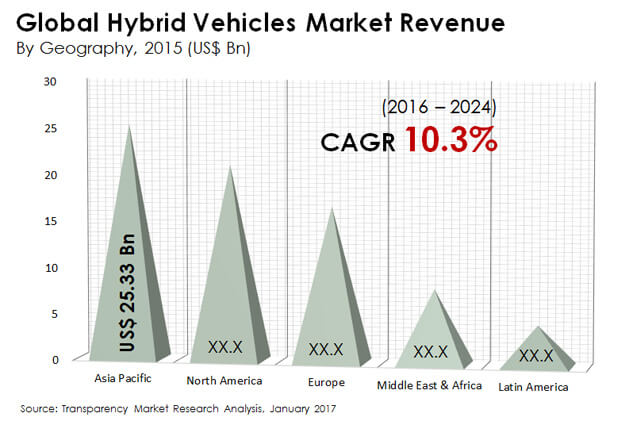

The global hybrid vehicles market has been gaining momentum over the past few years as vehicles available in this market are known to have a sophisticated performance. Hybrid vehicles operate without separate alternators and engines and usually have multiple combined motor or generators, which is used for starting internal combustion engine. These motor and generators deliver a better performance as compared to others, making hybrid vehicles superior as compared to conventional ones. Furthermore, the fact that pure hybrid vehicles are emit lesser carbon dioxide and are environment friendly is also driving the growth of the global market. Owing to these reasons, the global hybrid vehicles market is expected to be worth US$193.29 bn by 2024 as compared to US$75.52 bn in 2015. Between the forecast years of 2016 and 2024, the global market is estimated to expand at a CAGR of 10.3%.

The report states that the demand for hybrid vehicles will rise against the backdrop of rising concerns pertaining to pollution. The shocking rise in air pollution and its adverse effects on human health and the environment has coaxed governments and the consumers to opt for environment-friendly vehicles. Furthermore, the soaring fuel prices has also augmented the demand for pure hybrid, pure electric hybrid, and battery driven hybrid vehicles across developed regional of North America and Europe.

Though the demand for hybrid vehicles seems to be consistent, the market is likely to face a few tough challenges on the way. The high cost of research and development of hybrid vehicles is seen to be percolating to the selling price, which is discouraging several end users from making purchases. Furthermore, the skepticism surrounding the usage of hybrid vehicles amongst end users is also likely to hamper the growth of the overall market in the coming years.

On the basis of type of vehicles, the global hybrid vehicles market is segmented into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Of these, the passenger vehicles segment is expected to grow at a significant pace in the coming years due to the high demand for passenger vehicles across the globe. Furthermore, the introduction of technologically advanced passenger vehicles that are eco-friendly and are powered with sophisticated engines is expected to shape the trajectory of the overall segment in a positive manner in the coming years.

In terms of geography, the global market is segmented into Asia Pacific, North America, Latin America, Europe, and the Middle East and Africa. Of these, Asia Pacific is expected to lead the pack. This regional market will be driven by the booming automotive industry in the region and the growing investments by foreign companies in the emerging economies. The Asia Pacific hybrid vehicles market is likely to be fueled by the improving disposable incomes of rising nations such as India and China. Changing lifestyles, higher fuel prices, and increasing awareness about benefits of hybrid vehicles is also expected to have a positive impact on this regional market.

Key players operating in the global market are General Motors Company, Bayerische Motoren Werke (BMW) AG, Ford Motor Company, Audi AG, Mercedes-Benz USA, LLC, Hyundai Motor Company, Toyota Motor Corporation, MAN SE, Nissan Motor Co. Ltd., and Renault SA.

Chapter 1 Preface

1.1 Research Scope

1.2 Market Segmentation

1.3 Research Objectives

1.4 Key Questions Answered

Chapter 2 Assumptions and Research Methodology

2.1 Report Assumptions

2.2 Acronyms Used

2.3 Research Methodology

Chapter 3 Executive Summary

3.1 Global Hybrid Vehicles Market Snapshot

3.2 Market Opportunity Map

Chapter 4 Market Dynamics

4.1 Overview

4.2 Key Trend Analysis

4.3 Drivers and Restraints Snapshot Analysis

4.3.1 Drivers

4.3.2 Restraints

4.4 Opportunity Analysis

4.5 Company Market Share Analysis

4.6 Competitive Strategies Adopted by Major Players

4.7 Market Attractiveness Analysis Analysis

Chapter 5 Hybrid Vehicles Market Analysis, by Engine Type

5.1 Introduction

5.2 Global Hybrid Vehicles Market Value Share Analysis, By Engine Type

5.3 Global Hybrid Vehicles Market Revenue and Forecast, By Engine Type

5.4 Hybrid Electric-Petroleum Vehicles

5.5 Continuously Outboard Recharged Electric Vehicle (COREV)

5.6 Hybrid Fuel (Dual Mode)

5.7 Fluid Power Hybrid

5.7 Others

Chapter 6 Hybrid Vehicles Market Analysis, by Vehicle Type

6.1 Introduction

6.2 Global Hybrid Vehicles Market Value Share Analysis, By Vehicle Type

6.3 Global Hybrid Vehicles Market Revenue and Forecast, By Vehicle Type

6.4 Passenger Vehicles

6.5 Light Commercial Vehicles

6.6 Heavy Commercial Vehicles

Chapter 7 Hybrid Vehicles Market Analysis, by Region

7.1 Geographical Scenario

7.2 Global Hybrid Vehicles Market Value Share Analysis, By Region

7.3 Global Hybrid Vehicles Market Revenue and Forecast, By Region

Chapter 8 North America Hybrid Vehicles Market Analysis

8.1 North America Hybrid Vehicles Market Value Share Analysis, by Engine Type

8.2 North America Hybrid Vehicles Market Revenue and Forecast, by Engine Type

8.3 North America Hybrid Vehicles Market Value Share Analysis, by Vehicle Type

8.4 North America Hybrid Vehicles Market Revenue and Forecast, by Vehicle Type

8.5 North America Hybrid Vehicles Market Value Share Analysis, by Country

8.6 North America Hybrid Vehicles Market Revenue and Forecast, by Country

8.7 U.S. Hybrid Vehicles Market Analysis

8.8 Canada Hybrid Vehicles Market Analysis

8.9 Mexico Hybrid Vehicles Market Analysis

Chapter 9 Europe Hybrid Vehicles Market Analysis

9.1 Europe Hybrid Vehicles Market Value Share Analysis, by Engine Type

9.2 Europe Hybrid Vehicles Market Revenue and Forecast, by Engine Type

9.3 Europe Hybrid Vehicles Market Value Share Analysis, by Vehicle Type

9.4 Europe Hybrid Vehicles Market Revenue and Forecast, by Vehicle Type

9.5 Europe Hybrid Vehicles Market Value Share Analysis, by Country

9.6 Europe Hybrid Vehicles Market Revenue and Forecast, by Country

9.7 GermanyHybrid Vehicles Market Analysis

9.8 FranceHybrid Vehicles Market Analysis

9.9 U.K.Hybrid Vehicles Market Analysis

9.10 Italy Hybrid Vehicles Market Analysis

9.11 Rest of Europe Hybrid Vehicles Market Analysis

Chapter 10 Asia Pacific Hybrid Vehicles Market Analysis

10.1 Asia Pacific Hybrid Vehicles Market Value Share Analysis, by Engine Type

10.2 Asia Pacific Hybrid Vehicles Market Revenue and Forecast, by Engine Type

10.3 Asia Pacific Hybrid Vehicles Market Value Share Analysis, by Vehicle Type

10.4 Asia Pacific Hybrid Vehicles Market Revenue and Forecast, by Vehicle Type

10.5 Asia Pacific Hybrid Vehicles Market Value Share Analysis, by Country

10.6 Asia Pacific Hybrid Vehicles Market Revenue and Forecast, by Country

10.7 China Hybrid Vehicles Market Analysis

10.8 IndiaHybrid Vehicles Market Analysis

10.9 JapanHybrid Vehicles Market Analysis

10.10 Rest of Asia PacificHybrid Vehicles Market Analysis

Chapter 11 Middle East and Africa Hybrid Vehicles Market Analysis

11.1 Middle East and Africa Hybrid Vehicles Market Value Share Analysis, by Engine Type

11.2 Middle East and Africa Hybrid Vehicles Market Revenue and Forecast, by Engine Type

11.3 Middle East and Africa Hybrid Vehicles Market Value Share Analysis, by Vehicle Type

11.4 Middle East and Africa Hybrid Vehicles Market Revenue and Forecast, by Vehicle Type

11.5 Middle East and Africa Hybrid Vehicles Market Value Share Analysis, by Country

11.6 Middle East and Africa Hybrid Vehicles Market Revenue and Forecast, by Country

11.7 IranHybrid Vehicles Market Analysis

11.8 South Africa Hybrid Vehicles Market Analysis

11.9 Rest of Middle East and AfricaHybrid Vehicles Market Analysis

Chapter 12 Latin America Hybrid Vehicles Market Analysis

12.1 Latin America Hybrid Vehicles Market Value Share Analysis, by Engine Type

12.2 Latin America Hybrid Vehicles Market Revenue and Forecast, by Engine Type

12.3 Latin America Hybrid Vehicles Market Value Share Analysis, by Vehicle Type

12.4 Latin America Hybrid Vehicles Market Revenue and Forecast, by Vehicle Type

12.5 Latin America Hybrid Vehicles Market Value Share Analysis, by Country

12.6 Latin America Hybrid Vehicles Market Revenue and Forecast, by Country

12.7 Brazil Hybrid Vehicles Market Analysis

12.8 ArgentinaHybrid Vehicles Market Analysis

12.9 Rest of Latin AmericaHybrid Vehicles Market Analysis

Chapter 13 Company Profiles

12.1 General Motors Company

12.1.1 Company Details (HQ, Foundation Year, Employee Strength)

12.1.2 Market Presence, By Segment and Geography

12.1.3. Strategy and SWOT Analysis

12.1.4 Revenue and Y-o-Y Growth

12.2 Bayerische Motoren Werke (BMW) AG

12.2.1 Company Details (HQ, Foundation Year, Employee Strength)

12.2.2 Market Presence, By Segment and Geography

12.2.3. Strategy and SWOT Analysis

12.2.4 Revenue and Y-o-Y Growth

12.3 Ford Motor Company

12.3.1 Company Details (HQ, Foundation Year, Employee Strength)

12.3.2 Market Presence, By Segment and Geography

12.3.3. Strategy and SWOT Analysis

12.3.4 Revenue and Y-o-Y Growth

12.4 Audi AG

12.4.1 Company Details (HQ, Foundation Year, Employee Strength)

12.4.2 Market Presence, By Segment and Geography

12.4.3. Strategy and SWOT Analysis

12.4.4 Revenue and Y-o-Y Growth

12.5 Mercedes-Benz USA, LLC

12.5.1 Company Details (HQ, Foundation Year, Employee Strength)

12.5.2 Market Presence, By Segment and Geography

12.5.3. Strategy and SWOT Analysis

12.5.4 Revenue and Y-o-Y Growth

12.6 Hyundai Motor Company

12.6.1 Company Details (HQ, Foundation Year, Employee Strength)

12.6.2 Market Presence, By Segment and Geography

12.6.3. Strategy and SWOT Analysis

12.6.4 Revenue and Y-o-Y Growth

12.7 Toyota Motor Corporation

12.7.1 Company Details (HQ, Foundation Year, Employee Strength)

12.7.2 Market Presence, By Segment and Geography

12.7.3. Strategy and SWOT Analysis

12.7.4 Revenue and Y-o-Y Growth

12.8 MAN SE

12.8.1 Company Details (HQ, Foundation Year, Employee Strength)

12.8.2 Market Presence, By Segment and Geography

12.8.3. Strategy and SWOT Analysis

12.8.4 Revenue and Y-o-Y Growth

12.9 Nissan Motor Co. Ltd.

12.9.1 Company Details (HQ, Foundation Year, Employee Strength)

12.9.2 Market Presence, By Segment and Geography

12.9.3. Strategy and SWOT Analysis

12.9.4 Revenue and Y-o-Y Growth

12.10 Renault SA

12.10.1 Company Details (HQ, Foundation Year, Employee Strength)

12.10.2 Market Presence, By Segment and Geography

12.10.3. Strategy and SWOT Analysis

12.10.4 Revenue and Y-o-Y Growth

List of Tables

TABLE 1 Global hybrid vehicles market size and forecast by engine type, 2015 – 2024 (US$Bn)

TABLE 2 Global hybrid vehicles market size and forecast by vehicle type, 2015 – 2024 (US$Bn)

TABLE 3 Global Hybrid vehicles market size and forecast by region, 2015 – 2024 (US$Bn)

TABLE 4 North AmericaHybrid vehicles market size and forecast by engine type, 2015 – 2024 (US$Bn)

TABLE 5 North America Hybrid vehicles market size and forecast by vehicle type, 2015 – 2024 (US$Bn)

TABLE 6 North AmericaHybrid vehicles market size and forecast by country, 2015 – 2024 (US$Bn)

TABLE 7 EuropeHybrid vehicles market size and forecast by engine type, 2015 – 2024 (US$Bn)

TABLE 8 Europe Hybrid vehicles market size and forecast by vehicle type, 2015 – 2024 (US$Bn)

TABLE 9 EuropeHybrid vehicles market size and forecast by country, 2015 – 2024 (US$Bn)

TABLE 10 Asia PacificHybrid vehicles market size and forecast by engine type, 2015 – 2024 (US$Bn)

TABLE 11 Asia Pacific Hybrid vehicles market size and forecast by vehicle type, 2015 – 2024 (US$Bn)

TABLE 12 Asia PacificHybrid vehicles market size and forecast by country, 2015 – 2024 (US$Bn)

TABLE 13 Middle East and AfricaHybrid vehicles market size and forecast by engine type, 2015 – 2024 (US$Bn)

TABLE 14 Middle East and Africa Hybrid vehicles market size and forecast by vehicle type, 2015 – 2024 (US$Bn)

TABLE 15 Middle East and AfricaHybrid vehicles market size and forecast by country, 2015 – 2024 (US$Bn)

TABLE 16 Latin AmericaHybrid vehicles market size and forecast by engine type, 2015 – 2024 (US$Bn)

TABLE 17 Latin America Hybrid vehicles market size and forecast by vehicle type, 2015 – 2024 (US$Bn)

TABLE 18 Latin AmericaHybrid vehicles market size and forecast by country, 2015 – 2024 (US$Bn)

List of Figures

FIG. 1 Research Scope and Market Segmentation

FIG. 2 Research Methodology

FIG. 3 Market Snapshot

FIG. 4 Key Trends

FIG. 5 Revenue Share (2015)

FIG. 6 Drivers and Restraints Snapshot Analysis

FIG. 7 Opportunity Analysis

FIG. 8 Global Hybrid Vehicles Market Share Analysis By Company (2015)

FIG. 9 Market Attractiveness Analysis, By Vehicle Type, 2015

FIG. 10 Global Hybrid Vehicles Market Value Share Analysis By Engine Type, 2015 and 2024

FIG. 11 Global Hybrid Electric-Petroleum VehiclesMarket Revenue (US$ Bn), 2015 – 2024

FIG. 12 Global Continuously Outboard Recharged Electric Vehicle (COREV)Market Revenue (US$ Bn), 2015 – 2024

FIG. 13 Global Hybrid Fuel (Dual Mode)Market Revenue (US$ Bn), 2015 – 2024

FIG. 14 Global Fluid Power Hybrid Market Revenue (US$ Bn), 2015 – 2024

FIG. 15 Global Others Market Revenue (US$ Bn), 2015 – 2024

FIG. 16 Global Hybrid Vehicles Market Value Share Analysis By VehicleType, 2015 and 2024

FIG. 17 Global Passenger Vehicles Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 18 Global Light Commercial Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 19 Global Heavy Commercial Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 20 Geographical Scenario

FIG. 21 Global Hybrid Vehicles Market Value Share Analysis By Region, 2015 and 2024

FIG. 22 North America Hybrid Vehicles Market Value Share Analysis By Engine Type, 2015 and 2024

FIG. 23 North America Hybrid Vehicles Market Value Share Analysis By Vehicle Type, 2015 and 2024

FIG. 24 North America Hybrid VehiclesMarket Value Share Analysis By Country, 2015 and 2024

FIG. 25 U.S. Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 26 Canada Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 27 Mexico Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 28 Europe Hybrid Vehicles Market Value Share Analysis By Engine Type, 2015 and 2024

FIG. 29 Europe Hybrid Vehicles Market Value Share Analysis By Vehicle Type, 2015 and 2024

FIG. 30 Europe Hybrid Vehicles Market Value Share Analysis By Country, 2015 and 2024

FIG. 31 GermanyHybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 32 FranceHybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 33 U.K.Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 34 Italy Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 35 Rest of Europe Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 36 Asia Pacific Hybrid VehiclesMarket Value Share Analysis By Engine Type, 2015 and 2024

FIG. 37 Asia Pacific Hybrid Vehicles Market Value Share Analysis By Vehicle Type, 2015 and 2024

FIG. 38 Asia Pacific Hybrid Vehicles Market Value Share Analysis By Country, 2015 and 2024

FIG. 39 China Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 40 IndiaHybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 41 JapanHybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 42 Rest of Asia PacificHybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 43 Middle East and Africa Hybrid VehiclesMarket Value Share Analysis By Engine Type, 2015 and 2024

FIG. 44 Middle East and Africa Hybrid Vehicles Market Value Share Analysis By Vehicle Type, 2015 and 2024

FIG. 45 Middle East and Africa Hybrid Vehicles Market Value Share Analysis By Country, 2015 and 2024

FIG. 46 Iran Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 47 South Africa Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 48 Rest of Middle East and AfricaHybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 49 Latin America Hybrid VehiclesMarket Value Share Analysis By Engine Type, 2015 and 2024

FIG. 50 Latin America Hybrid Vehicles Market Value Share Analysis By Vehicle Type, 2015 and 2024

FIG. 51 Latin America Hybrid Vehicles Market Value Share Analysis By Country, 2015 and 2024

FIG. 52 Brazil Hybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 53 ArgentinaHybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024

FIG. 54 Rest of Latin AmericaHybrid Vehicles Market Revenue (US$ Bn), 2015 – 2024