Analysts’ Viewpoint on HVAC Equipment Market Scenario

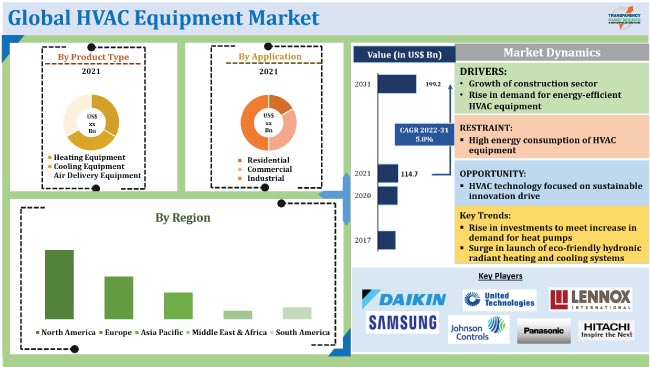

Rapid urbanization and increase in demand for sustainable products are driving the global HVAC equipment market. New products in the market are eco-friendly and do not rely on harmful refrigerants. Rise in focus on energy conservation has led to a surge in demand for energy-efficient HVAC products. Integration of IoT systems such as sensors, remote control, and mobile apps has enabled users to easily control, monitor, and interact with HVAC systems. Leading players in the market are focusing on technological advancements to improve the efficiency and cost-effectiveness of HVAC equipment. They are also establishing new manufacturing plants to enhance their revenue streams.

Heating, ventilation, and cooling (HVAC) systems control the temperature, humidity, and purity of the air in an enclosed space. They include heating equipment such as heat pumps, furnaces, unitary pumps, and boilers; cooling equipment such as chillers, air conditioners, and water cooling towers; and air delivery equipment such as ventilation fans and humidifiers/dehumidifiers. HVAC systems are deployed in industrial, commercial, residential, and institutional buildings. Central air conditioning; ductless, mini-split air conditioners; multi-split system air conditioning; variable refrigerant volume and variable refrigerant flow systems; and chillers are various types of HVAC systems used in commercial settings. HVAC system’s working principle is based on thermodynamics, fluid mechanics, and heat transfer. It uses three basic methods of heating: conduction, convection, and radiation. The system adjusts and changes the air conditions of a building to maintain thermal comfort.

Rapid urbanization has led to the expansion of residential and commercial infrastructure. Majority of air-handling systems such as heat pumps, furnaces, boilers, and air-cooled chillers are used in residential and commercial buildings. Many commercial structures, including retail complexes, multiplexes, hospitals, clinics, hotels, and restaurants, are built with ventilation ducts and fans to ensure optimal ventilation and sufficient airflow. The commercial sector is likely to grow significantly in the next few years. According to the Construction Products Association, the U.K.-based construction industry trade association, the commercial sector is expected to grow by 9.7% in 2022. According to the report ‘Future of Construction’ published by Oxford Economics and Marsh and GuyCarpenter, a cumulative total of US$ 135 Trn in construction output is forecast in the decade to 2030.

Implementation of laws and regulations that require commercial and residential buildings to meet safety standards and energy consumption targets has led to a surge in demand for energy-efficient HVAC equipment. Climate change is driving the traction of new technologies in the renewable energy market such as solar-powered HVAC systems and geothermal heat pumps.

HVAC equipment accounts for 40% to 60% of the total energy consumption of a building, depending on climate and other factors. This is driving the need for efficient HVAC systems, which can meet the changing climatic variations, while lowering energy consumption. Innovative HVAC technologies have changed the way of heating and cooling residential and commercial interiors. They offer significant energy savings and reduced carbon emissions. Recent developments in the HVAC equipment market include the launch of thermally-driven air conditioners and ice-powered air-conditioning to reduce energy usage and the overall environmental impact of HVAC equipment.

Increase in adoption of home automation and rise in construction of green buildings have prompted HVAC equipment manufacturers to develop sustainable products integrated with smart technologies. Recent developments in the HVAC sensors market have led to a rise in demand for products with intelligent features and functions that offer smooth operation and higher energy savings. Manufacturers are providing remote control of equipment using mobile applications, intelligent sensors, and automated control systems. They are also introducing eco-friendly equipment by phasing out chlorofluorocarbons, hydrochlorofluorocarbons, and other harmful refrigerants.

In terms of product type, the global HVAC equipment market has been segmented into heating equipment, cooling equipment, and air delivery equipment. The cooling equipment segment held major share of the global market in 2021. Improvement in standard of living in hot climates and focus on reducing food waste are expected to drive the segment during the forecast period. Chillers and air conditioning equipment significantly contribute to the rise in demand for cooling equipment. However, demand for water cooling towers has been declining due to high costs.

Asia Pacific is the fastest-growing market for HVAC equipment, followed by North America. The region accounted for 52.9% revenue of the HVAC equipment market worldwide in 2021, and is projected to retain its leading position by 2031. Growth of the market can be ascribed to robust economic development in countries such as China and India. China is one of the largest producers of HVAC equipment and a key supplier to the European market. Expansion of the air conditioning system market and rise in export of low-priced products to Africa and South America are also driving the market in Asia Pacific.

Detailed profiles of players in the HVAC equipment market are provided in the report to evaluate their financials, key product offerings, recent developments, and strategies. Majority of companies are investing significantly in comprehensive R&D activities, primarily to launch eco-friendly products. Expansion of product portfolios and mergers & acquisitions are key strategies adopted by manufacturers.

Key players operating in the global HVAC equipment market include Daikin Industries, Ltd., Fujitsu General Ltd., Gree Electric Appliances, Inc. of Zhuhai, Hitachi Ltd., Hubei Donper Electromechanical Group Co., Ltd., Ingersoll-Rand, Mitsubishi Electric Corporation, Moon Environment Technology Co., Ltd., Panasonic Corporation, and Sanden Holdings Corp.

Each of these players has been profiled in the HVAC equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 (Base Year) | US$ 114.7 Bn |

| Market Forecast Value in 2031 | US$ 199.2 Bn |

| Growth Rate (CAGR) | 5.8% |

| Forecast Period | 2022-2031 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player – Competition Dashboard and Revenue Share Analysis 2021 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The HVAC equipment market was valued at US$ 114.7 Bn in 2021.

The HVAC equipment market is expected to reach US$ 199.2 Bn by 2031.

Expansion of construction sector and rise in demand for energy-efficient HVAC equipment.

The cooling equipment segment held the largest share of the market in 2021.

Asia Pacific accounted for 52.9% share of the global HVAC equipment market in 2021.

Daikin Industries, Ltd., Fujitsu General Ltd., Gree Electric Appliances, Inc. of Zhuhai, Hitachi Ltd., Hubei Donper Electromechanical Group Co., Ltd., Ingersoll-Rand, Mitsubishi Electric Corporation, Moon Environment Technology Co., Ltd., Panasonic Corporation, and Sanden Holdings Corp.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall HVAC Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Technological Overview

5.9. Regulatory Framework Analysis

5.10. HVAC Equipment Market Analysis and Forecast, 2017-2031

5.10.1. Market Revenue Projections (US$ Bn)

5.10.2. Market Revenue Projections (Thousand Units)

6. Global HVAC Equipment Market Analysis and Forecast, By Product Type

6.1. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017-2031

6.1.1. Heating Equipment

6.1.1.1. Heat Pumps

6.1.1.2. Furnaces

6.1.1.3. Unitary Pumps

6.1.1.4. Boilers

6.1.1.5. Others

6.1.2. Cooling Equipment

6.1.2.1. Chillers

6.1.2.2. Air Conditioners

6.1.2.3. Water Cooling Towers

6.1.2.4. Others

6.1.3. Air Delivery Equipment

6.1.3.1. Ventilation Fans

6.1.3.2. Humidifiers/Dehumidifiers

6.1.3.3. Others

6.2. Incremental Opportunity, by Product Type

7. Global HVAC Equipment Market Analysis and Forecast, By Application

7.1. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017-2031

7.1.1. Residential

7.1.2. Commercial

7.1.3. Industrial

7.2. Incremental Opportunity, By Application

8. HVAC Equipment Market Analysis and Forecast, by Region

8.1. HVAC Equipment Market Size (US$ Bn and Thousand Units), by Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Global Incremental Opportunity, by Region

9. North America HVAC Equipment Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Key Trend Analysis

9.3. Price Trend Analysis

9.3.1. Weighted Average Selling Price

9.4. Key Supplier Analysis

9.5. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017-2031

9.5.1. Heating Equipment

9.5.1.1. Heat Pumps

9.5.1.2. Furnaces

9.5.1.3. Unitary Pumps

9.5.1.4. Boilers

9.5.1.5. Others

9.5.2. Cooling Equipment

9.5.2.1. Chillers

9.5.2.2. Air Conditioners

9.5.2.3. Water Cooling Towers

9.5.2.4. Others

9.5.3. Air Delivery Equipment

9.5.3.1. Ventilation Fans

9.5.3.2. Humidifiers/Dehumidifiers

9.5.3.3. Others

9.6. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017-2031

9.6.1. Residential

9.6.2. Commercial

9.6.3. Industrial

9.7. HVAC Equipment Market Size (US$ Bn and Thousand Units), by Country/Sub-region, 2017-2031

9.7.1. U.S.

9.7.2. Mexico

9.7.3. Rest of North America

9.8. Incremental Opportunity Analysis

10. Europe HVAC Equipment Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Trend Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Selling Price

10.4. Key Supplier Analysis

10.5. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017-2031

10.5.1. Heating Equipment

10.5.1.1. Heat Pumps

10.5.1.2. Furnaces

10.5.1.3. Unitary Pumps

10.5.1.4. Boilers

10.5.1.5. Others

10.5.2. Cooling Equipment

10.5.2.1. Chillers

10.5.2.2. Air Conditioners

10.5.2.3. Water Cooling Towers

10.5.2.4. Others

10.5.3. Air Delivery Equipment

10.5.3.1. Ventilation Fans

10.5.3.2. Humidifiers/Dehumidifiers

10.5.3.3. Others

10.6. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017-2031

10.6.1. Residential

10.6.2. Commercial

10.6.3. Industrial

10.7. HVAC Equipment Market Size (US$ Bn and Thousand Units), by Country/Sub-region, 2017-2031

10.7.1. U.K.

10.7.2. Germany

10.7.3. France

10.7.4. Rest of Europe

10.8. Incremental Opportunity Analysis

11. Asia Pacific HVAC Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trend Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price

11.4. Key Supplier Analysis

11.5. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017-2031

11.5.1. Heating Equipment

11.5.1.1. Heat Pumps

11.5.1.2. Furnaces

11.5.1.3. Unitary Pumps

11.5.1.4. Boilers

11.5.1.5. Others

11.5.2. Cooling Equipment

11.5.2.1. Chillers

11.5.2.2. Air Conditioners

11.5.2.3. Water Cooling Towers

11.5.2.4. Others

11.5.3. Air Delivery Equipment

11.5.3.1. Ventilation Fans

11.5.3.2. Humidifiers/Dehumidifiers

11.5.3.3. Others

11.6. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017-2031

11.6.1. Residential

11.6.2. Commercial

11.6.3. Industrial

11.7. HVAC Equipment Market Size (US$ Bn and Thousand Units), by Country/Sub-region, 2017-2031

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. Rest of Asia Pacific

11.8. Incremental Opportunity Analysis

12. Middle East & Africa HVAC Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price

12.4. Key Supplier Analysis

12.5. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017-2031

12.5.1. Heating Equipment

12.5.1.1. Heat Pumps

12.5.1.2. Furnaces

12.5.1.3. Unitary Pumps

12.5.1.4. Boilers

12.5.1.5. Others

12.5.2. Cooling Equipment

12.5.2.1. Chillers

12.5.2.2. Air Conditioners

12.5.2.3. Water Cooling Towers

12.5.2.4. Others

12.5.3. Air Delivery Equipment

12.5.3.1. Ventilation Fans

12.5.3.2. Humidifiers/Dehumidifiers

12.5.3.3. Others

12.6. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017-2031

12.6.1. Residential

12.6.2. Commercial

12.6.3. Industrial

12.7. HVAC Equipment Market Size (US$ Bn and Thousand Units), by Country/Sub-region, 2017-2031

12.7.1. GCC

12.7.2. South Africa

12.7.3. Rest of Middle East & Africa

12.8. Incremental Opportunity Analysis

13. South America HVAC Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price

13.4. Key Supplier Analysis

13.5. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017-2031

13.5.1. Heating Equipment

13.5.1.1. Heat Pumps

13.5.1.2. Furnaces

13.5.1.3. Unitary Pumps

13.5.1.4. Boilers

13.5.1.5. Others

13.5.2. Cooling Equipment

13.5.2.1. Chillers

13.5.2.2. Air Conditioners

13.5.2.3. Water Cooling Towers

13.5.2.4. Others

13.5.3. Air Delivery Equipment

13.5.3.1. Ventilation Fans

13.5.3.2. Humidifiers/Dehumidifiers

13.5.3.3. Others

13.6. HVAC Equipment Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017-2031

13.6.1. Residential

13.6.2. Commercial

13.6.3. Industrial

13.7. HVAC Equipment Market Size (US$ Bn and Thousand Units), by Country/Sub-region, 2017-2031

13.7.1. Brazil

13.7.2. Rest of South America

13.8. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Revenue Share Analysis (%), (2021)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. Daikin Industries, Ltd.

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. Fujitsu General Ltd.

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. Gree Electric Appliances, Inc. of Zhuhai

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Hitachi Ltd.

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. Hubei Donper Electromechanical Group Co. Ltd.

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. Ingersoll-Rand

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Mitsubishi Electric Corporation

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. Moon Environment Technology Co., Ltd.

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.9. Panasonic Corporation

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.10. Sanden Holdings Corp.

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.1.1. By Type

15.1.2. By Application

15.1.3. By Region

15.2. Understanding the Buying Process of Customers

15.3. Preferred Sales & Marketing Strategy

15.4. Prevailing Market Risk

List of Tables

Table 1: Global HVAC Equipment Market Value, by Product Type, US$ Bn, 2017-2031

Table 2: Global HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Table 3: Global HVAC Equipment Market Value, by Application, US$ Bn, 2017-2031

Table 4: Global HVAC Equipment Market Volume, by Application, Thousand Units, 2017-2031

Table 5: Global HVAC Equipment Market Value, by Region, US$ Bn, 2017-2031

Table 6: Global HVAC Equipment Market Volume, by Region, Thousand Units,2017-2031

Table 7: North America HVAC Equipment Market Volume, by Product Type, US$ Bn, 2017-2031

Table 8: North America HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Table 9: North America HVAC Equipment Market Volume, by Application, US$ Bn, 2017-2031

Table 10: North America HVAC Equipment Market Volume, by Application, Thousand Units, 2017-2031

Table 11: North America HVAC Equipment Market Volume, by Country, US$ Bn, 2017-2031

Table 12: North America HVAC Equipment Market Volume, by Country, Thousand Units, 2017-2031

Table 13: Europe HVAC Equipment Market Volume, by Product Type, US$ Bn, 2017-2031

Table 14: Europe HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Table 15: Europe HVAC Equipment Market Volume, by Application, US$ Bn, 2017-2031

Table 16: Europe HVAC Equipment Market Volume, by Application, Thousand Units, 2017-2031

Table 17: Europe HVAC Equipment Market Volume, by Country, US$ Bn, 2017-2031

Table 18: Europe HVAC Equipment Market Volume, by Country, Thousand Units, 2017-2031

Table 19: Asia Pacific HVAC Equipment Market Volume, by Product Type, US$ Bn, 2017-2031

Table 20: Asia Pacific HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Table 21: Asia Pacific HVAC Equipment Market Volume, by Application, US$ Bn, 2017-2031

Table 22: Asia Pacific HVAC Equipment Market Volume, by Application, Thousand Units, 2017-2031

Table 23: Asia Pacific HVAC Equipment Market Volume, by Country, US$ Bn, 2017-2031

Table 24: Asia Pacific HVAC Equipment Market Volume, by Country, Thousand Units, 2017-2031

Table 25: Middle East & Africa HVAC Equipment Market Volume, by Product Type, US$ Bn, 2017-2031

Table 26: Middle East & Africa HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Table 27: Middle East & Africa HVAC Equipment Market Volume, by Application, US$ Bn, 2017-2031

Table 28: Middle East & Africa HVAC Equipment Market Volume, by Application, Thousand Units, 2017-2031

Table 29: Middle East & Africa HVAC Equipment Market Volume, by Country, US$ Bn, 2017-2031

Table 30: Middle East & Africa HVAC Equipment Market Volume, by Country, Thousand Units, 2017-2031

Table 31: South America HVAC Equipment Market Volume, by Product Type, US$ Bn, 2017-2031

Table 32: South America HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Table 33: South America HVAC Equipment Market Volume, by Application, US$ Bn, 2017-2031

Table 34: South America HVAC Equipment Market Volume, by Application, Thousand Units, 2017-2031

Table 35: South America HVAC Equipment Market Volume, by Country, US$ Bn, 2017-2031

Table 36: South America HVAC Equipment Market Volume, by Country, Thousand Units, 2017-2031

List of Figures

Figure 1: Global HVAC Equipment Market Value, by Product Type, US$ Bn, 2017-2031

Figure 2: Global HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 3: Global HVAC Equipment Market Incremental Opportunity, by Product Type, 2021-2031

Figure 4: Global HVAC Equipment Market Value, by Application, US$ Bn, 2017-2031

Figure 5: Global HVAC Equipment Market Volume, by Application, Thousand Units, 2017-2031

Figure 6: Global HVAC Equipment Market Incremental Opportunity, by Application, 2021-2031

Figure 7: Global HVAC Equipment Market Value, by Region, US$ Bn, 2017-2031

Figure 8: Global HVAC Equipment Market Volume, by Region, Thousand Units,2017-2031

Figure 9: North America HVAC Equipment Market Incremental Opportunity, by Product Type, 2017-2031

Figure 10: North America HVAC Equipment Market Value, by Product Type, US$ Bn, 2017-2031

Figure 11: North America HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 12: North America HVAC Equipment Market Incremental Opportunity, by Application, 2017-2031

Figure 13: North America HVAC Equipment Market Value, by Application, US$ Bn, 2017-2031

Figure 14: North America HVAC Equipment Market Volume, by Application, Thousand Units, 2017-2031

Figure 15: North America HVAC Equipment Market Incremental Opportunity, by Country, 2017-2031

Figure 16: North America HVAC Equipment Market Value, by Country, US$ Bn, 2017-2031

Figure 17: Europe HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 18: Europe HVAC Equipment Market Incremental Opportunity, by Product Type, 2017-2031

Figure 19: Europe HVAC Equipment Market Value, by Product Type, US$ Bn, 2017-2031

Figure 20: Europe HVAC Equipment Market Volume, by Application, Thousand Units, 2017-2031

Figure 21: Europe HVAC Equipment Market Incremental Opportunity, by Application, 2017-2031

Figure 22: Europe HVAC Equipment Market Value, by Application, US$ Bn, 2017-2031

Figure 23: Europe HVAC Equipment Market Volume, by Country, Thousand Units, 2017-2031

Figure 24: Europe HVAC Equipment Market Incremental Opportunity, by Country, 2017-2031

Figure 25: Asia Pacific HVAC Equipment Market Value, by Product Type, US$ Bn, 2017-2031

Figure 26: Asia Pacific HVAC Equipment Market Volume, by Product Type, Thousand Units, 2017-2031

Figure 27: Asia Pacific HVAC Equipment Market Incremental Opportunity, by Product Type, 2017-2031

Figure 28: Asia Pacific HVAC Equipment Market Value, by Application, US$ Bn, 2017-2031

Figure 29: Asia Pacific HVAC Equipment Market Volume, by Application, Thousand Units,2017-2031

Figure 30: Asia Pacific HVAC Equipment Market Incremental Opportunity, by Application, 2017-2031

Figure 31: Asia Pacific HVAC Equipment Market Value, by Country, US$ Bn, 2017-2031

Figure 32: Asia Pacific HVAC Equipment Market Volume, by Country, Thousand Units,2017-2031

Figure 33: Middle East & Africa HVAC Equipment Market Incremental Opportunity, by Product Type, 2017-2031

Figure 34: Middle East & Africa HVAC Equipment Market Value, by Product Type, US$ Bn, 2017-2031

Figure 35: Middle East & Africa HVAC Equipment Market Volume, by Product Type, Thousand Units,2017-2031

Figure 36: Middle East & Africa HVAC Equipment Market Incremental Opportunity, by Application, 2017-2031

Figure 37: Middle East & Africa HVAC Equipment Market Value, by Application, US$ Bn, 2017-2031

Figure 38: Middle East & Africa HVAC Equipment Market Volume, by Application, Thousand Units,2017-2031

Figure 39: Middle East & Africa HVAC Equipment Market Incremental Opportunity, by Country,2017-2031

Figure 40: Middle East & Africa HVAC Equipment Market Value, by Country, US$ Bn, 2017-2031

Figure 41: South America HVAC Equipment Market Volume, by Product Type, Thousand Units,2017-2031

Figure 42: South America HVAC Equipment Market Incremental Opportunity, by Product Type, 2017-2031

Figure 43: South America HVAC Equipment Market Value, by Product Type, US$ Bn, 2017-2031

Figure 44: South America HVAC Equipment Market Volume, by Application, Thousand Units,2017-2031

Figure 45: South America HVAC Equipment Market Incremental Opportunity, by Application, 2017-2031

Figure 46: South America HVAC Equipment Market Value, by Application, US$ Bn, 2017-2031

Figure 47: South America HVAC Equipment Market Volume, by Country ,Thousand Units,2017-2031

Figure 48: South America HVAC Equipment Market Incremental Opportunity, by Country,2017-2031