacities in lubricating waxes to protect chains and other components from wear and corrosion.

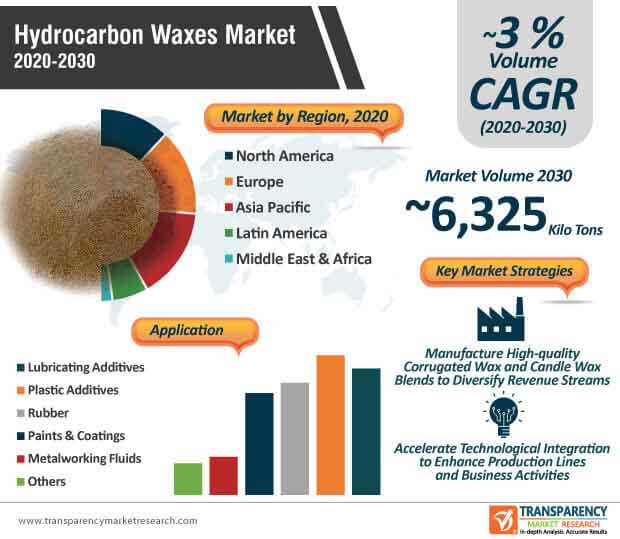

The hydrocarbon waxes market is projected to surpass the revenue of US$ 5 Bn by 2030. Apart from lubricants and cosmetics, manufacturers are increasing their production capabilities in candle wax blends, agriculture, and corrugated wax, among others. Stakeholders in the PVC pipes industry are major buyers of hydrocarbon waxes. Applications such as electrical insulation, distillation, and packaging wax are creating business opportunities for manufacturers.

Innovations in skin moisturizers, hand salves, and balms are gaining popularity in the hydrocarbon waxes market. On the other hand, therapeutic benefits of hydrocarbon wax are associated with pain relief treatment of several medical conditions. Hydrocarbon and paraffin bath therapies are being publicized for reduced pain and tenderness.

Analysts’ Viewpoint

The steady growth in demand for shared mobility and e-hailing services is contributing toward the recovery of the hydrocarbon waxes market amidst the ongoing coronavirus pandemic. In India, experts and industry professionals are stressing on the importance of accelerating technological integration to enhance production lines and business activities during the pandemic. However, the market of hydrocarbon waxes is expected to register a sluggish CAGR of 3% during the forecast period. Alternate products for hydrocarbon wax such as biowax-based barrier coatings are growing popular for their environment-friendly attributes. Hence, companies should tap opportunities in personal care, cosmetics, and lubrication applications to explore new business avenues.

Hydrocarbon Waxes Market: Overview

Hydrocarbon Waxes Market: Key Drivers and Restraints

Hydrocarbon Waxes Market: Prominent Applications

Asia Pacific to be Highly Lucrative Region of Hydrocarbon Waxes Market

Hydrocarbon Waxes Market: Competition Landscape

Hydrocarbon Waxes Market is expected to Reach US$ 5 Bn by 2030

Hydrocarbon Waxes Market is estimated to rise at a CAGR of 3% during forecast period

Hydrocarbon waxes market is driven by the increase in demand for lubricating additives, especially in the polyvinyl chloride (PVC) plastic processing sector

Europe is more attractive for vendors in the Hydrocarbon Waxes Market

Key players of Hydrocarbon Waxes Market are Sasol Ltd., Exxon Mobil Corp, Kerax Limited, Faith Industries Limited, Poth Hille & Company Limited, Strahl & Pitsch Inc, Blended Waxes Inc, Calwax Llc, Goyel Chemical Corporation and others

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Tendency

2.3. Key Developments/ Timeline

2.4. Market Definitions

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Hydrocarbon Waxes Market Analysis and Forecast

2.6.1. Global Hydrocarbon Waxes Market Volume (Tons), 2019–2030

2.6.2. Global Hydrocarbon Waxes Market Value (US$ Mn), 2019–2030

2.7. Porters Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Medical Composites Manufacturers

2.9.2. List of Suppliers/Distributors

2.9.3. List of Potential Customers

3. Covid-19 Impact Analysis

3.1. Impact on the Supply Chain of Hydrocarbon Waxes Market

4. Global Fiber Production Output Analysis, 2019 (%)

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Global Hydrocarbon Waxes Market Price Trend Analysis, 2019–2030

5.1. By Region

6. Global Hydrocarbon Waxes Market Analysis and Forecast, by Application

6.1. Key Findings, by Application

6.2. Global Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

6.2.1. Lubricating Additives

6.2.2. Plastic Additives

6.2.3. Rubber

6.2.4. Paints & Coatings

6.2.5. Metalworking Fluids

6.2.6. Others

6.3. Global Hydrocarbon Waxes Market Attractiveness Analysis, by Application

7. Global Hydrocarbon Waxes Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Global Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn), by Region, 2019–2030

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. Asia Pacific

7.2.5. Middle East & Africa

8. North America Hydrocarbon Waxes Market Analysis and Forecast, by Application

8.1. Key Findings, by Application

8.2. North America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.2.1. Lubricating Additives

8.2.2. Plastic Additives

8.2.3. Rubber

8.2.4. Paints & Coatings

8.2.5. Metalworking Fluids

8.2.6. Others

8.3. North America Hydrocarbon Waxes Market Attractiveness Analysis, by Application

8.4. North America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2019–2030

8.5. U.S. Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.5.1. Lubricating Additives

8.5.2. Plastic Additives

8.5.3. Rubber

8.5.4. Paints & Coatings

8.5.5. Metalworking Fluids

8.5.6. Others

8.6. Canada Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.6.1. Lubricating Additives

8.6.2. Plastic Additives

8.6.3. Rubber

8.6.4. Paints & Coatings

8.6.5. Metalworking Fluids

8.6.6. Others

9. Europe Hydrocarbon Waxes Market Analysis and Forecast, by Application

9.1. Key Findings, by Application

9.2. Europe Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.2.1. Lubricating Additives

9.2.2. Plastic Additives

9.2.3. Rubber

9.2.4. Paints & Coatings

9.2.5. Metalworking Fluids

9.2.6. Others

9.3. Europe Hydrocarbon Waxes Market Attractiveness Analysis, by Application

9.4. Europe Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

9.5. Germany Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.5.1. Lubricating Additives

9.5.2. Plastic Additives

9.5.3. Rubber

9.5.4. Paints & Coatings

9.5.5. Metalworking Fluids

9.5.6. Others

9.6. France Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.6.1. Lubricating Additives

9.6.2. Plastic Additives

9.6.3. Rubber

9.6.4. Paints & Coatings

9.6.5. Metalworking Fluids

9.6.6. Others

9.7. U.K. Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.7.1. Lubricating Additives

9.7.2. Plastic Additives

9.7.3. Rubber

9.7.4. Paints & Coatings

9.7.5. Metalworking Fluids

9.7.6. Others

9.8. Italy Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.8.1. Lubricating Additives

9.8.2. Plastic Additives

9.8.3. Rubber

9.8.4. Paints & Coatings

9.8.5. Metalworking Fluids

9.8.6. Others

9.9. Spain Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.9.1. Lubricating Additives

9.9.2. Plastic Additives

9.9.3. Rubber

9.9.4. Paints & Coatings

9.9.5. Metalworking Fluids

9.9.6. Others

9.10. Russia & CIS Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.10.1. Lubricating Additives

9.10.2. Plastic Additives

9.10.3. Rubber

9.10.4. Paints & Coatings

9.10.5. Metalworking Fluids

9.10.6. Others

9.11. Rest of Europe Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.11.1. Lubricating Additives

9.11.2. Plastic Additives

9.11.3. Rubber

9.11.4. Paints & Coatings

9.11.5. Metalworking Fluids

9.11.6. Others

10. Asia Pacific Hydrocarbon Waxes Market Analysis and Forecast, by Application

10.1. Key Findings, by Application

10.2. Asia Pacific Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.2.1. Lubricating Additives

10.2.2. Plastic Additives

10.2.3. Rubber

10.2.4. Paints & Coatings

10.2.5. Metalworking Fluids

10.2.6. Others

10.3. Asia Pacific Hydrocarbon Waxes Market Attractiveness Analysis, by Application

10.4. Asia Pacific Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

10.5. China Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.5.1. Lubricating Additives

10.5.2. Plastic Additives

10.5.3. Rubber

10.5.4. Paints & Coatings

10.5.5. Metalworking Fluids

10.5.6. Others

10.6. India Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.6.1. Lubricating Additives

10.6.2. Plastic Additives

10.6.3. Rubber

10.6.4. Paints & Coatings

10.6.5. Metalworking Fluids

10.6.6. Others

10.7. Japan Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.7.1. Lubricating Additives

10.7.2. Plastic Additives

10.7.3. Rubber

10.7.4. Paints & Coatings

10.7.5. Metalworking Fluids

10.7.6. Others

10.8. ASEAN Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.8.1. Lubricating Additives

10.8.2. Plastic Additives

10.8.3. Rubber

10.8.4. Paints & Coatings

10.8.5. Metalworking Fluids

10.8.6. Others

10.9. Rest of Asia Pacific Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.9.1. Lubricating Additives

10.9.2. Plastic Additives

10.9.3. Rubber

10.9.4. Paints & Coatings

10.9.5. Metalworking Fluids

10.9.6. Others

10.10. Latin America Hydrocarbon Waxes Market Attractiveness Analysis, by Fiber Type

11. Latin America Hydrocarbon Waxes Market Analysis and Forecast, by Application

11.1. Key Findings, by Application

11.2. Latin America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

11.2.1. Lubricating Additives

11.2.2. Plastic Additives

11.2.3. Rubber

11.2.4. Paints & Coatings

11.2.5. Metalworking Fluids

11.2.6. Others

11.3. Latin America Hydrocarbon Waxes Market Attractiveness Analysis, by Application

11.4. Latin America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

11.5. Brazil Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

11.5.1. Lubricating Additives

11.5.2. Plastic Additives

11.5.3. Rubber

11.5.4. Paints & Coatings

11.5.5. Metalworking Fluids

11.5.6. Others

11.6. Mexico Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

11.6.1. Lubricating Additives

11.6.2. Plastic Additives

11.6.3. Rubber

11.6.4. Paints & Coatings

11.6.5. Metalworking Fluids

11.6.6. Others

11.7. Rest of Latin America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

11.7.1. Lubricating Additives

11.7.2. Plastic Additives

11.7.3. Rubber

11.7.4. Paints & Coatings

11.7.5. Metalworking Fluids

11.7.6. Others

12. Middle East & Africa Hydrocarbon Waxes Market Analysis and Forecast, by Application

12.1. Key Findings, by Application

12.2. Middle East & Africa Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.2.1. Lubricating Additives

12.2.2. Plastic Additives

12.2.3. Rubber

12.2.4. Paints & Coatings

12.2.5. Metalworking Fluids

12.2.6. Others

12.3. Middle East & Africa Hydrocarbon Waxes Market Attractiveness Analysis, by Application

12.4. Middle East & Africa Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

12.5. GCC Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.5.1. Lubricating Additives

12.5.2. Plastic Additives

12.5.3. Rubber

12.5.4. Paints & Coatings

12.5.5. Metalworking Fluids

12.5.6. Others

12.6. South Africa Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.6.1. Lubricating Additives

12.6.2. Plastic Additives

12.6.3. Rubber

12.6.4. Paints & Coatings

12.6.5. Metalworking Fluids

12.6.6. Others

12.7. Rest of Middle East & Africa Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.7.1. Lubricating Additives

12.7.2. Plastic Additives

12.7.3. Rubber

12.7.4. Paints & Coatings

12.7.5. Metalworking Fluids

12.7.6. Others

13. Competition Landscape

13.1. Competition Matrix, by Key Players

13.2. Global Hydrocarbon Waxes Market Share Analysis, by Company (2019)

13.3. Market Footprint Analysis

13.3.1. By Application

13.4. Key Business Strategies

13.5. Company Profiles

13.5.1. Sasol Ltd.

13.5.1.1. Company Description

13.5.1.2. Business Overview

13.5.1.3. Product Segment

13.5.1.4. Strategic Outlook

13.5.1.5. Revenue Analysis

13.5.2. Exxon Mobil Corp.

13.5.2.1. Company Description

13.5.2.2. Business Overview

13.5.2.3. Product Segment

13.5.3. Kerax Limited

13.5.3.1. Company Description

13.5.3.2. Business Overview

13.5.3.3. Product Segment

13.5.4. Faith Industries Limited

13.5.4.1. Company Description

13.5.4.2. Business Overview

13.5.4.3. Product Segment

13.5.5. Poth Hille & Company Limited

13.5.5.1. Company Description

13.5.5.2. Business Overview

13.5.5.3. Product Segment

13.5.6. Strahl & Pitsch Inc.

13.5.6.1. Company Description

13.5.6.2. Business Overview

13.5.6.3. Product Segment

13.5.7. Blended Waxes Inc.

13.5.7.1. Company Description

13.5.7.2. Business Overview

13.5.7.3. Product Segment

13.5.8. Calwax Llc

13.5.8.1. Company Description

13.5.8.2. Business Overview

13.5.8.3. Product Segment

13.5.9. Goyel Chemical Corporation

13.5.9.1. Company Description

13.5.9.2. Business Overview

3.5.9.3. Product Segment

13.5.10. Valan Wax Products Limited

13.5.10.1. Company Description

13.5.10.2. Business Overview

13.5.10.3. Product Segment

13.5.11. A F Suter & Company Limited

13.5.11.1. Company Description

13.5.11.2. Business Overview

13.5.11.3. Product Segment

13.5.12. Matchem

13.5.12.1. Company Description

13.5.12.2. Business Overview

13.5.12.3. Product Segment

13.5.13. King Honor International Ltd.

13.5.13.1. Company Description

13.5.13.2. Business Overview

13.5.13.3. Product Segment

14. Key Primary Insights

List of Tables

Table 1 Global Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 2 Global Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2019–2030

Table 3 North America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 4 North America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2019–2030

Table 5 U.S. Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 6 Canada Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 7 Europe Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 8 Europe Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 9 Germany Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 10 France Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 11 U.K. Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 12 Italy Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 13 Spain Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 14 Russia & CIS Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 15 Rest of Europe Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 16 Asia Pacific Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 17 Asia Pacific Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 18 China Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 19 India Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 20 Japan Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 21 ASEAN Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 22 Rest of Asia Pacific Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 23 Latin America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 24 Latin America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 25 Brazil Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 26 Mexico Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 27 Rest of Latin America Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 28 Middle East & Africa Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 29 Middle East & Africa Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 30 GCC Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 31 South Africa Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 32 Rest of Middle East & Africa Hydrocarbon Waxes Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

List of Figures

Figure 1 Global Hydrocarbon Waxes Market Share Analysis, by Application

Figure 2 Global Hydrocarbon Waxes Market Attractiveness Analysis, by Application

Figure 3 Global Hydrocarbon Waxes Market Share Analysis, by Region

Figure 4 Global Hydrocarbon Waxes Market Attractiveness Analysis, by Region

Figure 5 North America Hydrocarbon Waxes Market Share Analysis, by Application

Figure 6 North America Hydrocarbon Waxes Market Attractiveness Analysis, by Application

Figure 7 North America Hydrocarbon Waxes Market Share Analysis, by Country

Figure 8 North America Hydrocarbon Waxes Market Attractiveness Analysis, by Country

Figure 9 Europe Hydrocarbon Waxes Market Share Analysis, by Application

Figure 10 Europe Hydrocarbon Waxes Market Attractiveness Analysis, by Application

Figure 11 Europe Hydrocarbon Waxes Market Share Analysis, by Country and Sub-region

Figure 12 Europe Hydrocarbon Waxes Market Attractiveness Analysis, by Country and Sub-region

Figure 13 Asia Pacific Hydrocarbon Waxes Market Share Analysis, by Application

Figure 14 Asia Pacific Hydrocarbon Waxes Market Attractiveness Analysis, by Application

Figure 15 Asia Pacific Hydrocarbon Waxes Market Share Analysis, by Country and Sub-region

Figure 16 Asia Pacific Hydrocarbon Waxes Market Attractiveness Analysis, by Country and Sub-region

Figure 17 Latin America Hydrocarbon Waxes Market Share Analysis, by Application

Figure 18 Latin America Hydrocarbon Waxes Market Attractiveness Analysis, by Application

Figure 19 Latin America Hydrocarbon Waxes Market Share Analysis, by Country and Sub-region

Figure 20 Latin America Hydrocarbon Waxes Market Attractiveness Analysis, by Country and Sub-region

Figure 21 Middle East & Africa Hydrocarbon Waxes Market Share Analysis, by Application

Figure 22 Middle East & Africa Hydrocarbon Waxes Market Attractiveness Analysis, by Application

Figure 23 Middle East & Africa Hydrocarbon Waxes Market Share Analysis, by Country and Sub-region

Figure 24 Middle East & Africa Hydrocarbon Waxes Market Attractiveness Analysis, by Country and Sub-region